Global Food Grade And Animal Feed Grade Salt Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

9.73 Million

USD

9.73 Million

2025

2033

USD

9.73 Million

USD

9.73 Million

2025

2033

| 2026 –2033 | |

| USD 9.73 Million | |

| USD 9.73 Million | |

|

|

|

|

Global Food Grade and Animal Feed Grade Salt Market Segmentation, By Product Type (Rock, Sea Salt, Brine, Vacuum, and Others), Purity (Purity 98% - 99.5% and Purity Above 99.5%), Production Processes (Evaporation Method, Mining Method, and Others), Distribution Channel (Direct and Indirect), End User (Food & Beverages Industry and Food Service Sector), Application (Food Products, Sport Nutrition, Beverages, and Animal Feed) - Industry Trends and Forecast to 2033

What is the Global Food Grade and Animal Feed Grade Salt Market Size and Growth Rate?

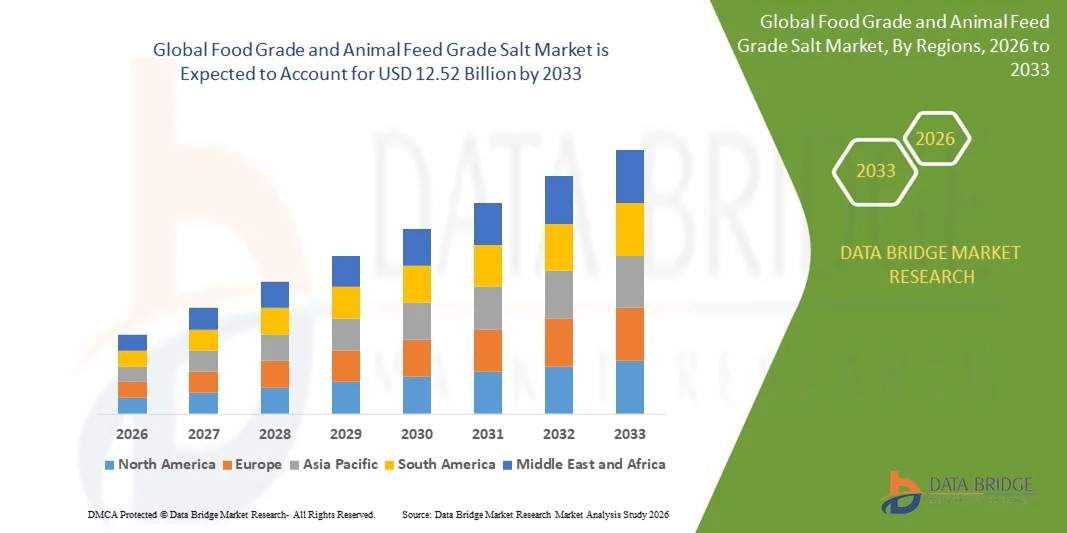

- The global food grade and animal feed grade salt market size was valued at USD 9.73 billion in 2025 and is expected to reach USD 12.52 billion by 2033, at a CAGR of 3.20% during the forecast period

- Increasing demand for food grade salt in food & beverage industry, the growth of salt is increasing in the market. Similarly, the increased usage of salt in animal feed is also boosting the growth in the market.

What are the Major Takeaways of Food Grade and Animal Feed Grade Salt Market?

- Certain government initiatives and policies for salt reduction are hampering the growth of food grade salt in the market. The various launches in the food grade salt are propelling the market growth

- North America dominated the food grade and animal feed grade salt market with an estimated 42.1% revenue share in 2025, driven by high consumption of processed foods, strong meat and dairy production, and well-established livestock farming across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.36% from 2026 to 2033, driven by rapid urbanization, population growth, and increasing consumption of packaged foods across China, India, Southeast Asia, and Japan

- The Vacuum Salt segment dominated the market with an estimated 41.8% share in 2025, owing to its high purity, uniform crystal size, and suitability for food processing and animal feed formulations

Report Scope and Food Grade and Animal Feed Grade Salt Market Segmentation

|

Attributes |

Food Grade and Animal Feed Grade Salt Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Food Grade and Animal Feed Grade Salt Market?

Increasing Shift Toward Purity-Enhanced, Fortified, and Application-Specific Salt Products

- The food grade and animal feed grade salt market is witnessing a growing shift toward high-purity, contaminant-controlled, and standardized salt products to meet stringent food safety and animal nutrition regulations

- Manufacturers are introducing fortified and functional salt variants, including iodine-enriched, mineral-balanced, and trace-element-added salts for both human consumption and livestock feed

- Rising demand for consistent quality, uniform granulation, and reliable mineral composition is driving adoption across food processing plants and feed mills

- For instance, companies such as Cargill, Morton Salt, K+S, and Windsor Salt are expanding production of refined, food-safe, and feed-optimized salt grades with improved processing and packaging standards

- Increasing focus on animal health, feed efficiency, and nutritional supplementation is accelerating demand for feed-grade salt solutions

- As regulatory compliance and nutrition optimization gain importance, food grade and animal feed grade salts remain essential inputs for food processing and livestock management

What are the Key Drivers of Food Grade and Animal Feed Grade Salt Market?

- Rising demand for safe, hygienic, and nutritionally compliant ingredients in packaged foods, meat processing, dairy products, and animal feed formulations

- For instance, during 2024–2025, leading salt producers such as Cargill, Morton Salt, and K+S increased capacity for food-grade and fortified salt products to support growing demand from food and feed manufacturers

- Growth of processed food consumption, meat production, and commercial livestock farming across the U.S., Europe, and Asia-Pacific is boosting salt demand

- Advancements in refining technologies, purification processes, and contamination control have improved product quality and regulatory adherence

- Increasing use of feed-grade salt for electrolyte balance, digestion, and growth optimization in cattle, poultry, and aquaculture

- Supported by expanding food processing industries and rising global protein consumption, the Food Grade and Animal Feed Grade Salt market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Food Grade and Animal Feed Grade Salt Market?

- Stringent regulations related to food safety, purity standards, and additive compliance increase production and certification costs for manufacturers

- For instance, during 2024–2025, rising energy prices, transportation costs, and environmental compliance requirements impacted operational margins for salt producers

- Fluctuations in raw salt availability due to climatic conditions, mining restrictions, and logistics disruptions affect supply stability

- Growing consumer preference for low-sodium diets and salt reduction initiatives limits volume growth in certain food categories

- Competition from salt substitutes, mineral blends, and alternative dietary supplements creates pricing and demand pressures

- To overcome these challenges, companies are focusing on process optimization, product differentiation, sustainable sourcing, and value-added fortified salt offerings

How is the Food Grade and Animal Feed Grade Salt Market Segmented?

The market is segmented on the basis of product type, purity, production processes, distribution channel, end user, and application.

- By Product Type

On the basis of product type, the food grade and animal feed grade salt market is segmented into Rock Salt, Sea Salt, Brine, Vacuum Salt, and Others. The Vacuum Salt segment dominated the market with an estimated 41.8% share in 2025, owing to its high purity, uniform crystal size, and suitability for food processing and animal feed formulations. Vacuum salt is widely used in bakery, dairy, meat processing, and feed applications due to its low impurity levels and consistent mineral composition.

The Sea Salt segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for minimally processed, natural-origin salt in both food and specialty feed applications. Increasing preference for sea salt in premium food products and growing awareness of trace mineral benefits support rapid growth.

- By Purity

On the basis of purity, the market is segmented into Purity 98%–99.5% and Purity Above 99.5%. The Purity Above 99.5% segment dominated the market with a 57.3% share in 2025, supported by stringent food safety regulations and growing demand from processed food manufacturers and commercial feed producers. High-purity salt ensures consistency, hygiene, and compliance with regulatory standards, making it a preferred choice across large-scale food production.

The Purity 98%–99.5% segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use in animal feed, aquaculture, and cost-sensitive food applications. Balanced pricing and adequate mineral content make this purity range attractive for high-volume feed formulations.

- By Production Processes

On the basis of production processes, the market is segmented into Evaporation Method, Mining Method, and Others. The Evaporation Method segment dominated the market with an estimated 46.5% share in 2025, due to its ability to produce high-purity salt with controlled crystallization. This method is widely used for food-grade and feed-grade applications where consistency and contamination control are critical.

The Mining Method segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by expanding underground and solution mining operations, improved refining technologies, and growing demand for bulk feed-grade salt. Increased investment in sustainable mining practices further supports segment growth.

- By Distribution Channel

On the basis of distribution channel, the food grade and animal feed grade salt market is segmented into Direct and Indirect channels. The Direct channel dominated the market with a 52.6% share in 2025, driven by strong demand from large food processors, meat producers, and feed manufacturers seeking stable supply, customized specifications, and cost efficiency. Direct procurement ensures quality assurance, traceability, and long-term supplier relationships.

The Indirect channel is projected to grow at the fastest CAGR from 2026 to 2033, supported by expansion of wholesalers, distributors, and retail networks catering to small and medium food producers, foodservice operators, and regional feed mills.

- By End User

On the basis of end user, the market is segmented into Food & Beverages Industry and Food Service Sector. The Food & Beverages Industry segment dominated the market with an estimated 64.9% share in 2025, owing to extensive usage in processed foods, bakery, dairy, meat processing, and packaged snacks. Large-scale production volumes and stringent quality requirements drive sustained demand.

The Food Service Sector segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by expansion of quick-service restaurants, catering services, and institutional kitchens, along with rising consumption of prepared foods.

- By Application

On the basis of application, the food grade and animal feed grade salt market is segmented into Food Products, Sports Nutrition, Beverages, and Animal Feed. The Food Products segment dominated the market with a 48.7% share in 2025, supported by high usage in processed foods, bakery, dairy, and meat preservation. Salt remains a critical ingredient for flavor enhancement, texture, and shelf-life extension.

The Animal Feed segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising livestock production, increasing focus on animal health, and growing use of salt as an essential mineral supplement in feed formulations.

Which Region Holds the Largest Share of the Food Grade and Animal Feed Grade Salt Market?

- North America dominated the food grade and animal feed grade salt market with an estimated 42.1% revenue share in 2025, driven by high consumption of processed foods, strong meat and dairy production, and well-established livestock farming across the U.S. and Canada

- Strict food safety regulations, widespread use of fortified and high-purity salt, and advanced feed formulation practices continue to support sustained demand

- Presence of leading salt producers, efficient distribution networks, and large-scale food processing facilities further reinforce North America’s market leadership

U.S. Food Grade and Animal Feed Grade Salt Market Insight

The U.S. is the largest contributor in North America, supported by strong demand from packaged food manufacturers, meat processors, and commercial livestock farms. High consumption of processed foods, increasing use of fortified salt, and advanced feed nutrition standards drive consistent market growth. Presence of major producers and large foodservice chains further strengthens demand.

Canada Food Grade and Animal Feed Grade Salt Market Insight

Canada contributes significantly to regional growth, driven by expanding food processing capacity, growing dairy and meat exports, and rising demand for feed-grade salt in livestock and aquaculture. Strong regulatory oversight and emphasis on food quality support steady market adoption.

Asia-Pacific Food Grade and Animal Feed Grade Salt Market

Asia-Pacific is projected to register the fastest CAGR of 10.36% from 2026 to 2033, driven by rapid urbanization, population growth, and increasing consumption of packaged foods across China, India, Southeast Asia, and Japan. Expansion of commercial livestock farming, poultry production, and aquaculture is boosting demand for animal feed-grade salt. Rising investments in food processing infrastructure and improving cold-chain logistics further accelerate regional growth

China Food Grade and Animal Feed Grade Salt Market Insight

China is the largest contributor in Asia-Pacific due to massive food processing output, growing meat consumption, and strong demand for feed-grade salt in large-scale livestock and aquaculture operations. Government focus on food safety and nutrition standards supports market expansion.

India Food Grade and Animal Feed Grade Salt Market Insight

India is emerging as a key growth hub, driven by rapid growth in packaged foods, expanding dairy and poultry sectors, and rising demand for affordable feed-grade salt. Increasing urban consumption and government initiatives supporting food processing boost adoption.

Japan Food Grade and Animal Feed Grade Salt Market Insight

Japan shows stable growth supported by mature food manufacturing, high-quality dietary standards, and consistent demand for refined food-grade salt. Strong emphasis on product purity and safety sustains steady market demand.

South Korea Food Grade and Animal Feed Grade Salt Market Insight

South Korea contributes steadily due to growing consumption of processed foods, expanding livestock production, and rising demand for high-purity salt in food and feed applications. Advanced supply chains and quality-focused manufacturing support long-term growth.

Which are the Top Companies in Food Grade and Animal Feed Grade Salt Market?

The food grade and animal feed grade salt industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Morton Salt, Inc. (U.S.)

- K+S Aktiengesellschaft (Germany)

- Ciech S.A. (Poland)

- Windsor Salt Ltd. (Canada)

- United Salt Corporation (U.S.)

- SaltWorks (U.S.)

- The Cope Company Salt (U.S.)

- SAN FRANCISCO SALT CO (U.S.)

- ZOUTMAN NV (Belgium)

- Salinen Austria Aktiengesellschaft (Austria)

- WA Salt Group (Australia)

- Cimsal Indústria Salineira (Brazil)

- Cheetham Salt (Australia)

- British Salt (U.K.)

- Mozyrsalt, JSC (Belarus)

- Sifto Canada (Canada)

- Midwest Salt (U.S.)

- ROCK (U.K.)

- Ahir Salt Industries (India)

- Donald Brown Group (U.K.)

What are the Recent Developments in Global Food Grade and Animal Feed Grade Salt Market?

- In May 2023, Cargill entered into a strategic collaboration with CIECH Group to expand its specialty and evaporated food salt solutions across Europe. This development aims to diversify Cargill’s product offerings tailored for food manufacturers and strengthen its market presence in the region. The move positions Cargill to meet the rising demand for specialty salts in food processing, reinforcing its innovation-driven leadership in the European salt market

- In December 2022, CIECH Soda Polska signed a long-term supply agreement with Inowrocław Salt Mines "Solino" to secure a consistent brine supply. This initiative enhances production stability and operational efficiency for CIECH, ensuring uninterrupted output. The agreement supports CIECH’s role as a major player in the European salt market through reliable sourcing and sustainable growth

- In April 2022, Tata Salt launched Tata Salt Immuno in India, a zinc-fortified edible salt designed to support immune health. This product innovation addresses increasing consumer focus on health and nutrition, going beyond basic iodization. The launch strengthens Tata’s product portfolio and highlights a growing trend toward functional salt in the Indian market

- In May 2021, Tanteo Tequila introduced flavored margarita salts to complement its tequila offerings, targeting the premium cocktail segment. These salts enhance taste profiles and provide a customizable drinking experience, aligning with the evolving preferences in the beverage industry. The launch showcases the expansion of salt applications into lifestyle and niche markets, creating new growth avenues beyond traditional food use

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.