Europe Rumen Bypass Fat Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

372.70 Million

USD

485.81 Million

2024

2032

USD

372.70 Million

USD

485.81 Million

2024

2032

| 2025 –2032 | |

| USD 372.70 Million | |

| USD 485.81 Million | |

|

|

|

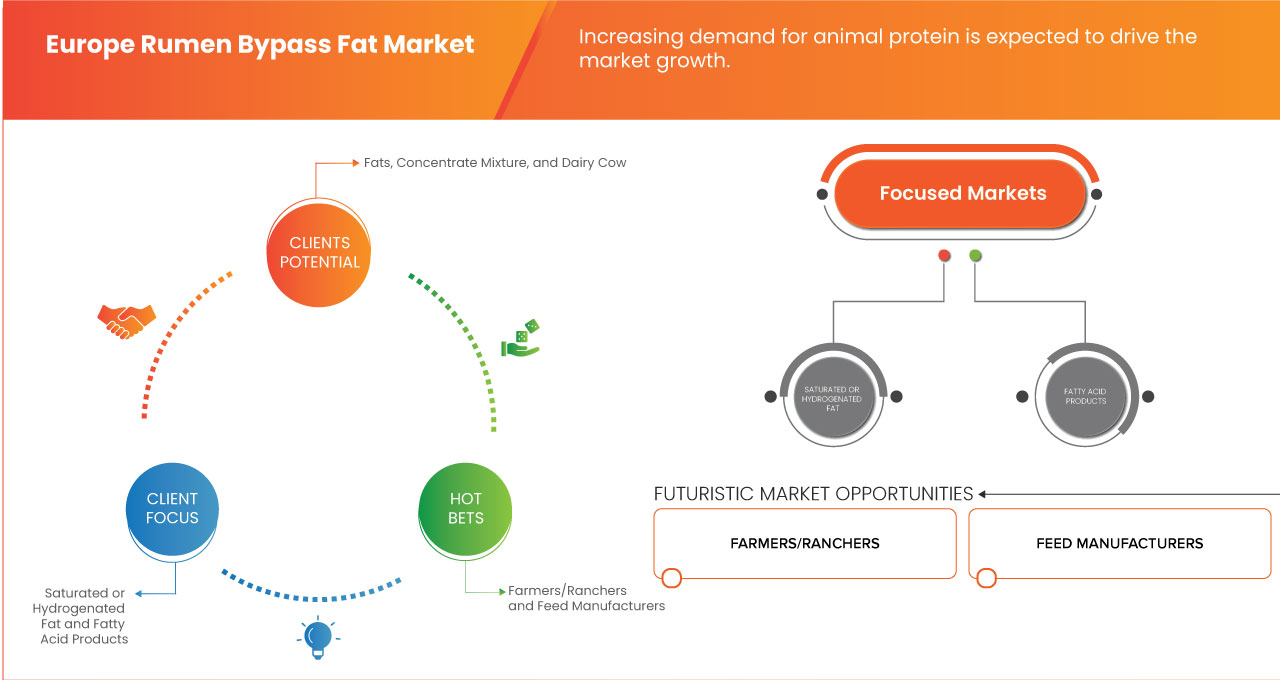

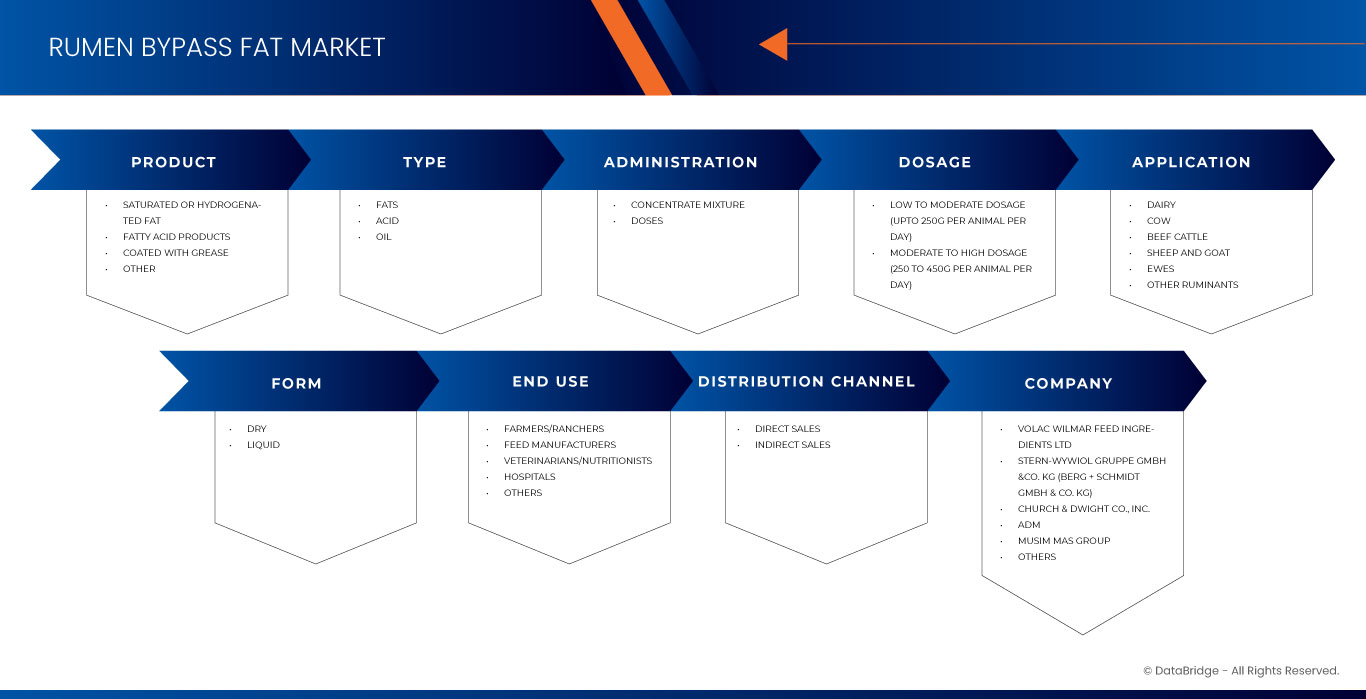

Europe Rumen Bypass Fat Market Segmentation, By Product (Saturated Or Hydrogenated Fat, Fatty Acid Products, Coated With Grease, and Other), Type (Fats, Acid, and Oil), Administration (Concentrate Mixture and Doses), Dosage (Low To Moderate Dosage (Upto 250G Per Animal Per Day) and Moderate To High Dosage (250 To 450G Per Animal Per Day), Application (Dairy Cow, Beef Cattle, Sheep and Goat, Ewes, and Other Ruminants), Form (Dry and Liquid), End Use (Farmers/Ranchers, Feed Manufacturers, Veterinarians/Nutritionists, Hospitals, and Others), Distribution Channel (Direct Sales and Indirect Sales) – Industry Trends and Forecast to 2032

Rumen Bypass Fat Market Analysis

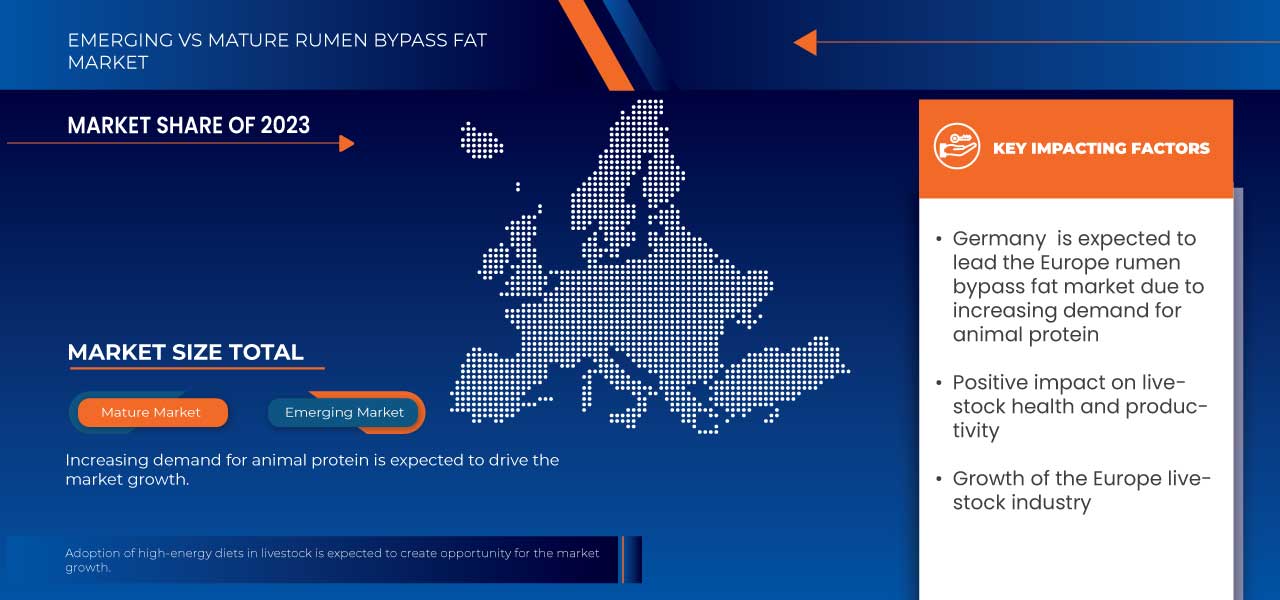

The rumen bypass fat market is experiencing steady growth, driven by increasing demand for high-energy feed additives in dairy and beef cattle farming. Rumen bypass fats enhance milk yield, improve reproductive efficiency, and boost overall animal health. Rising global dairy consumption and the need for improved livestock productivity are key market drivers. Germany dominate the market due to large dairy industries. However, fluctuating raw material prices and regulatory challenges may hinder growth. Key players focus on innovation and sustainable production. Future trends indicate increased adoption of encapsulated fats and plant-based alternatives for enhanced digestibility and efficiency.

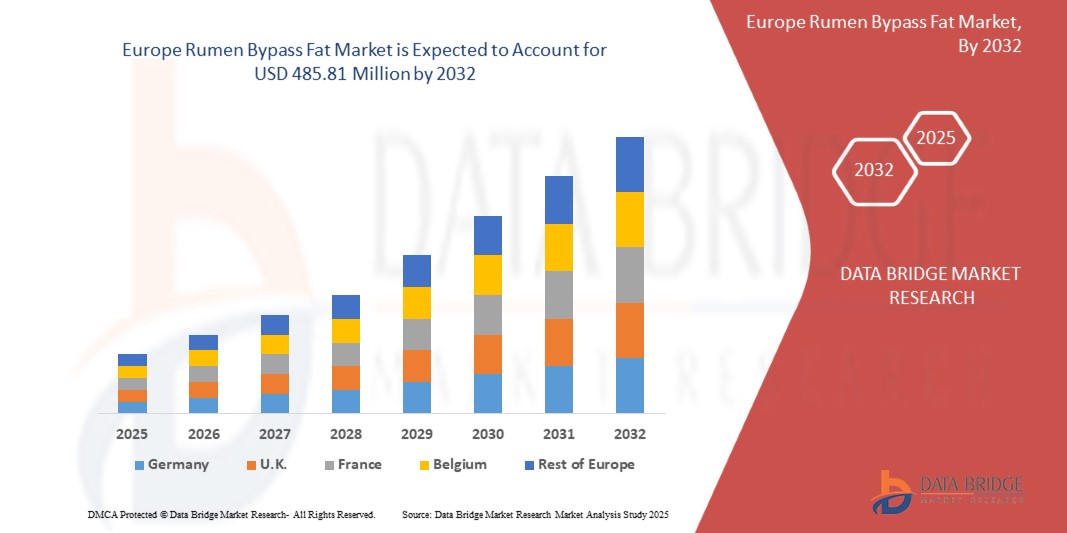

Rumen Bypass Fat Market Size

Europe rumen bypass fat market size was valued at USD 372.70 million in 2024 and is projected to reach USD 485.81 million by 2032, growing with a CAGR of 3.4% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Rumen Bypass Fat Market Trends

“Increasing Demand for High-Energy Feed Additives”

The demand for high-energy feed additives is rising due to increasing livestock productivity needs and growing global meat and dairy consumption. High-energy additives, such as rumen bypass fats and specialized supplements, enhance weight gain, milk yield, and reproductive performance in animals. Farmers seek efficient nutrition solutions to improve feed conversion rates and overall herd health. Rising awareness of animal nutrition, intensive farming practices, and fluctuating feed costs further drive demand. Germany led market growth, with innovations in sustainable and plant-based additives shaping future trends. Regulatory compliance and raw material availability remain key challenges for manufacturers.

Report Scope and Rumen Bypass Fat Market Segmentation

|

Attributes |

Rumen Bypass Fat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Germany, Russia, Spain, France, Turkey, U.K., Italy, Netherlands, Belgium, Switzerland, Denmark, Sweden, Poland, and rest of Europe |

|

Key Market Players |

Volac Wilmar Feed Ingredients Ltd (U.K.), Stern-Wywiol Gruppe GmbH & Co. KG (Berg + Schmidt GmbH & Co. KG) (Germany), Church & Dwight Co., Inc. (U.S.), ADM (U.S.), Musim Mas Group (Singapore), IFFCO (U.A.E.), Peter Cremer Holding GmbH & Co. KG (Germany), Kemin Industries, Inc. (U.S.), BASF (Germany), AB Agri Ltd (Subsidiary of Associated British Foods plc) (U.K.), GOPIFAT (U.K.), Ecolex (Singapore), Prathista Industries Limited (India), and Pioneerfeed Bioscience Sdn Bhd (Malaysia) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rumen Bypass Fat Market Definition

Rumen bypass fat is a specially processed fat supplement designed for ruminant animals, primarily dairy and beef cattle. Unlike regular fats, bypass fats are formulated to resist breakdown in the rumen, allowing them to be digested and absorbed in the small intestine. This provides a high-energy source without disrupting microbial fermentation in the rumen. Bypass fats enhance milk production, improve reproductive performance, and support overall animal health. They are commonly derived from sources such as palm oil, soybean oil, and calcium salts of fatty acids. Their use is increasing in livestock nutrition to optimize feed efficiency and maximize productivity.

Rumen Bypass Fat Market Dynamics

Drivers

- Increasing Demand for Animal Protein

Rumen bypass fat, also known as protected fat, is a specialized type of fat that is designed to bypass the rumen and be digested in the lower digestive tract of ruminant animals such as dairy cows, beef cattle, and sheep. This unique characteristic of rumen bypass fat has garnered attention from livestock producers and nutritionists, driving the demand for this product.

Furthermore, with the rising awareness of animal health and welfare, there is a growing emphasis on improving the nutritional quality of livestock feed. Rumen bypass fat plays a pivotal role in this endeavor by supplementing the diet with essential nutrients that contribute to overall animal well-being. This demand is particularly evident in dairy farming, where high milk yields are desired, and the nutritional requirements of lactating cows are of paramount importance.

For instance,

In 2023, according to a research article published on Elsevier B.V according to the Food and Agriculture Organization (FAO), meat consumption in Europe has been steadily increasing, particularly in countries like Germany, France, and Spain. This rise in demand for meat products directly correlates with the need for higher-quality animal feed, such as rumen bypass fats, to improve livestock productivity and meat quality.

- Positive Impact on Livestock Health and Productivity

Rumen bypass fat has emerged as a key driver of innovation in the livestock industry, revolutionizing the way animals are fed and nourished. This remarkable trend is attributed to the various ways in which rumen bypass fat enhances the health and productivity of livestock, making it a sought-after solution for producers and nutritionists alike.

One of the primary drivers behind the increasing demand for rumen bypass fat is its ability to provide a concentrated source of energy to animals. The fat is designed to bypass the rumen, the first compartment of the stomach in ruminant animals, and be digested in the lower digestive tract. This unique characteristic allows for the direct delivery of energy-rich fatty acids to the animal's system, contributing to enhanced energy intake and utilization. This increased energy availability translates into improved growth rates, weight gain, and milk production, all of which are critical factors in livestock productivity.

For instance,

The Livestock Health & Disease Control scheme aims to enhance animal health through vaccination, disease control, and veterinary infrastructure improvement. Its goals include eradicating diseases, boosting productivity, and uplifting livestock farmers. Funding ratios vary; central assistance is 100% for some components. The objectives encompass disease control, doorstep veterinary services, and disease prevention. The scheme addresses critical diseases such as Peste des Petits Ruminants (PPR) and Classical Swine Fever (CSF), emphasizing vaccination and improved veterinary facilities, supported by central funding.

Opportunities

- Adoption of High-Energy Diets in Livestock

High-energy diets are being increasingly recognized as essential for enhancing animal growth, productivity, and overall performance. Rumen bypass fats align seamlessly with this trend, making them a valuable tool in optimizing livestock nutrition.

High-energy diets are designed to provide animals with increased calorie intake, vital for efficient weight gain and enhanced milk or meat production. Rumen bypass fats contribute to these diets by offering a concentrated source of energy that is easily digestible and absorbed in the intestines. As livestock producers strive to maximize output while minimizing feed costs, the inclusion of rumen bypass fats can help achieve these goals.

Furthermore, rumen bypass fats can complement high-energy diets by ensuring a balanced nutrient intake. While high-energy diets focus on calories, they may lack essential fatty acids that contribute to overall animal health and performance. Rumen bypass fats can bridge this nutritional gap, supplying critical fatty acids that support immune function, reproductive performance, and overall well-being.

- Focus on Animal Health and Welfare

The increasing focus on animal health and welfare represents a significant opportunity for the global rumen bypass fat market. As consumers and producers alike prioritize the well-being of animals, rumen bypass fats can play a pivotal role in enhancing livestock health, mitigating stress, and promoting overall animal welfare.

Rumen bypass fats contribute to animal health by providing essential fatty acids that are integral to various physiological functions. These fats support immune system function, reproductive performance, and the development of healthy skin and fur. By incorporating rumen bypass fats into animal diets, producers can help prevent deficiencies and ensure optimal health, reducing the need for interventions and medical treatments.

As consumer awareness of animal welfare practices increases, there is a growing demand for products that align with ethical and humane treatment of animals. Livestock producers who prioritize animal welfare by incorporating rumen bypass fats into diets can differentiate their products in the market and appeal to conscientious consumers. This can lead to enhanced brand reputation and customer loyalty.

Restraints/Challenges

- Limited Awareness Among Livestock Producers

The lack of awareness among livestock producers is a significant barrier to the global market for rumen bypass fat, despite the favorable growth prospects. This limitation prevents the market's potential growth and adoption because many producers are still ignorant of the advantages and uses of rumen bypass fats in animal nutrition. The lack of awareness stems from several factors. Firstly, traditional feeding practices have been deeply ingrained in the livestock industry, and many producers are hesitant to adopt new approaches without comprehensive information and proven results. Rumen bypass fats, being a relatively newer concept, require educational efforts to illustrate their advantages and dispel any misconceptions.

The limited awareness among livestock producers serves as a significant restraint for the global rumen bypass fat market. This challenge may limit the market expansion.

- Regulatory Complexities and Approvals

The introduction and distribution of feed additives, including rumen bypass fats, are subject to rigorous regulatory scrutiny and approval processes in various countries and regions. The different regulatory bodies around the world, such as the Food and Drug Administration (FDA) in the United States and the European Food Safety Authority (EFSA) in the European Union, have established stringent guidelines for assessing the safety, efficacy, and quality of feed additives. Obtaining the necessary approvals often involves comprehensive scientific studies, toxicology assessments, and data demonstrating the positive impact of rumen bypass fats on animal health and performance.

Navigating these regulatory complexities can be time-consuming and costly for manufacturers. The extensive documentation and research required for approvals can result in delays in bringing new rumen bypass fat products to market. Additionally, inconsistencies in regulatory requirements across different regions can further complicate the process, requiring manufacturers to tailor their submissions to meet specific criteria in each jurisdiction.

For instance,

European Food Safety Authority (EFSA) regulation ensures that all feed additives, including rumen bypass fats, undergo rigorous scientific evaluation for safety, efficacy, and quality before authorization. It mandates that the additives must not harm animals, humans consuming animal-derived products, or the environment. Applications must include details on chemical composition, usage, and safety studies.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Rumen Bypass Fat Market Scope

The market is segmented into eight notable segments based on product, type, administration, dosage, application, form, end use, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Saturated or Hydrogenated Fat

- Fatty Acid Products

- Coated With Grease

- Other

Type

- Fats

- Calcium Soap

- Triglycerides

- Hydrogenated Fats

- Special Blends

- Acid

- Palmitic Acid

- Stearic Acid

- حمض اللينوليك

- حمض الميريستيك

- زيت

- زيت النخيل

- زيت بذور اللفت

- زيت الزيتون

- آحرون

إدارة

- خليط مركّز

- الجرعات

- جرعة واحدة

- جرعة متعددة

الجرعة

- جرعة منخفضة إلى معتدلة (تصل إلى 250 جرامًا لكل حيوان يوميًا)

- جرعة معتدلة إلى عالية (250 إلى 450 جرامًا لكل حيوان يوميًا)

طلب

- بقرة حلوب

- الأبقار المرضعة

- الرضاعة المبكرة

- الرضاعة الخفيفة

- الأبقار الجافة

- ماشية اللحم البقري

- الأغنام والماعز

- النعاج

- المجترات الأخرى

استمارة

- جاف

- سائل

الاستخدام النهائي

- المزارعون/مربي الماشية

- مصنعي الأعلاف

- الأطباء البيطريين / خبراء التغذية

- المستشفيات

- آحرون

قناة التوزيع

- المبيعات المباشرة

- المبيعات غير المباشرة

- غير متصل

- متصل

تحليل إقليمي لسوق الدهون المتحولة في الكرش

يتم تحليل السوق وتقديم رؤى حول حجم السوق واتجاهاته في ثمانية قطاعات بارزة بناءً على المنتج والنوع والإدارة والجرعة والتطبيق والشكل والاستخدام النهائي وقناة التوزيع كما هو مذكور أعلاه.

الدول المشمولة في السوق هي ألمانيا وروسيا وإسبانيا وفرنسا وتركيا والمملكة المتحدة وإيطاليا وهولندا وبلجيكا وسويسرا والدنمارك والسويد وبولندا وبقية أوروبا.

تهيمن ألمانيا على سوق الدهون المتحولة للكرش بفضل صناعة إضافات الأعلاف القوية لديها، والأبحاث المتقدمة في مجال تغذية الحيوانات، ووجود لاعبين رئيسيين مثل BASF وStern-Wywiol Gruppe. وتدفعها معايير الجودة الصارمة والابتكار إلى ريادتها في حلول أعلاف الماشية.

تبرز روسيا في سوق الدهون المتحولة للكرش بسبب توسع قطاع الألبان والثروة الحيوانية، والدعم الحكومي لإنتاج الأعلاف المحلية، والطلب المتزايد على إضافات الأعلاف عالية الطاقة. كما تعمل الاستثمارات المتزايدة في الزراعة وتكنولوجيا الأعلاف على دفع نمو السوق.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب والاتجاهات الفنية وتحليل قوى بورتر الخمس ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. أيضًا، يتم النظر في وجود وتوافر العلامات التجارية الأوروبية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

حصة سوق الدهون المتحولة في الكرش

يوفر المشهد التنافسي للسوق تفاصيل عن المنافسين. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أوروبا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بالسوق.

الشركات الرائدة في سوق تحويل مسار الدهون في الكرش هي:

- شركة فولاك ويلمار لمكونات الأعلاف المحدودة (المملكة المتحدة)

- Stern-Wywiol Gruppe GmbH & Co. KG (Berg + Schmidt GmbH & Co. KG) (ألمانيا)

- شركة Church & Dwight Co., Inc. (شركة Arm & Hammer لإنتاج الحيوانات والأغذية) (الولايات المتحدة)

- ADM (الولايات المتحدة)

- موسم ماس (سنغافورة)

- IFFCO (الإمارات العربية المتحدة)

- شركة بيتر كريمر القابضة المحدودة وشركاه (ألمانيا)

- شركة كيمين للصناعات المحدودة (الولايات المتحدة)

- شركة باسف (ألمانيا)

- AB Agri Ltd (شركة تابعة لشركة Associated British Foods plc) (المملكة المتحدة)

- إيكولكس (ماليزيا)

- براثيستا للصناعات المحدودة (الهند)

أحدث التطورات في سوق الدهون المتحولة في الكرش

- في أبريل 2023، تعاونت شركة BASF وSchothorst Feed Research لدمج برنامج Opteinics لقياس البصمة البيئية لشركة BASF في خدمات استشارات التغذية الحيوانية لشركة SFR. تهدف هذه الشراكة إلى تعزيز الاستدامة داخل سلسلة قيمة البروتين الحيواني، وتقديم رؤى للحد من التأثير البيئي وتعزيز إنتاج الأعلاف والبروتين الحيواني المستدام. يجمع التعاون بين خبرة شركة BASF في مجال البرمجيات وريادة شركة SFR في أبحاث التغذية الحيوانية. وقد ساعد هذا الشركة على تعزيز قاعدة عملائها والنمو في السوق

- في فبراير 2022، أصبحت تغذية الحيوانات أيضًا أكثر وأكثر أهمية من حيث الاستدامة. يطلب العملاء بشكل متزايد بدائل "أكثر خضرة" للمواد الخام الحالية. ببساطة، صابون الكالسيوم القائم على زيت النخيل أقل تكلفة. حاليًا، يتغير هذا مع تحول المزيد والمزيد من مصنعي الأعلاف الحيوانية إلى الحصول على مكوناتهم الخام من الاتحاد الأوروبي بسبب متطلبات التصنيع والشهادات الأكثر صرامة. وهنا يأتي دور صابون الكالسيوم المصنوع من بذور اللفت وزيت الزيتون. منذ سنوات، تمكنت شركة CREMER OLEO GmbH & Co. KG من تصنيع صابون الكالسيوم على أساس زيت الزيتون

- في نوفمبر 2022، فازت مجموعة Musim Mas بجائزة التميز في التأثير على صغار المزارعين من المائدة المستديرة لزيت النخيل المستدام (RSPO). تدير مجموعة Musim Mas البرنامج الأكثر شمولاً لصغار المزارعين المستقلين في إندونيسيا. على مر السنين، استفاد أكثر من 40000 من صغار المزارعين المستقلين من برنامج مجموعة Musim Mas من خلال منحهم المعرفة اللازمة لزيادة إنتاجهم بشكل مستدام وتعزيز وصولهم إلى سلسلة التوريد. تم تكريم إنجازات مجموعة Musim Mas الرائعة في تعزيز الاستدامة وسبل عيش صغار المزارعين المستقلين بهذه الجائزة

- في مارس 2019، تم تقديم فكرة جديدة لتغذية شركة AB Agri Ltd (وهي شركة تابعة لشركة Associated British Foods plc) في مجال الألبان، وهي متاحة الآن بسهولة في جميع أنحاء المملكة المتحدة. قد يساعد بروتين NovaPro عالي الأداء المحمي للكرش الصناعة في تقليل اعتمادها الكبير على واردات فول الصويا مع توفير فوائد التكلفة للمزارعين. وهذا يساعد الشركة على التوسع التجاري الوطني

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BUYER/CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICE INDEX

4.4 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.5 VALUE CHAIN ANALYSIS: EUROPE RUMEN BYPASS FAT MARKET

4.6 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USERS FOR EUROPE RUMEN BYPASS FAT MARKET

4.7 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS FOR EUROPE RUMEN BYPASS FAT MARKET

4.8 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

4.8.1 DECLINE IN LIVESTOCK FARMING INVESTMENTS

4.8.2 REDUCED MILK PRODUCTION INCENTIVES

4.8.3 DISRUPTED SUPPLY CHAIN DYNAMICS

4.8.4 SHIFT TOWARD LOCALLY SOURCED PRODUCTS

4.8.5 POLICY AND SUBSIDY ADJUSTMENTS

4.8.6 FLUCTUATING EXCHANGE RATES

4.8.7 LONG-TERM MARKET IMPACTS

4.9 INDUSTRY TRENDS AND FUTURE PERSPECTIVES FOR EUROPE RUMEN BYPASS FAT MARKET

4.1 OVERVIEW OF TECHNOLOGICAL INNOVATIONS FOR EUROPE RUMEN BYPASS FAT MARKET

4.11 RAW MATERIAL SOURCING ANALYSIS FOR EUROPE RUMEN BYPASS FAT MARKET

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 OVERVIEW

4.12.2 RAW MATERIAL SOURCING

4.12.3 MANUFACTURING & PROCESSING

4.12.4 LOGISTICS & DISTRIBUTION

4.12.5 END-USE & MARKET DEMAND

4.12.6 CHALLENGES & FUTURE OUTLOOK

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR ANIMAL PROTEIN

6.1.2 POSITIVE IMPACT ON LIVESTOCK HEALTH AND PRODUCTIVITY

6.1.3 GROWTH OF THE EUROPE LIVESTOCK INDUSTRY

6.1.4 CONTINUED RESEARCH AND INNOVATION IN FEED ADDITIVES

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS AMONG LIVESTOCK PRODUCERS

6.2.2 COMPETITION FROM ALTERNATIVE NUTRITIONAL STRATEGIES

6.3 OPPORTUNITIES

6.3.1 ADOPTION OF HIGH-ENERGY DIETS IN LIVESTOCK

6.3.2 FOCUS ON ANIMAL HEALTH AND WELFARE

6.3.3 DEMAND FOR SUSTAINABLE LIVESTOCK FARMING PRACTICES

6.4 CHALLENGES

6.4.1 REGULATORY COMPLEXITIES AND APPROVALS

6.4.2 PRICE FLUCTUATIONS OF RAW MATERIALS

7 EUROPE RUMEN BYPASS FAT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SATURATED OR HYDROGENATED FAT

7.3 FATTY ACID PRODUCTS

7.4 COATED WITH GREASE

7.5 OTHERS

8 EUROPE RUMEN BYPASS FAT MARKET, BY TYPE

8.1 OVERVIEW

8.2 FATS

8.2.1 FATS, BY TYPE

8.3 ACID

8.3.1 ACID, BY TYPE

8.4 OIL

8.4.1 OIL, BY TYPE

9 EUROPE RUMEN BYPASS FAT MARKET, BY ADMINISTRATION

9.1 OVERVIEW

9.2 CONCENTRATE MIXTURE

9.3 DOSES

9.3.1 DOSES, BY TYPE

10 EUROPE RUMEN BYPASS FAT MARKET, BY DOSAGE

10.1 OVERVIEW

10.2 LOW TO MODERATE DOSAGE (UPTO 250G PER ANIMAL PER DAY)

10.3 MODERATE TO HIGH DOSAGE (250 TO 450G PER ANIMAL PER DAY)

11 EUROPE RUMEN BYPASS FAT MARKET, BY FORM

11.1 OVERVIEW

11.2 DRY

11.3 LIQUID

12 EUROPE RUMEN BYPASS FAT MARKET, BY END USE

12.1 OVERVIEW

12.2 FARMERS/RANCHERS

12.3 FEED MANUFACTURERS

12.4 VETERINARIANS/NUTRITIONISTS

12.5 HOSPITALS

12.6 OTHERS

13 EUROPE RUMEN BYPASS FAT MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 DAIRY COW

13.2.1 DAIRY COW, BY TYPE

13.3 BEEF CATTLE

13.4 SHEEP AND GOAT

13.5 EWES

13.6 OTHER RUMINANTS

14 EUROPE RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 INDIRECT SALES

14.3.1 INDIRECT SALES, BY TYPE

15 EUROPE RUMEN BYPASS FAT MARKET, BY COUNTRY

15.1 EUROPE

15.1.1 GERMANY

15.1.2 RUSSIA

15.1.3 SPAIN

15.1.4 FRANCE

15.1.5 TURKEY

15.1.6 U.K.

15.1.7 ITALY

15.1.8 NETHERLANDS

15.1.9 BELGIUM

15.1.10 SWITZERLAND

15.1.11 DENMARK

15.1.12 SWEDEN

15.1.13 POLAND

15.1.14 REST OF EUROPE

16 EUROPE RUMEN BYPASS FAT MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 VOLAC WILMAR FEED INGREDIENTS LTD

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 STERN-WYWIOL GRUPPE GMBH &CO. KG (BERG + SCHMIDT GMBH & CO. KG)

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 CHURCH & DWIGHT CO., INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 BRAND PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 ADM

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 MUSIM MAS GROUP GROUP

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENT

18.6 AB AGRI LTD (IT’S A SUBSIDIARY OF ASSOCIATED BRITISH FOODS PLC)

18.6.1 COMPANY SNAPSHOT

18.6.2 BRAND PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BASF

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ECOLEX

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 GOPIFAT

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 IFFCO

18.10.1 COMPANY SNAPSHOT

18.10.2 BRAND PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 KEMIN INDUSTRIES, INC.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 PETER CREMER HOLDING GMBH & CO. KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 PIONEERFEED BIOSCIENCE SDN BHD

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 PRATHISTA INDUSTRIES LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 PRICE INDEX

TABLE 2 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 3 REGULATORY COVERAGE

TABLE 4 EUROPE RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 6 EUROPE RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 7 EUROPE RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 TONS)

TABLE 9 EUROPE RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 10 EUROPE FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE RUMEN BYPASS FAT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE RUMEN BYPASS FAT MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 24 GERMANY RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 GERMANY RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 26 GERMANY RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 GERMANY RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 28 GERMANY FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 GERMANY ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 GERMANY OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 GERMANY RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 32 GERMANY DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 GERMANY RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 34 GERMANY RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 GERMANY DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 GERMANY RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 37 GERMANY RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 38 GERMANY RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 39 GERMANY INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 RUSSIA RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 41 RUSSIA RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 42 RUSSIA RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 RUSSIA RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 44 RUSSIA FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 RUSSIA ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 RUSSIA OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 RUSSIA RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 48 RUSSIA DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 RUSSIA RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 50 RUSSIA RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 RUSSIA DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 RUSSIA RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 53 RUSSIA RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 54 RUSSIA RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 55 RUSSIA INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SPAIN RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 57 SPAIN RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 58 SPAIN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SPAIN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 60 SPAIN FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SPAIN ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SPAIN OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SPAIN RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 64 SPAIN DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SPAIN RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 66 SPAIN RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 SPAIN DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SPAIN RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 69 SPAIN RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 70 SPAIN RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 SPAIN INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 74 FRANCE RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 FRANCE RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 FRANCE FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 FRANCE ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 FRANCE OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 FRANCE RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 80 FRANCE DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 FRANCE RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 82 FRANCE RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 FRANCE DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 FRANCE RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 85 FRANCE RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 86 FRANCE RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 FRANCE INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 TURKEY RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 89 TURKEY RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 90 TURKEY RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 TURKEY RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 92 TURKEY FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 TURKEY ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 TURKEY OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 TURKEY RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 96 TURKEY DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 TURKEY RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 98 TURKEY RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 TURKEY DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 TURKEY RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 101 TURKEY RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 102 TURKEY RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 103 TURKEY INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 U.K. RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 105 U.K. RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 106 U.K. RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 U.K. RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 108 U.K. FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 U.K. ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 U.K. OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 U.K. RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 112 U.K. DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.K. RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 114 U.K. RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 U.K. DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 U.K. RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 117 U.K. RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 118 U.K. RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 119 U.K. INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 ITALY RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 121 ITALY RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 122 ITALY RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 ITALY RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 124 ITALY FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 ITALY ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 ITALY OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 ITALY RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 128 ITALY DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ITALY RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 130 ITALY RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 131 ITALY DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 ITALY RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 133 ITALY RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 134 ITALY RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 135 ITALY INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 NETHERLANDS RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 NETHERLANDS RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 138 NETHERLANDS RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 NETHERLANDS RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 140 NETHERLANDS FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 NETHERLANDS ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 NETHERLANDS OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NETHERLANDS RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 144 NETHERLANDS DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NETHERLANDS RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 146 NETHERLANDS RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 NETHERLANDS DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 NETHERLANDS RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 149 NETHERLANDS RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 150 NETHERLANDS RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 151 NETHERLANDS INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 BELGIUM RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 153 BELGIUM RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 154 BELGIUM RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 BELGIUM RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 156 BELGIUM FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 BELGIUM ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 BELGIUM OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 BELGIUM RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 160 BELGIUM DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 BELGIUM RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 162 BELGIUM RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 163 BELGIUM DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 BELGIUM RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 165 BELGIUM RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 166 BELGIUM RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 167 BELGIUM INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SWITZERLAND RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 169 SWITZERLAND RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 170 SWITZERLAND RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SWITZERLAND RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 172 SWITZERLAND FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SWITZERLAND ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 SWITZERLAND OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SWITZERLAND RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 176 SWITZERLAND DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SWITZERLAND RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 178 SWITZERLAND RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 179 SWITZERLAND DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SWITZERLAND RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 181 SWITZERLAND RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 182 SWITZERLAND RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 183 SWITZERLAND INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 DENMARK RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 185 DENMARK RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 186 DENMARK RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 DENMARK RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 188 DENMARK FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 DENMARK ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 DENMARK OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 DENMARK RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 192 DENMARK DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 DENMARK RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 194 DENMARK RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 DENMARK DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 DENMARK RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 197 DENMARK RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 198 DENMARK RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 199 DENMARK INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SWEDEN RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 201 SWEDEN RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 202 SWEDEN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SWEDEN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 204 SWEDEN FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SWEDEN ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SWEDEN OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SWEDEN RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 208 SWEDEN DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SWEDEN RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 210 SWEDEN RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 211 SWEDEN DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SWEDEN RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 213 SWEDEN RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 214 SWEDEN RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 215 SWEDEN INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 POLAND RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 217 POLAND RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 218 POLAND RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 POLAND RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 220 POLAND FATS IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 POLAND ACID IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 POLAND OIL IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 POLAND RUMEN BYPASS FAT MARKET, BY ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 224 POLAND DOSES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 POLAND RUMEN BYPASS FAT MARKET, BY DOSAGE, 2018-2032 (USD THOUSAND)

TABLE 226 POLAND RUMEN BYPASS FAT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 227 POLAND DAIRY COW IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 POLAND RUMEN BYPASS FAT MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 229 POLAND RUMEN BYPASS FAT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 230 POLAND RUMEN BYPASS FAT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 231 POLAND INDIRECT SALES IN RUMEN BYPASS FAT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 REST OF EUROPE RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 233 REST OF EUROPE RUMEN BYPASS FAT MARKET, BY PRODUCT, 2018-2032 (TONS)

List of Figure

FIGURE 1 EUROPE RUMEN BYPASS FAT MARKET

FIGURE 2 EUROPE RUMEN BYPASS FAT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE RUMEN BYPASS FAT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE RUMEN BYPASS FAT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 EUROPE RUMEN BYPASS FAT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE RUMEN BYPASS FAT MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE RUMEN BYPASS FAT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE RUMEN BYPASS FAT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE RUMEN BYPASS FAT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE RUMEN BYPASS FAT MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE RUMEN BYPASS FAT MARKET: SEGMENTATION

FIGURE 12 FOUR SEGMENTS COMPRISE THE EUROPE RUMEN BYPASS FAT MARKET, BY PRODUCT

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING DEMAND FOR ANIMAL PROTEIN IS EXPECTED TO DRIVE THE EUROPE RUMEN BYPASS FAT MARKET IN THE FORECAST PERIOD

FIGURE 16 THE SATURATED OR HYDROGENATED FAT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE EUROPE RUMEN BYPASS FAT MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 VALUE CHAIN ANALYSIS OF THE EUROPE RUMEN BYPASS FAT MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE RUMEN BYPASS FAT MARKET

FIGURE 21 EUROPE RUMEN BYPASS FAT MARKET: BY PRODUCT, 2024

FIGURE 22 EUROPE RUMEN BYPASS FAT MARKET: BY TYPE, 2024

FIGURE 23 EUROPE RUMEN BYPASS FAT MARKET: BY ADMINISTRATION, 2024

FIGURE 24 EUROPE RUMEN BYPASS FAT MARKET: BY DOSAGE, 2024

FIGURE 25 EUROPE RUMEN BYPASS FAT MARKET: BY FORM, 2024

FIGURE 26 EUROPE RUMEN BYPASS FAT MARKET: BY END USE, 2024

FIGURE 27 EUROPE RUMEN BYPASS FAT MARKET: BY APPLICATION, 2024

FIGURE 28 EUROPE RUMEN BYPASS FAT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 EUROPE RUMEN BYPASS FAT MARKET, SNAPSHOT 2024

FIGURE 30 EUROPE RUMEN BYPASS FAT MARKET: COMPANY SHARE 2024 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.