Global Organic Cocoa Beverages Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

3.04 Billion

USD

5.90 Billion

2025

2033

USD

3.04 Billion

USD

5.90 Billion

2025

2033

| 2026 –2033 | |

| USD 3.04 Billion | |

| USD 5.90 Billion | |

|

|

|

|

Global Organic Cocoa Beverages Market Segmentation, By Product Type (Cocoa Butter, Cocoa Liquor, and Cocoa Powder), Distribution Channel (Online and Offline) - Industry Trends and Forecast to 2033

What is the Global Organic Cocoa Beverages Market Size and Growth Rate?

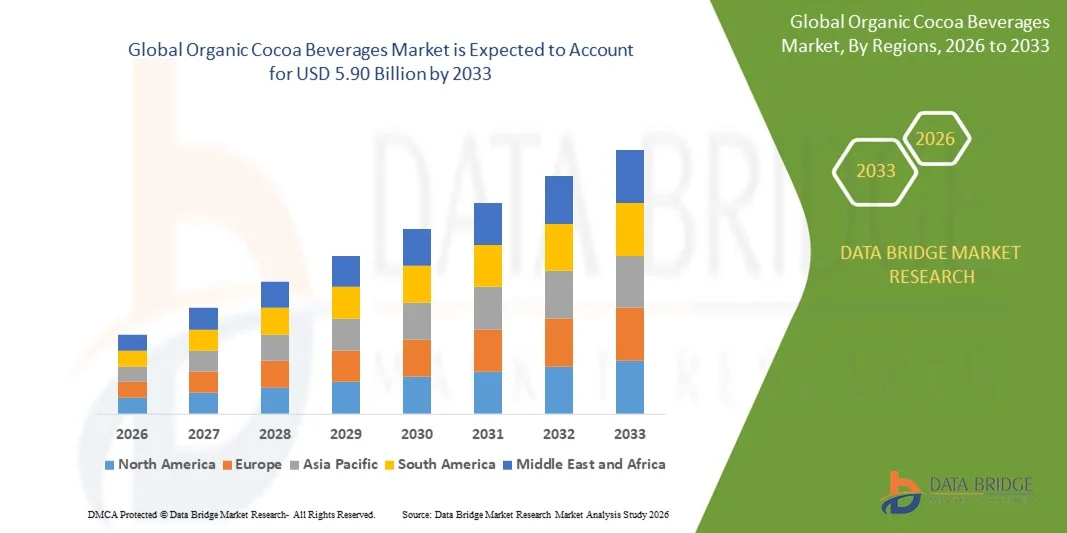

- The global organic cocoa beverages market size was valued at USD 3.04 billion in 2025 and is expected to reach USD 5.90 billion by 2033, at a CAGR of8.65% during the forecast period

- Rise in the awareness among consumers of the health benefits of chocolate consumption is the major driver escalating the market growth, also increase in the application of cocoa in other end-user sectors, such as the cosmetic industry and pharmaceutical industry, rise in the demand from emerging economies and increase in the research and development activities in the market are also the factors driving the organic cocoa beverages market growth

What are the Major Takeaways of Organic Cocoa Beverages Market?

- Rise in the technological advancements and modernization in the production techniques will further create new opportunities for the organic cocoa beverages market manufacturers

- However, rise in the cost of research and development activities acts as the major factor acting as a restraint, and will further challenge the growth of organic cocoa beverages market

- North America dominated the organic cocoa beverages market with a 38.59% revenue share in 2025, driven by high consumer awareness regarding organic, clean-label, and ethically sourced beverages across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.32% from 2026 to 2033, driven by rising disposable incomes, growing urbanization, and increasing awareness of organic and functional beverages across China, Japan, India, South Korea, and Southeast Asia

- The Cocoa Powder segment dominated the market with an estimated 46.7% revenue share in 2025, as it is the most widely used ingredient in organic cocoa beverages due to its rich flavor profile, high antioxidant content, and ease of blending with plant-based and dairy formulations

Report Scope and Organic Cocoa Beverages Market Segmentation

|

Attributes |

Organic Cocoa Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Organic Cocoa Beverages Market?

Rising Shift Toward Clean-Label, Functional, and Sustainably Sourced Organic Cocoa Beverages

- The organic cocoa beverages market is witnessing increasing demand for clean-label, organic, and minimally processed cocoa drinks, driven by growing consumer awareness of health, transparency, and ingredient sourcing

- Manufacturers are focusing on functional formulations enriched with antioxidants, minerals, plant-based proteins, and adaptogens to position organic cocoa beverages as wellness-focused products

- Rising preference for plant-based, dairy-free, and low-sugar beverages is accelerating innovation in organic cocoa drinks made with almond, oat, coconut, and soy milk bases

- For instance, leading brands and organic food companies are expanding portfolios with certified organic, fair-trade cocoa beverages, emphasizing ethical sourcing and sustainability credentials

- Growing popularity of ready-to-drink (RTD) organic cocoa beverages supports on-the-go consumption among health-conscious and urban consumers

- As consumers increasingly prioritize nutrition, sustainability, and ethical consumption, organic cocoa beverages are emerging as a premium yet mainstream beverage category

What are the Key Drivers of Organic Cocoa Beverages Market?

- Rising consumer demand for organic, non-GMO, and chemical-free beverages to support digestive health, immunity, and overall wellness

- For instance, in 2024–2025, multiple beverage manufacturers launched organic cocoa drinks with reduced sugar, natural sweeteners, and functional ingredients, strengthening market visibility

- Growing adoption of plant-based diets and vegan lifestyles is significantly boosting demand for dairy-free organic cocoa beverage alternatives across North America, Europe, and Asia-Pacific

- Increasing availability through supermarkets, health food stores, online retail, and direct-to-consumer channels improves market accessibility

- Expanding awareness of cocoa’s antioxidant and mood-enhancing properties is driving its use in functional and nutritional beverages

- Supported by rising disposable incomes, premiumization trends, and sustainable food investments, the organic cocoa beverages market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Organic Cocoa Beverages Market?

- High costs of organic cocoa sourcing, certification, and sustainable farming practices increase product pricing and limit affordability for price-sensitive consumers

- For instance, during 2024–2025, volatility in global cocoa prices, climate-related supply disruptions, and certification costs impacted raw material availability

- Shorter shelf life and clean-label formulation constraints pose challenges in product stability and large-scale distribution

- Limited consumer awareness in emerging markets regarding organic certifications and functional benefits slows adoption

- Competition from conventional cocoa beverages, flavored plant-based drinks, and functional alternatives increases pricing pressure

- To address these challenges, companies are investing in sustainable supply chains, innovative formulations, cost optimization, and consumer education, supporting broader adoption of Organic Cocoa Beverages

How is the Organic Cocoa Beverages Market Segmented?

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the organic cocoa beverages market is segmented into Cocoa Butter, Cocoa Liquor, and Cocoa Powder. The Cocoa Powder segment dominated the market with an estimated 46.7% revenue share in 2025, as it is the most widely used ingredient in organic cocoa beverages due to its rich flavor profile, high antioxidant content, and ease of blending with plant-based and dairy formulations. Organic cocoa powder is extensively utilized in ready-to-drink beverages, instant mixes, and functional drinks, supported by strong consumer preference for low-fat, nutrient-dense cocoa products. Its longer shelf life, cost efficiency, and compatibility with clean-label formulations further strengthen adoption across mass and premium beverage categories.

The Cocoa Liquor segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for premium, full-bodied cocoa beverages with higher cocoa solids. Increasing focus on artisanal, minimally processed, and high-flavanol drinks is accelerating the use of cocoa liquor in premium organic beverage formulations.

- By Distribution Channel

On the basis of distribution channel, the organic cocoa beverages market is segmented into Online and Offline channels. The Offline segment dominated the market with a 61.3% share in 2025, supported by strong sales through supermarkets, hypermarkets, specialty organic stores, health food outlets, and convenience stores. Physical retail channels allow consumers to assess product quality, certifications, and ingredient transparency, which is particularly important for organic and premium beverage purchases. In-store promotions, brand visibility, and immediate product availability continue to drive higher offline sales volumes, especially in North America and Europe.

The Online segment is projected to register the fastest CAGR from 2026 to 2033, fueled by rapid growth in e-commerce platforms, direct-to-consumer brand strategies, and subscription-based beverage models. Rising digital adoption, wider product variety, competitive pricing, and home-delivery convenience are accelerating online penetration, particularly among younger and health-conscious consumers.

Which Region Holds the Largest Share of the Organic Cocoa Beverages Market?

- North America dominated the organic cocoa beverages market with a 38.59% revenue share in 2025, driven by high consumer awareness regarding organic, clean-label, and ethically sourced beverages across the U.S. and Canada. Strong demand for plant-based drinks, functional cocoa beverages, and low-sugar indulgent products continues to support market expansion. Widespread availability through supermarkets, specialty organic stores, and online platforms, along with premium pricing acceptance, further fuels regional growth

- Leading beverage manufacturers and organic brands in North America are expanding product portfolios with fair-trade, non-GMO, and sustainably sourced cocoa formulations, strengthening the region’s competitive advantage. Continuous innovation in flavor variants, fortified beverages, and ready-to-drink formats supports long-term market expansion

- High disposable income levels, strong health-conscious consumer base, and well-developed retail infrastructure further reinforce North America’s leadership position

U.S. Organic Cocoa Beverages Market Insight

The U.S. is the largest contributor within North America, supported by strong demand for organic hot chocolate mixes, functional cocoa drinks, and dairy-free cocoa beverages. Rising focus on antioxidant-rich products, sustainable sourcing, and premium indulgence drives consumption across households, cafés, and foodservice channels. Presence of leading organic food brands, strong e-commerce penetration, and frequent product launches further accelerate market growth.

Canada Organic Cocoa Beverages Market Insight

Canada contributes significantly to regional growth, driven by increasing preference for organic and ethically sourced beverages. Rising adoption of plant-based diets, strong demand for clean-label cocoa products, and expanding availability through health food retailers and online channels support market expansion. Government support for organic certification and sustainable agriculture further strengthens adoption.

Asia-Pacific Organic Cocoa Beverages Market

Asia-Pacific is projected to register the fastest CAGR of 7.32% from 2026 to 2033, driven by rising disposable incomes, growing urbanization, and increasing awareness of organic and functional beverages across China, Japan, India, South Korea, and Southeast Asia. Expanding café culture, premium chocolate beverage consumption, and growing interest in Western-style cocoa drinks accelerate demand. Rapid growth of e-commerce and modern retail formats further supports market penetration.

China Organic Cocoa Beverages Market Insight

China is the largest contributor to Asia-Pacific growth due to expanding middle-class population, increasing health awareness, and rising consumption of premium and imported organic beverages. Growing demand for functional cocoa drinks and online retail dominance strengthens market adoption.

Japan Organic Cocoa Beverages Market Insight

Japan shows steady growth supported by high demand for premium, minimally processed, and high-quality organic beverages. Strong preference for functional ingredients, antioxidant benefits, and premium packaging drives sustained market expansion.

India Organic Cocoa Beverages Market Insight

India is emerging as a high-growth market, driven by rising health awareness, increasing penetration of organic products, and expanding café and premium beverage culture. Growth in online retail and urban consumption patterns accelerates adoption.

South Korea Organic Cocoa Beverages Market Insight

South Korea contributes notably due to strong demand for premium, functional, and wellness-focused beverages. Growing café culture, innovative cocoa drink formats, and strong branding support continued market growth.

Which are the Top Companies in Organic Cocoa Beverages Market?

The organic cocoa beverages industry is primarily led by well-established companies, including:

- Olam International (Singapore)

- Cargill, Incorporated (U.S.)

- Barry Callebaut (Switzerland)

- Nestlé (Switzerland)

- PURATOS (Belgium)

- NATRA (Spain)

- TOUTON S.A. (France)

- Kuruvilla & Sons (India)

- JBCOCOA Sdn. Bhd. (Malaysia)

- Ecuakao Group Ltd (Ecuador)

- ALTINMARKA (Turkey)

- MONER COCOA, S.A. (Spain)

- Indcre S.A. (France)

- Blommer Chocolate Company (U.S.)

- Guan Chong Berhad (GCB) (Malaysia)

- UNITED COCOA PROCESSOR, INC. (Ghana)

- ciranda, inc. (U.S.)

- TRADIN ORGANIC AGRICULTURE B.V. (Netherlands)

- Huyser Möller (Netherlands)

- Sucden (France)

- Plot Enterprise Ghana Ltd (Ghana)

- Ecom Dutch Cocoa (Netherlands)

- FTN Cocoa Processors PLC (Nigeria)

- Jindal Cocoa (India)

What are the Recent Developments in Global Organic Cocoa Beverages Market?

- In May 2025, Justin’s broadened its organic chocolate portfolio by launching two new candy bars, Dark Chocolate Peanut Caramel Nougat and Milk Chocolate Peanut Caramel Nougat, both USDA organic and non-GMO certified. Introduced across Sprouts and Whole Foods stores, the launch aligns with rising consumer preference for mindful, clean-label snacking and premium organic confectionery. This expansion strengthens Justin’s brand visibility and helps consolidate its market share across North America

- In January 2025, Nestlé Travel Retail unveiled a new range of sustainably produced, organically grown chocolates under its Cocoa Plan, carrying Rainforest Alliance certification. Designed specifically for global airport and duty-free retail channels, the range emphasizes traceability, ethical sourcing, and high-quality organic ingredients to appeal to international travelers. This initiative reinforces Nestlé’s commitment to sustainability while expanding its organic cocoa presence in travel retail

- In December 2024, Scotland-based Ocelot Chocolate launched Miche Crumb, a 70% organic cocoa dark chocolate blended with caramelised bakery crumbs and brown-butter honey, developed in collaboration with artisan bakeries Wild Hearth and Twelve Triangles. Positioned as a gourmet reinterpretation of traditional dark chocolate, the product targets both chocolate connoisseurs and environmentally conscious consumers. This launch enhances Ocelot Chocolate’s premium positioning in the organic and craft chocolate segment

- In March 2024, Cargill India, a subsidiary of Cargill Inc., expanded its NatureFresh Professional portfolio by introducing block chocolates, chocolate chips, and cocoa powder products tailored for food and bakery manufacturers across India. The expanded range supports professional applications while addressing demand for consistent quality and scalable cocoa solutions. This development strengthens Cargill’s footprint in India’s growing bakery and food manufacturing sector

- In June 2023, Belgium-based Puratos Group acquired Foley’s Chocolates, a Canadian chocolate manufacturer, to broaden its product offerings across plant-based, protein-enhanced, no-sugar, and reduced-sugar chocolate solutions. The acquisition enhances Puratos’ innovation capabilities and geographic reach in North America. This strategic move accelerates Puratos’ growth in health-focused and functional chocolate categories

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.