Global Liquid Biopsy Market

市场规模(十亿美元)

CAGR :

%

USD

2.69 Billion

USD

9.34 Billion

2024

2032

USD

2.69 Billion

USD

9.34 Billion

2024

2032

| 2025 –2032 | |

| USD 2.69 Billion | |

| USD 9.34 Billion | |

|

|

|

|

Global Liquid Biopsy Market, By Product (Instruments, Consumables and Accessories, and Services and Software), Biomarker Type (Circulating Tumor Cells (CTCS), Circulating Cell-Free DNA (CFDNA), Cell-free RNA, Extracellular Vesicles, Exosomes, and Others), Sample Type (Blood Sample Based, Urine Sample Based, Saliva and Other Tissue Fluid Sample-Based, Fecal Based Sampling, and Others), Analytical Type (Molecular, Proteomics, and Histology/Imaging), Application Type (Cancer Applications and Non-Cancer Applications), Clinical Application (Routine Screening, Patient Work-Up, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, and Others), Technology (Multi-Gene Parallel Analysis, and Single-Gene Analysis), End User (Hospitals, Reference Laboratories, Diagnostic Centers, Research Centers and Academic Institutes, and Others), Distribution Channel (Direct Tender, Third Party Distributor, and Others) – Industry Trends and Forecast to 2031.

Liquid Biopsy Market Analysis and Size

In the liquid biopsy market, monitoring minimal residual disease (MRD) represents a significant application. This involves utilizing liquid biopsy techniques to detect and analyze residual cancer cells or DNA in the bloodstream post-treatment. This non-invasive approach offers a valuable tool for assessing treatment efficacy and predicting the likelihood of cancer recurrence. The continuous development of liquid biopsy technologies and their integration into clinical practice further drives the growth and adoption of liquid biopsy solutions for MRD monitoring within the market.

In November 2023, Illumina Inc. announced TruSight Oncology 500 ctDNA v2, an advanced iteration of its liquid biopsy assay designed for comprehensive genomic profiling in oncology. This upgraded version promises enhanced sensitivity and specificity in detecting cancer-associated mutations from circulating tumor DNA.

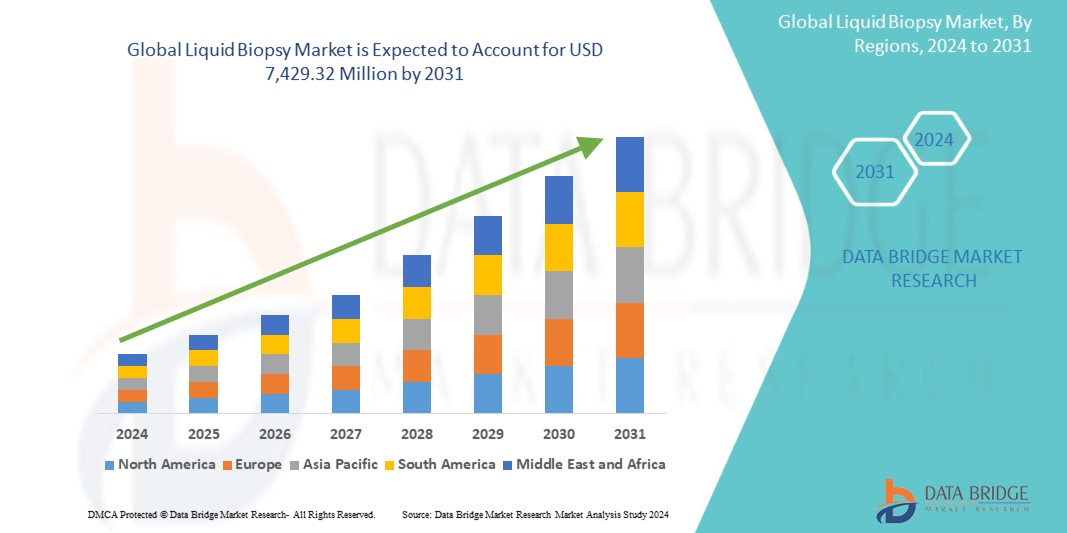

Global liquid biopsy market size was valued at USD 2.31 billion in 2023 and is projected to reach USD 8 billion by 2031, with a CAGR of 16.8% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Instruments, Consumables and Accessories, and Services and Software), Biomarker Type (Circulating Tumor Cells (CTCs), Circulating Cell-Free DNA (CFDNA), Cell-free RNA, Extracellular Vesicles, Exosomes, and Others), Sample Type (Blood Sample Based, Urine Sample Based, Saliva and Other Tissue Fluid Sample-Based, Fecal Based Sampling, and Others), Analytical Type (Molecular, Proteomics, and Histology/Imaging), Application Type (Cancer Applications and Non-Cancer Applications), Clinical Application (Routine Screening, Patient Work-Up, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, and Others), Technology (Multi-Gene Parallel Analysis, and Single-Gene Analysis), End User (Hospitals, Reference Laboratories, Diagnostic Centers, Research Centers and Academic Institutes, and Others), Distribution Channel (Direct Tender, Third Party Distributor, and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), BIOCEPT, INC. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Exact Sciences Corporation (U.S.), Menarini Silicon Biosystems (Italy), Epic Sciences (U.S.), NeoGenomics Laboratories (U.S.), mdxhealth (Belgium), F. Hoffmann-La Roche Ltd (Switzerland), QIAGEN (Netherlands), Oncocyte Corporation (U.S.), Johnson & Johnson Services, Inc. (U.S.), PathAI, Inc. (U.S.), Guardant Health (U.S.), Laboratory Corporation of America Holdings (U.S.), ANGLE plc (U.K.), Natera, Inc. (U.S.), Sysmex Inostics Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Liquid biopsy is a medical technique transforming diagnostics by analyzing biomolecules such as DNA, RNA, and proteins in bodily fluids such as blood. Unsuch as invasive traditional biopsies, it is non-invasive, offering vital diagnostic insights into conditions such as cancer without surgery. Although still evolving, liquid biopsies show immense promise in enhancing cancer detection and management, marking a significant leap in medical innovation.

Liquid Biopsy Market Dynamics

Drivers

- Rise in Integration of AI Enhances Accuracy of Cellular Data Extracted from Liquid Biopsy Samples

Artificial Intelligence (AI) is transforming liquid biopsy technology by enhancing its accuracy, efficiency, and predictive capabilities. Through advanced algorithms and machine learning, AI can analyze vast amounts of genetic, proteomic, and cellular data extracted from liquid biopsy samples. This enables early detection of diseases such as cancer, offering personalized treatment insights and monitoring disease progression. AI-driven liquid biopsy platforms streamline diagnostics, making them more accessible and cost-effective, thus driving market growth. With its ability to uncover actionable insights from complex biological data, AI is catalyzing the expansion of liquid biopsy applications in healthcare, leading to improved patient outcomes and driving the market forward.

In November 2020, NeoGenomics, Inc. launched a mobile phlebotomy service for liquid biopsy tests, leveraging AI-enhanced diagnostics such as InvisionFirst and NeoLAB. This initiative aligns with the growing trend of AI-driven liquid biopsy technologies, extending accessibility to patients through convenient sample collection at their locations. Partnering with phlebotomy companies for widespread coverage, NeoGenomics optimizes the efficiency of its AI-powered liquid biopsy solutions, driving market adoption and improving patient access to advanced diagnostics.

- Rising Healthcare Expenditure Promotes the Adoption of Liquid Biopsy Technologies

With greater investment in healthcare infrastructure and resources, there's heightened emphasis on advanced diagnostic tools such as liquid biopsies. These technologies offer non-invasive and efficient methods for cancer detection, monitoring, and personalized treatment planning. As healthcare systems strive to improve patient outcomes with the benefits of liquid biopsies in terms of early detection, treatment efficacy assessment, and minimal invasiveness make them an attractive option. Consequently, the rising healthcare expenditure acts as a catalyst for the widespread adoption and growth of the liquid biopsy market.

Opportunities

- Growing Demand for Non-Invasive Liquid Biopsy Techniques due to its Impact on Cancer Diagnosis

Over the last decade, traditional invasive methods have given way to non-invasive techniques such as liquid biopsy. This approach involves isolating tumor-derived components, such as circulating tumor cells and DNA, from bodily fluids for genomic and proteomic analysis. Consequently, the market is witnessing substantial growth as healthcare providers increasingly rely on these advanced, less intrusive methods for more accurate cancer detection and personalized treatment strategies.

- Growing Advancements in Precision Medicine due to Liquid Biopsy

Advancements in this field enable non-invasive detection and monitoring of diseases through analysis of circulating biomarkers such as circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes. This approach facilitates early diagnosis, treatment selection, and monitoring of treatment response, enhancing patient outcomes. With its ability to provide real-time insights into disease progression and therapeutic efficacy, liquid biopsy holds immense potential for personalized medicine, driving growth in the liquid biopsy market as it becomes an indispensable tool in oncology and beyond.

Restraints/Challenges

- High Cost of Liquid Biopsy Tests Limits its Adoption among the Patients

Liquid biopsy tests often involve advanced technologies and specialized equipment, contributing to their expensive nature. Additionally, factors such as laboratory processing fees and the need for skilled personnel further elevate the overall cost. As a result, patients may encounter financial barriers, particularly in regions with limited access to healthcare resources or inadequate insurance coverage. The affordability gap hinders widespread adoption of liquid biopsy tests, despite their potential benefits in terms of early cancer detection and personalized treatment.

- Shortage of Skilled Professionals Limits the Scalability of Liquid Biopsy Techniques

Liquid biopsy, a non-invasive method for detecting biomarkers in bodily fluids such as blood, requires specialized training and expertise for accurate analysis and interpretation of results. The scarcity of qualified professionals capable of conducting these intricate tests limits the widespread adoption and scalability of liquid biopsy techniques, thereby constraining market growth. This bottleneck impedes the efficient utilization of liquid biopsy as a diagnostic tool in oncology and other fields, hindering its potential impact on healthcare outcomes.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In January 2022, QIAGEN's Biotech Grants program winners were announced, displaying the company's dedication to fostering partnerships with biotech and pharma firms. Supporting these businesses, QIAGEN aims to bolster their success in the market, contributing to its revenue growth strategy

- 2022 年 1 月,Exact Sciences Corporation 通过收购基因检测实验室 Prevention Genetics 扩大了其癌症诊断产品组合。这一战略举措使 Exact Sciences 能够进军遗传性癌症检测领域,补充其现有产品并增强其在诊断市场的地位

- 2021 年 7 月,Biocept Inc. 获得了其 Primer-Switch 技术的韩国专利,这对该分子诊断服务提供商来说是一个重要的里程碑。该技术基于实时 PCR 和相关方法,能够检测循环肿瘤 DNA 中的突变,有助于识别罕见的癌症生物标志物,并巩固 Biocept 在癌症诊断领域的地位

液体活检市场范围

市场根据产品、生物标记类型、样本类型、分析类型、应用类型、临床应用、技术、最终用户和分销渠道进行细分。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

产品

- 仪器

- 耗材和配件

- 服务和软件

生物标志物类型

- 循环肿瘤细胞 (CTCc)

- 循环游离 DNA (CFDNA)

- 无细胞RNA

- 细胞外囊泡

- 外泌体

- 其他的

样品类型

- 基于血液样本

- 基于尿液样本

- 唾液和其他组织液样本

- 基于粪便样本

- 其他的

分析类型

- 分子

- 蛋白质组学

- 组织学/成像

应用类型

- 癌症应用

- 非癌症应用

临床应用

- 常规筛查

- 患者检查

- 治疗选择

- 治疗监测

- 复发监测

- 其他的

技术

- 多基因平行分析

- 单基因分析

最终用户

- 医院

- 参考实验室

- 诊断中心

- 研究中心和学术机构

- 其他的

分销渠道

- 直接招标

- 第三方分销商

- 其他的

液体活检市场区域分析/见解

根据产品、生物标志物类型、样本类型、分析类型、应用类型、临床应用、技术、最终用户和分销渠道,市场分为九个显著的部分。

本市场报告涵盖的国家包括美国、加拿大、墨西哥、德国、英国、法国、俄罗斯、意大利、西班牙、土耳其、波兰、比利时、荷兰、瑞士、丹麦、瑞典、挪威、芬兰、欧洲其他地区、中国、日本、印度、澳大利亚、韩国、新西兰、新加坡、泰国、菲律宾、马来西亚、印度尼西亚、越南、台湾、亚太其他地区、巴西、阿根廷、南美洲其他地区、沙特阿拉伯、阿联酋、南非、埃及、卡塔尔、科威特、阿曼、巴林以及中东和非洲其他地区。

在北美,美国预计将占据市场主导地位,因为该国慢性病患病率高,老年人口庞大,对护士呼叫系统的需求巨大,以支持患者护理。此外,美国医疗支出的增长凸显了对医疗基础设施和技术(包括护士呼叫系统)的投资不断增加。这些因素共同使美国成为推动该地区市场增长和创新的领导者,反映了其对改善患者治疗效果和医疗服务的承诺。

在欧洲,德国占据市场主导地位,因为罗氏公司、QIAGEN 和 Sysmex Inostics Inc. 等主要参与者占据了主导地位。这种主导地位归功于德国强大的研发基础设施、高技能劳动力和促进创新的政府支持政策。该国在欧洲的战略地理位置也有利于合作和进入整个欧洲大陆的市场。因此,德国是整个欧洲生物技术和生命科学行业尖端研究、技术进步和市场领导地位的中心。

在亚太地区,中国凭借其满足日益增长的需求(尤其是来自新兴市场的需求)的能力占据市场主导地位。凭借其制造能力和有竞争力的价格,中国公司已在该地区占据了相当大的市场份额。此外,中国在扩大其在新兴市场影响力方面的战略重点也为其领导地位做出了贡献。这一趋势凸显了中国已成为全球液体活检市场的关键参与者,这得益于其生产能力和亚太地区充满活力的市场不断增长的需求。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测单个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

医疗保健基础设施增长安装基础和新技术渗透

该市场还为您提供每个国家/地区资本设备医疗支出增长、市场上不同类型产品的安装基数、使用生命线曲线的技术影响以及医疗监管情景的变化及其对市场的影响的详细市场分析。数据适用于 2016-2021 年的历史时期。

竞争格局和液体活检市场分析

市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品批准、产品宽度和广度、应用主导地位以及产品类型生命线曲线。以上提供的数据点仅与公司对市场的关注有关。

市场上的一些主要参与者包括:

- 赛默飞世尔科技公司(美国)

- Illumina 公司(美国)

- BIOCEPT, INC.(美国)

- Bio-Rad Laboratories, Inc.(美国)

- 精确科学公司 (美国)

- Menarini Silicon Biosystems(意大利)

- Epic Sciences(美国)

- NeoGenomics 实验室(美国)

- mdxhealth(比利时)

- F. Hoffmann-La Roche Ltd(瑞士)

- QIAGEN(荷兰)

- Oncocyte 公司 (美国)

- 强生服务公司(美国)

- PathAI, Inc.(美国)

- Guardant Health(美国)

- 美国实验室控股公司(美国)

- ANGLE plc(英国)

- Natera, Inc.(美国)

- Sysmex Inostics Inc.(美国)

- STRECK(美国)

- Predicine(美国)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。