Middle East And Africa Battery Energy Storage System

市场规模(十亿美元)

CAGR :

%

USD

16.35 Billion

USD

56.83 Billion

2024

2032

USD

16.35 Billion

USD

56.83 Billion

2024

2032

| 2025 –2032 | |

| USD 16.35 Billion | |

| USD 56.83 Billion | |

|

|

|

|

中東和非洲電池儲能係統市場細分,按要素(電池和硬體)、連接類型(併網(併網)系統和離網(獨立)系統)、所有權(客戶擁有、公用事業所有和第三方所有)、能源容量(500 MWh 以上、100 至 500 MWh 之間和 100 MWh 區域等

電池儲能係統市場分析

受再生能源整合、電網穩定性需求以及電氣化趨勢的推動,中東和非洲電池儲能係統 (BESS) 市場正在迅速擴張。鋰離子電池因其效率和成本效益而佔據主導地位,儘管固態電池和液流電池等替代品也正在興起。其主要應用包括住宅、商業和公用事業規模項目的峰值、負載轉移和備用電源。領先的參與者包括特斯拉、LG Energy Solution 和 Fluence。政府激勵措施、碳減排政策以及電池成本下降推動了市場成長。亞太地區處於領先地位,其次是北美和歐洲。挑戰包括高昂的初始投資、供應鏈限制以及電池處置問題。未來技術和能源管理的進步將進一步推動電池的採用和市場擴張。

電池儲能係統市場規模

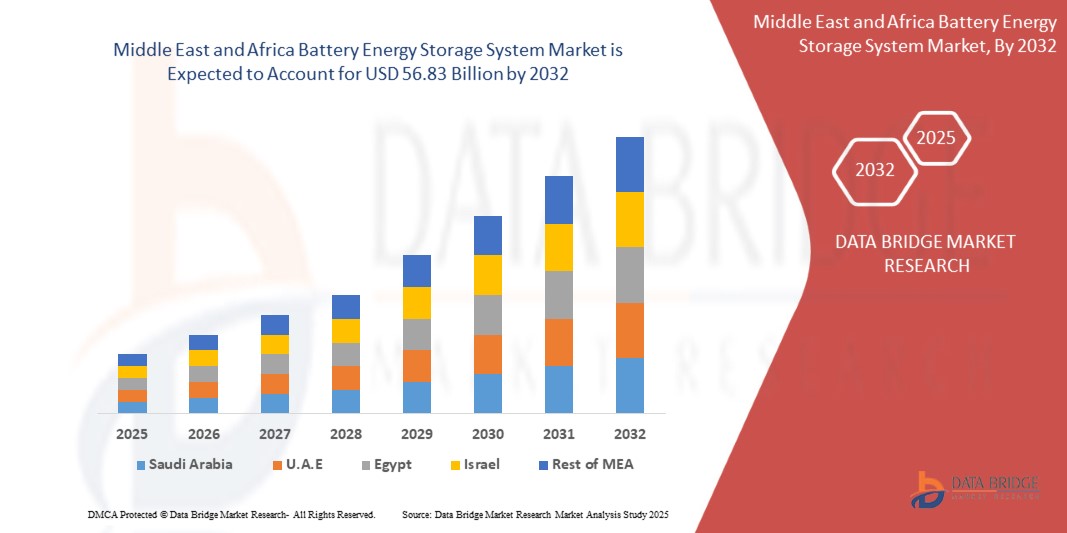

中東和非洲電池儲能係統市場預計將從 2024 年的 163.5 億美元增至 2032 年的 568.3 億美元,在 2025 年至 2032 年的預測期內,複合年增長率將達到 16.95%。

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

電池儲能係統市場趨勢

“再生能源的整合、電網穩定需求和電氣化趨勢”

在再生能源整合、電網穩定需求和電氣化趨勢的推動下,中東和非洲的電池儲能係統 (BESS) 市場正在迅速擴張。鋰離子電池因其效率高且成本下降而佔據主導地位,而固態電池和液流電池的進步則有望提升其性能。世界各國政府正在推出政策和激勵措施來推廣儲能,其中亞太地區(中國、印度)、北美和歐洲等地區在儲能應用方面處於領先地位。公用事業規模的儲能係統正在發展壯大,以支持電網彈性,而住宅和商業儲能部署則因能源獨立和成本節約而不斷增加。挑戰包括供應鏈限制、原材料成本和回收問題。未來趨勢指向人工智慧驅動的能源管理、混合儲能解決方案和二次電池應用。

報告範圍和電池儲能係統市場細分

|

屬性 |

電池儲能係統市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

沙烏地阿拉伯、阿聯酋、南非、埃及、以色列、中東和非洲其他地區 |

|

主要市場參與者 |

比亞迪股份有限公司(中國)、LG Energy Solution(韓國)、ABB(瑞士)、博世有限公司(德國)、AES Corporation(美國)、瓦錫蘭(芬蘭)、施耐德電氣(法國)、SMA Solar Technology AG(德國)、科德寶集團(德國)、Eoscon Energy Enterprises(美國)、ATX Networks Corp.(加拿大)和 Beacon Energy Enterprises(美國)、ATX Networks Corp.(加拿大)和 Beacon Energy Enterprises(美國)、ATX Networks Corp.(加拿大)和 Beacon Energy Enterprises(美國)、ATX Networks Corp.(加拿大)和 Beacon Energy Enterprises(美國)、ATX Networks Corp.(加拿大)和 Beacon Energy Enterprises(美國)、ATX Networks Corp.(加拿大)和 Beacon Energy Enterprises(美國)。 |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

電池儲能係統市場定義

電池儲能係統 (BESS) 是一種將電能儲存在可充電電池中以備後用的技術。它在穩定電網、整合太陽能和風能等再生能源以及提高能源效率方面發揮著至關重要的作用。 BESS 可以提供備用電源、管理尖峰需求,並透過平衡供需來提高電網可靠性。鋰離子電池因其高能量密度和高效率而佔據市場主導地位,但固態電池和液流電池等替代化學電池也正在興起。

電池儲能係統市場動態

驅動程式

- 再生能源整合與採用的興起

隨著世界向清潔能源轉型,太陽能和風能等再生能源的使用正在迅速增長。然而,這些能源並非總能在需要時獲得。夜晚沒有太陽,風並非總是吹拂。這給維持穩定的電力供應帶來了挑戰。電池儲能係統 (BESS) 有助於解決這個問題。這些系統儲存再生能源產生的多餘電力,並在需求高或再生能源發電量低時釋放。這確保了穩定可靠的電力供應,並減少了對傳統化石燃料的依賴。採用 BESS 的一個主要驅動力是電池技術成本的下降。鋰離子電池和其他類型電池的進步使得儲能更經濟實惠。各國政府和企業正在投資這些系統,以提高能源效率並支持清潔能源目標。

例如,

- 2019年3月,Chary Publications Pvt. Ltd. 發表的一篇文章指出,電池儲能係統 (BESS) 透過儲存多餘電力並在需要時釋放來支援再生能源的整合,從而確保電網穩定。隨著電池技術的進步和成本的降低,BESS 的採用率正在上升。政府的激勵措施和政策進一步推動了投資,使再生能源更加可靠、更易於取得。

- 根據 Business Prizm 發表的一篇文章,電池儲能係統 (BESS) 透過儲存多餘電力並確保電網穩定,在再生能源整合中發揮著至關重要的作用。隨著再生能源的普及,BESS 有助於平衡供需,減少停電並提高能源可靠性。政府激勵措施和技術進步進一步推動了 BESS 的普及。

- 2025年2月,《衛報》新聞傳媒有限公司發表文章稱,受政策支持和再生能源成本下降的推動,澳洲對大型風能和太陽能專案的投資在2024年達到了六年來的最高峰,達到90億美元。澳洲的目標是到2030年實現82%的再生能源發電量,加速清潔能源解決方案的採用。

對電網穩定性和能源彈性的需求不斷增長

隨著能源系統日益複雜,對穩定可靠電力供應的需求也日益增長。電網必須應對不斷增長的電力需求、太陽能和風能等再生能源的波動以及意外斷電。為了確保能源平穩流動,電池儲能係統 (BESS) 正變得至關重要。

電池儲能係統 (BESS) 透過在供電高峰時儲存多餘的電力,並在需求上升時釋放,幫助維持電網穩定。這可以防止停電,並確保即使在高峰時段也能穩定供電。當突然出現電力短缺時,電池儲能係統 (BESS) 可以迅速介入,確保家庭、企業和工業部門不間斷運作。

電池儲能係統 (BESS) 的另一個主要優點是能源彈性。自然災害、極端天氣和網路威脅都可能擾亂電網,導致停電。而電池儲能係統則可儲存電力,並在電網發生故障時使用,確保醫院、急診中心和通訊網路等基本服務持續運作。

例如,

- 根據 WElink 發布的一篇文章,電池儲能係統 (BESS) 透過儲存多餘的能量並在高峰需求時釋放,從而增強電網穩定性,確保穩定的電力供應。它們能夠在幾毫秒內做出反應,平衡頻率偏差,防止斷電並提高能源彈性。 BESS 支援再生能源整合,從而建立更可靠的電網。

- 路透社2025年2月發表的一篇文章稱,太陽能板和電池成本的下降正在擴大再生能源在電力市場中的地位。較低的價格使清潔能源項目更加經濟實惠,從而推動了中東和非洲地區的採用。隨著儲能成本的降低,再生能源可以提供更穩定、更可靠的電力供應。

- 2025年2月,根據路透社報道,澳洲AGL能源公司計劃開發1.4千兆瓦的電網規模電池存儲,以支持綠色轉型,到2035年實現淨零排放。該公司正在投資儲能,以增強電網穩定性,並將更多再生能源納入電力系統

機會

- 電池技術的進步與創新

電池技術的進步和創新正在為中東和非洲電池儲能係統 (BESS) 市場創造巨大的機會。隨著各行各業對再生能源整合、電網穩定性和電氣化的需求日益增長,電池儲能解決方案正變得至關重要。市場成長的關鍵驅動力之一是新一代電池的開發,例如固態電池、鋰硫電池和鈉離子電池,與傳統鋰離子電池相比,這些電池的能量密度、安全性和使用壽命更高。這些創新提高了儲能係統的效率,使其更具成本效益和可靠性。

此外,由於材料、製造流程和回收技術的進步,電池成本下降也擴大了市場應用。各國政府和私人實體正大力投資電池研發和生產,以減少對鋰和鈷等有限原料的依賴。回收和二次電池利用的創新進一步促進了電池的可持續性和成本降低,使電池儲能係統 (BESS) 對公用事業公司、商業和住宅用戶更具吸引力。

另一個重要機會是電網規模儲能係統的發展,以解決太陽能和風能等再生能源的間歇性問題。增強的電池性能可以實現更好的負載平衡、頻率調節和尖峰需求管理,從而提高電網可靠性。此外,車輛到電網 (V2G) 技術和雙向充電使電動車 (EV) 能夠充當分散式儲能單元,從而促進更分散的能源基礎設施的發展。

例如,

- 根據Saft部落格報導,固態電池、鋰硫電池和鈉離子電池的發展正在透過提供更高的能量密度、更高的安全性和更長的使用壽命,徹底改變電池儲能市場。 Saft強調,這些技術是未來儲能解決方案的關鍵創新,能夠增強電網可靠性和再生能源的整合。

- Heila Technologies 的部落格指出,人工智慧驅動的電池管理系統 (BMS) 和智慧儲能解決方案正在優化電池效能和效率。 Heila Technologies 重點介紹了人工智慧和分散式能源網路如何增強即時監控、預測性維護和電網可靠性,從而實現更好的能源管理和無縫的可再生能源整合。

大規模公用事業儲能投資不斷增加

大規模公用事業儲能投資的不斷增長,為中東和非洲電池儲能係統 (BESS) 市場創造了巨大的機會。隨著中東和非洲能源格局向再生能源轉型,公用事業規模的電池儲能已成為確保電網穩定性、能源可靠性和高效電力管理的關鍵。由於對太陽能和風力發電廠多餘能源的儲存需求日益增長,各國政府、公用事業公司和私營企業正在投入大量資金,開發和部署先進的電池儲能專案。

推動投資的主要因素之一是日益增長的電網現代化需求。傳統電網難以應對再生能源供應波動,而大規模電池儲能係統透過提供負載平衡、頻率調節和峰值功能,有助於緩解這些挑戰。對液流電池和混合儲能係統等長時儲能 (LDES) 技術的投資,正在進一步推動全天候再生能源供電的轉型。

鋰離子電池成本的下降以及包括固態電池、鈉離子電池和鋰硫電池在內的新一代電池化學技術的進步,使得公用事業規模的儲能係統更加經濟高效。政府激勵措施、稅收抵免和政策指令也推動儲能容量的擴張。美國、中國、德國和澳洲等國家正在實施雄心勃勃的電池儲能部署目標,為大型專案提供資金支持。

例如,

- 根據 Alexa Capital 的一篇文章,Alexa Capital 的報告強調,中東和非洲對儲能的投資激增,並日益關注公用事業規模的項目。這一趨勢是由支持再生能源整合和提高電網可靠性的需求推動的,預計持續的投資將在未來十年推動能源轉型。

限制/挑戰

- 初始投資和安裝成本高

電池儲能係統 (BESS) 對再生能源整合和電網穩定至關重要。然而,阻礙其廣泛應用的最大限制因素之一是高昂的初始投資和安裝成本。部署 BESS 涉及電池採購、先進電力電子設備、安裝和基礎設施開發等諸多方面,費用不菲。

儘管近期價格有所下降,但佔據電池儲能係統 (BESS) 市場主導地位的鋰離子電池成本仍居高不下。逆變器成本、熱管理系統和控制軟體等其他因素也增加了總成本。此外,場地準備、人工成本以及監管要求的合規性也進一步加重了尋求部署這些系統的企業和公用事業公司的財務負擔。

對於許多再生能源開發商和電網營運商來說,大規模電池儲能係統 (BESS) 專案所需的前期資金是一個主要障礙。儘管這些系統可以透過降低尖峰電力成本和提高能源可靠性來產生長期節約,但其初始成本可能過高,尤其對於資金有限的中小企業 (SME) 或發展中市場而言。

此外,電池儲能係統 (BESS) 的投資回報率 (ROI) 取決於多種因素,包括電價波動、政府激勵措施以及市場對電網服務的需求。由於缺乏強有力的財政誘因、補貼或支持政策,許多潛在投資者不願大規模部署電池儲能係統 (BESS)。

例如,

- 根據《印度商業線報》2023年12月報道,印度電力部估計電池儲能係統(BESS)的成本為每兆瓦時(MWh)2.20-2.40億盧比。高額的資本投入仍是大規模應用的關鍵挑戰,影響儲能專案的可行性。

- 根據 NenPower.com 於 2024 年 1 月發表的一篇文章,安裝電池儲能係統 (BESS) 的成本在每千瓦時 300 美元至 800 美元之間,具體取決於容量和技術。儘管具有長期節能和電網穩定性優勢,但高昂的初始投資仍是限制其大規模應用的關鍵因素。

關於電池回收和處置的環境永續性問題

電池回收和處置的環境永續性問題對中東和非洲電池儲能係統 (BESS) 市場構成了重大挑戰。隨著對儲能解決方案和電動車 (EV) 的需求不斷增長,隨之而來的電池產量成長也引發了人們對電池報廢管理的擔憂。電池,尤其是鋰離子電池,由重金屬和有毒化學物質等有害物質組成。不當的處置或回收會導致環境污染,對土壤、水和空氣品質構成風險。中東和非洲地區安全且高效的電池回收基礎設施和能力有限,進一步加劇了這項挑戰。

主要問題之一是缺乏能夠以環保的方式從廢棄電池中回收鋰、鈷和鎳等關鍵材料的回收技術。雖然回收過程可以回收這些寶貴的材料,但通常成本高昂、回收率低且效率低下,無法滿足日益增長的原材料需求。回收基礎設施不足進一步加劇了這個問題,尤其是在發展中地區,這些地區往往缺乏妥善處理電池的法規和技術。這導致供應鏈對採礦的依賴日益加深,而採礦本身也會帶來環境後果,例如森林砍伐和污染。

此外,隨著電動車和儲能係統數量的持續成長,電池廢棄物管理正面臨日益嚴峻的挑戰。將電池掩埋或焚燒處理會導致有害化學物質釋放到環境中,造成長期污染。回收和再利用專案對於解決此問題至關重要,但許多地區仍在努力建立高效的系統,這增加了不當處置的風險。

例如,

- Invinity Energy Systems 的一篇文章指出,電池廢棄問題日益嚴重,尤其是在電動車 (EV) 和儲能係統使用量不斷擴大的情況下。缺乏高效的回收基礎設施,以及鋰和鈷等高價值材料的低迴收率,加劇了對環境的影響,凸顯了改善回收技術和實踐的必要性。

- 2024年1月,根據Centurian Media Limited的一篇文章,《國際消防與安全雜誌》強調了電池處置不當的環境風險,包括電池被丟棄在垃圾掩埋場或焚燒時產生的有毒化學物質和金屬污染。有效的電池回收和再利用項目對於減輕污染和推廣可持續的處置方法至關重要。

原材料短缺和運輸延誤的影響和當前市場情勢

Data Bridge 市場研究提供高水準的市場分析,並結合原材料短缺和運輸延誤的影響和當前市場環境提供資訊。這可以評估策略可能性,制定有效的行動計劃,並協助企業做出重要決策。

除了標準報告外,我們還提供對採購層面的深入分析,包括預測運輸延遲、按地區劃分的經銷商映射、商品分析、生產分析、價格映射趨勢、採購、類別績效分析、供應鏈風險管理解決方案、高級基準測試以及其他採購和戰略支援服務。

經濟放緩對產品定價和供應的預期影響

當經濟活動放緩時,各行各業都會受到影響。 DBMR 提供的市場洞察報告和情報服務,充分考慮了經濟衰退對產品定價和可及性所造成的預測影響。借助這些,我們的客戶通常能夠領先競爭對手一步,預測銷售和收入,並估算損益支出。

電池儲能係統市場範圍

市場根據要素、連接類型、所有權、能源容量和應用進行細分。這些細分市場的成長將有助於您分析行業中成長乏力的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

元素

- 電池

- 電池,依元件分類

- 鋰離子電池

- 先進的鉛酸電池

- 液流電池

- 鈉硫電池

- 其他電池技術

- 硬體

連接類型

- 併網(併網)系統

- 離網(獨立)系統

所有權

- 客戶擁有

- 公用事業公司所有

- 第三方擁有

能量容量

- 500兆瓦時以上

- 100至500兆瓦時之間

- 低於100兆瓦時

應用

- 住宅

- 非住宅

- 實用工具

- 軍事與國防

- 偏遠地區及離網地區

- 其他的

電池儲能係統市場區域分析

對市場進行分析,並按國家、要素、連接類型、所有權、能源容量和應用提供市場規模洞察和趨勢,如上所述。

市場涵蓋的國家有沙烏地阿拉伯、阿聯酋、南非、埃及、以色列、中東其他地區和非洲。

由於工業化進程加快、再生能源採用率不斷提高、政府激勵措施以及對可靠儲能解決方案的需求不斷增長,沙烏地阿拉伯預計將在電池儲能係統市場佔據主導地位。

由於政府的強力激勵、再生能源採用率的提高、電網現代化的努力以及對能源可靠性日益增長的需求,南非成為成長最快的電池儲能係統 (BESS) 市場。

報告的國家部分還提供了各個市場的影響因素以及國內市場監管變化,這些變化會影響市場的當前和未來趨勢。下游和上游價值鏈分析、技術趨勢、波特五力模型分析以及案例研究等數據點是預測各國市場情景的一些指標。此外,在對國家/地區數據進行預測分析時,還考慮了中東和非洲品牌的存在和供應情況,以及它們因本土和國內品牌的激烈競爭或稀缺而面臨的挑戰,以及國內關稅和貿易路線的影響。

電池儲能係統市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、中東和非洲業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據點僅與公司在市場中的重點相關。

電池儲能係統市場領導者包括:

- 比亞迪股份有限公司(中國)

- LG能源解決方案(韓國)

- ABB(瑞士)

- 博世有限公司(德國)

- AES公司(美國)

- 瓦錫蘭(芬蘭)

- 施耐德電機(法國)

- SMA Solar Technology AG(德國)

- 科德寶集團(德國)

- Eos Energy Enterprises(美國)

- ATX Networks Corp.(加拿大)

- Beacon Power, LLC(美國)

電池儲能係統市場的最新發展

- 2024年10月,比亞迪宣布與《黑神話:悟空》在中東和非洲地區建立戰略合作夥伴關係,成為該遊戲的獨家汽車品牌合作夥伴。中國首款3A遊戲《黑神話:悟空》在中東和非洲地區創下銷售紀錄,發行三天內銷量突破1,000萬份。

- 2024年12月,Eos Energy Enterprises 將擴大其生產基地,以滿足美國日益增長的鋅基儲能需求。除了 AMAZE 項目下的 Mon Valley Works 擴建項目外,該公司還在尋找新的工廠——Factory 2 Works,以支持其安全、經濟高效和可持續儲能的使命。此次擴建對於滿足日益增長的長時儲能需求至關重要,有助於支援再生能源並穩定電網。

- 2024年10月,施耐德電機與諾伊達國際機場合作,實施包括電氣SCADA和高階配電管理系統在內的樓宇和能源管理解決方案。此次合作旨在提高營運效率、永續性並降低能耗。施耐德電機將提供用於監控暖通空調、電氣和管道系統的創新技術,並整合各種機場子系統。此次合作將協助機場實現其永續發展目標並提升整體營運效率。

- 2024年4月,SMA Solar Technology AG 推出了 SMA eCharger,這是一款專為電動車設計的全新光伏優化充電解決方案。它結合了太陽能和電網電力,使電動車的充電速度比標準壁掛式充電盒快50%。該解決方案與 SMA 家庭能源解決方案無縫集成,並透過 Sunny Home Manager 2.0 進行管理,從而最大限度地利用自產太陽能。 SMA eCharger 憑藉便利的安裝、自動更新和麵向未來的技術,支援永續出行,並為安裝人員提供全新的電動出行解決方案,推動能源轉型。

- 2024年12月,瓦錫蘭被Origin Energy選中,負責其位於澳洲新南威爾斯州Eraring發電站的Eraring電池專案第三階段的交付。此次擴建將增加700兆瓦時的儲能容量,使該設施的總容量達到700兆瓦/2800兆瓦時,使其成為澳洲最大的電池項目,也是中東和非洲最大的電池項目之一。瓦錫蘭的Quantum儲能係統和GEMS數位能源平台將增強電網穩定性,並支持Origin Energy擺脫煤炭發電的轉型。預計第三階段將於2025年底完工。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 LOGISTIC COST SCENARIO

4.3.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4.1 ADVANCES IN BATTERY CHEMISTRY AND DESIGN

4.4.2 ADVANCES IN BATTERY MANAGEMENT SYSTEMS (BMS)

4.4.3 ENERGY DENSITY IMPROVEMENTS

4.4.4 ADVANCEMENTS IN BATTERY RECYCLING AND REPURPOSING TECHNOLOGIES

4.4.5 INTEGRATION WITH RENEWABLE ENERGY SYSTEMS

4.4.6 ULTRA-FAST CHARGING TECHNOLOGIES

4.4.7 GRID-SCALE ENERGY STORAGE SOLUTIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING RENEWABLE ENERGY INTEGRATION AND ADOPTION

5.1.2 GROWING DEMAND FOR GRID STABILITY AND ENERGY RESILIENCE

5.1.3 DECLINING BATTERY COSTS AND IMPROVED EFFICIENCY

5.1.4 ELECTRIFICATION OF TRANSPORTATION AND EV CHARGING INFRASTRUCTURE

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENT AND INSTALLATION COSTS

5.2.2 LIMITED BATTERY LIFESPAN AND DEGRADATION ISSUES

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS AND INNOVATIONS IN BATTERY TECHNOLOGIES

5.3.2 RISING INVESTMENTS IN LARGE-SCALE UTILITY STORAGE

5.3.3 DEVELOPMENT OF SECOND-LIFE BATTERY MARKET

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL SUSTAINABILITY CONCERNS REGARDING BATTERY RECYCLING AND DISPOSAL

5.4.2 SUPPLY CHAIN DISRUPTIONS AND RAW MATERIAL SHORTAGE

6 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT

6.1 OVERVIEW

6.2 BATTERY

6.3 HARDWARE

7 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE

7.1 OVERVIEW

7.2 ON-GRID (GRID-TIED) SYSTEMS

7.3 OFF-GRID (STANDALONE) SYSTEMS

8 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP

8.1 OVERVIEW

8.2 CUSTOMER-OWNED

8.3 THIRD-PARTY OWNED

8.4 UTILITY-OWNED

9 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY

9.1 OVERVIEW

9.2 ABOVE 500 MWH

9.3 BETWEEN 100 AND 500 MWH

9.4 BELOW 100 MWH

10 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 RESIDENTIAL

10.3 NON-RESIDENTIAL

10.4 UTILITIES

10.5 MILITARY & DEFENSE

10.6 REMOTE & OFF-GRID AREAS

10.7 OTHERS

11 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 SOUTH AFRICA

11.1.3 UNITED ARAB EMIRATES

11.1.4 QATAR

11.1.5 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BYD COMPANY LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 LG ENERGY SOLUTION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 ABB

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT NEWS

14.4 BOSCH LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 THE AES CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ATX NETWORKS CORP.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BEACON POWER, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EOS ENERGY ENTERPRISES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 FREUDENBERG GROUP

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 SCHNEIDER ELECTRIC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 SMA SOLAR TECHNOLOGY AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 WÄRTSILÄ

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 3 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/UNIT)

TABLE 4 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 6 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 8 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/UNITS)

TABLE 9 MIDDLE EAST AND AFRICA HARDWARE IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA HARDWARE IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 11 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY ELEMENT, 2018-2032 (USD/UNIT)

TABLE 14 MIDDLE EAST AND AFRICA ON-GRID (GRID-TIED) SYSTEMS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA ON-GRID (GRID-TIED) SYSTEMS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 16 MIDDLE EAST AND AFRICA OFF-GRID (STANDALONE) SYSTEMS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA OFF-GRID (STANDALONE) SYSTEMS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 18 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY OWNERSHIP, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY OWNERSHIP, 2018-2032 (THOUSAND UNITS)

TABLE 20 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY OWNERSHIP, 2018-2032 (USD/UNIT)

TABLE 21 MIDDLE EAST AND AFRICA CUSTOMER-OWNED IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA CUSTOMER-OWNED IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 23 MIDDLE EAST AND AFRICA THIRD-PARTY OWNED IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA THIRD-PARTY OWNED IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 25 MIDDLE EAST AND AFRICA UTILITY-OWNED IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA UTILITY-OWNED IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 27 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY ENERGY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY ENERGY CAPACITY, 2018-2032 (THOUSAND UNITS)

TABLE 29 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY ENERGY CAPACITY, 2018-2032 (USD/UNIT)

TABLE 30 MIDDLE EAST AND AFRICA ABOVE 500 MWH IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ABOVE 500 MWH IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 32 MIDDLE EAST AND AFRICA BETWEEN 100 AND 500 MWH IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA BETWEEN 100 AND 500 MWH IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 34 MIDDLE EAST AND AFRICA BELOW 100 MWH IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA BELOW 100 MWH IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 36 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 38 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY APPLICATION, 2018-2032 (USD/UNIT)

TABLE 39 MIDDLE EAST AND AFRICA RESIDENTIAL IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA RESIDENTIAL IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 41 MIDDLE EAST AND AFRICA NON-RESIDENTIAL IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA NON-RESIDENTIAL IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 43 MIDDLE EAST AND AFRICA UTILITIES IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA UTILITIES IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 45 MIDDLE EAST AND AFRICA MILITARY & DEFENSE IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA MILITARY & DEFENSE IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 47 MIDDLE EAST AND AFRICA REMOTE & OFF-GRID AREAS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA REMOTE & OFF-GRID AREAS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS AREAS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS AREAS IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018-2032, (THOUSAND UNITS)

TABLE 51 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 53 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY COUNTRY, 2018-2032 (USD/ UNIT)

TABLE 54 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 56 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 57 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 59 MIDDLE EAST AND AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 60 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 62 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD/ UNIT)

TABLE 63 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (THOUSAND UNITS)

TABLE 65 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD/ UNIT)

TABLE 66 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (THOUSAND UNITS)

TABLE 68 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD/ UNIT)

TABLE 69 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 71 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD/ UNIT)

TABLE 72 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 74 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 75 SAUDI ARABIA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 76 SAUDI ARABIA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 77 SAUDI ARABIA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 78 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 80 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD/ UNIT)

TABLE 81 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (THOUSAND UNITS)

TABLE 83 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD/ UNIT)

TABLE 84 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 85 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (THOUSAND UNITS)

TABLE 86 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD/ UNIT)

TABLE 87 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 89 SAUDI ARABIA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD/ UNIT)

TABLE 90 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 92 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 93 SOUTH AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 95 SOUTH AFRICA BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 96 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 98 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD/ UNIT)

TABLE 99 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (THOUSAND UNITS)

TABLE 101 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD/ UNIT)

TABLE 102 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (THOUSAND UNITS)

TABLE 104 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD/ UNIT)

TABLE 105 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 107 SOUTH AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD/ UNIT)

TABLE 108 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 109 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 110 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 111 UNITED ARAB EMIRATES BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 112 UNITED ARAB EMIRATES BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 113 UNITED ARAB EMIRATES BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 114 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 116 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD/ UNIT)

TABLE 117 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD THOUSAND)

TABLE 118 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (THOUSAND UNITS)

TABLE 119 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD/ UNIT)

TABLE 120 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 121 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (THOUSAND UNITS)

TABLE 122 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD/ UNIT)

TABLE 123 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 125 UNITED ARAB EMIRATES BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD/ UNIT)

TABLE 126 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 127 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 128 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 129 QATAR BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 130 QATAR BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 131 QATAR BATTERY IN BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

TABLE 132 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 134 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2018-2032 (USD/ UNIT)

TABLE 135 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD THOUSAND)

TABLE 136 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (THOUSAND UNITS)

TABLE 137 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2018-2032 (USD/ UNIT)

TABLE 138 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 139 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (THOUSAND UNITS)

TABLE 140 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2018-2032 (USD/ UNIT)

TABLE 141 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 142 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 143 QATAR BATTERY ENERGY STORAGE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD/ UNIT)

TABLE 144 REST OF MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD THOUSAND)

TABLE 145 REST OF MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (THOUSAND UNITS)

TABLE 146 REST OF MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2018-2032 (USD/ UNIT)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET

FIGURE 2 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING INDUSTRIAL AUTOMATION ENHANCES DEMAND FOR SYNCHRONOUS MOTORS MIDDLE EAST AND AFRICA LY IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE BATTERY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET

FIGURE 20 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ELEMENT, 2024

FIGURE 21 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY CONNECTION TYPE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY OWNERSHIP, 2024

FIGURE 23 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET, BY ENERGY CAPACITY, 2024

FIGURE 24 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: BY APPLICATION, 2024

FIGURE 25 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: SNAPSHOT (2024)

FIGURE 26 MIDDLE EAST AND AFRICA BATTERY ENERGY STORAGE SYSTEM MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。