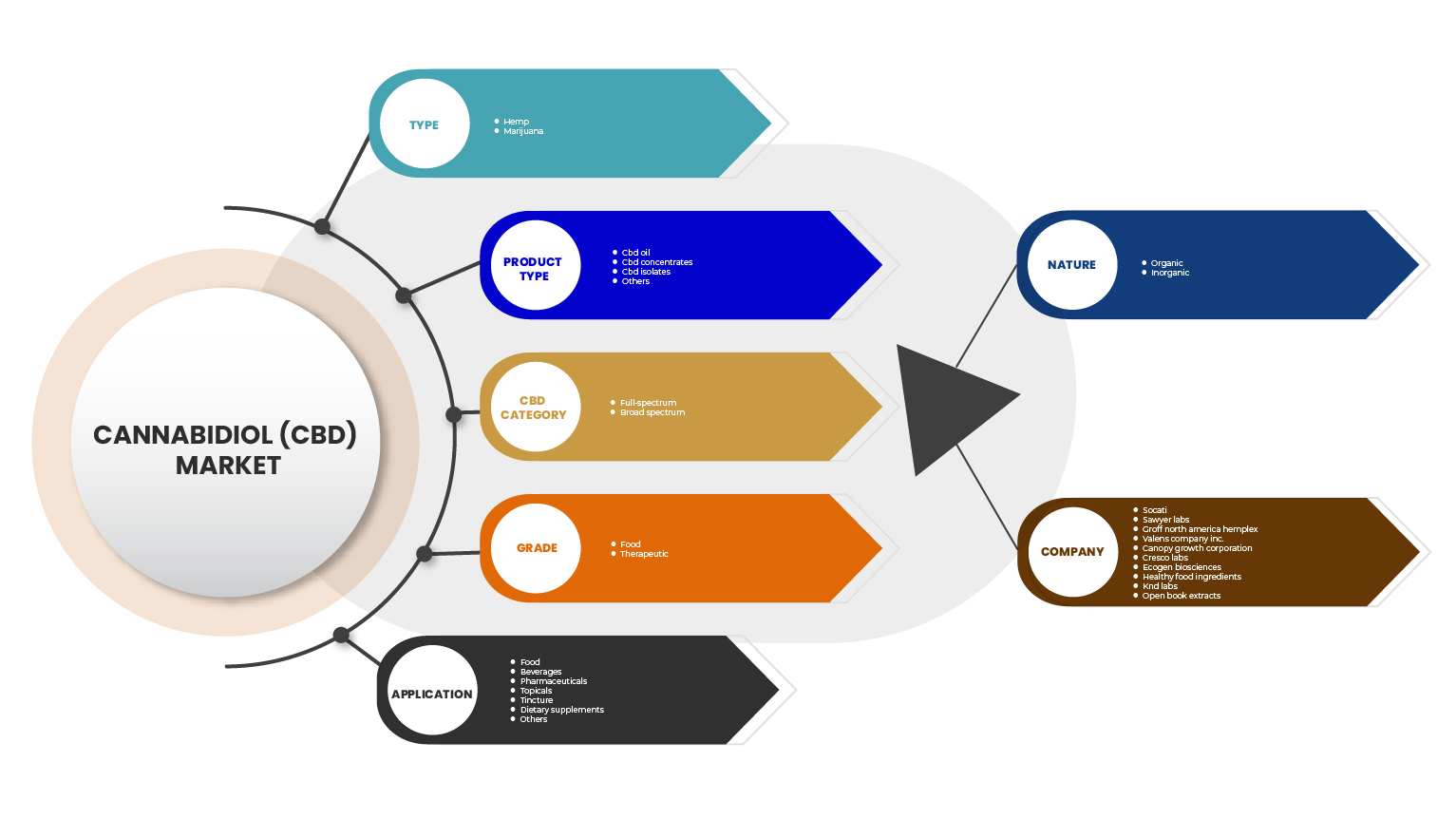

U.S. Cannabidiol (CBD) Market, By CBD Type (Hemp, Marijuana), Product Type (CBD Oil, CBD Concentrates, CBD Isolates, Others), CBD Category (Full-Spectrum, Broad Spectrum), Nature (Organic, Inorganic), Grade (Food, Therapeutic), Application (Food, Beverages, Pharmaceuticals, Topicals, Tincture, Dietary Supplements, Others), Market Trends and Forecast to 2029.

Market Analysis and Insights

The U.S. cannabidiol (CBD) market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 28.6% in the forecast period of 2022 to 2029 and is expected to reach USD 13,655.70 million by 2029. The major factor driving the growth of the cannabidiol market is the growing demand for CBD in health & fitness, improving government approvals & regulations, therapeutic properties of CBD oil, and consumers’ shift towards legally purchasing cannabis, for medical as well as recreational use.

Cannabidiol (CBD) is obtained from the cannabis plant, which can be used for various applications. Also, commonly found in hemp and marijuana plants, the extract is also used for research and development proficiencies. The extract consists of 40% of the entire plant, and does not have any harmful effects on humans. Cannabidiol (CBD) has various health benefits, such as treating health disorders such as Parkinson's disease, Alzheimer’s, and multiple sclerosis. It is effective against stress, reduces acne, and alleviates cancer-related symptoms; thus, it is used in many pharmaceutical applications.

Cannabidiol derived from hemp is anticipated to witness rapid growth owing to increasing demand from the pharmaceutical sector and rising awareness among consumers regarding health.

The increasing acceptance of refined CBD products combined with the increasing legalization of marijuana and marijuana-derived products for various medical applications is expected to drive the growth of the marijuana CBD market.

The U.S. cannabidiol (CBD) market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

按 CBD 类型(大麻、印度大麻)、产品类型(CBD 油、CBD 浓缩物、CBD 分离物、其他)、CBD 类别(全谱、广谱)、性质(有机、无机)、等级(食品、治疗)、应用(食品、饮料、药品、外用药、酊剂、膳食补充剂、其他) |

|

覆盖国家 |

我们 |

|

涵盖的市场参与者 |

Cresco Labs.、EcoGen Biosciences、Canopy Growth Corporation、The Valens Company、Open Book Extracts、Groff North America Hemplex、Healthy Food Ingredients, LLC、KND Labs、Socati Corp. 和 Swayer Labs。 |

市场定义

大麻二酚 (CBD) 是从大麻植物中提取的,可用于多种用途。此外,大麻二酚提取物通常存在于大麻和大麻植物中,也用于研究和开发。该提取物占整个植物的 40%,对人体没有任何有害影响。大麻二酚 (CBD) 具有多种健康益处,例如治疗帕金森病、阿尔茨海默病和多发性硬化症等健康障碍。大麻二酚 (CBD) 可有效缓解压力、减少痤疮和缓解癌症相关症状,因此被用于许多药物应用

美国大麻二酚 (CBD) 市场动态

驱动程序

- 健康和健身领域对 CBD 的需求不断增加

CBD 油还有助于缓解延迟性肌肉酸痛和运动引起的肌肉损伤,这些损伤在体力活动后由于肌肉纤维的微观损伤而自然发生。它的治疗特性可以减轻肌肉疼痛、身体疼痛和炎症。CBD 具有许多好处,因为它可以诱导睡眠和减少炎症,是肌肉恢复的完美组合。如果人们在健身房或任何比赛中感到焦虑,CBD 可以帮助镇静神经并提供信心。因此,CBD 产品的广泛使用和消费者观点的改变增加了 CBD 产品的采用,这可能会推动美国大麻二酚 (CBD) 市场的需求。

- 改善 CBD 产品的政府审批和监管

美国食品药品管理局 (FDA) 和美国农业部 (USDA) 批准的新政府政策支持该行业,降低大麻二酚生产成本,并提升制造基础设施和专业知识。这预计将为美国 CBD 公司带来激烈的竞争,并有望在未来几年推动美国大麻二酚 (CBD) 市场的发展。

- CBD 油的治疗特性

CBD 的临床试验已证明其在治疗各种形式的癫痫方面有效。基于这一发展,包括美国在内的各国都在寻求纳入基于 CBD 的疗法,从而大大增加了市场需求。因此,CBD 提供了一系列治疗益处,从治疗癫痫等严重问题到治疗焦虑和压力。预计这将进一步推动对基于 CBD 的产品的需求,进而扩大美国大麻二酚 (CBD) 市场的增长。

机会

- 加大对基于 CBD 的新产品开发的投资

需求的增加增加了研究 CBD 对某些健康状况影响的试验数量,预计这将开发新产品,从而为未来几年需求的增长提供机会。此外,许多公司批量采购 CBD 油并生产注入 CBD 的产品。此外,许多健康和保健零售商都在提供基于 CBD 的产品,例如 Rite Aid、CVS Health 和 Walgreens Boots Alliance。

- CBD 的医疗应用日益广泛

医用 CBD 可能最常用于治疗关节炎和癌症相关的疼痛。CBD 在治疗局部疼痛方面也显示出了有效的效果。CBD 的止痛能力使其成为阿片类药物的有希望的替代品。CBD 还证明了其在治疗复杂运动障碍方面的功效,包括癫痫、痉挛和肌张力障碍以及 Dravet 综合征。CBD 在治疗痴呆、大麻依赖、烟草和阿片类药物依赖、精神病和精神分裂症、一般社交焦虑、创伤后应激障碍、神经性厌食症、注意力缺陷多动障碍、帕金森病和图雷特氏症方面也显示出了良好的效果。

限制/挑战

- CBD 产品成本高

此外,种植大麻需要更多的时间和劳动力,农民需要在作物生长过程中密切检查。此外,一旦收获,提取大麻二酚是一个困难且昂贵的过程。CBD 的加工商和提取商在提取过程中使用乙醇或超临界二氧化碳 (CO2 萃取)。提取和精炼过程需要特殊的机器,需要很长时间,这也推高了 CBD 的成本。因此,所有这些因素加起来增加了 CBD 产品的成本,使其比其他产品贵得多,这可能会抑制市场的需求。

- 市场上存在假冒和合成产品

此类替代产品为消费者提供了更便宜的品种,同时影响了对 CBD 产品的需求。然而,由于此类错误标记和使用合成大麻的情况,FDA 积极采取行动,在对许多公司的产品进行测试后,向其发出了警告信,发现其中没有发现 CBD 的痕迹。FDA 不批准将这些产品用于诊断、治愈、缓解、治疗或预防任何疾病,消费者在购买和使用任何此类产品时应注意。然而,CBD 的廉价合成替代品的出现可能会阻碍市场需求。

- CBD 油相关的副作用

此外,含有 CBD 和草药成分混合物的膳食补充剂可能并不适合所有人,因为许多草药可能会与常用处方药发生相互作用。所有这些副作用可能因人而异,因为对某些人来说是轻微的副作用,对其他人来说可能是严重的。这可能会对美国大麻二酚 (CBD) 市场对 CBD 产品日益增长的需求构成挑战。

- CBD 营销方面的障碍

除此之外,有关 CBD 产品的批准和标准化的规定是另一个障碍,这阻碍了市场的增长。某些法规不允许在国际市场上销售这些产品,并阻止各国之间的贸易活动。所有这些障碍预计都会对美国大麻二酚 (CBD) 市场的增长构成挑战。

COVID-19 对美国大麻二酚 (CBD) 市场影响甚微

2020-2021 年,COVID-19 影响了各个制造业,导致工作场所关闭、供应链中断和运输限制。此外,由于美国供应链中断,其他原材料的供应受到限制,这扰乱了 CBD 消费保健产品的制造和供应链。在 COVID-19 疫情期间,投资者和制造商正在撤回生产并重新考虑投资。这预计将成为美国大麻二酚 (CBD) 市场增长的主要阻力。然而,CBD 在感染的早期阶段阻断了 SARS-CoV-2 感染,并且 CBD 给药与人类感染 SARS-CoV-2 的风险较低有关。此外,由于政府批准,产品的接受度和使用率不断提高,预计是促进 CBD 注入产品生产的主要因素。由于其具有治疗功效,大麻二酚 (CBD) 在健康和保健方面的需求很高,这是推动市场增长的主要因素。

近期发展

- 2022 年 3 月,Cresco Labs 和 Columbia Care Inc. 达成最终协议,收购 Columbia Care 已发行和流通的所有股份。根据协议条款,Columbia Care 股东每持有一股 Columbia Care 普通股,即可获得 0.5579 股 Cresco Labs 的次级投票股份。

美国大麻二酚 (CBD) 市场范围

美国大麻二酚 (CBD) 市场根据 CBD 类型、产品类型、CBD 类别、等级、应用和性质进行分类。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以做出战略决策来确定核心市场应用。

CBD类型

- 麻

- 大麻

根据 CBD 类型,美国大麻二酚 (CBD) 市场分为大麻和印度大麻。

产品类型

- CBD 油

- CBD分离物

- CBD 浓缩物

- 其他的

根据产品类型,美国大麻二酚 (CBD) 市场分为 CBD 油、CBD 分离物、CBD 浓缩物和其他。

CBD类别

- 全光谱

- 广谱

根据 CBD 类别,美国大麻二酚 (CBD) 市场分为全谱和广谱。

年级

- 食物

- 治疗

根据等级,美国大麻二酚 (CBD) 市场分为食品和治疗

应用

- 酊剂

- 食物

- 药品

- 膳食补充剂

- 饮料

- 专题

- 其他的

根据应用,美国大麻二酚 (CBD) 市场分为酊剂、食品、药品、膳食补充剂、饮料、外用药和其他。

自然

- 有机的

- 无机

根据性质,美国大麻二酚 (CBD) 市场分为有机和无机。

竞争格局和美国大麻二酚 (CBD) 市场份额分析

美国大麻二酚 (CBD) 市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用主导地位、技术生命线曲线。以上提供的数据点仅与公司对美国大麻二酚 (CBD) 市场的关注有关。

美国大麻二酚 (CBD) 市场的一些知名参与者包括 Socati、Sawyer Labs、Groff North America Hemplex、Valens Company Inc.、Canopy Growth Corporation、Cresco Labs、EcoGen Biosciences、Healthy Food Ingredients、KND Labs 和 Open Book Extracts 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. CANNABIDIOL (CBD) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE PRICING ANALYSIS: U.S. CANNABIDIOL (CBD) MARKET

4.2 AVERAGE PRODUCTION/SUPPLY CAPACITY: U.S. CANNABIDIOL (CBD) MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR CBD IN HEALTH AND FITNESS

5.1.2 IMPROVING GOVERNMENT APPROVALS AND REGULATIONS FOR CBD PRODUCTS

5.1.3 THERAPEUTIC PROPERTIES OF CBD OIL

5.1.4 CONSUMERS' SHIFT TOWARDS LEGALLY PURCHASING CANNABIS FOR MEDICAL AND RECREATIONAL USE

5.2 RESTRAINTS

5.2.1 HIGH COST OF CBD PRODUCTS

5.2.2 AVAILABILITY OF COUNTERFEIT AND SYNTHETIC PRODUCTS IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD BASED PRODUCTS

5.3.2 GROWING MEDICAL APPLICATIONS OF CBD

5.4 CHALLENGES

5.4.1 SIDE EFFECTS ASSOCIATED WITH CBD OIL

5.4.2 BARRIERS IN TERMS OF MARKETING OF CBD

6 U.S. CANNABIDIOL (CBD) MARKET, BY CBD TYPE

6.1 OVERVIEW

6.2 HEMP

6.3 MARIJUANA

7 U.S. CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CBD OIL

7.2.1 CARBON DIOXIDE EXTRACTION

7.2.2 STEAM DISTILLATION

7.2.3 SOLVENT EXTRACTION

7.2.4 OTHERS

7.3 CBD ISOLATES

7.4 CBD CONCENTRATES

7.5 OTHERS

8 U.S. CANNABIDIOL (CBD) MARKET, BY CBD CATEGORY

8.1 OVERVIEW

8.2 FULL-SPECTRUM

8.3 BROAD SPECTRUM

9 U.S. CANNABIDIOL (CBD) MARKET, BY NATURE

9.1 OVERVIEW

9.2 ORGANIC

9.3 INORGANIC

10 U.S. CANNABIDIOL (CBD) MARKET, BY GRADE

10.1 OVERVIEW

10.2 FOOD

10.3 THERAPEUTIC

11 U.S. CANNABIDIOL (CBD) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 TINCTURE

11.3 FOOD

11.3.1 CHOCOLATE & CONFECTIONARY

11.3.1.1 CANDY

11.3.1.2 CHOCOLATE

11.3.1.3 CHEWS

11.3.1.4 GUMMIES

11.3.1.5 OTHERS

11.3.2 HONEY

11.3.3 DAIRY BASED EDIBLE

11.3.3.1 MILK

11.3.3.2 ICE CREAM

11.3.3.3 OTHERS

11.3.4 SAUCES & SEASONINGS

11.3.5 BAKERY EDIBLE

11.3.5.1 COOKIES & BISCUITS

11.3.5.2 BROWNIES

11.3.5.3 OTHERS

11.3.6 OTHERS

11.4 BEVERAGES

11.4.1 NON-ALCOHOLIC BEVERAGES

11.4.1.1 ENERGY DRINKS

11.4.1.2 SOFT DRINKS

11.4.1.3 RTD COFFEE

11.4.1.4 TEA

11.4.1.5 SPARKLING WATER

11.4.1.6 OTHERS

11.4.2 FLAVORED DRINKS

11.4.2.1 ORANGE

11.4.2.2 LEMON

11.4.2.3 BERRIES

11.4.2.4 COCONUT

11.4.2.5 OTHERS

11.4.3 ALCOHOLIC BEVERAGES

11.4.3.1 BEER

11.4.3.2 WINE

11.4.3.3 OTHERS

11.4.4 OTHERS

11.5 PHARMACEUTICAL

11.5.1 DRAVET SYNDROME

11.5.2 MULTIPLE SCLEROSIS DRUG APPLICATION

11.5.3 NEUROLOGICAL DRUG APPLICATION

11.5.4 CANCER DRUG APPLICATION

11.5.5 OTHERS

11.6 TOPICALS

11.6.1 LOTION

11.6.2 SALVE

11.6.3 LIP BALM

11.6.4 OTHERS

11.7 DIETARY SUPPLEMENTS

11.7.1 CAPSULES

11.7.2 GUMMIES

11.7.3 OTHERS

11.8 OTHERS

12 U.S. CANNABIDIOL (CBD) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

12.2 FACILITY EXPANSION

12.3 PRODUCT LAUNCHES

12.4 FACILITY EXPANSIONS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 CRESCO LABS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 ECOGEN BIOSCIENCES

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT UPDATES

14.3 CANOPY GROWTH CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 VALENS COMPANY INC. (2021)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 OPEN BOOK EXTRACTS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 GROFF NORTH AMERICA HEMPLEX

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 HEALTHY FOOD INGREDIENTS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 KND LABS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 SOCATI

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 SAWYER LABS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF TRUE HEMP "CANNABIS SATIVA L." PROCESSED BUT NOT SPUN; TOW AND WASTE OF HEMP, INCL. YARN; HS CODE - 530290 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TRUE HEMP "CANNABIS SATIVA L." PROCESSED BUT NOT SPUN; TOW AND WASTE OF HEMP, INCL. YARN; HS CODE - 530290 (USD THOUSAND)

TABLE 3 U.S. CANNABIDIOL (CBD) MARKET, BY CBD TYPE, 2020-2029 (USD MILLION)

TABLE 4 U.S. CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.S. CBD OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 6 U.S. CANNABIDIOL (CBD) MARKET, BY CBD CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 U.S. CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 8 U.S. CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 9 U.S. CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION

TABLE 10 U.S. FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 U.S. CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 U.S. DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.S. ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.S. PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 19 U.S. TOPICALS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 U.S. CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 2 U.S. CANNABIDIOL (CBD) MARKET: DATA TRIANGULATION

FIGURE 3 U.S. CANNABIDIOL (CBD) MARKET: DROC ANALYSIS

FIGURE 4 U.S. CANNABIDIOL (CBD) MARKET: U.S. MARKET ANALYSIS

FIGURE 5 U.S. CANNABIDIOL (CBD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. CANNABIDIOL (CBD) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 U.S. CANNABIDIOL (CBD) MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. CANNABIDIOL (CBD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. CANNABIDIOL (CBD) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. CANNABIDIOL (CBD) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 U.S. CANNABIDIOL (CBD) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 U.S. CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR CBD IN HEALTH AND FITNESS IS EXPECTED TO DRIVE U.S. CANNABIDIOL (CBD) MARKET IN THE FORECAST PERIOD

FIGURE 14 HEMP CBD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. CANNABIDIOL (CBD) MARKET IN 2022 & 2029

FIGURE 15 AVERAGE PRICE ANALYSIS FOR U.S. CANNABIDIOL (CBD) MARKET (USD/KG)

FIGURE 16 AVERAGE PRODUCTION/SUPPLY TREND FOR U.S. CANNABIDIOL (CBD) MARKET (TONS)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF U.S. CANNABIDIOL (CBD) MARKET

FIGURE 18 U.S. CANNABIDIOL (CBD) MARKET: BY CBD TYPE, 2021

FIGURE 19 U.S. CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 U.S. CANNABIDIOL (CBD) MARKET: BY CBD CATEGORY, 2021

FIGURE 21 U.S. CANNABIDIOL (CBD) MARKET: BY NATURE, 2021

FIGURE 22 U.S. CANNABIDIOL (CBD) MARKET: BY GRADE, 2021

FIGURE 23 U.S. CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2021

FIGURE 24 U.S. CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。