Canada Fleet Management Market, By Offering (Solutions and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engine and Electric vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags, Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles) and Large & Enterprise Fleets (20-50+ Vehicles), Communication Range (Short Range Communication and Long Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Method & Decision Making, RFID, and Others), Functions (Monitoring Driver Behavior, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Business and Large Business), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) – Industry Trends and Forecast to 2030.

Canada Fleet Management Market Analysis and Size

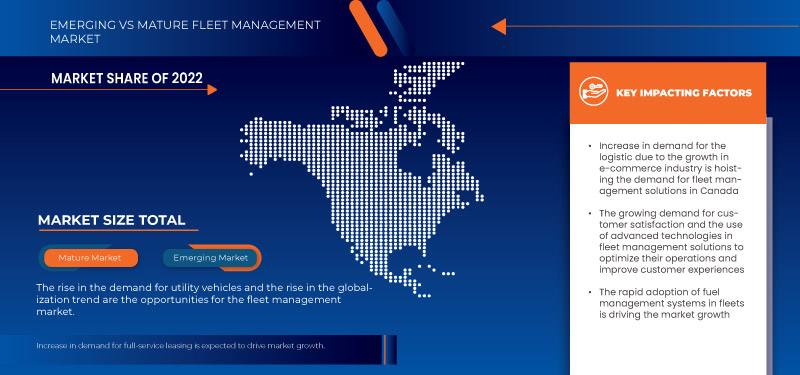

Major factors expected to boost the growth of the fleet management market in the forecast period are the rise in several industrial applications, including aerospace, steel, power, chemical, and others. Furthermore, the increased resistance to load variations is the benefit of fleet management, which is further anticipated to propel the growth of the fleet management market.

Data Bridge Market Research analyses that the Canada fleet management market is expected to reach the value of USD 2,204,927.30 thousand by 2030, at a CAGR of 8.1% during the forecast period. The fleet management market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 - 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

产品(解决方案和服务)、租赁类型(租赁和非租赁)、运输方式(汽车、船舶、机车车辆和飞机)、车辆类型(内燃机和电动汽车)、硬件(GPS 跟踪设备、行车记录仪、蓝牙跟踪标签、数据记录器等)、车队规模(小型车队(1-5 辆)、中型车队(5-20 辆)和大型及企业车队(20-50+ 辆)、通信范围(短距离通信和长距离通信)、部署模型(本地、云和混合)、技术(GNSS、蜂窝系统、电子数据交换 (EDI)、遥感、计算方法和决策、RFID 等)、功能(监控驾驶员行为、燃油消耗、资产管理、ELD 投诉、路线管理、车辆维护更新、交货时间表、事故预防、实时车辆定位、移动应用程序等)、运营(私人和商业)、业务类型(小型企业和大型企业)、最终用户(汽车、运输和物流、零售、制造、食品和饮料、能源和公用事业、采矿、政府、医疗保健、农业、建筑等) |

|

覆盖国家 |

加拿大 |

|

涵盖的市场参与者 |

Element Fleet Management Corp.(美国)、Verizon.(美国)、Geotab Inc.(加拿大)、Motive Technologies, Inc.(美国)、Jim Pattison Lease(加拿大)、Holman, Inc.(美国)、Cisco Systems, Inc.(美国)、Donlen(美国)、Omnitracs(Solera 的一部分)(美国)、Wheels Inc.(美国)、DENSO CORPORATION(日本)、AT&T(美国)、Continental AG(德国)、ORBCOMM(美国)、Summit Fleet Leasing and Management(加拿大)、Siemens(德国)、ADDISON LEASING OF CANADA LTD(加拿大)、Robert Bosch GmbH(德国)、RAM Tracking(英国)、TRANSFLO(美国)、Foss National Leasing Ltd.(加拿大)、Samsara Inc.(美国)、Sierra Wireless。 (美国)、Mendix Technology BV(荷兰)、ALD Automotive(法国)、IBM(美国)、ADDISON LEASING OF CANADA LTD(加拿大)、Robert Bosch GmbH(德国)、RAM Tracking(英国)、TRANSFLO(美国)等 |

市场定义

车队管理是管理公司车队所涉及的流程和实践。车队管理包括用于商业目的的汽车、卡车、货车和其他车辆。它还涉及许多实践,例如车辆采购、维护、燃料管理、驾驶员管理以及安全和合规性。车队管理的目标是优化公司车辆的使用,以提高效率、降低成本和增强安全性。有效的车队管理可以帮助公司提高生产力、减少停机时间并延长车辆的使用寿命。它还可以帮助改善驾驶员行为、减少事故并确保遵守法规和政策。车队管理用于各种行业,包括运输、物流、送货服务和建筑。近年来,GPS 跟踪和远程信息处理等先进技术使车队管理更加有效和高效。

加拿大车队管理市场动态

本节旨在了解市场驱动因素、机遇、限制因素和挑战。下文将详细讨论所有这些内容:

驱动程序

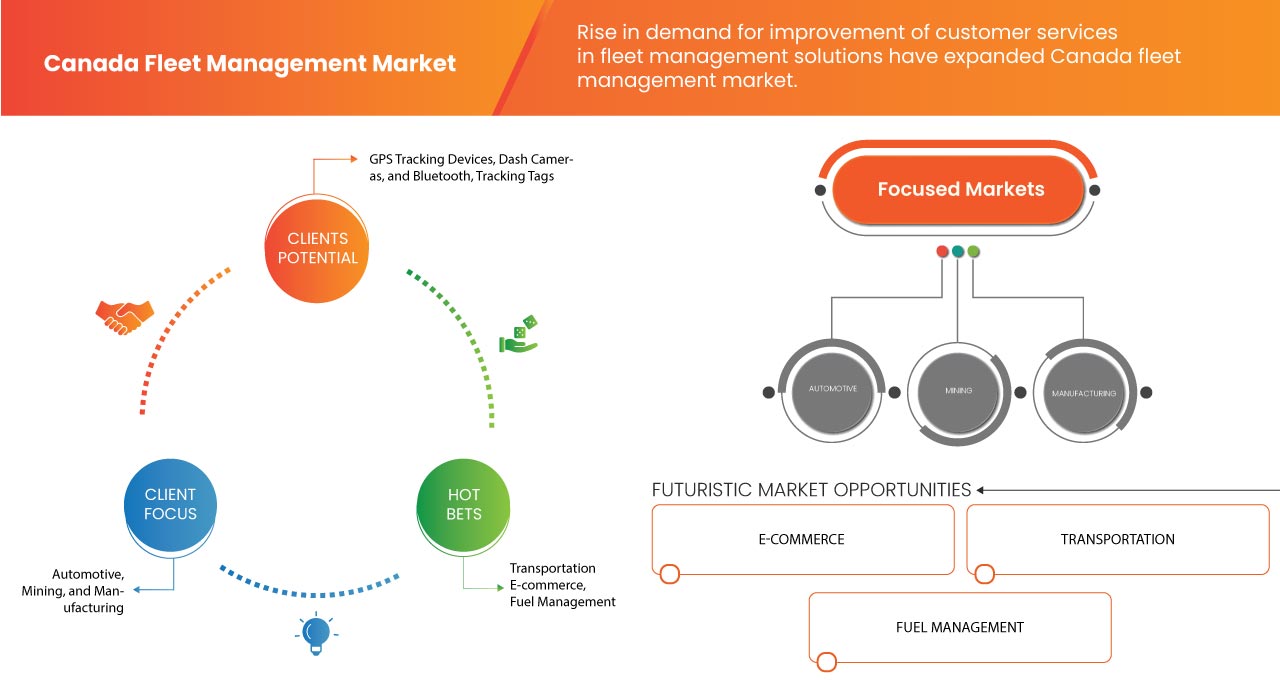

- 电子商务行业对物流的需求增加

车队管理是一种允许组织管理和协调运输车辆以实现最佳效率并降低成本的实践。车队管理实践用于监控和记录快递员和送货人员。它需要一套技术系统,使车队经理更容易协调从燃料管理到规划路线的活动 - 并且可以使用车队管理软件轻松管理。电子商务行业的扩张对物流行业产生了重大影响。物流一直被认为是电子商务行业的支柱,因为它直接影响计划运营、仓库和生产网络组织。他们将越来越依赖于重新评估来处理与电子商务部分发展相关的不断增长的需求。无论是最后一英里的运输还是为了满足需求,采用这一路线都将使他们能够保证可预测、可靠、高效和无故障的运输。因此,这可能是管理和扩大电子商务行业预期增长带来的压力的重要因素。

- 改善客户服务的需求不断增加

如今,客户比以往任何时候都更加聪明,期望也更高。客户满意度和幸福感是任何公司最重要的考虑因素之一。无论在哪个行业,不满意的客户不会成为长期客户,因此让他们感到满意并感到被重视非常重要。这对于物流和车队管理也是如此,留住客户是长期成功的关键。通过提高车队管理绩效来改善客户服务和满意度是有望推动加拿大车队管理市场发展的关键因素。在当今竞争激烈的市场中,企业认识到客户满意度的重要性,并在车队管理解决方案中使用先进技术来优化运营并改善客户体验

机会

- 多功能车需求上升

多功能车是专为运载货物或乘客而设计和使用的车辆。这些车辆包括卡车、厢式货车、公共汽车和用于商业目的的类似车辆。多功能车市场是加拿大汽车工业的重要组成部分,在过去几十年中经历了显着增长。多功能车需求的增长可归因于多种因素,包括电子商务行业的增长、城市化进程加快以及对高效运输系统的需求。随着越来越多的企业依赖多功能车来满足其运输需求,对车队管理服务和软件的需求预计也会增加。多功能车需求上升的原因之一是电子商务行业的增长。随着在线购物平台数量的增加,对运输服务的需求也随之增加。多功能车的使用变得越来越普遍,车队管理变得越来越重要。

限制/挑战

- 连接效率较低

近年来,物流和运输行业发生了重大变化。数字化、大数据和连通性等概念相继出现,许多车队现在正在使用这些新技术的早期版本。在许多情况下,它们正在改变车队经理的日常运营方式。连通性是最重要和最有效的概念之一。车队经理可以通过自动化流程概览整个车队,并与司机、卡车和拖车保持联系,这些流程从车载设备提供可操作的数据。通过远程信息处理设备和联网软件解决方案,车队可以在车辆出现小问题时收到警报,使他们能够尽早解决问题并在故障发生之前处理问题。这提供了提前进行运行维修或定期维护的灵活性,使卡车能够更频繁地在路上行驶,花更多时间运送货物。

- 启用路线的不当指导

车辆跟踪系统可以定义为车队管理系统的一部分,它使车队运营商能够在整个行程中随时了解车辆的位置。除了利用车辆跟踪系统生成的数据来执行公交车时刻表外,这些数据还为决策提供了重要的输入。该系统有助于计算给定时间段内的精确行驶距离、计算公交车在给定位置的速度、分析车辆行驶一定距离所需的时间等。对于运营机构来说,它是一个非常强大的工具。

最新动态

- 2023 年 6 月,西门子 Xcelerator 与 Helixx 的合作标志着他们在追求电动汽车制造业革命方面迈出了关键一步。通过整合西门子的工业软件和服务,Helixx 旨在迅速在全球范围内部署其创新的电动汽车制造系统,通过可访问的零排放城市交通解决方案促进可持续的经济增长。此次合作凸显了 Helixx 开创性的 Helixx 移动枢纽概念,该概念将使全球授权工厂能够生产各种电动汽车,使其影响力远远超出最初的生产预测。

- 2023 年 6 月,Foss National Leasing Ltd. 对 Foss 电动汽车试点计划进行了为期一年的更新,该公司将电动汽车 (EV) 整合到车队中,获得了富有洞察力的运营数据,帮助客户采用电动汽车。该计划通过解决不确定性,有效地促进了向可持续车队管理解决方案的平稳过渡。总之,该公司的持续努力表明该计划在促进明智决策以实现更环保、更高效的未来方面发挥着关键作用。

加拿大车队管理市场范围

加拿大车队管理市场根据产品、租赁类型、运输方式、车辆类型、硬件、车队规模、通信范围、部署模式、技术、功能、运营、业务类型和最终用户进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

奉献

- 解决方案

- 服务

根据产品供应,市场分为解决方案和服务。

租赁类型

- 租赁

- 无租约

根据租赁类型,市场分为租赁和无租赁。

交通方式

- 汽车

- 海洋

- 机车车辆

- 飞机

根据运输方式,市场分为汽车、船舶、机车车辆和飞机。

车辆类型

- 内燃机

- 电动汽车

根据车辆类型,市场分为内燃机汽车和电动汽车。

硬件

- GPS 追踪设备

- 行车记录仪

- 蓝牙追踪标签

- 数据记录器

- 其他的

根据硬件,市场分为 GPS 跟踪设备、DASH 摄像头、蓝牙跟踪标签、数据记录器等。

船队规模

- 小型车队(1-5 辆车)

- 中型车队(5-20 辆车)

- 大型及企业车队(20-50+ 辆车)

根据车队规模,市场分为小型车队(1-5 辆车)、中型车队(5-20 辆车)以及大型及企业车队(20-50+ 辆车)。

通信范围

- 短距离通信

- 长距离通信

根据通信范围,市场分为短距离通信和长距离通信。

部署模型

- 本地部署

- 云

- 杂交种

根据部署模型,市场分为内部部署、云端和混合部署。

技术

- 全球导航卫星系统

- 蜂窝系统

- 电子数据交换 (EDI)

- 遥感

- 计算方法与决策

- 射频识别

- 其他的

根据技术,市场细分为 GNSS、蜂窝系统、电子数据交换 (EDI)、遥感、计算方法和决策、RFID 等。

功能

- 资产管理

- 路线管理

- 燃料消耗

- 实时车辆定位

- 送货时间表

- 事故预防

- 移动应用程序

- 监控驾驶员行为

- 车辆维护更新

- ELD 合规性

- 其他的

根据功能,市场细分为资产管理、路线管理、燃料消耗、实时车辆位置、交货计划、事故预防、移动应用、监控驾驶员行为、车辆维护更新、ELD 合规等。

运营

- 私人的

- 商业的

根据运营情况,市场分为私人市场和商业市场。

业务类型

- 小型企业

- 大型企业

根据业务类型,市场分为小型企业和大型企业。

最终用户

- 汽车

- 运输与物流

- 零售

- 制造业

- 食品和饮料

- 能源与公用事业

- 矿业

- 政府

- 卫生保健

- 农业

- 建造

- 其他的

根据最终用户,市场细分为汽车、运输和物流、零售、制造、食品和饮料、能源和公用事业、采矿、政府、医疗保健、农业、建筑等。

竞争格局和加拿大车队管理市场份额分析

加拿大车队管理市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、国家存在、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对车队管理市场的关注有关。

市场上的一些主要参与者包括 Element Fleet Management Corp.(美国)、Verizon.(美国)、Geotab Inc.(加拿大)、Motive Technologies, Inc.(美国)、Jim Pattison Lease(加拿大)、Holman, Inc.(美国)、Cisco Systems, Inc.(美国)、Donlen(美国)、Omnitracs(Solera 的一部分)(美国)、Wheels Inc.(美国)、DENSO CORPORATION(日本)、AT&T(美国)、Continental AG(德国)、ORBCOMM(美国)、Summit Fleet Leasing and Management(加拿大)、Siemens(德国)、ADDISON LEASING OF CANADA LTD(加拿大)、Robert Bosch GmbH(德国)、RAM Tracking(英国)、TRANSFLO(美国)、Foss National Leasing Ltd.(加拿大)、Samsara Inc.(美国)和Sierra Wireless。 (美国)、Mendix Technology BV(荷兰)、ALD Automotive(法国)、IBM(美国)、ADDISON LEASING OF CANADA LTD(加拿大)、Robert Bosch GmbH(德国)、RAM Tracking(英国)和 TRANSFLO(美国)等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CANADA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF GLOBALIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS

6.1 OVERVIEW

6.2 ASSET MANAGEMENT

6.3 ROUTE MANAGEMENT

6.4 FUEL CONSUMPTION

6.5 REAL TIME VEHICLE LOCATION

6.6 DELIVERY SCHEDULE

6.7 ACCIDENT PREVENTION

6.8 MOBILE APPS

6.9 MONITORING DRIVER BEHAVIOR

6.1 VEHICLE MAINTENANCE UPDATES

6.11 ELD COMPLIANCE

6.12 OTHERS

7 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS

7.1 OVERVIEW

7.2 COMMERCIAL

7.3 PRIVATE

8 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

8.1 OVERVIEW

8.2 LARGE BUSINESS

8.2.1 FLORIST & GIFT DELIVERY BUSINESS

8.2.2 CATERING & FOOD DELIVERING COMPANY

8.2.3 CLEANING SERVICE COMPANY

8.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

8.2.5 LANDSCAPING BUSINESS

8.3 SMALL BUSINESS

8.3.1 RENTAL CAR/TRUCK COMPANY

8.3.2 MOVING COMPANY

8.3.3 TAXI COMPANY

8.3.4 DELIVERY COMPANY

8.3.5 LONG HAUL SEMI-TRUCK COMPANY

9 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE

9.1 OVERVIEW

9.2 ON-LEASE

9.3 WITHOUT LEASE

9.3.1 OPEN ENDED

9.3.2 CLOSE ENDED

10 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

10.1 OVERVIEW

10.1.1 AUTOMOTIVE

10.1.2 LIGHT COMMERCIAL VEHICLE

10.1.2.1 PICK UP TRUCKS

10.1.2.2 VANS

10.1.2.2.1 PASSENGER VAN

10.1.2.2.2 CARGO VAN

10.1.2.3 MINI BUS

10.1.2.4 OTHERS

10.1.3 PASSENGER CARS

10.1.3.1 SUV

10.1.3.2 HATCHBACK

10.1.3.3 SEDAN

10.1.3.4 COUPE

10.1.3.5 CROSSOVER

10.1.3.6 CONVERTIBLE

10.1.3.7 OTHERS

10.1.4 HEAVY COMMERCIAL VEHICLE

10.1.4.1 TRUCKS

10.1.4.2 TRAILERS

10.1.4.3 FORKLIFTS

10.1.4.4 SPECIALIST VEHICLES (SUCH AS MOBILE CONSTRUCTION MACHINERY)

10.1.5 MARINE

10.1.6 ROLLING STOCK

10.1.7 AIRCRAFT

11 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 INTERNAL COMBUSTION ENGINE

11.2.1 PETROL

11.2.2 DIESEL

11.2.3 CNG

11.2.4 OTHERS

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 PLUG-IN ELECTRIC VEHICLE (PEV)

11.3.3 HYBRID ELECTRIC VEHICLES (HEVS)

12 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE

12.1 OVERVIEW

12.2 GPS TRACKING DEVICES

12.3 DASH CAMERAS

12.4 BLUETOOTH TRACKING TAGS

12.5 DATA LOGGERS

12.6 OTHERS

13 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE

13.1 OVERVIEW

13.2 SMALL FLEETS (1-5 VEHICLES)

13.3 MEDIUM FLEETS (5-20 VEHICLES)

13.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

14 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

14.1 OVERVIEW

14.2 SHORT RANGE COMMUNICATION

14.3 LONG RANGE COMMUNICATION

15 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

15.1 OVERVIEW

15.2 ON-PREMISE

15.3 CLOUD

15.4 HYBRID

16 CANADA FLEET MANAGEMENT MARKET, BY OFFERING

16.1 OVERVIEW

16.2 SOLUTIONS

16.2.1 ETA PREDICTIONS

16.2.1.1 STREAMLINED ROUTES

16.2.1.2 DETAILED LOCATION DATA

16.2.1.3 BREAKDOWN NOTIFICATION

16.2.2 OPERATIONS MANAGEMENT

16.2.2.1 FLEET TRACKING & GEO-FENCING

16.2.2.2 ROUTING & SCHEDULING

16.2.2.3 REAL & IDLE TIME MONITORING

16.2.3 PERFORMANCE MANAGEMENT

16.2.3.1 DRIVER MANAGEMENT

16.2.3.1.1 TRACKING

16.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

16.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

16.2.3.2 FLEET MANAGEMENT & TRACKING

16.2.3.2.1 REAL TIME ROUTING

16.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

16.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

16.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

16.2.5 SAFETY & COMPLIANCE MANAGEMENT

16.2.6 FLEET ANALYTICS AND REPORTING

16.2.7 CONTRACT MANAGEMENT

16.2.7.1 BY STRUCTURE

16.2.7.1.1 LEASING

16.2.7.1.2 FUEL MANAGEMENT AND EV CHARGING

16.2.7.1.3 MAINTENANCE SPEND PLANNING

16.2.7.1.4 ACCIDENT MANAGEMENT

16.2.7.1.5 VEHICLE REGISTRATION

16.2.7.1.6 ADMINISTRATIVE COST

16.2.7.1.7 OTHERS

16.2.7.2 BY MODEL

16.2.7.2.1 LONG TERM CONTRACT

16.2.7.2.2 SHORT TERM CONTRACT

16.2.8 RISK MANAGEMENT

16.2.9 ELECTRIFICATION

16.2.10 REMARKETING

16.2.11 OTHERS

16.3 SERVICES

16.3.1 PROFESSIONAL SERVICES

16.3.1.1 SUPPORT & MAINTENANCE

16.3.1.2 IMPLEMENTATION

16.3.1.3 CONSULTING

16.3.2 MANAGED SERVICES

17 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 GNSS

17.3 CELLULAR SYSTEMS

17.4 ELECTRONIC DATA INTERCHANGE (EDI)

17.5 REMOTE SENSING

17.6 COMPUTATIONAL METHOD & DECISION MAKING

17.7 RFID

17.8 OTHERS

18 CANADA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.1.8 RISK MANAGEMENT

18.2.1.9 ELECTRIFICATION

18.2.1.10 REMARKETING

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.1.8 RISK MANAGEMENT

18.3.1.9 ELECTRIFICATION

18.3.1.10 REMARKETING

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.1.8 RISK MANAGEMENT

18.4.1.9 ELECTRIFICATION

18.4.1.10 REMARKETING

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.1.8 RISK MANAGEMENT

18.5.1.9 ELECTRIFICATION

18.5.1.10 REMARKETING

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.1.8 RISK MANAGEMENT

18.6.1.9 ELECTRIFICATION

18.6.1.10 REMARKETING

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.1.8 RISK MANAGEMENT

18.7.1.9 ELECTRIFICATION

18.7.1.10 REMARKETING

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 FLEET ANALYTICS AND REPORTING

18.8.1.7 CONTRACT MANAGEMENT

18.8.1.8 RISK MANAGEMENT

18.8.1.9 ELECTRIFICATION

18.8.1.10 REMARKETING

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 FLEET ANALYTICS AND REPORTING

18.9.1.7 CONTRACT MANAGEMENT

18.9.1.8 RISK MANAGEMENT

18.9.1.9 ELECTRIFICATION

18.9.1.10 REMARKETING

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 FLEET ANALYTICS AND REPORTING

18.10.1.7 CONTRACT MANAGEMENT

18.10.1.8 RISK MANAGEMENT

18.10.1.9 ELECTRIFICATION

18.10.1.10 REMARKETING

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 FLEET ANALYTICS AND REPORTING

18.11.1.7 CONTRACT MANAGEMENT

18.11.1.8 RISK MANAGEMENT

18.11.1.9 ELECTRIFICATION

18.11.1.10 REMARKETING

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 FLEET ANALYTICS AND REPORTING

18.12.1.7 CONTRACT MANAGEMENT

18.12.1.8 RISK MANAGEMENT

18.12.1.9 ELECTRIFICATION

18.12.1.10 REMARKETING

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 CANADA FLEET MANAGEMENT MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: CANADA

20 SWOT ANALYSIS

21 COMPANY PROFILE

21.1 ELEMENT FLEET MANAGEMENT CORP.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 SOLUTION PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 VERIZON

21.2.1 COMPANY SNAPSHOT

21.2.3 SOLUTION PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 GEOTAB INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 SOLUTION PORTFOLIO

21.3.3 RECENT DEVELOPMENTS

21.4 MOTIVE TECHNOLOGIES, INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENTS

21.5 JIM PATTISON LEASE (A SUBSIDIARY OF THE JIM PATTISON GROUP)

21.5.1 COMPANY SNAPSHOT

21.5.2 SOLUTION PORTFOLIO

21.5.3 RECENT DEVELOPMENT

21.6 ADDISON LEASING OF CANADA LTD

21.6.1 COMPANY SNAPSHOT

21.6.2 SOLUTION PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 ALD AUTOMOTIVE

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 SOLUTION PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 AT&T INTELLECTUAL PROPERTY

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 SOLUTION PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 CISCO SYSTEMS, INC.

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 SOLUTION PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 CONTINENTAL AG

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 SOLUTION PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 DENSO CORPORATION

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 SOLUTION PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 DONLEN

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 SOLUTION PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 FOSS NATIONAL LEASING LTD.

21.13.1 COMPANY SNAPSHOT

21.13.2 SOLUTION PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 HOLMAN, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 SOLUTION PORTFOLIO

21.14.3 RECENT DEVELOPMENTS

21.15 IBM CORPORATION

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 SOLUTION PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 MENDIX TECHNOLOGY BV

21.16.1 COMPANY SNAPSHOT

21.16.2 SOLUTION PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 OMNITRACS

21.17.1 COMPANY SNAPSHOT

21.17.2 SOLUTION PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 ORBCOMM

21.18.1 COMPANY SNAPSHOT

21.18.2 SOLUTION PORTFOLIO

21.18.3 RECENT DEVELOPMENT

21.19 RAM TRACKING

21.19.1 COMPANY SNAPSHOT

21.19.2 SOLUTION PORTFOLIO

21.19.3 RECENT DEVELOPMENTS

21.2 ROBERT BOSCH GMBH

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 SOLUTION PORTFOLIO

21.20.4 RECENT DEVELOPMENTS

21.21 SAMSARA INC.

21.21.1 COMPANY SNAPSHOT

21.21.2 SOLUTION PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SIEMENS

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 SOLUTION PORTFOLIO

21.22.4 RECENT DEVELOPMENTS

21.23 SIERRA WIRELESS

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 SOLUTION PORTFOLIO

21.23.4 RECENT DEVELOPMENT

21.24 SUMMIT FLEET LEASING AND MANAGEMENT LEASING AND MANAGEMENT

21.24.1 COMPANY SNAPSHOT

21.24.2 SOLUTION PORTFOLIO

21.24.3 RECENT DEVELOPMENTS

21.25 TRANSFLO

21.25.1 COMPANY SNAPSHOT

21.25.2 SOLUTION PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 WHEELS INC.

21.26.1 COMPANY SNAPSHOT

21.26.2 SOLUTION PORTFOLIO

21.26.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

表格列表

TABLE 1 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 2 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 3 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 CANADA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 CANADA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 CANADA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 9 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 CANADA LIGHT COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 CANADA VANS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 CANADA PASSENGER CARS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 CANADA HEAVY COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 CANADA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 CANADA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 18 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 20 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 21 CANADA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 CANADA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CANADA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CANADA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CANADA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CANADA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 CANADA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 36 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 39 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 54 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 57 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 60 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 63 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 66 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

图片列表

FIGURE 1 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 CANADA FLEET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 CANADA FLEET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 CANADA FLEET MANAGEMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 CANADA FLEET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CANADA FLEET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 CANADA FLEET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 CANADA FLEET MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 9 CANADA FLEET MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 10 CANADA FLEET MANAGEMENT MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND OF FULL SERVICE LEASING IS EXPECTED TO DRIVE THE CANADA FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA FLEET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF CANADA FLEET MANAGEMENT MARKET

FIGURE 15 CANADA FLEET MANAGEMENT MARKET: BY FUNCTIONS, 2022

FIGURE 16 CANADA FLEET MANAGEMENT MARKET: BY OPERATIONS, 2022

FIGURE 17 CANADA FLEET MANAGEMENT MARKET: BY BUSINESS TYPE, 2022

FIGURE 18 CANADA FLEET MANAGEMENT MARKET: BY LEASE TYPE, 2022

FIGURE 19 CANADA FLEET MANAGEMENT MARKET: BY MODE OF TRANSPORT, 2022

FIGURE 20 CANADA FLEET MANAGEMENT MARKET: BY VEHICLE TYPE, 2022

FIGURE 21 CANADA FLEET MANAGEMENT MARKET: BY HARDWARE, 2022

FIGURE 22 CANADA FLEET MANAGEMENT MARKET: BY FLEET SIZE, 2022

FIGURE 23 CANADA FLEET MANAGEMENT MARKET: BY COMMUNIATION RANGE, 2022

FIGURE 24 CANADA FLEET MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 CANADA FLEET MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 26 CANADA FLEET MANAGEMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 27 CANADA FLEET MANAGEMENT MARKET: END USER, 2022

FIGURE 28 CANADA FLEET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。