U.S. Refrigerated Warehousing Market Analysis and Insights

Refrigerated warehousing is referred to as senior care, which includes meeting all the requirements A refrigerated warehousing can be defined as an industrial complex consist of facilities and equipment to store perishable or temperature-sensitive products. The refrigerated warehouses helps in offering temperature controlled services to producers, retailers, and food service providers of various industries. Latest and innovative technologies are used to maximize the efficiency and to store products in temperature-controlled environment. The refrigerated warehouses are used to store food products, beverages, dietary supplements, personal care products, pharmaceuticals & biological products, and other products.

Nowadays, innovative and new refrigerated warehouses are available with different and new technologies such as automated, blast freezing, vapor compressor, evaporative cooling, and others. The growing demand for refrigerated warehouses to store perishable food products, coupled with a rapid expansion of retail network in the U.S. and Canada, is anticipated to boost the demand for the market. However, high operating cost of refrigerated warehouses may hamper the growth of the market.

Technological advancement to improve the efficiency will create immense opportunity for the growth of the market, whereas stiff competition among market players may create a challenge for the growth of the market.

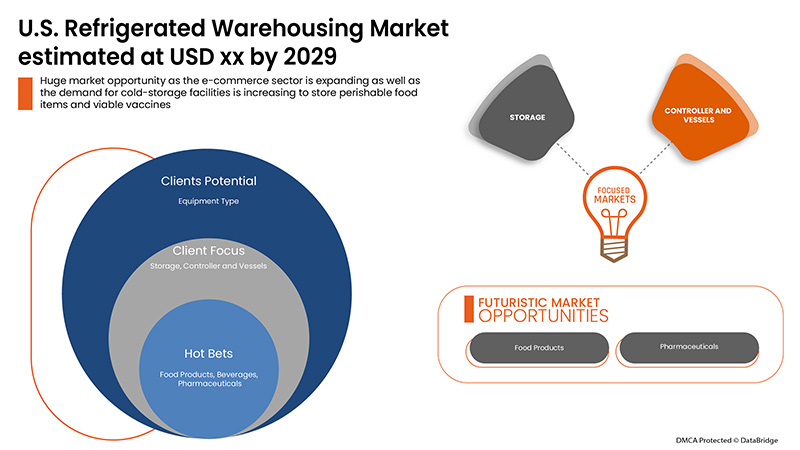

U.S. refrigerated warehousing market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.8% in the forecast period of 2022 to 2029 and is expected to reach USD 14,002.84 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2021 to 2029 |

|

Base Year |

2020 |

|

Historic Years |

2019 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Equipment Type (Storage, Compressors, Condensers, Evaporators, Controller And Vessels, Pumps, And Auxiliary Equipment), Technology (Blast Freezing, Vapor Compression, Programmable Logic Controller, Evaporative Cooling, Cryogenic Systems, And Other Technologies), Temperature Type (Chilled And Frozen), End-Users (Producers, Retailers, Food Service Providers, And Others), Application (Food Products, Beverages, Dietary Supplements, Personal Care Products, Pharmaceuticals & Biological Products, And Others) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Trenton Cold Storage, LINEAGE LOGISTICS HOLDING, LLC, CONESTOGA COLD STORAGE, Kloosterboer, Congebec, Americold, John Swire & Sons (H.K.) Ltd., Delta Pacific Seafoods, Cold Storage Inc., Iceberg Cold Storage |

Refrigerated Warehousing Market Dynamics

Drivers

- Growing demand for refrigerated warehousing storage to store perishable food products

The rising demand to increase the shelf life of food products and to reduce the food wastage, is increasing the demand for cold storage facilities as they provide temperature-controlled conditions. Moreover, the demand for sustainable and fresh food has increased among U.S. consumers in recent years which is also increasing the import of fresh food products in cold-storage facilities.

- Rapid Urbanization and the Expansion of Retail Channels

Rapid urbanization has eventually brought in the requirement of retail channels to meet the increasing requirement of the end users which has eventually brought in the requirement for cold refrigeration. The need for new cold storage capacity is amplified by the fact that many existing food buildings are old, inefficient, and poorly suited to deal with e-commerce.

Opportunities

- Technological Advancements in Refrigerated Warehousing

Technological advancements in terms of automated handling, inventory tracking, and real-time temperature tracking coupled with diversification initiatives will help the market by providing future market growth. The rising demand for new technology to cut down the additional cost as well as improve the efficiency of refrigerated warehousing will provide lucrative opportunities for the manufacturers.

Restraints/Challenges

- High cost of Refrigerated Warehouses

Cold storage facilities are expensive to build, and it has high operating cost as well as maintenance cost which concerns the manufactures. Additionally, high initial investment is also required to build a refrigerated warehousing facility.

Post COVID-19 Impact on Refrigerated Warehousing Market

The COVID-19 has affected the market in a positive direction as the pandemic has increased the trend of online shopping especially for groceries. The pandemic has also increased the demand for sustainable, fresh as well as frozen food products which has increased the demand for refrigerated warehousing market and this trend is expected to last for longer period of time. Additionally, the demand for vaccine transportation increased to keep it viable.

Recent Development

- In March 2022, LINEAGE LOGISTICS HOLDING, LLC acquired MTC Logistics, a leading cold-chain provider to expand their access to the ports on the U.S. and Gulf Coasts. The company acquired four facilities located near the ports of Baltimore, MD, Wilmington, DE and Mobile, AL. The acquisition helped the company to add around 38 million cubic feet of capacity and over 113,000 pallet positions in the U.S.

- In August 2020, Americold acquired a 3.2 million cubic foot cold storage facility in Florida for USD 25 million and an AM-C warehouse a 13.8 million cubic feet cold storage for USD 82.5 million. This acquisition aimed to expand the company presence in Florida and Texas.

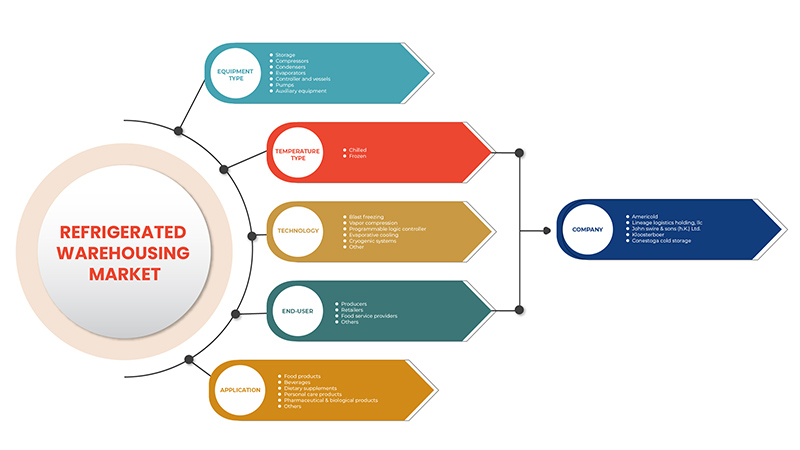

Global Refrigerated Warehousing Market Scope

The refrigerated warehousing market is segmented into equipment type, technology, temperature type, end-users, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Equipment Type

- Storage

- Compressors

- Condensers

- Evaporators

- Controller And Vessels

- Pumps

- Auxiliary Equipment

Based on equipment type, the U.S. refrigerated warehousing market is segmented into storage, compressors, condensers, evaporators, controller and vessels, pumps, and auxiliary equipment.

Technology

- Blast Freezing

- Vapor Compression

- Programmable Logic Controller

- Evaporative Cooling

- Cryogenic Systems

- Other Technologies

Based on technology, the U.S. refrigerated warehousing market is segmented into blast freezing, vapor compression, programmable logic controller, evaporative cooling, cryogenic systems, and other technologies.

Temperature Type

- Chilled

- Frozen

On the basis of temperature type, the U.S. refrigerated warehousing market is segmented into chilled and frozen.

End-Users

- Producers

- Retailers

- Food Service Providers

- Others

On the basis of end-users, the U.S. refrigerated warehousing market is segmented into producers, retailers, food service providers, and others.

Application

- Food Products

- Beverages

- Dietary Supplements

- Personal Care Products

- Pharmaceuticals & Biological Products,

- Others

On the basis of application, the U.S. refrigerated warehousing market is segmented into food products, beverages, dietary supplements, personal care products, pharmaceuticals & biological products, and others.

Refrigerated Warehousing Market Regional Analysis/Insights

The refrigerated warehousing market is analyzed and market size insights and trends are provided by country, equipment type, technology, temperature type, end-users, and application.

U.S. is dominating the refrigerated warehousing market during the forecast period owing to the presence of large number of key market players coupled with rising number of expansion and acquisition for refrigerated warehousing in the market.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Refrigerated Warehousing Market Share Analysis

The refrigerated warehousing market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on Refrigerated Warehousing market.

Some of the major players operating in the Refrigerated Warehousing market are Trenton Cold Storage, LINEAGE LOGISTICS HOLDING, LLC, CONESTOGA COLD STORAGE, Kloosterboer, Congebec, Americold, John Swire & Sons (H.K.) Ltd., Delta Pacific Seafoods, Cold Storage Inc., and Iceberg Cold Storage and others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. REFRIGERATED WAREHOUSING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 EQUIPMENT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN OF U.S. REFRIGERATED WAREHOUSING MARKET

4.1.1 COMPONENTS OF REFRIGERATED WAREHOUSE

4.1.2 END-USERS

4.2 VALUE CHAIN OF U.S. REFRIGERATED WAREHOUSING MARKET

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5 TECHNOLOGICAL ADVANCEMENT IN THE REFRIGERATED WAREHOUSING INDUSTRY

4.6 POST-COVID MARKET SCENARIO

4.7 GLOBAL OVERVIEW

5 U.S AND CANADA REFRIGERATED WAREHOUSE MARKET, REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR REFRIGERATED STORAGE TO STORE PERISHABLE FOOD PRODUCTS

6.1.2 RAPID URBANIZATION AND THE EXPANSION OF RETAIL CHANNELS.

6.1.3 INCREASE IN THE NUMBER OF SUPERMARKETS IS FOSTERING THE DEMAND FOR REFRIGERATED WAREHOUSING

6.1.4 INCREASE IN DEMAND FOR REFRIGERATED WAREHOUSING IN THE PHARMACEUTICAL AND PERSONAL CARE INDUSTRY

6.2 RESTRAINS

6.2.1 HIGH COSTS ASSOCIATED WITH REFRIGERATED WAREHOUSING

6.2.2 HIGH INVESTMENT IN RESEARCH AND DEVELOPMENT ACTIVITIES FOR REFRIGERATED WAREHOUSING

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN REFRIGERATED WAREHOUSING PROVIDE LUCRATIVE OPPORTUNITIES FOR MARKET GROWTH

6.3.2 EXPANSION OF THE E-COMMERCE INDUSTRY

6.3.3 INCREASE IN NUMBER OF LAUNCHES OF REFRIGERATED WAREHOUSING BY MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH OPERATING COST OF REFRIGERATED WAREHOUSE

6.4.2 HIGH COMPETITION AMONG MARKET PLAYERS

7 U.S. REFRIGERATED WAREHOUSING MARKET, BY EQUIPMENT TYPE

7.1 OVERVIEW

7.2 STORAGE

7.3 AUXILIARY EQUIPMENT

7.4 COMPRESSORS

7.5 CONDENSERS

7.6 EVAPORATORS

7.7 CONTROLLER AND VESSELS

7.8 PUMPS

8 U.S. REFRIGERATED WAREHOUSING MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 BLAST FREEZING

8.3 PROGRAMMABLE LOGIC CONTROLLER

8.4 EVAPORATIVE COOLING

8.5 VAPOR COMPRESSION

8.6 CRYOGENIC SYSTEMS

8.7 OTHERS

9 U.S. REFRIGERATED WAREHOUSING MARKET, BY TEMPERATURE TYPE

9.1 OVERVIEW

9.2 FROZEN

9.3 CHILLED

10 U.S. REFRIGERATED WAREHOUSING MARKET, BY END USER

10.1 OVERVIEW

10.2 PRODUCERS

10.3 FOOD SERVICE PROVIDERS

10.4 RETAILERS

10.5 OTHERS

11 U.S. REFRIGERATED WAREHOUSING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD PRODUCTS

11.2.1 FISH, MEAT, SEA FOOD

11.2.2 FUNCTIONAL FOOD

11.2.3 DAIRY PRODUCTS

11.2.3.1 DAIRY PRODUCTS, BY TYPE

11.2.3.1.1 ICE CREAM

11.2.3.1.2 CHEESE

11.2.3.1.3 YOGURT

11.2.3.1.4 OTHERS

11.2.4 PROCESSED FOOD

11.2.4.1 PROCESSED FOOD, BY TYPE

11.2.4.1.1 READY MEALS

11.2.4.1.2 JAMS, PRESERVES & MARMALADES

11.2.4.1.3 SAUCES, DRESSINGS AND CONDIMENTS

11.2.4.1.4 SOUPS

11.2.4.1.5 OTHERS

11.2.5 CONVENIENCE FOOD

11.2.5.1 CONVENIENCE FOOD, BY TYPE

11.2.5.1.1 SNACKS & EXTRUDED SNACKS

11.2.5.1.2 PIZZA & PASTA

11.2.5.1.3 INSTANT NOODLES

11.2.5.1.4 OTHERS

11.2.6 BAKERY

11.2.6.1 BAKERY, BY TYPE

11.2.6.1.1 CAKES, PASTRIES & TRUFFLE

11.2.6.1.2 BISCUIT, COOKIES & CRACKERS

11.2.6.1.3 BREAD & ROLLS

11.2.6.1.4 TART & PIES

11.2.6.1.5 BROWNIES

11.2.6.1.6 OTHERS

11.2.7 INFANT FORMULA

11.2.7.1 INFANT FORMULA, BY TYPE

11.2.7.1.1 FIRST INFANT FORMULA

11.2.7.1.2 COMFORT FORMULA

11.2.7.1.3 HYPOALLERGENIC FORMULA

11.2.7.1.4 ANTI-REFLUX (STAY DOWN) FORMULA

11.2.7.1.5 FOLLOW-ON FORMULA

11.2.7.1.6 OTHERS

11.2.8 CONFECTIONERY

11.2.8.1 CONFECTIONERY, BY TYPE

11.2.8.1.1 CHOCOLATE

11.2.8.1.2 CHOCOLATE SYRUPS

11.2.8.1.3 CARAMELS & TOFFEES

11.2.8.1.4 GUMS & JELLIES

11.2.8.1.5 HARD-BOILED SWEETS

11.2.8.1.6 MINTS

11.2.8.1.7 OTHERS

11.2.9 FROZEN DESSERTS

11.2.9.1 FROZEN DESSERTS, BY TYPE

11.2.9.1.1 GELATO

11.2.9.1.2 CUSTARD

11.2.9.1.3 OTHERS

11.2.10 OTHERS

11.3 PHARMACEUTICALS & BIOLOGICAL PRODUCTS

11.3.1 PHARMACEUTICALS & BIOLOGICAL PRODUCTS, BY TYPE

11.3.1.1 VACCINES

11.3.1.2 BLOOD AND BLOOD COMPONENTS

11.3.1.3 INSULIN

11.3.1.4 CAPSULES

11.3.1.5 TABLETS

11.3.1.6 OTHERS

11.4 BEVERAGES

11.4.1 BEVERAGES, BY TYPE

11.4.1.1 NON-ALCOHOLIC BEVERAGES

11.4.1.1.1 NON-ALCOHOLIC BEVERAGES, BY TYPE

11.4.1.1.1.1 DAIRY BASED DRINKS

11.4.1.1.1.1.1 REGULAR PROCESSED MILK

11.4.1.1.1.1.2 FLAVORED MILK

11.4.1.1.1.1.3 MILK SHAKES

11.4.1.1.1.2 PLANT BASED MILK

11.4.1.1.1.3 JUICES

11.4.1.1.1.4 SPORTS DRINKS

11.4.1.1.1.5 ENERGY DRINKS

11.4.1.1.1.6 SMOOTHIES

11.4.1.1.1.7 OTHERS

11.4.1.2 ALCOHOLIC BEVERAGES

11.4.1.2.1 ALCOHOLIC BEVERAGES, BY TYPE

11.4.1.2.1.1 BEERS

11.4.1.2.1.2 PACKAGED COCKTAIL BEVERAGES

11.4.1.2.1.3 OTHERS

11.5 DIETARY SUPPLEMENTS

11.5.1 DIETARY SUPPLEMENTS, BY TYPE

11.5.1.1 IMMUNITY SUPPLEMENTS

11.5.1.2 OVERALL WELLBEING SUPPLEMENTS

11.5.1.3 BONE AND JOINT HEALTH SUPPLEMENTS

11.5.1.4 SKIN HEALTH SUPPLEMENTS

11.5.1.5 OTHERS

11.6 PERSONAL CARE PRODUCTS

11.6.1 PERSONAL CARE PRODUCTS, BY TYPE

11.6.1.1 SKIN CARE

11.6.1.2 ORAL CARE

11.6.1.3 OTHERS

11.7 OTHERS

12 U.S. REFRIGERATED WAREHOUSING MARKET, BY COUNTRY

12.1 U.S.

13 U.S. REFRIGERATED WAREHOUSING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LINEAGE LOGISTICS HOLDING, LLC

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 AMERICOLD

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 JOHN SWIRE & SONS (H.K.) LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 COLD STORAGE INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 CONESTOGA COLD STORAGE

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 CONGEBEC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DELTA PACIFIC SEAFOODS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ICEBERG COLD STORAGE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KLOOSTERBOER

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 TRETON COLD STORAGE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONARE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA MARKET LEADER IN TEMPERATURE-CONTROLLED WAREHOUSING

TABLE 2 GLOBAL MARKET LEADER IN TEMPERATURE-CONTROLLED WAREHOUSING

TABLE 3 STOCKS OF FROZEN AND CHILLED MEATS, DOMESTIC AND IMPORTED, IN COLD STORAGE, QUARTERLY (IN TONNES) (CANADA)

TABLE 4 CANADIAN STOCKS OF FROZEN AND CHILLED MEAT IN COLD STORAGE (IN TONNES)

TABLE 5 CANADIAN STOCKS OF FROZEN AND CHILLED MEAT IN COLD STORAGE (IN TONNES)

TABLE 6 CANADIAN STOCKS OF FROZEN AND CHILLED MEAT IN COLD STORAGE (IN TONNES)

TABLE 7 U.S. REFRIGERATED WAREHOUSING MARKET, BY EQUIPMENT TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.S. REFRIGERATED WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 9 U.S. REFRIGERATED WAREHOUSING MARKET, BY TEMPERATURE TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.S. REFRIGERATED WAREHOUSING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 11 U.S. REFRIGERATED WAREHOUSING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 U.S. FOOD PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. DAIRY PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. PROCESSED FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. CONVENIENCE FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. BAKERY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.S. INFANT FORMULA IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.S. CONFECTIONARY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. FROZEN DESSERT IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. PHARMACEUTICAL & BIOLOGICAL PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 U.S. BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.S. NON-ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 U.S. DAIRY BASED DRINKS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.S. ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. DIETARY SUPPLEMENTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 U.S. PERSONAL CARE PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. REFRIGERATED WAREHOUSING MARKET, BY EQUIPMENT TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. REFRIGERATED WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 29 U.S. REFRIGERATED WAREHOUSING MARKET, BY TEMPERATURE TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. REFRIGERATED WAREHOUSING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 31 U.S. REFRIGERATED WAREHOUSING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 U.S. FOOD PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. BAKERY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. DAIRY PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. PROCESSED FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.S. CONFECTIONARY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. FROZEN DESSERT IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. INFANT FORMULA IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. CONVENIENCE FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. NON-ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. DAIRY BASED DRINKS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. DIETARY SUPPLEMENTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. PERSONAL CARE PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. PHARMACEUTICALS & BIOLOGICAL PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 U.S. REFRIGERATED WAREHOUSING MARKET: SEGMENTATION

FIGURE 2 U.S. REFRIGERATED WAREHOUSING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. REFRIGERATED WAREHOUSING MARKET: DROC ANALYSIS

FIGURE 4 U.S. REFRIGERATED WAREHOUSING MARKET: COUNTRY ANALYSIS

FIGURE 5 U.S. REFRIGERATED WAREHOUSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. REFRIGERATED WAREHOUSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. REFRIGERATED WAREHOUSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. REFRIGERATED WAREHOUSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. REFRIGERATED WAREHOUSING MARKET: SEGMENTATION

FIGURE 10 RAPID URBANIZATION AND EXPANSION OF RETAIL CHANNELS IS EXPECTED TO DRIVE THE U.S. REFRIGERATED WAREHOUSING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 STORAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. REFRIGERATED WAREHOUSING MARKET IN 2022 & 2029

FIGURE 12 VALUE CHAIN OF U.S. REFRIGERATED WAREHOUSING MARKET

FIGURE 13 PERISHABLE FOOD PRODUCTS IMPORTED AND EXPORTED FROM CANADA (CAD BILLIONS)

FIGURE 14 BOVINE PRODUCTS IMPORTED AND EXPORTED FROM CANADA (CAD BILLIONS)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. REFRIGERATED WAREHOUSING MARKET

FIGURE 16 U.S. REFRIGERATED WAREHOUSING MARKET: BY EQUIPMENT TYPE, 2021

FIGURE 17 U.S. REFRIGERATED WAREHOUSING MARKET: BY TECHNOLOGY, 2021

FIGURE 18 U.S. REFRIGERATED WAREHOUSING MARKET: BY TEMPERATURE TYPE, 2021

FIGURE 19 U.S. REFRIGERATED WAREHOUSING MARKET: BY END-USER, 2021

FIGURE 20 U.S. REFRIGERATED WAREHOUSING MARKET: BY APPLICATION, 2021

FIGURE 21 U.S. REFRIGERATED WAREHOUSING MARKET: COMPANY SHARE 2021 (%)

Us Refrigerated Warehousing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Refrigerated Warehousing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Refrigerated Warehousing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.