Global Baby Powder Market

市场规模(十亿美元)

CAGR :

%

USD

1.40 Billion

USD

2.01 Billion

2024

2032

USD

1.40 Billion

USD

2.01 Billion

2024

2032

| 2025 –2032 | |

| USD 1.40 Billion | |

| USD 2.01 Billion | |

|

|

|

|

Global Baby Powder Market Segmentation, By Ingredient (Talc-Based and Corn-Starch-Based), Price (Premium and Mass), Nature (Organic and Conventional), Distribution Channel (Direct Sales, Modern Trade, Convenience Stores, Departmental Stores, Specialty Stores, Mono Brand Stores, Online Retailers, Drug Stores, and Others) - Industry Trends and Forecast to 2032

Baby Powder Market Size

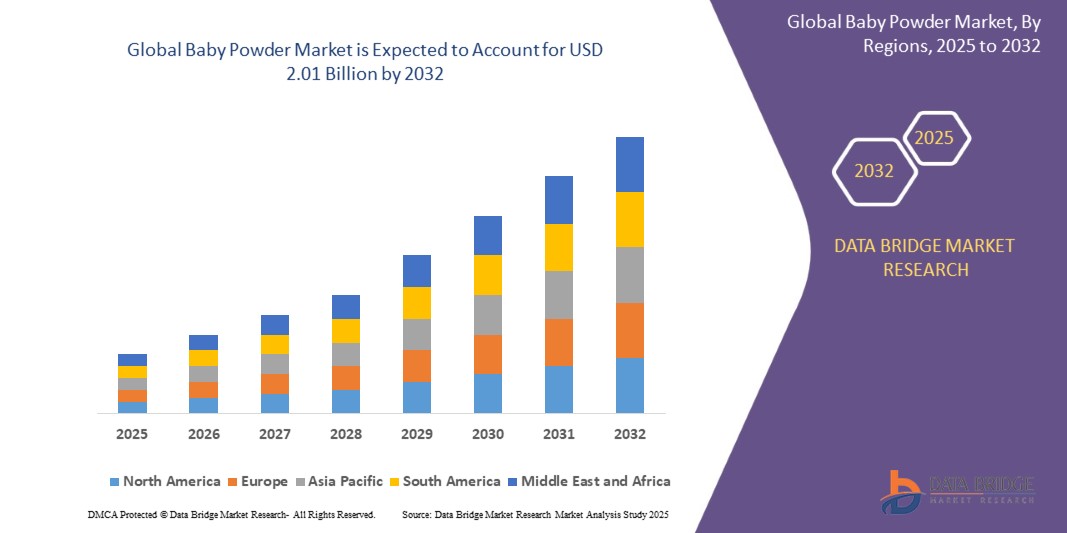

- The global baby powder market was valued atUSD 1.40 billion in 2024and is expected to reachUSD 2.01 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 4.63%,primarily driven by easy availability of natural baby powders

- This growth is driven by factors such as growth of e-commerce & online retail and expansion of organic & natural product lines

Baby Powder Market Analysis

- Baby powder is a widely used personal care product designed to keep a baby’s skin dry, reduce friction, and prevent rashes. It is available in talc-based and talc-free formulations, with increasing demand for natural and organic alternatives. The market is driven by growing parental awareness, product innovations, and regulatory shifts affecting traditional powders

- The industry is expanding due to rising birth rates, increasing consumer preference for organic and hypoallergenic baby care products, and the growth of online and offline retail channels. As parents become more conscious of baby hygiene and skin safety, manufacturers are focusing on chemical-free, plant-based formulations to cater to evolving consumer needs

- The shift toward talc-free, organic baby powders is reshaping the market, with brands incorporating plant-based ingredients, dermatologically tested formulas, and eco-friendly packaging

- For instance,Burt’s Bees Baby and The Honest Companyhave introduced cornstarch-based baby powders that emphasize natural and sustainable ingredients, addressing consumer concerns over talc-related health risks

- The baby powder market is set for sustained growth, driven by innovations in natural skincare, regulatory changes favoring safer formulations, and the expansion of e-commerce distribution. Increasing demand for chemical-free and dermatologist-approved baby powders will continue to shape market trends, with brands prioritizing transparency, sustainability, and product safety to stay competitive

Report Scope and Baby Powder Market Segmentation

|

Attributes |

Baby Powder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Baby Powder Market Trends

“Growing Demand for Organic and Plant-Based Baby Powders”

- One prominent trend in the global baby powder market is thegrowing demand for organic and plant-based baby powders

- This trend is driven by the parents seeking safer, non-toxic alternatives that are free from talc, parabens, artificial fragrances, and other potentially harmful additives. As a result, manufacturers are developing baby powders with organic cornstarch, arrowroot powder, and botanical extracts to provide gentle and effective skin protection

- For instance,The Honest Company and Burt’s Bees Babyhave launchedtalc-free, plant-based baby powders featuring organic ingredients such as cornstarch and shea butter, appealing to eco-conscious and health-focused parents

- As the clean beauty and organic movement gain traction, baby powder brands are emphasizing natural certifications, cruelty-free formulations, and eco-friendly sourcing practices to strengthen their market position

- This shift is expected to drive further innovation in baby skincare, with brands investing in research and development to enhance product efficacy while maintaining transparency and sustainability in ingredient sourcing

Baby Powder Market Dynamics

Driver

“Rising Awareness of Baby Hygiene”

- The increasing awareness of baby hygiene is a key driver of growth in the baby powder market. As parents become more educated about infant skincare and the importance of moisture control, demand for baby powders continues to rise

- This shift is particularly evident in regions such asNorth America, Europe, and Asia-Pacific,where healthcare professionals and parenting organizations emphasize the need for baby hygiene products to prevent rashes, irritation, and skin infections

- With parents seeking safer and more effective hygiene solutions, baby powder manufacturers are innovating with dermatologist-tested, hypoallergenic, and talc-free formulations that provide gentle protection for delicate baby skin

- The growing preference for organic and plant-based baby care products has led to significant investments in natural baby powders, featuring ingredients such as cornstarch, aloe vera, and chamomile. These formulations cater to health-conscious parents who prioritize non-toxic and chemical-free alternatives

- As baby hygiene awareness continues to expand, companies are leveraging this trend by launching educational campaigns, collaborating with pediatricians, and promoting the benefits of baby powder as part of a complete infant skincare routine

For instance,

- Johnson & Johnsonhas shifted its focus toward talc-free baby powders, aligning with consumer concerns and regulatory guidelines

- Himalaya and The Honest Companyhave introduced herbal and organic baby powders, reinforcing the demand for natural skincare solutions

- With increasing investments in baby hygiene education, product innovation, and sustainable formulations, the baby powder market is set for sustained growth, driving advancements in ingredient safety, eco-friendly packaging, and global market expansion

Opportunity

“Innovation in Sustainable and Eco-Friendly Packaging”

- The growing consumer preference for sustainable and eco-friendly packaging presents a significant opportunity for baby powder brands to differentiate themselves and attract environmentally conscious parents

- Brands that invest in sustainable materials such as paper-based containers, compostable packaging, and refillable dispensers, can strengthen their environmental credentials and appeal to eco-conscious consumers. In addition, using minimalistic packaging with reduced plastic content can align with sustainability goals while maintaining product integrity

- Regulatory changes and corporate sustainability commitments further support this shift, encouraging companies to adopt greener packaging practices to comply with global environmental standards

For instance,

- The Honest Companyhas introduced baby powders inrecyclable and responsibly sourced packaging, appealing to sustainability-focused parents

- Brands such asJohnson & Johnson and Pigeonare exploring eco-friendly alternatives, such as refillable packaging and plant-based materials, to reduce plastic waste and improve their environmental impact

- As sustainability becomes a key purchasing factor, companies that proactively adopt green packaging innovations will gain a competitive advantage, enhance brand reputation, and contribute to a more sustainable baby care industry

Restraint/Challenge

“Decline in Infant Mortality Rate”

- The decline in infant mortality rates poses a significant challenge for the baby powder market. As global healthcare standards improve, better prenatal and postnatal care, vaccinations, and enhanced infant nutrition have led to a lower birth-to-death ratio, impacting overall demand for baby care products

- With improved medical care, fewer newborn-related complications, and increased awareness of infant hygiene, parents are shifting toward alternative skincare solutions such as lotions, creams, and oils, reducing reliance on traditional baby powders

- In addition, concerns over certain ingredients in conventional baby powders, such as talc, have led some parents to explore alternative baby care products, further impacting market demand.

For instance,

- According to global health organizations,infant mortality rates have steadily declined over the past few decades due to advancements in healthcare, nutrition, and hygiene education, leading to a shift in parental purchasing patterns

- As infant mortality rates continue to decline and parents explore alternative skincare options, baby powder manufacturers must innovate by reformulating products with safer ingredients, diversifying their product portfolios, and enhancing their marketing strategies to maintain relevance in the evolving baby care industry

Baby Powder Market Scope

The market is segmented on the basis of ingredient, price, nature, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Ingredient |

|

|

By Price |

|

|

By Nature |

|

|

By Distribution Channel

|

|

Baby Powder Market Regional Analysis

“Europe is the Dominant Region in the Baby PowderMarket”

- Europedominates thebaby powdermarket, driven bythehigh penetration of baby care products in high-income countries such as Germany, France, and the United Kingdom. The region's well-established healthcare infrastructure, high awareness of infant hygiene, and preference for premium baby care products contribute to its market leadership

- Germanyholds a significant share due toits strong consumer preference for organic and dermatologist-tested baby powders

- Leading brands in the region, includingJohnson & Johnson, Nivea, and Weleda, continue to introduce innovative formulations with natural and hypoallergenic ingredients, catering to the increasing demand for safer baby care alternatives

- In addition, the growing trend of sustainable and eco-friendly baby products has led manufacturers to develop baby powders with biodegradable packaging and plant-based ingredients, further strengthening Europe’s leadership in the global market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- TheAsia-Pacificregion is expected to witness the highest growth rate in thebaby powdermarket, driven byincreasing awareness of infant hygiene, rapid urbanization, and the high birth rate in countries such as India and China

- Rising disposable incomes, expanding middle-class populations, and improved access to healthcare are driving demand for high-quality baby care products, with both international and domestic brands expanding their footprint in the region

- In addition, the increasing adoption of e-commerce and digital marketing in the region has made baby powder products more accessible, with online platforms such as Alibaba, Amazon India, and JD.com playing a crucial role in market expansion

- As demand for baby care products continues to surge in Asia-Pacific, companies are focusing on affordability, regional customization, and sustainable packaging to capture the market's growth potential, making it the fastest-growing region in the baby powder industry

Baby Powder Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson & Johnson Private Limited (U.S.)

- Procter & Gamble (U.S.)

- Unilever (U.K.)

- Chicco (Italy)

- Burt's Bees, Inc. (U.S.)

- Himalaya Wellness Company (India)

- Beiersdorf AG (Germany)

- Craft.co (U.S.)

- Prestige Consumer Healthcare Inc. (U.S.)

- Chattem Chemicals Inc. (U.S.)

- Pigeon Corporation (Japan)

- PZ Cussons (U.K.)

Latest Developments in Global Baby Powder Market

- In July 2024,Himalaya Wellnessbroadened its baby care portfolio byintroducing a new product range featuring cow ghee as a key ingredient. This move highlights the company's commitment to natural and safe baby care solutions, aligning with the increasing consumer demand for organic and holistic offerings. By incorporating a traditionally valued ingredient, Himalaya strengthens its positioning as a wellness-focused and sustainability-driven baby care brand

- In August 2024, Indian baby products retailerFirstCrysecured an overwhelming response for itsUSD 501 million IPO, attracting bids worth USD 3.4 billion. This strong investor interest highlights confidence in India's rapidly growing childcare market. The IPO reinforces FirstCry’s market leadership and growth potential, reflecting the sector’s increasing appeal to investors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。