亚太镁合金市场、按产品(铸造合金和锻造合金)、应用(汽车和运输、航空航天和国防、电子、电动工具等)的行业趋势和预测到 2029 年。

亚太镁合金市场分析及规模

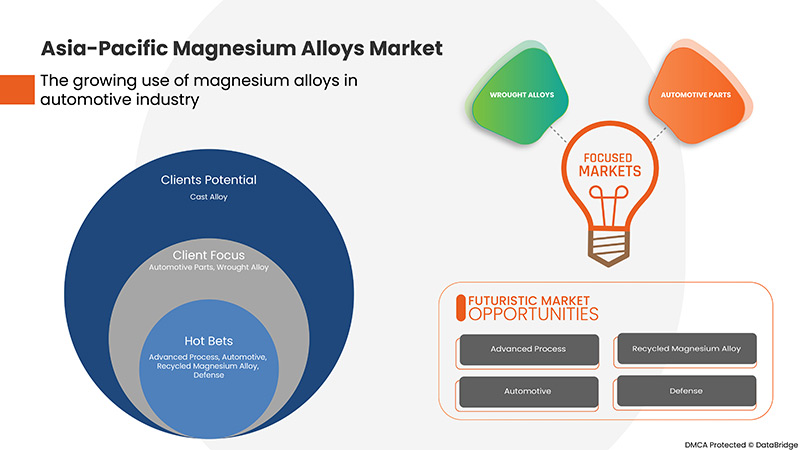

镁合金在汽车行业的日益广泛应用有望推动市场增长和亚太地区镁合金市场的需求。然而,该市场扩张的主要障碍是镁的价格不确定性以及可焊性和耐腐蚀性问题。

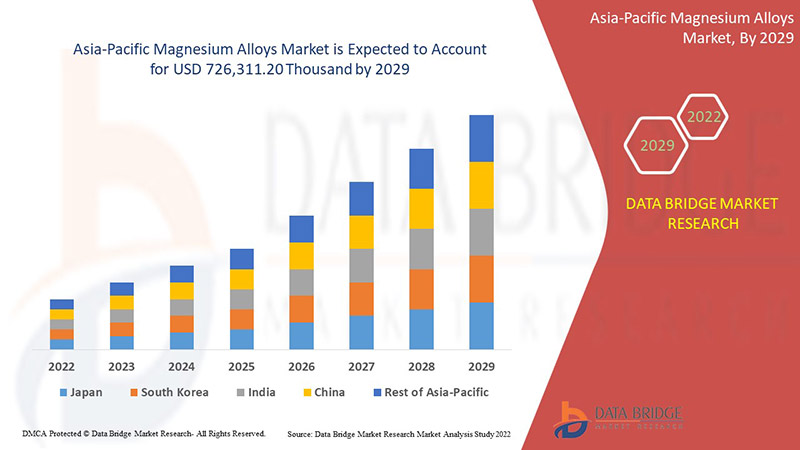

这些亚太镁合金主要用于汽车和运输、变速箱、前端和 IP 梁、转向柱和驾驶员安全气囊外壳、方向盘、座椅框架和油箱盖。Data Bridge Market Research 分析称,到 2029 年,亚太镁合金市场预计将达到 726,311.20 万美元,预测期内的复合年增长率为 5.4%。Data Bridge Market Research 团队策划的市场报告包括深入的专家分析、进出口分析、定价分析、生产消费分析和气候链情景。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元),数量(吨) |

|

涵盖的领域 |

按产品(铸造合金和锻造合金)、应用(汽车和运输、航空航天和国防、电子、电动工具等)。 |

|

覆盖国家 |

日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚、新西兰以及亚太地区其他地区 |

|

涵盖的市场参与者 |

Luxfer MEL Technologies、山东省费县银光镁业有限公司、regal-mg、US Magnesium LLC、Namoalloy、Dead sea Magnesium、DSM、Amacor、Dynacast、RIMA INDUSTRIAL、Mag Specialties Inc.、MAGONTEC Limited、南京云海特种金属有限公司等。 |

市场定义

镁是最轻的结构材料,密度为 1.74 g/cm,将镁与金属制成合金可提高硬度、铸造性和强度,同时对粘度的影响可忽略不计。铝主要用作镁的合金金属。镁合金具有重量轻、导热性、强度、耐用性、耐腐蚀性和高温蠕变性等特性。

COVID-19 对亚太镁合金市场影响甚微

2020-2021 年, COVID-19影响了各个制造业,导致工作场所关闭、供应链中断和运输限制。在 COVID-19 爆发期间,由于汽车和航空航天工业的制造停止,镁合金市场遭受了重大损失。只有医疗供应和生命支持部门被允许运营。由于物流限制,供应链也中断了。因此,镁合金市场的增长也受到阻碍。

亚太镁合金市场的市场动态包括:

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

亚太镁合金市场面临的驱动因素/机遇

- 镁合金在汽车工业中的应用增长

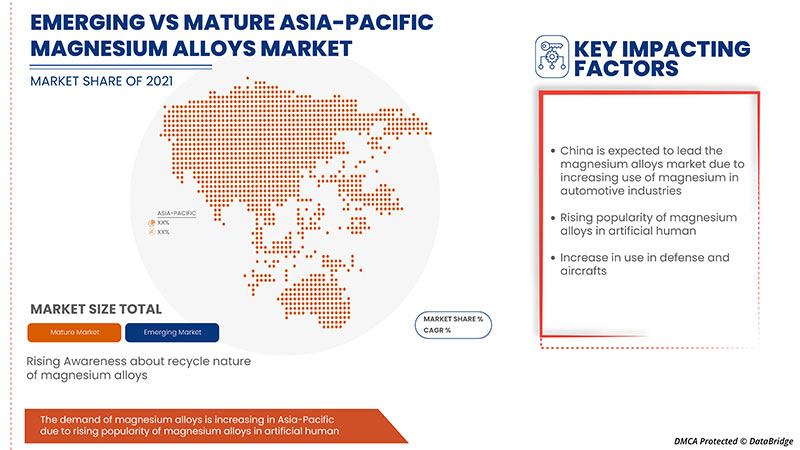

镁合金在汽车行业的使用量不断增长,这是推动亚太地区镁合金市场进一步发展的关键。市场的发展受到工程部件制造量不断增长的推动,这些部件用于减轻重量,同时又不损害车辆的整体强度,以及对减震能力的需求不断增长。此外,镁合金为车辆提供强度、重量轻、耐用性、导热性、高温蠕变和耐腐蚀性。因此,由于这些特性,预计对镁合金的需求将大幅增长。

- 镁合金在人造人体植入物和医疗器械中的普及度不断上升

镁合金在人造人体植入物中的日益普及以及该材料在医疗器械中的应用日益广泛,可能会推动该行业的增长。医疗器械和植入物生产商大多使用镁合金,因为其密度低。镁合金因其重量轻的特性而用于制造便携式医疗设备和轮椅。

由于这些优势,各种医疗植入物和设备制造商已经开始使用镁合金作为生产中的重要材料。

- 该材料在航空航天和国防工业中的应用增加

航空航天和国防领域对轻型部件的需求不断增长是亚太镁合金市场的主要驱动力。镁合金用于制造直升机变速箱壳体、飞机发动机、变速箱壳体、涡轮发动机、喷气发动机风扇框架、航天器和导弹。因此,预计国防领域支出的增加和对新型商用飞机的需求仍将是亚太镁合金市场的主要增长驱动因素。

例如:

- 2019年,美国政府为国防部提出了6860亿美元的预算,其中在飞机方面的重点投资包括77架F-35联合攻击战斗机、10架P-8A飞机和15架KC-46加油机替换机

- 2019 年,波音公司发布的一项研究显示,到 2038 年,北美地区新飞机交付量可能达到 9,130 架,仅次于亚太地区,居第二位。此外,人们对节油汽车的偏好预计将推动此类轻质材料的使用,从而增加对镁合金产品的需求

- 引入触变成型和新流变铸造等新工艺

低成本铸造高强度、抗拉、耐压部件是为了将镁合金引入液压和结构应用。在低于液体温度(半固态或含有大量固体)铸造部件方面已经开展了大量开发工作。因此,所有这些新开发的工艺在镁合金加工方面具有优势,将为亚太地区镁合金市场的增长和发展提供有利可图的机会。

亚太镁合金市场面临的限制/挑战

- 镁价波动

镁及镁合金价格波动预计将在一定程度上限制亚太镁合金市场的扩张。过去,煤炭供应减少、停产等各种因素导致镁价上涨。在供应方面,整体紧缩导致镁锭产量下降。

面对剧烈波动的镁价,镁合金企业正通过扩产、设备升级、上高附加值项目等方式积极布局行业。

- 镁合金的腐蚀和焊接相关问题

由于镁合金耐腐蚀性差、柔韧性低,其使用受到限制。这些合金在普通环境下的耐腐蚀性与低碳钢大致相同,但耐腐蚀性不如铝合金(无论是通用合金还是电镀合金)。

此外,制造工程师面临的最大困难之一是确定哪种工艺能够以最低的成本通过焊接工艺产生令人满意的镁合金性能。通常,镁合金的焊接不是一件容易的事,因为它需要使用先进可靠的技术和策略,例如钨极惰性气体保护焊 (TIG)、

- 镁合金替代材料种类繁多

在所有常用压铸合金中,铝仍然是每立方英寸最便宜的合金。因此,其他各种合金类型的供应将对亚太地区镁合金市场的销售和增长构成挑战。

亚太镁合金市场范围

亚太镁合金市场根据产品和应用进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

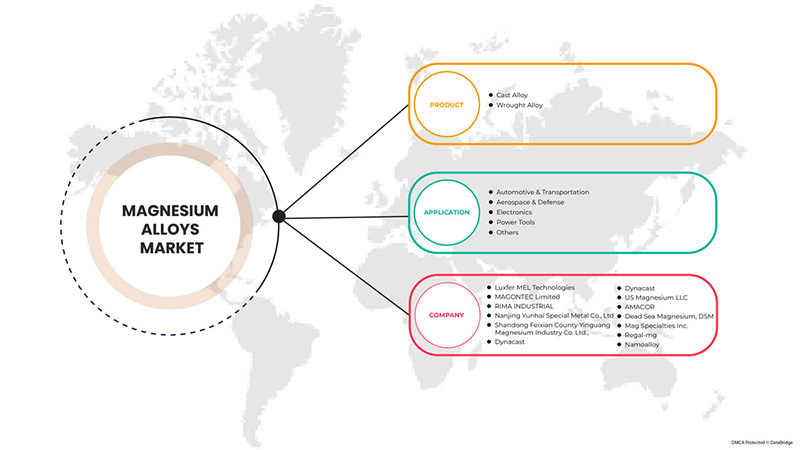

产品

- 铸造合金

- 锻造合金

根据产品,市场分为铸造合金和锻造合金。

应用

- 汽车与运输

- 航空航天和国防

- 电子产品

- 电动工具

- 其他的

根据应用,市场细分为汽车和运输、航空航天和国防、电子、电动工具等。

亚太镁合金市场区域分析/见解

对亚太镁合金市场进行了分析,并按国家、产品和应用提供了市场规模见解和趋势,如上所述。

亚太镁合金市场报告涵盖日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚和新西兰以及亚太其他地区。

由于此类轻质材料的使用增加,中国在镁合金市场占据主导地位,从而增加了该地区对节油汽车的产品需求。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势、波特五力分析和案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在对国家数据进行预测分析时,还考虑了品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

亚太镁合金竞争格局及份额分析

亚太镁合金市场竞争格局提供了竞争对手的详细信息。 其中包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、欧洲业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。 以上数据点仅与专注于亚太镁合金市场的公司有关。

亚太镁合金市场的一些主要参与者包括Luxfer MEL Technologies、山东费县银光镁业有限公司、regal-mg、US Magnesium LLC、Namoalloy、Dead sea Magnesium、DSM、Amacor、Dynacast、RIMA INDUSTRIAL、Mag Specialties Inc.、MAGONTEC Limited、南京云海特种金属有限公司等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC MAGNESIUM ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 IMPORT EXPORT SCENARIO

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THE THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 REGULATORY COVERAGE

5 PRODUCTION CAPACITY OUTLOOK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY

6.1.2 RISING POPULARITY OF MAGNESIUM ALLOYS IN ARTIFICIAL HUMAN IMPLANTS AND MEDICAL DEVICES

6.1.3 INCREASING APPLICATIONS OF THE MATERIAL IN AEROSPACE AND DEFENSE INDUSTRIES

6.1.4 RISING USES AS A REPLACEMENT OF PLASTICS IN ELECTRONIC APPLICATIONS

6.2 RESTRAINTS

6.2.1 FLUCTUATING MAGNESIUM PRICES

6.2.2 ISSUES ASSOCIATED WITH CORROSION AND WELDING OF MAGNESIUM ALLOYS

6.2.3 ENGINEERING BARRIERS SUCH AS FORMABILITY AT ROOM TEMPERATURE AND DIFFICULTY FORGING

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF NEW PROCESSES SUCH AS THIXOMOLDING AND NEW RHEOCASTING

6.3.2 RECYCLABLE NATURE OF MAGNESIUM ALLOYS

6.3.3 HIGH ABUNDANCE OF MAGNESIUM ELEMENTS ACROSS THE GLOBE

6.4 CHALLENGES

6.4.1 VARIOUS AVAILABILITY OF ALTERNATIVE MATERIALS FOR MAGNESIUM ALLOYS

6.4.2 PROBLEMS RELATED TO PURITY OF MAGNESIUM ALLOYS

7 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAST ALLOY

7.3 WROUGHT ALLOY

8 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.2.1 CAST ALLOY

8.2.2 WROUGHT ALLOY

8.3 AEROSPACE & DEFENSE

8.3.1 CAST ALLOY

8.3.2 WROUGHT ALLOY

8.4 ELECTRONICS

8.4.1 CAST ALLOY

8.4.2 WROUGHT ALLOY

8.5 POWER TOOLS

8.5.1 CAST ALLOY

8.5.2 WROUGHT ALLOY

8.6 OTHERS

8.6.1 CAST ALLOY

8.6.2 WROUGHT ALLOY

9 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 SOUTH KOREA

9.1.5 AUSTRALIA & NEW ZEALAND

9.1.6 SINGAPORE

9.1.7 INDOENASIA

9.1.8 THAILAND

9.1.9 MALAYSIA

9.1.10 PHILIPPINES

9.1.11 REST OF ASIA PACIFIC

10 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.1.1 EXPANSIONS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LUXFER MEL TECHNOLOGIES

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 SWOT

12.1.5 RECENT DEVELOPMENT

12.2 MAGNOTEC LIMITED

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY PROFILE

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATES

12.3 RIMA INDUSTRIAL

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT DEVELOPMENTS

12.4 NANJING YUNHAI SPECIAL METAL CO., LTD

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 SWOT

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 SHANDONG FEIXIAN COUNTY YINGUANG MAGNESIUM INDUSTRY CO. LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENT

12.6 AMACOR

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT DEVELOPMENT

12.7 DEAD SEA MAGNESIUM, DSM

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT DEVELOPMENTS

12.8 DYNACAST

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 MAG SPECIALITY INC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT DEVELOPMENTS

12.1 NAMOALLOY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 REGAL-MG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT DEVELOPMENTS

12.12 US MAGNESIUM LLC

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 ASIA PACIFIC CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 ASIA PACIFIC WROUGHT ALLOY IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC WROUGHT ALLOY IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 12 ASIA PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 14 ASIA PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 16 ASIA PACIFIC AEROSPACE & DEFENSE IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC AEROSPACE & DEFENSE IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 18 ASIA PACIFIC AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 20 ASIA PACIFIC ELECTRONICS IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC ELECTRONICS IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 22 ASIA PACIFIC ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 24 ASIA PACIFIC POWER TOOLS IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC POWER TOOLS IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 26 ASIA PACIFIC POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 28 ASIA PACIFIC OTHERS IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC OTHERS IN ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 30 ASIA PACIFIC OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 32 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 34 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 36 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 38 ASIA-PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 40 ASIA-PACIFIC AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 42 ASIA-PACIFIC ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 44 ASIA-PACIFIC POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 46 ASIA-PACIFIC OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 48 CHINA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 CHINA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 50 CHINA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 CHINA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 52 CHINA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 CHINA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 54 CHINA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 CHINA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 56 CHINA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 58 CHINA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 60 CHINA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 62 INDIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 INDIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 64 INDIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 INDIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 66 INDIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 68 INDIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 INDIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 70 INDIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 72 INDIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 INDIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 74 INDIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 INDIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 76 JAPAN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 78 JAPAN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 JAPAN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 80 JAPAN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 81 JAPAN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 82 JAPAN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 JAPAN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 84 JAPAN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 JAPAN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 86 JAPAN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 JAPAN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 88 JAPAN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 JAPAN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 90 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 92 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 94 SOUTH KOREA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 SOUTH KOREA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 96 SOUTH KOREA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 97 SOUTH KOREA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 98 SOUTH KOREA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 SOUTH KOREA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 100 SOUTH KOREA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 101 SOUTH KOREA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 102 SOUTH KOREA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 103 SOUTH KOREA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 104 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 105 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 106 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 108 AUSTRALIA & NEW ZEALAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 AUSTRALIA & NEW ZEALAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 110 AUSTRALIA & NEW ZEALAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 AUSTRALIA & NEW ZEALAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 112 AUSTRALIA & NEW ZEALAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 AUSTRALIA & NEW ZEALAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 114 AUSTRALIA & NEW ZEALAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 AUSTRALIA & NEW ZEALAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 116 AUSTRALIA & NEW ZEALAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 AUSTRALIA & NEW ZEALAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 118 SINGAPORE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 119 SINGAPORE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 120 SINGAPORE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 SINGAPORE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 122 SINGAPORE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 123 SINGAPORE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 124 SINGAPORE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 125 SINGAPORE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 126 SINGAPORE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 127 SINGAPORE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 128 SINGAPORE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 129 SINGAPORE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 130 SINGAPORE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 SINGAPORE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 132 INDONESIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 SINGAPORE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 134 INDONESIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 INDONESIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 136 INDONESIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 INDONESIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 138 INDONESIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 INDONESIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 140 INDONESIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 141 INDONESIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 142 INDONESIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 143 INDONESIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 144 INDONESIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 145 INDONESIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 146 THAILAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 147 THAILAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 148 THAILAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 THAILAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 150 THAILAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 151 THAILAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 152 THAILAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 THAILAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 154 THAILAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 THAILAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 156 THAILAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 THAILAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 158 THAILAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 THAILAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 160 MALAYSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 MALAYSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 162 MALAYSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 MALAYSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 164 MALAYSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 165 MALAYSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 166 MALAYSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 167 MALAYSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 168 MALAYSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 169 MALAYSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 170 MALAYSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 171 MALAYSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 172 MALAYSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 173 MALAYSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 174 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 176 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 177 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 178 PHILIPPINES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 PHILIPPINES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 180 PHILIPPINES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 PHILIPPINES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 182 PHILIPPINES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 PHILIPPINES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 184 PHILIPPINES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 185 PHILIPPINES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 186 PHILIPPINES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 187 PHILIPPINES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 188 REST OF ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 189 REST OF ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

图片列表

FIGURE 1 ASIA PACIFIC MAGNESIUM ALLOYS MARKET

FIGURE 2 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC MAGNESIUM ALLOYS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE ASIA PACIFIC MAGNESIUM ALLOYS MARKET IN THE FORECAST PERIOD

FIGURE 16 CAST ALLOY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MAGNESIUM ALLOY MARKET IN 2022 & 2029

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC MAGNESIUM ALLOYS MARKET

FIGURE 19 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: BY PRODUCT, 2021

FIGURE 20 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: BY APPLICATION, 2021

FIGURE 21 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 22 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 23 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2029)

FIGURE 26 ASIA PACIFIC MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。