Asia Pacific Fibc Packaging Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

2.48 Billion

USD

3.96 Billion

2025

2033

USD

2.48 Billion

USD

3.96 Billion

2025

2033

| 2026 –2033 | |

| USD 2.48 Billion | |

| USD 3.96 Billion | |

|

|

|

|

تقسيم سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ، حسب نوع المنتج (النوع أ، النوع ب، النوع ج (موصل)، النوع د (مبدد للشحنات الساكنة))، حسب تصميم الكيس (كيس ذو حواجز (كيس Q)، كيس ذو لوحة U، كيس ذو أربع لوحات، كيس دائري/أنبوبي)، حسب التطبيق (المواد الكيميائية (2000)، الأغذية والمشروبات (1000 و1100)، الزراعة (0100)، المستحضرات الصيدلانية (2100)، البناء (4100)، التعدين والمعادن (0100 و0001)، النفايات وإعادة التدوير (3800)، أخرى)، حسب المستخدم النهائي (مصنعو المواد الكيميائية (2000)، المنتجون الزراعيون والتعاونيات (0100)، مصنعو الأغذية وموردي المكونات (1000 و1100)، مقاولو البناء (4100)، شركات التعدين (0100 و0001)، شركات المستحضرات الصيدلانية) (2100)، شركات إدارة النفايات وإعادة التدوير (3800)، أخرى)، حسب قناة التوزيع (غير مباشرة، مباشرة) - اتجاهات الصناعة والتوقعات حتى عام 2033

حجم سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

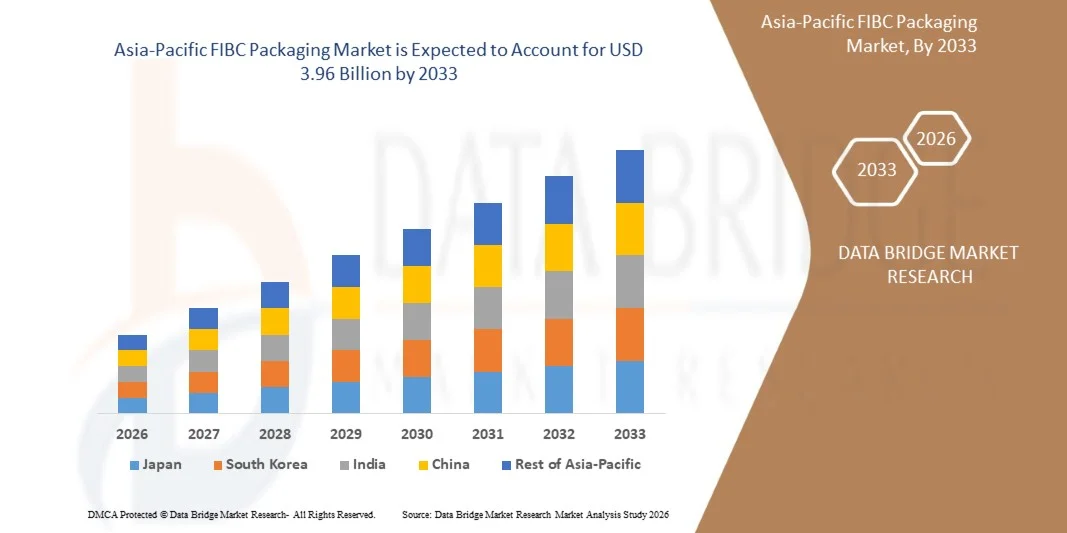

- بلغت قيمة سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ 2.48 مليار دولار أمريكي في عام 2025، ومن المتوقع أن تصل إلى 3.96 مليار دولار أمريكي بحلول عام 2033 ، بمعدل نمو سنوي مركب قدره 6.1% خلال فترة التوقعات.

- يشهد سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ نموًا مطردًا مدفوعًا بالطلب من القطاعات الصناعية مثل الكيماويات والأغذية والمشروبات ومواد البناء والمنتجات الزراعية. كما يدعم توسع السوق ازدياد التجارة البينية في منطقة آسيا والمحيط الهادئ، وأنشطة التصدير، والحاجة إلى حلول تخزين ونقل فعالة للبضائع السائبة.

- إن التركيز المتزايد على الخدمات ذات القيمة المضافة، بما في ذلك حلول FIBC المخصصة، وتكامل 3PL/4PL، وتخزين المنتجات السائبة الحساسة في بيئة خاضعة للتحكم، يعزز مكانة منطقة آسيا والمحيط الهادئ كسوق ناشئة ذات إمكانات نمو قوية على المدى الطويل في حلول التعبئة والتغليف السائبة.

تحليل سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

- يشمل سوق تغليف FIBC في منطقة آسيا والمحيط الهادئ إنتاج وتوزيع واستخدام حلول التغليف بالجملة (أكياس FIBC) في مختلف الصناعات، مثل الكيماويات والمنتجات الزراعية ومواد البناء والأدوية وغيرها. ويُعزى النمو إلى تزايد الطلب على حلول التخزين والنقل والمناولة الفعّالة، مدعومًا بتزايد التجارة البينية في منطقة آسيا والمحيط الهادئ، والنشاط الصناعي، والخدمات اللوجستية للتجارة الإلكترونية.

- من المتوقع أن تهيمن الصين على سوق تغليف FIBC في منطقة آسيا والمحيط الهادئ بحصة سوقية تبلغ 19.93% بحلول عام 2026، كما يُتوقع أن تسجل أعلى معدل نمو سنوي مركب خلال فترة التوقعات، وذلك بفضل قاعدتها الصناعية القوية، وقطاع التصنيع المتقدم، والاستثمارات الكبيرة في الخدمات اللوجستية والبنية التحتية لتغليف FIBC، واعتمادها الاستراتيجي لحلول مناولة المواد السائبة المبتكرة من قبل الصناعات الرئيسية.

- من المتوقع أن تهيمن منتجات حاويات التخزين المرنة من النوع A على سوق آسيا والمحيط الهادئ، حيث ستستحوذ على الحصة الأكبر بنسبة 37.84%، وذلك بفضل تنوع استخداماتها وفعاليتها من حيث التكلفة وملاءمتها للتعامل مع مجموعة واسعة من المواد السائبة في التطبيقات الصناعية والزراعية.

نطاق التقرير وتجزئة سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

|

صفات |

رؤى رئيسية حول سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ |

|

القطاعات التي تم تغطيتها |

|

|

الدول المشمولة |

منطقة آسيا والمحيط الهادئ

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات بيانات القيمة المضافة |

بالإضافة إلى المعلومات المتعلقة بسيناريوهات السوق مثل قيمة السوق ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها شركة Data Bridge Market Research أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على الطاقة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاهات الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام/المستهلكات، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

اتجاهات سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

" التكامل مع التعبئة والتغليف الرقمية والآلية لأكياس FIBC "

- تقوم الشركات بشكل متزايد بدمج حاويات FIBC في أنظمة التخزين الآلية وأنظمة مناولة المواد، مما يتيح حركة أسرع وأكثر أمانًا وكفاءة للمنتجات السائبة داخل المستودعات ومراكز التوزيع.

- إن اعتماد تقنيات إدارة وتتبع المخزون الرقمي يسمح بالمراقبة في الوقت الفعلي لمخزونات حاويات التخزين المرنة (FIBC)، مما يحسن من وضوح سلسلة التوريد، ويقلل من الأخطاء، ويحسن من استخدام مساحة المستودعات.

- يدعم التكامل مع حلول الخدمات اللوجستية المتقدمة عمليات الإنتاج بكميات كبيرة وتوزيع التجارة الإلكترونية، مما يدفع الطلب على حلول التعبئة والتغليف FIBC الموحدة والمتينة والمتوافقة مع الأتمتة في القطاعات الصناعية والتجارية.

على سبيل المثال،

- في أبريل 2024، افتتحت شركة باكم أوماسري المحدودة (مشروع مشترك بين شركة باكم البرازيلية وشركة أوماسري تيكسبلاست الهندية) ما يُرجّح أنه أول مصنع في الهند يُنتج أكياس FIBC مستدامة بنسبة 100% من زجاجات PET المعاد تدويرها (rPET). يستخدم هذا المصنع، الذي يُحوّل الزجاجات إلى أكياس، والواقع بالقرب من أحمد آباد، تقنية إنتاج متطورة لتحويل PET المُستهلك إلى أكياس FIBC عالية الأداء.

- في أبريل 2023، أعلنت شركة LC Packaging International BV عن "حل إعادة تدوير مغلق" لأكياس FIBC بالشراكة مع شركة إعادة التدوير RAFF Plastics، بهدف جمع الأكياس الكبيرة المستخدمة وإعادة تدويرها وإعادة إدخال المواد بما يتماشى مع أهداف الاقتصاد الدائري.

ديناميكيات سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

السائق

"تزايد التجارة عبر الحدود للمواد الكيميائية ومكونات الأغذية"

- يؤدي تزايد التجارة عبر الحدود للمواد الكيميائية ومكونات الأغذية إلى زيادة الطلب على حلول التعبئة والتغليف بالجملة مثل حاويات FIBC، حيث يحتاج المصدرون والمستوردون إلى حاويات آمنة ومتينة وموحدة لنقل المواد بكفاءة عبر الأسواق الدولية.

- يؤدي التوسع في قطاعات التصنيع الكيميائي وتصنيع الأغذية والصناعات الزراعية إلى زيادة الحاجة إلى أنظمة تخزين ومناولة منظمة، مما يشجع الشركات على الاستثمار في أكياس FIBC المتخصصة ذات السعة العالية للمواد الخام والمنتجات الوسيطة والسلع النهائية.

- تعتمد الشركات تقنيات سلسلة التوريد الحديثة، بما في ذلك إدارة المخزون، والمعالجة الآلية، وتحسين الخدمات اللوجستية، لضمان حركة أسرع وأكثر أمانًا وموثوقية عبر الحدود للسلع السائبة، مما يدعم بشكل مباشر نمو سوق تغليف FIBC في منطقة آسيا والمحيط الهادئ.

على سبيل المثال

- في ديسمبر 2024، أفاد مؤتمر الأمم المتحدة للتجارة والتنمية (الأونكتاد) أن التجارة العالمية في السلع من المتوقع أن تصل إلى ما يقرب من 33 تريليون دولار أمريكي في عام 2024، بزيادة قدرها تريليون دولار أمريكي عن العام السابق، مما يعكس طفرة واسعة النطاق في تجارة السلع عبر القطاعات بما في ذلك المواد الكيميائية ومكونات الأغذية.

- في يوليو 2025، أشار مؤتمر الأمم المتحدة للتجارة والتنمية (الأونكتاد) إلى أن التجارة العالمية نمت بنحو 300 مليار دولار أمريكي في النصف الأول من العام، مدفوعة جزئياً باستمرار الواردات والصادرات من الاقتصادات الكبرى، وهو نمو يعني زيادة تدفقات السلع الأساسية عبر الحدود التي تتطلب حلول التعبئة والتغليف بكميات كبيرة.

- أكد تقرير منظمة التجارة العالمية لعام 2024 أن نمو التجارة الدولية لا يزال محركًا رئيسيًا للصناعات التي تعتمد على التجارة، بما في ذلك المواد الكيميائية والسلع الغذائية السائبة، والتي تستخدم عادة الحاويات السائبة وحاويات FIBC للشحن.

ضبط النفس/التحدي

"تقلب أسعار البولي بروبيلين واضطرابات الإمداد تؤثر على تكلفة حاويات FIBC"

- تؤثر أسعار البولي بروبيلين المتقلبة بشكل مباشر على تكلفة تصنيع حاويات FIBC، مما يؤدي إلى ارتفاع الأسعار للمستخدمين النهائيين ويؤثر على هوامش الربح الإجمالية للمنتجين والموزعين.

- يمكن أن تؤدي اضطرابات سلسلة التوريد، بما في ذلك نقص المواد الخام أو القيود اللوجستية، إلى تأخير جداول إنتاج وتسليم حاويات FIBC، مما يؤثر على الصناعات التي تعتمد على حلول التعبئة والتغليف بالجملة في الوقت المناسب.

- إن تقلبات توافر المواد الخام تشجع المصنعين على استكشاف استراتيجيات التوريد البديلة، لكن عدم اتساق الإمدادات وعدم استقرار التكاليف لا يزالان يمثلان تحديًا رئيسيًا لنمو السوق وإمكانية التنبؤ بالأسعار.

على سبيل المثال،

- في سبتمبر 2023، أفادت شركة ChemAnalyst أن أسعار البولي بروبيلين ارتفعت في جميع أنحاء أوروبا بعد تعليق عمليات العديد من المصانع الرئيسية لمدة شهر واحد (بما في ذلك مصنع Borealis)، مما أدى إلى عجز شهري في الإمدادات يقدر بنحو 13333 طن متري.

- في يناير 2024، أشارت أخبار سوق المشتريات إلى أن أسعار البولي بروبيلين في أوروبا ارتفعت بشكل طفيف بسبب انخفاض الواردات من آسيا والشرق الأوسط نتيجة لاضطرابات الشحن العالمية (مثل مخاطر العبور في البحر الأحمر) التي أدت إلى تضييق العرض المحلي.

- في فبراير 2025، أظهرت تقارير أسعار البولي بروبيلين في السوق الآسيوية انخفاضًا في إمدادات البولي بروبيلين بسبب توقف المصانع ونقص الإمدادات الإقليمية؛ ونتيجة لذلك، اضطر بعض المشترين الآسيويين إلى العودة إلى استخدام الراتنج المحلي ذي التكلفة الأعلى، مما زاد الضغط على أسعار البولي بروبيلين.

نطاق سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

ينقسم سوق تغليف FIBC العالمي في منطقة آسيا والمحيط الهادئ إلى خمسة قطاعات بارزة تستند إلى نوع المنتج، وبنية الكيس، والتطبيق، والاستخدام النهائي، وقناة التوزيع.

حسب نوع المنتج

على أساس نوع المنتج، يتم تقسيم سوق تغليف FIBC العالمي في منطقة آسيا والمحيط الهادئ إلى النوع أ، والنوع ب، والنوع ج (الموصل)، والنوع د (المبدد للكهرباء الساكنة).

من المتوقع أن يهيمن النوع "أ" على السوق بحصة تبلغ 37.84%، وأن يحقق أعلى معدل نمو سنوي مركب بنسبة 6.2%، وذلك بفضل انخفاض تكلفته، وتوافره الواسع، واستخدامه المكثف في تطبيقات المواد السائبة غير الخطرة. إن تنوع استخداماته، وسهولة تصنيعه، والطلب القوي عليه من الصناعات ذات الأحجام الكبيرة، مثل الزراعة، ومكونات الأغذية، ومواد البناء، والمواد الكيميائية العامة، تجعل أكياس "أ" المرنة ذات الأغشية المتمددة الخيار الأمثل للتعبئة السائبة. إضافةً إلى ذلك، فإن التوسع السريع في صادرات السلع الأساسية في الاقتصادات الناشئة، والتحول المتزايد نحو حلول التعبئة والتغليف الفعالة من حيث التكلفة، يُعززان ريادة أكياس "أ" المرنة ذات الأغشية المتمددة في السوق.

بناء بواسطة باغ

على أساس تصميم الكيس، يتم تقسيم سوق تغليف FIBC العالمي في منطقة آسيا والمحيط الهادئ إلى أكياس ذات حواجز (أكياس Q)، وأكياس ذات لوحة U، وأكياس ذات أربع لوحات، وأكياس دائرية / أنبوبية.

من المتوقع أن يهيمن قطاع الأكياس ذات الحواجز (أكياس Q) على السوق بنسبة 37.26%، محققًا أعلى معدل نمو سنوي مركب بنسبة 7.4%، وذلك بفضل قدرتها الفائقة على الحفاظ على شكلها، وكفاءة تكديسها المحسّنة، واستغلالها الأمثل للمساحة أثناء التخزين والنقل. توفر أكياس Q كفاءة استخدام مساحة أفضل بنسبة تتراوح بين 30 و40% مقارنةً بأكياس FIBC التقليدية، مما يجعلها الخيار الأمثل في الصناعات التي تتطلب تغليفًا مكعب الشكل وثابتًا، مثل مكونات الأغذية، والأدوية، والمواد الكيميائية، والمساحيق عالية الكثافة. إن قدرتها على الحفاظ على شكل موحد، والحد من الانتفاخ، وتحسين سعة تحميل الحاويات، تُخفض تكاليف الخدمات اللوجستية بشكل ملحوظ، مما يدفع إلى اعتمادها بقوة في سلاسل التوريد العالمية. بالإضافة إلى ذلك، فإن الطلب المتزايد على التغليف بالجملة الموجه للتصدير، والتحول نحو أنظمة إدارة المستودعات الفعالة من حيث التكلفة، يعزز ريادة أكياس Q في سوق أكياس FIBC.

عن طريق التقديم

على أساس التطبيق، يتم تقسيم سوق تغليف FIBC العالمي في منطقة آسيا والمحيط الهادئ إلى المواد الكيميائية (2000)، والأغذية والمشروبات (1000 و1100)، والزراعة (0100)، والمستحضرات الصيدلانية (2100)، والبناء (4100)، والتعدين والمعادن (0100 و0001)، والنفايات وإعادة التدوير (3800)، وغيرها.

من المتوقع أن يهيمن قطاع الكيماويات (2000) على السوق بحصة تبلغ 37.44%، وأن يحقق أعلى معدل نمو سنوي مركب بنسبة 6.0%، وذلك بفضل اعتماده الكبير على حاويات FIBC لنقل المساحيق والحبيبات والراتنجات والمضافات والمواد الوسيطة عبر سلاسل إمداد البتروكيماويات والكيماويات المتخصصة والكيماويات الصناعية. تُعد صناعة الكيماويات من أكبر المستهلكين العالميين لعبوات التغليف السائبة، مدفوعةً بأحجام الإنتاج الكبيرة، والشحنات العابرة للحدود المتكررة، ومتطلبات السلامة الصارمة في التعامل مع المواد الخطرة والحساسة للرطوبة. توفر حاويات FIBC متانة فائقة، وتحكمًا فعالًا في التلوث، وكفاءة في التكلفة، وتوافقًا مع معايير الأمم المتحدة للبضائع الخطرة، مما يجعلها خيار التغليف المفضل لمصنعي الكيماويات. بالإضافة إلى ذلك، يُعزز تزايد الاستثمار في الكيماويات المتخصصة، وتوسع إنتاج البوليمرات في منطقة آسيا والمحيط الهادئ، وزيادة التجارة العالمية للمركبات الكيميائية، هيمنة قطاع الكيماويات القوية على السوق.

حسب الاستخدام النهائي

على أساس الاستخدام النهائي، يتم تقسيم سوق تغليف FIBC العالمي في منطقة آسيا والمحيط الهادئ إلى مصنعي المواد الكيميائية (2000)، والمنتجين الزراعيين والتعاونيات (0100)، ومصنعي الأغذية وموردي المكونات (1000 و1100)، ومقاولي البناء (4100)، وشركات التعدين (0100 و0001)، وشركات الأدوية (2100)، وشركات إدارة النفايات وإعادة التدوير (3800)، وغيرها.

من المتوقع أن يهيمن قطاع مصنعي المواد الكيميائية (2000) على السوق بنسبة 36.30%، محققًا أعلى معدل نمو سنوي مركب بنسبة 5.9%، وذلك نظرًا للطلب المرتفع للغاية على حاويات FIBC في مناولة وتخزين ونقل المواد الكيميائية السائبة والبوليمرات والمواد الوسيطة والمركبات المتخصصة على مستوى العالم. وتتعامل الصناعة الكيميائية مع كميات كبيرة من المساحيق والحبيبات والراتنجات والمواد الخطرة التي تتطلب حلول تغليف آمنة وفعالة ومتوافقة مع المعايير. وتوفر حاويات FIBC، وخاصة الأنواع B وC وD، حماية فائقة ضد التلوث والرطوبة والمخاطر الكهروستاتيكية، وهي عوامل بالغة الأهمية في البيئات الكيميائية. بالإضافة إلى ذلك، ساهم ارتفاع إنتاج المواد الكيميائية في منطقة آسيا والمحيط الهادئ، وزيادة صادرات البتروكيماويات والمواد الكيميائية المتخصصة، واللوائح العالمية الصارمة لتغليف المواد الخطرة، في تعزيز استخدام حاويات FIBC في هذا القطاع بشكل ملحوظ.

عن طريق قناة التوزيع

على أساس قناة التوزيع، يتم تقسيم سوق تغليف FIBC العالمي في منطقة آسيا والمحيط الهادئ إلى غير مباشر ومباشر.

من المتوقع أن يهيمن قطاع التوزيع غير المباشر على السوق بحصة تبلغ 62.96%، وأن يحقق أعلى معدل نمو سنوي مركب بنسبة 5.9%، وذلك بفضل انتشاره الواسع، وشبكات التوريد الراسخة، وحضوره القوي في مختلف قطاعات الاستخدام النهائي. ويلعب الموزعون والتجار دورًا محوريًا في توفير توافر موثوق، وتسليم سريع، وأسعار تنافسية، مما يجعلهم الخيار المفضل للمشترين من الشركات الصغيرة والمتوسطة. بالإضافة إلى ذلك، ساهم التوسع السريع لمنصات التجارة الإلكترونية في تعزيز مبيعات التوزيع غير المباشر بشكل ملحوظ، من خلال توفير رؤية أوسع للمنتجات، وتسهيل عمليات الشراء، وتبسيط مقارنة أنواع حاويات FIBC.

تحليل إقليمي لسوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

- تمثل منطقة آسيا والمحيط الهادئ (بقيادة الصين والهند واليابان وكوريا الجنوبية) سوقًا إقليميًا هامًا لتغليف FIBC، حيث تستحوذ الصين على الحصة الأكبر بنسبة 19.93% من الطلب الإقليمي. ويدعم هذا السوق قطاعات صناعية قوية، تشمل الكيماويات والمنتجات الزراعية ومواد البناء والأدوية، والتي تعتمد على التغليف بالجملة للمواد الجافة والمساحيق والسلع الصناعية. ومن المتوقع أن تشهد المنطقة نموًا مطردًا، مدفوعًا بالتجارة البينية في منطقة آسيا والمحيط الهادئ، وتوسع قطاع التصنيع، وزيادة استخدام FIBC للتخزين والنقل الفعالين للمواد السائبة.

- تستفيد منطقة آسيا والمحيط الهادئ من بنية تحتية صناعية متطورة، ومعايير تنظيمية صارمة (خاصةً فيما يتعلق بسلامة المواد الكيميائية والأغذية والأدوية)، وشبكات لوجستية وتخزينية متطورة. ويعزز التوجه المتزايد نحو حلول حاويات التعبئة والتغليف المرنة ذات القيمة المضافة، وأتمتة المستودعات، ومرافق التخزين المتخصصة، من انتشارها في السوق، بينما تضمن ريادة الصين كأكبر مساهم إمكانات نمو مستقرة واستمرار الاستثمار في حلول التعبئة والتغليف بالجملة في جميع أنحاء المنطقة.

نظرة عامة على سوق عبوات FIBC في الصين ومنطقة آسيا والمحيط الهادئ

تُعدّ الصين أكبر سوق لتغليف FIBC في منطقة آسيا والمحيط الهادئ، حيث تستحوذ على الطلب الإقليمي بفضل قاعدتها الصناعية القوية وقطاعاتها التصنيعية المتقدمة. وتعتمد صناعات رئيسية، مثل الكيماويات والمنتجات الزراعية ومواد البناء والأدوية، اعتمادًا كبيرًا على FIBC لتخزين ونقل المساحيق والحبيبات والسلع الجافة بكميات كبيرة وبشكل آمن وفعال. ويدعم نمو السوق بنية تحتية لوجستية حديثة، ومعايير تنظيمية صارمة، واعتماد أنظمة أتمتة المستودعات وأنظمة إدارة المخزون الرقمية. وتُهيمن منتجات FIBC من النوع A على السوق، حيث تُشكّل حصتها الأكبر، وذلك بفضل تنوّع استخداماتها وفعاليتها من حيث التكلفة وملاءمتها لمختلف تطبيقات مناولة المواد السائبة.

حصة سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

تتولى شركات راسخة قيادة صناعة تغليف FIBC بشكل أساسي، بما في ذلك:

- شركة أمكور بي إل سي (سويسرا)

- آي بي جي (الولايات المتحدة)

- غريف (الولايات المتحدة)

- شركة إل سي للتغليف (هولندا)

- شركة منتجات سونيكو (الولايات المتحدة الأمريكية)

- شركة أوماسري تيكسبلاست المحدودة (الهند)

- شركة غاوتشينغ أنثينتي كونتينر باكج المحدودة (الصين)

- شركة فليكسي تاف فنتشرز الدولية المحدودة (الهند)

- شركة شانكار للتغليف المحدودة (الهند)

- شركة BAG (الولايات المتحدة الأمريكية)

- شركة غلوبال باك (الولايات المتحدة الأمريكية)

- شركة بالك-باك (الولايات المتحدة الأمريكية)

آخر التطورات في سوق عبوات FIBC في منطقة آسيا والمحيط الهادئ

- في فبراير 2023، أعلنت شركة LC packaging عن شراكة مع Buenassa (جمهورية الكونغو الديمقراطية) و Shankar Packagings (الهند) لتوزيع حاويات FIBC والإنتاج المحلي في قطاع التعدين في جمهورية الكونغو الديمقراطية.

- في فبراير 2025، استحوذت شركة United Bags, Inc. على شركة BAG Corp، مما أدى إلى توسيع عروض منتجات FIBC بما في ذلك أكياس SUPER SACK الكبيرة لتعزيز قيمة العملاء في التعبئة والتغليف بالجملة.

- في أغسطس 2025، رفعت شركة ساك ميكر مخزونها من أكياس الرمل المعبأة إلى أكثر من 4000 وحدة جاهزة للشحن الفوري، مما عزز جاهزيتها للاستجابة لحالات الطوارئ، والحماية من الفيضانات، ومتطلبات البناء. وتساهم هذه الزيادة في المخزون وسرعة التوصيل في تعزيز موثوقية العمليات خلال فترات ذروة الطلب.

- في مارس، أكملت شركة Greif عملية الاستحواذ على شركة Ipackchem، وهي شركة عالمية رائدة في مجال عبوات الجركن عالية الأداء ذات الحاجز وغير الحاجز والحاويات البلاستيكية الصغيرة، في صفقة نقدية بقيمة 538 مليون دولار أمريكي. وهذا يوسع نطاق منتجات Greif من البلاستيك الصغير / عبوات الجركن على مستوى العالم ويضيف قدرات التعبئة والتغليف ذات الحاجز.

- في عام 2025، عززت شركة جامبو باج المحدودة قدراتها الإنتاجية من خلال مرافق التصنيع المتكاملة بالكامل في تشيناي ومومباي بطاقة إنتاج سنوية تتجاوز 4.3 مليون كيس جامبو (FIBCs)، واستمرت في التركيز على إنتاج أكياس FIBC في غرف نظيفة لتطبيقات الأغذية والأدوية، مما يعكس التزامها بتوسيع حلول التعبئة والتغليف بالجملة عالية الجودة والتي تركز على العملاء.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC FIBC PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 SHIFT FROM PRICE-BASED TO VALUE-BASED PURCHASING

4.2.2 STRONG DEMAND FOR CUSTOMIZATION AND APPLICATION-SPECIFIC DESIGNS

4.2.3 GROWING IMPORTANCE OF TRACEABILITY, QUALITY ASSURANCE, AND CERTIFICATIONS

4.2.4 INCREASING ADOPTION OF SMART PACKAGING TECHNOLOGIES

4.2.5 SUSTAINABILITY AS A CORE PURCHASE DRIVER

4.2.6 PREFERENCE FOR RELIABLE, LARGE-SCALE VENDORS WITH ASIA-PACIFIC REACH

4.2.7 EMPHASIS ON SAFETY AND REGULATORY COMPLIANCE

4.2.8 COLLABORATIVE SUPPLIER RELATIONSHIPS OVER TRANSACTIONAL PURCHASING

4.2.9 INFLUENCE OF ASIA-PACIFIC ECONOMIC CONDITIONS ON BUYING VOLUME

4.2.10 CONCLUSION

4.3 COST ANALYSIS BREAKDOWN – ASIA-PACIFIC FIBC PACKAGING MARKET

4.3.1 INTRODUCTION

4.3.2 MATERIAL COSTS

4.3.3 MANUFACTURING AND PROCESSING COSTS

4.3.4 LABOR AND WORKFORCE COSTS

4.3.5 QUALITY ASSURANCE AND COMPLIANCE COSTS

4.3.6 LOGISTICS AND SUPPLY CHAIN COSTS

4.3.7 PACKAGING, HANDLING, AND POST-PRODUCTION COSTS

4.3.8 OVERHEADS AND ADMINISTRATIVE COSTS

4.3.9 CONCLUSION

4.4 PATENT ANALYSIS – ASIA-PACIFIC FIBC PACKAGING MARKET

4.4.1 INTRODUCTION

4.4.2 PATENT QUALITY AND STRENGTH

4.4.2.1 STRUCTURAL INNOVATION

4.4.2.2 MATERIAL-ORIENTED PATENTS

4.4.2.3 SAFETY-CENTRIC ENHANCEMENTS

4.4.2.4 SUSTAINABILITY-FOCUSED SOLUTIONS

4.4.3 PATENT FAMILIES

4.4.3.1 MATERIAL ENGINEERING FAMILIES

4.4.3.2 STRUCTURAL AND DESIGN FAMILIES

4.4.3.3 FILLING, HANDLING, AND DISCHARGE SYSTEM FAMILIES

4.4.3.4 SAFETY AND STATIC CONTROL FAMILIES

4.4.3.5 REUSABILITY AND SUSTAINABILITY FAMILIES

4.4.4 LICENSING AND COLLABORATIONS

4.4.4.1 MATERIAL SUPPLIER AND MANUFACTURER PARTNERSHIPS

4.4.4.2 TECHNOLOGY INTEGRATION AGREEMENTS

4.4.4.3 INDUSTRY–ACADEMIA COLLABORATION

4.4.4.4 CROSS-INDUSTRY KNOWLEDGE SHARING

4.4.5 REGIONAL PATENT LANDSCAPE

4.4.5.1 EUROPE

4.4.5.2 ASIA-PACIFIC

4.4.5.3 NORTH AMERICA

4.4.5.4 MIDDLE EAST

4.4.6 IP STRATEGY AND MANAGEMENT

4.4.6.1 STRATEGIC PATENT FILING

4.4.6.2 PORTFOLIO DIVERSIFICATION

4.4.6.3 CONTINUOUS MONITORING

4.4.6.4 LIFECYCLE OPTIMIZATION

4.4.6.5 ALIGNMENT WITH SUSTAINABILITY GOALS

4.4.7 CONCLUSION

4.5 PORTERS FIVE FORCES ANALYSIS

4.6 PRICING ANALYSIS

4.7 PROFIT MARGINS SCENARIO IN THE ASIA-PACIFIC FIBC PACKAGING MARKET

4.7.1 INTRODUCTION

4.7.2 RAW MATERIAL COST PRESSURES AND MARGIN SENSITIVITY

4.7.3 OPERATIONAL EFFICIENCY AND PRODUCTION COST OPTIMIZATION

4.7.4 MARKET PRICING DYNAMICS AND COMPETITIVE PRESSURE

4.7.5 REGIONAL PRODUCTION ECONOMICS AND MARGIN VARIABILITY

4.7.6 VALUE-ADDED PRODUCTS AND PREMIUM OFFERINGS

4.7.7 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 POLYPROPYLENE (PP): THE BACKBONE OF FIBC MANUFACTURING

4.8.2 POLYETHYLENE (PE) FOR LINERS AND PROTECTIVE BARRIERS

4.8.3 ADDITIVES AND MASTERBATCHES

4.8.4 CONDUCTIVE YARNS AND THREADS

4.8.5 SEWING THREADS AND WEBBING MATERIALS

4.8.6 FILMS, COATINGS & LAMINATION MATERIALS

4.8.7 RECYCLED PP & SUSTAINABLE MATERIAL STREAMS

4.8.8 METAL AND PLASTIC COMPONENTS

4.8.9 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 OVERVIEW

4.10.2 SMART FIBCS: RFID, QR CODES, AND SENSOR INTEGRATION

4.10.3 MATERIAL SCIENCE UPGRADES: LINERS, COATINGS, AND NANOTECH

4.10.4 SUSTAINABILITY: RECYCLED RESINS, BIODEGRADABLE BLENDS, AND CIRCULAR DESIGN

4.10.5 SAFETY AND COMPLIANCE TECHNOLOGIES

4.10.6 AUTOMATION AND SMARTER FABRICATION

4.10.7 CUSTOMISATION AND APPLICATION-SPECIFIC ENGINEERING

4.10.8 BUSINESS IMPLICATIONS

4.10.9 CHALLENGES AND WHERE THE MARKET GOES NEXT

4.10.10 CONCLUSION

4.11 ASIA-PACIFIC FBIC PACKAGING MARKET – VALUE CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 RAW MATERIAL SUPPLY

4.11.3 COMPONENT MANUFACTURING AND PROCESSING

4.11.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.11.5 DISTRIBUTION AND LOGISTICS

4.11.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.11.7 CONCLUSION

4.12 VENDOR SELECTION CRITERIA

4.12.1 PRODUCT QUALITY & TECHNICAL SPECIFICATIONS

4.12.2 CERTIFICATIONS & REGULATORY COMPLIANCE

4.12.3 MATERIAL INNOVATION & TECHNOLOGY ADOPTION

4.12.4 SUSTAINABILITY CAPABILITIES

4.12.5 CUSTOMISATION AND DESIGN FLEXIBILITY

4.12.6 PRODUCTION SCALE, RELIABILITY & LEAD TIMES

4.12.7 COST STRUCTURE & VALUE FOR MONEY

4.12.8 ASIA-PACIFIC PRESENCE & CUSTOMER SUPPORT

4.12.9 TRACK RECORD, REPUTATION & CLIENT PORTFOLIO

4.12.9.1 ETHICAL, SOCIAL & SAFETY PRACTICES

4.12.10 CONCLUSION

4.13 INNOVATION TRACKER & STRATEGIC ANALYSIS – ASIA-PACIFIC FIBC PACKAGING MARKET

4.13.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.13.1.1 Joint Ventures

4.13.1.2 Mergers and Acquisitions (M&A)

4.13.1.3 Licensing and Partnerships

4.13.1.4 Technology Collaborations

4.13.1.5 Strategic Divestments

4.13.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.13.3 TIMELINES AND MILESTONES

4.13.4 INNOVATION STRATEGIES AND METHODOLOGIES

4.13.5 RISK ASSESSMENT AND MITIGATION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING CROSS-BORDER TRADE OF CHEMICALS, FOOD INGREDIENTS

7.1.2 AGRICULTURAL COMMODITIES USING BULK BAGS

7.1.3 COST EFFICIENCY AND HANDLING BENEFITS OVER DRUMS AND SMALL SACKS

7.1.4 GROWING PREFERENCE FOR REUSABLE/MULTI-TRIP FIBCS

7.2 RESTRAINS

7.2.1 POLYPROPYLENE PRICE VOLATILITY AND SUPPLY DISRUPTIONS IMPACTING FIBC COST

7.2.2 ENVIRONMENTAL REGULATIONS ON PLASTICS AND END-OF-LIFE WASTE MANAGEMENT

7.3 OPPORTUNITY

7.3.1 ADOPTION OF FOOD- AND PHARMA-GRADE FIBCS WITH ADVANCED LINERS AND HYGIENE CERTIFICATIONS

7.3.2 GROWTH IN TYPE C/TYPE D ANTISTATIC SOLUTIONS FOR HAZARDOUS POWDERS

7.3.3 RFID AND TRACK-AND-TRACE ADOPTION ENHANCES FIBC EFFICIENCY

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH UN HAZARDOUS GOODS NORMS AND ELECTROSTATIC SAFETY

7.4.2 QUALITY ASSURANCE, COUNTERFEIT RISKS, AND VARIABILITY IN ASIA-PACIFIC TESTING/STANDARDS

8 ASIA-PACIFIC FIBC PACKAGING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TYPE A

8.2.1 COATED

8.2.2 UNCOATED

8.2.3 UNLINED

8.2.4 PE LINED

8.3 TYPE B

8.3.1 COATED

8.3.2 UNCOATED

8.3.3 UNLINED

8.3.4 PE LINED

8.4 TYPE C (CONDUCTIVE)

8.4.1 EXTERNAL GROUNDING CLIPS

8.4.2 SEWN-IN GROUND TABS

8.4.3 CONDUCTIVE LINER

8.4.4 ANTISTATIC LINER

8.5 TYPE D (STATIC DISSIPATIVE)

8.5.1 STATIC DISSIPATIVE YARNS

8.5.2 CORONA DISCHARGE FABRICS

8.5.3 ANTISTATIC LINER

8.5.4 FOOD-GRADE LINER

9 ASIA-PACIFIC FIBC PACKAGING MARKET, BY BAG CONSTRUCTION

9.1 OVERVIEW

9.2 BAFFLE (Q-BAG)

9.2.1 CORNER BAFFLES

9.2.2 INTERNAL TIES

9.2.3 VENTED

9.2.4 DUST-PROOF

9.3 U-PANEL

9.3.1 4 LOOP

9.3.2 2 LOOP

9.3.3 FLAT

9.3.4 CONICAL

9.3.5 FULL DISCHARGE

9.4 FOUR-PANEL

9.4.1 4-LOOP

9.4.2 SINGLE-POINT LIFT

9.4.3 WITH BAFFLES

9.4.4 WITHOUT BAFFLES

9.5 CIRCULAR / TUBULAR

9.5.1 4-LOOP

9.5.2 2-LOOP

9.5.3 COATED

9.5.4 UNCOATED

10 ASIA-PACIFIC FIBC PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CHEMICALS (2000)

10.2.1 PETROCHEMICALS & POLYMERS

10.2.2 DYES, PIGMENTS & COLORANTS

10.2.3 INDUSTRIAL CHEMICALS

10.2.4 SPECIALTY CHEMICALS & ADDITIVES

10.2.5 DETERGENTS & CLEANING AGENTS

10.2.6 ADHESIVES & SEALANTS RAW MATERIALS

10.2.7 FERTILIZER INTERMEDIATES

10.3 FOOD & BEVERAGES (1000 & 1100)

10.3.1 CEREALS & GRAINS

10.3.2 SUGAR, SALT & FLOUR

10.3.3 NUTS & DRY FRUITS

10.3.4 POWDERED INGREDIENTS & SPICES

10.3.5 PET FOOD & ADDITIVES

10.3.6 OILS & FATS

10.3.7 BEVERAGE RAW MATERIALS

10.4 AGRICULTURE (0100)

10.4.1 GRAINS & SEEDS

10.4.2 FERTILIZERS

10.4.3 ANIMAL FEED & SUPPLEMENTS

10.4.4 FRUIT & VEGETABLE BULK PACKAGING

10.4.5 ORGANIC COMPOST & SOIL AMENDMENTS

10.4.6 HERBS & SPICES (RAW)

10.4.7 BULB & ROOT CROPS

10.5 PHARMACEUTICALS (2100)

10.5.1 ACTIVE PHARMACEUTICAL INGREDIENTS (APIS)

10.5.2 BULK INTERMEDIATES & EXCIPIENTS

10.5.3 NUTRACEUTICAL POWDERS & SUPPLEMENTS

10.5.4 FINE CHEMICALS

10.5.5 COSMETIC & PERSONAL CARE INGREDIENTS

10.5.6 MEDICAL SALT & SALINE

10.6 CONSTRUCTION (4100)

10.6.1 CEMENT & SAND

10.6.2 AGGREGATES

10.6.3 MORTAR & PLASTER PREMIXES

10.6.4 GYPSUM & LIME

10.6.5 INDUSTRIAL POWDERS

10.6.6 ROOFING & INSULATION MATERIALS

10.7 MINING & MINERALS (0100 & 0001)

10.7.1 COAL & COKE FINES

10.7.2 IRON ORE, COPPER ORE, BAUXITE

10.7.3 INDUSTRIAL MINERALS

10.7.4 METAL CONCENTRATES & POWDERS

10.7.5 LIMESTONE & DOLOMITE

10.7.6 PRECIOUS METAL RESIDUES

10.8 WASTE & RECYCLING (3800)

10.8.1 PLASTIC WASTE

10.8.2 CONSTRUCTION & DEMOLITION WASTE

10.8.3 HAZARDOUS & INDUSTRIAL WASTE

10.8.4 SCRAP METAL & METAL POWDERS

10.8.5 COMPOST & ORGANIC WASTE COLLECTION

10.8.6 ELECTRONIC WASTE (E-WASTE)

10.9 OTHERS

10.9.1 TEXTILE FIBERS & YARN WASTE

10.9.2 WOOD CHIPS & BIOMASS PELLETS

10.9.3 RUBBER & TIRE RECYCLING MATERIALS

10.9.4 PAPER & PULP MATERIALS

10.9.5 DEFENSE & RELIEF MATERIALS

10.9.6 HOUSEHOLD GOODS BULK TRANSPORT

11 ASIA-PACIFIC FIBC PACKAGING MARKET, BY END USE

11.1 OVERVIEW

11.2 CHEMICAL MANUFACTURERS (2000)

11.2.1 TYPE C

11.2.2 TYPE B

11.2.3 TYPE D

11.2.4 TYPE A

11.3 AGRICULTURAL PRODUCERS & CO-OPS (0100)

11.3.1 TYPE A

11.3.2 TYPE B

11.3.3 TYPE C

11.3.4 TYPE D

11.4 FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100)

11.4.1 TYPE A

11.4.2 TYPE C

11.4.3 TYPE D

11.4.4 TYPE B

11.5 CONSTRUCTION CONTRACTORS (4100)

11.5.1 TYPE A

11.5.2 TYPE B

11.5.3 TYPE C

11.5.4 TYPE D

11.6 MINING COMPANIES (0100 & 0001)

11.6.1 TYPE A

11.6.2 TYPE C

11.6.3 TYPE D

11.6.4 TYPE B

11.7 PHARMACEUTICAL COMPANIES (2100)

11.7.1 TYPE A

11.7.2 TYPE C

11.7.3 TYPE D

11.7.4 TYPE B

11.8 WASTE MANAGEMENT & RECYCLING FIRMS (3800)

11.8.1 TYPE B

11.8.2 TYPE A

11.8.3 TYPE C

11.8.4 TYPE D

11.9 OTHERS

11.9.1 TYPE A

11.9.2 TYPE B

11.9.3 TYPE C

11.9.4 TYPE D

12 ASIA-PACIFIC FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT

12.2.1 DISTRIBUTORS/DEALERS

12.2.2 ONLINE/E-COMMERCE

12.3 DIRECT

12.3.1 OEM DIRECT SALES

12.3.2 KEY ACCOUNT/ENTERPRISE CONTRACTS

13 ASIA-PACIFIC FIBC PACKAGING MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 INDONESIA

13.1.6 THAILAND

13.1.7 MALAYSIA

13.1.8 AUSTRALIA

13.1.9 PHILIPPINES

13.1.10 TAIWAN

13.1.11 SINGAPORE

13.1.12 NEW ZEALAND

13.1.13 HONG KONG

13.1.14 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC FIBC PACKAGING MARKET

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AMCOR PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVEOPMENT

16.2 IPG.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 GREIF.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 LC PACKAGING

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 SONOCO PRODUCTS COMPANY (CONITEX SONOCO)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACTION BAGS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVEOPMENT

16.7 ALPINE FIBC PVT.LTD

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVEOPMENT

16.8 AMERIGLOBE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVEOPMENT

16.9 BIG BAGS INTERNATIONAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVEOPMENT

16.1 BAG CORP.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVEOPMENT

16.11 BULK-PACK, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVEOPMENT

16.12 CENTURY FIBC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVEOPMENT

16.13 FIBC SILVASSA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVEOPMENT

16.14 FLEXITUFF VENTURES INTERNATIONAL LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVEOPMENT

16.15 GLOBAL-PAK, INC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVEOPMENT

16.16 IPG.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 İŞBIR MEWAR.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 JUMBO BAG LIMITED

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 LANGSTON BAG

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PALMETTO INDUSTRIES INTERNATIONAL INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PACIFICBULKBAGS.COM

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 RDA BULK PACKAGING LTD.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 S.R. INDUSTRY

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SACKMAKER

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SHANKAR PACKAGINGS LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SHREE MARUTI EXIM

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TAIHUA FIBC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TISZATEXTIL

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 UMASREE TEXPLAST PVT. LTD.

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 WOVEN INTERNATIONAL

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 COMAPANY PROFILES DISTRIBUTOR

17.1 HALSTED CORPORATION

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 BULK BAG DEPOT

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 MIDWESTERN BAG

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 NATIONAL BULK BAG (A SUBSIDIARY COMPANY OF RAPID PACKAGING)

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 FIBC DIRECT

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 CONSUMER PREFERENCE MATRIX

TABLE 3 ILLUSTRATIVE PROFIT MARGINS OF FIBC PRODUCTS (2018–2024)

TABLE 4 STAGE OF DEVELOPMENT

TABLE 5 INNOVATION AND STRATEGIC MILESTONES TIMELINE (2018–2024)

TABLE 6 ASIA-PACIFIC FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC TYPE C IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC CIRCULAR / TUBULAR IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC INDIRECT IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC DIRECT IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC FIBC PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 83 ASIA-PACIFIC BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 85 ASIA-PACIFIC U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 87 ASIA-PACIFIC FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 88 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 89 ASIA-PACIFIC CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 90 ASIA-PACIFIC FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 ASIA-PACIFIC CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 ASIA-PACIFIC FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 ASIA-PACIFIC AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 ASIA-PACIFIC PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 ASIA-PACIFIC CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 ASIA-PACIFIC MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 ASIA-PACIFIC WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 ASIA-PACIFIC FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 100 ASIA-PACIFIC CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 ASIA-PACIFIC AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 ASIA-PACIFIC FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 ASIA-PACIFIC CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 ASIA-PACIFIC MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 ASIA-PACIFIC PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 ASIA-PACIFIC WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 ASIA-PACIFIC OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 ASIA-PACIFIC FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 ASIA-PACIFIC INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 ASIA-PACIFIC DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 CHINA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 CHINA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 113 CHINA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 114 CHINA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 115 CHINA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 116 CHINA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 117 CHINA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 118 CHINA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 119 CHINA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 120 CHINA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 121 CHINA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 122 CHINA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 123 CHINA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 124 CHINA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 CHINA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 126 CHINA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 127 CHINA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 128 CHINA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 129 CHINA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 130 CHINA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 CHINA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 CHINA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 CHINA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 CHINA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 CHINA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 CHINA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 CHINA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 CHINA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 139 CHINA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 CHINA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 CHINA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 CHINA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 CHINA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 CHINA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 CHINA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 CHINA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 CHINA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 148 CHINA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 CHINA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 INDIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 INDIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 152 INDIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 153 INDIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 154 INDIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 155 INDIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 156 INDIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 157 INDIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 158 INDIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 159 INDIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 160 INDIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 161 INDIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 162 INDIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 163 INDIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 INDIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 165 INDIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 166 INDIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 167 INDIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 168 INDIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 169 INDIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 INDIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 INDIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 INDIA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 INDIA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 INDIA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 INDIA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 INDIA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 INDIA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 178 INDIA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 INDIA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 INDIA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 INDIA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 INDIA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 INDIA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 INDIA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 INDIA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 INDIA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 187 INDIA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 INDIA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 JAPAN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 JAPAN TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 191 JAPAN TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 192 JAPAN TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 193 JAPAN TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 194 JAPAN TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 195 JAPAN TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 196 JAPAN TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 197 JAPAN TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 198 JAPAN FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 199 JAPAN BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 200 JAPAN BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 201 JAPAN U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 202 JAPAN U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 JAPAN FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 204 JAPAN FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 205 JAPAN CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 206 JAPAN CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 207 JAPAN FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 208 JAPAN CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 JAPAN FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 JAPAN AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 JAPAN PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 JAPAN CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 JAPAN MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 JAPAN WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 JAPAN OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 JAPAN FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 217 JAPAN CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 JAPAN AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 JAPAN FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 JAPAN CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 JAPAN MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 JAPAN PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 JAPAN WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 JAPAN OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 JAPAN FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 226 JAPAN INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 JAPAN DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 SOUTH KOREA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 SOUTH KOREA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 230 SOUTH KOREA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 231 SOUTH KOREA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 232 SOUTH KOREA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 233 SOUTH KOREA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 234 SOUTH KOREA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 235 SOUTH KOREA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 236 SOUTH KOREA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 237 SOUTH KOREA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 238 SOUTH KOREA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 239 SOUTH KOREA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 240 SOUTH KOREA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 241 SOUTH KOREA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 SOUTH KOREA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 243 SOUTH KOREA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 244 SOUTH KOREA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 245 SOUTH KOREA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 246 SOUTH KOREA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 247 SOUTH KOREA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 SOUTH KOREA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 SOUTH KOREA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 SOUTH KOREA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 SOUTH KOREA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 SOUTH KOREA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 SOUTH KOREA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 SOUTH KOREA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 SOUTH KOREA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 256 SOUTH KOREA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 SOUTH KOREA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 SOUTH KOREA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 SOUTH KOREA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 SOUTH KOREA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 SOUTH KOREA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 SOUTH KOREA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 SOUTH KOREA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 SOUTH KOREA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 265 SOUTH KOREA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 SOUTH KOREA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 INDONESIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 INDONESIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 269 INDONESIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 270 INDONESIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 271 INDONESIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 272 INDONESIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 273 INDONESIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 274 INDONESIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 275 INDONESIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 276 INDONESIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 277 INDONESIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 278 INDONESIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 279 INDONESIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 280 INDONESIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 INDONESIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 282 INDONESIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 283 INDONESIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 284 INDONESIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 285 INDONESIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 286 INDONESIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 INDONESIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 INDONESIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 INDONESIA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 INDONESIA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 INDONESIA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 INDONESIA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 INDONESIA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 INDONESIA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 295 INDONESIA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 INDONESIA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 INDONESIA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 INDONESIA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 INDONESIA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 300 INDONESIA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 301 INDONESIA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 INDONESIA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 INDONESIA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 304 INDONESIA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 305 INDONESIA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 THAILAND FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 307 THAILAND TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 308 THAILAND TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 309 THAILAND TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 310 THAILAND TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 311 THAILAND TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 312 THAILAND TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 313 THAILAND TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 314 THAILAND TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 315 THAILAND FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 316 THAILAND BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 317 THAILAND BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 318 THAILAND U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 319 THAILAND U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 THAILAND FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 321 THAILAND FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 322 THAILAND CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 323 THAILAND CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 324 THAILAND FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 325 THAILAND CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 THAILAND FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 327 THAILAND AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 THAILAND PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 THAILAND CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 330 THAILAND MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 THAILAND WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 THAILAND OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 THAILAND FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 334 THAILAND CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 335 THAILAND AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 336 THAILAND FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 337 THAILAND CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 338 THAILAND MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 339 THAILAND PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 340 THAILAND WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 341 THAILAND OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 342 THAILAND FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 343 THAILAND INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 344 THAILAND DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 345 MALAYSIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 346 MALAYSIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 347 MALAYSIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 348 MALAYSIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 349 MALAYSIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 350 MALAYSIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 351 MALAYSIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 352 MALAYSIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 353 MALAYSIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 354 MALAYSIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 355 MALAYSIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 356 MALAYSIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 357 MALAYSIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 358 MALAYSIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 359 MALAYSIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 360 MALAYSIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 361 MALAYSIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 362 MALAYSIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 363 MALAYSIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 364 MALAYSIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 365 MALAYSIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 366 MALAYSIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 367 MALAYSIA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 368 MALAYSIA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 369 MALAYSIA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 370 MALAYSIA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 371 MALAYSIA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 372 MALAYSIA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 373 MALAYSIA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 374 MALAYSIA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 375 MALAYSIA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 376 MALAYSIA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 377 MALAYSIA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 378 MALAYSIA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 379 MALAYSIA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 380 MALAYSIA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 381 MALAYSIA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 382 MALAYSIA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 383 MALAYSIA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 384 AUSTRALIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 385 AUSTRALIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 386 AUSTRALIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 387 AUSTRALIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 388 AUSTRALIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 389 AUSTRALIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 390 AUSTRALIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 391 AUSTRALIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 392 AUSTRALIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 393 AUSTRALIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 394 AUSTRALIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 395 AUSTRALIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 396 AUSTRALIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 397 AUSTRALIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 398 AUSTRALIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 399 AUSTRALIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 400 AUSTRALIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 401 AUSTRALIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 402 AUSTRALIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 403 AUSTRALIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 404 AUSTRALIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 405 AUSTRALIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)