Asia Pacific Blood Collection And Sampling Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

985.91 Million

USD

1,825.06 Million

2024

2032

USD

985.91 Million

USD

1,825.06 Million

2024

2032

| 2025 –2032 | |

| USD 985.91 Million | |

| USD 1,825.06 Million | |

|

|

|

Asia-Pacific Blood Collection And Sampling Devices Market Segmentation, By Product (Venous Blood Collection and Sampling Devices and Capillary Blood Collection and Sampling Devices) – Industry Trends and Forecast to 2032

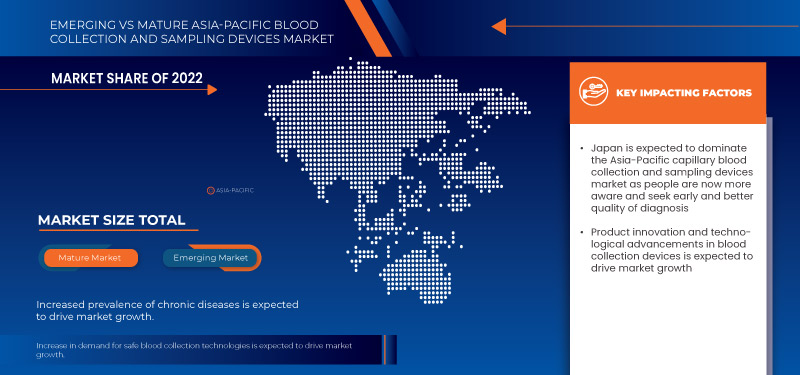

Blood Collection And Sampling Devices Market Analysis

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disordersIn May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Blood Collection And Sampling Devices Market Size

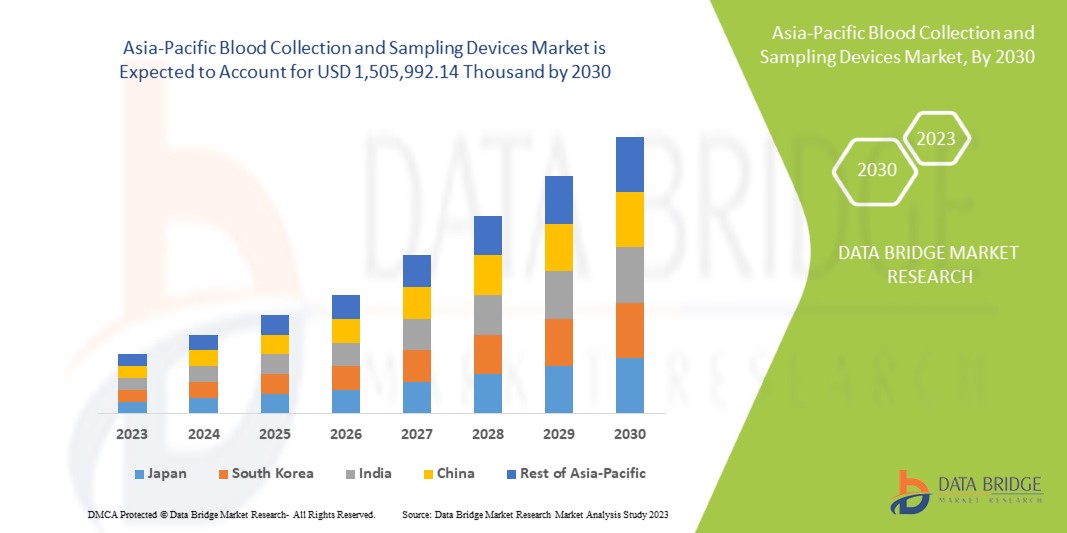

Asia-Pacific blood collection and sampling devices market size was valued at USD 985.91 million in 2024 and is projected to reach USD 1,825.06 million by 2032, with a CAGR of 8.3% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Blood Collection And Sampling Devices Market Trends

“Increased Prevalence Of Chronic Diseases”

Increased Prevalence of Chronic Diseases is a significant driver in the growth of the Blood Collection and Sampling Devices market, particularly in Japan and other countries in the Asia-Pacific region. The trend of rising chronic conditions, such as diabetes, cardiovascular diseases, and hypertension, is contributing to the growing demand for regular diagnostic testing. As more individuals suffer from these long-term health issues, healthcare providers are increasingly relying on blood collection and sampling devices to monitor and manage these conditions. As the burden of chronic diseases increases, healthcare systems are becoming more reliant on accurate, consistent, and frequent testing, which requires advanced blood collection and sampling devices. These devices are essential for early detection, disease management, and ongoing monitoring of chronic conditions, as regular blood tests help in tracking the progression of diseases, adjusting treatments, and improving patient outcomes.

In response to this trend, medical device manufacturers are focusing on developing innovative blood collection technologies that ensure better patient comfort, higher accuracy, and quicker results. Additionally, the trend towards preventive healthcare further amplifies the need for blood tests as individuals seek early diagnosis and monitoring, thus propelling the demand for blood collection devices in both hospitals and home-care settings.

Overall, the rising prevalence of chronic diseases and the shift towards more frequent and advanced diagnostic testing are key factors driving the rapid expansion of the blood collection and sampling devices market. This trend emphasizes the need for accurate, efficient, and minimally invasive devices to collect blood samples for diagnostic testing and ongoing health management, driving market growth.

Report Scope and Blood Collection And Sampling Devices Market Segmentation

|

Attributes |

Blood Collection And Sampling Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and Rest of Asia-Pacific |

|

Key Market Players |

BD (U.S.), TERUMO BCT, INC. (Japan), Thermo Fisher Scientific Inc. (U.S.), Cardinal Health (U.S.), Owen Mumford Ltd (United Kingdom), Abbott (U.S.), Nipro Europe Group Companies (Japan), Greiner Bio-One International GmbH (Austria), SARSTEDT AG & Co. KG (Germany), Bio-Rad Laboratories, Inc. (U.S.), ICU Medical, Inc. (U.S.), CML Biotech (India), Narang Medical Limited (India), Hindustan Syringes & Medical Devices Ltd (India), Sparsh Mediplus (India), and B. Braun Medical Ltd (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Collection And Sampling Devices Market Definition

Capillary blood collection devices are defined as devices that are used for capillary blood withdrawal. Capillary blood can be obtained by puncturing in finger, earlobe, or heel. It can also be performed by giving an incision on the skin. Its procedure gained wide attention as it withdraws an accurate amount of blood and reduces the chances of anemia. There are various kinds of needles, lancets, and syringes offered by market players for capillary blood collection. The need for blood tests is increasing as the prevalence of chronic disease increases. Moreover, the rising geriatric population and neonates have put a challenge for invasive blood-collecting procedures. This is why minimal invasive capillary blood collection procedure has gained wide attention. Nowadays volumetric micro sampling technique has gained attention for capillary blood collection. Moreover, new technological advancements are taking place to fulfill the needs of physicians and consumers.

Blood Collection And Sampling Devices Market Dynamics

Drivers

- Increased Prevalence Of Chronic Diseases

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.

Capillary and venous blood collection is a common method to obtain small blood samples for various diagnostic tests, such as blood glucose monitoring for diabetes management or any other blood test.

For instance,

In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders

In May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Lower middle-income countries are the worst affected by chronic diseases therefore, the disease also becomes a financial burden for the underprivileged countries. The disease must be diagnosed accurately for the early detection and timely treatment of the disease. For this, efficient blood collection and sampling are necessary, creating a demand for technologically advanced capillary and venous blood testing devices. Thus, the increased prevalence of infectious and chronic diseases is expected to drive market growth.

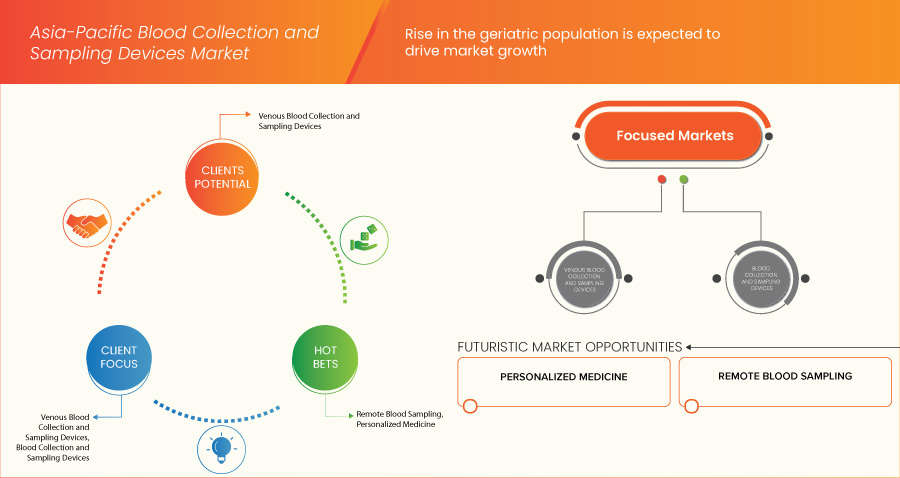

- Rise In The Geriatric Population

The population is experiencing a significant demographic shift characterized by an increasing number of older adults. The rising geriatric population in the Asia-Pacific is primarily attributed to several factors, such as increased life expectancy, advancements in healthcare, improved living conditions, and better access to medical services, which have contributed to increased life expectancy in China. This means that people are living longer, leading to a more significant proportion of older adults in the population.

The older generation is prone to more chronic disease that requires regular blood tests and diagnostics tests.

For instance,

In March 2019, according to Japan's Internal Affairs and Communications Ministry, the population of people aged 65 years and above was 35.88 million in 2019, up by 3,20,000 from the previous year by 2050, the population of people who are 60

In July 2021, According to WHO, 69% of adults have two or more chronic conditions. These diseases can lower the quality of life of adults and can be a leading cause of death in this population and adults who are 65 years and above experience a higher risk of chronic diseases than the younger generation

In June 2019, According to the Census of India, the population aged 60 years and above accounted for approximately 8.6% of the total population at that time India's geriatric population will reach around 319 million, accounting for nearly 20% of the country's total population

It is essential to diagnose the disease at an early stage to treat adults with chronic disease. Regular, proper, and accurate blood tests must be done. The capillary and venous blood testing technique is preferred for them. Hence, the rising geriatric population is expected to drive market growth.

- Rising Availability Of Point-Of-Care Diagnostics

Point-of-care testing is a type of diagnostic testing that can be performed at home or anywhere at any time. Therefore, it is commonly known as bedside testing. Earlier, testing was only limited to laboratories and hospitals, where the specimen was sent and then it took hours to days to obtain the sample.

For instance,

According to various reports, the total worth of the market was USD 40.00 billion to USD 45.00 billion, out of which the contribution of POC diagnostics is USD 12.00 billion to USD 13.00 billion

According to a review from investment bank Morgan Stanley, 37% of the USD 3 billion POC market is dedicated to infectious disease testing

With the rise in health awareness and incidence of infectious diseases, there has been a rise in the demand for POC testing. Conventional blood collection methods are painful and invasive and have a higher risk of needlestick injuries and contamination if not performed by skilled people.

The POC devices are minimally invasive, cause less pain, and have significantly fewer side effects. Also, they do not require skilled professionals to carry out the blood sampling and collection procedure. With the rise in POC testing, there has also been advancement in capillary and venous collection devices.

For instance,

Neoteryx, LLC developed a Mitra cartridge device used for capillary blood sampling anywhere, anytime, and by anyone

Elabscience, Inc. is manufacturing and distributing COVID-19 IgG/IgM Rapid Test for testing COVID-19 symptoms

Less time consumption and enhanced efficiency improve healthcare performance, resulting in more significant economic advantages for healthcare providers and patients. Thus, techniques such as capillary blood sampling, which can be used at the POC are preferred. Therefore, the rising availability of POC diagnostics is expected to drive market growth.

Opportunities

- Favorable Medical Device Regulations

The U.S. Food and Drug Administration regulates all medical devices in the U.S. Any medical device manufactured, relabeled, imported, or repackaged by any company to sell in India has to meet Central Drugs Standard Control Organization (CDSCO) regulations.

Capillary and Venous blood collection devices used for diagnostics are regulated in India by the CDSCO, which operates under the purview of the Ministry of Health and Family Welfare. The regulatory framework for medical devices in India has been evolving and recent changes have been introduced to strengthen the regulation and ensure the safety and efficacy of medical devices, including capillary and venous blood collection devices.

In India, medical devices are classified into different categories based on risk level, and the regulatory requirements vary accordingly. Capillary and venous blood collection devices typically fall under the category of In vitro Diagnostic Devices (IVDs).

Die Medical Device Rules sind die wichtigsten Vorschriften für Medizinprodukte in Indien. Nach diesen Vorschriften müssen Hersteller, Importeure und Händler von Medizinprodukten, einschließlich Geräten zur kapillaren und venösen Blutentnahme, die Registrierungs- und Lizenzierungsanforderungen gemäß der Risikoklassifizierung des Geräts erfüllen. Der Regulierungsprozess umfasst die Einreichung technischer Unterlagen, klinischer Daten (falls zutreffend) und die Einhaltung der Anforderungen des Qualitätsmanagementsystems. Diese Vorschriften gelten jedoch nicht für selbst durchgeführte persönliche Tests durch Mitarbeiter oder Bewohner einer Einrichtung. Daher fallen Personen, die regelmäßig Blutzucker mit Lanzetten messen, nicht unter dieses Gesetz.

Es ist wichtig zu beachten, dass sich die regulatorischen Rahmenbedingungen im Laufe der Zeit ändern können. Es wird empfohlen, die neuesten Richtlinien und Vorschriften des CDSCO und anderer relevanter Regulierungsbehörden zu konsultieren, um die aktuellsten Informationen zu den günstigen Bestimmungen für Geräte zur Kapillar- und Venenblutentnahme in Indien zu erhalten, die den Herstellern bessere Möglichkeiten bieten, ihre Produkte auf den Markt zu bringen.

- Produktinnovation und technologische Fortschritte bei Blutentnahmegeräten

Die Blutentnahme ist ein äußerst wichtiger Schritt in der Gesundheitsversorgung. 70-80 % der klinischen Entscheidungen basieren auf der Analyse von Blutproben. Mit dem wachsenden Trend zu Innovationen bei der Blutentnahme verwenden viele Unternehmen sichere, einfache und effizientere Methoden zur Blutentnahme.

Die kapillare und venöse Blutentnahme ist eine ideale Technik für Apotheken. Diese Methode wird der Venenpunktion vorgezogen, da sie einfacher anzuwenden und sicherer ist. Außerdem sind keine qualifizierten Techniker erforderlich. Einer der Nachteile von Fingerstichen besteht jedoch darin, dass es Unterschiede zwischen den Blutstropfen gibt. Dies kann durch die Einführung neuer und innovativer Produkte überwunden werden.

Zum Beispiel,

Im Dezember 2024 hat laut einem Artikel von IMetropolis Healthcare Limited, einem der führenden indischen Anbieter von Diagnosedienstleistungen, das innovative UltraTouch Push Button Blood Collection Set (PBBCS) auf den Markt gebracht, eine landesweit einzigartige Technologie. Dieses hochmoderne Gerät verfügt über eine dünnere Nadel, die den Einstichschmerz deutlich reduziert und die Blutentnahme angenehmer macht, insbesondere für Erstpatienten, Kinder und Senioren. Die Einführung von UltraTouch steht im Einklang mit der Mission von Metropolis Healthcare, die Patientenversorgung durch Innovation und Technologie zu verbessern.

Im Januar 2023 werden laut einem Artikel der National Library Medicine minimalinvasive Probenentnahmetechniken wie die Kapillarblutentnahme routinemäßig für Point-of-Care-Tests in der häuslichen Gesundheitspflege und in klinischen Umgebungen wie der Intensivstation eingesetzt und verursachen weniger Schmerzen und Verletzungen als die herkömmliche Venenpunktion.

Bei der kapillaren und venösen Blutentnahme werden moderne Technologien und innovative Entnahmemethoden eingesetzt, um bessere und effizientere Ergebnisse zu erzielen. Daher wird erwartet, dass Produktinnovationen und technologische Fortschritte bei Blutentnahmegeräten Chancen für Marktwachstum bieten.

Einschränkungen/Herausforderungen

- Hohes Risiko im Zusammenhang mit Blutkonservierungstechnologien

Innovationen bei der Fernprobenentnahme und POC-Tests haben zur Popularität der Blutentnahme durch Fingerstich geführt. Sie bietet mehrere Vorteile gegenüber herkömmlichen Blutentnahmeverfahren in Kliniklaboren, Krankenhauslaboren und an Orten, an denen Proben vor Ort entnommen werden müssen. Obwohl sie sicherer und einfacher zu verwenden sind als herkömmliche Geräte, haben sie ihre Nebenwirkungen. Mit der steigenden Zahl der Fingerstichverfahren nehmen auch die Fälle von versehentlichen Verletzungen und der Übertragung von Krankheitserregern durch infiziertes Blut zu.

Beim Einstechen in den Finger von Patienten und beim Umgang mit den gebrauchten Teststreifen wird das medizinische Personal mit durch Blut übertragbaren Infektionserregern konfrontiert, die zur Übertragung von Krankheiten wie Hepatitis B führen können.

Diese Risiken ergeben sich aus mehreren Faktoren, darunter Kontaminationsbedenken, unsachgemäße Handhabung und das Potenzial für Fehler bei der Probenentnahme, Lagerung und dem Transport, die alle die Integrität der Blutproben beeinträchtigen und zu ungenauen Diagnoseergebnissen führen können. Solche Ungenauigkeiten sind besonders in kritischen Szenarien problematisch, wie etwa bei der Diagnose chronischer Krankheiten, der Überwachung therapeutischer Eingriffe oder der Durchführung genetischer Tests, bei denen präzise und zuverlässige Ergebnisse von größter Bedeutung sind. Darüber hinaus führt die invasive Natur traditioneller Blutentnahmemethoden oft zu Unbehagen, Angst und Besorgnis bei den Patienten, was die Betroffenen zusätzlich davon abhält, sich regelmäßigen Diagnoseverfahren zu unterziehen.

In den Gesundheitssystemen im Asien-Pazifik-Raum werden diese Probleme durch die unterschiedlichen Niveaus der Infrastruktur und des Fachwissens in den einzelnen Ländern noch verschärft, da unterentwickelte Gesundheitseinrichtungen möglicherweise keinen Zugang zu fortschrittlichen Technologien oder angemessenen Schulungsprogrammen haben, was zu inkonsistenten Praktiken und erhöhten Risiken führt. Diese Herausforderungen tragen insgesamt zur Skepsis unter den Endnutzern bei, darunter Krankenhäuser, Diagnoselabore und Patienten, was sich letztlich auf die Geschwindigkeit der Einführung und die allgemeine Wachstumskurve des Marktes für Blutentnahmegeräte in dieser Region auswirkt. Um diese Risiken anzugehen, sind konzertierte Anstrengungen aller Beteiligten erforderlich, darunter Gesundheitsdienstleister, Gerätehersteller, Aufsichtsbehörden und politische Entscheidungsträger, um robuste Sicherheitsmaßnahmen zu implementieren, in die Forschung und Entwicklung minimalinvasiver oder nichtinvasiver Technologien zu investieren und eine umfassende Aufklärung über ordnungsgemäße Praktiken bei der Blutentnahme sicherzustellen .

- Zunehmende Produktrückrufe

Geräte zur Blutentnahme sind für die Gesundheitsbranche von entscheidender Bedeutung. Wenn diese Produkte unsicher oder fehlerhaft sind, können sie schädliche Auswirkungen haben. Daher erlässt die FDA strenge Vorschriften für die Verwendung dieser Produkte. Trotz der strengen Gesetze gibt es einige Fälle, in denen das Produkt auf den Markt gebracht und später zurückgerufen wurde, um die Sicherheit der Menschen vor seinen gefährlichen Auswirkungen zu schützen.

Zum Beispiel,

Im Juli 2021 erweiterte Magellan Diagnostics laut dem vom Laboratory Outreach Communication System (LOCS) der CDC veröffentlichten Artikel den Rückruf seiner LeadCare-Blutbleitestkits, nachdem ein erhebliches Risiko falsch niedriger Ergebnisse festgestellt wurde. Dieser Defekt verzögerte möglicherweise die Identifizierung und Behandlung von Bleibelastungen bei gefährdeten Bevölkerungsgruppen, insbesondere Kindern.

Im März 2019 rief das Unternehmen laut einem von Becton Dickinson (BD) veröffentlichten Artikel bestimmte Chargen seiner Vacutainer®-Blutentnahmeröhrchen zurück, da bei der Analyse der Proben mit bestimmten Instrumenten falsche Erhöhungen des Carboxyhämoglobinspiegels (COHb) gemeldet wurden. Dieses Problem birgt das Risiko einer Fehldiagnose und einer unangemessenen Behandlung der Patienten.

Produktrückrufe stellen für Hersteller medizinischer Geräte ein Hindernis dar, da sie für die Hersteller zu hohe Kosten verursachen. Darüber hinaus müssen die Hersteller auch Entschädigungen zahlen, was wiederum hohe Kosten verursacht. Daher dürften die hohen Kosten und die Diffamierung des Firmennamens auf dem Markt eine Herausforderung für das Marktwachstum darstellen.

Dieser Marktbericht enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang für Blutentnahme- und Probenahmegeräte

Der Markt ist nach Produkten segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Geräte zur venösen Blutentnahme und Probenentnahme

- Nach Typ

- Poc

- Nach Altersgruppe

- Kleinkinder

- Pädiatrie

- Geriatrie

- Erwachsene

- Nach Anwendung

- Herz-Kreislauf-Erkrankungen

- Atemwegserkrankung

- Ansteckende Krankheiten

- Stoffwechselstörungen

- Sonstiges

- Konventionell

- Nach Altersgruppe

- Kleinkinder

- Pädiatrie

- Geriatrie

- Erwachsene

- Nach Anwendung

- Herz-Kreislauf-Erkrankungen

- Atemwegserkrankung

- Ansteckende Krankheiten

- Stoffwechselstörungen

- Sonstiges

- Nach Endbenutzer

- Krankenhäuser

- Pathologielabore

- Kliniken

- Blutbanken

- Einstellungen für die häusliche Pflege

- Forschungs- und akademische Institute

- Sonstiges

- Geräte zur Kapillarblutentnahme und Probenentnahme

- Nach Typ

- Poc

- Nach Altersgruppe

- Kleinkinder

- Pädiatrie

- Geriatrie

- Erwachsene

- Nach Anwendung

- Herz-Kreislauf-Erkrankungen

- Atemwegserkrankung

- Ansteckende Krankheiten

- Stoffwechselstörungen

- Sonstiges

- Nach Punktionstyp

- Einschnitt

- Punktion

- Fingerpunktion

- Fersenpunktion

- Konventionell

- Nach Altersgruppe

- Kleinkinder

- Pädiatrie

- Geriatrie

- Erwachsene

- Nach Anwendung

- Herz-Kreislauf-Erkrankungen

- Atemwegserkrankung

- Ansteckende Krankheiten

- Stoffwechselstörungen

- Sonstiges

- Nach Punktionstyp

- Einschnitt

- Punktion

- Fingerpunktion

- Fersenpunktion

- Nach Endbenutzer

- Krankenhäuser

- Pathologielabore

- Kliniken

- Blutbanken

- Einstellungen für die häusliche Pflege

- Forschungs- und akademische Institute

- Sonstiges

Blood Collection And Sampling Devices Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country and product as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and rest of Asia-Pacific.

China is expected to dominate the market due to its large aging population, high prevalence of cardiovascular diseases, and increased government investments in healthcare infrastructure and technology.

Japan is expected to be the fastest growing due to the rising health awareness, and strong government support for healthcare advancements.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Blood Collection And Sampling Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Blood Collection And Sampling Devices Market Leaders Operating in the Market Are:

- BD (U.S.)

- Terumo BCT, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cardinal Health (U.S.)

- Owen Mumford Ltd (United Kingdom)

- Abbott (U.S.)

- Nipro Europe Group Companies (Japan)

- Greiner Bio-One International GmbH (Austria)

- SARSTEDT AG & Co. KG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- CML Biotech (India)

- Narang Medical Limited (India)

- Hindustan Syringes & Medical Devices Ltd (India)

- Sparsh Mediplus (India)

- B. Braun Medical Ltd (Germany)

Latest Developments in Blood Collection And Sampling Devices Market

- In September 2024, Abbott and Seed Global Health are partnering to enhance maternal and child healthcare in Malawi. Their initiative includes establishing a Maternal Health Center of Excellence at Queen Elizabeth Central Hospital, focusing on training health workers to improve care quality and sustainability

- In September 2024, BD completed its acquisition of Edwards Lifesciences' Critical Care product group, renaming it BD Advanced Patient Monitoring. This move expanded BD's portfolio with advanced monitoring technologies and AI-enabled clinical tools, enhancing its smart connected care solutions and supporting future innovations in patient care

- In March 2024, Medtronic has received FDA approval for its latest Evolut FX+ TAVR system, designed to treat symptomatic severe aortic stenosis. This new generation features a modified diamond-shaped frame that offers larger coronary access windows, enhancing catheter maneuverability while maintaining the exceptional valve performance and strength associated with the Evolut platform

- In March 2024, Abbott has extended its partnership with Real Madrid and the Real Madrid Foundation through the 2026-27 season, focusing on combating childhood malnutrition and promoting healthy habits. The collaboration has provided extensive nutrition education and screening for millions of children worldwide

- In November 2023, Boston Scientific Corporation concluded its acquisition of Relievant Medsystems on November 17, 2023, adding the Intracept Intraosseous Nerve Ablation System to its chronic pain portfolio. The acquisition, costing USD 850 million upfront plus contingent payments, expands access to vertebrogenic pain treatment through national coverage, benefiting over 150 million lives

- In November 2023, BD and Bio Farma signed a memorandum of understanding to combat tuberculosis in Indonesia by providing access to BD's TB diagnostics. This collaboration aimed to optimize the supply chain and enhance TB diagnosis, aligning with Indonesia’s goal to eliminate the disease by 2030

- In September 2023, Boston Scientific Corporation announced it had entered into an agreement to acquire Relievant Medsystems, Inc.for USD 850 million upfront, plus contingent payments. The acquisition, expected to close in early 2024, aimed to enhance Boston Scientific's chronic low back pain treatment portfolio with the Intracept system

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATORY

5.1 JAPAN –

5.2 CHINA –

5.3 INDIA –

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC DISEASES

6.1.2 RISE IN THE GERIATRIC POPULATION

6.1.3 RISING AVAILABILITY OF POINT-OF-CARE DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH RISK ASSOCIATED WITH BLOOD ASSORTMENT TECHNOLOGIES

6.2.2 DISADVANTAGES OF MICRO-COLLECTION OF BLOOD

6.3 OPPORTUNITIES

6.3.1 FAVORABLE MEDICAL DEVICE REGULATIONS

6.3.2 PRODUCT INNOVATION AND TECHNOLOGICAL ADVANCEMENTS IN BLOOD COLLECTION DEVICES

6.4 CHALLENGE

6.4.1 INCREASING PRODUCT RECALLS

7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 VENOUS BLOOD COLLECTION AND SAMPLING DEVICES

7.2.1 CONVENTIONAL

7.2.2 GERIATRICS

7.2.3 INFANTS

7.2.4 PEDIATRICS

7.2.5 ADULT

7.2.6 INFECTIOUS DISEASES

7.2.7 METABOLIC DISORDERS

7.2.8 CARDIOVASCULAR DISEASE

7.2.9 RESPIRATORY DISEASES

7.2.10 OTHERS

7.2.11 POC

7.2.12 GERIATRICS

7.2.13 INFANTS

7.2.14 PEDIATRICS

7.2.15 ADULT

7.2.16 INFECTIOUS DISEASES

7.2.17 METABOLIC DISORDERS

7.2.18 CARDIOVASCULAR DISEASE

7.2.19 RESPIRATORY DISEASES

7.2.20 OTHERS

7.2.21 HOSPITALS

7.2.22 PATHOLOGY LABORATORIES

7.2.23 CLINICS

7.2.24 BLOOD BANKS

7.2.25 HOME CARE SETTINGS

7.2.26 RESEARCH & ACADEMIC LABORATORIES

7.2.27 OTHERS

7.3 CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES

7.3.1 POC

7.3.2 GERIATRICS

7.3.3 INFANTS

7.3.4 PEDIATRICS

7.3.5 ADULT

7.3.6 INFECTIOUS DISEASES

7.3.7 METABOLIC DISORDERS

7.3.8 CARDIOVASCULAR DISEASE

7.3.9 RESPIRATORY DISEASES

7.3.10 OTHERS

7.3.11 PUNCTURE

7.3.12 INCISION

7.3.13 FINGER PUNCTURE

7.3.14 HEEL PUNCTURE

7.3.15 CONVENTIONAL

7.3.16 GERIATRICS

7.3.17 INFANTS

7.3.18 PEDIATRICS

7.3.19 ADULT

7.3.20 INFECTIOUS DISEASES

7.3.21 METABOLIC DISORDERS

7.3.22 CARDIOVASCULAR DISEASE

7.3.23 RESPIRATORY DISEASES

7.3.24 OTHERS

7.3.25 PUNCTURE

7.3.26 INCISION

7.3.27 FINGER PUNCTURE

7.3.28 HEEL PUNCTURE

7.3.29 HOSPITALS

7.3.30 PATHOLOGY LABORATORIES

7.3.31 CLINICS

7.3.32 BLOOD BANKS

7.3.33 HOME CARE SETTINGS

7.3.34 RESEARCH & ACADEMIC LABORATORIES

7.3.35 OTHERS

8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET BY COUNTRIES

8.1 ASIA-PACIFIC

8.1.1 JAPAN

8.1.2 AUSTRALIA

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 MALAYSIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 INDONESIA

8.1.9 PHILIPPINES

8.1.10 REST OF ASIA

9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BD

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 CARDINAL HEALTH

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENTS

11.3 THERMO FISHER SCIENTIFIC INC.

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 TERUMO MEDICAL CORPORATION

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENTS

11.5 ABBOTT

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 BIO-RAD LABORATORIES INC

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 B. BRAUN SE

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 CML BIOTECH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 GREINER BIO-ONE INTERNATIONAL GMBH

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENTS

11.1 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 ICUMEDICAL INC

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 NARANG MEDICAL LIMITED

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 NIPRO

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT DEVELOPMENT

11.14 OWEN MUMFORD LTD

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 SARSTEDT AG & CO. KG

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENT

11.16 SPARSH MEDIPLUS

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

Tabellenverzeichnis

TABLE 1 CLINICAL LAB TESTS THAT ARE INFLUENCED BY HEMOLYSIS

TABLE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 20 JAPAN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 23 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 29 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 JAPAN PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 33 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 37 AUSTRALIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 40 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 42 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 44 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 46 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 50 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH KOREA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH KOREA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 72 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 INDIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 MALAYSIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 89 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 91 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 93 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 97 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MALAYSIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 101 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 105 SINGAPORE BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 108 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 110 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 112 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 114 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SINGAPORE PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 118 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 125 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 127 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 129 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 139 INDONESIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 140 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 142 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 144 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 148 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 INDONESIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 152 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 156 PHILIPPINES BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 157 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 159 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 160 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 161 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 162 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 163 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 165 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 PHILIPPINES PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 169 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 173 REST OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 INCREASED PREVALENCE OF CHRONIC DISEASES AND RISE IN THE GERIATRIC POPULATION ARE FACTORS EXPECTED TO DRIVE THE GROWTH OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN THE FORECAST PERIOD 2025 TO 2032

FIGURE 13 THE BLOOD SAMPLING DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN 2025 AND 2032

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

FIGURE 15 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2024

FIGURE 16 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 17 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 18 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SNAPSHOT

FIGURE 20 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.