Latam Distributed Antenna System Das Market

市场规模(十亿美元)

CAGR :

%

USD

916.32 Million

USD

1,898.64 Million

2024

2032

USD

916.32 Million

USD

1,898.64 Million

2024

2032

| 2025 –2032 | |

| USD 916.32 Million | |

| USD 1,898.64 Million | |

|

|

|

拉丁美洲分散式天線系統 (DAS) 市場細分,按產品(硬體和服務)、DAS 類型(被動、有源和混合)、覆蓋範圍(室內和室外)、所有權(中立主機、運營商和企業)、技術(運營商 Wi-Fi 和小型基地台)、用戶設施( 500K FT2、200K–50K 2032 年

分散式天線系統(DAS)市場分析

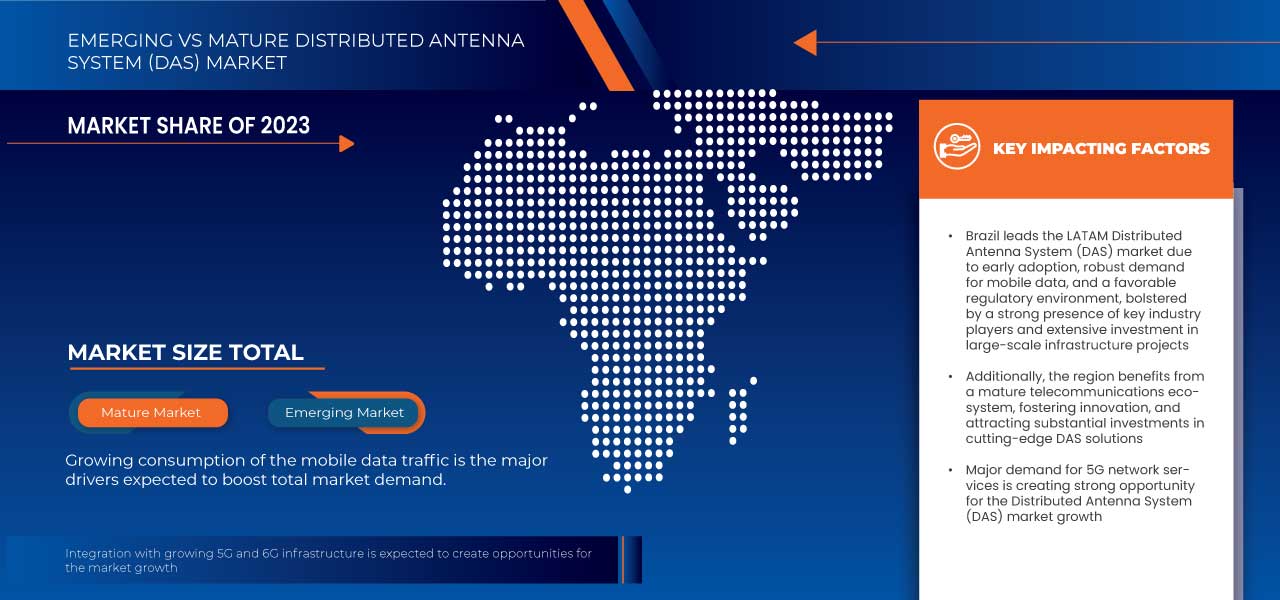

數位化、智慧型手機消費和技術嫻熟的人口的成長,創造了對增強網路連接解決方案的需求,從而促進了分散式天線系統 (DAS)市場的成長。行動網路連接的日益普及和行動數據流量的不斷增長正在促進分散式天線系統 (DAS) 市場的成長。為了為設備提供增強的網路覆蓋和連接,DAS 發揮重要作用,加速了分散式天線系統 (DAS) 市場的成長。不同的最終用戶正在採用該技術來增強通訊和服務,這增加了幾乎所有工業垂直領域的網路連接,並成為分散式天線系統 (DAS) 市場的主要驅動力。然而,訊號增強器等替代解決方案的存在以及分散式天線系統 (DAS) 網路的高安裝成本可能會阻礙分散式天線系統 (DAS) 市場的成長。

分散式天線系統(DAS)市場規模

拉丁美洲分散式天線系統 (DAS) 市場規模將從 2024 年的 9.1632 億美元增至 2032 年的 18.9864 億美元,在 2025 年至 2032 年的預測期內以 9.8% 的複合年增長率增長。除了市場價值、成長率、市場細分、地理覆蓋範圍、市場參與者和市場情景等市場洞察外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 PESTLE 分析。

分散式天線系統(DAS)市場趨勢

“人們對安全連接的需求激增”

拉丁美洲對安全可靠連接日益增長的趨勢為分散式天線系統 (DAS) 市場帶來了重大機會。隨著越來越多的城鄉居民依賴行動和網路服務滿足個人、職業和教育需求,確保安全和不間斷的連接已成為重中之重。這種安全需求不僅限於資料保護,還需要能夠處理流量激增的強大網絡,確保人們在緊急情況、自然災害或其他危急情況下能夠保持聯繫。 DAS 系統在提供此類安全連接解決方案所需的覆蓋範圍和可靠性方面可以發揮關鍵作用,特別是在密集的城市環境和連接經常不穩定的偏遠地區。

隨著 5G 技術在該地區持續推廣,對安全連接的需求更加明顯,特別是對於醫療保健、金融和緊急服務等關鍵領域。 DAS 系統非常適合處理 5G 網路日益增長的流量和安全需求,確保平穩安全地運作。此外,DAS系統提供的基礎設施可支援物聯網等技術,實現即時監控和回應安全威脅或系統故障。安全連接需求的激增為 DAS 解決方案帶來了不斷增長的市場,這些解決方案可以確保人們能夠在整個拉丁美洲享受安全、高品質的通訊服務。

報告範圍和分散式天線系統(DAS)市場細分

|

屬性 |

分散式天線系統(DAS)關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

巴西、墨西哥、阿根廷、哥倫比亞和拉丁美洲其他地區 |

|

主要市場參與者 |

AT&T 智慧財產權(美國),ATC TRS V LLC。 (美國)、康寧公司(美國)、康普公司(美國)、休斯網路系統有限責任公司(美國)、Zinwave(美國)、HUBER+SUHNER(瑞士)、BTI wireless(美國)、WESCO INTERNATIONAL, INC.(美國)和 Advanced RF Technologies, Inc.(美國)等 |

|

市場機會 |

|

|

加值數據 |

除了市場價值、成長率、市場細分、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 PESTLE 分析。 |

分散式天線系統(DAS)市場定義

分散式天線系統 (DAS) 是在空間上劃分並分散在給定地面區域的天線群,用於增強由蜂窩和無線電訊號組成的主流無線服務。在天線的幫助下,數位訊號轉換為射頻訊號,射頻訊號轉換為數位訊號,從而提供蜂窩訊號。分散式天線系統 (DAS) 的部署是為了在不常使用但對無線網路服務需求很高的建築物和場館(如音樂廳、體育場和禮堂)提供額外的網路覆蓋和容量。 DAS 網路可以部署在室內或室外。分散式天線系統 (DAS) 由各種硬體組件組成,例如頭端單元、天線、無線電單元等,它們可以提高效率並改善網路覆蓋和連接效能。

分散式天線系統(DAS)市場動態

驅動程式

- 行動數據流量消耗不斷成長

隨著拉丁美洲(LATAM)地區智慧型手機普及率和數位連接需求的激增,行動數據流量消費的成長成為該地區分散式天線系統(DAS)市場的主要驅動力。隨著視訊串流、線上遊戲和遠端工作工具等高頻寬應用程式的使用日益增多,行動網路面臨著提供無縫連接的巨大壓力。 DAS 透過增強訊號覆蓋和網路容量提供了有效的解決方案,特別是在人口稠密的城市和基礎設施密集的地區,如機場、體育場和購物中心,而傳統網路系統在這些地區經常遇到挑戰。

此外,拉丁美洲 4G 和 5G 網路的擴張加速了對強大基礎設施的需求,以支援不斷增長的數據流量。該地區各國正積極投資電信領域,以彌補連結性差距並滿足消費者對更快、更可靠網路的期望。 DAS 技術使服務提供者能夠有效地應對這些挑戰,提供更好的網路效能和使用者體驗。隨著數位轉型計畫在拉丁美洲地區蓬勃發展,行動數據流量的不斷增長凸顯了 DAS 在區域電信領域日益增長的重要性

例如,

- 2024年8月,根據Developing Telecom發表的文章稱,Claro Argentina已與諾基亞合作,在全國部署5G基礎設施。該交易將為主要城市提供可靠、低延遲、超高速的連接,諾基亞將提供其 5G AirScale 產品組合中的設備。 Claro Argentina 也將成為拉丁美洲第一家在其整個網路中實施諾基亞交叉被動主動天線 (IPAA+) 的公司。此次重要的 5G 部署凸顯了隨著 5G 普及率的提高,對行動數據流量的需求也日益增長。對更快、更可靠的網路的需求將推動對分散式天線系統 (DAS) 的需求,以確保無縫覆蓋、管理更高的數據負載並滿足整個拉丁美洲城市和農村地區的連接需求。

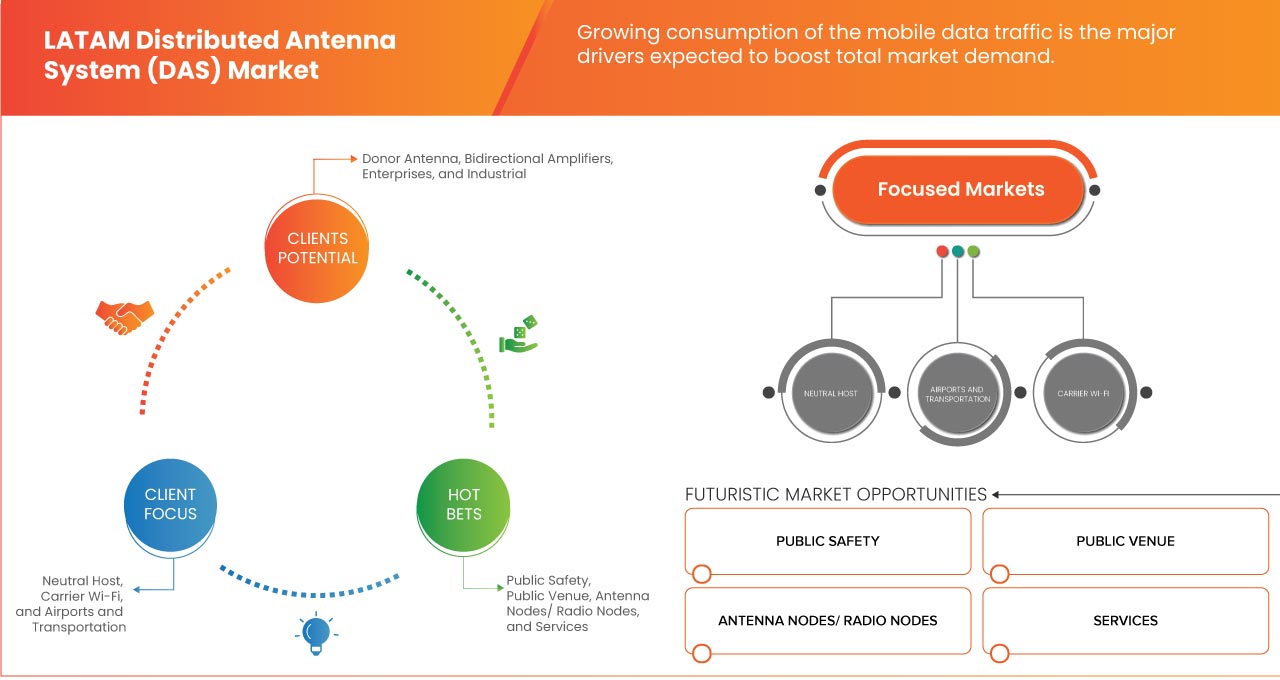

各類終端用戶的需求不斷成長

包括消費者、企業和行業在內的各種終端用戶不斷增長的需求正在極大地推動分散式天線系統 (DAS) 市場的成長。隨著行動數據消耗的激增,特別是 5G 網路的快速擴張,對強大而可靠的網路基礎設施的需求日益增加。消費者要求視訊串流、線上遊戲和社交媒體等活動實現無縫連接,而企業則整合需要不間斷高速互聯網接入的物聯網、自動化和雲端解決方案。對行動網路的日益依賴,加上連網裝置的增加,正在推動 DAS 的部署,以確保在資料流量大的地區實現覆蓋並保持網路可靠性。

此外,醫療保健、製造業和運輸業等各行業正在採用依賴一致且高效能無線連接的先進技術。在機場、體育場、醫院和工業設施等環境中,對 DAS 的需求尤其高,因為在這些環境中,傳統蜂窩網路常常由於物理障礙或高用戶密度而難以提供足夠的覆蓋。隨著這些行業擴展其數位基礎設施,對能夠支援關鍵通訊、確保順暢的資料傳輸並提供可擴展性的 DAS 解決方案的需求正在加速成長。來自不同行業的廣泛需求是推動全球 DAS 市場成長的關鍵因素,尤其是在拉丁美洲等地區

例如,

- 2024年11月,根據Stadium Tech Report發表的文章,AT&T體育場最近透過增加14個MatSing Lens天線增強了其分散式天線系統(DAS),以改善C波段覆蓋範圍。此次升級可提供高達 4 Gbps 的下載速度,凸顯了大型場館對大容量連線日益增長的需求。隨著拉丁美洲 5G 普及率的提高,對 MatSing 天線等先進 DAS 解決方案的需求也將隨之增加,從而推動該地區的市場成長,以滿足高流量地區對無縫連接的需求。

機會

- 與不斷發展的5G和6G基礎設施的融合

分散式天線系統 (DAS) 與快速發展的 5G 和 6G 基礎設施的集成為拉丁美洲 DAS 市場提供了重要機會。隨著電信公司不斷擴展其 5G 網絡,尤其是在城市和人口稠密地區,DAS 技術對於確保最佳網路覆蓋、容量和效能至關重要。對無縫連接和更高資料速度的需求使得對 DAS 部署的需求日益增長,這有助於緩解覆蓋範圍差距、增強行動體驗並支援 5G 和 6G 預期的密集網路流量。

隨著全球向 5G 的轉變以及未來 6G 技術的預期推出,拉丁美洲國家預計將越來越多地採用先進的 DAS 解決方案。這些系統對於支援滿足下一代無線技術需求所需的不斷發展的基礎設施至關重要。 DAS 與拉丁美洲的 5G 和 6G 網路的整合不僅可以增強連通性,還可以使該地區在全球數位領域保持競爭力,促進創新並支持不斷增長的數據驅動型經濟。

例如,

- 2023年5月,根據《微波雜誌》發表的文章,下一代DAS技術應運而生,以滿足5G需求。最近的一項研究發現,超過 80% 的手機語音和數據使用發生在室內,這表明室內用戶對 5G 服務的需求很大。由於高頻頻譜特性,傳統蜂窩網路難以有效穿透建築物。這對公共交通、大型場館和辦公空間的室內覆蓋提出了挑戰。 DAS 技術面臨類似的挑戰,需要複雜的基礎設施和互連以確保足夠的覆蓋範圍。隨著 5G 的出現,DAS 系統正在不斷發展,以支援更高的資料速率並適應新的頻段,同時滿足使用者多樣化的需求。

農村地區的網路改善機會

The LATAM Distributed Antenna System (DAS) market presents significant opportunities for network improvement in rural areas. As Latin American countries continue to focus on enhancing connectivity, expanding 5G infrastructure to underserved rural regions is a key priority. DAS systems, with their ability to provide efficient and scalable coverage, are essential in bridging the connectivity gap between urban and rural areas. By deploying DAS in rural areas, telecom operators can enhance network coverage, reduce signal dead zones, and provide reliable high-speed internet to remote communities, thereby improving access to essential digital services such as education, healthcare, and e-commerce.

In addition, to improving connectivity, rural network improvements through DAS can contribute to economic development in these regions. With better network access, businesses in rural areas can expand their digital presence, enabling growth and innovation. Moreover, the integration of DAS technology will play a critical role in supporting the broader rollout of next-generation technologies such as 5G and AI-driven applications, which can further enhance productivity and sustainability in rural industries such as agriculture and mining. The growing demand for connectivity in rural areas represents a valuable opportunity for the DAS market to contribute to the region’s digital transformation and economic growth.

For instance,

- In October 2024, according to the article published by TowerXchange, Highline has secured USD 11.9 million in financing from Brazil’s National Bank for Economic and Social Development (BNDES) to build 181 towers across 23 states, expanding 4G and 5G coverage, especially in rural areas and favelas. Funded by the Telecommunications Services Universalisation Fund (Fust), the initiative aims to enhance digital inclusion. This presents an opportunity for the LATAM Distributed Antenna System (DAS) market, as DAS solutions will be essential to improve connectivity and network performance in these underserved regions, supporting the growing 4G and 5G infrastructure.

Restraints/Challenges

- Availability of the Alternative Solution

Technologies such as Wi-Fi, small cells, and femtocells present lower-cost and often easier-to-deploy options compared to DAS, making them attractive alternatives in less densely populated regions or smaller buildings. These alternatives are especially beneficial in areas where rapid deployment and cost-efficiency are prioritized, which may limit the demand for the more complex and expensive DAS solutions. As businesses and organizations in LATAM seek budget-friendly solutions, the competition from these alternatives could slow the expansion of DAS networks in certain markets.

此外,拉丁美洲 5G 網路的推出可能會加劇 DAS 採用的挑戰。 5G技術憑藉其高速能力和低延遲通信,可以實現更靈活、更有效率的覆蓋,尤其是在城市環境中。隨著 5G 網路在整個地區不斷擴展,它們可能會減少對傳統 DAS 安裝的需求,特別是在行動網路覆蓋強大的地區。向 5G 和其他先進無線技術的轉變可能會影響拉丁美洲 DAS 的成長前景,因為企業和服務供應商可能會選擇 5G 基礎設施和替代無線解決方案,而不是投資部署 DAS 系統。

例如,

- 2023年3月,根據發展電信有限公司發表的文章稱,華為旨在促進先進數位社會發展的5G室內數位系統已經發布。儘管營運商專注於實現廣泛的全國覆蓋,但室內覆蓋仍然至關重要,大約 70% 的 4G 和 5G 流量來自室內。華為透過其數位室內系統 (DIS) 系列滿足了這一需求,為傳統分散式天線系統 (DAS) 提供了更優越的替代方案。與僅支援 1T1R 或 2T2R 而室外系統最高支援 64T64R 的 DAS 不同,華為的 DIS 彌補了這一差距,確保了室內外的一致連接。

- 限制組織採用的技術挑戰

拉丁美洲各組織採用分散式天線系統 (DAS) 面臨多項技術挑戰,這些挑戰可能會阻礙其廣泛實施。一個主要障礙是將 DAS 與現有網路基礎設施整合的複雜性。許多企業的舊系統可能與先進的 DAS 技術不相容,需要進行重大升級或更換。此外,DAS 的部署通常需要精心規劃,包括優化訊號覆蓋、解決幹擾問題以及確保跨各種建築結構之間的無縫連接。這些因素可能會導致更高的初始成本和更長的安裝時間,這可能會阻礙希望採用 DAS 解決方案的組織。

此外,技術進步的快速步伐帶來了另一個挑戰。隨著 5G 等新型無線技術的不斷湧現,組織必須確保其 DAS 解決方案具有可擴展性並能夠支援未來的網路升級。標準和技術的不斷發展使得組織難以致力於特定的 DAS 解決方案,而不用擔心過時。這可能會讓拉丁美洲的公司感到猶豫,因為他們面臨著在現有技術和為未來需求做好準備之間做出選擇的困境。因此,克服這些技術挑戰對於推動該地區採用 DAS 系統至關重要。

例如,

- 2024年1月,據EBC報道,儘管一些城市取得了進展,但巴西的5G技術擴展由於當地天線法律過時而面臨重大挑戰,阻礙了基礎設施的安裝。僅有 7.16% 的城市更新了立法,重要的 5G 網路的推出仍然緩慢。這凸顯了拉丁美洲分散式天線系統 (DAS) 市場面臨的關鍵挑戰,因為 5G 等進步需要監管協調才能實現基礎設施部署。缺乏更新的立法和市政當局的延遲適應限制了組織採用 DAS 解決方案,限制了它們從高速、可靠的連接中受益以提高營運效率和改善服務的能力。

本市場報告提供了最新發展、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地化市場參與者的影響的詳細信息,分析了新興收入領域的機會、市場法規的變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品批准、產品發布、地理擴展、市場技術創新。要獲取更多市場信息,請聯繫 Data Bridge Market Research 獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

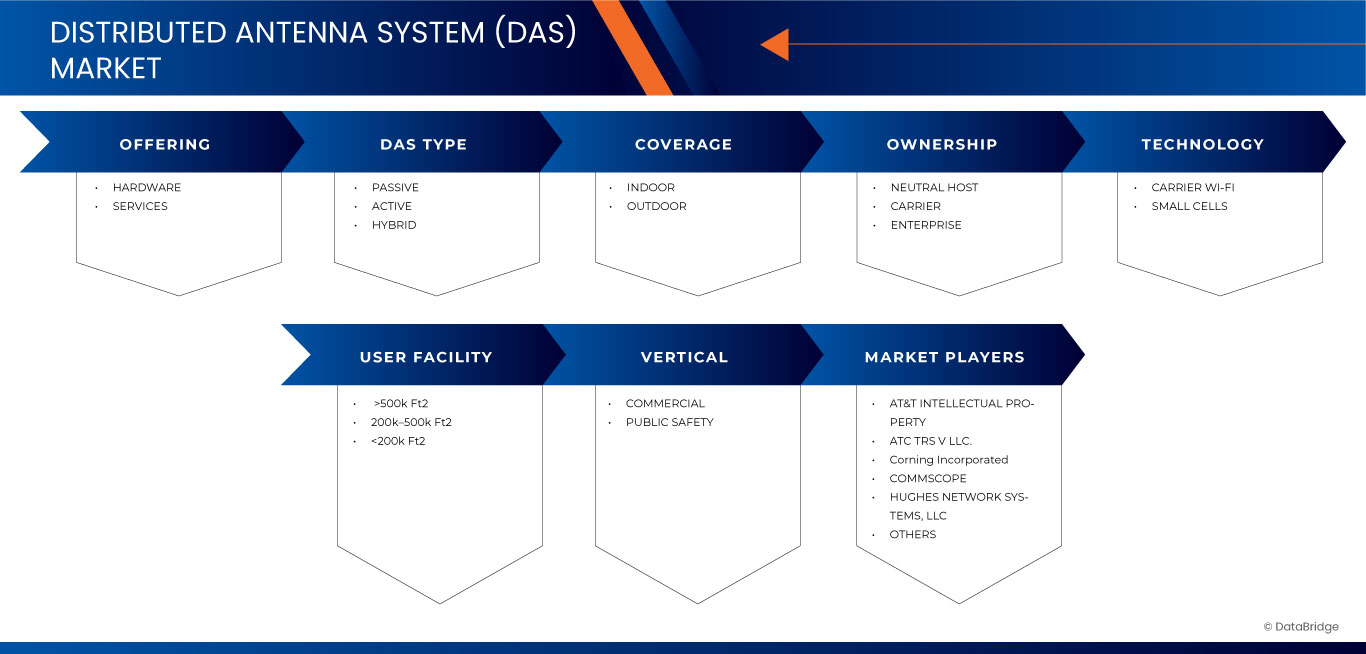

分散式天線系統(DAS)市場範圍

市場根據產品、DAS 類型、覆蓋範圍、所有權、技術、用戶設施和垂直領域分為七個顯著的細分市場。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

奉獻

- 硬體

- 天線節點/無線電節點

- 捐贈天線

- 雙向擴大機

- 無線電單元

- 頭端單元

- 其他的

- 服務

- 安裝服務

- 售前服務

- 安裝後服務

DAS類型

- 被動的

- 積極的

- 雜交種

覆蓋範圍

- 室內的

- 被動的

- 積極的

- 雜交種

- 戶外的

- 被動的

- 積極的

- 雜交種

所有權

- 中立主持人

- 載體

- 企業

科技

- 無線上網

- 小型基地台

使用者設施

- >50萬英尺²

- 200K–500K FT2

- <20萬英尺²

垂直的

- 商業的

- 按類型

- 公共場所

- 機場和交通

- 企業

- 大型企業

- 中小企業

- 工業的

- 零售

- 政府

- 飯店業

- 衛生保健

- 教育

- 船舶

- 依 DAS 類型

- 被動的

- 積極的

- 雜交種

- 按類型

- 公安

- 被動的

- 積極的

- 雜交種

分散式天線系統(DAS)市場區域分析/洞察

對市場進行分析,並透過產品、DAS 類型、覆蓋範圍、所有權、技術、用戶設施和垂直行業提供市場規模洞察和趨勢。

拉丁美洲分散式天線系統 (DAS) 市場報告涵蓋的國家包括巴西、墨西哥、阿根廷、哥倫比亞和拉丁美洲其他地區。

The LATAM distributed antenna system (DAS) market is dominated by the Brazil leading due to its advanced telecommunications infrastructure and widespread adoption of wireless technologies.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Distributed Antenna System (DAS) Market Share

The market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, Market potential, investment in research and development, new Market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Distributed Antenna System (DAS) Market Leaders Operating in the Market are:

- AT&T Intellectual Property (U.S.)

- ATC TRS V LLC. (U.S.)

- Corning Incorporated (U.S.)

- CommScope, Inc. (U.S.)

- Hughes Network Systems, LLC (U.S.)

- Zinwave (U.S.)

- HUBER+SUHNER (Switzerland)

- BTI wireless (U.S.)

- WESCO INTERNATIONAL, INC. (U.S.)

- Advanced RF Technologies, Inc. (U.S.)

Recent Developments in Distributed Antenna System (DAS) Market

- In February 2024, AT&T pilots 5G for healthcare with U.S. Veterans Affairs, aiming to leverage distributed antenna systems and edge computing. With plans to deploy millimeter wave spectrum alongside MEC technologies, AT&T's initiative reflects the potential for 5G to revolutionize healthcare delivery. Despite competition from Verizon, AT&T's expansive installation at the Seattle VA Medical Center showcases its commitment to advancing healthcare through cutting-edge technology

- 2023 年 7 月,ATC TRS V LLC 和明尼蘇達荒野隊增強了 Xcel 能源中心的球迷體驗,部署了尖端的分散式天線系統 (DAS) 解決方案,將 5G 技術帶入該體育場。此次升級旨在滿足每年 170 萬遊客和 150 多場活動(包括 44 場 NHL 比賽)的需求。 (ATC TRS V LLC)American Tower 在體育場館連接和技術創新方面的專業知識促進了這一關鍵的網路升級,確保球迷享受快速可靠的連接以分享現場體驗。這一發展鞏固了美國塔作為主要場館先進連接解決方案領先供應商的聲譽,增強了其市場影響力,並吸引了更多體育和娛樂行業的合作夥伴,從而為美國塔的進一步發展奠定了基礎。

- 2022 年 9 月,Advanced RF Technologies, Inc. 推出了 C 波段無線解決方案,包括 ADXV DAS 模組和 SDRX 中繼器,承諾為建築物和場館提供無處不在的 5G 覆蓋,滿足不同利益相關者的需求。這些產品的 C 波段頻率範圍為 3.7 GHz 至 3.98 GHz,可促進從 4G/LTE 系統的無縫升級,確保在 2022 年第四季度增強連接性和性能

- 2020年10月,Advanced RF Technologies, Inc.宣布加入非營利組織國家系統承包商協會(NSCA)。該公司成為第一家加入該協會的DAS和緊急無線電通訊增強系統(ERCES)提供者。這有助於提高他們的信譽和品牌價值

- 2020 年 3 月,Advanced RF Technologies, Inc. 宣布與 Windy City Wire (WCW) 合作,為商業和公共安全用例分發其室內無線解決方案。這有助於該公司擴大服務範圍並增加客戶群

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 OFFERING TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET VERTICAL COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 CASE STUDY

4.3 VALUE CHAIN ANALYSIS

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 PRICING ANALYSIS

4.6 PATENT ANALYSIS

4.7 TECHNOLOGICAL TRENDS

4.8 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC

5.1.2 GROWING DEMAND FROM THE VARIOUS END USERS

5.1.3 DIGITAL TRANSFORMATION OF BUSINESS

5.1.4 INCREASING NUMBER OF CONNECTED DEVICES DUE TO INTERNET OF THINGS (IOTS)

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF THE ALTERNATIVE SOLUTION

5.2.2 STRICT GOVERNMENT REGULATORY NORMS

5.3 OPPORTUNITIES

5.3.1 INTEGRATION WITH GROWING 5G AND 6G INFRASTRUCTURE

5.3.2 NETWORK IMPROVEMENT OPPORTUNITIES IN THE RURAL AREAS

5.3.3 UPSURGE IN A REQUIREMENT FOR SAFE CONNECTIVITY FOR PEOPLE

5.4 CHALLENGES

5.4.1 TECHNOLOGICAL CHALLENGES RESTRICTING THE ADOPTION IN ORGANIZATIONS

5.4.2 DIFFICULTY IN UPGRADATION OF DISTRIBUTED ANTENNA SYSTEMS

6 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 ANTENNA NODES/ RADIO NODES

6.2.2 DONOR ANTENNA

6.2.3 BIDIRECTIONAL AMPLIFIERS

6.2.4 RADIO UNITS

6.2.5 HEAD END UNITS

6.2.6 OTHERS

6.3 SERVICES

6.3.1 INSTALLATION SERVICES

6.3.2 PRE-SALES SERVICES

6.3.3 POST-INSTALLATION SERVICES

7 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE

7.1 OVERVIEW

7.2 PASSIVE

7.3 ACTIVE

7.4 HYBRID

8 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE

8.1 OVERVIEW

8.2 INDOOR

8.2.1 PASSIVE

8.2.2 ACTIVE

8.2.3 HYBRID

8.3 OUTDOOR

8.3.1 PASSIVE

8.3.2 ACTIVE

8.3.3 HYBRID

9 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 COMMERCIAL

9.2.1 PUBLIC VENUE

9.2.2 AIRPORTS AND TRANSPORTATION

9.2.3 ENTERPRISES

9.2.3.1 LARGE ENTERPRISES

9.2.3.2 SMALL AND MEDIUM ENTERPRISES

9.2.4 INDUSTRIAL

9.2.5 RETAIL

9.2.6 GOVERNMENT

9.2.7 HOSPITALITY

9.2.8 HEALTHCARE

9.2.9 EDUCATION

9.2.10 SHIPS

9.2.10.1 PASSIVE

9.2.10.2 ACTIVE

9.2.10.3 HYBRID

9.3 PUBLIC SAFETY

9.3.1 PASSIVE

9.3.2 ACTIVE

9.3.3 HYBRID

10 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE

10.1 OVERVIEW

10.2 PASSIVE

10.3 ACTIVE

10.4 HYBRID

11 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP

11.1 OVERVIEW

11.2 NEUTRAL HOST

11.3 CARRIER

11.4 ENTERPRISE

12 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 CARRIER WI-FI

12.3 SMALL CELLS

13 LATAM DISTRIBUTED ANTENNA SYSTEM MARKET, BY COUNTRY

13.1 LATAM

13.1.1 BRAZIL

13.1.2 MEXICO

13.1.3 ARGENTINA

13.1.4 COLOMBIA

13.1.5 REST OF LATAM

14 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: LATAM

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AT&T INTELLECTUAL PROPERTY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 ATC TRS V LLC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 SOLUTION PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 CORNING INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 APPLICATION PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 COMMSCOPE, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 HUGHES NETWORK SYSTEMS, LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 ADVANCED RF TECHNOLOGIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BTI WIRELESS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 HUBER+SUHNER

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 WESCO INTERNATIONAL, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 ZINWAVE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 2 LATAM HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 3 LATAM SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 4 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 5 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 6 LATAM INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 7 LATAM OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 8 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 9 LATAM COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 10 LATAM ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 11 LATAM COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 12 LATAM PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 13 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 14 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 15 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 16 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COUNTRY, 2022-2032 (USD THOUSAND)

TABLE 17 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 18 BRAZIL HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 19 BRAZIL SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 20 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 21 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 22 BRAZIL INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 23 BRAZIL OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 24 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 25 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 26 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 27 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 28 BRAZIL COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 29 BRAZIL ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 30 BRAZIL COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 31 BRAZIL PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 32 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 33 MEXICO HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 34 MEXICO SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 35 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 36 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 37 MEXICO INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 38 MEXICO OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 39 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 40 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 41 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 42 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 43 MEXICO COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 44 MEXICO ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 45 MEXICO COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 46 MEXICO PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 47 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 48 ARGENTINA HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 49 ARGENTINA SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 50 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 51 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 52 ARGENTINA INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 53 ARGENTINA OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 54 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 55 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 56 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 57 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 58 ARGENTINA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 59 ARGENTINA ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 60 ARGENTINA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 61 ARGENTINA PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 62 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 63 COLOMBIA HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 64 COLOMBIA SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 65 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 66 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 67 COLOMBIA INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 68 COLOMBIA OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 69 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 70 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 71 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 72 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 73 COLOMBIA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 74 COLOMBIA ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 75 COLOMBIA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 76 COLOMBIA PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 77 REST OF LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

图片列表

FIGURE 1 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 2 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DATA TRIANGULATION

FIGURE 3 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DROC ANALYSIS

FIGURE 4 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: LATAM VS REGIONAL MARKET ANALYSIS

FIGURE 5 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: OFFERING TIMELINE CURVE

FIGURE 7 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING (2024)

FIGURE 13 EXECUTIVE SUMMARY: LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 14 STRATEGIC DECISIONS: LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 15 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC IS EXPECTED TO DRIVE LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN 2025 & 2032

FIGURE 17 VALUE CHAIN FOR LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 18 BRAND COMPARISON

FIGURE 19 COMPARISON OF ACTIVE, PASSIVE AND HYBRID DAS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 21 TOTAL MOBILE DATA TRAFFIC IN LATIN AMERICA

FIGURE 22 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING, 2024

FIGURE 23 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DAS TYPE, 2024

FIGURE 24 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COVERAGE, 2024

FIGURE 25 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY VERTICAL, 2024

FIGURE 26 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY DAS TYPE, 2024

FIGURE 27 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OWNERSHIP, 2024

FIGURE 28 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY TECHNOLOGY, 2024

FIGURE 29 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, SNAPSHOT (2024)

FIGURE 30 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。