North America Veterinary Medicine Market

Market Size in USD Billion

CAGR :

%

USD

19.17 Billion

USD

31.73 Billion

2024

2032

USD

19.17 Billion

USD

31.73 Billion

2024

2032

| 2025 –2032 | |

| USD 19.17 Billion | |

| USD 31.73 Billion | |

|

|

|

|

North America Veterinary Medicine Market Analysis

The North America veterinary medicine market is expanding rapidly, driven by increasing pet ownership, rising animal health awareness, and advancements in veterinary care. The demand for specialized treatments, vaccines, antibiotics, and anti-inflammatory medications is growing, alongside the need for better disease prevention and management in both companion animals and livestock. Technological advancements, such as biologics and digital diagnostic tools, are further enhancing treatment options. In addition, the increasing prevalence of zoonotic diseases and the focus on preventive care contribute to market growth. With rising spending on pet healthcare and livestock management, the veterinary medicine market is poised for sustained expansion.

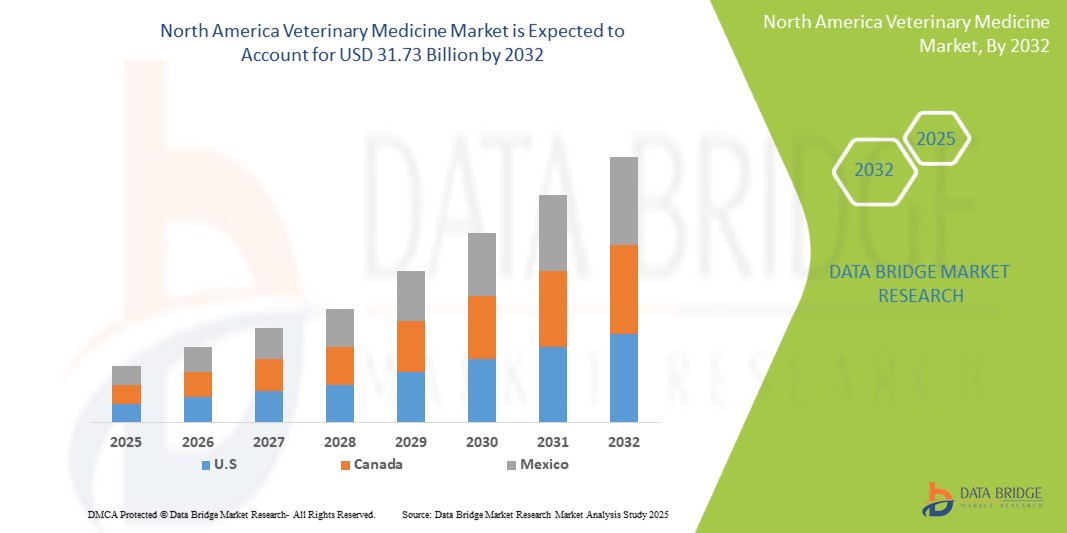

North America Veterinary Medicine Market Size

The North America veterinary medicine market is expected to reach USD 31.73 billion by 2032 from USD 19.17 billion in 2024, growing at a CAGR of 6.5% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

North America Veterinary Medicine Market Trends

“Increase in Pet Ownership and Advancements”

The North America veterinary medicine market is witnessing significant growth driven by increasing pet ownership, rising animal health awareness, and advancements in veterinary care. The market is shifting toward more specialized treatments for both companion animals and livestock. A growing demand for vaccines, antibiotics, and anti-inflammatory medications is leading to innovations in drug formulations, contributing to better disease prevention and management. The increasing adoption of preventive care practices, such as routine vaccinations and health check-ups, further boosts the market. Moreover, the surge in zoonotic diseases and the need for better disease control in livestock farming are propelling the demand for veterinary medicines.

Report Scope and North America Veterinary Medicine Market Segmentation

|

Attributes |

North America Veterinary Medicine Market Insights |

|

Segments Covered |

|

|

Region Covered |

U.S., Canada, Mexico |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Veterinary Medicine Market Definition

The North America veterinary medicine market encompasses the development, production, and distribution of pharmaceutical products, vaccines, diagnostics, and medical devices aimed at preventing, diagnosing, and treating diseases in animals. It serves both companion animals (such as pets) and livestock (including cattle, poultry, and swine). This market is driven by factors like increasing pet ownership, demand for animal-derived food, heightened awareness of animal health, and technological advancements. It includes products like drugs, vaccines, and parasiticides, with growth fueled by innovations in biotechnology, regulatory standards, and a focus on food safety, quality, and animal welfare worldwide.

North America Veterinary Medicine Market Dynamics

Drivers

- Increasing Pet Ownership Boosts Demand for Veterinary Services

The Global veterinary medicine market has experienced significant growth in recent years, driven by an increasing trend in pet ownership and a growing awareness of animal care. As more individuals and families welcome pets into their homes, there is a heightened recognition of the need for professional veterinary services to ensure the health and well-being of these animals. Pet owners are becoming more conscious of the importance of regular veterinary check-ups, preventive care, vaccinations, and early detection of diseases, prompting a surge in demand for veterinary medicines and treatments. In addition, the rise in animal healthcare awareness has led to greater acceptance and adoption of advanced diagnostic tools, therapeutic interventions, and specialized treatments that improve the quality of life for pets. This growing awareness extends beyond traditional pets like dogs and cats, as pet ownership now includes exotic animals, birds, and other species, further diversifying the veterinary medicine market. The increase in disposable income, especially in emerging economies, has allowed more pet owners to afford and prioritize veterinary care, fueling market growth. The expanding pet insurance market also plays a role in driving demand for veterinary medicines, as pet owners seek to protect their pets against unexpected medical expenses. Moreover, the shift towards e-commerce and online veterinary consultations has provided greater accessibility to veterinary products, creating a broader global market for both prescription and over-the-counter veterinary medications. This combination of increased pet ownership, greater awareness of animal health, and advancements in veterinary medicine has created a dynamic and rapidly evolving market, positioning veterinary medicine as a key segment within the broader healthcare industry.

For instance,

- In September 2021, according to the article published by ReserchGate India's growing pet industry is fueled by increasing awareness of pet care, lifestyle changes, and rising incomes. Pet owners, treating pets as family, invest in health, food, and accessories. Factors like urbanization, pet humanization, and evolving consumer preferences drive this growth, leading to higher pet ownership and awareness.

- In May 2023, according to the article published by the Times of India , India's growing awareness of animal welfare is driven by the Prevention of Cruelty to Animals Act, 1960, and initiatives like the Animal Birth Control program. NGOs, such as People for Animals and the Blue Cross of India, actively promote animal protection, rescue efforts, and education, fostering greater pet ownership and care awareness.

In conclusion, the Global veterinary medicine market has experienced substantial growth, largely driven by the increasing trend of pet ownership and a heightened awareness of animal care. As more people adopt pets, they recognize the critical need for professional veterinary services, leading to a surge in demand for veterinary medicines, treatments, and preventive care. This shift towards proactive animal health has also spurred the adoption of advanced diagnostic tools and specialized treatments, benefiting a wider range of pets, including exotic animals and birds. The growing disposable income in emerging economies and the expanding pet insurance market further contribute to this growth, allowing pet owners to prioritize their pets’ healthcare. In addition, the rise of e-commerce and online consultations has improved accessibility to veterinary products, broadening the market for both prescription and over-the-counter medications. Ultimately, the increasing focus on pet health, along with continuous advancements in veterinary medicine, has positioned this sector as a key player in the broader healthcare industry.

- Rising Animal Diseases Drive Need for Advanced Veterinary Care

The rise in animal diseases, particularly infectious and chronic conditions, has become a significant driver of growth in the Global veterinary medicine market. As diseases like canine parvovirus, feline leukemia, and emerging zoonotic diseases such as avian influenza and swine flu continue to impact both domestic and livestock animals, there is an increased demand for veterinary treatments and preventive measures. The growing prevalence of chronic conditions like arthritis, diabetes, and obesity in pets, alongside a rise in infectious disease outbreaks, has underscored the importance of early detection, vaccination, and continuous management, further driving the need for advanced veterinary care. In addition, the rise in diseases has placed greater emphasis on biosecurity measures, diagnostic testing, and the development of new vaccines and therapeutics, leading to an uptick in veterinary pharmaceutical innovations. As the global animal population increases, particularly in densely populated urban areas, the spread of diseases becomes more likely, necessitating the ongoing development and deployment of veterinary medicines to mitigate health risks. The increasing frequency of disease outbreaks, combined with greater public awareness of the importance of animal health, has spurred investments in research and development, advancing veterinary medicine to address a wide range of animal health challenges. As a result, the demand for veterinary products—ranging from antibiotics and antivirals to vaccines and nutraceuticals—is expected to continue growing, solidifying the veterinary medicine market as a vital segment of the global healthcare industry.

For instance,

- In June 2022, according to the article published by NCBI, Zoonotic diseases, responsible for millions of human illnesses and deaths annually, pose significant public health risks, as seen with the SARS-CoV-2 pandemic. These diseases impact human, animal, and environmental health, causing economic damage through healthcare costs, lost livestock production, and ecosystem disruption, emphasizing the need for effective prevention strategies.

- In June 2021, according to the article published by Indian Journal of Medical Research, increased human-animal contact, driven by deforestation, wildlife product demands, and agricultural practices, facilitates the emergence of zoonotic diseases like COVID-19. These outbreaks cause significant health and economic losses. Inadequate public health systems and lack of interdisciplinary approaches highlight the need for comprehensive policies focusing on wildlife protection, land use, and disease prevention.

The rise in animal diseases, both infectious and chronic, is significantly driving growth in the global veterinary medicine market. Conditions like canine parvovirus, feline leukemia, and emerging zoonotic diseases are increasing the demand for veterinary treatments and preventive care. Chronic illnesses such as arthritis and diabetes are also more common, prompting a need for continuous management and early detection. This has led to greater investments in biosecurity, diagnostic testing, vaccines, and therapeutics. As disease outbreaks become more frequent, especially in urban areas, the demand for veterinary medicines continues to rise, making veterinary care a critical segment of global healthcare.

Opportunities

- Increasing Number Of Animals Leading To The Demand Of Veterinary Medicine

The increasing number of animals, particularly in the livestock sector, provides a significant opportunity for the Global veterinary medicine market. With the rising global population and the corresponding demand for meat, dairy, and other animal products, there is an urgent need for efficient, productive, and healthy livestock. As farmers strive to maximize productivity and ensure animal welfare, the demand for veterinary services and products such as vaccines, antibiotics, and nutritional supplements is set to rise. This growth is further driven by the need to prevent disease outbreaks and ensure food safety, which are critical to maintaining both public health and animal health. Consequently, as the number of livestock animals continues to increase, veterinary medicine will play a crucial role in supporting this industry.

For instance,

- In March 2021, according to an article published in the Frontiers in Veterinary Science, there are about one billion goats worldwide, and the global goat population has more than doubled during the last four decades. According to the Food and Agriculture Organization, over 90% of goats are found in developing countries; Asia has the largest proportion of the world's goat population, followed by Africa

Moreover, advancements in agricultural practices and the shift towards intensive farming systems are creating additional opportunities within the veterinary medicine market. As farms grow larger and more complex, the health management strategies required to maintain high standards of animal welfare and biosecurity become increasingly sophisticated. This progress opens up avenues for innovative veterinary technologies, including diagnostic tools and health monitoring systems that help farmers identify and mitigate health risks promptly. In addition, the growing emphasis on sustainable farming practices and responsible use of medications is driving the development of more targeted and eco-friendly veterinary products. This alignment of veterinary medicine with evolving agricultural practices generates a fertile ground for growth, innovation, and collaboration among veterinarians, farmers, and pharmaceutical companies.

- Growth In Animal Health Biotechnology

The growth in animal health biotechnology presents a significant opportunity for the Global veterinary medicine market by facilitating the development of innovative and targeted solutions for animal health management. Advancements in biotechnology, such as genetic engineering, gene therapy, and immunology, enable the creation of vaccines tailored to specific diseases, improving their efficacy and safety. This shift towards biotechnological approaches addresses the increasing concerns over antibiotic resistance in livestock, as biotechnology can lead to the development of alternatives to traditional antibiotics, thereby ensuring healthier animals and enhancing food safety. As consumers demand safer and higher-quality animal products, the application of biotechnology in veterinary medicine can meet these expectations while facilitating more sustainable agricultural practices.

For instance,

- In September 2023, according to an article published by ResearchGate, Animal biotechnology represents a cutting-edge field that has revolutionized our interactions with the animal kingdom. Recent advancements encompass various domains, including genetic editing techniques like CRISPR-Cas9, which allow precise genetic modifications for improved animal health and product quality.

- In August 2024, according to an article published by the National Institute of Food and Agriculture, Advances in animal biotechnology have been facilitated by recent progress in sequencing animal genomes, gene expression and metabolic profiling of animal cells. More recently, genome editing technologies (Zinc Finger Nucleases, TALENS, and CRISPR-Cas systems) have opened up new opportunities to easily create genetic variations in animals that can improve their health and well-being, agricultural production, and protection against diseases.

In addition, the integration of biotechnology into animal health fosters improved diagnostics and treatments that can enhance animal welfare and productivity. Tools derived from biotechnological advancements, such as molecular diagnostics and biomarker identification, allow for more precise disease detection and monitoring, enabling veterinarians to implement timely interventions. This not only benefits the health of the animals but also reduces economic losses for farmers due to disease outbreaks and suboptimal productivity. The growing emphasis on precision veterinary medicine—leveraging data to tailor interventions—further amplifies the demand for biotechnological innovations. As a result, stakeholders in the Global Veterinary Medicine Market—including pharmaceutical companies, researchers, and technology developers—stand to gain significantly as they invest in and harness the potential of animal health biotechnology to improve outcomes for both animals and the agricultural sector as a whole.

Restraints/Challenges

- High Veterinary Care Costs Limit Market Accessibility

The high cost of veterinary care represents a significant restraint on market accessibility, directly impacting both pet owners and livestock producers globally. For pet owners, the expense associated with advanced diagnostics, surgeries, and specialty care often leads to difficult healthcare decisions, with many opting for cost-effective solutions or delaying necessary treatments for their animals. This has driven a growing demand for affordable alternatives such as over-the-counter medications, preventive care treatments, and vaccines. In addition, pet insurance has become a more popular option to offset the financial burden of veterinary services. In parallel, livestock producers, particularly in developing economies, face financial constraints that hinder their ability to access the full spectrum of veterinary care required to maintain optimal animal health. This limitation affects the quality of care they can provide to their animals, leading to an increased need for more cost-efficient solutions like generic medications, nutraceuticals, and vaccines for disease prevention. The high costs also spur innovation within the veterinary industry as companies seek to develop affordable treatments that do not sacrifice quality. Furthermore, as veterinary care becomes more specialized and reliant on advanced technologies, the focus is shifting toward streamlining services and implementing preventive care models. These models aim to reduce long-term costs for both pet owners and agricultural producers, emphasizing the importance of cost efficiency in shaping the evolution of the veterinary medicine market. Despite these efforts, the high cost of veterinary services remains a major barrier, limiting accessibility and influencing the growth trajectory of the market.

For instance,

- In July 2024, according to the article published by NCBI, veterinary procedure costs, such as dog and cat GDY, saw significant increases between autumn 2022 and winter 2023/2024, with prices rising by 2–24%. Emergency surgeries and equine GDY also experienced sharp cost hikes, highlighting the financial burden of veterinary care, with substantial price variations across countries and procedures.

- In July 2020, according to the article published by NCBI, despite the growing popularity of dog ownership, veterinary visits have declined, while the average cost per visit has risen from USD 138 to USD 161. Increased labor costs, medical supplies, and equipment contribute to the higher expenses. Pet health insurance also raises veterinary spending, impacting pet owners’ overall care costs.

In conclusion, the high cost of veterinary care is a significant driver in the global veterinary medicine market, influencing both pet owners and livestock producers to seek more affordable and accessible solutions. This has led to a rising demand for cost-effective products such as vaccines, preventive treatments, and generics. In addition, the high costs are encouraging innovation within the industry, with a focus on developing affordable, quality treatments and streamlining services. As both pet and livestock owners seek to manage expenses, the demand for economical veterinary care options will continue to shape the growth and evolution of the veterinary medicine market.

- Challenges Of Regulatory Compliance And Complexity

Regulatory and compliance issues are significant challenges in the Global veterinary medicine market due to the complex, region-specific requirements that companies must navigate to ensure their products meet safety standards and are approved for use. Different countries and regions have varying regulatory bodies, each with its own set of guidelines for the approval of veterinary medicines. For instance, in the U.S., the Food and Drug Administration (FDA) is responsible for ensuring the safety and efficacy of veterinary products, while in the European Union, the European Medicines Agency (EMA) regulates these products. These regulatory bodies often have rigorous and time-consuming approval processes, including extensive testing, documentation, and periodic reviews, which can delay the launch of new veterinary medicines.

Moreover, the increasing focus on animal welfare and environmental safety has introduced additional layers of complexity. Compliance with these regulations often requires manufacturers to conduct more comprehensive research, including animal testing and long-term safety assessments, which can be costly and time-consuming. In certain countries, regulations may be stricter or less transparent, creating uncertainties and slowing down market entry. Companies must also adapt their products to meet different regulatory frameworks for different markets, which can further complicate product distribution and increase operational costs.

For instance,

- In July 2024, according to an news published by Rebexa Group, Navigating diverse regulatory requirements across regions creates significant challenges for the global veterinary medicine market. Varying approval processes, safety standards, and animal welfare regulations increase costs and delay product launches. Emerging concerns, like antimicrobial resistance, lead to evolving guidelines, further complicating compliance and hindering the market's growth potential.

- In July 2021, according to an article published by ScienceDriect the complexities of global veterinary medicine regulations, noting that each country, such as the USA, EU, and Australia, has different approval processes and safety standards. The absence of unified frameworks for zoonotic diseases, veterinary drug stockpiling, and pharmacovigilance centers in many nations adds to the challenge, hindering market development and consistency in veterinary care globally.

Regulatory and compliance challenges create significant barriers to entry, delay product availability, and increase costs for companies in the veterinary medicine market. Addressing these obstacles through streamlined processes and international regulatory harmonization could alleviate some of the pressure, enabling faster market access, better alignment with animal health needs, and ultimately improved animal welfare worldwide.

North America Veterinary Medicine Market Scope

North America veterinary medicine market is segmented into five notable segments based on type, application, animal type, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Therapeutics

- Pharmaceuticals

- Antibiotics

- Tetracycline

- Penicillins

- Macrolides

- Aminoglycosides

- Lincosamides

- Colistin

- Others

- Parasiticides

- Benzimidazoles

- Macrocyclic Lactones

- Pyrethroids

- Amprolium

- Nitroimidazoles

- Piperazine

- Others

- Anlagesics/Anti-Inflammatory (Nsaids)

- Carprofen

- Meloxicam

- Phenylbutazone

- Acetaminophen

- Firocoxib

- Deracoxib

- Others

- Antihistamines

- Cetirizine

- Brompheniramine

- Diphenhydramine

- Terfenadine

- Trimeprazine

- Others

- Corticosteroids

- Dexamethasone

- Prednisolone

- Prednisone

- Others

- Antibloat

- Docusate

- Simethicone

- Others

- Hormonal

- Equine Chorionic Gonadotropin

- Cloprostenol

- Oxytocin

- Others

- Antibiotics

- Opioids

- Mu Agonists

- Methadone

- Meperidine

- Morphine

- Oxymorphone

- Others

- Partial Mu Agonist

- Buprenorphine

- Others

- Kappa Agonist-Mu Anatgonist

- Butorphanol

- Others

- Mu Agonists

- Others

- Branded

- Generic

- Prescription Based

- Over The Counter

- Oral

- Tablets

- Solutions

- Powder

- Others

- Parental

- Intraveneous

- Subcutaneous

- Others

- Topical

- Others

- Pharmaceuticals

- Vaccines

- Live Attenuated Vaccines

- Toxoid Vaccines

- Recombinant Vaccines

- Inactivated Vaccines

- Others

- Biologics

- Marketed

- Toceranib

- Lomustine

- Cyclophosphamide

- Chlorambucil

- Others

- Emerging

- Marketed

- Medicated Feed Additives

- Enzymes

- Phytase

- Carbohydrase

- Protease

- Amylase

- Cellulase

- Mannase

- Glucanase

- Xylanase

- Others

- Enzymes

- Amino Acid

- Lysine

- Methionine

- Threonine

- Tryptophan

- Others

- Vitamins

- Fat-Soluble Vitamin

- Vitamin A

- Vitamin E

- Vitamin D

- Vitamin K

- Water-Soluble Vitamin

- Vitamin B Complex

- Vitamin C

- Fat-Soluble Vitamin

- Antioxidants

- Bha

- Bht

- Ethoxyquin

- Others

- Probiotics

- Lactobacilli

- Bifidobacteria

- Yeast

- Stretococcus Thermophilus

- Feed Acidifiers

- Propionic Acid

- Formic Acid

- Lactic Acid

- Citric Acid

- Others

- Mycotoxin Detoxifiers

- Mycotoxin Binders

- Silicates

- Clays

- Chemical Polymers

- Glucan Products

- Others

- Mycotoxin Modifiers

- Mycotoxin Binders

- Phytogenic

- Essential Oils

- Herbs & Spices

- Oleoresin

- Others

- Carotenoids

- Beta-Carotene

- Astaxanthin

- Lutein

- Canthaxanthin

- Trace Minerals

- Zinc

- Copper

- Manganese

- Iron

- Selenium

- Others

- Preservatives

- Anticaking Agents

- Mold Inhibitors

- Flavours And Sweeteners

- Flavours

- Sweeteners

- Saccharin

- Neohesperidin Dihydrochalcone

- Glycyrrhizin

- Thaumatin

- Others

- Others

- Diagnostics

- Instruments & Devices

- Imaging Devices

- X-Ray Imaging (Radiography)

- Small Animals

- Large Animals

- Ultrasound

- Small Animals

- Large Animals

- Computed Tomography

- Small Animals

- Large Animals

- Magnetic Resonance Imaging

- Small Animals

- Large Animals

- Single-Photon Emission Computed Tomography (Spect)

- Small Animals

- Large Animals

- Others

- X-Ray Imaging (Radiography)

- Imaging Devices

- Instruments & Devices

- Laboratory Instruments

- Hematology Analyzers

- Automatic

- Semi-Automatic

- High Price Range

- Standard Price Range

- Benchtop

- Portable

- Others

- Chemistry Analyzers

- Automatic

- Semi-Automatic

- Benchtop

- Portable

- Blood

- Urine

- Stool

- Others

- Point-Of-Care Instruments

- Lateral Flow Poct

- Molecular Poct

- Others

- Coagulation Analyzers

- Automatic

- Semi-Automatic

- 4-Channel

- 1-Channel

- Whole Blood

- Plasma

- Benchtop

- Portable

- Urinalysis Equipment

- Automatic

- Semi-Automatic

- Refractometer

- Optical

- Digital

- Benchtop

- Portable

- Others

- Hematology Analyzers

- Reagents & Consumables

- Kits

- Pcr Kits

- Rapid Test Kits

- Multiplex Kits

- Elisa Kits

- Sample Preparation Kits Isolation And Extraction Kits

- Others

- Reagents

- Nucleic Acid Extraction Reagents

- Immunofluorescence Reagents

- Coombs Reagents

- Others Reagents

- Kits

- Media

- Panel

- Strips

- Cassette

- Control Standards

- Probes And Primer

- Others Consumable And Accessories

Application

- Bacterial Diseases

- Production Animals

- Companion Animals

- Canine Atopic Dermatitis

- Companion Animals

- Production Animals

- Heminthes Infection

- Production Animals

- Companion Animals

- Animal Cancer

- Companion Animals

- Production Animals

- Foot And Mouth Disease

- Production Animals

- Companion Animals

- Autoimmune Diseases

- Companion Animals

- Production Animals

- Bluetongue

- Production Animals

- Companion Animals

- Others

- Companion Animals

- Production Animal

Animal Type

- Companion Animals

- Dogs

- Cats

- Horses

- Others

- Production Animal

- Poultry

- Cattle

- Swine

- Fish

- Sheep & Goats

- Others

End User

- Veterinary Hospitals

- Private

- Public

- Tier 2

- Tier 1

- Tier 3

- Veterinary Clinics

- Public

- Private

- Animal And Veterinary Farms

- Reference Laboratories

- Academic And Research Institute

- Point-Of-Care Testing/In-House Testing

- Others

Distribution Channel

- Retail Sales

- Offline

- Hospital Pharmacy

- Retail Pharmacy

- Online

- E-Commerce Platforms

- Company Website

- Others

- Offline

- Direct Tender

- Others

North America Veterinary Medicine Market Regional Analysis

The market is analyzed and market size insights and trends are provided based on country, type, application, animal type, end user, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, Mexico.

U.S. is expected to dominate the North America veterinary medicine market due to technological advancements, strategic investments, and expanding pharmaceutical exports. Its competitive pricing and innovation in animal healthcare solutions are helping it gain a strong foothold, challenging local players and reshaping the region's veterinary landscape.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Veterinary Medicine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Veterinary Medicine Market Leaders Operating in the Market Are:

- Zoetis Services LLC (U.S.)

- Merck & Co., Inc. (U.S.)

- Elanco or its affiliates (U.S.)

- C.H. Boehringer Ingelheim International GmbH (Germany)

- IDEXX LABORATORIES, INC (Germany)

- AB Science (France)

- AdvaCare Pharma (U.S.)

- ALMAX IMAGING srl (Italy)

- Anivive (U.S.)

- BIOMÉRIEUX (France)

- Bionote USA Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- CANON MEDICAL SYSTEMS EUROPE B.V. (Japan)

- Cargill, Incorporated (U.S.)

- Ceva (France)

- CureLab Oncology (U.S.)

- Dechra Pharmaceuticals Limited (UK)

- Demeditec Diagnostics GmbH (Germany)

- DHN International (U.S.)

- Diagnostic Imaging Systems (U.S.)

- ESAOTE SPA (Italy)

- Eurofins Scientific (Luxembourg)

- Evonik Industries AG (Germany)

- FUJIFILM Holdings Corporation (Japan)

- Gold Standard Diagnostics (U.S.)

- Hallmarq Veterinary Imaging (UK)

- Hebei Veyong Pharmaceutical Co., Ltd. (China)

- Heska Corporation (U.S.)

- IBIS S.R.L. (Italy)

- Karyopharm (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- Narang Medical Limited (India)

- Neogen Corporation (U.S.)

- NIPPON ZENYAKU KOGYO CO., LTD. (Japan)

- Novavive Inc. (U.S.)

- Nutreco (Netherlands)

- PLANMECA OY (Finland)

- RINGPU BIOLOGY Co., Ltd. (China)

- Shenzhen SONTU Medical Imaging Equipment Co., Ltd (China)

- Thermo Fisher Scientific Inc. (U.S.)

- Torigen Pharmaceuticals Inc. (U.S.)

- VetDC (U.S.)

- Vetoquinol (France)

- Virbac (France)

- VMRD, Inc. (U.S.)

Latest Developments North America Veterinary Medicine Market

- In February 2023 , Vetoquinol introduces Lygoferrin, a scientifically formulated, natural immunity booster designed to strengthen defense mechanisms in animals. This innovative product enhances resistance against infections by supporting the body's innate immune response. Lygoferrin helps reduce dependency on antibiotics, promoting overall health and well-being in livestock and companion animals. Its advanced formula ensures rapid absorption and effective protection, minimizing the risk of bacterial and viral infections. With this launch, Vetoquinol reinforces its commitment to sustainable animal health solutions, providing veterinarians and farmers with a reliable, natural alternative to enhance immunity and improve productivity in animal care

- In February 2023, Vetoquinol introduces Immun-C Aqua, an advanced water-soluble immune booster designed to enhance the health and resilience of aquatic species. This innovative formula strengthens disease resistance, improves overall vitality, and optimizes growth performance in fish and shrimp farming. By fortifying the immune system, Immun-C Aqua helps reduce mortality rates and enhances survival in challenging environments. With a scientifically developed composition, it ensures rapid absorption and effective action, contributing to sustainable and productive aquaculture. This launch underscores Vetoquinol’s commitment to providing high-quality, research-backed solutions for the aquaculture industry, supporting healthier aquatic livestock and improving farm profitability

- In January 2025 , Laurie Hueneke Martens, Associate VP of North America Public Policy and Government Relations at Merck Animal Health, received the 8th Annual Feather in Her Cap Award. Recognized for her leadership in public policy and mentoring future women leaders, Hueneke also saw a USD 5,000 donation made to her chosen animal charities

- In February 2024, Merck Animal Health announced that the European Commission has granted marketing authorization for BRAVECTO TriUNO, a new chewable tablet for dogs. This product targets both internal and external parasites, offering protection against fleas, ticks, gastrointestinal nematodes, heartworm, and angiostrongylosis. It is now approved in multiple countries, including Peru and Costa Rica

- In November 2024, Merck Animal Health announced the winners of the 2024 High-Quality Pork Pignnovation Award. Romain Delcombel of BioAZ won Champion, with Joao Lopes of Redsoft Technologica LTDA as Runner-Up and Jaap de Wit of Westfort in third. The awards recognize their innovative contributions to swine industry advancements in health, welfare, and sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA VETERINARY MEDICINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END USER COVERAGE GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 PIPELINE ANALYSIS

4.4 TOP ENTITIES BASED ON R&D GLANCE FOR VETERINARY MEDICINE MARKET

4.5 EPIDEMIOLOGY

5 NORTH AMERICA VETERINARY MEDICINE MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PET OWNERSHIP BOOSTS DEMAND FOR VETERINARY SERVICES

6.1.2 RISING ANIMAL DISEASES DRIVE NEED FOR ADVANCED VETERINARY CARE

6.1.3 VETERINARY MEDICINE ADVANCES IMPROVE DIAGNOSIS AND TREATMENT OPTIONS

6.1.4 RISING DEMAND FOR ANIMAL-DERIVED FOOD PRODUCTS INCREASES VETERINARY NEEDS

6.2 RESTRAINTS

6.2.1 HIGH VETERINARY CARE COSTS LIMIT MARKET ACCESSIBILITY

6.2.2 LACK OF AWARENESS ABOUT ANIMAL HEALTH LIMITS PROPER VETERINARY CARE ACCESS

6.3 OPPORTUNITIES

6.3.1 INCREASING NUMBER OF ANIMALS LEADING TO THE DEMAND OF VETERINARY MEDICINE

6.3.2 GROWTH IN ANIMAL HEALTH BIOTECHNOLOGY

6.3.3 GROWTH IN DEMAND FOR NUTRITIONAL SUPPLEMENTS

6.4 CHALLENGES

6.4.1 CHALLENGES OF REGULATORY COMPLIANCE AND COMPLEXITY

6.4.2 SHORTAGE OF VETERINARY PROFESSIONALS

7 NORTH AMERICA VETERINARY MEDICINE MARKET, BY TYPE

7.1 OVERVIEW

7.2 THERAPEUTICS

7.2.1 PHARMACEUTICALS

7.2.1.1 ANTIBIOTICS

7.2.1.1.1 TETRACYCLINE

7.2.1.1.2 PENICILLINS

7.2.1.1.3 MACROLIDES

7.2.1.1.4 AMINOGLYCOSIDES

7.2.1.1.5 LINCOSAMIDES

7.2.1.1.6 COLISTIN

7.2.1.1.7 OTHERS

7.2.1.2 PARASITICIDES

7.2.1.2.1 BENZIMIDAZOLES

7.2.1.2.2 MACROCYCLIC LACTONES

7.2.1.2.3 PYRETHROIDS

7.2.1.2.4 AMPROLIUM

7.2.1.2.5 NITROIMIDAZOLES

7.2.1.2.6 PIPERAZINE

7.2.1.2.7 OTHERS

7.2.1.3 ANALGESICS/ANTI-INFLAMMATORY (NSAIDS)

7.2.1.3.1 CARPROFEN

7.2.1.3.2 MELOXICAM

7.2.1.3.3 PHENYLBUTAZONE

7.2.1.3.4 ACETAMINOPHEN

7.2.1.3.5 FIROCOXIB

7.2.1.3.6 DERACOXIB

7.2.1.3.7 OTHERS

7.2.1.4 ANTIHISTAMINES

7.2.1.4.1 CETIRIZINE

7.2.1.4.2 BROMPHENIRAMINE

7.2.1.4.3 DIPHENHYDRAMINE

7.2.1.4.4 TERFENADINE

7.2.1.4.5 TRIMEPRAZINE

7.2.1.4.6 OTHERS

7.2.1.5 CORTICOSTEROIDS

7.2.1.5.1 DEXAMETHASONE

7.2.1.5.2 PREDNISOLONE

7.2.1.5.3 PREDNISONE

7.2.1.5.4 OTHERS

7.2.1.6 ANTIBLOAT

7.2.1.6.1 DOCUSATE

7.2.1.6.2 SIMETHICONE

7.2.1.6.3 OTHERS

7.2.1.7 HORMONAL

7.2.1.7.1 EQUINE CHORIONIC GONADOTROPIN

7.2.1.7.2 CLOPROSTENOL

7.2.1.7.3 OXYTOCIN

7.2.1.7.4 OTHERS

7.2.1.8 OPIOIDS

7.2.1.8.1 MU AGONISTS

7.2.1.8.1.1 METHADONE

7.2.1.8.1.2 MEPERIDINE

7.2.1.8.1.3 MORPHINE

7.2.1.8.1.4 OXYMORPHONE

7.2.1.8.1.5 OTHERS

7.2.1.8.2 PARTIAL MU AGONIST

7.2.1.8.2.1 BUPRENORPHINE

7.2.1.8.2.2 OTHERS

7.2.1.8.3 KAPPA AGONIST-MU ANTAGONIST

7.2.1.8.3.1 BUTORPHANOL

7.2.1.8.3.2 OTHERS

7.2.1.9 OTHERS

7.2.1.10 PHARMACEUTICALS BY DRUG TYPE

7.2.1.10.1 BRANDED

7.2.1.10.2 GENERIC

7.2.1.11 PHARMACEUTICALS BY PRESCRIPTION MODE

7.2.1.11.1 PRESCRIPTION BASED

7.2.1.11.2 OVER THE COUNTER

7.2.1.12 PHARMACEUTICALS BY ROUTE OF ADMINISTRATION,

7.2.1.12.1 ORAL

7.2.1.12.1.1 TABLETS

7.2.1.12.1.2 SOLUTIONS

7.2.1.12.1.3 POWDER

7.2.1.12.1.4 OTHERS

7.2.1.12.2 PARENTAL

7.2.1.12.2.1 INTRAVENOUS

7.2.1.12.2.2 SUBCUTANEOUS

7.2.1.12.2.3 OTHERS

7.2.1.12.3 TOPICAL

7.2.1.12.4 OTHERS

7.2.2 VACCINES

7.2.2.1 LIVE ATTENUATED VACCINES

7.2.2.2 TOXOID VACCINES

7.2.2.3 RECOMBINANT VACCINES

7.2.2.4 INACTIVATED VACCINES

7.2.2.5 OTHERS

7.2.3 BIOLOGICS

7.2.3.1 MARKETED

7.2.3.1.1 TOCERANIB

7.2.3.1.2 LOMUSTINE

7.2.3.1.3 CYCLOPHOSPHAMIDE

7.2.3.1.4 CHLORAMBUCIL

7.2.3.1.5 OTHERS

7.2.3.2 EMERGING

7.2.4 MEDICATED FEED ADDITIVES

7.2.4.1 ENZYMES

7.2.4.1.1 PHYTASE

7.2.4.1.2 CARBOHYDRASE

7.2.4.1.3 PROTEASE

7.2.4.1.4 AMYLASE

7.2.4.1.5 CELLULASE

7.2.4.1.6 MANNASE

7.2.4.1.7 GLUCANASE

7.2.4.1.8 XYLANASE

7.2.4.1.9 OTHERS

7.2.4.2 AMINO ACID

7.2.4.2.1 LYSINE

7.2.4.2.2 METHIONINE

7.2.4.2.3 THREONINE

7.2.4.2.4 TRYPTOPHAN

7.2.4.2.5 OTHERS

7.2.4.3 VITAMINS

7.2.4.3.1 FAT-SOLUBLE VITAMIN

7.2.4.3.1.1 VITAMIN A

7.2.4.3.1.2 VITAMIN E

7.2.4.3.1.3 VITAMIN D

7.2.4.3.1.4 VITAMIN K

7.2.4.3.2 WATER-SOLUBLE VITAMIN

7.2.4.3.2.1 VITAMIN B COMPLEX

7.2.4.3.2.2 VITAMIN C

7.2.4.4 ANTIOXIDANTS

7.2.4.4.1 BHA

7.2.4.4.2 BHT

7.2.4.4.3 ETHOXYQUIN

7.2.4.4.4 OTHERS

7.2.4.5 PROBIOTICS

7.2.4.6 LACTOBACILLI

7.2.4.7 BIFIDOBACTERIA

7.2.4.8 YEAST

7.2.4.9 STRETOCOCCUS THERMOPHILUS

7.2.4.10 FEED ACIDIFIERS

7.2.4.10.1 PROPIONIC ACID

7.2.4.10.2 FORMIC ACID

7.2.4.10.3 LACTIC ACID

7.2.4.10.4 CITRIC ACID

7.2.4.10.5 OTHERS

7.2.4.11 MYCOTOXIN DETOXIFIERS

7.2.4.11.1 MYCOTOXIN BINDERS

7.2.4.11.1.1 SILICATES

7.2.4.11.1.2 CLAYS

7.2.4.11.1.3 CHEMICAL POLYMERS

7.2.4.11.1.4 GLUCAN PRODUCTS

7.2.4.11.1.5 OTHERS

7.2.4.11.2 MYCOTOXIN MODIFIERS

7.2.4.12 PHYTOGENIC

7.2.4.12.1 ESSENTIAL OILS

7.2.4.12.2 HERBS & SPICES

7.2.4.12.3 OLEORESIN

7.2.4.12.4 OTHERS

7.2.4.13 CAROTENOIDS

7.2.4.13.1 BETA-CAROTENE

7.2.4.13.2 ASTAXANTHIN

7.2.4.13.3 LUTEIN

7.2.4.13.4 CANTHAXANTHIN

7.2.4.14 TRACE MINERALS

7.2.4.14.1 ZINC

7.2.4.14.2 COPPER

7.2.4.14.3 MANGANESE

7.2.4.14.4 IRON

7.2.4.14.5 SELENIUM

7.2.4.14.6 OTHERS

7.2.4.15 PRESERVATIVES

7.2.4.15.1 ANTICAKING AGENTS

7.2.4.15.2 MOLD INHIBITORS

7.2.4.16 FLAVOURS AND SWEETENERS

7.2.4.16.1 FLAVORS

7.2.4.16.2 SWEETENERS

7.2.4.16.2.1 SACCHARIN

7.2.4.16.2.2 NEOHESPERIDIN DIHYDROCHALCONE

7.2.4.16.2.3 GLYCYRRHIZIN

7.2.4.16.2.4 THAUMATIN

7.2.4.16.2.5 OTHERS

7.2.4.17 OTHERS

7.3 DIAGNOSTICS

7.3.1 INSTRUMENTS & DEVICES

7.3.1.1 IMAGING DEVICES

7.3.1.2 X-RAY IMAGING (RADIOGRAPHY)

7.3.1.2.1 SMALL ANIMALS

7.3.1.2.2 LARGE ANIMALS

7.3.1.3 ULTRASOUND

7.3.1.3.1 SMALL ANIMALS

7.3.1.3.2 LARGE ANIMALS

7.3.1.4 COMPUTED TOMOGRAPHY

7.3.1.4.1 SMALL ANIMALS

7.3.1.4.2 LARGE ANIMALS

7.3.1.5 MAGNETIC RESONANCE IMAGING

7.3.1.5.1 SMALL ANIMALS

7.3.1.5.2 LARGE ANIMALS

7.3.1.6 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT)

7.3.1.6.1 SMALL ANIMALS

7.3.1.6.2 LARGE ANIMALS

7.3.1.6.3 OTHERS

7.3.2 LABORATORY INSTRUMENTS

7.3.2.1 HEMATOLOGY ANALYZERS

7.3.2.1.1 BY MODE

7.3.2.1.1.1 AUTOMATIC

7.3.2.1.1.2 SEMI-AUTOMATIC

7.3.2.1.2 BY PRICE RANGE

7.3.2.1.2.1 HIGH PRICE RANGE

7.3.2.1.2.2 STANDARD PRICE RANGE

7.3.2.1.3 BY MODALITY,

7.3.2.1.3.1 BENCHTOP

7.3.2.1.3.2 PORTABLE

7.3.2.1.3.3 OTHERS

7.3.2.2 CHEMISTRY ANALYZERS

7.3.2.2.1 BY MODE

7.3.2.2.1.1 AUTOMATIC

7.3.2.2.1.2 SEMI-AUTOMATIC

7.3.2.2.2 BY MODALITY,

7.3.2.2.2.1 BENCHTOP

7.3.2.2.2.2 PORTABLE

7.3.2.2.3 BY SAMPLE TYPE,

7.3.2.2.3.1 BLOOD

7.3.2.2.3.2 URINE

7.3.2.2.3.3 STOOL

7.3.2.2.3.4 OTHERS

7.3.2.3 POINT-OF-CARE INSTRUMENTS

7.3.2.3.1 BY TYPE

7.3.2.3.1.1 LATERAL FLOW POCT

7.3.2.3.1.2 MOLECULAR POCT

7.3.2.3.1.3 OTHERS

7.3.2.3.2 BY MODE

7.3.2.3.2.1 AUTOMATIC

7.3.2.3.2.2 SEMI-AUTOMATIC

7.3.2.4 COAGULATION ANALYZERS

7.3.2.4.1 BY CHANNEL,

7.3.2.4.1.1.1 4-CHANNEL

7.3.2.4.1.1.2 1-CHANNEL

7.3.2.4.2 BY SAMPLE TYPE

7.3.2.4.2.1 WHOLE BLOOD

7.3.2.4.2.2 PLASMA

7.3.2.4.3 BY MODALITY,

7.3.2.4.3.1 BENCHTOP

7.3.2.4.3.2 PORTABLE

7.3.2.5 URINALYSIS EQUIPMENT

7.3.2.5.1 BY MODE

7.3.2.5.1.1 AUTOMATIC

7.3.2.5.1.2 SEMI-AUTOMATIC

7.3.2.6 REFRACTOMETER

7.3.2.6.1 BY MODE,

7.3.2.6.1.1 OPTICAL

7.3.2.6.1.2 DIGITAL

7.3.2.6.2 BY MODALITY,

7.3.2.6.2.1 BENCHTOP

7.3.2.6.2.2 PORTABLE

7.3.2.7 OTHERS

7.3.3 REAGENTS & CONSUMABLES

7.3.3.1 KITS

7.3.3.1.1 PCR KITS

7.3.3.1.2 RAPID TEST KITS

7.3.3.1.3 MULTIPLEX KITS

7.3.3.1.4 ELISA KITS

7.3.3.1.5 SAMPLE PREPARATION KITS ISOLATION AND EXTRACTION KITS

7.3.3.1.6 OTHERS

7.3.3.2 REAGENTS

7.3.3.2.1 NUCLEIC ACID EXTRACTION REAGENTS

7.3.3.2.2 IMMUNOFLUORESCENCE REAGENTS

7.3.3.2.3 COOMBS REAGENTS

7.3.3.2.4 OTHERS REAGENTS

7.3.4 MEDIA

7.3.5 PANEL

7.3.6 STRIPS

7.3.7 CASSETTE

7.3.8 CONTROL STANDARDS

7.3.9 PROBES AND PRIMER

7.3.10 OTHERS CONSUMABLE AND ACCESSORIES

8 NORTH AMERICA VETERINARY MEDICINE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BACTERIAL DISEASES

8.2.1 PRODUCTION ANIMALS

8.2.2 COMPANION ANIMALS

8.3 CANINE ATOPIC DERMATITIS

8.3.1 COMPANION ANIMALS

8.3.2 PRODUCTION ANIMALS

8.4 HEMINTHES INFECTION

8.4.1 PRODUCTION ANIMALS

8.4.2 COMPANION ANIMALS

8.5 ANIMAL CANCER

8.5.1 COMPANION ANIMALS

8.5.2 PRODUCTION ANIMALS

8.6 FOOT AND MOUTH DISEASE

8.6.1 PRODUCTION ANIMALS

8.6.2 COMPANION ANIMALS

8.7 AUTOIMMUNE DISEASES

8.7.1 COMPANION ANIMALS

8.7.2 PRODUCTION ANIMALS

8.8 BLUETONGUE

8.8.1 PRODUCTION ANIMALS

8.8.2 COMPANION ANIMALS

8.9 OTHERS

8.9.1 COMPANION ANIMALS

8.9.2 PRODUCTION ANIMAL

9 NORTH AMERICA VETERINARY MEDICINE MARKET, BY ANIMAL TYPE

9.1 OVERVIEW

9.2 COMPANION ANIMALS

9.2.1 DOGS

9.2.2 CATS

9.2.3 HORSES

9.2.4 OTHERS

9.3 PRODUCTION ANIMAL

9.3.1 POULTRY

9.3.2 CATTLE

9.3.3 SWINE

9.3.4 FISH

9.3.5 SHEEP & GOATS

9.3.6 OTHERS

10 NORTH AMERICA VETERINARY MEDICINE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.2.1 OFFLINE

10.2.1.1 HOSPITAL PHARMACY

10.2.1.2 RETAIL PHARMACY

10.2.2 ONLINE

10.2.2.1 E-COMMERCE PLATFORMS

10.2.2.2 COMPANY WEBSITE

10.2.2.3 OTHERS

10.3 DIRECT TENDER

10.4 OTHERS

11 NORTH AMERICA VETERINARY MEDICINE MARKET, BY END USER

11.1 OVERVIEW

11.2 VETERINARY HOSPITALS

11.2.1 PRIVATE

11.2.2 PUBLIC

11.2.3 VETERINARY HOSPITALS BY LEVEL

11.2.3.1 TIER 2

11.2.3.2 TIER 1

11.2.3.3 TIER 3

11.3 VETERINARY CLINICS

11.3.1 VETERINARY CLINICS BY TYPE

11.3.1.1 PUBLIC

11.3.1.2 PRIVATE

11.4 ANIMAL AND VETERINARY FARMS

11.5 REFERENCE LABORATORIES

11.6 ACADEMIC AND RESEARCH INSTITUTE

11.7 POINT-OF-CARE TESTING/IN-HOUSE TESTING

11.8 OTHERS

12 NORTH AMERICA VETERINARY MEDICINE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA VETERINARY MEDICINE MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ZOETIS SERVICES LLC SERVICES LLC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 MERCK KGAA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ELANCO OR ITS AFFILIATES. OR ITS AFFILIATES

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 IDEXX LABORATORIES, INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 AB SCIENCE

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ADVACARE PHARMA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ALMAX IMAGING SRL

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ANIVIVE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BIOMÉRIEUX

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 BIONOTE USA INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 BIO-RAD LABORATORIES, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 CANON MEDICAL SYSTEMS EUROPE B.V.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 CARGIL INCORPORATED

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CEVA

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 CURELAB ONCOLOGY

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 DECHRA PHARMACEUTICALS LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 DEMEDITEC DIAGNOSTICS GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 DHN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 DIAGNOSTIC IMAGING SYSTEMS

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ESAOTE SPA

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 EUROFINS SCIENTIFIC

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 EVONIK ANIMAL NUTRITION

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 1.1.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 FUJIFILM HOLDINGS CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 GOLD STANDARD DIAGNOSTICS

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 HALLMARQ VETERINARY IMAGING

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 HEBEI VEYONG PHARMACEUTICAL CO., LTD.

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 IBIS S.R.L.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 VIRBAC

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 VMRD, INC

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENT

15.31 HESKA CORPORATION

15.31.1 COMPANY SNAPSHOT

15.31.2 REVENUE ANALYSIS

15.31.3 PRODUCT PORTFOLIO

15.31.4 RECENT DEVELOPMENT

15.32 KARYOPHARM

15.32.1 COMPANY SNAPSHOT

15.32.2 REVENUE ANALYSIS

15.32.3 PRODUCT PORTFOLIO

15.32.4 RECENT DEVELOPMENT

15.33 MERIDIAN BIOSCIENCE, INC

15.33.1 COMPANY SNAPSHOT

15.33.2 PRODUCT PORTFOLIO

15.33.3 RECENT DEVELOPMENT

15.34 NARANG MEDICAL LIMITED

15.34.1 COMPANY SNAPSHOT

15.34.2 PRODUCT PORTFOLIO

15.34.3 RECENT DEVELOPMENT

15.35 NEOGEN CORPORATION

15.35.1 COMPANY SNAPSHOT

15.35.2 REVENUE ANALYSIS

15.35.3 PRODUCT PORTFOLIO

15.35.4 RECENT DEVELOPMENT

15.36 NIPPON ZENYAKU KOGYO CO., LTD.

15.36.1 COMPANY SNAPSHOT

15.36.2 PRODUCT PORTFOLIO

15.36.3 RECENT DEVELOPMENT

15.37 VETDC

15.37.1 COMPANY SNAPSHOT

15.37.2 PRODUCT PORTFOLIO

15.37.3 RECENT DEVELOPMENT

15.38 NOVAVIVE INC.

15.38.1 COMPANY SNAPSHOT

15.38.2 PRODUCT PORTFOLIO

15.38.3 RECENT DEVELOPMENT

15.39 NUTRECO

15.39.1 COMPANY SNAPSHOT

15.39.2 PRODUCT PORTFOLIO

15.39.3 RECENT DEVELOPMENT

15.4 PLANMECA OY

15.40.1 COMPANY SNAPSHOT

15.40.2 PRODUCT PORTFOLIO

15.40.3 RECENT DEVELOPMENT

15.41 RANDOX LABORATORIES LTD.

15.41.1 COMPANY SNAPSHOT

15.41.2 PRODUCT PORTFOLIO

15.41.3 RECENT DEVELOPMENT

15.42 RINGPU BIOLOGY CO., LTD.

15.42.1 COMPANY SNAPSHOT

15.42.2 PRODUCT PORTFOLIO

15.42.3 RECENT DEVELOPMENT

15.43 SHENZHEN SONTU MEDICAL IMAGING EQUIPMENT CO., LTD

15.43.1 COMPANY SNAPSHOT

15.43.2 PRODUCT PORTFOLIO

15.43.3 RECENT DEVELOPMENT

15.44 THERMO FISHER SCIENTIFIC INC

15.44.1 COMPANY SNAPSHOT

15.44.2 REVENUE ANALYSIS

15.44.3 PRODUCT PORTFOLIO

15.44.4 RECENT DEVELOPMENT

15.45 TORIGEN PHARMACEUTICALS INC.

15.45.1 COMPANY SNAPSHOT

15.45.2 PRODUCT PORTFOLIO

15.45.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA THERAPEUTICS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA THERAPEUTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA ANTIBIOTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA PARASITICIDES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA ANALGESICS/ANTI INFLAMMATORY (NSAIDS) IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA AANTIHISTAMINES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA CORTICOSTEROIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA ANTIBLOAT IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA HORMONAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA OPIOIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA MU AGONISTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PARTIAL MU AGONISTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA KAPPA AGONIST MU ANTAGONIST IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY DRUG TYPE, 2018 2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY PRESCRIPTION MODE, 2018 2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY ROUTE OF ADMINISTRATION, 2018 2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA ORAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA PARENTAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA VACCINES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA BIOLOGICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA MARKETED IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA MEDICATED FEED ADDITIVES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA ENZYMES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA AMINO ACID IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA VITAMINS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA FAT SOLUBLE VITAMIN IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA WATER SOLUBLE VITAMIN IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA ANTIOXIDANTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA PROBIOTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA FEED ACIDIFIERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA MYCOTOXIN DETOXIFIERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA MYCOTOXIN BINDERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA PHYTOGENIC IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA CAROTENOIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA TRACE MINERALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA PRESERVATIVES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA FLAVORS AND SWEETENERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA SWEETENERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA DIAGNOSTICS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA DIAGNOSTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA INSTRUMENTS & DEVICES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA IMAGING DEVICES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA X RAY IMAGING (RADIOGRAPHY) IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA ULTRASOUND IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPUTED TOMOGRAPHY IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA MAGNETIC RESONANCE IMAGING IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA SINGLE PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT) IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA LABORATORY INSTRUMENTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA HEMATOLOGY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA HEMATOLOGY ANALYZERS IN VETERINARY MEDICINE MARKET, BY PRICE RANGE, 2018 2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA HEMATOLOGY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA CHEMISTRY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA CHEMISTRY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA CHEMISTRY ANALYZERS IN VETERINARY MEDICINE MARKET, BY SAMPLE TYPE, 2018 2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA POINT OF CARE INSTRUMENTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY CHANNEL, 2018 2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY SAMPLE TYPE, 2018 2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA URINALYSIS EQUIPMENT IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA REFRACTOMETER IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA REFRACTOMETER IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA REAGENTS & CONSUMABLES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA KITS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA REAGENTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA VETERINARY MEDICINE MARKET, BY APPLICATION, 2018 2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA BACTERIAL DISEASES IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA BACTERIAL DISEASES IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA CANINE ATOPIC DERMATITIS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA CANINE ATOPIC DERMATITIS IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA HEMINTHES INFECTION IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA HEMINTHES INFECTION IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA ANIMAL CANCER IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA ANIMAL CANCER IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA FOOT AND MOUTH DISEASE IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA FOOT AND MOUTH DISEASE IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA AUTOIMMUNE DISEASES IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA AUTOIMMUNE DISEASES IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA BLUETONGUE IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA BLUETONGUE IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA OTHERS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA OTHERS IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA COMPANION ANIMALS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA COMPANION ANIMALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA PRODUCTION ANIMAL IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA PRODUCTION ANIMAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA VETERINARY MEDICINE MARKET, BY DISTRIBUTION CHANNEL, 2018 2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA RETAIL SALES IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA RETAIL SALES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA OFFLINE IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA ONLINE IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA DIRECT TENDER IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA OTHERS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA VETERINARY MEDICINE MARKET, BY END USER, 2018 2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA VETERINARY HOSPITALS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA VETERINARY HOSPITALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA VETERINARY HOSPITALS IN VETERINARY MEDICINE MARKET, BY LEVEL, 2018 2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA VETERINARY CLINICS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA VETERINARY CLINICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA ANIMAL AND VETERINARY FARMS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA REFERENCE LABORATORIES IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTE IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA POINT OF CARE TESTING/IN HOUSE TESTING IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA OTHERS IN VETERINARY MEDICINE MARKET, BY REGION, 2018 2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA VETERINARY MEDICINE MARKET, BY COUNTRY, 2018 2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA THERAPEUTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA ANTIBIOTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA PARASITICIDES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA ANALGESICS/ANTI INFLAMMATORY (NSAIDS) IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA ANTIHISTAMINES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA CORTICOSTEROIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA ANTIBLOAT IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA HORMONAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA OPIOIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA MU AGONISTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA PARTIAL MU AGONISTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA KAPPA AGONIST MU ANTAGONIST IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY DRUG TYPE, 2018 2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY PRESCRIPTION MODE, 2018 2032 (USD THOUSAND)

TABLE 125 NORTH AMERICA PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY ROUTE OF ADMINISTRATION, 2018 2032 (USD THOUSAND)

TABLE 126 NORTH AMERICA ORAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 127 NORTH AMERICA PARENTAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 128 NORTH AMERICA VACCINES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 129 NORTH AMERICA BIOLOGICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 130 NORTH AMERICA MARKETED IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 131 NORTH AMERICA MEDICATED FEED ADDITIVES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 132 NORTH AMERICA ENZYMES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 133 NORTH AMERICA AMINO ACID IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 134 NORTH AMERICA VITAMINS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 135 NORTH AMERICA FAT SOLUBLE VITAMIN IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 136 NORTH AMERICA WATER SOLUBLE VITAMIN IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 137 NORTH AMERICA ANTIOXIDANTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 138 NORTH AMERICA PROBIOTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 139 NORTH AMERICA FEED ACIDIFIERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 140 NORTH AMERICA MYCOTOXIN DETOXIFIERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 141 NORTH AMERICA MYCOTOXIN BINDERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 142 NORTH AMERICA PHYTOGENIC IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 143 NORTH AMERICA CAROTENOIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 144 NORTH AMERICA TRACE MINERALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 145 NORTH AMERICA PRESERVATIVES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 146 NORTH AMERICA FLAVORS AND SWEETENERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 147 NORTH AMERICA SWEETENERS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 148 NORTH AMERICA DIAGNOSTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 149 NORTH AMERICA INSTRUMENTS & DEVICES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 150 NORTH AMERICA IMAGING DEVICES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 151 NORTH AMERICA X RAY IMAGING (RADIOGRAPHY) IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 152 NORTH AMERICA ULTRASOUND IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 153 NORTH AMERICA COMPUTED TOMOGRAPHY IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 154 NORTH AMERICA MAGNETIC RESONANCE IMAGING IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 155 NORTH AMERICA SINGLE PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT) IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 156 NORTH AMERICA LABORATORY INSTRUMENTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 157 NORTH AMERICA HEMATOLOGY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 158 NORTH AMERICA HEMATOLOGY ANALYZERS IN VETERINARY MEDICINE MARKET, BY PRICE RANGE, 2018 2032 (USD THOUSAND)

TABLE 159 NORTH AMERICA HEMATOLOGY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 160 NORTH AMERICA CHEMISTRY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 161 NORTH AMERICA CHEMISTRY ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 162 NORTH AMERICA CHEMISTRY ANALYZERS IN VETERINARY MEDICINE MARKET, BY SAMPLE TYPE, 2018 2032 (USD THOUSAND)

TABLE 163 NORTH AMERICA POINT OF CARE INSTRUMENTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 164 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 165 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY CHANNEL, 2018 2032 (USD THOUSAND)

TABLE 166 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY SAMPLE TYPE, 2018 2032 (USD THOUSAND)

TABLE 167 NORTH AMERICA COAGULATION ANALYZERS IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 168 NORTH AMERICA URINALYSIS EQUIPMENT IN VETERINARY MEDICINE MARKET, BY MODE, 2018 2032 (USD THOUSAND)

TABLE 169 NORTH AMERICA REFRACTOMETER IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 170 NORTH AMERICA REFRACTOMETER IN VETERINARY MEDICINE MARKET, BY MODALITY, 2018 2032 (USD THOUSAND)

TABLE 171 NORTH AMERICA REAGENTS & CONSUMABLES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 172 NORTH AMERICA KITS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 173 NORTH AMERICA REAGENTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 174 NORTH AMERICA VETERINARY MEDICINE MARKET, BY APPLICATION, 2018 2032 (USD THOUSAND)

TABLE 175 NORTH AMERICA BACTERIAL DISEASES IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 176 NORTH AMERICA CANINE ATOPIC DERMATITIS IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 177 NORTH AMERICA HEMINTHES INFECTION IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 178 NORTH AMERICA ANIMAL CANCER IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 179 NORTH AMERICA FOOT AND MOUTH DISEASE IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 180 NORTH AMERICA AUTOIMMUNE DISEASES IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 181 NORTH AMERICA BLUETONGUE IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 182 NORTH AMERICA OTHERS IN VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 183 NORTH AMERICA VETERINARY MEDICINE MARKET, BY ANIMAL TYPE, 2018 2032 (USD THOUSAND)

TABLE 184 NORTH AMERICA COMPANION ANIMALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 185 NORTH AMERICA PRODUCTION ANIMAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 186 NORTH AMERICA VETERINARY MEDICINE MARKET, BY END USER, 2018 2032 (USD THOUSAND)

TABLE 187 NORTH AMERICA VETERINARY HOSPITALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 188 NORTH AMERICA VETERINARY HOSPITALS IN VETERINARY MEDICINE MARKET, BY LEVEL, 2018 2032 (USD THOUSAND)

TABLE 189 NORTH AMERICA VETERINARY CLINICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 190 NORTH AMERICA VETERINARY MEDICINE MARKET, BY DISTRIBUTION CHANNEL, 2018 2032 (USD THOUSAND)

TABLE 191 NORTH AMERICA RETAIL SALES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 192 NORTH AMERICA OFFLINE IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 193 NORTH AMERICA ONLINE IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 194 U.S. VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 195 U.S. THERAPEUTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 196 U.S. PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 197 U.S. ANTIBIOTICS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 198 U.S. PARASITICIDES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 199 U.S. ANALGESICS/ANTI INFLAMMATORY (NSAIDS) IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 200 U.S. ANTIHISTAMINES IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 201 U.S. CORTICOSTEROIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 202 U.S. ANTIBLOAT IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 203 U.S. HORMONAL IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 204 U.S. OPIOIDS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 205 U.S. MU AGONISTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 206 U.S. PARTIAL MU AGONISTS IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 207 U.S. KAPPA AGONIST MU ANTAGONIST IN VETERINARY MEDICINE MARKET, BY TYPE, 2018 2032 (USD THOUSAND)

TABLE 208 U.S. PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY DRUG TYPE, 2018 2032 (USD THOUSAND)

TABLE 209 U.S. PHARMACEUTICALS IN VETERINARY MEDICINE MARKET, BY PRESCRIPTION MODE, 2018 2032 (USD THOUSAND)