北美糖替代品市場,按類型(高果糖漿、高強度甜味劑、低強度甜味劑)、形態(結晶、液體、粉末)、類別(天然、合成)、應用(飲料、食品、口腔護理、藥品、其他)劃分-產業趨勢及預測(至 2029 年)

市場分析與規模

肥胖、糖尿病和代謝症候群都已成為主要的公共衛生問題,因為它們與卡路里攝取不平衡有關。作為整體健康飲食和體能活動計畫的一部分,糖替代品在減少卡路里方面發揮重要作用,可以對抗上述情況。

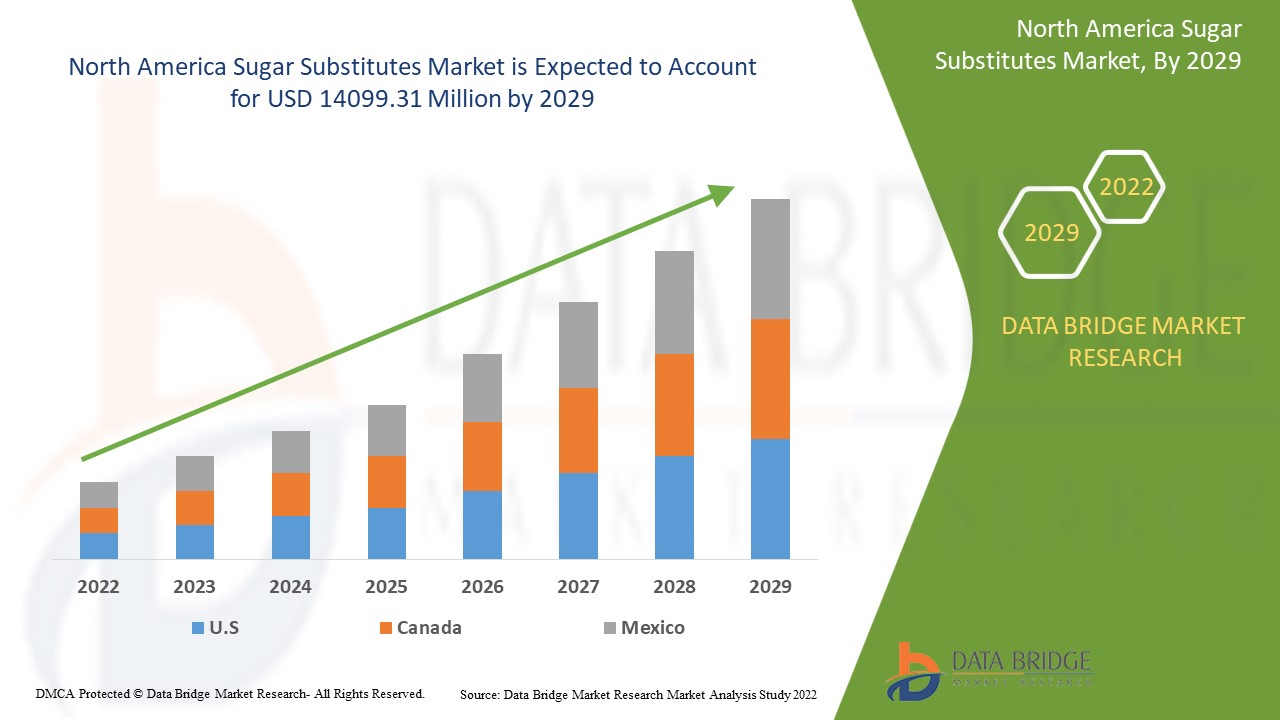

Data Bridge Market Research 分析稱,糖替代品市場在 2021 年增長至 76.1742 億美元,預計到 2029 年將達到 140.9931 億美元,在 2022 年至 2029 年的預測期內複合年增長率為 8.0%。

市場定義

糖替代品是一種食品添加劑,其味道與糖相似,但所含熱量遠低於糖基甜味劑,因此它是一種零熱量或低熱量甜味劑。它們源自天然物質或使用化學物質和防腐劑人工製造。

報告範圍和市場細分

|

報告指標 |

細節 |

|

預測期 |

2022年至2029年 |

|

基準年 |

2021 |

|

歷史歲月 |

2020(可自訂為 2019 - 2014) |

|

定量單位 |

收入(百萬美元)、銷售(單位)、定價(美元) |

|

涵蓋的領域 |

類型(高果糖漿、高強度甜味劑、低強度甜味劑)、形態(結晶、液體、粉末)、類別(天然、合成)、應用(飲料、食品、口腔護理、藥品、其他) |

|

覆蓋國家 |

美國、加拿大和墨西哥 |

|

涵蓋的市場參與者 |

杜邦公司(美國)、ADM公司(美國)、泰萊公司(英國)、宜瑞安公司(美國)、嘉吉公司(美國)、羅蓋特公司(法國)、PureCircle有限公司(美國)、MacAndrews & Forbes公司(美國)、JK Sucralose Inc.(中國)、味之素株式會社(日本)、JKucralose(日本) Inc.(中國)、味之素株式會社(日本)、NutraSweetM公司(美國)、Südzucker AG(德國)、萊茵集團(中國)、諸城市昊天製藥有限公司(中國)、HSWT(法國) |

|

機會 |

|

糖替代品市場動態

驅動程式

- 對天然糖的偏好日益增加

糖替代品通常用作軟性飲料或碳酸飲料、調味果汁和其他食品中的糖替代品。隨著消費者偏好轉向有機食品和飲料,天然糖替代品在美國越來越受歡迎。天然糖是一種從甜菊、羅漢果等植物中提取的低熱量甜味劑,比糖甜 200 倍。糖替代品的這些優勢及其有機優勢促進了市場的成長。

各終端用戶產業的需求不斷成長

糖替代品在醫藥、化妝品、食品、乙醇生產、飼料等各種終端用途的使用增加也推動了市場的發展。它可用作個人護理和化妝品精華中的保水劑,以及糖漿和注射等藥品中的營養補充劑。強大的研發實力加上技術專長推動公司走在前列,因此,結晶糖的需求隨著時間的推移而擴大。

機會

食品加工領域的技術創新不斷增長以及對營養小吃店的需求不斷增加將促進市場成長。糖替代品製造商預計將受益於糖價波動。由於這些因素,市場隨著糖尿病患者的數量和消費者健康意識的提高而擴大。

限制

然而,許多科學家認為,過量食用糖替代品會導致嚴重的健康問題,如第二型糖尿病、心臟病、肥胖症,在某些情況下還會導致癌症。糖替代品供應的減少,加上人工甜味劑的發展,導致消費者的偏好轉向人工甜味劑,限制了市場的成長。

本糖替代品市場報告詳細介紹了近期發展、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地化市場參與者的影響,分析了新興收入來源、市場法規變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品批准、產品發布、地理擴展、市場技術創新等方面的機會。要獲取有關糖替代品市場的更多信息,請聯繫 Data Bridge Market Research 獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

COVID-19對糖替代品市場的影響

北美新冠疫情大流行正成為北美經濟的一大阻礙,並對食品和飲料行業的成長產生影響。食品製造商減少了主要食品的產量。此外,隨著人們尋求改善整體健康和福祉的解決方案,由於 COVID-19 疫情,對低糖和增強免疫力產品的需求迅速增加,大多數注重健康的消費者都轉向低熱量或無糖食品。由於北美民眾健康意識的增強和對減糖解決方案的需求增加,製造商和產品配方師被迫使用糖替代品。

近期發展

- 泰萊公司將於 2020 年 7 月發表 VANTAGE 甜味劑解決方案設計工具。它是一系列全新創新的甜味劑解決方案設計工具以及教育計劃,用於使用低熱量甜味劑製作低糖食品和飲料。

北美糖替代品市場範圍

糖替代品市場根據類型、形式、類別和應用進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

類型

- 高強度甜味劑

- 低強度甜味劑

- 高果糖糖漿

根據類型,市場分為高強度甜味劑、低強度甜味劑和高果糖糖漿。

形式

- 粉末

- 結晶

- 液體。

根據形態,市場分為粉末、結晶和液體。

類別

- 自然的

- 合成的

根據類別,市場分為天然市場和合成市場。

應用

- 食品

- 口腔護理

- 製藥

- 飲料

根據應用,市場分為飲料、食品、口腔護理、藥品和其他。

糖替代品市場區域分析/洞察

對糖替代品市場進行了分析,並按國家、類型、形式、類別和應用提供了市場規模洞察和趨勢。如上所述。

糖替代品市場報告涉及的國家包括美國、加拿大和墨西哥。

在北美糖替代品市場,北美和歐洲佔據了絕大多數市場份額,因為該地區有主要市場參與者、在研發方面投入大量資金、生產方法技術先進、原材料供應充足。事實證明,透過使用天然糖來促進藥物研發是最有希望實現市場成長的途徑。

報告的國家部分還提供了影響市場當前和未來趨勢的個別市場影響因素和市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了北美品牌的存在和可用性以及由於來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

競爭格局和糖替代品市場佔有率分析

糖替代品市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、北美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用主導地位。以上提供的數據點僅與公司對糖替代品市場的關注有關。

糖替代品市場的一些主要參與者包括:

- 杜邦(美國)

- ADM(美國)

- 泰特萊爾(英國)

- Ingredion(美國)

- 嘉吉公司(美國)

- 羅蓋特兄弟公司(法國)

- PureCircle Ltd(美國)

- MacAndrews & Forbes Incorporated(美國)

- JK三氯蔗糖股份有限公司(中國)

- 味之素株式會社(日本)

- JK三氯蔗糖股份有限公司(中國)

- 味之素株式會社(日本)

- NutraSweetM公司(美國)

- Südzucker AG(德國)

- 萊茵集團 (中國)

- 諸城市昊天藥業有限公司 (中國)

- HSWT(法國)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 GROWING NUMBER OF OBESITY & DIABETIC POPULATION

3.1.2 RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS

3.1.3 INCREASED USAGE OF SUGAR SUBSTITUTES IN FOOD & BAKERY PRODUCTS

3.1.4 INCREASING DEMAND FOR NATURAL SWEETENERS/PLANT SOURCED SWEETENERS

3.1.5 FLUCTUATING PRICES OF SUGAR AND INCREASED TAXATION ON SUGAR PRODUCTS

3.2 RESTRAINTS

3.2.1 STRINGENT REGULATIONS AND POLICIES FOR SUGAR SUBSTITUTE

3.2.2 SIDE EFFECTS OF THE SUGAR SUBSTITUTE

3.3 OPPORTUNITIES

3.3.1 GROWING CONSUMPRION OF HEALTHY AND NUTRITIONAL DRINKS HAVING SUGAR SUBSTITUTES

3.3.2 INCREASING AWARENESS OF SUGAR SUBSTITUTE IN DEVELOPING NATIONS

3.3.3 STRONG INITIATIVES AND STUDIES FOR THE PRODUCT DEVELOPMENT

3.3.4 NEW SUGAR LABELING RULES

3.4 CHALLENGES

3.4.1 MORE EFFORTS TOWARDS TASTE IMPROVEMENT

3.4.2 VAGUENESS ABOUT SUGAR SUBSTITUTE BENEFITS

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PARENT MARKET ANALYSIS

5.2 EXPECTED GROWTH OF SWEETENERS USAGE FOR NEXT 3 YEARS

6 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE

6.1 OVERVIEW

6.2 HIGH-FRUCTOSE SYRUPS

6.3 HIGH-INTENSITY SWEETENERS

6.3.1 ASPARTAME

6.3.2 CYCLAMATE

6.3.3 ACE-K

6.3.4 SACCHARINE

6.3.5 STEVIA

6.3.6 SUCROLOSE

6.3.7 HONEY

6.3.8 GLYCYRRHIZIN

6.3.9 ALITAME

6.3.10 NEOTAME

6.3.11 OTHERS

6.4 LOW-INTENSITY SWEETENERS

6.4.1 ERYTHRITOL

6.4.2 MALTITOL

6.4.3 SORBITOL

6.4.4 XYLITOL

6.4.5 ISOMALT

6.4.6 HYDROGENATED STARCH HYDROYSATES

6.4.7 MANNITOL

6.4.8 LACITOL

6.4.9 D-TAGATOSE

6.4.10 TREHALOSE

6.4.11 OTHERS

7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM

7.1 OVERVIEW

7.2 CRYSTALLIZED

7.3 LIQUID

7.4 POWDER

8 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BEVERAGES

8.2.1 CARBONATED SOFT DRINKS

8.2.2 FLAVORED DRINKS

8.2.3 POWDERED BEVERAGES

8.2.3.1 RTD COFFEE

8.2.3.2 RTD TEA

8.2.3.3 SMOOTHIES

8.2.3.4 OTHERS

8.2.4 JUICES

8.2.5 DAIRY ALTERNATIVE DRINKS

8.2.6 FUNCTIONAL DRINKS

8.2.7 OTHERS

8.3 FOOD PRODUCTS

8.3.1 DAIRY PRODUCTS

8.3.1.1 ICE CREAM

8.3.1.2 TOPPINGS

8.3.1.3 YOGURTS

8.3.1.4 PUDDING

8.3.1.5 OTHERS

8.3.2 BAKERY PRODUCTS

8.3.2.1 COOKIES & BISCUITS

8.3.2.2 CAKE & PASTRIES

8.3.2.3 MUFFINS & DONUTS

8.3.2.4 BREADS & ROLLS

8.3.2.5 OTHERS

8.3.3 CONFECTIONERY

8.3.3.1 CHOCOLATE

8.3.3.2 GUMMIES & MARSHMALLOWS

8.3.3.3 HARD CANDIES

8.3.3.4 OTHERS

8.3.4 TABLE-TOP SWEETENER

8.3.5 NUTRITIONAL BARS

8.3.6 BREAKFAST CEREALS

8.3.7 OTHERS

8.4 ORAL CARE

8.4.1.1 TOOTHPASTE

8.4.1.2 ORAL RINSES

8.4.1.3 OTHERS

8.5 PHARMACEUTICALS

8.5.1.1 SYRUPS

8.5.1.2 GRANULATED POWDERS

8.5.1.3 TABLETS

8.5.1.4 OTHERS

8.6 OTHERS

9 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 NATURAL

9.3 SYNTHETIC

10 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT & DBMR ANALYSIS

12.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 COMPANY PROFILES

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 CARGILL, INCORPORATED.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 INGREDION INCORPORATED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 TATE & LYLE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 AJINOMOTO HEALTH & NUTRITION NORTH AMERICA, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALSIANO

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BENEO (A SUBSIDIARY OF SÜDZUCKER AG)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 DUPONT.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FOODCHEM INTERNATIONAL CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 HYET SWEET

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 JK SUCRALOSE INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 MAFCO WORLDWIDE LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MATSUTANI CHEMICAL INDUSTRY CO., LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MITSUI SUGAR CO.,LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 NUTRASWEET CO.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PURECIRCLE

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENEUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PYURE BRANDS LLC

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 ROQUETTE FRÈRES

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 STARTINGLINE S.P.A.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 ZUCHEM INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA HIGH-FRUCTOSE SYRUPS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA CRYSTALLIZED FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA LIQUID FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA POWDER FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA BEVERAGES APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA FOOD PRODUCTS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA ORAL CARE APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA PHARMACEUTICALS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA NATURAL CATGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA SYNTHETIC CATEGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 43 U.S. SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 U.S. HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 45 U.S. LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 46 U.S. SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 47 U.S. SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 48 U.S. SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 49 U.S. BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 50 U.S. POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 U.S. FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 52 U.S. BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 53 U.S. CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 54 U.S. DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 U.S. ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 56 U.S. PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 CANADA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 CANADA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 59 CANADA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 60 CANADA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 61 CANADA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 62 CANADA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 CANADA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 CANADA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 CANADA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 CANADA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 CANADA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 68 CANADA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 CANADA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 70 CANADA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 71 MEXICO SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 MEXICO HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 73 MEXICO LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 74 MEXICO SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 75 MEXICO SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 76 MEXICO SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 77 MEXICO BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 MEXICO POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 79 MEXICO FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 80 MEXICO BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 MEXICO CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 82 MEXICO DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 83 MEXICO ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 84 MEXICO PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUGAR SUBSTITUTES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUGAR SUBSTITUTES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SUGAR SUBSTITUTES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SUGAR SUBSTITUTES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

FIGURE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 12 GROWING NUMBER OF OBESITY & DIABETIC POPULATION AND RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS ARE EXPECTED TO DRIVE THE NORTH AMERICA SUGAR SUBSTITUTES MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 HIGH-FRUCTOSE SYRUPS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SUGAR SUBSTITUTES MARKET IN 2020 & 2027

FIGURE 14 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE, 2019

FIGURE 15 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY FORM, 2019

FIGURE 16 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY APPLICATION, 2019

FIGURE 17 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY CATEGORY, 2019

FIGURE 18 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SNAPSHOT (2019)

FIGURE 19 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019)

FIGURE 20 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE (2020-2027)

FIGURE 23 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY SHARE 2019 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。