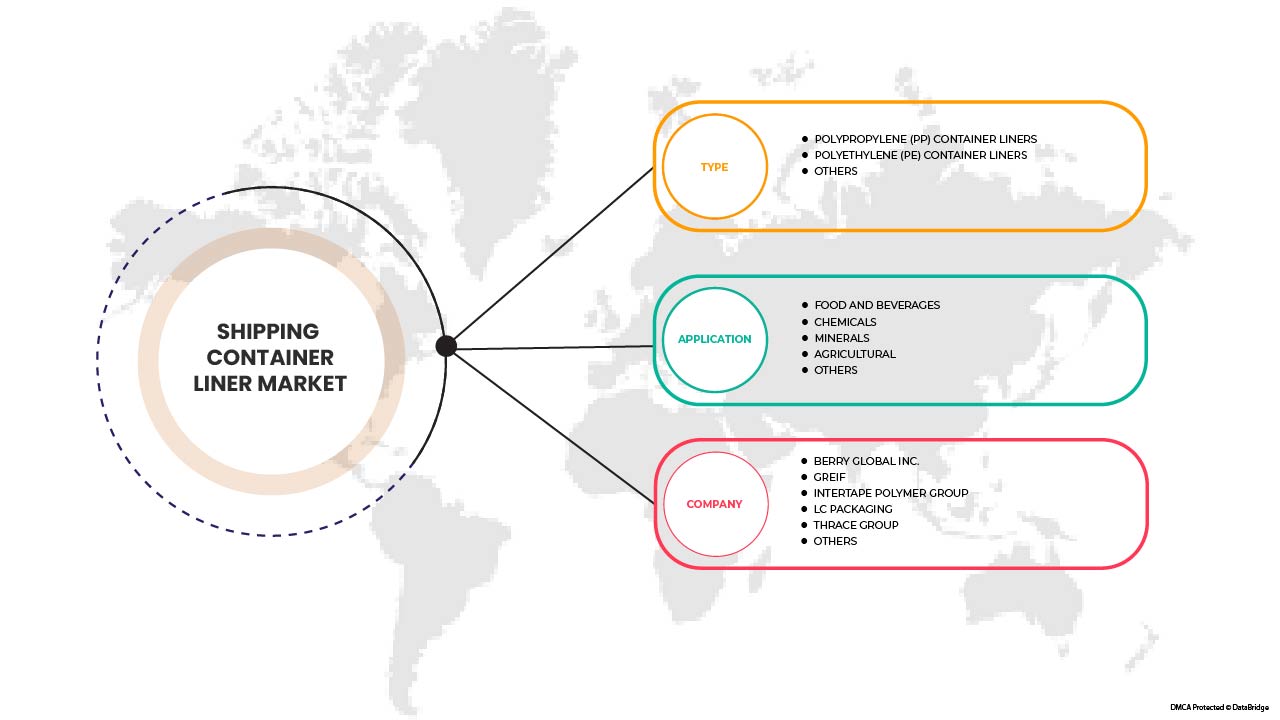

北美集装箱内衬市场,按类型(聚丙烯 (PP) 集装箱内衬、聚乙烯 (PE) 集装箱内衬等)、应用(食品和饮料、化学品、矿产、农业等)划分 - 行业趋势和预测到 2029 年。

北美集装箱班轮市场分析与洞察

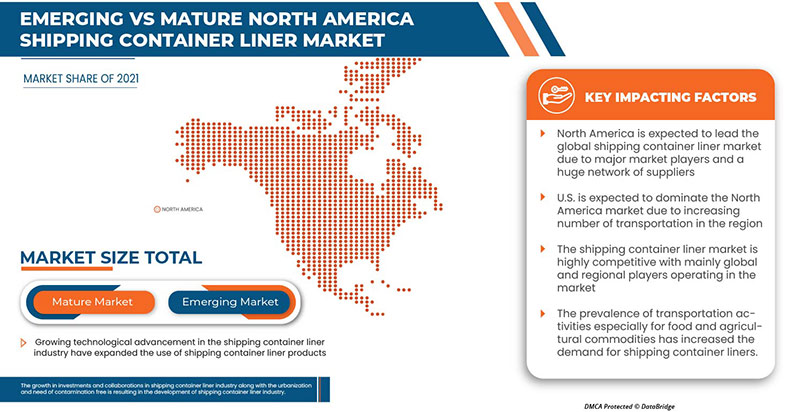

集装箱内衬可用于包装各种干粮,如小麦、大米、咖啡、豆类、糖和其他食品。对于安全、无污染的包装,集装箱内衬是一种经济高效、保护性强且有价值的包装解决方案。集装箱内衬在食品和农业行业中的普及率不断提高,运输活动的增加预计将推动北美集装箱内衬市场的发展。此外,集装箱内衬的可重复使用性和成本效益将推动北美集装箱内衬市场的增长。然而,高昂的运输成本和不断上涨的运费可能会阻碍市场的增长。

北美集装箱班轮市场报告提供了市场份额、新发展以及国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

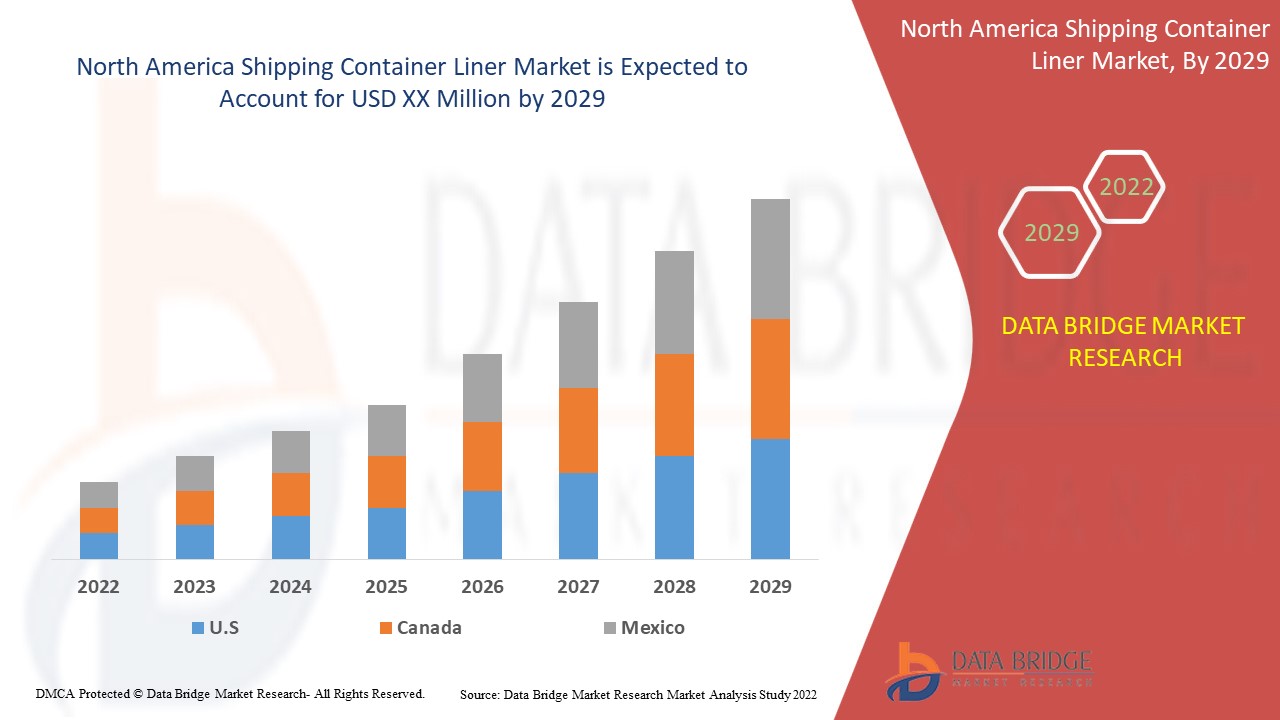

Data Bridge Market Research分析,2022年至2029年的预测期内,北美集装箱班轮市场将以3.7%的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按类型(聚丙烯 (PP) 容器内衬、聚乙烯 (PE) 容器内衬等)、应用(食品和饮料、化学品、矿物、农业等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

BERRY GLOBAL INC、Eceplast、Greif、LC Packaging、Thrace Group、United Bags Inc. |

市场定义

集装箱内衬是包装和运输散装干燥、自由流动产品的最经济的方式。对于散装货物和其他材料的包装要求,它们至关重要。当货物从一个地理位置移动到另一个地理位置时,它们自然会与油、灰尘、空气和土壤等自然元素接触,所有这些都会破坏或降低货物的质量。过度污染往往会导致货物不合适。为了避免运输的货物被当局拒绝,货物符合目的地国家相关政府规定的质量标准非常重要。为了防止所有这些情况,散装集装箱内衬被用作保护层。通过使用散装集装箱内衬进行运输,可以保证货物的安全,并完全避免污染。

北美集装箱班轮市场动态

驱动程序

-

集装箱班轮在食品和农业行业中的普及度不断提高

集装箱内衬在航运业,尤其是食品和农业领域越来越受欢迎。食品和物品必须使用维护良好的链条和预防措施进行运输,以保持其质量和食品安全。同样,在农业行业,种子、肥料和各种化学品的运输也必须小心谨慎。集装箱内衬可防止货物受潮、受热和其他污染。各种制造商根据最终用户的需求为不同应用提供此类集装箱内衬。集装箱内衬在食品和农业领域的广泛适用性带来了更高的需求,预计将推动市场增长

-

需要集装箱班轮的运输活动增加

全球货物运输量的激增导致该行业对集装箱班轮的需求增加。班轮为货物提供安全性,装卸效率高。随着运输量的增加,对集装箱班轮的需求也在增加,预计将推动市场的增长。

机会

-

领先组织的战略举措

集装箱班轮在市场上的接受度和高使用率增加了对该产品的需求。为了满足最终用户对各种应用的需求,制造商正在做出战略决策,并向市场提供新的创新产品。

-

散装货物大包装需求不断增加

集装箱衬垫可防止包装后运输的货物和其他产品受到污染。它保护散装货物免受潮湿,并确保货物安全卫生地运输。使用集装箱衬垫,运输过程中几乎不需要处理,使所有操作变得简单。制造商提供不同设计和尺寸的集装箱衬垫,以运输散装货物,同时确保产品安全。因此,散装货物大包装需求的不断增长可能会为北美集装箱运输市场创造机会。

限制/挑战

- 运输成本高昂

由于货物运输价格上涨,航运业整体受到影响。经验证据表明,运输成本提高 10% 会导致贸易量减少 20% 以上。高昂的运输成本影响经济活动结构和国际贸易,最终影响对集装箱班轮的需求

- 运输集装箱短缺

为了减轻这些损失,需要制造新的集装箱来恢复全球高效的供应链,但现有的集装箱数量仍然远远少于实际需要的数量。集装箱数量和短缺的差异显著影响了集装箱班轮的需求

因此,集装箱短缺将对集装箱班轮市场产生负面影响,并预计将阻碍市场的增长。

新冠肺炎疫情对北美集装箱班轮市场的影响

COVID-19 在一定程度上影响了市场。由于封锁,许多大大小小的公司的制造和生产都停止了,而且由于检疫措施严重影响了航运和运输活动,对集装箱班轮的需求也下降了,从而影响了市场。由于许多法规和规定发生变化,制造商可以设计和在市场上推出新产品,这将有助于市场的增长。

最新动态

- United Bags Inc. 与一家回收公司合作,该公司安装了打包机,并定期免费从客户那里回收使用过的 FIBC。参与该计划的人将获得认证,表明他们所有的 FIBC 都已回收,不会对环境造成危害

北美集装箱班轮市场范围

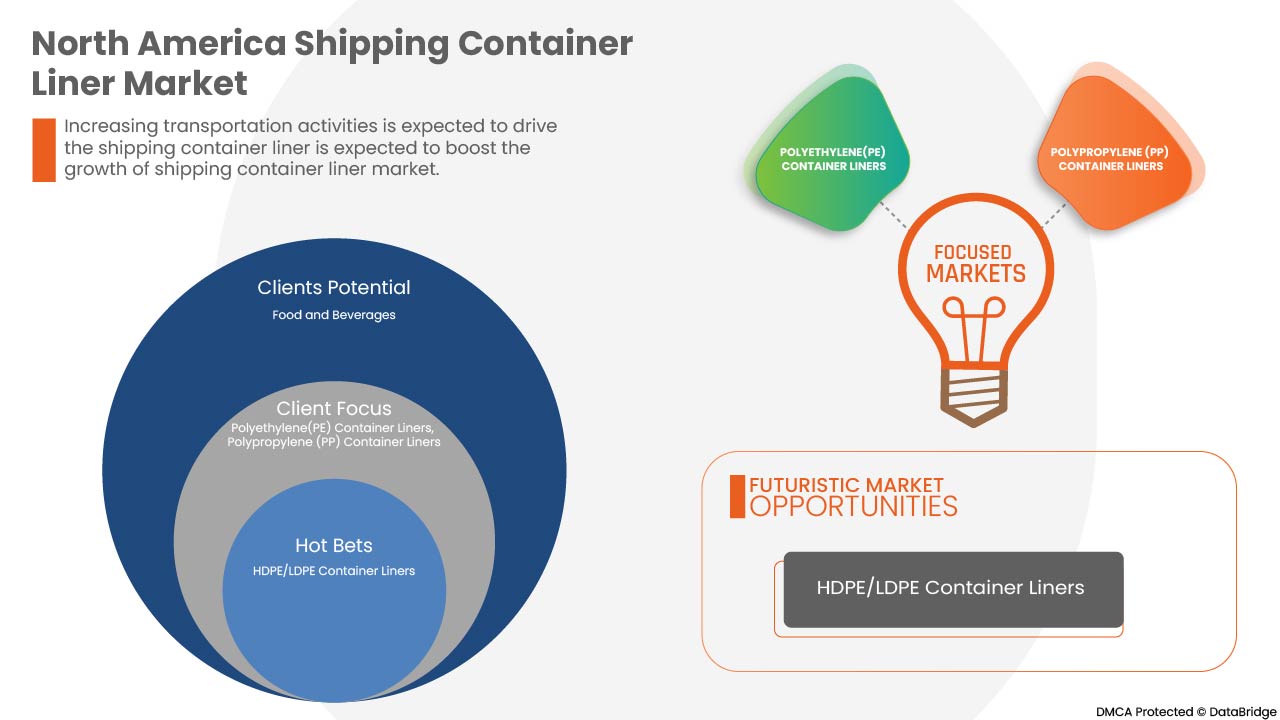

北美集装箱班轮市场根据类型和应用进行分类。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 聚丙烯 (PP) 容器内衬

- 聚乙烯 (PE) 集装箱内衬

- 其他的

根据类型,北美集装箱运输内衬市场分为两个部分:聚丙烯 (PP) 集装箱内衬、聚乙烯 (PE) 集装箱内衬和其他

应用

- 食品和饮料

- 化学品

- 矿物质

- 农业

- 其他的

根据应用,北美集装箱班轮市场分为五个部分:食品和饮料、化学品、矿产、农业和其他

北美集装箱班轮市场区域分析/洞察

对北美集装箱班轮市场进行了分析,并根据上述参考提供了市场规模洞察和趋势。

北美集装箱班轮市场报告涵盖的国家包括美国、加拿大和墨西哥。

就市场份额和市场收入而言,美国预计将在北美集装箱班轮运输市场占据主导地位。由于各行业对集装箱班轮的需求不断增长,以及终端用户的消费需求不断增长,预计美国将在预测期内保持主导地位。

报告的区域部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场法规变化。新旧销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和北美集装箱班轮市场份额分析

北美集装箱班轮市场竞争格局提供了有关竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对北美集装箱班轮市场的关注有关。

北美集装箱班轮市场的一些主要参与者包括 BERRY GLOBAL INC.、Eceplast、Greif、LC Packaging、Thrace Group 和 United Bags Inc. 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SHIPPING CONTAINER LINER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CONSUMER BUYING BEHAVIOR

4.1.1 OVERVIEW

4.1.1.1 COMPLEX BUYING BEHAVIOR

4.1.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.1.1.3 HABITUAL BUYING BEHAVIOR

4.1.1.4 VARIETY-SEEKING BEHAVIOR

4.1.1.5 CONCLUSION

4.2 FACTORS INFLUENCING BUYING DECISION

4.3 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA SHIPPING CONTAINER LINER MARKET

4.3.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.2 BARGAINING POWER OF SUPPLIERS

4.3.3 THE THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES

4.3.5 RIVALRY AMONG EXISTING COMPETITORS

4.4 PRICING INDEX

4.4.1 FOB & B2B PRICES –NORTH AMERICA SHIPPING CONTAINER LINER MARKET

4.4.2 B2B PRICES – NORTH AMERICA SHIPPING CONTAINER LINER MARKET

4.5 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: RAW MATERIAL SOURCING ANALYSIS

4.5.1 POLYETHYLENE (PE)

4.5.2 POLYPROPYLENE (PP)

4.5.3 HIGH DENSITY POLYETHYLENE(HDPE) AND LOW DENSITY POLYETHYLENE (LDPE)

4.6 TRADE ANALYSIS

4.6.1 NORTH AMERICA EXPORTERS OF SHIPPING CONTAINER LINERS, HS CODE OF PRODUCT: 392321

4.6.2 NORTH AMERICA IMPORTERS OF SHIPPING CONTAINER LINER, HS CODE OF PRODUCT: 392321

4.6.3 IMPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.6.4 EXPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.7 PRODUCT ADOPTION SCENARIO

4.7.1 OVERVIEW

4.7.2 PRODUCT AWARENESS

4.7.3 PRODUCT INTEREST

4.7.4 PRODUCT EVALUATION

4.7.5 PRODUCT TRIAL

4.7.6 PRODUCT ADOPTION

4.7.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CONTAINER LINERS IN THE FOOD AND AGRICULTURE INDUSTRY

7.1.2 INCREASED TRANSPORTATION ACTIVITIES REQUIRING SHIPPING CONTAINER LINERS

7.1.3 HIGHER DEMANDS DUE TO THE COST-EFFECTIVE AND REUSABILITY OF SHIPPING CONTAINER LINERS

7.1.4 WIDE APPLICABILITY OF CONTAINER LINERS IN CHEMICAL AND MINERAL TRANSPORTATION

7.2 RESTRAINTS

7.2.1 HIGH COSTS FOR TRANSPORTATION

7.2.2 SHORTAGE IN SHIPPING CONTAINERS FOR TRANSPORTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY LEADING ORGANIZATIONS

7.3.2 INCREASING DEMANDS FOR LARGE PACKAGING FOR BULK CARGO COMMODITIES

7.4 CHALLENGES

7.4.1 LACK OF EMPLOYEES ON PORTS

7.4.2 STRINGENT ENVIRONMENTAL REGULATIONS

8 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE

8.1 OVERVIEW

8.2 POLYETHYLENE

8.3 POLYPROPYLENE

8.4 OTHERS

9 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD AND BEVERAGE

9.2.1 POLYPROPYLENE

9.2.2 POLYETHYLENE

9.2.3 OTHERS

9.3 CHEMICAL

9.3.1 POLYPROPYLENE

9.3.2 POLYETHYLENE

9.3.3 OTHERS

9.4 AGRICULTURAL

9.4.1 POLYPROPYLENE

9.4.2 POLYETHYLENE

9.4.3 OTHERS

9.5 MINERAL

9.5.1 POLYPROPYLENE

9.5.2 POLYETHYLENE

9.5.3 OTHERS

9.6 OTHERS

9.6.1 POLYPROPYLENE

9.6.2 POLYETHYLENE

9.6.3 OTHERS

10 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 COMPANY LANDSCAPE, NORTH AMERICA SHIPPING CONTAINER LINER MARKET

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 COMPANY PROFILES

12.1 BERRY NORTH AMERICA INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT UPDATES

12.2 GREIF

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATE

12.3 INTERTAPE POLYMER GROUP

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT UPDATE

12.4 LC PACKAGING

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 BULK HANDLING AUSTRALIA

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT UPDATE

12.6 BULK CORP INTERNATIONAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 BULK FLOW

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 COMPOSITE CONTAINERS, LLC

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT UPDATE

12.9 CDF CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT UPDATE

12.1 DEV VENTURES INDIA PVT. LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 ECEPLAST

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 NIER SYSTEMS INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 RISHI FIBC SOLUTIONS PVT. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATE

12.14 THRACE GROUP

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 SWOT

12.14.4 PRODUCT PORTFOLIO

12.14.5 RECENT UPDATE

12.15 UNITED BAGS, INC

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT UPDATE

12.16 VEN PACK

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 SWOT

12.16.4 RECENT UPDATES

13 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 FREE ON BOARD (FOB) OF SCREEN PRINTING MESH

TABLE 2 EXPORTERS OF SHIPPING CONTAINER LINERS UNIT: USD THOUSAND

TABLE 3 IMPORTERS OF SHIPPING CONTAINER LINER , UNIT: USD THOUSAND

TABLE 4 IMPORTS BY RUSSIAN FEDERATION , UNIT: USD THOUSAND

TABLE 5 EXPORTS BY RUSSIAN FEDERATION UNIT: USD THOUSAND

TABLE 6 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA POLYETHYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA POLYPROPYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.S. SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 U.S. FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CANADA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 CANADA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 CANADA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 CANADA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CANADA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 CANADA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 CANADA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MEXICO SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 MEXICO FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 MEXICO CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MEXICO AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MEXICO MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MEXICO OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 10 RISING PREVALANCE OF SHIPPING CONTAINER LINER IN FOOD AND AGRICULTURE INSUTRY IS DRIVING THE NORTH AMERICA SHIPPING CONTAINER LINER MARKET IN THE FORECAST PERIOD

FIGURE 11 XXX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SHIPPING CONTAINER LINER MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: TYPES OF CONSUMER BUYING BEHAVIOR

FIGURE 13 PORTER'S 5 ANALYSIS

FIGURE 14 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SHIPPING CONTAINER LINER MARKET

FIGURE 16 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2021

FIGURE 18 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 19 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 20 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 23 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。