North America Plastic Bottles and Containers Market Analysis and Size

San Francisco’s International Airport (SFO) just barred convenience shops, restaurants, and vending machines from selling plastic water bottles. This change is a part of SFO’s five-year strategic plan. The use of plastic will slow down with the rising awareness about the environment. Consumers in the U.S and Canada are progressively moving toward eco-friendly packaging materials.

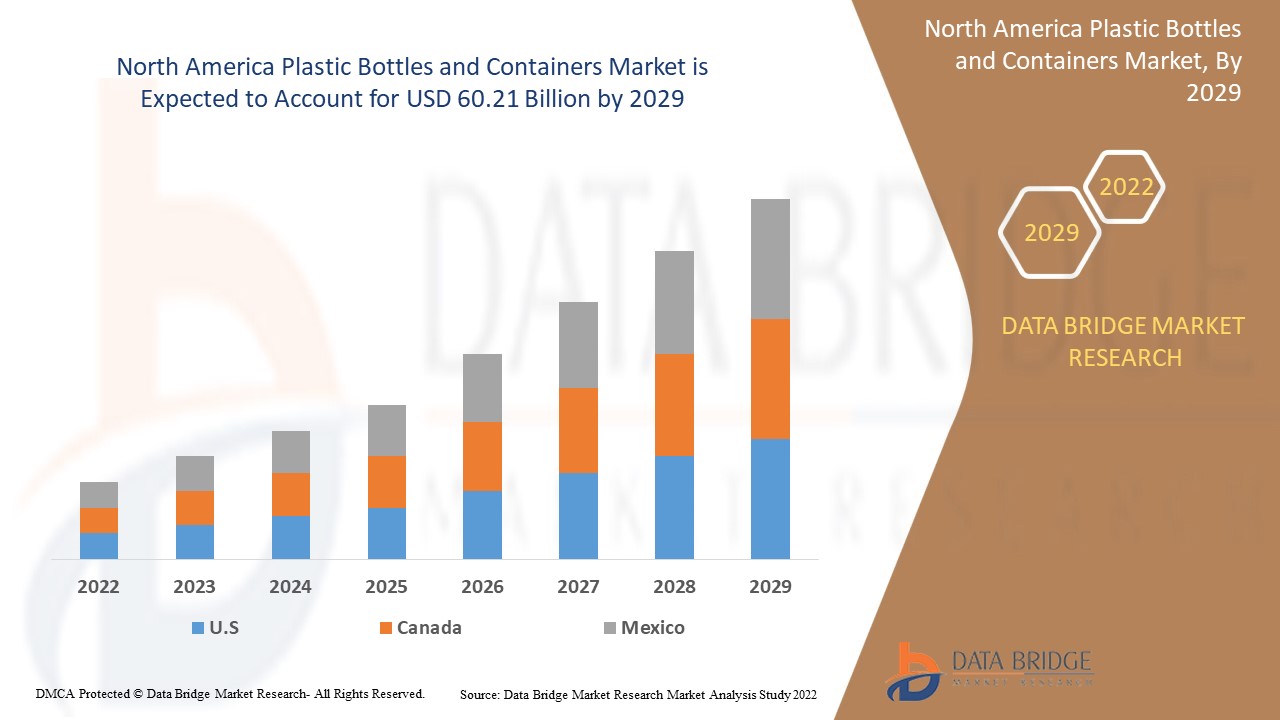

Data Bridge Market Research analyses that the plastic bottles and containers market was valued at USD 37.92 billion in 2021 and is expected to reach USD 60.21 billion by 2029, registering a CAGR of 5.95 % during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Market Definition

Plastic containers are made up of plastic resin such as HDPE, LDPE, PET, PE, etc. These plastic resins are mainly used to form various products such as bottles, jars, and pawls. Plastic-based bottles and containers are favourable for durability, lightweight, non-permeability of moisture and protection from sunlight. Increasing the demand for rigid packaging of food and beverages increases product shelf life and positively influences the plastic bottles and containers market.

North America Plastic Bottles and Containers Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Raw Material (Polyethylene Terephthalate (PET), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE) and Polypropylene (PP), Technology (Injection Molding, Stretch Blow Molding, Extrusion, Thermoforming and Others), Capacity (Less Than 100 ml, 100-500 ml, 500-1000 ml, 1000-1500 ml, 1500-2000 ml and more than 2000 ml), Appearance (Transparent and Coloured), Neck Finish (1 to 4, 300 to 360, 400 & 400 m, 405 & 405 m, 410 & 410 m, 415 & 415 m, 420 to 485, 490 & 490 m, 495 & 495 m, 500, 530 & 530 m, 535 to 655, 665 & 665 m, 710 to 2000, 2010 & 2010 m, 2020 & 2020 m, 2030 & 2030 m, 2035 to 3140, 3150 & 3150 m, 3160 & 3160 m and above 3160), Neck Type (Three Start, Double Start, PCO 1881, PCO 1810, PCO Hybrid, BPF, ROPP (Without Collar), Liquor Neck, Fridge Bottle Neck, CTC/BERI and Others), Shapes (Boston Round, Square, Oval, Oblong, Wide Mouth, Cosmo Round, Cylinder, Narrow Mouth, Specialty and Others), End-User (Food and Beverages, Healthcare, Personal Care & Cosmetics, Household, Automotive and Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Dahl-Tech, Inc (US), Us Pack Group (US), Dash Packaging Inc (US), Canyon Plastics Inc (US), MJS Packaging (US), Berry Global Inc. (US), Graham Packaging Company (US), Alpack Plastics (US), Plastipak Holdings, Inc (US), Indorama Ventures Public Company Limited (Thailand), Kaufman Container (US), Amcor plc (Switzerland), Containers Plus (US), Green Bay Plastics (US), Mai animal health (US), Zauba technologies and Data service private limited (India), Inmark global holding LLC (US) and APEX Plastics (US) |

|

Market Opportunities |

|

Plastic Bottles and Containers Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing adoption of lightweight packaging methods

Plastics are appreciated for their low weight due to this company use plastic for the manufacturing of bottles and containers. The replacements of plastic with alternatives such as steel, aluminum, cloth, glass, rubber, paper, and paperboard are 4.5 times heavier on average plastic to produce the same packaging style. The lightweight property of plastic is driving the growth of plastic packaging.

Rising disposable income and urbanization will propel market value growth. The market is powered by customers' continuously changing lifestyles and the retail sector's rise. The market's growth rate is predicted to be boosted by rising awareness of eco-friendly and biodegradable packaging materials, as well as rising demand for packaged and processed food products.

Opportunities

- Rise in product innovations

The increasing number of product developments will drive new market opportunities and accelerate industry expansion. Various product innovations aimed at enhancing design and manufacturing processes also contribute to market growth. Manufacturers are developing more efficient, dependable, and convenient products.

Restraints/ Challenges

Pollution because of plastic has now become a global issue. Use of plastic affects the environment. As a result, North America aimed to reduce the usage of plastics. The public's awareness of the harmful effects of plastic use has risen considerably in the recent year. This is the major restrain to obstructing the use of plastic bottles and containers which decreases the growth of the market.

This plastic bottles and containers market report provide details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the plastic bottles and containers market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Plastic Bottles and Containers Market

COVID-19 affects the worldwide economy mainly in three ways: affecting production and demand, creating supply chain and market disruption, and its financial impact on firms and financial markets. Our analysts observe the situation and analyze that the market will generate remunerative prospects for producers post COVID-19 crisis. The market goals to provide an additional illustration of the modern scenario, economic go-slow and COVID-19 impact on the whole industry.

Recent Development

- In July 2020, SC Johnson from, United States prominent manufacturer of household cleaning products has, declared a new line of Mr. Muscle Platinum Window & Glass cleaner featuring 100% recycled ocean-bound plastic bottles and containers. The company's goal to triple the amount of post-consumer recycled plastic content in packaging by 2025.

- In October 2020, Gerresheimer developed a new type of dropper insert, with DropControl, for recent drugs with low viscosity, which protect the drug from flowing uncontrollably during use.

North America Plastic Bottles and Containers Market Scope

The plastic bottles and containers market is segmented on the basis of raw materials, technology, capacity, appearance, neck finish, neck type, shapes and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Raw materials

- Polyethylene Terephthalate (PET)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

On the basis of raw material, the plastic bottles and containers market is segmented into Polyethylene Terephthalate (PET), Low-Density Polyethylene (LDPE), and High-Density Polyethylene (HDPE) and Polypropylene (PP).

Technology

- Injection Molding

- Stretch Blow Molding

- Extrusion

- Thermoforming

- Others

On the basis of technology, the plastic bottles and containers market is segmented injection molding, stretch blow molding, extrusion, thermoforming and others.

Capacity

- Less Than 100 ml

- 100-500 ml

- 500-1000 ml

- 1000-1500 ml

- 1500-2000 ml

- more than 2000 ml

On the basis of capacity, the plastic bottles and containers market is segmented into less than 100 ml, 100-500 ml, 500-1000 ml, 1000-1500 ml, 1500-2000 ml and more than 2000 ml.

Apperance

- Transparent

- Coloured

On the basis of appearance, the plastic bottles and containers market is segmented transparent and coloured.

Neck finish

- 1 to 4

- 300 to 360

- 400 & 400 m

- 405 & 405 m

- 410 & 410 m

- 415 & 415 m

- 420 to 485

- 490 & 490 m

- 495 & 495 m

- 500, 530 & 530 m

- 535 to 655

- 665 & 665 m

- 710 to 2000

- 2010 & 2010 m

- 2020 & 2020 m

- 2030 & 2030

- 2035 to 3140

- 3150 & 3150

- 3160 & 3160 m

- Above 3160

On the basis of neck finish, the plastic bottles and containers market is segmented into neck finish (1 to 4, 300 to 360, 400 & 400 m, 405 & 405 m, 410 & 410 m, 415 & 415 m, 420 to 485, 490 & 490 m, 495 & 495 m, 500, 530 & 530 m, 535 to 655, 665 & 665 m, 710 to 2000, 2010 & 2010 m, 2020 & 2020 m, 2030 & 2030 m, 2035 to 3140, 3150 & 3150 m, 3160 & 3160 m and above 3160.

Shape

- Boston Round

- Square, Oval

- Oblong

- Wide Mouth

- Cosmo Round Cylinder

- Narrow Mouth

- Specialty

- Others

On the basis of shape, the plastic bottles and containers market is segmented into boston round, square, oval, oblong, wide mouth, cosmo round cylinder, narrow mouth, specialty and others.

Neck Type

- Three Start

- Double Start

- PCO 1881

- PCO 1810

- PCO Hybrid

- BPF

- ROPP (Without Collar)

- Liquor Neck

- Fridge Bottle Neck

- CTC/BERI

- Others

On the basis of neck type, the plastic bottles and containers market is segmented into three start, double start, PCO 1881, PCO 1810, PCO hybrid, BPF, ROPP (Without Collar), liquor neck, fridge bottle neck, CTC/BERI and others.

End-User

- Food and Beverages

- Healthcare

- Personal Care & Cosmetics

- Household, Automotive

- Others

On the basis of end-user, the plastic bottles and containers market is segmented into food and beverages, healthcare, personal care & cosmetics, household, automotive and others.

Plastic Bottles and Containers Market Regional Analysis/Insights

The plastic bottles and containers market is analyzed and market size insights and trends are provided by country, raw materials, technology, capacity, appearance, neck finish, neck type, shapes and end-user as referenced above.

The countries covered in the plastic bottles and containers market report are U.S., Canada, Mexico Rest of North America.

US dominate the plastic bottles and containers market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the rising use of personal care products, cosmetics and fragrances. U.S is one of the significant markets for cosmetics, unique care products, and fragrances, increasing the demand for plastic bottles and containers and increasing market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Plastic Bottles and Containers Market Share Analysis

The plastic bottles and containers market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to plastic bottles and containers market.

Some of the major players operating in the plastic bottles and containers market are:

- Dahl-Tech, Inc (US)

- Us Pack Group (US)

- Dash Packaging (US)

- Canyon Plastics Inc (US)

- MJS Packaging (US)

- Berry Global Inc. (US)

- Graham Packaging Company (US)

- Alpack plastics (US)

- Plastipak Holdings, Inc (US)

- Indorama Ventures Public Company Limited (Thailand)

- Kaufman Container (US)

- Amcor plc (Switzerland)

- Containers Plus (US)

- Green Bay Plastics (US)

- Mai animal health (US)

- Zauba technologies and Data service private limited (India)

- Inmark global holding LLC (US)

- APEX Plastics (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Plastic Bottles And Containers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Plastic Bottles And Containers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Plastic Bottles And Containers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.