Asia Pacific Textured Butter Market

Marktgröße in Milliarden USD

CAGR :

%

USD

364.21 Million

USD

465.27 Million

2024

2032

USD

364.21 Million

USD

465.27 Million

2024

2032

| 2025 –2032 | |

| USD 364.21 Million | |

| USD 465.27 Million | |

|

|

|

Marktsegmentierung für texturierte Butter im asiatisch-pazifischen Raum nach Typ (ungesalzene texturierte Butter und gesalzene texturierte Butter), Produkttyp (tierische (Milch-)Butter und pflanzliche Butter), Kategorie (biologisch und konventionell), Anwendung (Bäckerei, Eiscreme, Saucen und Gewürze, Süßwaren und andere) – Branchentrends und Prognose bis 2032

Marktgröße für texturierte Butter

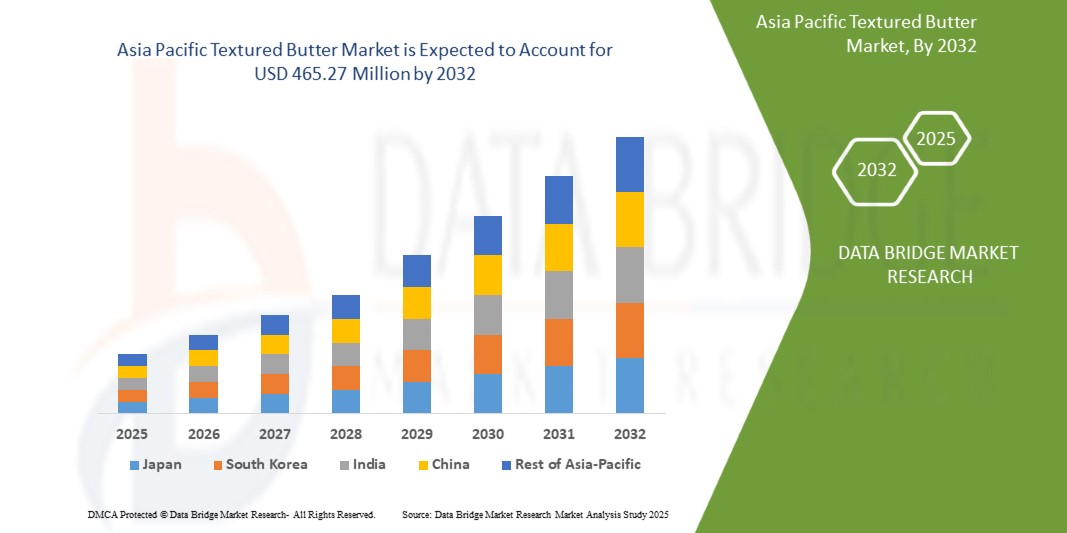

- Der Markt für texturierte Butter im asiatisch-pazifischen Raum wurde im Jahr 2024 auf 364,21 Millionen US-Dollar geschätzt und soll bis 2032 465,27 Millionen US-Dollar erreichen.

- Im Prognosezeitraum von 2025 bis 2032 wird der Markt voraussichtlich mit einer jährlichen Wachstumsrate von 3,17 % wachsen, vor allem aufgrund der steigenden Verbrauchernachfrage nach verbesserten sensorischen Lebensmittelerlebnissen, Clean-Label-Trends und der zunehmenden Präferenz für hochwertige, streichfähige Butteroptionen sowohl im Einzelhandel als auch in der Gastronomie.

- Dieses Wachstum ist auf Faktoren wie die steigende Nachfrage nach hochwertigen Milchprodukten, die zunehmende Vorliebe der Verbraucher für Clean-Label- und natürliche Zutaten sowie Innovationen in der Lebensmittelverarbeitung und bei der Buttertextur zurückzuführen.

Marktanalyse für texturierte Butter im asiatisch-pazifischen Raum

- Das steigende Interesse der Verbraucher an handwerklich hergestellten und hochwertigen Milchprodukten treibt die Nachfrage nach texturierter Butter an. Dieser Trend wird durch veränderte Geschmacksvorlieben, Gesundheitsbewusstsein und die Attraktivität reichhaltiger, cremiger Texturen in der Gourmet- und Hausmannskost, insbesondere in entwickelten und städtischen Märkten, vorangetrieben.

- Fortschritte in der Lebensmittelverarbeitung ermöglichen es Herstellern, Butter mit verbesserter Textur, Streichfähigkeit und einem besseren Mundgefühl anzubieten. Diese Innovationen eignen sich für spezielle kulinarische Anwendungen, darunter Backwaren und Süßwaren, und steigern ihre Attraktivität sowohl bei gewerblichen Lebensmittelherstellern als auch bei Privatkunden.

- Der Markt für texturierte Butter wächst, da Verbraucher zunehmend Produkte mit sauberen Etiketten, Bio-Zertifizierungen und minimaler Verarbeitung suchen. Butter, insbesondere aus Weidehaltung oder Bio-Zutaten, gilt als gesündere Fettalternative und steigert ihre Beliebtheit sowohl im traditionellen als auch im pflanzlichen Segment.

- Ein Beispiel hierfür ist die Wiederbelebung von Vollfettmilchprodukten in Großbritannien. Einzelhändler wie Marks & Spencer und Yeo Valley berichten von steigenden Umsätzen bei Vollmilch und Butter, bedingt durch die Vorliebe der Verbraucher für cremigere Texturen und die Skepsis gegenüber fettarmen, verarbeiteten Alternativen.

- Texturierte Butter erfreut sich in verschiedenen Lebensmittelsegmenten wie Backwaren, Süßwaren, Soßen und Fertiggerichten zunehmender Beliebtheit. Ihre Vielseitigkeit und ihre Fähigkeit, Geschmack und Konsistenz zu verbessern, machen sie zu einer unverzichtbaren Zutat in der Haushalts- und Industrieküche und erweitern ihren Markt im asiatisch-pazifischen Raum.

Berichtsumfang und Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke für texturierte Butter im asiatisch-pazifischen Raum |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für texturierte Butter im Asien-Pazifik-Raum

„Steigende Nachfrage nach hochwertigen, handwerklich hergestellten Milchprodukten“

- Der Markt für texturierte Butter im asiatisch-pazifischen Raum wird von der steigenden Nachfrage der Verbraucher nach Gourmet- und handwerklichen Produkten geprägt. Da die Menschen Wert auf hochwertige kulinarische Erlebnisse legen, erfreut sich texturierte Butter – mit ihrem vollen Geschmack und ihrer ansprechenden Optik – sowohl in privaten Küchen als auch in gehobenen Gastronomiebetrieben zunehmender Beliebtheit, insbesondere in städtischen und entwickelten Märkten, wo Qualität und Ästhetik die Kaufentscheidung beeinflussen.

- Gesundheitsbewusste Verbraucher treiben das Wachstum des Marktes für texturierte Butter voran, wobei Bio- und Clean-Label-Produkte eine deutliche Präferenz haben. Reich an natürlichen Fetten und oft nur minimal verarbeitet, entspricht texturierte Butter den aktuellen Ernährungstrends, die Vollwertkost gegenüber fettarmen Alternativen bevorzugen. Dies verstärkt ihre Bedeutung für eine ausgewogene, hochwertige Ernährung.

- Der Anstieg des Backens und Kochens zu Hause, beschleunigt durch die veränderten Lebensstile nach der Pandemie, hat die Nachfrage nach Spezialzutaten wie texturierter Butter erhöht. Ihr verbesserter Geschmack und ihre Konsistenz machen sie zu einer bevorzugten Wahl für Backwaren, Soßen und Brotaufstriche und tragen zur Diversifizierung der Verwendung in verschiedenen Lebensmittelkategorien bei.

- Beispielsweise steigt die Vorliebe der Verbraucher für handwerklich hergestellte, lokal hergestellte Produkte – ein Hinweis auf einen breiteren Trend zu Gourmet-Lebensmitteln, einschließlich texturierter Butter.

- Hersteller führen Innovationen im Markt für texturierte Butter ein, indem sie pflanzliche und laktosefreie Alternativen anbieten, um vegane und laktoseintolerante Verbraucher zu bedienen. Diese Produktinnovationen, kombiniert mit nachhaltigen Verpackungs- und Beschaffungsinitiativen, erweitern die Kundenbasis und unterstützen das langfristige Marktwachstum.

Marktdynamik für texturierte Butter im asiatisch-pazifischen Raum

Treiber

„ Steigende Nachfrage nach Premium-Milchprodukten “

- Consumers today are more conscious about the ingredients and processing methods used in their food, leading to a surge in demand for premium dairy products that offer superior taste, texture, and nutritional benefits

- Textured butter, known for its enhanced spreadability, smoothness, and consistency, is becoming a preferred choice among both home cooks and professional chefs. The rise of fine dining, bakery, and confectionery industries has further fueled this trend, as textured butter enhances the quality of pastries, desserts, and premium food offerings. In addition, health-conscious consumers are opting for high-quality butter alternatives that contain fewer additives and preservatives while retaining natural richness

- For instance, In October 2024, Danone announced a USD 21.60 million investment to expand its operations in Punjab, capitalizing on the rising demand for premium dairy products in India. As consumers increasingly seek healthier and high-quality dairy options, Danone aims to grow its market share, competing with established players such as Amul

- In August 2024,edairynews published an article which states that the demand for premium dairy products in India surged as health-conscious consumers prioritized quality over cost. Driven by a growing awareness of natural ingredients, organic, grass-fed, and hormone-free options, the market is seeing increasing consumer preference for products offering superior taste and health benefits, reshaping the dairy sector

- The growth of organic and grass-fed dairy products has contributed to the increasing demand for premium butter varieties. Consumers are willing to pay a premium for products that are ethically sourced, environmentally friendly, and free from artificial ingredients. As a result, dairy manufacturers are innovating with different textures, flavors, and organic certifications to cater to this expanding market segment, further driving the textured butter market’s growth

Opportunities

“Shifting Consumer Inclination Towards Sustainable And Ethical Sourced Products”

- Consumers are increasingly shifting towards sustainable and ethically sourced textured butter, creating significant opportunities for the market. With rising awareness of environmental impact and ethical farming, buyers prefer butter made from responsibly sourced dairy. They look for certifications such as organic, fair trade, and grass-fed, ensuring that the product aligns with their values

- Sustainable sourcing involves eco-friendly farming practices that protect natural resources, reduce carbon footprints, and support biodiversity. Ethical sourcing ensures fair wages for farmers and humane treatment of animals. Many brands are now adopting transparent supply chains to meet these consumer expectations

- The growing demand for such products encourages manufacturers to invest in responsible sourcing and sustainable production methods. Companies that focus on eco-friendly packaging, reduced waste, and ethical ingredient sourcing can gain a competitive edge in the Asia Pacific textured butter market. As consumer preferences continue to evolve, businesses that align with sustainability and ethical standards will likely experience increased brand loyalty and market growth. This trend presents a lucrative opportunity for manufacturers to expand their product range while meeting the demand for responsible food choices

For instance,

- In January 2023, a study published on Sustainably Produced Butter: The Effect of Product Knowledge, interest in Sustainability, and Consumer Characteristics on Purchase Frequency highlights that consumer knowledge, interest in sustainability, and product certifications such as organic and fair trade significantly influence the purchase frequency and preferences for ethically sourced butter. This trend emphasizes the growing demand for responsibly produced dairy products

- In August 2024, an article published by Ethical Consumer Research Association Ltd highlights that consumers are increasingly opting for butter and spreads with ethical certifications such as fair-trade and organic, prioritizing sustainability and responsible sourcing in their purchasing decisions

- An article published by the World Wildlife Fund states that sustainable agriculture practices, including eco-friendly dairy farming methods and responsible sourcing, are crucial for protecting natural resources, reducing carbon footprints, and promoting biodiversity

Consumers are increasingly demanding sustainably and ethically sourced textured butter, driving market opportunities. With rising awareness of environmental impact and ethical farming, brands focusing on responsible sourcing, eco-friendly packaging, and transparent supply chains gain a competitive edge. This trend boosts market growth, encouraging manufacturers to align with sustainability and ethical standards.

Restraints/Challenges

“High Production Costs Of Textured Butter”

- Textured butter, due to its specialized production process, requires more advanced technology and higher-quality raw materials, such as organic or grass-fed cream. These factors contribute to its increased cost compared to regular butter. The need for precise manufacturing techniques to achieve the desired consistency and texture further drives up production expenses

- For manufacturers, the higher costs associated with sourcing premium ingredients, maintaining quality control, and investing in specialized equipment can limit the scalability and affordability of textured butter, especially in price-sensitive markets. This, in turn, can restrict its widespread adoption, particularly among small and medium-sized businesses in the food industry that may struggle to absorb the added costs

For instance,

- Im Dezember 2024 wies ein Bericht von Fast Company auf den Anstieg der Butterpreise aufgrund von Lieferkettenunterbrechungen, Arbeitskräftemangel und gestiegenen Produktionskosten hin. Diese Faktoren, insbesondere bei texturierter Butter, belasten sowohl Köche als auch Verbraucher und treiben die Preise für hochwertige Butter und Rohstoffe weiter in die Höhe.

- Im April 2024 betonte William Reed Ltd, dass die steigenden Butterpreise auf Faktoren wie extreme Wetterbedingungen, politische Instabilität und gestiegene Energiekosten zurückzuführen seien, die die Milchpreise und damit die Butterproduktionskosten in die Höhe trieben. Es wird erwartet, dass dieser Anstieg aufgrund der anhaltenden Nachfrage anhält.

Die Preissensibilität der Verbraucher, insbesondere in Entwicklungsländern, kann die Nachfrage nach texturierter Butter hemmen, da Verbraucher möglicherweise günstigere Alternativen bevorzugen. Infolgedessen steht das Wachstum des Marktes für texturierte Butter vor Herausforderungen, insbesondere im Wettbewerb mit günstigeren Fetten und Ölen in der Lebensmittelindustrie.

Marktumfang für texturierte Butter im asiatisch-pazifischen Raum

Der Markt ist nach Typ, Produkttyp, Kategorie und Anwendung segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Typ |

|

|

Nach Produkttyp |

|

|

Nach Kategorie |

|

|

Nach Anwendung |

|

Regionale Analyse des Marktes für texturierte Butter im asiatisch-pazifischen Raum

„China ist das dominierende Land auf dem Markt für texturierte Butter im asiatisch-pazifischen Raum“

- China dürfte den Markt für texturierte Butter dominieren. Die Nachfrage nach Milchprodukten steigt rasant, angetrieben durch die westliche Ernährungsweise und eine wachsende Mittelschicht. Dieser Wandel hat zu einem deutlichen Anstieg der Butterimporte geführt, insbesondere aus Neuseeland und der Europäischen Union, um die Qualitätsstandards von Premiumbäckereien und Lebensmittelverarbeitern zu erfüllen. Darüber hinaus hat die Expansion der heimischen Bäckerei- und Süßwarenbranche die Nachfrage nach hochwertiger Butter weiter angekurbelt.

„ China wird voraussichtlich die höchste Wachstumsrate verzeichnen“

- China is projected to register the highest growth rate in the textured butter market due to increasing consumer demand for dairy products, driven by the adoption of Western diets and a growing middle class. This trend has led to a significant rise in butter imports, particularly from New Zealand and the European Union, to meet the quality standards required by premium bakeries and food processors. Additionally, the expansion of the domestic bakery and confectionery sectors has further fueled the demand for high-quality butter.

Textured Butter Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Asia-Pacific Textured Butter Market Leaders Operating in the Market Are:

- Flechard SAS (France)

- FrieslandCampina Professional (Netherlands)

- Royal VIVBuisman (Netherlands)

- Uelzena Ingredients (Germany)

- LACTALIS (France)

- NUMIDIA BV (Netherlands)

- Lakeland Dairies (Ireland)

- CORMAN (Belgium)

Latest Developments in Asia Pacific Textured Butter Market

- In January, Lactalis Ingredients is rolling out a new graphic identity for the packaging of its butter range. This update is part of the company's ongoing efforts to enhance brand visibility and modernize its product presentation. The new design aims to reflect Lactalis’ commitment to quality, innovation, and sustainability while making the packaging more appealing to consumers. This development helps Lactalis Ingredients strengthen brand recognition, improve consumer appeal, and reinforce its commitment to quality, innovation, and sustainability

- In March, Lakeland Dairies has completed the acquisition of De Brandt Dairy International NV, a Belgian-based butterfat business, aiming to enhance its value-added capabilities and expand its presence in the European market. And has strengthened its position in the European butter market, opening new markets and product categories. This strategic move is expected to deliver stronger returns to its farm families and further develop its world-class product offerings for both current and future customers

- Im Februar gab FrieslandCampina bekannt, die Butterproduktion im Rahmen seiner Bemühungen zur Effizienzsteigerung und Nachhaltigkeit nach Lochem in den Niederlanden zu verlagern. Dieser Schritt beinhaltet die geplante Schließung des Werks Den Bosch bis Anfang 2025. Davon sind rund 90 Mitarbeiter betroffen, denen das Unternehmen Unterstützung und alternative Beschäftigungsmöglichkeiten bietet. Die Verlagerung zielt darauf ab, die Produktionsprozesse zu optimieren und gleichzeitig langfristige betriebliche Verbesserungen zu gewährleisten. FrieslandCampina betont, dass die Entscheidung vor der endgültigen Umsetzung noch von Mitarbeiterkonsultationen und behördlichen Genehmigungen abhängig ist.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO AND ITS IMPACT ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 RISING TEMPERATURES AND DAIRY PRODUCTIVITY

4.7.1.2 WATER SCARCITY AND RESOURCE USE

4.7.1.3 GREENHOUSE GAS (GHG) EMISSIONS FROM DAIRY FARMING

4.7.1.4 DEFORESTATION AND LAND USE

4.7.2 INDUSTRY RESPONSE

4.7.2.1 SUSTAINABLE DAIRY FARMING PRACTICES

4.7.2.2 RENEWABLE ENERGY INTEGRATION

4.7.2.3 SUSTAINABLE PACKAGING AND WASTE REDUCTION

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 CLIMATE REGULATIONS AND CARBON TAXES

4.7.3.2 RESEARCH AND DEVELOPMENT (R&D) SUPPORT

4.7.3.3 TRADE POLICIES AND SUSTAINABILITY STANDARDS

4.7.4 ANALYST RECOMMENDATIONS

4.7.4.1 INVEST IN CLIMATE-RESILIENT SUPPLY CHAINS

4.7.4.2 PARTNER WITH SUSTAINABLE DAIRY FARMS

4.7.4.3 DIVERSIFY PRODUCT OFFERINGS

4.7.4.4 STRENGTHEN GOVERNMENT AND INDUSTRY COLLABORATION

4.7.5 CONCLUSION

4.8 CLIENT’S DATASET

4.8.1 LINDT & SPRÜNGLI

4.8.2 FERRERO GROUP

4.8.3 LANTMÄNNEN UNIBAKE

4.8.4 BRIDOR:

4.8.5 VANDEMOORTELE

4.8.6 MONDELEZ INTERNATIONAL

4.8.7 FRONERI

4.8.8 DÉLIFRANCE

4.8.9 WEWALKA

4.8.10 CÉRÉLIA

4.8.11 GRUPO BIMBO

4.8.12 LA LORRAINE BAKERY GROUP

4.8.13 ARYZTA AG

4.8.14 PHOON HUAT PTE LTD

4.8.15 CHEESE AND FOOD CO., LTD

4.8.16 AL-AHLAM COMPANY

4.8.17 UNILEVER

4.8.18 DEK SRL

4.8.19 NESTLÉ MEXICO S.A. DE C.V

4.8.20 PT TIRTA ALAM SEGAR

4.8.21 HAJI RAZAK HAJI HABIB JANOO

4.8.22 KELLAS INC.

4.8.23 WS WARMSENER SPEZIALITÄTEN GMBH

4.9 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.9.1 QUALITY AND TEXTURE

4.9.2 HEALTH AND NUTRITIONAL BENEFITS

4.9.3 INGREDIENT TRANSPARENCY AND CLEAN LABELING

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 FLAVOR AND PRODUCT VARIETY

4.9.6 PRICE SENSITIVITY AND AFFORDABILITY

4.9.7 BRAND REPUTATION AND TRUST

4.9.8 CONVENIENCE AND ACCESSIBILITY

4.9.9 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.9.10 MARKETING AND PROMOTIONAL STRATEGIES

4.9.11 CONCLUSION

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.10.1 PRODUCT INNOVATION AND DIFFERENTIATION

4.10.2 EXPANSION INTO EMERGING MARKETS

4.10.3 SUSTAINABLE AND CLEAN LABEL PRODUCTS

4.10.4 STRENGTHENING DISTRIBUTION CHANNEL

4.10.5 STRATEGIC MERGERS AND ACQUISITIONS (M&A)

4.10.6 INVESTMENTS IN ADVANCED PROCESSING TECHNOLOGIES

4.10.7 MARKETING AND BRANDING STRATEGIES

4.10.8 FOCUS ON HEALTH AND WELLNESS TRENDS

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.11.1 IMPACT ON PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11.5 CONCLUSION

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.12.1 RISING DEMAND FOR PREMIUM AND ARTISANAL BUTTER

4.12.2 GROWING POPULARITY OF FUNCTIONAL AND FORTIFIED BUTTER

4.12.3 EXPANSION OF PLANT-BASED AND DAIRY-FREE ALTERNATIVES

4.12.4 TECHNOLOGICAL INNOVATIONS IN BUTTER PROCESSING

4.12.5 CLEAN LABEL AND TRANSPARENCY TRENDS

4.12.6 SUSTAINABILITY AND ETHICAL SOURCING

4.12.7 E-COMMERCE AND DIRECT-TO-CONSUMER GROWTH

4.12.8 EXPANDING APPLICATIONS IN THE FOOD INDUSTRY

4.12.9 CONCLUSION

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED PROCESSING TECHNIQUES

4.13.1.1 MICROENCAPSULATION FOR IMPROVED STABILITY

4.13.1.2 CONTROLLED CRYSTALLIZATION FOR OPTIMAL TEXTURE

4.13.1.3 HIGH-PRESSURE PROCESSING (HPP)

4.13.2 AUTOMATION AND ARTIFICIAL INTELLIGENCE (AI) IN BUTTER PRODUCTION

4.13.2.1 AI-POWERED QUALITY CONTROL

4.13.2.2 ROBOTICS AND SMART MANUFACTURING

4.13.2.3 PREDICTIVE MAINTENANCE IN DAIRY PROCESSING

4.13.3 INGREDIENT INNOVATIONS AND FUNCTIONAL ENHANCEMENTS

4.13.3.1 FORTIFIED AND FUNCTIONAL BUTTER

4.13.3.2 HYBRID BUTTER PRODUCTS

4.13.3.3 CLEAN-LABEL AND NATURAL INGREDIENTS

4.13.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.13.4.1 CARBON-NEUTRAL DAIRY PRODUCTION

4.13.4.2 BIODEGRADABLE AND RECYCLABLE PACKAGING

4.13.5 INNOVATIONS IN DISTRIBUTION AND CONSUMER ENGAGEMENT

4.13.5.1 BLOCKCHAIN FOR SUPPLY CHAIN TRANSPARENCY

4.13.5.2 DIRECT-TO-CONSUMER (DTC) SALES AND SUBSCRIPTION MODELS

4.13.5.3 SMART LABELING AND AUGMENTED REALITY (AR)

4.13.6 CONCLUSION

4.14 RAW MATERIAL SOURCING ANALYSIS

4.14.1 INTRODUCTION

4.14.2 DAIRY-BASED RAW MATERIAL SOURCING

4.14.3 PLANT-BASED FAT SOURCING FOR ALTERNATIVE BUTTER VARIETIES

4.14.4 ADDITIVES AND FUNCTIONAL INGREDIENTS SOURCING

4.14.5 SUPPLY CHAIN CHALLENGES AND RISKS

4.14.6 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.14.7 FUTURE TRENDS IN RAW MATERIAL SOURCING

4.14.8 CONCLUSION

4.15 SUPPLY CHAIN ANALYSIS OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.15.1 LOGISTICS COST SCENARIO

4.15.1.1 RISING TRANSPORTATION COSTS

4.15.1.2 WAREHOUSING AND STORAGE EXPENSES

4.15.1.3 CUSTOMS AND TARIFFS IMPACTING COSTS

4.15.1.4 LAST-MILE DELIVERY CHALLENGES

4.15.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS IN THE TEXTURED BUTTER MARKET

4.15.2.1 ENSURING COLD CHAIN MANAGEMENT

4.15.3 ENHANCING SUPPLY CHAIN EFFICIENCY

4.15.3.1 MANAGING INTERNATIONAL TRADE COMPLIANCE

4.15.3.2 COST OPTIMIZATION STRATEGIES

4.15.3.3 ADAPTING TO MARKET CHANGES

4.15.4 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS

6.1.2 RAPIDLY EXPANDING BAKERY AND CONFECTIONERY INDUSTRY

6.1.3 INCREASED DEMAND FOR NATURAL AND ORGANIC PRODUCTS

6.1.4 INCREASED USAGE OF BUTTER IN FOOD PROCESSING AND FOOD SERVICE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF TEXTURED BUTTER

6.2.2 COMPLIANCE WITH FOOD SAFETY AND DAIRY PRODUCT REGULATIONS LIMITING MARKET EXPANSION

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER INCLINATION TOWARDS SUSTAINABLE AND ETHICAL SOURCED PRODUCTS

6.3.2 RISING URBANIZATION AND CHANGING DIETARY HABITS

6.3.3 DEVELOPMENT OF FLAVORED, ORGANIC, AND FUNCTIONAL BUTTER VARIANTS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION FROM CONVENTIONAL BUTTER

6.4.2 STORAGE AND SHELF-LIFE CONSTRAINTS

7 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 UNSALTED TEXTURED BUTTER

7.3 SALTED TEXTURED BUTTER

8 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ANIMAL BASED (MILK) BUTTER

8.3 PLANT-BASED BUTTER

9 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 ORGANIC

9.3 CONVENTIONAL

10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BAKERY

10.3 ICE CREAMS

10.4 SAUCES AND CONDIMENTS

10.5 CONFECTIONERY

10.6 OTHERS

11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 NEW ZEALAND

11.1.7 SINGAPORE

11.1.8 THAILAND

11.1.9 MALAYSIA

11.1.10 PHILIPPINES

11.1.11 VIETNAM

11.1.12 INDONESIA

11.1.13 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LACTALIS

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 LAKELAND DAIRIES

14.2.1 COMPANY SNAPSHOTS

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 UELZENA INGREDIENTS

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 FRIESLANDCAMPINA PROFESSIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FLECHARD SAS

14.5.1. COMPANY SNAPSHOT

14.5.2. COMPANY SHARE ANALYSIS

14.5.3. PRODUCT PORTFOLIO

14.5.4. RECENT DEVELOPMENT

14.6. CORMAN

14.6.1. COMPANY SNAPSHOT

14.6.2. PRODUCT PORTFOLIO

14.6.3. RECENT DEVELOPMENT

14.7. NUMIDIA BV

14.7.1. COMPANY SNAPSHOTS

14.7.2. PRODUCT PORTFOLIO

14.7.3. RECENT DEVELOPMENT/NEWS

14.8. ROYAL VIVBUISMAN

14.8.1. COMPANY SNAPSHOT

14.8.2. PRODUCT PORTFOLIO

14.8.3. RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 12 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 14 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 18 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 20 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 24 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 26 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 47 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 51 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 53 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 68 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 70 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 72 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 74 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 87 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 89 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 91 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 93 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 106 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 108 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 109 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 110 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 112 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 125 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 129 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 131 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 146 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 148 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 150 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 165 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 167 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 169 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 182 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 184 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 185 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 186 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 188 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 203 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 204 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 205 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 206 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 207 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 220 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 222 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 224 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 226 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 239 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 241 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 242 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 243 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 244 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 245 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 258 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 260 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 261 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 262 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 263 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 264 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 277 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 279 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 280 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 281 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 282 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 283 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 REST OF ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 2 ASIA-PACIFIC TEXTURED BUTTER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEXTURED BUTTER MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEXTURED BUTTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC TEXTURED BUTTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC TEXTURED BUTTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID: ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS IS EXPECTED TO DRIVE THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE UNSALTED TEXTURED BUTTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 ASIA-PACIFIC TEXTURED BUTTER MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 21 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY TYPE, 2024

FIGURE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY PRODUCT TYPE, 2024

FIGURE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY CATEGORY, 2024

FIGURE 24 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC TEXTURED BUTTER MARKET: SNAPSHOT, 2024

FIGURE 26 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.