西班牙商业车队燃油卡市场,按卡类型(通用燃油卡、品牌燃油卡、商户燃油卡)、功能(移动支付和无卡交易、车辆报告、实时更新、EMV 兼容、标记化、其他)、订阅类型(注册卡、不记名卡)、效用(油费支付、过路费支付、车辆停车费、车队维护、其他)、最终用户(车队、商业道路运输 (CRT))划分——行业趋势和预测到 2029 年。

市场分析和规模

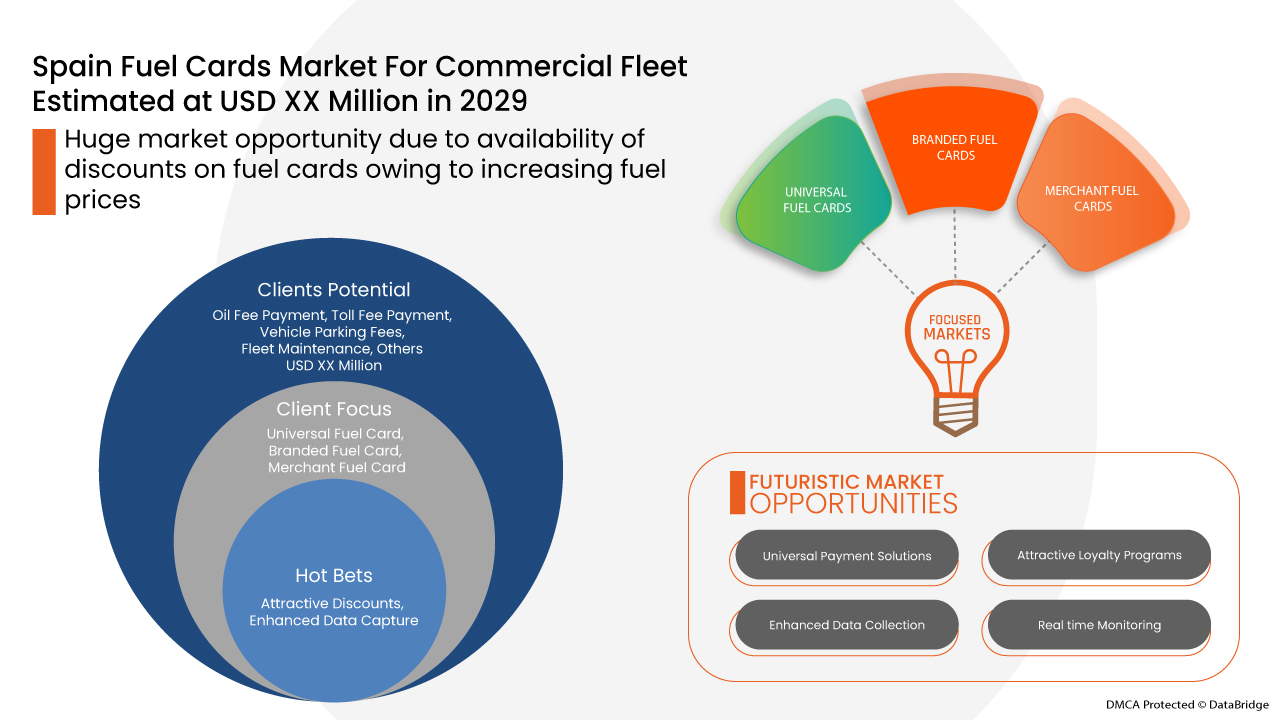

西班牙商业车队燃油卡市场的需求主要由无现金支付方式和加油站等终端节点的日益普及所驱动。优化运输成本和从车队检索数据以进行更好的管理一直是西班牙市场需求的驱动因素。燃油价格飞涨,车队经理正在寻找通过利用燃油卡公司提供的折扣来减少燃油消耗的方法。

Data Bridge Market Research 分析称,商业车队的燃油卡市场预计到 2029 年将达到 34.3208 亿美元的价值,预测期内的复合年增长率为 5.8%。 “通用燃油卡”是各自市场中最突出的外围类型部分,因为它们为车队提供优化的燃油数据管理并提供广泛的加油站访问权限。许多车队采用通用燃油卡计划,因为它们为所有商业采购需求提供灵活性、控制力和便利性。 Data Bridge Market Research 团队策划的市场报告包括深入的专家分析、进出口分析、定价分析、生产消费分析和气候链情景。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

卡类型(通用加油卡、品牌加油卡、商户加油卡)、功能(移动支付和无卡交易、车辆报告、实时更新、EMV 兼容、标记化、其他)、订阅类型(注册卡、不记名卡)、效用(油费支付、过路费支付、车辆停车费、车队维护、其他)、最终用户(车队、商业道路运输 (CRT)) |

|

覆盖国家 |

西班牙 |

|

涵盖的市场参与者 |

BP plc(英国)、DKV EURO SERVICE GmbH + Co. KG(德国)、MORGAN FUELS(爱尔兰)、WAG payment solutions. as(捷克共和国)、WEX Europe Services(英国)、UNION TANK Eckstein GmbH & Co KG(Edenred 公司的子公司)(荷兰)、Cepsa(西班牙)、Galp Energia(Galp 的子公司)(葡萄牙)、Repsol(西班牙)、IDS Europe BV(荷兰)、C2A(法国)、Andamur(西班牙)、AS 24(TotalEnergies 公司的子公司)(法国) |

市场定义

车队卡是一种支付卡,允许企业管理与其拥有和运营的车辆相关的费用。它们也称为加油卡,作用与信用卡相同,由主要石油和/或专业信贷公司提供。企业为其员工提供车队卡,用于加油、车辆维修和保养。车队卡已经使用很长时间了,由公司向员工发放,用于公司车辆。大多数使用车队卡的公司从事运输业。车队卡通常由卡车运输公司以及提供送货和拼车服务的公司使用。车队卡往往由一家公司发行。这意味着持卡人只能在发卡机构拥有、经营和特许经营的特定地点使用它们。企业将这些卡发给司机和其他可以使用它们的员工,而不是个人卡。这使得发卡机构可以直接向公司而不是员工收费。这将节省员工提交费用报告的时间,以便日后报销费用。

COVID-19 对商用车队燃油卡市场的影响

新冠疫情对西班牙商用车队燃油卡市场产生了重大影响。因此,由于与燃油卡市场相关的行业活动减少,西班牙商用车队燃油卡市场的预计同比增长率低于 2019 年。

商用车队燃油卡市场的市场动态包括:

- 增加全国燃油卡网络以管理燃油经济性

全球智能互联技术趋势正在渗透西班牙商业,更具体地说,渗透到车队运输领域。专注于优化和整合车队数据以提高效率和改善决策的远程信息处理软件正变得越来越普遍。越来越多地使用分析来优化车队管理流程,这导致了许多技术的集成和采用,包括远程信息处理和燃油卡系统,以收集和监控对公司经济管理有启发性的数据。

- 该地区对非接触式燃料交易的需求增加

近期疫情的爆发和数字化步伐的加快,推动了全球无现金社会的兴起。全球人民已开始采用数字支付方式,用户只需刷卡即可付款,从而避免接触。

- 使用燃油卡进行车队管理的优势日益凸显

随着加油卡越来越受欢迎,它在卡车运输行业提供的优势和选择也越来越多。传统上,加油卡是为了车队经理的利益,因为该服务专注于为车队经理提供控制和透明度。但随着数字化运营模式的加速,加油卡解决方案也旨在让司机受益。

- 燃油卡作为车队支付的未来越来越受到关注

车队管理者为管理其国内和国际车队的燃油费用而采用的支付方式发生了巨大变化。未来升级导致电动汽车、自动驾驶汽车的兴起,甚至将汽车本身变成支付机制的非接触式支付技术的出现也在不断涌现。

- 由于燃油价格上涨,燃油卡可享受折扣

化石燃料的压力越来越大,加上俄罗斯与乌克兰交战,欧洲目前的政治危机使欧洲的化石燃料形势变得严峻。燃料价格不断上涨,影响了该地区的运输成本。燃料是大多数卡车运输公司的第二大运营支出,占公司总成本的 20% 以上。

- 增强数据采集以实现高效的车队管理

如今,燃油卡或车队卡提供许多功能,包括为企业车队提供方便全面的报告、向车主提供实时更新,并使他们能够跟踪所有与业务相关的活动。它们还有助于消除提交收据和审计的手动任务。在某些情况下,它还有助于提供折扣燃油价格。

商业车队燃油卡市场面临的限制/挑战

- 燃油卡利率高且未结清余额

加油卡是个人加油公司或其他商家提供的一种信用卡。持卡人可以使用加油卡在相应品牌的加油站购买汽油,然后根据购买的汽油金额进行计费。持卡人可以灵活选择全额还清欠款或分期付款,就像普通信用卡一样。

- 燃油卡账户只能用于商业目的

燃油卡是适用于任何类型汽车业务的智能解决方案。公司燃油卡允许驾驶员使用燃油卡而不是现金或信用卡或借记卡支付燃油费用。这使公司能够节省燃油成本,并减少处理员工索回公司燃油费用所需的管理时间。

这份商用车队燃油卡市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地理扩展、市场技术创新等方面的机会。如需了解有关商用车队燃油卡市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报。我们的团队将帮助您做出明智的市场决策,以实现市场增长。

最新动态

- 2021 年 5 月,DKV MOBILITY SERVICES HOLDING GmbH + Co. KG 宣布将其在西班牙的供应网络扩大到 704 个 Cepsa 品牌的服务站。其中 44 个服务站适合卡车,位于最重要的交通路线沿线。其余 660 个位于城市地区。这些加油站的 Cepsa 还允许 DKV 客户使用他们的燃油卡支付汽油费用

- 2021 年 7 月,C2A 宣布 Mendy 集团一直在使用 C2A 卡车卡为其在西班牙的车辆提供燃料,并使用 C2A 回收西班牙 TICPE。Mendy 集团由三家公司组成:Transports Ibaremborde、Transports Etchego 和 Mintegui Logistique。其董事 Patrick Mendy 已强制使用 C2A 卡进行跨境、加油以及在西班牙工作的所有司机。由于 C2A 获得 12% 的折扣,C2A 卡使该公司能够从西班牙 TICPE 中每升回收 0.05 欧元

西班牙商用车队燃油卡市场范围:

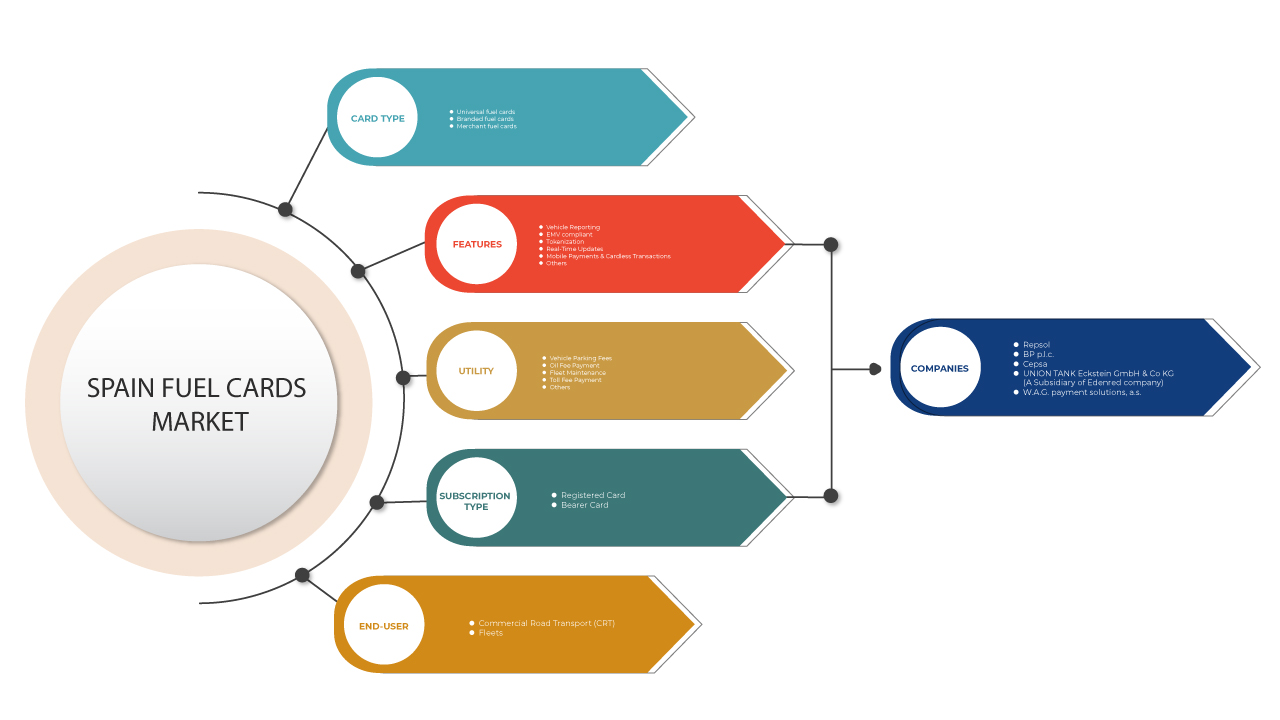

商业车队的加油卡市场根据卡类型、功能、订阅类型、效用和最终用户进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

卡类型

- 通用加油卡

- 品牌卡

- 商家加油卡

根据卡类型,西班牙商业车队燃油卡市场分为通用燃油卡、品牌卡和商户燃油卡。

特征

- 移动支付和无卡交易

- 车辆报告

- 实时更新

- 符合 EMV 标准

- 标记化

- 其他的

根据特点,西班牙商用车队燃油卡市场细分为车辆报告、EMV 兼容、标记化、实时更新、移动支付和无卡交易等。

订阅类型

- 注册卡

- 不记名卡

根据订阅类型,西班牙商业车队燃油卡市场分为注册卡和不记名卡。

公用事业

- 油费支付

- 支付通行费

- 车辆停车费

- 车队维护

- 其他的

根据实用性,西班牙商业车队燃油卡市场分为油费支付、通行费支付、车辆停车费、车队维护等。

终端用户

- 车队

- 商业公路运输(CRT)

根据最终用户,西班牙商业车队燃油卡市场分为商业公路运输(CRT)和车队。

商业车队燃油卡市场区域分析/见解

对商业车队的燃油卡市场进行了分析,并按国家、卡类型、功能、订阅类型、实用性和最终用户提供了市场规模洞察和趋势。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

商用车队的竞争格局和燃油卡市场份额分析

商用车队燃油卡市场竞争格局提供了按竞争对手划分的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对商用车队燃油卡市场的关注有关。

商业车队燃油卡市场的一些主要参与者包括 BP plc、DKV EURO SERVICE GmbH + Co. KG、MORGAN FUELS、WAG payment solutions. as、WEX Europe Services、UNION TANK Eckstein GmbH & Co KG (Edenred 公司的子公司)、Cepsa、Galp Energia (Galp 的子公司)、Repsol、IDS Europe BV、C2A、Andamur、AS 24 (TotalEnergies 公司的子公司) 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SPAIN FUEL CARDS FOR FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 END USER GRID

2.9 CHALLENGE MATRIX

2.1 MULTIVARIATE MODELING

2.11 CARD TYPE TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FLEET LEASING COMPANIES / TRENDS

4.2 USE CASE ANALYSIS

4.3 REGULATORY FRAMEWORK

4.3.1 PAYMENT SERVICE DIRECTIVE

4.4 TECHNOLOGICAL TRENDS

4.4.1 MOBILE & CONNECTED PAYMENTS

4.4.2 TELEMATICS INTERFACE

4.4.3 HOST CARD EMULATION

4.5 PRICING ANALYSIS

4.5.1 ANNUAL CARD CHARGE

4.5.2 NETWORK SERVICE FEE

4.5.3 REPLACEMENT CARD CHARGE

4.5.4 CONVENIENCE CHARGE

4.5.5 INVOICING

4.5.6 DIRECT DEBIT ADMIN

4.5.7 RISK-BASED FEES

4.6 SUPPLY CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NATIONWIDE FUEL CARD NETWORKS FOR MANAGING FUEL ECONOMY

5.1.2 INCREASE IN DEMAND FOR CONTACTLESS FUEL TRANSACTIONS IN REGION

5.1.3 INCREASING ADVANTAGES OF USING A FUEL CARDS FOR FLEET MANAGEMENT

5.2 RESTRAINTS

5.2.1 HIGH INTEREST RATES ON FUEL CARD UNSETTLED BALANCES

5.2.2 FUEL CARD ACCOUNTS CAN ONLY BE SET UP FOR BUSINESSES PURPOSES

5.3 OPPORTUNITIES

5.3.1 INCREASING FOCUS ON USE OF FUEL CARDS AS THE FUTURE OF FLEET PAYMENTS

5.3.2 AVAILABILITY OF DISCOUNTS ON FUEL CARDS OWING TO INCREASING FUEL PRICES

5.3.3 ENHANCED DATA CAPTURE FOR EFFICIENT FLEET ADMINISTRATION

5.4 CHALLENGES

5.4.1 INCREASING THREAT OF FUEL CARD SKIMMERS AT THE FUEL STATION

5.4.2 RISK OF FUEL CARD FRAUD

6 ANALYSIS OF IMPACT OF COVID 19 ON THE SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET

6.1 AFTERMATH OF THE SPAIN FUEL CARD MARKET FOR COMMERCIAL FLEET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE

7.1 OVERVIEW

7.2 UNIVERSAL FUEL CARDS

7.2.1 FUEL CREDIT CARDS

7.2.2 OVER THE ROAD FUEL CARDS

7.2.3 NETWORK CARDS

7.3 BRANDED FUEL CARDS

7.4 MERCHANT FUEL CARDS

8 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES

8.1 OVERVIEW

8.2 MOBILE PAYMENT & CARDLESS TRANSACTIONS

8.3 VEHICLE REPORTING

8.4 REAL TIME UPDATES

8.5 EMV COMPLIANT

8.6 TOKENIZATION

8.7 OTHERS

9 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE

9.1 OVERVIEW

9.2 REGISTERED CARD

9.3 BEARER CARD

10 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY

10.1 OVERVIEW

10.2 OIL FEE PAYMENT

10.3 TOLL FEE PAYMENT

10.4 VEHICLE PARKING FEES

10.5 FLEET MAINTENANCE

10.6 OTHERS

11 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER

11.1 OVERVIEW

11.2 FLEETS

11.2.1 DELIVERY FLEETS

11.2.1.1 UNIVERSAL FUEL CARDS

11.2.1.2 BRANDED FUEL CARDS

11.2.1.3 MERCHANT FUEL CARDS S

11.2.2 TAXI CAB FLEETS

11.2.2.1 UNIVERSAL FUEL CARDS

11.2.2.2 BRANDED FUEL CARDS

11.2.2.3 MERCHANT FUEL CARDS

11.2.3 CAR RENTAL FLEETS

11.2.3.1 UNIVERSAL FUEL CARDS

11.2.3.2 BRANDED FUEL CARDS

11.2.3.3 MERCHANT FUEL CARDS

11.2.4 PUBLIC UTILITY FLEETS

11.2.4.1 UNIVERSAL FUEL CARDS

11.2.4.2 BRANDED FUEL CARDS

11.2.4.3 MERCHANT FUEL CARDS

11.2.5 OTHERS

11.2.5.1 UNIVERSAL FUEL CARDS

11.2.5.2 BRANDED FUEL CARDS

11.2.5.3 MERCHANT FUEL CARDS

11.3 COMMERCIAL ROAD TRANSPORT (CRT)

11.3.1 MEDIUM DUTY VEHICLES

11.3.1.1 UNIVERSAL FUEL CARDS

11.3.1.2 BRANDED FUEL CARDS

11.3.1.3 MERCHANT FUEL CARDS

11.3.2 HEAVY DUTY VEHICLES

11.3.2.1 UNIVERSAL FUEL CARDS

11.3.2.2 BRANDED FUEL CARDS

11.3.2.3 MERCHANT FUEL CARDS

12 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: SPAIN

13 SWOT

14 COMPANY PROFILES

14.1 REPSOL

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 BP P.L.C.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 CEPSA

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 UNION TANK ECKSTEIN GMBH & CO KG (A SUBSIDIARY OF EDENRED COMPANY)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 W.A.G. PAYMENT SOLUTIONS, A.S.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ANDAMUR

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AS 24 (A SUBSIDIARY OF TOTALENERGIES COMPANY)

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 C2A

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 DKV MOBILITY SERVICES HOLDING GMBH + CO. KG

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 GALP ENERGIA (A SUBSIDIARY OF GALP)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 IDS EUROPE B.V.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 MORGAN FUELS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 WEX EUROPE SERVICES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 LIST OF LEASING COMPANIES IN SPAIN

TABLE 2 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 3 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 4 SPAIN UNIVERSAL FUEL CARDS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 5 SPAIN UNIVERSAL FUEL CARDS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 7 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 8 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 9 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 10 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 11 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 12 SPAIN FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 SPAIN FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 14 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 15 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 16 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 17 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 18 SPAIN CAR RENTAL FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 19 SPAIN CAR RENTAL FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 20 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 21 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 22 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 23 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 24 SPAIN COMMERCIAL ROAD TRANSPORT (CRT) IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 SPAIN COMMERCIAL ROAD TRANSPORT (CRT) IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 26 SPAIN MEDIUM DUTY VEHICLES IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 27 SPAIN MEDIUM DUTY VEHICLES IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 28 SPAIN HEAVY DUTY VEHICLES IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 29 SPAIN HEAVY DUTY VEHICLES IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

图片列表

FIGURE 1 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: SEGMENTATION

FIGURE 2 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: DATA TRIANGULATION

FIGURE 3 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: DROC ANALYSIS

FIGURE 4 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: COUNTRY ANALYSIS

FIGURE 5 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: DBMR MARKET POSITION GRID

FIGURE 8 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: VENDOR SHARE ANALYSIS

FIGURE 9 SPAIN FUEL CARDS FOR FLEET MANAGEMENT MARKET: END USER GRID

FIGURE 10 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: CHALLENGE MATRIX

FIGURE 11 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: SEGMENTATION

FIGURE 12 INCREASING NATIONWIDE FUEL CARD NETWORKS FOR MANAGING FUEL ECONOMY IS EXPECTED TO DRIVE SPAIN FUEL CARDS MARKET FOR FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 UNIVERSAL FUEL CARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET MARKET

FIGURE 15 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY CARD TYPE, 2021

FIGURE 16 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY FEATURES, 2021

FIGURE 17 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY SUBSCRIPTION TYPE, 2021

FIGURE 18 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY UTILITY, 2021

FIGURE 19 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY END-USER, 2021

FIGURE 20 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。