Global Microphone Market

市场规模(十亿美元)

CAGR :

%

USD

2.30 Billion

USD

3.47 Billion

2024

2032

USD

2.30 Billion

USD

3.47 Billion

2024

2032

| 2025 –2032 | |

| USD 2.30 Billion | |

| USD 3.47 Billion | |

|

|

|

|

Global Microphone Market Segmentation, By Technology (MEMS and Electret), MEMS Type (Analog and Digital), Communication Technology (Wired, Bluetooth, Wi-Fi, and AirPlay), SNR (Low 64 dB), Application (Automotive, Consumer Security and Surveillance, Consumer Electronics, Industrial, Medical, and Noise Monitoring and Sensing), and ConnectivityUSB Microphones and XLR Microphones) - Industry Trends and Forecast to 2032

Microphone Market Size

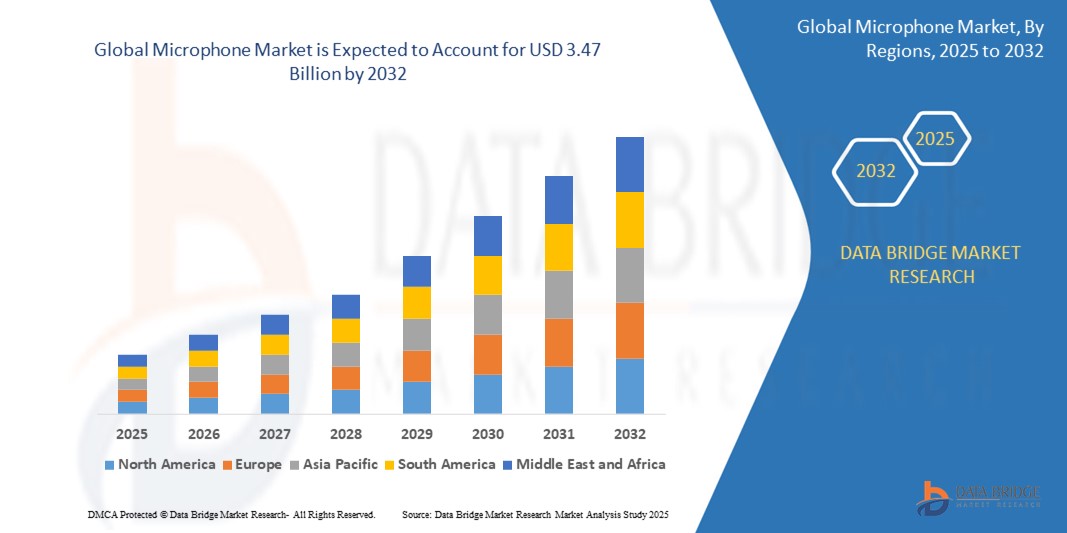

- The global Microphone market size was valued atUSD 2.30 billion in 2024and is expected to reachUSD 3.47 billion by 2032, at aCAGR of 5.30%during the forecast period

- This growth is driven by growth in the entertainment industry

Microphone Market Analysis

- Microphones are transforming the audio industry by providing superior sound quality, enhanced noise cancellation, and improved reliability compared to traditional microphones, enabling high-performance audio applications in various sectors such as automotive,consumer electronics, and healthcare

- The increasing demand for microphones is driven by the rapid growth in consumer electronics, the rise in demand for wireless communication devices, and the proliferation of smart devices that require high-quality audio input

- North America is expected to dominate the microphone market with the largest market share of 41.22%, driven by the high demand for professional audio equipment, consumer electronics, and robust technological infrastructure

- Asia-Pacific is expected to witness the fastest growth in the microphone market, driven by rising demand for consumer electronics, increasing adoption of mobile communication devices, and a boom in the entertainment industry

- The XLR microphones segment is expected to dominate the market with the largest market share of 80.22% due to their excellent audio quality, reliability, and versatility. They are commonly used in studios, live performances, broadcasting, and podcasting because they provide balanced audio signals and reduce interference, even over long cable lengths

Report Scope and Microphone Market Segmentation

|

Attributes |

Microphone Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Microphone Market Trends

“Integration of MEMS Technology for Compact and High-Performance Microphones”

- A prominent trend in the microphone market is the increasing adoption of MEMS (Micro-Electro-Mechanical Systems) technology, which enables the production of smaller, more efficient, and higher-performing microphones

- MEMS microphones offer benefits such as reduced size, enhanced sound quality, and increased reliability, making them ideal for use in consumer electronics, automotive, and medical devices

- Manufacturers are focusing on optimizing MEMS designs to achieve better noise cancellation, higher sensitivity, and superior durability for applications in high-demand environments

- For instance, in May 2024, Knowles Corporation introduced a new MEMS microphone series offering ultra-low power consumption and superior audio performance for wearables and smart home devices

- The growing adoption of MEMS microphones is expected to drive innovation in the portable audio segment, particularly in compact devices where size and performance are crucial

Microphone Market Dynamics

Driver

“Demand for High-Quality Audio in Consumer Electronics”

- The continuous demand for better audio experiences in consumer electronics, such assmartphones,smart speakers, and wearables, is significantly driving the market for high-performance microphones

- Consumers are seeking microphones that offer high sensitivity, noise reduction, and clear audio quality for voice recognition, music streaming, and hands-free operation

- Advancements inartificial intelligence(AI) and voice recognition systems are also pushing the demand for better microphones that can effectively capture and process sound in noisy environments

- For instance, in 2023, Apple integrated advanced microphones into its new line of AirPods to enhance voice clarity and noise cancellation during calls and voice commands

- This growing demand for premium audio quality is expected to continue fueling innovation in the microphone market, especially in the consumer electronics sector

Opportunity

“Expansion of Microphone Use in Automotive Applications”

- An emerging opportunity for the microphone market is the expanding use of high-quality microphones in automotive applications, particularly for voice-activated systems and hands-free communication

- The integration of microphones in advanced driver-assistance systems (ADAS), in-vehicle infotainment, and autonomous vehicles presents significant growth prospects for the market

- Automotive manufacturers are increasingly adopting microphones for improved voice recognition, noise cancellation, and communication clarity in smart car technologies

- For instance, in 2024, Bosch Automotive launched a new range of microphones designed for enhanced voice control and hands-free communication in their next-generation vehicle systems

- The automotive sector’s growing demand for innovative, high-quality microphones is poised to drive substantial market growth in the coming years

Restraint/Challenge

“Regulatory and Certification Challenges in Global Markets”

- A key challenge facing the microphone market is the varying regulatory requirements and certification standards across different global markets, which can delay product development and increase costs for manufacturers

- Differences in safety, environmental, and performance regulations can complicate the process of bringing new microphone technologies to market, especially in regions such as Europe and North America

- Manufacturers must invest in compliance testing, certifications, and localization strategies to meet the regulatory requirements of each target market, which can be resource-intensive

- For instance, in 2023, a global microphone manufacturer faced delays in launching its new product line in the European Union due to stringent RoHS (Restriction of Hazardous Substances) compliance regulations

- Overcoming these regulatory hurdles will be essential for global market penetration and product scalability for microphone manufacturers

Microphone Market Scope

The market is segmented on the basis of technology, MEMS type, communication technology, SNR, and application.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By MEMS Type |

|

|

By Communication Technology |

|

|

By SNR |

|

|

By Application |

|

|

By Connectivity |

|

In 2025, the XLR microphones is projected to dominate the market with a largest share in application segment

The above XLR microphones segment is expected to dominate the microphone market with the largest market share of 80.22% in 2025 due to their excellent audio quality, reliability, and versatility. They are commonly used in studios, live performances, broadcasting, and podcasting because they provide balanced audio signals and reduce interference, even over long cable lengths.

The analog is expected to account for the largest share during the forecast period in MEMS type segment

In 2025, the analog segment is expected to dominate the market with the largest market share of 64.21% due to their extensive use in professional audio equipment, consumer electronics, and industrial applications.

Microphone Market Regional Analysis

“North America Holds the Largest Share in the Microphone Market”

- North America is expected to dominate the microphone market with the largest market share of 41.22%, driven by the high demand for professional audio equipment, consumer electronics, and robust technological infrastructure

- The U.S. dominates the region’s growth, bolstered by a thriving entertainment industry, advanced communication technologies, and the presence of major microphone manufacturers

- The region benefits from increasing adoption of microphones in various applications, such as live performances, podcasting, gaming, and virtual communication, further fueling market demand

“Asia-Pacific is projected to register the Highest CAGR in the Microphone Market”

- Asia-Pacific is expected to witness the fastest growth in the microphone market, driven by rising demand for consumer electronics, increasing adoption of mobile communication devices, and a boom in the entertainment industry

- Countries such as China, India, and Japan are at the forefront of this growth, supported by strong manufacturing capabilities, expanding digital media consumption, and government initiatives promoting technological innovation

- The rapid adoption of smart devices, such as smartphones, tablets, and wearable technology, is further accelerating the demand for advanced microphone solutions in the region

- This rapid market expansion positions Asia-Pacific as a key driver for the global microphone market, presenting ample growth opportunities for manufacturers, innovators, and investors aiming to capitalize on the region’s technological progress

Microphone Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AAC Technologies (China)

- Cognex Corporation (U.S.)

- Gettop Acoustic Co., Ltd. (China)

- Goertek (China)

- Hosiden Corporation (Japan)

- Infineon Technologies AG (Germany)

- Omron Corporation (Japan)

- STMicroelectronics (Switzerland)

- TDK Corporation (Japan)

- ZillTek Technology (Unknown)

- Knowles Electronics, LLC (U.S.)

- HARMAN International(U.S.)

- Logitech (Switzerland)

- Sennheiser electronic SE & Co. KG (Germany)

- Sony Group Corporation (Japan)

- Saramonic (China)

- Shure Inc.(U.S.)

- Jiayz Group (China)

- Audio-Technica Ltd. (Japan)

- RØDE(Australia)

- Samson Distribution LLC(U.S.)

- Harman International Industries (U.S.)

- beyerdynamic (Germany)

- Bosch Sicherheitssysteme GmbH (Germany)

- Bose Corporation (U.S.)

- ClearOne Inc. (U.S.)

- MXL Microphones (U.S.)

- Panasonic Corporation (Japan)

- TOA Corporation (Japan)

- Yamaha Corporation (Japan)

Latest Developments in Global Microphone Market

- In February 2023, AAC Technologies launched a comprehensive set of automotive MEMS microphone modules to accelerate its automotive business. With an SNR ratio ranging from 63 dB to 70 dB, these microphones are designed to meet the needs of various applications across different levels and scenarios, positioning AAC Technologies as a leader in automotive audio solutions

- In February 2023, Infineon unveiled the latest addition to its XENSIV MEMS microphone portfolio, the ultra-low power digital microphone IM69D128S. This microphone is crafted for applications demanding a high signal-to-noise ratio (SNR), low microphone self-noise, extended battery life, and high reliability, setting a new benchmark in energy-efficient microphone technology

- In January 2023, TDK Corporation introduced the InvenSense T5838 and T5837 MEMS microphones. These microphones feature the industry's most energy-efficient Pulse Density Modulation (PDM) multi-mode functionality, coupled with an exceptionally high acoustic overload point, ensuring superior performance in demanding applications

- In January 2023, Knowles launched its latest series of SiSonic MEMS microphones: Titan (Digital), Falcon (Differential Analog), and Robin (Single Ended Analog). These advanced microphones offer exceptional performance for space-constrained applications such as True Wireless Stereo (TWS) earbuds, smartwatches, and Augmented Reality (AR) glasses, providing cutting-edge audio solutions for next-generation wearable devices

- In December 2022, Knowles introduced two MEMS microphone solutions optimized for over-the-counter (OTC) hearing aids. These solutions are tailored for the value-based segment of the OTC hearing aid market, offering reliable performance and lower power consumption compared to competing commercial microphones, making them ideal for hearing aid manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。