Europe High Barrier Packaging Films Market, By Type (Non-Woven Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films, Others), Material (Plastic, Aluminum, Oxides, Others), Packaging Type (Pouches, Bags, Lids, Shrink Films, Laminated Tubes, Others), End-User (Food, Beverages, Pharmaceuticals, Electronic Devices, Medical Devices, Agriculture, Chemicals, Others) Industry Trends and forecast to 2029.

Market Analysis and Insights

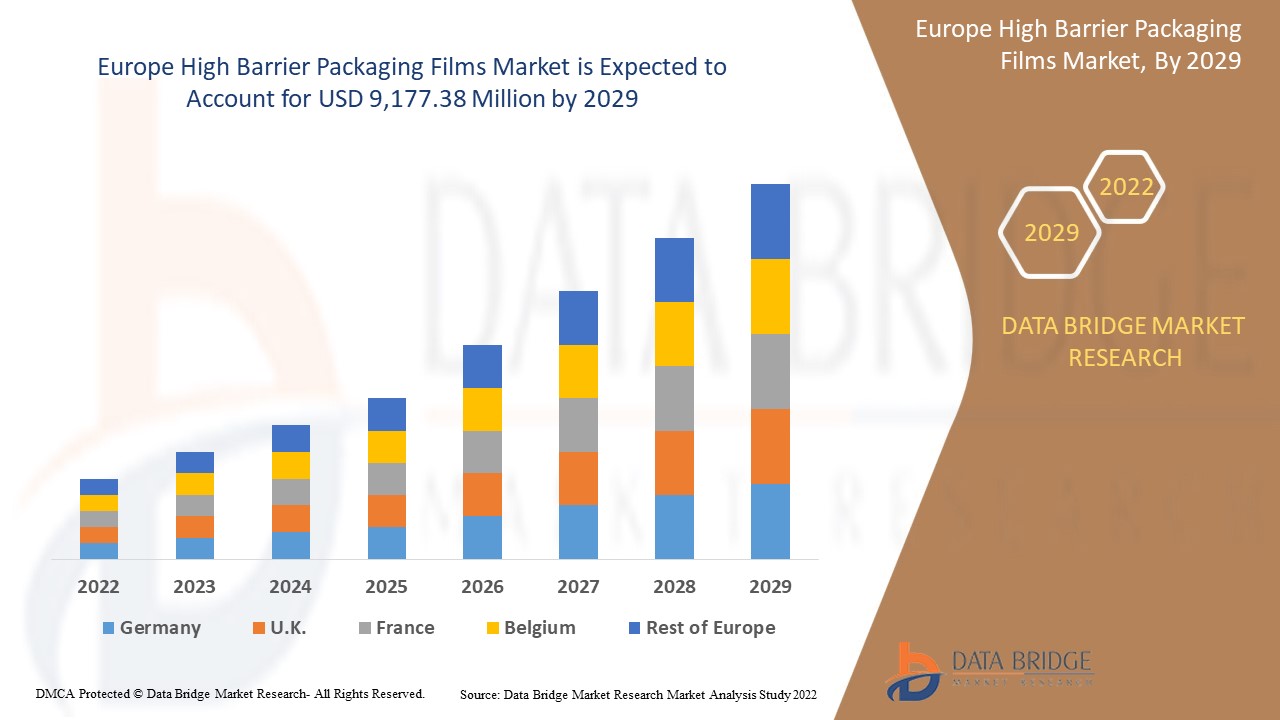

Europe high barrier packaging films market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.6% in the forecast period of 2022 to 2029 and is expected to reach USD 9,177.38 million by 2029. The primary factor driving the growth of the high barrier packaging films market is the increasing demand for a multi-layer packaging for preventing oxygen and water permeation, the growing need for high barrier packaging films for longer shelf-life, shifting consumer preference toward the packaged food, and the rising adoption of high barrier packaging films in pharmaceutical and agriculture industry.

The high barrier packaging films help prevent contact with oxygen, carbon dioxide, or moisture while restricting the effect of mineral oil and UV light. The powerful barrier created using functional materials used in the packaging film also holds the qualities of food such as color, taste, texture, aroma, and flavor. High barrier films play a major role in providing products with required properties and help extend the product's shelf life. It also helps make the structure recyclable with all layers relating to the same family of polymers. Moreover, high barrier films have an impermeable co-extruded & resilient structure. It is solvent-free and usually does not react with packaged food.

Moreover, the increasing popularity of ready-to-eat food influences the consumer shift toward packaged products. Hectic work-life balance and increasing workload also contribute to the rising demand for packaged foods by working professionals. Thus, with the growing demand for packaged food, the Europe high barrier packaging films market is expected to propel the market's growth.

欧洲高阻隔包装薄膜市场报告提供了市场份额、新发展和国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史年份 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按类型(无纺布金属化薄膜、透明薄膜、有机涂层薄膜、无机氧化物涂层薄膜、其他)、材料(塑料、铝、氧化物、其他)、包装类型(袋、包、盖子、收缩膜、层压管、其他)、最终用户(食品、饮料、药品、电子设备、医疗器械、农业、化学品)。 |

|

覆盖国家 |

英国、俄罗斯、法国、西班牙、意大利、德国、土耳其、荷兰、瑞士、比利时、欧洲其他国家。 |

|

涵盖的市场参与者 |

Advanced Converting Works、Constantia Flexibles、HPM EUROPE INC、FLAIR Flexible Packaging Corporation、ClearBags、Perlen Packaging、OLIVER、Celplast Metallized Products、Toray Plastics (America), Inc.(Toray Industries Inc. 的子公司)、ISOFlex Packaging、KREHALON、MULTIVAC、BERNHARDT Packaging & Process、Sonoco Products Company、Sealed Air、WINPAL LTD.、Schur Flexibles Holding GesmbH、Amcor Ltd. |

市场定义

高阻隔包装膜的软包装解决方案包括包装袋、袋子、盖子、收缩膜、层压管等。包装袋可以用拉链重新密封,并取代玻璃罐和金属罐等硬包装设计,因为客户对产品安全性和便利性的要求日益增加,鼓励使用高阻隔包装类型的包装袋。包装袋还可以保护产品免受外界影响,如湿气、光线、生物污染、气体和机械损伤,从而影响其质量或有效性。

欧洲高阻隔包装薄膜市场动态

驱动程序

- 为防止氧气和水进入而对多层包装的需求不断增加

高阻隔包装膜中的多层结构有助于防止与氧气、水分和二氧化碳等其他气体接触,并限制矿物油和紫外线的影响。这种使用功能性材料制成的强大屏障有助于保持其中存储的材料的完整性,例如食品质量,如其颜色、味道、质地、香气和风味。为了使产品保持其完整性,为它们提供所有重要的阻隔性能(如水分、气体和香气)非常重要。高阻隔膜在为产品提供这些必需性能方面发挥着重要作用。此外,高阻隔膜具有不透水的共挤和弹性结构,使其不含溶剂,不会与药品、食品等包装物品发生反应。

- 为延长保质期,对高阻隔包装薄膜的需求不断增长

随着许多消费者不再购买新鲜食品,转而青睐储存保质期较长的食品,加工食品和冷冻食品的销量也在上升。消费者日益繁忙的生活方式以及随之而来的对方便食品包装的需求推动了市场对高阻隔性薄膜的需求。随着消费者越来越意识到自己的行为对环境的影响,他们越来越有兴趣找到减少碳足迹的具体方法。现在,消费者比以往任何时候都更希望购买能够反映其价值观、采购、生产和包装尽可能可持续的产品。保质期是当今消费者考虑的关键因素。

- 消费者偏好转向包装食品

随着加工和即食包装食品的消费和需求不断增加,食品和饮料行业对高阻隔包装膜的需求也越来越大。此外,随着可支配收入的增加,工作人士和学生愿意在包装食品和方便即食产品上花更多的钱,这使得高阻隔包装膜市场在不久的将来会增长。人们对即食、冷冻到微波炉、即食包装食品和加工食品的需求很高,这些食品易于携带、打开,准备时间也更短。

- 制药和农业行业越来越多地采用高阻隔包装薄膜

制药行业对包装解决方案提出了不同的要求,例如与外界环境隔离、高水平保护、成本效益和易于操作。因此,高阻隔包装膜被广泛使用,因为这些薄膜不允许气体在包装内交换并控制包装内的温度,从而促进了市场的增长。主要的包装材料是塑料,因为它可以保护药品免受氧气和气味、水蒸气渗透、潮湿、污染和细菌的影响。这些特性使聚丙烯材料成为高阻隔包装的良好选择。聚丙烯高阻隔膜具有高熔点,使其适用于可煮沸包装和可序列化产品。

机会

- 可生物降解高阻隔包装薄膜的采用日益广泛

由于可回收问题和可生物降解的创新包装解决方案,高阻隔包装薄膜市场预计在不久的将来会增长,因为材料生产商将继续开发用于包装生产的新型和改进型塑料薄膜和添加剂。这些包括高阻隔和箔替代薄膜、密封膜和更易于回收和自然降解的薄膜。减少材料使用是整个包装和包装袋制造行业的另一个主要趋势,无论是通过更薄的薄膜还是更少的薄膜层。

- 客户友好型包装需求激增

在选择包装薄膜之前,消费者会考虑一些关键点。其中一些是卫生和食品安全、保质期、易用性、耐用性、标签信息、外观和环境影响。消费者对再生和可回收塑料中的纤维包装更感兴趣。因此,随着客户友好型包装的趋势和需求不断增加,高阻隔包装薄膜市场有巨大的机会可以利用,在未来实现显着增长。这可以通过推出更多客户需要的、使用方便、可持续且环保的产品来实现。

限制/挑战

- 易受降解

当暴露于高温时,它可以改变塑料薄膜的氧化机制。然而,可生物降解聚合物的完全降解只有在受控条件下才能实现,例如温度和压力升高,而这些条件在水生和海洋栖息地等自然环境中是不存在的。因此,当条件不理想时,这些高阻隔包装膜预计会降解并破坏其性能。这可能会抑制欧洲高阻隔包装膜市场的增长。

- 原材料价格波动

各种高阻隔包装膜都是使用各种原材料制造的。这些原材料包括聚乙烯和聚丙烯等塑料材料以及铝等金属材料。这些材料不可生物降解、难以回收,并且对水和土地等环境有害。原材料的选择主要基于阻隔膜的最终用途。包装膜中使用的一些主要原材料包括 LDPE、LLDPE、HDPE、BOPP、CPP、BOPET、PVC、EVOH、PLA、PVDC、PVOH 等。

- 与多层薄膜回收相关的问题

考虑到环境影响,这些包装解决方案效率很高,但问题是它们很难在现有的废物管理基础设施中回收。例如在欧洲,回收单位广泛依赖传统的机械回收方法进行脱粒工艺,即对材料进行组合加工。不同组合材料的热不相容性是再加工的一个主要障碍。然而,化学回收等新技术已经可用,并取得了令人鼓舞的成果,但它们需要进一步深入研究和扩大规模,这将需要时间和巨额资本投入。这反过来又对欧洲高阻隔包装膜市场的发展和增长道路构成了重大挑战。

- 严格的政府监管和环境问题

高阻隔包装膜主要由塑料材料制成,即聚乙烯、聚丙烯等。这些材料不可生物降解、难以回收,并且对环境(包括水和土地)有害。因此,政府、监管机构和环保主义者一直在宣传使用此类薄膜的危害。在包装领域,塑料的使用率超过 40%。塑料需要数年才能分解,因此许多国家不赞成在任何行业消费和使用塑料。

COVID-19 对欧洲高阻隔包装薄膜市场影响甚微

2020-2021 年,COVID-19 影响了各个制造业,导致工作场所关闭、供应链中断和运输限制。然而,高阻隔包装膜市场受到了显著影响。该地区拥有多家制造工厂的高阻隔包装膜业务和供应链仍在运营。在后疫情时代,服务提供商在采取卫生和安全措施后继续提供高阻隔包装膜。

近期发展

- 2021年5月,杜邦移动与材料部门向其位于德国和瑞士的制造工厂投资了500万美元的资本和运营资源,以提高产能。

欧洲高阻隔包装薄膜市场范围

欧洲高阻隔包装膜市场根据类型、材料、包装类型和最终用户进行分类。这些细分市场之间的增长将帮助您分析主要的行业增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 无纺布金属化薄膜

- 透明薄膜

- 有机涂膜

- 无机氧化物涂膜

- 其他的

根据类型,欧洲高阻隔包装薄膜市场分为五个部分:无纺布金属化薄膜、透明薄膜、有机涂层薄膜、无机氧化物涂层薄膜和其他。

材料

- 塑料

- 铝

- 氧化物

- 其他的

根据材料,欧洲高阻隔包装薄膜市场分为四个部分:塑料、铝、氧化物和其他。

包装类型

- 袋装

- 包

- 盖子

- 收缩膜

- 层压管

- 其他的

根据包装类型,欧洲高阻隔包装薄膜市场分为六个部分:袋、包、盖子、收缩膜、层压管和其他。

终端用户

- 食物

- 饮料

- 药品

- 电子设备

- 医疗设备

- 农业

- 化学品

- 其他的

根据最终用户,欧洲高阻隔包装薄膜市场细分为食品、饮料、药品、电子设备、医疗设备、农业、化学品等。

欧洲高阻隔包装薄膜市场区域分析/见解

欧洲包装行业的高阻隔包装薄膜市场根据类型、材料、包装类型和最终用户进行细分。

欧洲高阻隔包装薄膜市场国家包括英国、俄罗斯、法国、西班牙、意大利、德国、土耳其、荷兰、瑞士、比利时和欧洲其他国家。德国在市场份额和市场收入方面占据欧洲高阻隔包装薄膜市场的主导地位,并将在预测期内继续保持主导地位。这是由于医院和诊断中心的客流量增加。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术测试和波特五力分析以及案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了欧洲品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和欧洲高阻隔包装薄膜市场份额分析

Europe high barrier packaging films market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the Europe high barrier packaging films market.

Some of the prominent participants operating in the Europe High barrier packaging films market are Advanced Converting Works, Constantia Flexibles, HPM EUROPE INC, FLAIR Flexible Packaging Corporation, ClearBags, Perlen Packaging, OLIVER, Celplast Metallized Products, Toray Plastics (America), Inc. (a subsidiary of Toray Industries Inc), ISOFlex Packaging, KREHALON, MULTIVAC, BERNHARDT Packaging & Process, Sonoco Products Company, Sealed Air, WINPAL LTD., Schur Flexibles Holding GesmbH, Amcor Ltd.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Europe Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HIGH BARRIER PACKAGING FILMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 KEY PATENT LAUNCHED

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGY ADVANCEMENTS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATORY COVERAGE

5 REGIONAL SUMMARY

5.1 EUROPE

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR MULTI-LAYER PACKAGING FOR PREVENTING OXYGEN AND WATER

6.1.2 GROW IN DEMAND FOR HIGH BARRIER PACKAGING FILMS FOR LONGER SHELF-LIFE

6.1.3 SHIFTING CONSUMER PREFERENCE TOWARD THE PACKAGED FOOD

6.1.4 RISE IN ADOPTION OF HIGH BARRIER PACKAGING FILMS IN PHARMACEUTICAL AND AGRICULTURE INDUSTRY

6.2 RESTRAINTS

6.2.1 SUSCEPTIBILITY TO DEGRADATION

6.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROW IN ADOPTION OF BIODEGRADABLE HIGH BARRIER PACKAGING FILMS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.4 CHALLENGES

6.4.1 ISSUE RELATED TO RECYCLING OF MULTI-LAYER FILMS

6.4.2 STRICT GOVERNMENT REGULATION AND ENVIRONMENTAL CONCERNS

7 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-WOVEN METALIZED FILMS

7.3 CLEAR FILMS

7.4 ORGANIC COATING FILMS

7.5 INORGANIC OXIDE COATING FILMS

7.6 OTHERS

7.6.1 ALUMINIUM FOIL

7.6.2 REST OF OTHERS

8 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 ETHYLENE VINYL ALCOHOL (EVOH)

8.2.5 POLYETHYLENE NAPHTHALATE (PEN)

8.2.6 POLYVINYLIDENE CHLORIDE (PVDC)

8.2.7 POLYAMIDE (NYLON)

8.2.8 OTHERS (LCD, PS, PVC, PLA, PA)

8.3 ALUMINIUM

8.4 OXIDES

8.4.1 SILICON OXIDE

8.4.2 ALUMINUM OXIDE

8.5 OTHERS

9 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES

9.3 BAGS

9.4 LIDS

9.5 SHRINK FILMS

9.6 LAMINATED TUBES

9.7 OTHERS

10 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.2.1 MEAT, SEA FOOD & POULTRY

10.2.2 READY TO EAT MEALS

10.2.3 SNACKS

10.2.4 DAIRY FOODS

10.2.5 BAKERY & CONFECTIONARY

10.2.6 BABY FOOD

10.2.7 PET FOOD

10.2.8 OTHER FOOD

10.3 BEVERAGES

10.3.1 NON-ALCOHOLIC BEVERAGES

10.3.2 ALCOHOLIC BEVERAGES

10.4 PHARMACEUTICALS

10.5 ELECTRONIC DEVICES

10.6 MEDICAL DEVICES

10.7 AGRICULTURE

10.8 CHEMICALS

10.9 OTHERS

11 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 SWITZERLAND

11.1.8 TURKEY

11.1.9 BELGIUM

11.1.10 NETHERLANDS

11.1.11 REST OF EUROPE

12 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.2 ACQUISITION

12.3 PRODUCT LAUNCH

12.4 AWARD

12.5 CONFERENCE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AMCOR PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 DUPONT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 SONOCO PRODUCTS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 BERRY EUROPE INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 SEALED AIR

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADVANCED CONVERTING WORKS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BERNHARDT PACKAGING & PROCESS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELPLAST METALLIZED PRODUCTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CLEARBAGS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONSTANTIA FLEXIBLES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 FLAIR FLEXIBLE PACKAGING CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 HPM EUROPE INC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ISOFLEX PACKAGING

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 KREHALON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 MULTIVAC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 OLIVER

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 PERLEN PACKAGING

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATE

14.18 SCHUR FLEXIBLES HOLDING GESMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 TORAY PLASTICS (AMERICA), INC. (SUBSIDIARY OF TORAY INDUSTRIES INC)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT UPDATES

14.2 WINPAK LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 3 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 EUROPE NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 EUROPE CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 EUROPE ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 EUROPE INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 18 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 19 EUROPE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 EUROPE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 23 EUROPE ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 EUROPE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 EUROPE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 29 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 32 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 33 EUROPE POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS )

TABLE 35 EUROPE BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 EUROPE LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 EUROPE SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 EUROPE LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 47 EUROPE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 EUROPE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 EUROPE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 51 EUROPE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 53 EUROPE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 55 EUROPE PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 EUROPE PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 57 EUROPE ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 59 EUROPE MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 EUROPE MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 61 EUROPE AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 EUROPE AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 63 EUROPE CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 EUROPE CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 65 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 67 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 69 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 75 EUROPE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 EUROPE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 77 EUROPE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 EUROPE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 79 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 80 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 81 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 83 EUROPE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 EUROPE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 85 EUROPE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 EUROPE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 87 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 GERMANY OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 GERMANY OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 92 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 93 GERMANY PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 GERMANY OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 GERMANY OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 98 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 99 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 GERMANY HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 101 GERMANY FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 GERMANY FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 103 GERMANY BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 GERMANY BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 105 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 U.K. OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 109 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 111 U.K. PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.K. PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 113 U.K. OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.K. OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 117 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 U.K. HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 119 U.K. FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 U.K. FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 121 U.K. BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 U.K. BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 123 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 125 FRANCE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 FRANCE OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 127 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 128 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 129 FRANCE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 FRANCE PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 131 FRANCE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 FRANCE OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 134 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 135 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 FRANCE HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 137 FRANCE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 FRANCE FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 139 FRANCE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 FRANCE BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 141 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 143 ITALY OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 ITALY OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 145 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 146 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 147 ITALY PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 ITALY PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 149 ITALY OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 ITALY OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 151 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 153 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 154 ITALY HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 155 ITALY FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 156 ITALY FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 157 ITALY BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 ITALY BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 159 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 161 SPAIN OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 SPAIN OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 163 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 164 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 165 SPAIN PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SPAIN PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 167 SPAIN OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 SPAIN OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 169 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 170 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 171 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 SPAIN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 173 SPAIN FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 SPAIN FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 175 SPAIN BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 SPAIN BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 177 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 179 RUSSIA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 RUSSIA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 181 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 182 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 183 RUSSIA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 RUSSIA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 185 RUSSIA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 RUSSIA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 187 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 188 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 189 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 190 RUSSIA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 191 RUSSIA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 192 RUSSIA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 193 RUSSIA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 194 RUSSIA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 195 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 197 SWITZERLAND OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 SWITZERLAND OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 199 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 200 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 201 SWITZERLAND PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 SWITZERLAND PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 203 SWITZERLAND OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 SWITZERLAND OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 205 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 206 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 207 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 208 SWITZERLAND HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 209 SWITZERLAND FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 210 SWITZERLAND FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 211 SWITZERLAND BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 212 SWITZERLAND BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 213 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 215 TURKEY OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 TURKEY OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 217 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 218 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 219 TURKEY PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 TURKEY PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 221 TURKEY OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 TURKEY OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 223 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 224 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 225 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 226 TURKEY HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 227 TURKEY FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 228 TURKEY FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 229 TURKEY BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 230 TURKEY BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 231 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 233 BELGIUM OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 BELGIUM OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 235 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 236 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 237 BELGIUM PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 BELGIUM PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 239 BELGIUM OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 BELGIUM OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 241 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 242 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 243 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 244 BELGIUM HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 245 BELGIUM FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 246 BELGIUM FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 247 BELGIUM BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 248 BELGIUM BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 249 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 251 NETHERLANDS OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 NETHERLANDS OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 253 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 254 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 255 NETHERLANDS PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 NETHERLANDS PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 257 NETHERLANDS OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 NETHERLANDS OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 259 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 260 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 261 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 262 NETHERLANDS HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 263 NETHERLANDS FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 264 NETHERLANDS FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 265 NETHERLANDS BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 266 NETHERLANDS BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 267 REST OF EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 REST OF EUROPE HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

图片列表

FIGURE 1 EUROPE HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 2 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE HIGH BARRIER PACKAGING FILMS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SHIFTING CONSUMER PREFERENCE TOWARDS THE PACKAGED FOOD IS EXPECTED TO DRIVE EUROPE HIGH BARRIER PACKAGING FILMS MARKET FROM 2022 TO 2029

FIGURE 16 NON-WOVEN METALIZED FILMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HIGH BARRIER PACKAGING FILMS MARKET IN 2022 & 2029

FIGURE 17 SUPPLY CHAIN ANALYSIS- EUROPE HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 20 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE, 2021

FIGURE 21 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY MATERIAL, 2021

FIGURE 22 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY END USER, 2021

FIGURE 24 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: SNAPSHOT (2021)

FIGURE 25 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021)

FIGURE 26 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE (2022 - 2029)

FIGURE 29 EUROPE HIGH BARRIER PACKAGING FILMS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。