Refrigerated transport refers to temperature-controlled shipping services vehicles such as shipping containers and refrigerated trucks. "refrigerated transport" describes shipping containers and trucks for temperature-controlled freight. These vehicles have an integrated cooling system that keeps the desired temperature constant during transportation. They frequently transport food items, including fruits, vegetables, dairy, meat, and seafood, and non-food items, like medications and flowers. These methods help extend the product's shelf life and guarantee that seasonal goods are available all year round. Refrigerated transport systems are insulated container systems that actively and passively regulate temperature and are used for many kinds of transportation. Even in difficult situations, maintaining the right temperature settings helps keep the products' quality.

Additionally, despite being seasonal, it allows consumers worldwide to eat fruits and vegetables all year round. Perishable goods are carried from one location to another using a refrigerated transport service in a controlled atmosphere to maintain quality and freshness and prevent foodborne illness. Refrigerated transport has become essential to the distribution process because the storage and prevention of spoiling of food items and raw materials during transportation require controlled temperatures. The production of temperature-sensitive pharmaceutical medications and growing trade prospects globally are also boosting the market's expansion. The adoption of cost-effective government rules and regulations covering product manufacturing, processing, transportation, and quality, along with an increase in the use of marine transport vehicles, are further drivers that are anticipated to fuel market growth. The North America refrigerated transport market is predicted to reach USD 10,470.03 million by 2029, with sales increasing at a CAGR of roughly 7.1% between 2022 and 2029.

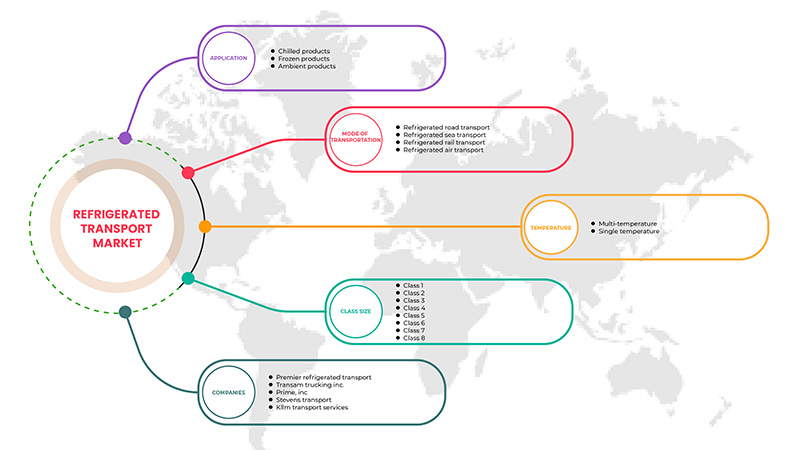

Market Segment Analysis Insights

North America refrigerated transport market is classified according to its application, temperature, mode of transport, class size, and region. Depending on the application, the market is divided into chilled, frozen, and ambient products. The market is divided into four categories based on the mode of transport. Those are refrigerated road transport, refrigerated sea transport, refrigerated rail transport, and refrigerated air transport. The market is divided into temperature segments, such as multi-temperature and single-temperature. The market is divided into class 1, class 2, class 3, class 4, class 5, class 6, class 7, and class 8, depending on the class size.

Based on the regional market is further classified into North America (U.S., Canada, and Mexico).

The diverse refrigerated transport applications can be categorized as chilled, frozen, and ambient product segments. Chilled products are expected to lead the way throughout the forecast period. Chilled products reduce the risk of bacterial growth. The risk is significantly reduced when a product is rapidly chilled (flash-frozen or cryogenic frozen). Additionally, food's natural quality is preserved through cryogenic freezing. One of the key forces driving the market is customers' growing choice for chilled and deli items and their focus on information and desire to grasp different nutritional contents. The demand for chilled meals is rising as customers prefer nutrient-rich superfoods. One of the main factors driving market expansion is expected to continue to be consumers' desire for prepared meals due to their convenience and busy lifestyles. Due to the rising demand for convenience foods in emerging nations, chilled food products are expanding significantly and are predicted to experience rapid expansion. In addition, the growth of supermarkets and fast-food chains is anticipated to open up profitable opportunities for producers of chilled food products and companies that offer refrigerated transport services in the upcoming years. As a result, income from chilled products is predicted to exceed USD 5,045.27 million by 2029.

The various mode of transport of refrigerated transport can be categorized as refrigerated road transport, refrigerated sea transport, refrigerated rail transport, and refrigerated air transport. Refrigerated road transport will likely be the market leader during the projection period. Customers can save time and money by skipping the grocery store and cooking altogether with the frozen food meal, which offers meal flexibility. Roadways are predicted to become a major sector throughout the forecast period due to the market's increasing usage of light commercial vehicles. These market trends are helping the frozen food industry, which will help the demand for refrigerated road transport.

The temperature of refrigerated transport can be categorized as multi-temperature and single-temperature. Multi-temperature is expected to lead the way throughout the forecast period. The network of multi-temperature refrigeration trailers has become more important as the food service sector has expanded. Evaporators and host unit controls in multi-temperature refrigerated trailers allow for the provision of multiple temperatures inside a single unit. The full multi-temperature system is controlled, monitored, pre-tripped, and troubleshot by these units' microprocessors. The collection of multi-temperature refrigerated vehicles has grown in size and importance along with the expansion of the food service sector. Evaporators and host unit controls in multi-temperature refrigerated trailers allow for the provision of various temperatures inside a single unit. These machines now use microprocessors to regulate, monitor, pre-trip and troubleshoot each temperature zone within the entire multi-temperature system. Typically, trucks are used to deliver perishable goods, including fish, meat, milk, and dairy products. The increased usage of multi-temperature refrigeration systems makes it possible to transport multiple perishable items at once, increasing the effectiveness of truck transportation. Thus, revenue is predicted to grow at a CAGR of roughly 7.4% between 2022 and 2029.

The various class size of refrigerated transport can be categorized as class 1, class 2, class 3, class 4, class 5, class 6, class 7, and class 8. The North American Class 8 truck has been expanding gradually amid healthy transportation and construction activity characterized by high freight volumes, rates, and fleet utilization levels among operators. At the same time, the demand for vehicles has been surging. Of these, class 8 is likely to dominate the market throughout the predicted period.

Some market players are PREMIER REFRIGERATED TRANSPORT, TRANSAM TRUCKING INC., PRIME, INC, STEVENS TRANSPORT, and KLLM TRANSPORT SERVICES among others.

Analysis of Regional Markets

The regional markets for North America Refrigerated Transport are the U.S., Canada, and Mexico. Among these, in 2022, the U.S. held a significant proportion of the North America refrigerated transport market. The general tendency in the marketplace in the United States is that food product retailers and manufacturers are shifting from local service suppliers to wider pan-service suppliers as a result of the development of technological web solutions, technological advancements in refrigerated systems and transportation, and a concentration on the deployment of high-quality guidelines required by the private and public sectors.

Additionally, increasing government spending in North American nations to develop the logistics and transportation sector, along with an increase in the region's population that consumes frozen foods and an increase in disposable income, are all anticipated to have a significant impact on the market's expansion in the United States. The U.S. food industry's growing e-commerce use is anticipated to favor the demand for refrigerated transportation.

Market Trends Prevailing and Anticipated in the Market

The market for refrigerated transportation is expected to be driven by rising demand for frozen food. The consumption and customer expectation of frozen meals are changing due to several variables, including increased employment of women globally, the immediate impact of pandemics, an increase in hectic lifestyles, and the culture of working from home. The predicted rise of frozen meals is encouraging, with prospects for expansion coming from developing markets.

Frozen foods are preferable when climatic circumstances impact crop yield since they have a greater shelf life. Food producers work hard to offer consumers frozen, processed, and packaged meals at reasonable prices. The best way to transfer food from the local farmers' market to the shop is to use freezing techniques since they make food more affordable, accessible, and less likely to spoil. The demand for frozen foods is accelerating due to the expansion of service industries such as fast food establishments, quick-serve restaurants, and hypermarkets.

The refrigerated transportation market is expanding due to the intensifying globalization, which has increased trade and raised global demand for chilled and processed foods. According to studies, exports make up most of the worldwide production of goods and services. The global development of the cold chain industry, in addition to the adoption of cutting-edge freezing technologies and automated freezing systems installed into carrier vehicles, is anticipated to have a significant impact on the expansion of the refrigerated transportation market.

Other significant factors that are anticipated to support the expansion of the chilled transport market include an increase in household demand for frozen food around the world and rising demand for meat products (chilling is an efficient method for keeping meat and fish products free of microbial contamination), and expanding food service sectors. Further predicted growth drivers for the refrigerated transport industry include increased governmental concern over food safety and rules governing frozen food production, manufacturing, and transport. However, the substantial capital expenditure needed for refrigerated transport may limit the market's expansion.

Refrigerated transport technological advancements have reduced food waste, increased food safety, and had a minimal negative environmental impact. Additionally, producers of refrigerated vehicles are developing technology to reduce their negative environmental effects, such as their carbon footprint and noise pollution. These are the primary forces influencing the market.

The market for chilled transportation will benefit from intermodal transportation since it will reduce gasoline expenditures. To reduce costs and improve supply chain efficiency, service providers seek new methods for choosing between different modes of transportation. The usage of multimodal transportation is expanding in the food and beverage sector. Intermodal transportation uses several modes to move perishable goods, primarily employing train shipments (trucks, ships, and air). Reefer containers are used in intermodal transportation as well. Due to the rising expense of fuel, chilled rail transportation is frequently employed. According to the Association of American Railroads (AAR), a Washington-based organization, companies have significantly invested in rail infrastructure and related technology.

For instance,

Union Pacific Corporation, companies one of North America's top transportation firms, has invested more than USD 30 billion in its rail network, allowing for the building projects or industrialization of intermodal facilities and the development of a route structure that provides delivery services that are competitive with those provided by trucks.

Various food goods are increasingly traded internationally, the main factor driving the industry. Globalization's effects are trade liberalization, communication, transportation infrastructure improvements, and the expansion of multinational corporations in the retail food industry. As a result, various fruits, vegetables, and processed foods are now offered at nearby supermarkets. The commerce of perishable goods is influenced and accelerated by several factors. Moving perishable goods across borders has been made easier by reducing tariffs and non-tariff trade obstacles.

Market expansion is anticipated to be fuelled by rising consumer demand for high-quality and safe food. As refrigerators are used to extend food's shelf life and preserve its ideal quality to limit the likelihood of bacterial growth, rising rates of foodborne illnesses are predicted to spur market expansion. To ensure the safety of food items, a high prevalence of several foodborne illnesses and disorders such as nausea, vomiting, and diarrhea is predicted to drive demand for refrigerated transportation for food distribution. During the forecast period, this factor is anticipated to fuel demand for refrigerators at various stages of the food supply chain, including manufacturing, distribution, and supply. This is anticipated to fuel expansion in the global market for refrigerated transport. As a result, the market for refrigerated transportation is anticipated to develop throughout the projected period due to the rising requirement to preserve food to meet consumer demand.

Growing product & technology launch activities and developing new markets also play a significant part in refrigerated transport growth.

For instance,

- In March 2022, Utility Connect was launched due to a partnership between United Technologies Corporation and Phillips Connect. Utility's proprietary wire harness, redesigned to function with the Philips Connect Smart7 nose box, is the foundation of the Utility Connect system. Utility saw the benefits of offering the best, corrosion-free harness that would smoothly and dependably connect to a variety of sensors for the lifetime of the trailer early on

Continuous climate change harms the transportation network and the availability of skilled labor in developed markets, which limits market expansion. Potential barriers to expanding the worldwide market include maintaining product integrity while shipping perishable goods and lacking standards and regulations. However, the development of technology in refrigeration systems and equipment, the use of intermodal transportation to reduce fuel costs, and the incorporation of multi-temperature systems in trucks and trailers all present promising growth prospects.

The industry is being driven by an increase in demand for the transportation of pharmaceutical drugs. Since most pharmaceutical medications are temperature-sensitive, storing and transporting them in a regulated environment is necessary to ensure their efficacy and safety. To prevent shipment losses, proper temperature-controlled transportation techniques, such as refrigerated transport, are now necessary due to an increase in accidents and occurrences. Several pharmaceutical companies have begun trading internationally to increase their revenue as a result of advancements in the technology of refrigerated transport and a decrease in shipping costs. There is an increase in demand to store and transport temperature-controlled biologics, cellular treatments, vaccines, and blood products.

The pharmaceutical sector is anticipated to increase the fastest during the forecast period. The demand for biologics, cell treatments, vaccines, and blood products is on the rise, and these items necessitate temperature-controlled storage and transportation containers. Promoting frozen perishables in recent years is anticipated to result in world trade growth.

The market for refrigerated transportation is being driven by an increase in the number of trade routes. A logistical network of stops and passageways for transporting merchandise can be referred to as a commerce route. One trade route has long-distance arteries that can be further linked to subnetworks of non-commercial and economical transportation routes, enabling commodities to prosper in distant marketplaces. Therefore, it is anticipated that there will be a significant demand for refrigerated transport due to the ongoing growth of the marine trade volume and the number of trade routes. The seaways category, a supported form of transportation, held the largest market share for refrigerated transport. It is anticipated that it will continue to hold the top spot in the coming years. This is because the merchant shipping industry uses commercial ships to carry out more than half of all global trade. Furthermore, barges frequently transport bulk cargo on rivers and canals.

This refrigerated transport market report DBMR offering, extensive coverage of market size, and product movement analysis are represented best.