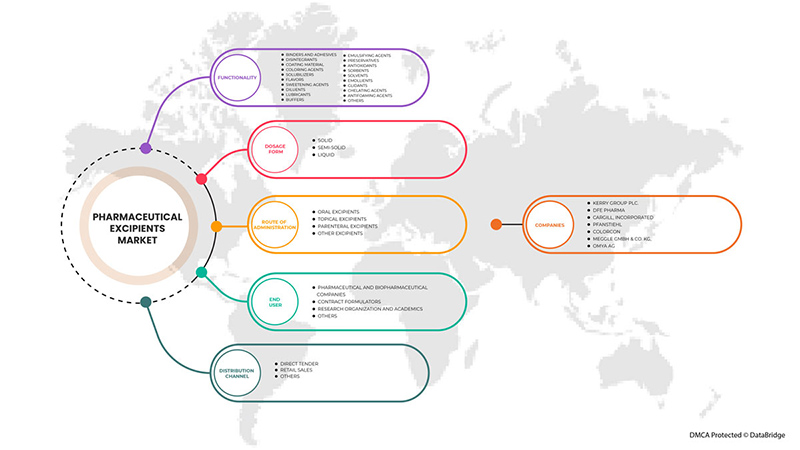

中东和非洲药用辅料市场,按功能(粘合剂和胶粘剂、崩解剂、涂层材料、着色剂、增溶剂、调味剂、甜味剂、稀释剂、润滑剂、缓冲剂、乳化剂、防腐剂、抗氧化剂、吸附剂、溶剂、润肤剂、助流剂、螯合剂、消泡剂等)、剂型(固体、半固体、液体)、给药途径(口服辅料、外用辅料、肠外辅料、其他辅料)、最终用户(制药和生物制药公司、合同配方师、研究组织和学者、其他)、分销渠道(直接招标、零售销售、其他)、行业趋势和预测到 2029 年。

中东和非洲药用辅料市场分析与洞察

药用辅料在药物配方和开发中起着重要作用。这些物质包括除药理活性药物或前体药物以外的物质。药用辅料可有效地将药物输送到目标部位。这些分子可防止药物在吸收过程中过早释放并增强药物功效。一些药用辅料可促进药物整合,从而促进药物在血液中的吸收。

此外,药用辅料还用于药物鉴别。药用辅料还用于增强药物风味,从而提高患者的依从性,特别是儿童的依从性。根据药用辅料的化学性质,它们可以从有机和无机来源获得。有机化学品包括碳水化合物、石化产品、油脂化学品和蛋白质等。药用辅料可以充当粘合剂、填充剂、稀释剂、悬浮剂或包衣剂、调味剂、崩解剂、着色剂、润滑剂和助流剂、甜味剂和防腐剂等。药用辅料具有多种功能,可用于不同目的,包括粘合剂和胶粘剂、崩解剂、增溶剂、调味剂、乳化剂、防腐剂、抗氧化剂、助流剂和螯合剂等。

然而,药品和辅料审批的监管日益严格,以及药物开发过程的成本和时间密集,预计会抑制该市场的增长。

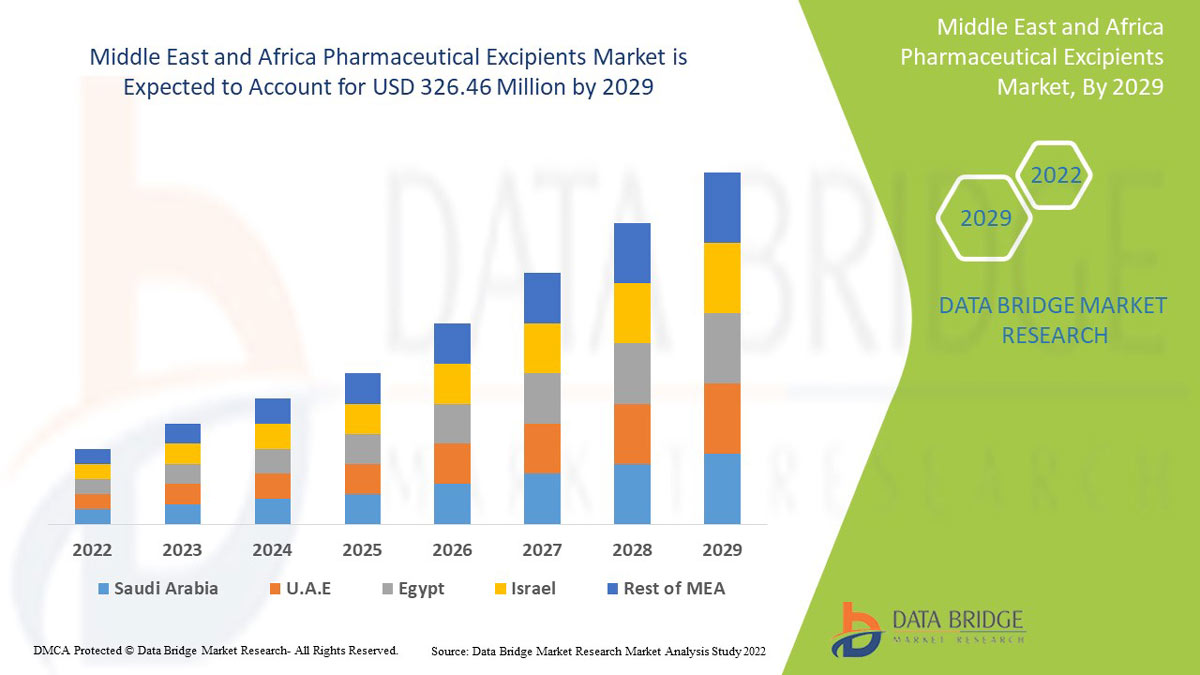

Data Bridge Market Research 分析,中东和非洲药用辅料市场预计到 2029 年将达到 3.2646 亿美元的价值,预测期内的复合年增长率为 5.5%。由于中东和非洲对 IT 解决方案和服务的需求迅速增长,功能性产品占据了市场中最大的类型细分市场。本市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按功能(粘合剂和胶粘剂、崩解剂、包衣材料、着色剂、增溶剂、调味剂、甜味剂、稀释剂、润滑剂、缓冲剂、乳化剂、防腐剂、抗氧化剂、吸附剂、溶剂、润肤剂、助流剂、螯合剂、消泡剂等)、剂型(固体、半固体、液体)、给药途径(口服辅料、外用辅料、肠外辅料、其他辅料)、最终用户(制药和生物制药公司、合同配方师、研究组织和学者、其他)、分销渠道(直接招标、零售、其他)。 |

|

覆盖国家 |

南非、沙特阿拉伯、阿联酋、以色列、科威特、埃及、中东和非洲其他地区。 |

|

涵盖的市场参与者 |

Kerry Group plc.、DFE Pharma、Cargill, Incorporated、Pfanstiehl、Colorcon、MEGGLE GmbH & Co. KG、Omya AG、Peter Greven GmbH & Co. KG、Ashland.、Evonik、Dow、Croda International Plc、Roquette Frères.、The Lubrizol Corporation、BASF SE、Avantor, Inc.、BENEO、Chemie Trade 等。 |

中东和非洲医药辅料市场定义

药用辅料包括药物中除活性药物成分以外的所有成分。这些分子不具有药用特性,最终用于增强药物的生理吸收。药用辅料本质上是惰性的,可使药物分子以正确的形式应用于患者。传统上,药用辅料是简单的分子,但技术创新和对新型药物输送系统日益增长的需求增加了药用辅料的复杂性。药用辅料可提高患者对药物的接受度,并提高药物的稳定性和生物利用度。

此外,药用辅料有助于保持药物的完整性,有助于药物的储存。不同的药用辅料基于其化学性质,包括无机和有机化学品。有机化学品包括碳水化合物、石化产品、油脂化学品和蛋白质等。药用辅料可以充当粘合剂、填充剂、稀释剂、悬浮剂或包衣剂、调味剂、崩解剂、着色剂、润滑剂和助流剂、甜味剂和防腐剂等。

辅料科学技术的未来已经改变并将继续改变。在协调辅料药典专论和应用新分析方法更好地表征辅料等方面取得了更好的进展。

中东和非洲药用辅料市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 仿制药生产和使用的增加

根据美国食品药品管理局(FDA)和美国国家生物技术信息中心(NCBI)的定义,仿制药是一种被制造成看起来像已获批准的品牌药的药物,该药物的剂型、安全性、强度、给药途径、质量和性能都与品牌药相似。在药物专利到期后,与传统药物使用相关的成本节省不会立即显现出来。仿制药和品牌药一样,需要仿制药市场的竞争才能降低成本;在失去独占权两到三年后,仿制药的价格通常比品牌药低60-70%。由于印度的人均支出最高,这些仿制药将节省大量资金,这些资金可用于其他健康问题。在全国范围内,近年来仿制药的使用量大幅增加。品牌药的廉价替代品是刺激制药行业增长的主要原因,仿制药行业在不久的将来将迎来发展。

因此,仿制药需求的增加和产量的上升预计将推动中东和非洲药用辅料市场的增长。此外,仿制药的成本较低,这增加了仿制药的使用。

- 辅料需求激增

药用辅料是药物剂型中不直接用于治疗用途,而是用于促进制造、保护、支持或改善稳定性和可用性的物质。随着中东和非洲制药业的不断发展,辅料也占有一席之地。最近,对仿制药的需求不断增加,这导致辅料需求增加。此外,慢性病病例急剧增加。

辅料是除药用活性药物之外的惰性物质,被引入到制造过程中或包含在药品剂型中。辅料广泛用于药物配方中,以增加固体制剂的体积、提供长期稳定性并促进药物吸收。此外,它还可以提高产品在使用或储存过程中的整体安全性或功能特性。

因此,辅料在药物配方中的广泛使用和辅料的应用有望推动中东和非洲药用辅料市场的发展。

克制

- 药品和辅料审批监管趋严

仿制药审批规则在世界各地大致相同,发展中国家差别不大。这是因为在发展中国家,仿制药审批不需要进行生物等效性 (BE) 研究。医学专家表示,政府必须确保所有仿制药的质量始终如一。只有这样,医生才会乐意和自信地开出仿制药。医生(甚至患者)对仿制药缺乏信心的一个主要原因是,对仿制药数量和允许的杂质数量缺乏严格的监管要求。

控制辅料的生产和分销现在被监管机构和药品制造商视为首要任务,因为混合辅料会导致患者出现不良反应。此外,随着新辅料和输送系统的出现,在体内活动的背景下,更好地控制药用辅料的质量和供应变得越来越重要。认识到辅料在药物剂型中的重要作用,需要辅料供应商满足制药行业的质量要求,而制药行业总体上必须努力确保产品的安全性。供应链中使用或存储的完整性。因此,对药物和辅料审批的监管日益严格,预计将抑制中东和非洲药用辅料市场的增长。

机会

-

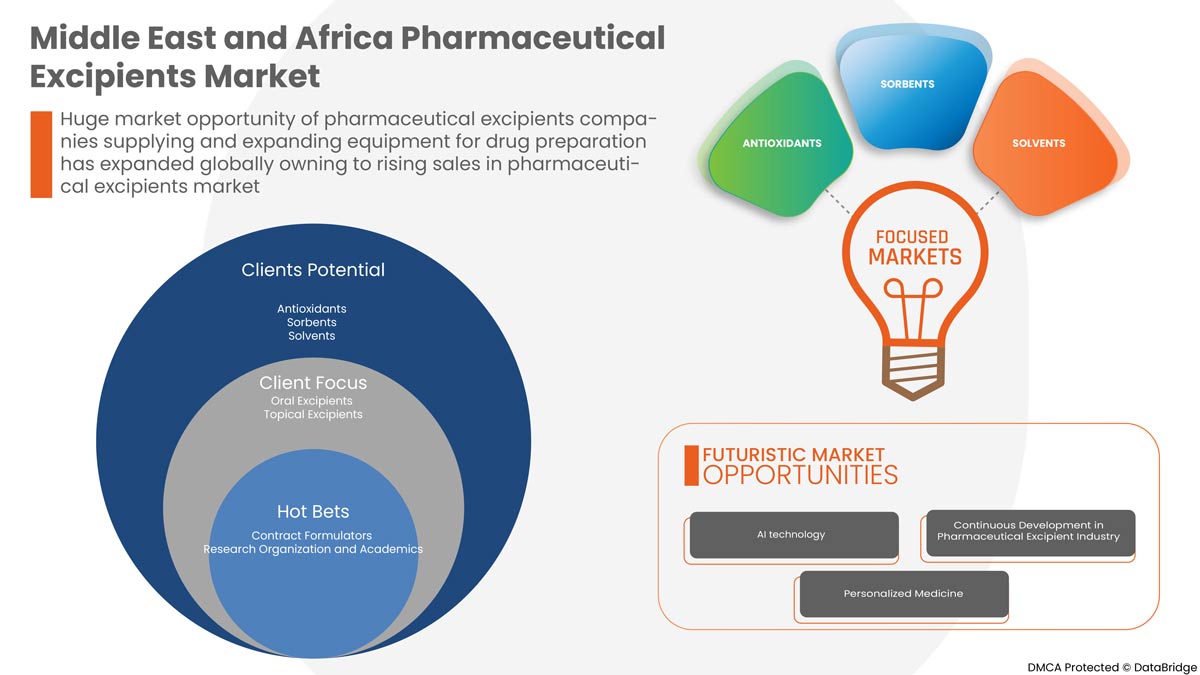

市场参与者的战略举措

药用辅料市场的崛起增加了对战略性商业理念的需求。它包括合作伙伴关系、业务扩张和其他发展。对药品的需求不断增长,大大增加了对药用辅料的需求,为了满足这种需求,公司正在建设新的生产基地,以及其他战略举措。

这些战略举措,例如主要市场参与者的产品发布、收购、协议和业务扩展,将促进药用辅料市场的增长,并有望为中东和非洲药用辅料市场带来机遇。

挑战

- 相关副作用

药物制剂中的药用辅料引起的不良反应通常并不常见,但高剂量(毫克/千克)会增加毒性的可能性,尤其是对于新生儿和婴儿。甲基和丙基对羟基苯甲酸酯(对羟基苯甲酸酯)、苯甲醇、苯甲酸钠、苯甲酸和丙二醇等是一些已报告副作用的常见药用辅料。

药用辅料并不总是我们所认为的惰性物质。它们对某些人而言是无法耐受的,或者如果未经过适当筛选,可能会导致药物发生化学变化,从而产生副作用。这可能会影响对辅料的需求,预计会成为中东和非洲药用辅料市场的挑战。

新冠肺炎疫情对中东和非洲药用辅料市场的影响

制药行业受到 COVID-19 疫情的严重影响。因疫情而实施的封锁中断了印度和中国等制造中心的原材料供应。这减缓了药物开发和生产,严重影响了严重依赖外包的公司。最初,整个制药生态系统被打乱。此外,监管机构不得不起草和制定新法律,以确保患者在使用药物后获得最大程度的安全。封锁结束后,制药行业获得了动力,尤其是由于对羟氯喹和瑞德西韦等药物的需求,这些药物在对抗 COVID-19 方面显示出了积极效果。对这些药物不断增长的需求推动了一些公司的营业额。

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动和产品发布,并建立战略合作伙伴关系,以改进药用辅料市场的技术和测试结果。

最新动态

- 2022 年 2 月,全球领先的口味和营养公司 Kerry Group Plc. 宣布已进行两项重大生物技术收购,扩大了其专业知识、技术组合和制造能力。该公司宣布已收购领先的生物技术创新公司 c-LEcta 和墨西哥酶制造商 Enmex。c-LEcta 是一家领先的生物技术创新公司,专门从事精准发酵、优化生物加工和生物转化。此外,Enmex 是一家总部位于墨西哥的知名酶制造商,为食品、饮料和动物营养市场提供多种生物工艺解决方案。这有助于公司增加收入。

- 2022 年 9 月,中东和非洲领先的制药和营养辅料解决方案提供商 DFE Pharma 在印度海得拉巴开设了新的卓越中心“Closer to the Formulator”(C2F)。C2F 通过其在药物开发各个阶段的专业知识,帮助制药公司缩短从概念到成品的时间。这有助于公司展示其进步。

中东和非洲药用辅料市场范围

中东和非洲药用辅料市场细分为功能、剂型、给药途径、最终用户和分销渠道。各细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

中东和非洲药用辅料市场,按功能划分

- 粘合剂和胶粘剂

- 崩解剂

- 涂层材料

- 着色剂

- 增溶剂

- 口味

- 甜味剂

- 稀释剂

- 润滑剂

- 缓冲区

- 乳化剂

- 防腐剂

- 抗氧化剂

- 吸附剂

- 溶剂

- 润肤剂

- 格利登斯

- 螯合剂

- 消泡剂

- 其他的

根据功能,中东和非洲药用辅料市场分为粘合剂和胶粘剂、崩解剂、包衣材料、着色剂、增溶剂、调味剂、甜味剂、稀释剂、润滑剂、缓冲剂、乳化剂、防腐剂、抗氧化剂、吸附剂、溶剂、润肤剂、助流剂、螯合剂、消泡剂等。

中东和非洲药用辅料市场(按剂型划分)

- 坚硬的

- 半固态

- 液体

根据剂型,中东和非洲药用辅料市场分为固体、半固体和液体。

中东和非洲药用辅料市场,按给药途径划分

- 口服辅料

- 外用辅料

- 肠外辅料

- 其他辅料

根据给药途径,中东和非洲药用辅料市场分为口服药用辅料、外用药用辅料、肠外药用辅料和其他辅料。

中东和非洲医药辅料市场(按最终用户划分)

- 制药和生物制药公司

- 合约配方师

- 研究组织和学术

- 其他的

根据最终用户,中东和非洲药用辅料市场分为制药和生物制药公司、合同配方商、研究机构和学术机构等。

中东和非洲药用辅料市场,按分销渠道划分

- 直接招标

- 零售销售

- 其他的

根据分销渠道,中东和非洲药用辅料市场分为直接招标、零售和其他。

中东和非洲药用辅料市场区域分析/见解

The Middle East & Africa pharmaceutical excipients market is analyzed, and market size information is provided functionality, dosage forms, route of administration, end-user, and distribution channel.

The countries covered in this market report are South Africa, Saudi Arabia, UAE, Israel, Kuwait, Egypt, and Rest of the Middle East & Africa

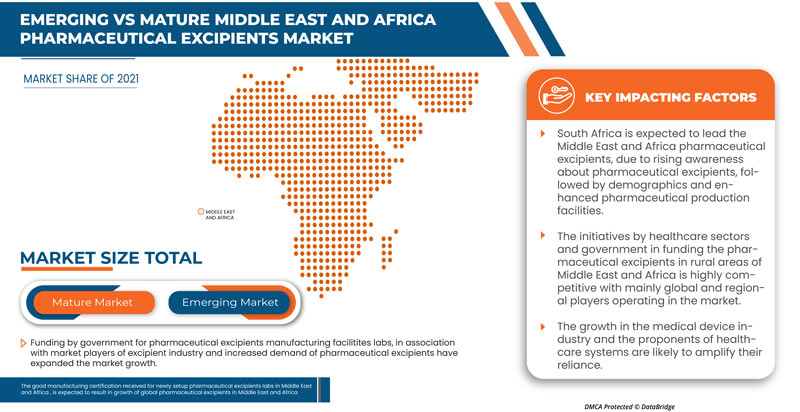

- In 2022, Middle East & Africa is dominating due to the presence of key market players in the largest consumer market with high GDP. South Africa is expected to grow due to the rise in technological advancement in Healthcare IT.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East & Africa Pharmaceutical Excipients Market Share Analysis

Middle East & Africa pharmaceutical excipients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Middle East & Africa pharmaceutical excipients market.

Some of the major players operating in the Middle East & Africa pharmaceutical excipients market are Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, Ashland. , Evonik, and Dow.

Research Methodology: Middle East & Africa Pharmaceutical Excipients Market

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、中东和非洲与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 FUNCTIONALITY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 INDUSTRIAL INSIGHTS:

4 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENT MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN GENERIC DRUG PRODUCTION AND USES

5.1.2 THE SURGE IN DEMAND FOR EXCIPIENTS

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN MULTIFUNCTIONAL EXCIPIENTS

5.1.4 RISING FOCUS ON ORPHAN DRUGS

5.2 RESTRAINTS

5.2.1 INCREASING REGULATORY STRINGENCY REGARDING THE APPROVAL OF DRUGS AND EXCIPIENTS

5.2.2 HIGH PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.2 RISING DEMAND FOR EASE OF USE

5.3.3 RISING DISPOSABLE INCOME

5.3.4 INCREASING DEMAND FOR ALTERNATIVE ROUTES OF DELIVERY/DOSAGE FORMS

5.4 CHALLENGES

5.4.1 ASSOCIATED SIDE EFFECTS

5.4.2 SAFETY CONSIDERATION OF PHARMACEUTICAL EXCIPIENTS IN STORAGE & TRANSPORTATION

5.4.3 LACK OF NOVEL PHARMACEUTICAL PHARMACEUTICAL EXCIPIENTS

6 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

6.1 OVERVIEW

6.2 BINDERS AND ADHESIVES

6.2.1 ORGANIC

6.2.2 INORGANIC

6.3 DISINTEGRANTS

6.3.1 ORGANIC

6.3.2 INORGANIC

6.4 COATING MATERIAL

6.4.1 ORGANIC

6.4.2 INORGANIC

6.5 COLORING AGENTS

6.5.1 ORGANIC

6.5.2 INORGANIC

6.6 SOLUBILIZERS

6.6.1 ORGANIC

6.6.2 INORGANIC

6.7 FLAVORS

6.7.1 ORGANIC

6.7.2 INORGANIC

6.8 SWEETENING AGENTS

6.8.1 ORGANIC

6.8.2 INORGANIC

6.9 DILUENTS

6.9.1 ORGANIC

6.9.2 INORGANIC

6.1 LUBRICANTS

6.10.1 ORGANIC

6.10.2 INORGANIC

6.11 BUFFERS

6.11.1 ORGANIC

6.11.2 INORGANIC

6.12 EMULSIFYING AGENTS

6.12.1 ORGANIC

6.12.2 INORGANIC

6.13 PRESERVATIVES

6.13.1 ORGANIC

6.13.2 INORGANIC

6.14 ANTIOXIDANTS

6.14.1 ORGANIC

6.14.2 INORGANIC

6.15 SORBENTS

6.15.1 ORGANIC

6.15.2 INORGANIC

6.16 SOLVENTS

6.16.1 ORGANIC

6.16.2 INORGANIC

6.17 EMOLLIENTS

6.17.1 ORGANIC

6.17.2 INORGANIC

6.18 GLIDENTS

6.18.1 ORGANIC

6.18.2 INORGANIC

6.19 CHELATING AGENTS

6.19.1 ORGANIC

6.19.2 INORGANIC

6.2 ANTIFOAMING AGENTS

6.20.1 ORGANIC

6.20.2 INORGANIC

6.21 OTHERS

7 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

7.1 OVERVIEW

7.2 SOLID

7.2.1 PLANT

7.2.2 ANIMALS

7.2.3 SYNTHETIC

7.2.4 MINERALS

7.3 SEMI-SOLID

7.3.1 PLANT

7.3.2 ANIMALS

7.3.3 SYNTHETIC

7.3.4 MINERALS

7.4 LIQUID

7.4.1 PLANT

7.4.2 ANIMALS

7.4.3 SYNTHETIC

7.4.4 MINERALS

8 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 ORAL EXCIPIENTS

8.3 TOPICAL EXCIPIENTS

8.4 PARENTERAL EXCIPIENTS

8.5 OTHER EXCIPIENTS

9 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.2.1 COMPANY TENDER

9.2.2 TENDER THROUGH MARCH MERCHANDISER

9.3 RETAIL SALES

9.4 OTHERS

10 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

10.3 CONTRACT FORMULATORS

10.4 RESEARCH ORGANIZATION

10.5 OTHERS

11 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 U.A.E

11.1.3 SAUDI ARABIA

11.1.4 KUWAIT

11.1.5 EGYPT

11.1.6 ISRAEL

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DOW

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROQUETTE FRÈRES.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 EVONIK

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 THE LUBRIZOL CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 BASF SE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ASHLAND (2021)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BENEO

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CARGILL, INCORPORATED.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CHEMIE TRADE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 COLORCON

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 CRODA INTERNATIONAL PLC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 DFE PHARMA (SUBSIDIARY OF ROYAL FRIESLANDCAMPINA N.V)

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 KERRY GROUP PLC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MEGGLE GMBH & CO. KG

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 OMYA AG

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PETER GREVEN GMBH & CO. KG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PFANSTIEHL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKETS, BY REGION, 2015-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SOLVENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SOLVENTS PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION, 2015-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA ORAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA TOPICAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA PARENTERAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA OTHER EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA RETAIL SALES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER, 2015-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA CONTRACT FORMULATORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA RESEARCH ORGANIZATION AND ACADEMICS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 12 THE RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS ON PHARMACEUTICAL EXCIPIENTS IS DRIVING THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE BINDERS AND ADHESIVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET

FIGURE 15 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2021

FIGURE 16 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2021

FIGURE 20 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2021

FIGURE 32 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY FUNCTIONALITY (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。