North America Sports Medicine Market

Market Size in USD Billion

CAGR :

%

USD

2.95 Billion

USD

5.42 Billion

2022

2030

USD

2.95 Billion

USD

5.42 Billion

2022

2030

| 2023 –2030 | |

| USD 2.95 Billion | |

| USD 5.42 Billion | |

|

|

|

|

North America Sports Medicine Market Analysis and Size

Increased participation in athletics and other sporting activities is one of the primary factors driving market growth. As a result of the general public's growing awareness of health issues, athletics has gained acceptance as a viable means of maintaining physical fitness and combating lifestyle disorders. As a result, the number of sports-related injuries and muscle rips has increased, necessitating the use of more treatment procedures and therapeutic products.

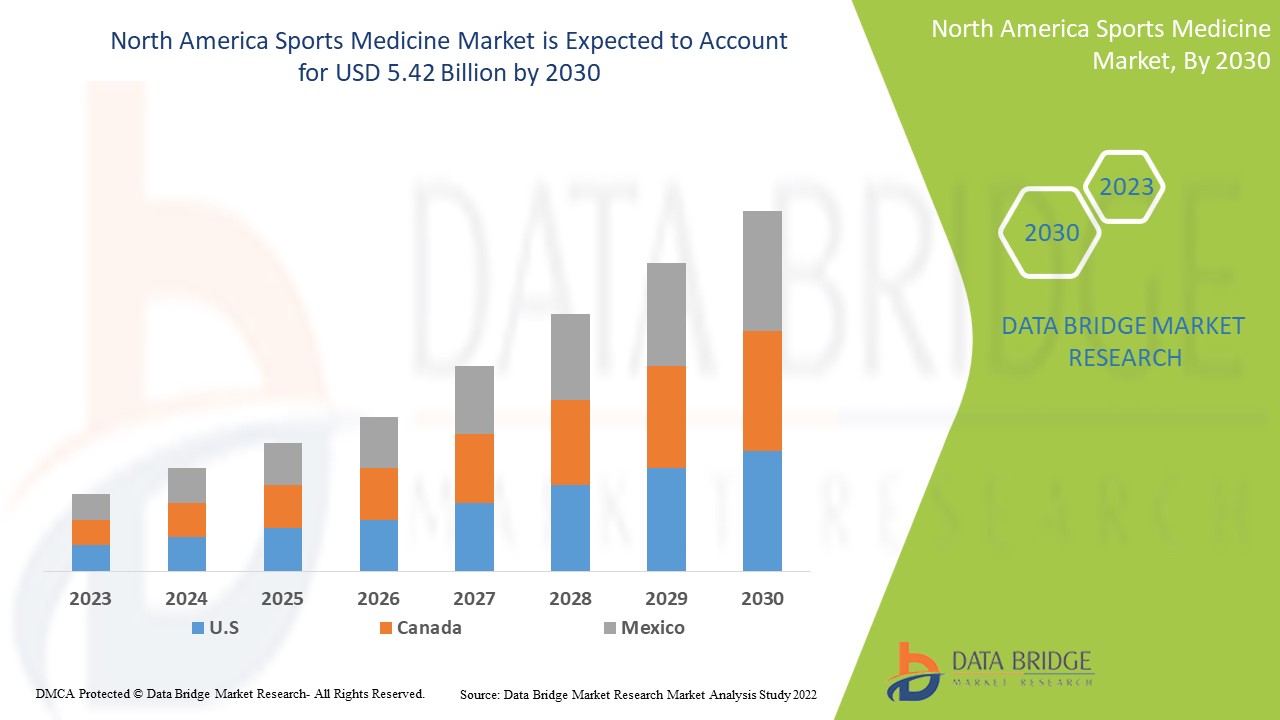

Data Bridge Market Research analyses that the sports medicine market which was USD 2.95 billion in 2022, would rocket up to USD 5.42 billion by 2030, and is expected to undergo a CAGR of 7.90% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Sports Medicine Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Products (Body Reconstruction Products, Body Support and Recovery Products), Application (Knee, Hip, Shoulder and Elbow, Foot and Ankle, Hand and Wrist, Back and Spine Injuries, Other Injuries), Procedure (Knee Arthroscopy Procedures, Hip Arthroscopy Procedures, Shoulder and Elbow Arthroscopy Procedures, Foot and Ankle Arthroscopy Procedures, Hand and Wrist Arthroscopy Procedures, Others), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Arthrex, Inc (U.S.), Smith+Nephew (U.K.), Stryker (U.S.), Breg Inc. (U.S.), DJO LLC (U.S.), Mueller Sports Medicine, Inc (US), Wright Medical Group N.V. (U.S.), Medtronic (Ireland), RTI Surgical (U.S.), Performance Health (U.S.), KARL STORZ (Germany), Bauerfeind (Germany), Össur (Iceland), MedShape (U.S.), Cramer Products (U.S.), Agilent Technologies, Inc ( India), RôG Sports Medicine (U.S.) |

|

Market Opportunities |

|

Market Definition

Sports medicine is a branch of medicine that focuses on preventing and treating sports-related injuries and diseases. Implants, fracture and ligament repair products, arthroscopy devices, prosthetics, orthobiologics, and body support and recovery products such as braces and supports, compression clothing, physiotherapy equipment, thermal therapy, electrostimulation, and accessories are all part of sports medicine.

North America Sports Medicine Market Dynamics

Drivers

- Rising Incidence of sports-related Injuries

Sports injuries are extremely common in North America. For instance, the Guangzhou Summer Asian Games in 2010 reported 725 injuries among 430 athletes. There were 288 new injuries in 209 athletes, with an incidence rate of 45.5 injuries per 1,000 athletes exposed. Soccer is the most popular sport in Australia, and more than 3,000 athletes from more than 13,000 clubs were admitted to hospitals between 2011 and 2012, with 22 members per team. During the forecast period, over 36,000 Australians aged 15 and up were hospitalised due to sports injuries. As a result, the region's high rate of sports injury is likely to drive the country's sports medicine market.

- Rising ankle and knee injuries

According to a study published in Plos One Journal 2019 by Yasuharu Nagano et al., a longitudinal survey of 29 female college swimmers in Japan found that the prevalence of shoulder injuries was 16.0%, knee injuries were 9.9%, and ankle injuries were 9.0%. Furthermore, ankle injuries are common among athletes in the Asia-Pacific region. Ligament damage is frequently caused by stumbling, an incorrect push-off, or over-rotation. A brace can be extremely helpful in preventing an ankle injury. As a result of the above-mentioned factors, it boosts the market growth.

Opportunities

- Expansion and market penetration opportunities in emerging economies

Emerging countries such as India and China have a huge patient population and are likely to offer substantial growth prospects for sports medicine players, owing to rising disposable incomes (as a result of rapid economic expansion) and increased engagement in sports and physical activities. In addition, governments in these countries are currently working to expand and modernize their healthcare systems. In the near years, untapped markets and shifting regulatory conditions for medicine are likely to create a replacement opportunity for the sports medicine sector.

Restraints/Challenges

- Dearth of Trained Professional

Sports medicine is a relatively new branch of medicine that focuses on the reconstruction, repair, and rehabilitation of injuries sustained during sporting events. There is a shortage of appropriately skilled professionals and with the rapid increase in the number of sports-related injuries, the need to address them is unmet, because fewer people specialize in this field. As a result, it is a significant restraint in the sports medicine market.

This sports medicine market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the sports medicine market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Sports Medicine Market

COVID-19 had a negative impact on the market. This was due to a decrease in demand for sports medicine. The initial drop in demand was caused by a decrease in sports competitions and activities as a result of strict global lockdowns in 2020. Furthermore, pharmaceutical manufacturing was disrupted during the initial wave of the pandemic, resulting in a negative impact in 2020. The sports medicine industry is expected to recover in 2021, because of increased demand and relaxations in lockdowns, which has resulted in an increase in the number of sporting activities around the world.

Recent Development

• On February 8, 2022, DJO Global announced the renewal of its partnership with the Professional Football Athletic Trainers Society (PFATS). The Professional Football Athletic Trainers Society (PFATS) is a professional football athletic trainers organisation. PFATS will recommend and endorse specific DJO products as part of its collaboration with DJO.

• In June 2020, Smith & Nephew acquired CE mark approval for the Regeneten Bioinductive Implant, allowing it to be sold in key European markets.

North America Sports Medicine Market Scope

The sports medicine market is segmented on the basis of product, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Body Reconstruction

- Fracture and Ligament Repair Products

- Arthroscopy Devices

- Implants

- Orthobiologics

- Prosthetics

- Body Support and Recovery

- Braces and Supports

- Physiotherapy

-

- Thermal Therapy

- Ultrasound Therapy

- Laser Therapy

- Electrostimulation Therapy

- Body Monitoring and Evaluation

- Cardiac Monitoring

- Respiratory Monitoring

- Hemodynamic Monitoring

- Musculoskeletal Monitoring

- Compression Clothing

- Accessories

- Bandages

- Disinfectants

- Tapes

- Others

Application

- Knee Injuries

- Shoulder Injuries

- Foot and Ankle Injuries

- Hip and Groin Injuries

- Elbow and Wrist Injuries

- Back and Spine Injuries

- Others

End-User

- Hospitals

- Orthopedic Specialty Clinics

- Fitness and Training Centers

- Ambulatory Surgical Centers (ASCs)

- Others

Sports Medicine Market Regional Analysis/Insights

The sports medicine market is analysed and market size insights and trends are provided by country, product, application and end-user as referenced above.

The countries covered in the sports medicine market report are U.S., Canada and Mexico in North America.

North America is expected to dominate the sports medicine market because of the increasing government initiative to encourage athletes to participate in any sport. In addition, many manufacturers are introducing new and advanced technology-based sports medicine in the region. The United States is expected to dominate and lead the growth of the market, which is expected to grow due to an increase in sports injuries among athletes.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Sports Medicine Market Share Analysis

The sports medicine market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to sports medicine market.

Some of the major players operating in the sports medicine market are:

- Arthrex, Inc (U.S.)

- Smith+Nephew (U.K.)

- Stryker (U.S.)

- Breg Inc. (U.S.)

- DJO LLC (U.S.)

- Mueller Sports Medicine, Inc (U.S.)

- Wright Medical Group N.V. (U.S.)

- Medtronic (Ireland)

- RTI Surgical (U.S.)

- Performance Health (U.S.)

- KARL STORZ (Germany)

- Bauerfeind (Germany)

- Össur (Iceland)

- MedShape (U.S.)

- Cramer Products (U.S.)

- Agilent Technologies, Inc (India)

- RôG Sports Medicine (U.S.)

Research Methodology: North America Sports Medicine Market

Data collection and base year analysis is done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more please request an analyst call or can drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.