Europe Laboratory Information System Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

417.21 Million

USD

803.44 Million

2024

2032

USD

417.21 Million

USD

803.44 Million

2024

2032

| 2025 –2032 | |

| USD 417.21 Million | |

| USD 803.44 Million | |

|

|

|

|

Europe Laboratory Information Systems (LIS) Market Segmentation, By Component (Service and Software), Product (Integrated LIS and Standalone LIS), Delivery (Cloud-Based, Remotely-Hosted, and On-Premise), End User (Hospital Laboratories, Independent Laboratories, Physician Office Laboratories, and Others) - Industry Trends and Forecast to 2032

Europe Laboratory Information Systems (LIS) Market Size

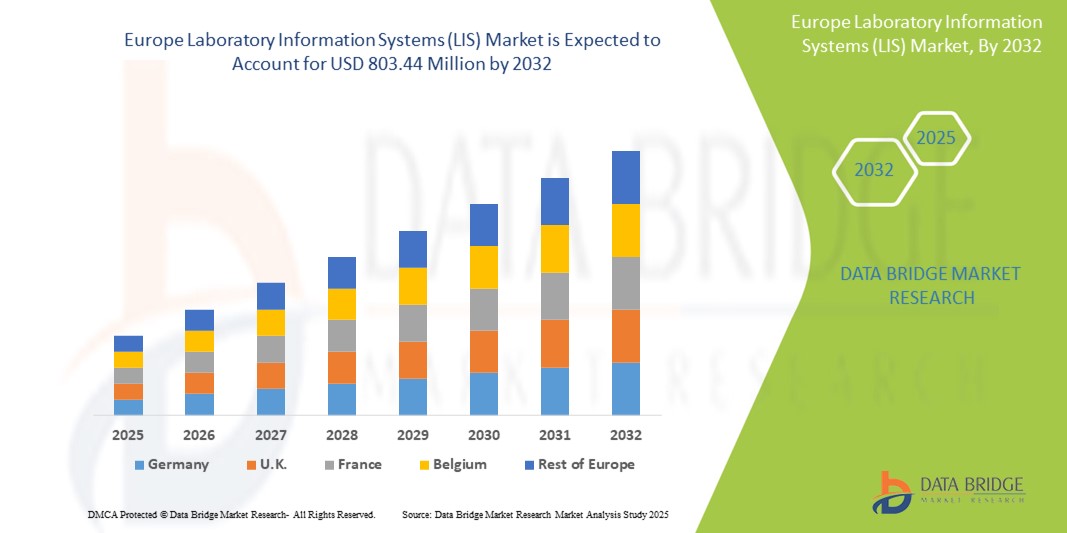

- The Europe laboratory information systems (LIS) market size was valued atUSD 412.21 billion in 2024and is expected to reachUSD 803.44 million by 2032, at aCAGR of 8.70 %during the forecast period

- This growth is driven by factors such as the increasing demand for accurate and timely test results, growing adoption of electronic health records (EHR), and rising government initiatives to digitize healthcare systems

Europe Laboratory Information Systems (LIS) Market Analysis

-

The laboratory information systems market is experiencing significant growth as healthcare facilities increasingly shift toward digitalization, enhancing laboratory data management and workflow efficiency

- Integration of advanced technologies such asartificial intelligenceand machine learning into laboratory information systems is expected to improve diagnostic accuracy and streamline operations

- Germany is expected to dominate the Europe Laboratory Information Systems (LIS)s market due to advanced healthcare infrastructure, high adoption rate of innovative technologies, and leading role in digitalizing healthcare processes

- Germany is expected to be the fastest growing region in the Europe Laboratory Information Systems (LIS) market during the forecast period due to strong focus on technological innovation, coupled with the rapid integration of digital solutions in healthcare facilities

- Cloud-based segment is expected to dominate the market with a market share of 44.3% due to its scalability, cost-effectiveness, and ability to provide remote access to laboratory data

Report Scope and Europe Laboratory Information Systems (LIS) Market Segmentation

|

Attributes |

Europe Laboratory Information Systems (LIS) KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Laboratory Information Systems (LIS) Market Trends

“Increasing Adoption of Cloud-Based Solutions”

- One noticeable trend in the Europe laboratory information systems market is the increasing adoption of cloud-based solutions

- Cloud-based laboratory information systems offer enhanced data storage, collaboration, and real-time access to information, which are critical in a highly regulated environment

- For instance, LabWare's cloud-based LIS solutions provide improved security, compliance, scalability, and reduced IT manpower needs, benefiting laboratories in navigating complexities while focusing on core operations

- Similarly, Thermo Fisher Scientific's cloud-based LIS platforms enable laboratories to streamline operations and improve patient care by leveraging cloud computing technologies

Europe Laboratory Information Systems (LIS) Market Dynamics

Driver

“Increasing Demand for Enhanced Data Management and Efficiency in Healthcare Facilities”

- One of the key drivers of the Europe Laboratory Information Systems (LIS) market is the increasing demand for enhanced data management and efficiency in healthcare facilities

- The growing volume of medical data generated from laboratory tests requires systems that can manage, store, and analyze data effectively

- Traditional manual methods are becoming insufficient, and LIS systems offer streamlined data management that reduces errors and improves turnaround times for test results

- For instance, hospitals such as the University of Edinburgh Medical School have integrated LIS to enhance data storage and streamline test result reporting, improving efficiency

- The integration of LIS with other healthcare systems, such as Electronic Health Records (EHR), ensures laboratory results are easily accessible and accurate, leading to better patient care

- For instance, collaboration between Cerner and various healthcare providers across Europe, which integrates LIS with EHR for seamless patient care management

- The growing demand for personalized medicine, which requires precise and quick data analysis, further boosts the adoption of LIS in healthcare organizations across Europe

- This shift towards automation and increased accuracy in healthcare infrastructure is a driving force for the continued growth of the LIS market in Europe

Opportunity

“Increasing Emphasis on Digitization and Integration of Technology”

- The ongoing digital transformation in healthcare presents significant opportunities for the Europe Laboratory Information Systems (LIS) market

- Increasing emphasis on digitization and the integration of technology in healthcare operations has led to the rapid adoption of cloud-based LIS solutions

- Cloud technology offers benefits such as scalability, cost-effectiveness, and real-time data access from any location, which is essential in today’s fast-paced healthcare environment

- For instance, cloud-based LIS solutions provided by companies such as LabWare help hospitals and laboratories store patient data without the need for on-premise hardware, reducing operational costs

- Advancements in cloud infrastructure enable healthcare organizations to ensure data security while benefiting from more efficient data storage and management

- The European Union’s healthcare modernization initiatives and focus on improving healthcare IT infrastructure further support the growth of the LIS market

- These initiatives encourage the adoption of digital solutions such as LIS to enhance operational efficiency, reduce costs, and ensure compliance with stringent healthcare regulations across Europe

- As hospitals and laboratories increasingly embrace digital transformation, the demand for innovative, cloud-based LIS solutions is expected to rise, opening up new growth opportunities in the market

Restraint/Challenge

“High Implementation Cost”

- Despite the advantages of Laboratory Information Systems (LIS), several challenges hinder the market's growth in Europe

- One of the main restraints is the high implementation cost associated with these systems, particularly for smaller healthcare organizations and laboratories

- Smaller institutions often struggle with the financial burden of purchasing, maintaining, and updating LIS software, including expenses for staff training and system integration

- For instance, smaller hospitals may find it difficult to allocate funds for the full deployment of advanced LIS solutions, delaying their adoption

- Healthcare organizations also hesitate to adopt LIS solutions due to concerns about data security and compliance with stringent regulations such as the General Data Protection Regulation (GDPR)

- The rising number of cyberattacks targeting healthcare data increases fears about the safety of sensitive patient information, especially in cloud-based systems

- Overcoming these challenges requires substantial investments in cybersecurity measures and compliance protocols, which may be out of reach for some institutions, particularly smaller ones

- In addition, integrating LIS with existing healthcare systems, such as EHR or laboratory equipment, can be complex and time-consuming, increasing implementation costs further

Europe Laboratory Information Systems (LIS) Market Scope

The market is segmented on the basis of component, product, delivery, and end user.

|

Segmentation |

Sub-Segmentation |

|

ByComponent |

|

|

ByProduct |

|

|

ByDelivery |

|

|

ByEnd User |

|

In 2025, the cloud-based is projected to dominate the market with a largest share in delivery segment

The cloud-based segment is expected to dominate the Europe laboratory information Systems (LIS) market with the largest share of 44.3% in 2025 due to its scalability, cost-effectiveness, and the ability to provide real-time access to data from any location, which is crucial for the fast-paced healthcare environment.

The integrated Laboratory Information Systems (LIS) is expected to account for the largest share during the forecast period in product market

In 2025, the integrated Laboratory Information Systems (LIS) segment is expected to dominate the market with the largest market share of 68.5% due to its ability to provide a comprehensive solution that integrates various laboratory functions, patient data, and healthcare management systems into a single platform.

Europe Laboratory Information Systems (LIS) Market Regional Analysis

“Germany Holds the Largest Share in the Europe Laboratory Information Systems (LIS) Market”

- The Rhine-Main-Neckar region is recognized as one of the largest IT clusters in Europe, hosting major companies in software and technology, which contribute to the development and adoption of advanced LIS solutions

- The region is home to renowned research institutions such as the German Research Centre for Artificial Intelligence, fostering innovations in healthcare technologies, including laboratory information systems

- Its strong biopharmaceutical and fintech sectors rely on efficient data management solutions such as LIS to enhance operational capabilities and meet regulatory standards

- As Germany’s digital model city, Darmstadt in the region is committed to advancing digital healthcare infrastructure, which encourages the adoption of laboratory information systems within the healthcare sector

“Germany is Projected to Register the HighestCAGR in the Europe Laboratory Information Systems (LIS) Market”

- The region’s focus on digital transformation and innovation in healthcare technologies accelerates the growth of LIS adoption in Germany, making it the fastest-growing in Europe

- Government initiatives aimed at improving healthcare and digital infrastructure create a supportive environment for the growth of LIS

- High investments in healthcare IT and collaborations between private and public sectors provide strong opportunities for new, innovative LIS solutions

- The region’s robust healthcare system and technological advancements make it a key driver of rapid LIS market expansion in Europe

Europe Laboratory Information Systems (LIS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Compugroup Medical (Germany)

- Autoscribe (U.K.)

- Eusoft Ltd (Portugal)

- Perimed AB (Sweden)

- Perimed AB (Sweden)

- Carl Zeiss AG(Germany)

- Smith & Nephew(U.K.)

- CompuGroup Medical SE & Co. KGaA(Germany)

- Tecan Group Ltd. (Switzerland)

- Sartorius AG(Germany)

- STRATEC SE (Germany)

- CliniSys Group Ltd. (U.K.)

Latest Developments in Europe Laboratory Information Systems (LIS) Market

- In September 2024, Agilent Technologies completed the acquisition of BIOVECTRA, a Canada-based contract development and manufacturing organization specializing in biologics and highly potent active pharmaceutical ingredients. This strategic move enhances Agilent's Diagnostics and Genomics Group by expanding its contract development and manufacturing organization (CDMO) services, particularly in gene editing and targeted therapeutics. The acquisition strengthens Agilent's capabilities in cGMP pharmaceutical manufacturing, aligning with the growing demand for advanced therapeutics. This development is expected to bolster Agilent's position in the pharmaceutical market by offering comprehensive solutions that accelerate therapeutic programslink

- In July 2021, Francisco Partners, a global investment firm specializing in technology businesses, announced the acquisition of the STARLIMS informatics product suite and related business assets from Abbott Laboratories. This strategic move aims to enhance STARLIMS's capabilities in laboratory data and workflow management across various sectors, including life sciences, pharmaceuticals, and manufacturing. The acquisition is expected to accelerate STARLIMS's growth by supporting customers throughout the entire product lifecycle, from research and development to manufacturing and compliance. Francisco Partners plans to leverage its sectoral knowledge and operational expertise to further evolve STARLIMS's innovative product suite, meeting the evolving needs of its customers while maintaining industry-leading safety and compliance standards

- In July 2021, Francisco Partners, a global investment firm specializing in technology businesses, acquired the STARLIMS informatics product suite and related business assets from Abbott Laboratories. This acquisition aims to enhance STARLIMS's capabilities in laboratory data and workflow management across various sectors, including life sciences, pharmaceuticals, and manufacturing. The move is expected to support STARLIMS's growth by providing comprehensive solutions that span the entire product lifecycle, from research and development to manufacturing and compliance. Francisco Partners plans to leverage its sectoral knowledge and operational expertise to further evolve STARLIMS's innovative product suite, meeting the evolving needs of its customers while maintaining industry-leading safety and compliance standards

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: REGULATIONS

5.1 REGULATORY GUIDELINES AND STANDARDS IN UNITED STATES: U.S. FOOD AND DRUG ADMINISTRATION (FDA)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE REQUIREMENT OF QUICK-DECISION MAKING PROCESS IN BIOTECHNOLOGY

6.1.2 RISING DEMAND FOR ADVANCED COMPUTATIONAL TOOLS IN RESEARCH LABORATORY

6.1.3 RISING USE OF LIMS FOR COMPLIANCE WITHOUT SACRIFICING FLEXIBILITY

6.1.4 INTEGRATION OF ADVANCED TECHNOLOGIES SUCH AS AI, MACHINE LEARNING

6.2 RESTRAINTS

6.2.1 HIGHER COST OF DATA MANAGEMENT & SOFTWARE

6.2.2 LACK OF WELL-DEFINED STANDARD FORMAT FOR DATA INTEGRATION

6.2.3 STRINGENT REGULATION BY GOVERNMENT ENTITLES IN INFORMATICS DOMAIN

6.3 OPPORTUNITIES

6.3.1 INCREASING STRATEGIC DECISIONS

6.3.2 ADVANCEMENTS IN R&D LABS SPECIALLY IN PHARMACEUTICAL SECTOR

6.3.3 INCREASE IN VARIOUS INITIATIVES FROM GOVERNMENT AS WELL AS PRIVATE SECTORS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED & TRAINED PROFESSIONALS TO USE THE COMPUTATIONAL TOOLS

6.4.2 DATA COMPLEXITY & LACK OF USER FRIENDLY TOOLS

7 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 INTEGRATED LIS

7.3 STANDALONE LIS

8 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 SERVICE

8.3 SOFTWARE

8.3.1 SAMPLE MANAGEMENT SOFTWARE

8.3.2 REPORTING SOFTWARE

8.3.3 WORKFLOW MANAGEMENT SOFTWARE

8.3.4 EMR/EHR SOFTWARE

8.3.5 OTHERS SOFTWARE

9 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY

9.1 OVERVIEW

9.2 CLOUD-BASED

9.3 REMOTELY-HOSTED

9.4 ON-PREMISE

10 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL LABORATORIES

10.3 INDEPENDENT LABORATORIES

10.4 PHYSICIAN OFFICE LABORATORIES

10.5 OTHERS

11 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 BELGIUM

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ROPER TECHNOLOGIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMAPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 PERKINELMER INC

14.3.1 COMPANY SNAPSHOT

14.3.2 COMAPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ILLUMINA INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMAPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 AGILENT TECHNOLOGIES, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMAPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AGARAM TECHNOLOGIES PVT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AUTOSCRIBE INFORMATICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BENCHLING

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COMPUGROUP MEDICAL

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.9.5 CLINISYS

14.9.6 COMPANY SNAPSHOT

1.1.4 PRODUCT PORTFOLIO 131

14.9.7 RECENT DEVELOPMENT

14.1 EPIC SYSTEMS CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 EUSOFT

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INFORS AG

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KRITILIMS.IN

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 LABSOLS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LQMS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 MCKESSON CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 NOVATEK INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SHIMADZU CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SIEMENS AG

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 STARLIMS CORPORATION

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 2 EUROPE INTEGRATED LIS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 3 EUROPE STANDALONE LIS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 4 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 5 EUROPE SERVICE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 EUROPE SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 EUROPE SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 8 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 9 EUROPE CLOUD-BASED IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 EUROPE REMOTELY-HOSTED IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 EUROPE ON-PREMISE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 13 EUROPE HOSPITAL LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 EUROPE INDEPENDENT LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 EUROPE PHYSICIAN OFFICE LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 EUROPE OTHERS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 18 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 19 EUROPE SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 20 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 21 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 22 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 23 GERMANY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 24 GERMANY SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 25 GERMANY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 26 GERMANY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 27 GERMANY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 28 FRANCE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 29 FRANCE SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 30 FRANCE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 31 FRANCE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 32 FRANCE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 33 U.K. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 34 U.K. SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 U.K. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 36 U.K. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 37 U.K. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 38 ITALY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 39 ITALY SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 40 ITALY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 41 ITALY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 42 ITALY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 43 SPAIN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 44 SPAIN SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 45 SPAIN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 46 SPAIN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 47 SPAIN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 48 RUSSIA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 49 RUSSIA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 50 RUSSIA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 51 RUSSIA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 52 RUSSIA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 53 NETHERLANDS LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 54 NETHERLANDS SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 55 NETHERLANDS LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 56 NETHERLANDS LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 57 NETHERLANDS LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 58 SWITZERLAND LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 59 SWITZERLAND SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 60 SWITZERLAND LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 61 SWITZERLAND LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 62 SWITZERLAND LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 63 BELGIUM LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 64 BELGIUM SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 65 BELGIUM LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 66 BELGIUM LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 67 BELGIUM LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 68 TURKEY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 69 TURKEY SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 70 TURKEY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 71 TURKEY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 72 TURKEY LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 73 REST OF EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: SEGMENTATION

FIGURE 2 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISION

FIGURE 14 INCREASE IN THE REQUIREMENT OF QUICK-DECISION MAKING PROCESS IN BIOTECHNOLOGY IS DRIVING THE GROWTH OF THE EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET FROM 2024 TO 2031

FIGURE 15 THE SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET IN 2024 AND 2031

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET

FIGURE 17 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, 2023

FIGURE 18 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 19 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 20 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 21 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, 2023

FIGURE 22 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 23 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, CAGR (2024-2031)

FIGURE 24 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 25 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, 2023

FIGURE 26 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, 2024-2031 (USD MILLION)

FIGURE 27 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, CAGR (2024-2031)

FIGURE 28 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, LIFELINE CURVE

FIGURE 29 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, 2023

FIGURE 30 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 31 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 32 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: SNAPSHOT (2023)

FIGURE 34 EUROPE LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY SHARE 2023 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.