Market Analysis and Insights

Thailand talc market is expected to grow significantly in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 1.7% in the forecast period of 2022 to 2029.

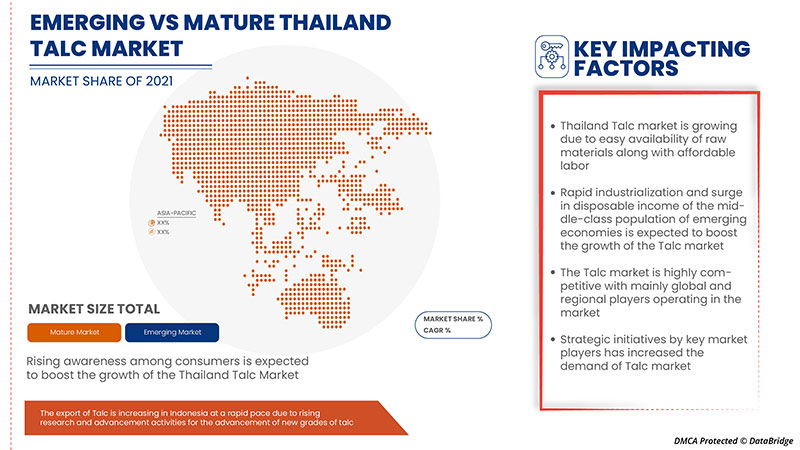

The major factor driving the growth of the talc market is the extensive applications in producing lightweight plastics for automotive components, the rapid industrialization and surge in disposable income of the middle-class population of emerging economies and the easy availability of raw materials along with affordable labor.

Talc is used in a wide range of applications due to its superior properties, such as heat resistance, excellent resistance to electricity, oil, and acids, and grease adsorption. This material is used in various end-use industries to enhance the properties of the product to which talc is applied, including thermal conductivity, stiffness, impact resistance, chemical resistance, and creep resistance, thus boosting the growth of the Thailand talc market.

Thailand talc market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

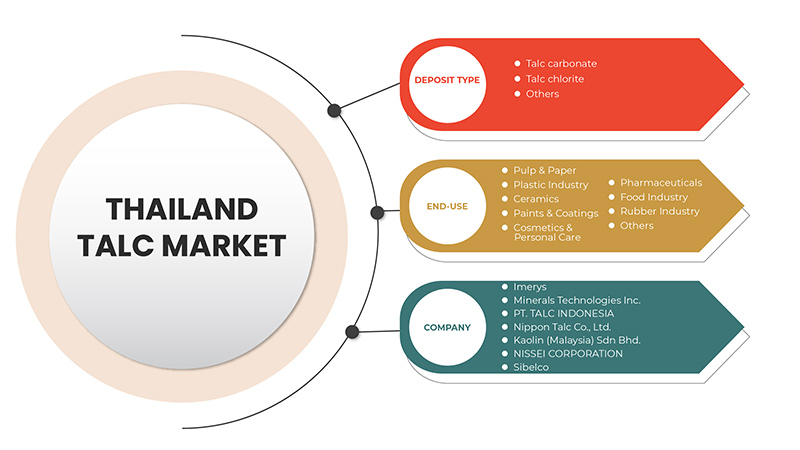

By Deposit Type (Talc Carbonate, Talc Chlorite, Others), End-Use (Pulp & Paper, Plastic Industry, Ceramics, Paints & Coatings, Cosmetics & Personal Care, Pharmaceuticals, Food Industry, Rubber Industry, Others) |

|

Countries Covered |

Thailand |

|

Market Players Covered |

Imerys, Minerals Technologies Inc., PT. TALC INDONESIA, Nippon Talc Co., Ltd., Kaolin (Malaysia) Sdn Bhd., NISSEI CORPORATION and Sibelco among others. |

Market Definition

Talc is a type of mineral rock made up of hydrated magnesium silicate. It has a wide variety of applications, the most common being baby powder. Due to its resistance to heat, electricity and resistance to absorption of acids, oil and grease, it is very widely demanded by several industries. Its characteristics are the softness of the mineral, the capability of retaining the fragrances, purity, and white color.

Talc is an industrial raw material in powdered form. It is the softest mineral with one hardness on the Mohs scale. It is a versatile mineral with various properties and is used in many applications. Talc is chemically inert. It is insoluble in acids and has a platelet-like structure. They have excellent thermal shock and scratch resistance. Talc has low costs and is readily available. It protects from corrosion and good adhesion between surfaces by absorbing moisture.

Thailand Talc Market Dynamics

Drivers

- Extensive applications in producing lightweight plastics for automotive components

There has been increasing demand for talc from the automotive industry due to its growing applications in manufacturing underhood automotive parts. This augmented demand for talc from the automotive industry drives market growth. The lightweight plastic parts used in the automotive industry are produced from talc-reinforced polypropylene, which improves their performance and durability. Moreover, talc extends resistance against abrasion and corrosion. Apart from this, the increasing demand for automotive refinishes and OEM components for the automotive industry are expected to drive the growth of the talc market shortly. In addition, rapid development and industrialization in economies such as Thailand are propelling the demand for more automobiles, which will further boost the growth of the talc market in these regions.

- Rapid industrialization and surge in disposable income of the middle-class population of emerging economies

With the increasing demand from emerging economies, rising industrialization rates, and increasing disposable income, especially in middle-class population, there has been a growing demand for finished products such as automobiles, paints & coatings, and many others. Rapid industrialization in emerging economies such as Thailand and Indonesia is driving the growth of the talc market as talc is used in various end-use industries for several applications. The growing population and increasing disposable income of the middle-class population of emerging economies have led to the increased demand for different consumer products, such as cosmetics, ceramics, automotive plastic parts, and pharmaceuticals, which is, in turn, driving the growth of the talc market.

- Easy availability of raw materials along with affordable labor

Talc is a clay mineral composed of hydrated magnesium silicate and is widely used as a thickening agent, filler, or lubricant in various applications. Talc is a metamorphic mineral in veins, foliated masses, and certain rocks. It is associated with serpentine, tremolite, forsterite, and almost always with carbonates (calcite, dolomite, or magnesite) in the lower metamorphic facies. It also occurs as an alteration product from tremor lite or forsterite. Moreover, the Southeast Asian countries have a substantial cheap workforce compared to other regions and are engaged in mining and synthetic talc manufacturing. Therefore, the easy availability of talc raw materials in these regions and around will help in the growth of the Thailand talc market.

Opportunity

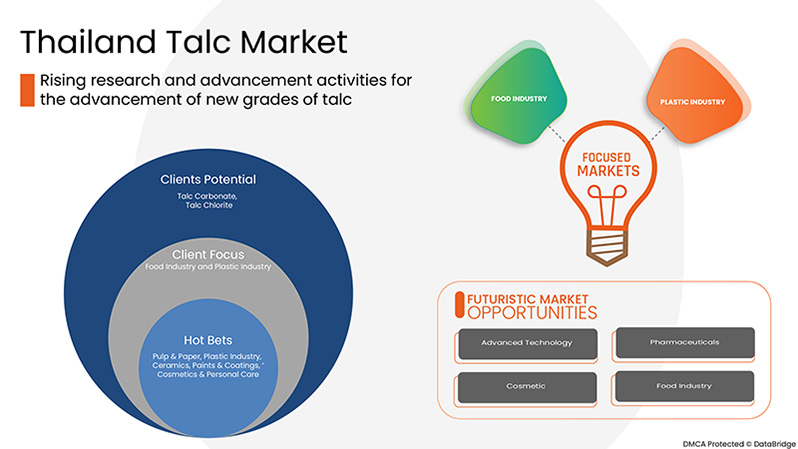

- Rise in research and advancement activities for the advancement of new grades of talc

The potential applications of talc are infinite, and continuous research & development activities in the talc industry are expected to help discover new applications and host a lot of opportunities for the growth of the talc industry. Continuous research & development activities are being carried out in the talc industry for the development of new grades of talc for use in various applications such as in barrier coatings in paperboard food packaging for the food industry and others. There are more emerging trends that have a direct impact on the dynamics of the talc industry. These include growing production of specialty micronized grade talc for plastic and increasing demand for talc in lightweight automotive plastic parts.

Restraints/Challenges

- Guidelines regulating the production as well as usage of talc

Stringent government regulations regarding the use of chemicals during the processing of talc and its usage are the factor that could hamper the growth of the Thailand talc market. There are strict concerns regarding the ill effects of chemicals used in manufacturing talc products. This has resulted in shifting preference from chemicals to green (bio-based) and environment-friendly talc products. Moreover, exposure to talc for a longer duration has serious ill effects on the body functions such as any application of talc on wounds can give rise to scab formation, possible infection, and foreign body granulomas in the dermis. Therefore, owing to these harmful effects created while the production and usage of talc, strict rules and regulations have been enforced, which can hamper the growth in the Thailand talc market.

- Moderate development of the pulp & paper industry due to digitization

The pulp & paper industry has been growing at a languid pace due to the evolution of digitization, which has reduced the demand for talc from the paper and pulp industry. During paper production, talc has huge benefits for the products during the process. Talc is used in paper recycling and a new production of paper, pulp, and cardboard as filler. The characteristic properties of talc prevent pitch agglomeration within the production machine. Moreover, the primary use of talc in the paper industry is to improve sizing. The pulp and paper industry has contracted slightly over the past years due to the transition to digital media and paperless communication across most countries. Therefore, due to digitization, slow growth of pulp and paper industry is a major factor expected to limit growth of the Thailand talc market shortly.

- Easy accessibility of substitutes

The availability of substitutes for talc is the primary factor that is expected to be a challenge to the growth of the Thailand talc market shortly. There is a wide range of substitutes for talc available in the market. In ceramics applications, these substitutes for talc include bentonite, chlorite, feldspar, kaolin, and pyrophyllite. Chlorite, kaolin, and mica in the paint industry. Calcium carbonate and kaolin in the pulp and paper industry. Bentonite, kaolin, mica, and wollastonite in plastics and kaolin and mica in the Rubber manufacturing industry. Thus, easy availability of a wide range of substitutes for talc in the market will significantly challenge the growth and development of Thailand talc market.

Recent Development

- In 2022, Nippon Talc Co., Ltd., acquired Pakistan-based FAITH MINERALS (PVT.) LTD., with which it had established a joint venture in 2015. The company is now a 100% owned subsidiary of Nippon Talc Co., Ltd.

COVID-19 had a Minimal Impact on Thailand Talc Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on the talc market. Talc operations and supply chain, with multiple manufacturing facilities, were still operating in the country. The service providers continued offering talc products following sanitation and safety measures in the post-COVID scenario.

Thailand Talc Market Scope

Thailand talc market is categorized based on deposit type and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Deposit Type

- Talc carbonate

- Talc chlorite

- Others

Based on deposit type, the Thailand talc market is segmented into talc carbonate, talc chlorite, and others

End-Use

- Pulp & paper

- Plastic industry

- Ceramics

- Paints & coatings

- Cosmetics & personal care

- Pharmaceuticals

- Food industry

- Rubber industry

- Others

Based on the end-use, the Thailand talc market is segmented into pulp & paper, plastic industry, ceramics, paints & coatings, cosmetics & personal care, pharmaceuticals, food industry, rubber industry and others.

Competitive Landscape and Thailand Talc Market Share Analysis

Thailand talc market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Thailand talc market.

Some of the major players operating in the market are Imerys, Minerals Technologies Inc., PT. TALC INDONESIA, Nippon Talc Co., Ltd., Kaolin (Malaysia) Sdn Bhd., NISSEI CORPORATION and Sibelco.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Thailand Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THAILAND TALC MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DEPOSIT TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT EXPORT SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 PRODUCTION CONSUMPTION ANALYSIS- THAILAND TALC MARKET

4.8 VENDOR SELECTION CRITERIA

5 THAILAND TALC MARKET

5.1 REGULATION COVERAGE

6 REGIONAL SUMMARY

6.1 THAILAND

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 EXTENSIVE APPLICATIONS IN PRODUCING LIGHTWEIGHT PLASTICS FOR AUTOMOTIVE COMPONENTS

7.1.2 RAPID INDUSTRIALIZATION AND SURGE IN DISPOSABLE INCOME OF THE MIDDLE-CLASS POPULATION OF EMERGING ECONOMIES

7.1.3 EASY AVAILABILITY OF RAW MATERIALS ALONG WITH AFFORDABLE LABOR

7.2 RESTRAINTS

7.2.1 GUIDELINES REGULATING THE PRODUCTION AS WELL AS USAGE OF TALC

7.2.2 MODERATE DEVELOPMENT OF THE PULP & PAPER INDUSTRY DUE TO DIGITIZATION

7.3 OPPORTUNITIES

7.3.1 RISING RESEARCH AND ADVANCEMENT ACTIVITIES FOR THE ADVANCEMENT OF NEW GRADES OF TALC

7.4 CHALLENGE

7.4.1 EASY ACCESSIBILITY OF SUBSTITUTES

8 THAILAND TALC MARKET, BY DEPOSIT TYPE

8.1 OVERVIEW

8.2 TALC CARBONATE

8.3 TALC CHLORITE

8.4 OTHERS

9 THAILAND TALC MARKET, BY END-USE

9.1 OVERVIEW

9.2 PULP & PAPER

9.2.1 PULP & PAPER, BY TYPE

9.2.1.1 TALC CARBONATE

9.2.1.2 TALC CHLORITE

9.2.1.3 OTHERS

9.3 PLASTIC INDUSTRY

9.3.1 PLASTIC INDUSTRY, BY TYPE

9.3.1.1 TALC CARBONATE

9.3.1.2 TALC CHLORITE

9.3.1.3 OTHERS

9.4 PAINTS & COATINGS

9.4.1 PAINTS & COATINGS, BY TYPE

9.4.1.1 TALC CARBONATE

9.4.1.2 TALC CHLORITE

9.4.1.3 OTHERS

9.5 CERAMICS

9.5.1 CERAMICS, BY TYPE

9.5.1.1 TALC CARBONATE

9.5.1.2 TALC CHLORITE

9.5.1.3 OTHERS

9.6 RUBBER INDUSTRY

9.6.1 RUBBER INDUSTRY, BY TYPE

9.6.1.1 TALC CARBONATE

9.6.1.2 TALC CHLORITE

9.6.1.3 OTHERS

9.7 COSMETICS & PERSONAL CARE

9.7.1 COSMETICS & PERSONAL CARE, BY TYPE

9.7.1.1 TALC CARBONATE

9.7.1.2 TALC CHLORITE

9.7.1.3 OTHERS

9.8 FOOD INDUSTRY

9.8.1 FOOD INDUSTRY, BY TYPE

9.8.1.1 TALC CARBONATE

9.8.1.2 TALC CHLORITE

9.8.1.3 OTHERS

9.9 PHARMACEUTICALS

9.9.1 PHARMACEUTICAL, BY TYPE

9.9.1.1 TALC CARBONATE

9.9.1.2 TALC CHLORITE

9.9.1.3 OTHERS

9.1 OTHERS

9.10.1 OTHERS, BY TYPE

9.10.1.1 TALC CARBONATE

9.10.1.2 TALC CHLORITE

9.10.1.3 OTHERS

10 THAILAND TALC MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 MERGER & ACQUISITION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 IMERYS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 PT. TALC INDONESIA.

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT UPDATES

12.3 NISSEI CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 PRODUCT PORTFOLIO

12.3.3 RECENT UPDATES

12.4 NIPPON TALC CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT UPDATES

12.5 MINERALS TECHNOLOGIES INC. (2021)

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 SIBELCO

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATE

12.7 KAOLIN (MALAYSIA) SDN BHD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF NATURAL STEATITE AND TALC, CRUSHED OR POWDERED; HS CODE - 252620 (USD THOUSAND)

TABLE 2 EXPORT DATA OF NATURAL STEATITE AND TALC, CRUSHED OR POWDERED; HS CODE - 252620 (USD THOUSAND)

TABLE 3 THAILAND TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 THAILAND TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (MILLION TONS)

TABLE 5 THAILAND TALC MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 6 THAILAND TALC MARKET, BY END-USE, 2020-2029 (MILLION TONS)

TABLE 7 THAILAND PULP & PAPER IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 THAILAND PULP & PAPER IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 9 THAILAND PLASTIC INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 THAILAND PLASTIC INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 11 THAILAND PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 THAILAND PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 13 THAILAND CERAMICS IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 THAILAND CERAMICS IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 15 THAILAND RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 THAILAND RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 17 THAILAND COSMETICS & PERSONAL CARE IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 THAILAND COSMETICS & PERSONAL CARE IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 19 THAILAND FOOD INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 THAILAND FOOD INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 21 THAILAND PHARMACEUTICAL IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 THAILAND PHARMACEUTICAL IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 23 THAILAND OTHERS IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 THAILAND OTHERS IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

List of Figure

FIGURE 1 THAILAND TALC MARKET: SEGMENTATION

FIGURE 2 THAILAND TALC MARKET: DATA TRIANGULATION

FIGURE 3 THAILAND TALC MARKET: DROC ANALYSIS

FIGURE 4 THAILAND TALC MARKET: THAILAND MARKET ANALYSIS

FIGURE 5 THAILAND TALC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THAILAND TALC MARKET: DEPOSIT TYPE LIFE LINE CURVE

FIGURE 7 THAILAND TALC MARKET: MULTIVARIATE MODELLING

FIGURE 8 THAILAND TALC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 THAILAND TALC MARKET: DBMR MARKET POSITION GRID

FIGURE 10 THAILAND TALC MARKET: END-USE COVERAGE GRID

FIGURE 11 THAILAND TALC MARKET: CHALLENGE MATRIX

FIGURE 12 THAILAND TALC MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 THAILAND TALC: SEGMENTATION

FIGURE 14 EXTENSIVE APPLICATIONS IN PRODUCING LIGHTWEIGHT PLASTICS FOR AUTOMOTIVE COMPONENTS IS EXPECTED TO DRIVE THE THAILAND TALC MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 TALC CARBONATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDONESIA TALC MARKET IN 2022 & 2029

FIGURE 16 TALC CARBONATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE THAILAND TALC MARKET IN 2022 & 2029

FIGURE 17 TALC CARBONATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE VIETNAM TALC MARKET IN 2022 & 2029

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 SUPPLY CHAIN ANALYSIS – THAILAND TALC MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THAILAND TALC MARKET

FIGURE 21 THAILAND TALC MARKET: BY DEPOSIT TYPE, 2021

FIGURE 22 THAILAND TALC MARKET: BY END-USE, 2021

FIGURE 23 THAILAND TALC MARKET: COMPANY SHARE 2021 (%)

Thailand Talc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Thailand Talc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Thailand Talc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.