Global Interventional Cardiology Peripheral Vascular Devices Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

21.53 Billion

USD

38.40 Billion

2024

2032

USD

21.53 Billion

USD

38.40 Billion

2024

2032

| 2025 –2032 | |

| USD 21.53 Billion | |

| USD 38.40 Billion | |

|

|

|

|

Global Interventional Cardiology and Peripheral Vascular Devices Market Segmentation, By Product (Angioplasty Balloons, Coronary Stent, Catheters, Endovascular Aneurysm Repair Stent Grafts, Inferior Vena Cava (IVC) Filters, Plaque Modification Devices, and Accessories and Hemodynamic Flow Alteration Devices), Product Type (Devices and Accessories), Type (Conventional, and Standard), Procedure (Iliac Intervention, Femoropopliteal Interventions, Tibial (Below-The-Knee) Interventions, Peripheral Angioplasty, Arterial Thrombectomy, and Peripheral Atherectomy), Indication (Peripheral Arterial Disease, and Coronary Intervention), Age Group (Geriatric, Adults, and Pediatric), End User (Hospitals, Ambulatory Surgery Centers, Nursing Facilities, Clinics, and Others), Distribution Channel (Direct Tender, Third Party Distributors, and Others) - Industry Trends and Forecast to 2032

Interventional Cardiology and Peripheral Vascular Devices Market Size

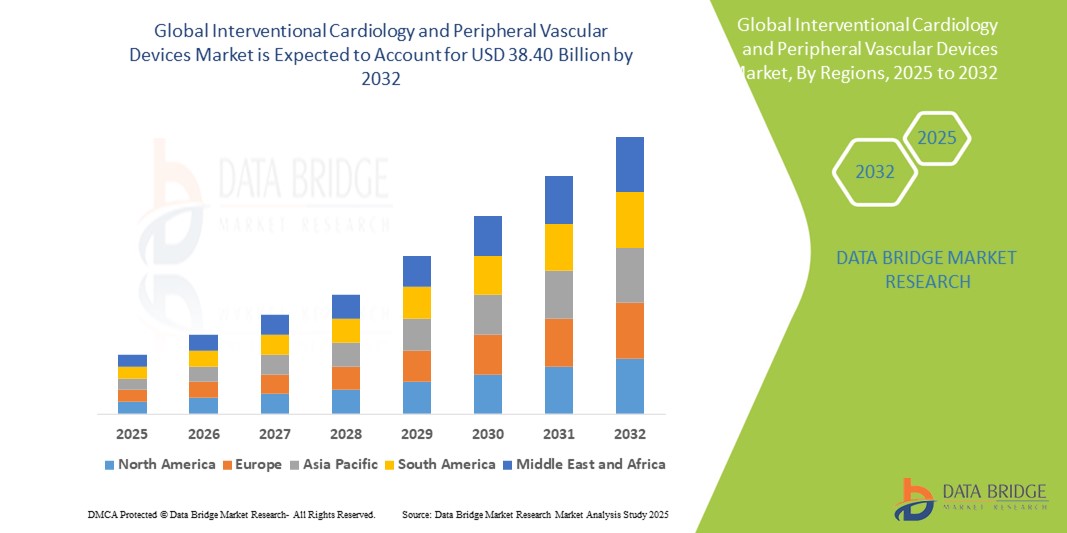

- The global interventional cardiology and peripheral vascular devices market size was valued atUSD 21.53 billion in 2024and is expected to reachUSD 38.40 billion by 2032, at aCAGR of 7.50%during the forecast period

- This growth is driven by factors such as the increasing global burden of cardiovascular diseases, rising geriatric population, and technological advancements in minimally invasive procedures and vascular devices

Interventional Cardiology and Peripheral Vascular Devices Market Analysis

- Interventional cardiology and peripheral vascular devices are critical tools used in the diagnosis and treatment of cardiovascular and peripheral artery diseases through minimally invasive procedures such as angioplasty, stenting, and atherectomy

- The demand for these devices is significantly driven by the increasing prevalence of cardiovascular diseases, rising geriatric population, and growing preference for minimally invasive procedures over traditional surgery

- North America is expected to dominate the interventional cardiology and peripheral vascular devices market with largest market share of 36.6%, due to its advanced healthcare infrastructure, strong presence of key market players, and high adoption of innovative cardiovascular technologies

- Asia-Pacific is expected to be the fastest growing region in the interventional cardiology and peripheral vascular devices market during the forecast period due to rising healthcare investments, increasing awareness of cardiovascular health, and improving access to modern treatment options

- Coronary stents segment is expected to dominate the market with a largest market share of 64.7% due to widespread use in coronary and peripheral interventions, along with continuous innovations such as drug-eluting and bioresorbable stents enhancing procedural success and patient outcomes

Report Scope and Interventional Cardiology and Peripheral Vascular Devices Market Segmentation

|

Attributes |

Interventional Cardiology and Peripheral Vascular Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Interventional Cardiology and Peripheral Vascular Devices Market Trends

“Technological Innovation Driving Precision and Minimally Invasive Cardiovascular Treatments”

- One prominent trend in the interventional cardiology and peripheral vascular devices market is the ongoing advancement in device miniaturization, imaging integration, and drug-delivery technologies

- These innovations enhance procedural accuracy and patient safety by enabling real-time imaging, targeted treatment delivery, and lower complication rates during complex cardiovascular and peripheral interventions

- For instance, the development of drug-coated balloons, bioresorbable vascular scaffolds, and image-guided atherectomy systems has improved outcomes in patients with peripheral artery disease and complex coronary lesions, while reducing the need for repeat interventions

- These technological advancements are reshaping cardiovascular care by supporting the global shift toward minimally invasive procedures, improving long-term patient outcomes, and fueling demand for next-generation interventional and vascular devices

Interventional Cardiology and Peripheral Vascular Devices Market Dynamics

Driver

“Rising Global Burden of Cardiovascular and Peripheral Artery Diseases”

- The increasing global prevalence of cardiovascular diseases (CVDs) and peripheral artery disease (PAD) is a major driver fueling demand for interventional cardiology and vascular devices

- As the global population ages, the incidence of heart disease, hypertension, and diabetes continues to rise—conditions that significantly elevate the risk for coronary and peripheral vascular complications requiring interventional treatment

- The growing number of patients undergoing angioplasty, stenting, and catheter-based procedures is contributing to the consistent expansion of this market, with minimally invasive options preferred due to faster recovery and lower complication rates

For instance,

- According to the World Health Organization (2023), cardiovascular diseases remain the leading cause of death globally, accounting for approximately 17.9 million deaths annually, with a substantial proportion of these cases being preventable through early diagnosis and timely intervention

- As a result, there is heightened demand for advanced, cost-effective, and minimally invasive interventional solutions, driving growth across both developed and emerging markets in the cardiovascular care segment

Opportunity

“Leveraging Artificial Intelligence and Digital Health Integration in Cardiovascular Interventions”

- The integration ofartificial intelligence (AI)and digital health technologies into interventional cardiology and peripheral vascular procedures presents a transformative opportunity to enhance precision, efficiency, and patient outcomes

- AI-driven platforms can assist in image-guided diagnostics, procedural planning, and real-time decision-making during catheter-based interventions, reducing variability and improving procedural success

- Additionally, remote monitoring tools and AI-powered data analytics enable continuous patient assessment post-procedure, optimizing follow-up care and helping to predict potential complications before they arise

For instance,

- In 2024 study published by the European Society of Cardiology, AI algorithms demonstrated high accuracy in interpreting intravascular imaging and electrocardiogram (ECG) data, supporting early diagnosis of arterial blockages and stratifying patient risk more effectively

- The growing adoption of AI-enhanced interventional platforms and connected cardiovascular care ecosystems is expected to expand treatment access, reduce healthcare costs, and significantly contribute to the growth and evolution of the global interventional cardiology and peripheral vascular devices market

Restraint/Challenge

“High Device Costs and Limited Accessibility in Developing Regions”

- The high cost of advanced interventional cardiology and peripheral vascular devices remains a significant barrier, particularly in low- and middle-income countries, limiting widespread adoption and procedural accessibility

- These devices, including drug-eluting stents, atherectomy systems, and image-guided catheters, often require substantial capital investment, making it challenging for smaller healthcare providers and public hospitals to procure and utilize them

- The financial burden is further compounded by the need for specialized training, supporting infrastructure, and post-procedural monitoring systems, creating disparities in care availability between high- and low-resource settings

For instance,

- In 2023 report by the World Bank, the cost of cardiovascular interventions in lower-income countries can exceed 50% of average annual income, significantly limiting treatment access for large segments of the population

- As a result, the high cost of devices and related technologies hinders market penetration in price-sensitive regions, slowing the adoption of advanced interventional solutions and posing a challenge to global market growth

Interventional Cardiology and Peripheral Vascular Devices Market Scope

The market is segmented on the basis of product, type, procedure, indication, age group, end user, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Procedure |

|

|

By Indication |

|

|

By Age Group |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the coronary stents is projected to dominate the market with a largest share in product segment

The coronary stents segment is expected to dominate the interventional cardiology and peripheral vascular devices market with the largest share of 64.7% due to widespread use in coronary and peripheral interventions, along with continuous innovations such as drug-eluting and bioresorbable stents enhancing procedural success and patient outcomes

The peripheral arterial disease is expected to account for the largest share during the forecast period in indication segment

In 2025, the peripheral arterial disease segment is expected to dominate the market with the largest market share of 45.4% due to growing prevalence of cardiovascular diseases and advancements in diagnostic technologies. This study surge aims to improve understanding of PAD’s pathophysiology, treatment options, and patient outcomes

Interventional Cardiology and Peripheral Vascular Devices Market Regional Analysis

“North America Holds the Largest Share in the Interventional Cardiology and Peripheral Vascular Devices Market”

- North America dominates the interventional cardiology and peripheral vascular devices market with largest market share of 36.6%, driven by robust healthcare infrastructure, high procedural volumes, and the early adoption of advanced cardiovascular technologies

- The U.S. holds a substantial market share of 26.8%, due to a high prevalence of cardiovascular diseases, favorable reimbursement policies, and strong R&D investment from major medical device companies

- The region benefits from a growing geriatric population and rising demand for minimally invasive procedures such as angioplasty, stenting, and peripheral interventions

- Additionally, ongoing clinical trials, FDA approvals, and the presence of leading market players such as Medtronic, Boston Scientific, and Abbott further bolster North America’s market leadership

“Asia-Pacific is Projected to Register the Highest CAGR in the Interventional Cardiology and Peripheral Vascular Devices Market”

- The Asia-Pacific region is expected to experience the fastest growth during the forecast period due to expanding healthcare infrastructure, rising disposable incomes, and a growing burden of lifestyle-related cardiovascular diseases

- Countries like China, India, and Japan are emerging as high-growth markets owing to large aging populations, increased awareness about heart health, and improved access to healthcare services

- Japan leads in innovation and adoption of advanced cardiovascular devices, while India and China are seeing significant public and private investments in catheterization labs and interventional services

- Moreover, government initiatives to reduce cardiovascular mortality and the entry of global device manufacturers into these markets are further accelerating regional market expansion

Interventional Cardiology and Peripheral Vascular Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Boston Scientific(U.S.)

- Abbott (U.S.)

- Johnson & Johnson(U.S.)

- Terumo Corporation(Japan)

- Cordis Corporation(U.S.)

- Siemens Healthineers(Germany)

- Koninklijke Philips N.V. (Netherlands)

- B. Braun Melsungen AG (Germany)

- Edwards Lifesciences (U.S.)

- Cook Medical (U.S.)

- LivaNova PLC (U.K.)

- LeMaitre Vascular (U.S.)

- MicroPort Scientific Corporation (China)

- OrbusNeich (Hong Kong)

- Biotronik (Germany)

- Abbott Vascular (U.S.)

- Terumo Interventional Systems (Japan)

- Avinger, Inc. (U.S.)

- Shockwave Medical (U.S.)

Latest Developments in Global Interventional Cardiology and Peripheral Vascular Devices Market

- In February 2022, Medtronic received approval from the U.S. Food and Drug Administration (FDA) for its Freezor and Freezor Xtra Cardiac Cryoablation Focal Catheters. These catheters are the first and only FDA-approved devices for the treatment of pediatric Atrioventricular Nodal Reentrant Tachycardia (AVNRT). This approval highlighting Medtronic's commitment to addressing complex arrhythmias in younger patients. The introduction of these specialized ablation catheters not only expands the range of treatment options for pediatric patients but also strengthens Medtronic's position within the global interventional cardiology and peripheral vascular devices market

- In June 2024, Philips introduced its Duo Venous Stent System in the U.S., designed to address venous obstructions. Having received approval in December, this innovative device aims to tackle the root causes of chronic deep venous disease, offering two distinct models tailored to various venous conditions. This advancement underscores Philips' dedication to enhancing treatment options for patients with chronic venous disease, positioning the company to strengthen its presence in the global interventional cardiology and peripheral vascular devices market

- In April 2024, the U.S. Food and Drug Administration (FDA) granted approval to Abbott for its groundbreaking Esprit BTK System, featuring an Enviroximes Eluting Resorbable Scaffold. This advanced technology is designed to manage chronic limb-threatening ischemia (CLTI) in the area beneath the knee (BTK). This approval highlights Abbott's role in advancing interventional cardiology. The Esprit BTK System is expected to enhance clinical outcomes for patients with CLTI, further strengthening Abbott's position within the global interventional cardiology and peripheral vascular devices market

- In January 2024, Cook Group launched its Slip-Cath Beacon Tip Hydrophilic Selective Catheter in the U.S. and Canada. This versatile catheter is designed for use in both vascular and nonvascular procedures, providing healthcare providers with a flexible solution across various medical applications. The introduction of this catheter highlights Cook Group’s commitment to advancing medical technology, offering a reliable tool for a wide range of interventional procedures

- In June 2023, Cook Medical expanded its Advance Serenity hydrophilic PTA balloon catheter product line by introducing new size options and expanding its availability to additional locations. Primarily used for above- and below-the-knee procedures to treat patients with Peripheral Artery Disease (PAD), the device is currently available in the U.S. and Canada, with plans for imminent availability in Europe. This expansion underscores Cook Medical's commitment to addressing the growing global demand for advanced, minimally invasive solutions for PAD treatment

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.