Global Animal Nutrition Market

Market Size in USD Billion

CAGR :

%

USD

27.78 Billion

USD

45.98 Billion

2024

2032

USD

27.78 Billion

USD

45.98 Billion

2024

2032

| 2025 –2032 | |

| USD 27.78 Billion | |

| USD 45.98 Billion | |

|

|

|

|

What is the Global Animal Nutrition Market Size and Growth Rate?

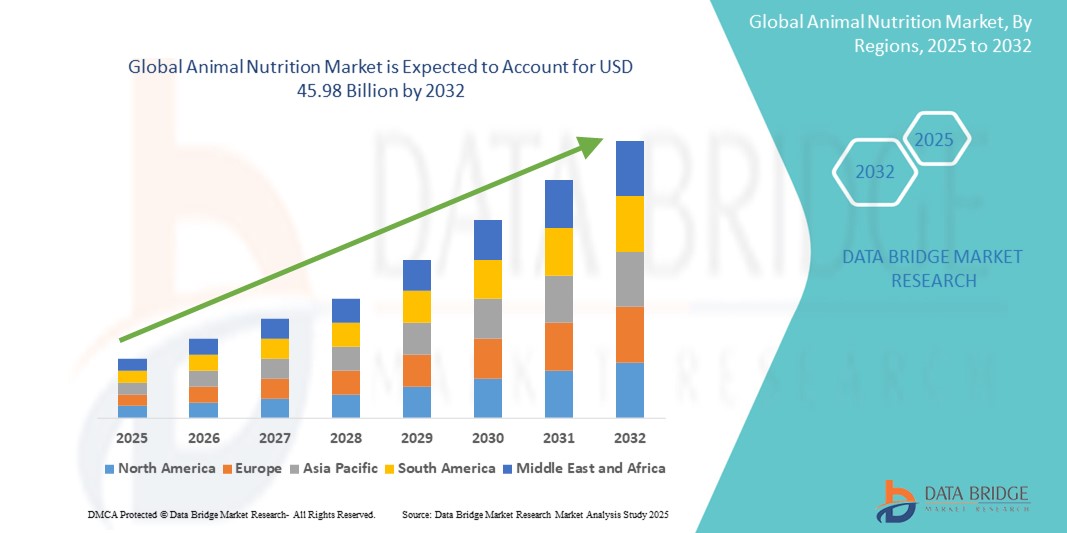

- The global animal nutrition market size was valued at USD 27.78 billion in 2024 and is expected to reach USD 45.98 billion by 2032, at a CAGR of 20.10% during the forecast period

- The animal nutrition market meets the rising demand for high-quality and nutritionally balanced pet food. Catering to discerning pet owners, the market offers a diverse range of pet nutrition products, such as specialized diets, supplements, and treats, specifically designed to address the unique dietary requirements of different companion animals. This application underscores the increasing preference for premium and functional pet food, contributing significantly to the overall health, well-being, and longevity of pets globally

What are the Major Takeaways of Animal Nutrition Market?

- Innovative additives, such as advanced enzymes, probiotics, and precision nutrition solutions, contribute to improved nutrient absorption and digestion in animals. This leads to enhanced overall feed efficiency, promoting faster and more effective conversion of feed into animal products

- As a result, the increased efficiency and productivity in animal farming, driven by these technological advancements, contribute to the growth and expansion of the global animal nutrition market

- Asia-Pacific dominated the animal nutrition market with the largest revenue share of 40.25% in 2024, driven by rapid growth in livestock production, increasing awareness of animal

- North America is expected to grow at the fastest CAGR of 12.59% during the forecast period from 2025 to 2032, driven by increased pet ownership, demand for functional feed, and innovation in specialty ingredients

- The Amino Acids segment dominated the animal nutrition market with the largest market revenue share of 27.4% in 2024, owing to their critical role in promoting growth performance, feed efficiency, and protein synthesis in livestock and poultry

Report Scope and Animal Nutrition Market Segmentation

|

Attributes |

Animal Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Animal Nutrition Market?

“Precision Nutrition through AI and Data-Driven Feed Formulation”

- A prominent and evolving trend in the global animal nutrition market is the adoption of AI-powered precision nutrition, which allows for individualized feed formulation based on species, age, growth stage, and environmental conditions. This technology is revolutionizing how livestock and poultry are nourished by maximizing feed efficiency and improving overall animal health

- For instance, companies such as Cargill and Alltech are leveraging big data and AI to monitor feed intake, health indicators, and environmental data in real-time, enabling highly customized nutrition solutions. These tools help farmers reduce feed waste, lower costs, and achieve optimal animal growth and productivity

- AI integration enables dynamic formulation that adjusts diets based on changing animal needs or external stressors such as heat or disease. Technologies such as machine learning algorithms analyze vast datasets to predict nutritional deficiencies and optimize nutrient uptake

- With sustainability becoming a core focus, precision nutrition minimizes overfeeding of proteins and minerals that can lead to environmental pollution. It supports carbon footprint reduction in animal farming by enhancing feed conversion ratios and reducing methane emissions

- Companies such as DSM and Evonik are also investing in AI-based platforms that offer real-time decision support systems for livestock nutrition planning, leading to improved profitability and compliance with stricter environmental regulations

- As climate change, food security, and sustainability become central concerns, this trend is expected to redefine feed manufacturing, shifting it from generalized to hyper-targeted, data-informed animal nutrition strategies

What are the Key Drivers of Animal Nutrition Market?

- Rising global demand for animal protein is a significant growth driver for the animal nutrition market. As populations increase and incomes rise, especially in Asia-Pacific and Latin America, the consumption of meat, dairy, and eggs is surging—driving the need for effective and scalable feed solutions

- For instance, in March 2024, Glanbia PLC launched a new range of functional feed additives in Southeast Asia to meet rising demand for high-quality poultry and dairy products, especially in urban markets

- Growing awareness of animal health and performance is also influencing feed formulation. Farmers are focusing on optimized diets that reduce mortality rates and enhance growth, fertility, and immunity. Nutritional efficiency is now tied directly to profitability and biosecurity

- In addition, the ban on antibiotics as growth promoters in many countries has increased demand for nutritional alternatives such as probiotics, prebiotics, enzymes, and organic minerals. These additives improve gut health and resilience while aligning with regulatory compliance and consumer expectations

- Technological advancements in feed analytics, automation, and digital farm management systems are streamlining operations and enabling traceability. This, combined with strategic investments in R&D and digitization, is accelerating innovation and market expansion across poultry, swine, aquaculture, and ruminant sectors

Which Factor is challenging the Growth of the Animal Nutrition Market?

- One of the primary challenges in the animal nutrition market is the volatility of raw material prices, especially for key ingredients such as corn, soybean meal, and fishmeal. Global supply chain disruptions, climate events, and geopolitical tensions can cause sharp fluctuations, impacting feed costs and margins

- For instance, drought conditions in major grain-producing countries during 2023 significantly affected feed production costs, prompting some livestock producers to reduce herd sizes or shift to less intensive nutrition strategies

- Another constraint is the lack of access to modern feed technologies and infrastructure in developing economies. Small-scale farmers may struggle to adopt advanced nutritional practices due to limited awareness, funding, or technical support, widening the performance gap across regions

- Furthermore, stringent regulatory frameworks and rising scrutiny over feed additives, particularly concerning environmental safety and food chain traceability, can slow innovation and product approvals. Navigating these rules often requires substantial investment in testing, certification, and labeling compliance

- Lastly, the fragmentation of the market and the presence of numerous unorganized players in certain regions can lead to inconsistent product quality and consumer skepticism, especially regarding functional additives and bio-based feed solutions

- Addressing these challenges will require investment in supply chain resilience, local production capabilities, and farmer education initiatives to build trust, boost adoption, and ensure consistent quality in animal nutrition practices

How is the Animal Nutrition Market Segmented?

The market is segmented on the basis of type, feed type, and end users.

- By Type

On the basis of type, the animal nutrition market is segmented into Amino Acids, Enzymes, Carotenoids, Fiber, Antioxidants, Eubiotics, Lipids, Fatty Acids, Medicated Feed Additives, Minerals, Vitamins, and Others. The Amino Acids segment dominated the animal nutrition market with the largest market revenue share of 27.4% in 2024, owing to their critical role in promoting growth performance, feed efficiency, and protein synthesis in livestock and poultry. Essential amino acids such as lysine, methionine, and threonine are increasingly used in compound feeds to optimize animal productivity and reduce nitrogen excretion, aligning with sustainability goals.

The Enzymes segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for enhanced nutrient digestibility, improved gut health, and cost-effective feed formulations. Enzymatic additives such as phytase, xylanase, and protease are gaining traction for their role in reducing anti-nutritional factors and improving feed conversion ratios.

- By Feed Type

On the basis of feed type, the market is segmented into Poultry Feed, Swine Feed, Ruminant Feed, Pet Food, and Others. The Poultry Feed segment held the largest market revenue share of 34.9% in 2024, fueled by the rapid expansion of the global poultry industry and the increasing consumption of poultry meat and eggs. Demand for balanced and cost-effective poultry nutrition solutions continues to rise, especially in Asia-Pacific and Latin America, where poultry is a key source of affordable protein.

The Pet Food segment is projected to witness the fastest growth rate over the forecast period, supported by rising pet ownership, humanization of pets, and the growing demand for nutritionally tailored pet food products. Functional ingredients such as omega-3s, probiotics, and joint support additives are driving innovation in the pet nutrition space.

- By End Users

On the basis of end users, the animal nutrition market is segmented into Feed Manufacturers, Veterinarians, Pet Food Manufacturers, Livestock Farmers, and Others. The Feed Manufacturers segment dominated the market with a market share of 39.2% in 2024, as they are the primary integrators of nutritional additives into commercial feed formulations. Their role in ensuring feed safety, cost optimization, and performance enhancement makes them key consumers of both macro- and micro-nutrients.

The Pet Food Manufacturers segment is expected to register the fastest CAGR from 2025 to 2032, driven by premiumization trends, innovation in functional pet nutrition, and the surge in demand for breed-specific and age-specific formulations across developed economies.

Which Region Holds the Largest Share of the Animal Nutrition Market?

- Asia-Pacific dominated the animal nutrition market with the largest revenue share of 40.25% in 2024, driven by rapid growth in livestock production, increasing awareness of animal health, and rising demand for high-quality feed additives across emerging economies

- Countries such as China, India, Japan, and Indonesia are witnessing significant investments in commercial animal farming, pet nutrition, and feed innovation to meet the growing consumption of meat, dairy, and eggs

- The region benefits from rising disposable incomes, government support for livestock productivity, and the increasing focus on sustainable farming practices, solidifying Asia-Pacific’s leadership in the global animal nutrition market

China Animal Nutrition Market Insight

The China animal nutrition market accounted for the largest market share in Asia-Pacific in 2024, supported by its massive livestock population, government-backed feed safety regulations, and a robust animal health industry. The rising demand for functional feed additives, especially for poultry and swine, is driving market expansion. China's rapidly growing pet population is also contributing to the surge in specialized pet nutrition solutions.

India Animal Nutrition Market Insight

The India animal nutrition market is projected to witness strong growth during the forecast period due to the increasing emphasis on improving feed efficiency, livestock health, and dairy yield. Government initiatives such as Rashtriya Gokul Mission and growth in organized dairy farming are driving demand for trace minerals, enzymes, and vitamins. The rapid modernization of feed mills and expansion of poultry farms further fuel market development.

Japan Animal Nutrition Market Insight

The Japan animal nutrition market is experiencing steady growth, propelled by high awareness of feed quality, advanced R&D capabilities, and an aging population that demands traceable and safe animal-derived food products. Japanese manufacturers are integrating precision nutrition solutions for aquaculture and livestock, along with customized feed formulations for companion animals, ensuring product quality and safety.

Which Region is the Fastest Growing Region in the Animal Nutrition Market?

North America is expected to grow at the fastest CAGR of 12.59% during the forecast period from 2025 to 2032, driven by increased pet ownership, demand for functional feed, and innovation in specialty ingredients. The region's highly organized livestock and pet food sectors, combined with rising concerns about animal health and performance, are fostering adoption of probiotics, eubiotics, and medicated feed additives. In addition, advancements in digital farming and feed formulation technologies are strengthening the market position.

U.S. Animal Nutrition Market Insight

The U.S. animal nutrition market dominated North America in 2024, bolstered by its advanced animal husbandry systems, growing demand for clean-label feed, and expanding pet food industry. Companies are investing in precision nutrition and bio-based additives to enhance feed efficiency and sustainability. Moreover, regulatory support for safe and antibiotic-free nutrition is enhancing product development.

Canada Animal Nutrition Market Insight

The Canada animal nutrition market is witnessing healthy growth, supported by its strong dairy, beef, and aquaculture sectors. Rising adoption of mineral blends, organic additives, and species-specific feed formulations, alongside government incentives for sustainable agriculture, is driving market expansion. The shift toward animal welfare and environmental stewardship is also shaping demand patterns in the country.

Which are the Top Companies in Animal Nutrition Market?

The animal nutrition industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- DSM (Netherlands)

- Kemin Industries, Inc. (U.S.)

- Alltech (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Mercer Milling Company, Inc. (U.S.)

- Rossari Biotech Limited (India)

- ADM (U.S.)

- Aries Agro Limited (India)

- Avitech Nutrition Pvt. Ltd. (India)

- Advanced Enzyme Technologies (India)

- Zoetis Services LLC (U.S.)

- Glanbia PLC (Ireland)

- DuPont (U.S.)

- Zinpro (U.S.)

- Novus International, Inc. (U.S.)

- NORVITE ANIMAL NUTRITION COMPANY LIMITED (U.K.)

- Biovet, S.A (Spain)

- Adisseo (China)

- Balchem Corp. (U.S.)

- Vetoquinol (France)

- EW Nutrition (Germany)

- BASF SE (Germany)

- Chr. Hansen A/S (Denmark)

- SIA Manufacturing Pvt Ltd (Latvia)

- Azelis Group (Belgium)

What are the Recent Developments in Global Animal Nutrition Market?

- In March 2023, Evonik is increasing its annual MetAMINOproduction capacity on Jurong Island, Singapore, by 40,000 metric tons to reach 340,000 metric tons by Q3 2024. The significant investment aims to achieve this expansion, with the MetAMINOmanufacturing in Singapore boasting a 6% lower carbon footprint due to proposed process improvements

- In February 2023, Evonik introduces PhytriCare IM, a plant-based product rich in flavonoids, known for reducing inflammation. Targeting dairy cows, sows, and laying hens, the product is now available across the EU, aiming to contribute to the overall health and well-being of livestock

- In March 2023, Trouw Nutrition announces MyFeedPrint, an online service providing environmental footprint data for animal feed products. Intending to enhance transparency in the livestock value chain, this program empowers farmers, feed manufacturers, and integrators to measure the environmental impact of animal feed, fostering a more sustainable future for animal nutrition

- In April 2023, BASF collaborates with Schothorst Feed Research (SFR), granting non-exclusive licensing rights to OpteinicsTM, BASF's digital tool for tracking the environmental impact of feed and animal protein. SFR plans to incorporate OpteinicsTM into its global animal nutrition consultancy services, working in collaboration with BASF to assist feed and animal producers in understanding and minimizing their environmental effects, promoting more sustainable feed and animal protein production

- In October 2021, BASF SE launched the trinamiX mobile Near Infrared (NIR) spectroscopy solution for the feed industry, streamlining on-site analysis of animal feed and ingredients. This innovation eliminates the need for customers to send samples to laboratories, providing a faster and more convenient testing process, consequently attracting more customers across the value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.