North America Soy Protein Concentrate Market

Market Size in USD Billion

CAGR :

%

USD

1.26 Billion

USD

3.44 Billion

2025

2033

USD

1.26 Billion

USD

3.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.26 Billion | |

| USD 3.44 Billion | |

|

|

|

|

North America Soy Protein Concentrate Market Size

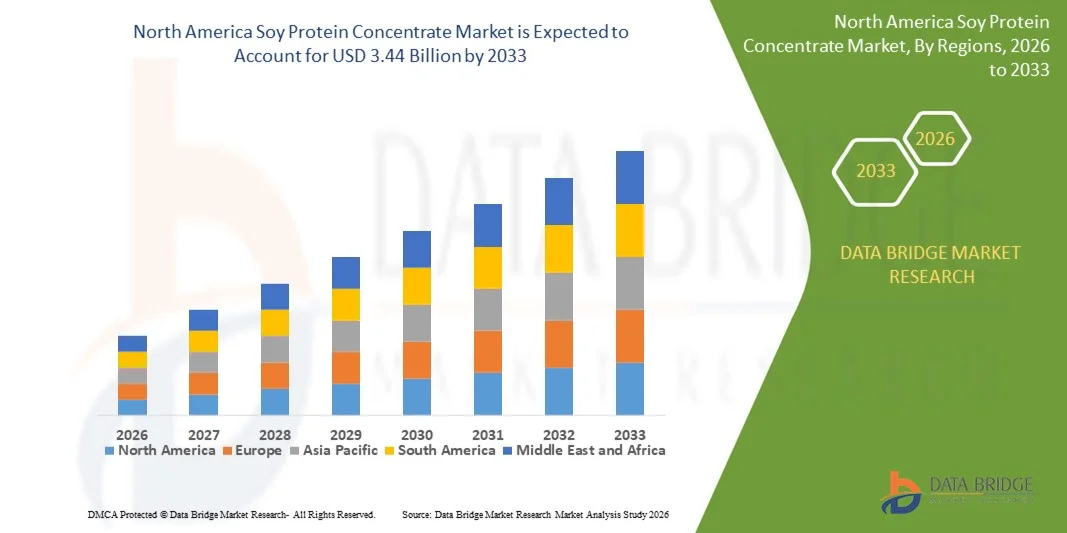

- The North America soy protein concentrate market size was valued at USD 1.26 billion in 2025 and is expected to reach USD 3.44 billion by 2033, at a CAGR of 13.3% during the forecast period

- The market growth is largely fueled by the rising demand for plant-based and high-protein food ingredients, supported by increasing consumer focus on health, nutrition, and sustainable dietary choices across both developed and emerging economies

- Furthermore, growing adoption of soy protein concentrate by food manufacturers for protein enrichment, texture improvement, and cost efficiency in processed foods and meat alternatives is accelerating market penetration, thereby significantly supporting overall market expansion

North America Soy Protein Concentrate Market Analysis

- Soy protein concentrate is a plant-derived protein ingredient produced by removing soluble carbohydrates from defatted soy flour, resulting in a high-protein product used to enhance nutritional value, texture, and functional performance in food, feed, and nutraceutical applications

- The increasing demand for soy protein concentrate is primarily driven by the shift toward plant-based diets, rising use in functional and fortified food products, and expanding application in animal nutrition due to its balanced amino acid profile and functional versatility

- U.S. dominated the soy protein concentrate market in 2025, due to high consumption of protein-enriched food products, strong demand for plant-based meat alternatives, and well-established food processing and nutraceutical industries

- Canada is expected to be the fastest growing region in the soy protein concentrate market during the forecast period due to rising demand for plant-based proteins, clean-label food products, and sustainable nutrition solutions

- Conventional segment dominated the market with a market share of 74.6% in 2025, due to established supply chains and cost advantages. Conventional soy protein concentrate meets large-scale demand from food and feed industries. Stable availability and competitive pricing sustain its leading position

Report Scope and Soy Protein Concentrate Market Segmentation

|

Attributes |

Soy Protein Concentrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Soy Protein Concentrate Market Trends

Increasing Use in Animal Feed

- The soy protein concentrate market is expanding rapidly as manufacturers and livestock producers recognize its value as a high-protein, cost-effective ingredient in animal feed, particularly for poultry, swine, and aquaculture sectors

- For instance, major companies such as Bunge have strengthened their position by acquiring specialized soy protein concentrate manufacturers such as CJ Selecta, enabling them to offer tailored feed solutions and support the increasing demand for sustainable, protein-rich livestock nutrition

- The adoption of soy protein concentrate in animal feed is driven by its superior amino acid profile, digestibility, and ability to enhance growth rates and feed efficiency, making it highly attractive for large-scale commercial farms

- Rising concerns about antibiotic use and the need for optimized animal health are prompting feed formulators to incorporate soy protein concentrate as a functional ingredient to improve gut health and immune response in livestock

- Technological advancements in processing are leading to the development of non-GMO, low-oligosaccharide, and highly digestible soy protein concentrates designed specifically for the feed industry, broadening the appeal to producers with varied needs

- Sustainable sourcing, lower environmental footprint compared to animal-based protein feed, and heightened focus on food chain transparency are further fueling its increasing adoption in the feed industry

North America Soy Protein Concentrate Market Dynamics

Driver

Rising Demand for Plant-Based Proteins

- The surge in health-conscious consumers, coupled with the growing popularity of vegetarian, vegan, and flexitarian diets, is significantly boosting global demand for plant-based proteins across food and beverage sectors

- For instance, leading players such as DuPont and Solae have collaborated to create soy protein concentrates with improved taste and texture, making them more suitable for plant-based meat alternatives and functional foods

- The versatility of soy protein concentrate—as a core ingredient in meat substitutes, protein bars, dairy alternatives, and health supplements—is underpinning its market growth among both mainstream and specialty food producers

- Affordability and balanced amino acid profiles position soy protein concentrates as an attractive alternative to animal proteins, especially in regions with limited access to traditional protein sources

- The growing focus on clean-label, non-GMO, and sustainably produced protein ingredients is prompting food companies to integrate soy protein concentrate into their portfolios, aligning with evolving consumer preferences for transparency and eco-friendly nutrition

Restraint/Challenge

Allergic Reactions to Soy

- Soy is one of the top eight food allergens globally, and the risk of allergic reactions presents a significant barrier to the broader adoption of soy protein concentrate in both food and feed industries

- For instance, Nestlé has implemented strict allergen labeling and segregation protocols across its soy-based product lines to comply with regulations in North America and Europe and to mitigate consumer safety risks

- The search for hypoallergenic formulations and the emergence of alternative plant-based proteins—such as pea, rice, and oat protein—are intensifying competitive pressures and driving innovation to address the allergen issue

- Consumer perception of soy, sometimes influenced by myths about genetic modification or health concerns, can affect purchasing decisions and necessitate additional education or marketing investment from brands

- Regulatory differences between regions regarding labeling, allowed levels of allergenic proteins, and permitted claims further complicate market expansion and require robust compliance strategies from manufacturers

North America Soy Protein Concentrate Market Scope

The market is segmented on the basis of category, extraction process, modification type, protein concentration, form, nature, function, and application.

- By Category

On the basis of category, the Soy Protein Concentrate market is segmented into single compound and fortified compound. The single compound segment dominated the largest market revenue share in 2025, supported by its widespread use as a cost-efficient protein source in food processing and animal nutrition. Manufacturers favor single compound soy protein concentrate due to its consistent protein profile and ease of formulation across multiple applications. Its neutral functionality supports stable texture and nutritional enhancement without altering end-product characteristics. Strong demand from large-scale food processors further reinforced its leading position.

The fortified compound segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for enhanced nutritional profiles in functional foods and dietary supplements. Fortified variants allow the inclusion of vitamins, minerals, and amino acids, improving overall health positioning. Growing consumer awareness of protein quality and targeted nutrition supports adoption. Premium product positioning and higher margins also encourage manufacturers to expand fortified offerings.

- By Extraction Process

On the basis of extraction process, the market is segmented into aqueous alcohol wash process, acid wash process, and water wash process with heat denaturation. The aqueous alcohol wash process segment dominated the market revenue share in 2025 due to its effectiveness in reducing anti-nutritional factors while preserving protein functionality. This process delivers high-purity concentrates with improved taste and color, making it suitable for human food applications. Consistent quality output supports its large-scale industrial adoption.

The water wash process with heat denaturation segment is anticipated to register the fastest growth during the forecast period, driven by growing preference for cleaner processing methods. This process aligns with clean-label trends by minimizing chemical usage. Improved protein digestibility and functional performance enhance its appeal in food and nutraceutical applications. Regulatory and consumer pressure toward natural processing further accelerates growth.

- By Modification Type

On the basis of modification type, the Soy Protein Concentrate market is segmented into thermal modification, chemical modification, and enzyme modification. Thermal modification held the dominant market share in 2025 owing to its wide acceptance and cost-effective scalability. This method improves protein functionality, including water absorption and texture, without complex processing steps. Its compatibility with existing manufacturing infrastructure supports extensive usage.

Enzyme modification is projected to witness the fastest growth rate from 2026 to 2033 due to its precision in tailoring functional properties. Enzymatic processes enhance solubility and digestibility, supporting advanced food formulations. Rising demand for high-performance plant proteins in specialized nutrition drives adoption. Innovation in enzyme technologies further strengthens growth prospects.

- By Protein Concentration

On the basis of protein concentration, the market is segmented into <20% protein, 20%–70% protein, and >70% protein. The 20%–70% protein segment dominated the market revenue share in 2025, supported by its balanced nutritional profile and functional versatility. This range is widely used across food products, animal feed, and nutraceuticals due to favorable cost-to-protein value. Broad applicability ensures sustained demand across industries.

The >70% protein segment is expected to grow at the fastest pace during the forecast period, driven by rising demand for high-protein formulations. Sports nutrition and dietary supplement manufacturers increasingly prefer higher protein concentrates. Consumer focus on muscle health and protein enrichment supports this trend. Premium positioning further enhances market expansion.

- By Form

On the basis of form, the Soy Protein Concentrate market is segmented into dry and liquid. The dry form segment dominated the market in 2025 due to its longer shelf life and ease of transportation. Dry soy protein concentrate offers formulation flexibility and cost efficiency for manufacturers. Its widespread use in bakery, snacks, and meat alternatives reinforces dominance.

The liquid form segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing use in beverages and ready-to-use formulations. Liquid concentrates enable faster processing and uniform blending. Growing demand for protein-enriched drinks and emulsified products supports adoption. Convenience in industrial applications accelerates growth momentum.

- By Nature

On the basis of nature, the market is segmented into organic and conventional. The conventional segment accounted for the largest market revenue share of 74.6% in 2025, supported by established supply chains and cost advantages. Conventional soy protein concentrate meets large-scale demand from food and feed industries. Stable availability and competitive pricing sustain its leading position.

The organic segment is expected to register the fastest growth during the forecast period, driven by rising consumer preference for organic and non-GMO products. Organic certification enhances product credibility in health-focused markets. Growth in clean-label and sustainable food consumption supports expansion. Premium pricing further encourages producer participation.

- By Function

On the basis of function, the market is segmented into solubility, gelation, emulsification, water binding, foaming, texturizing agent, stabilizer, thickening agent, and others. The emulsification function segment dominated the market in 2025 due to its critical role in processed food stability. Soy protein concentrate is widely used to improve texture and consistency in meat alternatives and dairy substitutes. Strong demand from food manufacturers sustains dominance.

The texturizing agent segment is projected to witness the fastest growth from 2026 to 2033, driven by expanding plant-based meat consumption. Texturizing functionality enhances mouthfeel and structural integrity of alternative proteins. Innovation in meat analog formulations supports rising demand. Consumer shift toward plant-based diets accelerates growth.

- By Application

On the basis of application, the Soy Protein Concentrate market is segmented into food products, beverages, nutraceuticals and dietary supplements, cosmetics and personal care, animal feed, pharmaceuticals, and others. The food products segment dominated the market revenue share in 2025, driven by extensive use in bakery, meat alternatives, and processed foods. Protein enrichment and functional benefits support widespread adoption. High-volume consumption sustains segment leadership.

The nutraceuticals and dietary supplements segment is expected to witness the fastest growth from 2026 to 2033, supported by rising health awareness and protein supplementation trends. Soy protein concentrate offers plant-based nutrition with high digestibility. Demand from aging populations and fitness-focused consumers drives growth. Product innovation and targeted formulations further strengthen expansion.

North America Soy Protein Concentrate Market Regional Analysis

- U.S. dominated the soy protein concentrate market with the largest revenue share in 2025, driven by high consumption of protein-enriched food products, strong demand for plant-based meat alternatives, and well-established food processing and nutraceutical industries

- Widespread utilization of soy protein concentrate across bakery, processed foods, dietary supplements, and animal feed segments, supported by advanced food manufacturing capabilities and strong consumer awareness of plant-based nutrition, continues to sustain robust demand across end-use industries

- The strong presence of major market players such as ADM, Cargill Incorporated, and DuPont, along with continuous product innovation, capacity expansion, and investments in clean-label and non-GMO soy ingredients, reinforces the U.S. leadership position. Ongoing growth in plant-based food consumption and functional nutrition products is expected to maintain the country’s dominance during the forecast period

Canada Soy Protein Concentrate Market Insight

Canada is projected to register the fastest CAGR in the North America soy protein concentrate market from 2026 to 2033, supported by rising demand for plant-based proteins, clean-label food products, and sustainable nutrition solutions. For instance, Canadian food manufacturers are increasingly incorporating soy protein concentrate into meat alternatives, sports nutrition, and fortified food products to meet growing consumer demand for high-protein and plant-based diets. Expanding investments in food innovation, increasing health consciousness, and supportive regulatory frameworks are accelerating market growth, positioning Canada as the fastest-growing country in the region.

Mexico Soy Protein Concentrate Market Insight

Mexico is expected to grow steadily from 2026 to 2033, driven by increasing use of soy protein concentrate in processed foods, animal feed, and affordable protein-rich food formulations. Growing urbanization, rising demand for cost-effective nutritional ingredients, and expansion of the local food processing sector are supporting consistent market demand. Improved supply chain integration with North American producers and gradual adoption of plant-based protein ingredients are strengthening market penetration. Continued growth in food manufacturing and livestock nutrition applications is contributing to stable soy protein concentrate market growth throughout the forecast period.

North America Soy Protein Concentrate Market Share

The soy protein concentrate industry is primarily led by well-established companies, including:

- Cargill Incorporated (U.S.)

- DuPont (U.S.)

- ADM (U.S.)

- THE VINCENT CORPORATION (U.S.)

- Wilmar International Ltd (Singapore)

- Batory Foods (U.S.)

- Nordic Soya Oy (Finland)

- Aminola (U.S.)

- Crown Soya Protein Group Company (China)

- Solbar Ningbo Protein Technology Co., Ltd (China)

- Victoria Group (Serbia)

- Yuwang (China)

- Shandong Yuxin Biotechnology Co., Ltd (China)

- Gushen Biotechnology Group Co., Ltd. (China)

- Arshine Pharmaceutical Co., Limited (China)

- Tianwei Biotech Group Co., Ltd. (China)

- Foodchem International Corporation (China)

Latest Developments in North America Soy Protein Concentrate Market

- In May 2025, Bunge introduced a new line of soy protein concentrates at IFFA, scheduled for launch in the fall. These concentrates are designed to tackle key formulation challenges in the plant-based protein sector by offering a clean taste, neutral color, and cost-efficiency. This strategic product expansion is expected to enhance Bunge’s market presence and drive greater adoption of soy protein concentrate among food manufacturers seeking scalable, high-performance ingredients

- In February 2024, Amfora announced the commercial launch of its first-generation ultra-high plant protein products. This entry into the market strengthens the competitive landscape and supports the rising demand for sustainable, nutrient-dense ingredients. Amfora’s innovation is likely to accelerate the growth of soy protein concentrate usage in functional and fortified food categories

- In June 2023, Nutra Ingredients launched a new soy protein concentrate enriched with essential amino acids, targeting the sports nutrition market. This innovative product promises enhanced muscle recovery and growth benefits, broadening the application of soy protein concentrates within the sports nutrition industry

- In February 2022, Benson Hill launched its TruVail soy protein ingredient portfolio, featuring distinct sustainability advantages tailored for diverse food applications. This launch marked a significant move toward integrating environmental stewardship with food innovation. The sustainability-focused approach is contributing to increased market interest in clean-label and eco-conscious soy protein solutions, reinforcing consumer and manufacturer alignment with responsible sourcing practices

- In July 2020, DuPont expanded its Danisco Planit portfolio with the launch of new products such as Response Textured Soy Protein Concentrates and Alpha Functional soy protein concentrates, catering to diverse applications and enhancing its soy protein concentrate offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Soy Protein Concentrate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Soy Protein Concentrate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Soy Protein Concentrate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.