Asia Pacific Unmanned Aerial Vehicle Market

Marktgröße in Milliarden USD

CAGR :

%

USD

11.92 Billion

USD

41.48 Billion

2025

2033

USD

11.92 Billion

USD

41.48 Billion

2025

2033

| 2026 –2033 | |

| USD 11.92 Billion | |

| USD 41.48 Billion | |

|

|

|

|

Asia-Pacific Unmanned Aerial Vehicle Market Segmentation, By Product Type (Rotary-Wing UAVS, Fixed-Wing UAVS, Hybrid UAVS, Others), By System Component (Platform, Software & Cybersecurity, Data Link, Launch & Recovery Systems), By Function (Intelligence, Surveillance, & Reconnaissance (ISR), Mapping & Surveying, Monitoring & Inspection, Delivery & Logistics, Agriculture & Precision Farming, Aerial Photography, Others), By Mobility Type (Rotary-Wing, Fixed-Wing, Hybrid VTOL, Single-Rotor Helicopter UAVs. Nano / Micro Drones, Others), By End User (Defense & Security, Commercial, Recreational, Civil, Others), By User Type (Military, Commercial Operators, Government & Law Enforcement, Consumer / Enthusiast) By Distribution Channel (Indirect, Direct) - Industry Trends and Forecast to 2033

Asia-Pacific Unmanned Aerial Vehicle Market Size

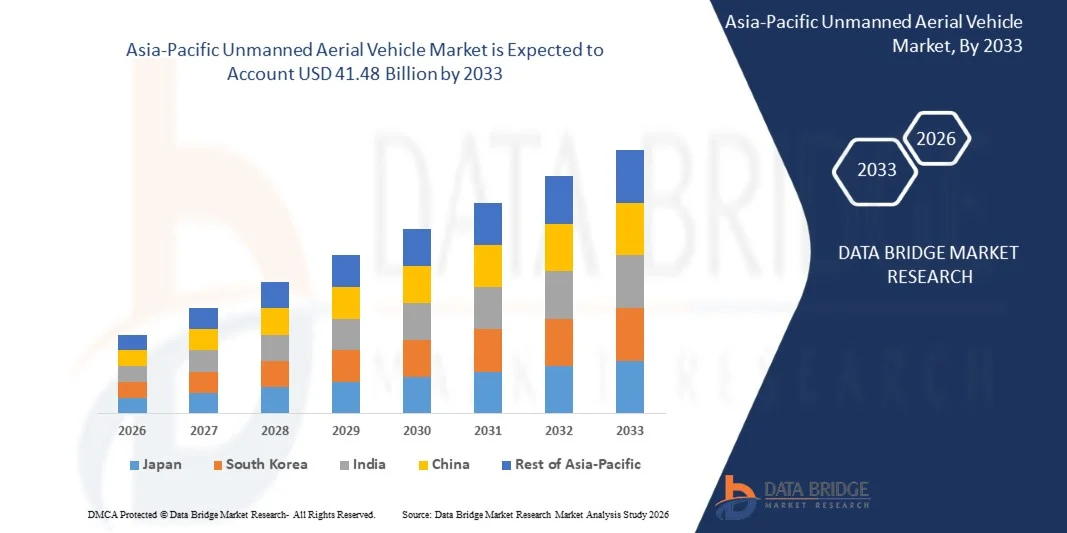

- The Asia-Pacific Unmanned Aerial Vehicle Market is expected to reach USD 41.48 billion by 2033 from USD 11.92 million in 2025 growing with a CAGR of 17.0% in the forecast period of 2026 to 2033.

- The Asia-Pacific UAV Market is experiencing rapid growth driven by increasing adoption across defense, agriculture, logistics, and industrial sectors, with rising demand for surveillance, delivery, and monitoring applications.

- Integration of advanced drone technologies, including AI-enabled navigation, automated flight systems, and real-time data analytics, is accelerating market expansion by enhancing operational efficiency and precision in various applications.

- Government initiatives, regulatory support, and infrastructure development—such as airspace modernization, drone-friendly policies, and investment in smart city projects—are fueling market growth and encouraging private and commercial UAV deployment. The rising trend toward value-added services, such as customized FIBC solutions, 3PL/4PL integration, and temperature-controlled storage for sensitive bulk goods, is reinforcing North America’s position as a mature market with strong long-term growth potential in bulk packaging solutions.

Asia-Pacific Unmanned Aerial Vehicle Market Analysis

- The Asia-Pacific UAV Market encompasses the production, distribution, and use of unmanned aerial vehicles across sectors such as agriculture, logistics, construction, defense, and industrial applications, driven by increasing demand for efficient monitoring, delivery, and data collection solutions.

- China dominates the market, accounting for 59.16%, supported by rapid industrialization, government initiatives, growing adoption of drone technologies, and expanding e-commerce and logistics activities.

- Rotary-Wing UAVs are the largest segment, holding 50.30% market share, due to their versatility, maneuverability, and suitability for surveillance, delivery, and agricultural applications.

- Rising adoption of advanced UAV technologies, including AI-enabled navigation, automated flight systems, and real-time data analytics, is enhancing operational efficiency and driving market expansion across commercial and industrial sectors.

- Supportive government policies, infrastructure development, and investment in smart city projects are further propelling market growth, encouraging private and commercial UAV deployment, and strengthening long-term industry potential.

Report Scope and Asia-Pacific Unmanned Aerial Vehicle Market Segmentation

|

Attributes |

Asia-Pacific Unmanned Aerial Vehicle Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Asia-Pacific Unmanned Aerial Vehicle Market Trends

“Integration with smart city projects, warehouse automation, and e-commerce logistics”

- UAVs are being deployed for traffic monitoring, urban planning, and public safety, enhancing data-driven decision-making in smart city initiatives.

- Drones facilitate inventory management, real-time stock monitoring, and automated material handling, improving operational efficiency in warehouses.

- UAVs are increasingly used for last-mile delivery, rapid order fulfillment, and supply chain optimization, supporting the growth of e-commerce platforms.

For Instance,

- In January 2025, unmanned aerial vehicles are now part of intelligent logistics systems that integrate AI, 5G networks, and robotics to make freight and delivery faster and safer showcasing how UAV technology is becoming a core component of next‑generation smart city logistics infrastructure.

- A recent industry overview highlights rapid growth in autonomous delivery solutions including drone delivery systems as e‑commerce expands, pointing to broader logistics adoption beyond traditional methods.

Asia-Pacific Unmanned Aerial Vehicle Market Dynamics

Driver

“Increasing defense modernization and military ISR (Intelligence, Surveillance, Reconnaissance) requirements”

- The Asia-Pacific defense sector is experiencing a rapid acceleration in the procurement and operational integration of unmanned aerial vehicles (UAVs), driven by evolving and increasingly complex intelligence, surveillance, reconnaissance (ISR), and force-protection requirements. Armed forces worldwide are prioritizing UAVs as key assets for a range of missions, from persistent ISR and border surveillance to electronic intelligence (ELINT) and precision strike operations. As military strategies evolve to meet new threats, there is a growing demand for UAV platforms capable of extended flight durations, autonomous mission execution, and secure communication links to enable real-time data transfer.

- The growing focus on UAVs in defense modernization initiatives has created a dynamic environment for suppliers to innovate, resulting in advancements in platform modularity, endurance, and subsystems like propulsion, sensors, and secure data links. In response to this demand-pull, defense contractors are investing heavily in developing versatile UAV solutions that can be easily adapted to various mission profiles, whether for ISR, tactical support, or offensive operations.

- These innovations are being driven by the operational needs of modern armed forces, which require adaptable, multi-role platforms that can operate in diverse and often hostile environments. As defense ministries continue to prioritize UAV integration into their force structures, this procurement momentum not only influences supplier investments but also reshapes Asia-Pacific military capabilities, reinforcing the role of UAVs as central components of modern warfare

For Instances

- In September 2023, according to the Center for Security and Emerging Technology’s article, the U.S. Department of Defense announced the “Replicator Initiative,” aimed at rapidly fielding thousands of autonomous and unmanned systems, including aerial drones, to counter emerging threats through accelerated acquisition and deployment pathways.

- As of February, 2024, article published by the Crown states that the United Kingdom Ministry of Defence reaffirmed unmanned and autonomous systems as core priorities under its defence modernization agenda, highlighting UAV integration for ISR, strike support, and operational resilience across air and land domains.

- In February 2025, the European Defence Agency (EDA) outlined ongoing multinational efforts to enhance unmanned aerial ISR capabilities, supporting joint procurement, interoperability, and capability harmonization among EU member states.

Restraint/Challenge

“Lack Of Harmonized Asia-Pacific Regulations For UAV Operations”

- The lack of harmonized Asia-Pacific regulations for unmanned aerial vehicle (UAV) operations represents a significant challenge for the Asia-Pacific UAV market, as regulatory frameworks vary widely across countries and regions.

- Civil aviation authorities apply different rules for airspace access, pilot licensing, platform certification, data protection, and operational approvals such as beyond visual line-of-sight (BVLOS) flights. This regulatory fragmentation forces UAV manufacturers and operators to customize platforms, software, and operational procedures for each jurisdiction, increasing compliance costs and prolonging time to market.

- As a result, companies face difficulties scaling UAV operations internationally, particularly for cross-border services such as logistics, mapping, and infrastructure inspection.

For Instances,

- In late November 2025, according to the post on LinkedIn , multiple local authorities in India (e.g., Mumbai, Uttarakhand, and Varanasi) issued temporary no-fly zone orders for drones around events and airport areas, with each jurisdiction setting different spatial and temporal restrictions. This patchwork of local rules illustrates regulatory fragmentation within a single country and challenges operators who must navigate varying regulatory requirements even within one nation.

- In May 2025, According to Times of India, Nashik police in India declared the entire city a no-fly zone for drones amid broader security concerns, despite national digital airspace frameworks like India’s Digital Sky Platform existing concurrently. The local blanket ban, which went beyond national UAV guidance, caused operational challenges for civilian and commercial drone operators who had to seek explicit permission for any flights during the ban period.

Asia-Pacific Unmanned Aerial Vehicle Market Scope

Asia-Pacific Unmanned Aerial Vehicle Market is categorized into Seven notable segments which are based on Product Type, Component, Function, Mobility Type, End User, User Type, distribution channel

By Product Type

On the basis of Product Type, Asia-Pacific Unmanned Aerial Vehicle Market is segmented into Rotary-Wing UAVS, Fixed-Wing UAVS, Hybrid UAVS, Others

the Rotary-Wing UAVS segment is expected to dominate the market due to due to its superior versatility, maneuverability, and ease of operation compared to fixed-wing platforms. These UAVs can take off and land vertically, hover precisely, and operate effectively in confined or urban environments without requiring runways. Such capabilities make them ideal for applications including aerial photography, surveillance, infrastructure inspection, mapping, agriculture, and public safety. Rotary-wing UAVs are also widely adopted by military and law enforcement agencies for short-range intelligence and tactical missions. Additionally, lower procurement costs, ease of deployment, and rapid technological advancements in multi-rotor designs continue to support their widespread adoption in Asia-Pacific.

By System Component

On the System Component, the Asia-Pacific Unmanned Aerial Vehicle Market is segmented into Platform, Software & Cybersecurity, Data Link, Launch & Recovery Systems

The Platform segment is expected to dominate the market due to it represents the core physical system that determines performance, capability, and mission suitability. UAV platforms account for the largest share of total system cost, encompassing airframes, propulsion units, flight control systems, and structural components. Growing demand from defense forces for advanced tactical, MALE, and HALE UAVs, along with rising commercial adoption of multi-rotor and fixed-wing drones, significantly drives platform sales. Additionally, frequent fleet expansion, replacement cycles, and customization for specific applications such as surveillance, delivery, and inspection further reinforce the platform segment’s leading market.

• By Function

On the basis of Function, the Asia-Pacific Unmanned Aerial Vehicle Market is segmented into Intelligence, Surveillance, & Reconnaissance (ISR), Mapping & Surveying, Monitoring & Inspection, Delivery & Logistics, Agriculture & Precision Farming, Aerial Photography, Others

The Intelligence segment is expected to dominate the market due to the growing Asia-Pacific emphasis on intelligence, surveillance, and reconnaissance (ISR) across defense and security operations. Governments and military forces increasingly rely on UAVs for real-time situational awareness, border monitoring, counterterrorism, and battlefield intelligence without risking human lives. UAV-based intelligence systems offer persistent monitoring, high-resolution imaging, and rapid data transmission at lower operational costs compared to manned aircraft. Additionally, rising geopolitical tensions, asymmetric warfare, and the integration of advanced sensors, AI-driven analytics, and secure communication systems are further strengthening the demand for intelligence-focused UAV solutions worldwide

By Mobility Type

On the basis of Mobility Type, the Asia-Pacific Unmanned Aerial Vehicle Market is segmented into Rotary-Wing, Fixed-Wing, Hybrid VTOL, Single-Rotor Helicopter UAVs. Nano / Micro Drones, Others

The Rotary-Wing segment is expected to dominate the market due to its superior operational flexibility and versatility across a wide range of applications. Rotary-wing UAVs can take off and land vertically, hover in place, and operate effectively in confined or urban environments where fixed-wing drones are limited. These capabilities make them ideal for surveillance, inspection, mapping, emergency response, and military missions. Their ability to carry diverse payloads such as cameras, LiDAR, sensors, and communication equipment further increases adoption. Additionally, strong demand from defense, public safety, infrastructure monitoring, and commercial photography continues to drive widespread deployment of rotary-wing UAVs in Asia-Pacific.

By End User

On the basis of End User, the Asia-Pacific Unmanned Aerial Vehicle Market is segmented into Defense & Security, Commercial, Recreational, Civil, Others.

The Defense & Security segment is expected to dominate the market due to sustained Asia-Pacific military investments in intelligence, surveillance, reconnaissance, and combat-ready platforms. Armed forces increasingly rely on UAVs for border monitoring, threat detection, target acquisition, and precision strikes, as they reduce operational risk to personnel and offer extended endurance at lower costs than manned aircraft. Rising geopolitical tensions, asymmetric warfare, and the need for real-time battlefield intelligence further strengthen demand. Additionally, defense UAV programs benefit from long-term procurement contracts, continuous upgrades, and high-value payload integrations, resulting in significantly higher revenue contribution compared to commercial and civilian UAV applications.

By User Type

On the basis of User Type, the Asia-Pacific Unmanned Aerial Vehicle Market is segmented into Military, Commercial Operators, Government & Law Enforcement, Consumer / Enthusiast.

The Military segment is expected to dominate the market due to sustained defense spending and the strategic importance of unmanned systems in modern warfare. Armed forces increasingly rely on UAVs for intelligence, surveillance, reconnaissance, border monitoring, and precision strike missions, as they reduce risks to personnel while enhancing operational effectiveness. Military UAVs command significantly higher unit costs and long-term service contracts compared to commercial drones, contributing more revenue per platform. Continuous geopolitical tensions, modernization of defense forces, demand for long-endurance and combat-capable UAVs, and ongoing investments in autonomous and AI-enabled systems further reinforce the military segment’s leading position in the Asia-Pacific UAV market.

By Distribution Channel

On the basis of Distribution Channel, the Asia-Pacific Unmanned Aerial Vehicle Market is segmented into Indirect, Direct

The Indirect segment is expected to dominate the market due to its ability to provide comprehensive solutions beyond drone manufacturing, including software, data analytics, maintenance, training, integration, and managed services. Many end users prefer indirect solutions as they reduce operational complexity, regulatory burden, and upfront capital investment. Defense agencies and enterprises increasingly outsource UAV operations, data processing, and fleet management to specialized service providers to improve efficiency and focus on core activities. Additionally, recurring revenues from services, upgrades, and long-term contracts generate higher and more stable value compared to one-time hardware sales, strengthening the dominance of the indirect segment.

Asia-Pacific Unmanned Aerial Vehicle Market Regional Analysis

- The Asia-Pacific region is the largest UAV market, accounting for 37.80% of Asia-Pacific demand. With a projected CAGR of 17%, growth is driven by rapid industrialization, government support, expanding e-commerce and logistics operations, and rising adoption of UAVs across agriculture, construction, and surveillance sectors.

- The region benefits from improving infrastructure, favorable regulatory policies, and increasing investment in smart city initiatives and drone technology. Growing end-use applications in agriculture, industrial inspection, and logistics support strong market penetration and long-term growth potential in Asia-Pacific.

China Unmanned Aerial Vehicle Market Insight

The China UAV market is rapidly expanding, driven by government support, technological innovation, and adoption across agriculture, logistics, surveillance, and e-commerce sectors. Strong manufacturing capabilities, infrastructure development, and investment in AI-enabled drones enhance operational efficiency, positioning China as a leading UAV market in Asia-Pacific with significant growth potential.

India Unmanned Aerial Vehicle Market Insight

The India UAV market is witnessing robust growth, fueled by defense modernization, agriculture monitoring, industrial inspection, and logistics applications. Government initiatives supporting drone technology, increasing adoption of rotary-wing UAVs, and integration of AI and IoT enhance efficiency, making India a fast-emerging market in the Asia-Pacific region.

Asia-Pacific Unmanned Aerial Vehicle Market Share

The Unmanned Aerial Vehicle is primarily led by well-established companies, including:

- DJI (China)

- Northrop Grumman Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

- General Atomics Aeronautical Systems (U.S.)

- BAE System (United Kingdom)

- Thales Group (France)

- Leonardo S.P.A. (Italy)

- Teledyne FLIR LLC (U.S.)

- Insitu (A Boeing Company) (U.S.)

- Autel Robotics (China)

- Ehang Holdings (China)

- Parrot SA (France)

Latest Developments in Asia-Pacific Unmanned Aerial Vehicle Market

- In November 2025, BAE Systems and Turkish Aerospace have signed a Memorandum of Understanding to form a strategic alliance focused on developing uncrewed air systems. The collaboration brings together BAE Systems’ FalconWorks combat air expertise and Turkish Aerospace’s proven UAS capabilities to jointly explore innovation, accelerate development, and unlock new Asia-Pacific market opportunities through cost-effective solutions.

- In July 2025, BAE Systems has successfully demonstrated a low-cost strike capability by launching precision-guided munitions from a multi-rotor uncrewed air system during US trials. Using an APKWS®-equipped TRV-150 platform, the tests destroyed air and ground targets, showcasing an affordable, multi-role UAS solution for modern battlefield operations.

- In December 2025, At I/ITSEC 2025, Thales unveiled a new drone training capability that integrates drones into live military simulations. Compatible with various drone types, it enables realistic training for both friendly and enemy drone scenarios. The system enhances operational readiness by simulating drone neutralization, loitering munitions, and provides data-driven analysis, preparing armed forces for evolving aerial threats on the modern battlefield.

- In June 2025, Leonardo and Baykar have established a 50:50 joint venture, LBA Systems, headquartered in Italy, to develop unmanned technologies. Announced at the Paris Airshow 2025, the partnership combines Baykar’s advanced UAS platforms with Leonardo’s expertise in electronics, certification, and multi-domain systems, aiming to jointly design, produce, and maintain next-generation unmanned aerial systems for European and Asia-Pacific markets.

- In June 2025, Leonardo and Baykar have established a 50:50 joint venture, LBA Systems, headquartered in Italy, to develop unmanned technologies. Announced at the Paris Airshow 2025, the partnership combines Baykar’s advanced UAS platforms with Leonardo’s expertise in electronics, certification, and multi-domain systems, aiming to jointly design, produce, and maintain next-generation unmanned aerial systems for European and Asia-Pacific markets.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 OVERVIEW

4.2.2 LOGISTIC COST SCENARIO

4.2.2.1 INBOUND LOGISTICS FOR COMPONENTS AND SUBSYSTEMS

4.2.2.2 DOMESTIC DISTRIBUTION AND SYSTEM DEPLOYMENT

4.2.2.3 EXPORT LOGISTICS AND ASIA-PACIFIC DEPLOYMENT

4.2.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.2.3.1 SPECIALIZED HANDLING AND SECURITY

4.2.3.2 SUPPLY CHAIN COORDINATION AND NETWORK DESIGN

4.2.3.3 REGULATORY COMPLIANCE AND EXPORT MANAGEMENT

4.2.3.4 RISK MITIGATION AND SUPPLY CHAIN RESILIENCE

4.2.3.5 SUPPORT FOR AFTERMARKET AND CUSTOMER SERVICE

4.2.4 CONCLUSION

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL AND COMPONENT SUPPLIERS: ENABLING PERFORMANCE AND RELIABILITY

4.3.2 TECHNOLOGY AND SOFTWARE PROVIDERS: POWERING AUTONOMY AND INTELLIGENCE

4.3.3 MANUFACTURERS AND FORMULATORS: CONVERTING DATA INTO CUSTOMIZED PRODUCTS

4.3.4 MANUFACTURERS AND SYSTEM INTEGRATORS: CONVERTING TECHNOLOGY INTO MISSION-READY UAVS

4.3.5 GROUND CONTROL, SUPPORT EQUIPMENT, AND PAYLOAD PROVIDERS: EXPANDING OPERATIONAL CAPABILITY

4.3.6 END USERS AND SERVICE OPERATORS: DRIVING DEMAND THROUGH MISSION REQUIREMENTS

4.3.7 REGULATORY AUTHORITIES AND STANDARDS BODIES

4.3.8 SUSTAINABILITY AND INNOVATION DRIVERS

4.4 VENDOR SELECTION CRITERIA

4.4.1 TECHNICAL CAPABILITY & PRODUCT PERFORMANCE

4.4.2 MANUFACTURING & INTEGRATION CAPABILITIES

4.4.3 SUPPLY CHAIN RELIABILITY & AFTER‑SALES SUPPORT

4.4.4 COST & COMMERCIAL COMPETITIVENESS

4.4.5 REGULATORY, SAFETY & SUSTAINABILITY PRACTICES

4.4.6 COLLABORATION, INNOVATION & PROGRAM FLEXIBILITY

4.5 TECHNOLOGICAL ADVANCEMENTS

4.5.1 ADVANCED SENSORS AND IMAGING SYSTEMS

4.5.2 ARTIFICIAL INTELLIGENCE (AI) AND AUTONOMOUS NAVIGATION

4.5.3 EXTENDED FLIGHT TIME AND BATTERY TECHNOLOGY

4.5.4 LIGHTWEIGHT AND ADVANCED MATERIALS

4.5.5 ANTI-COLLISION AND OBSTACLE AVOIDANCE SYSTEMS

4.5.6 MODULAR PAYLOAD SYSTEMS

4.6 COMPANY EVALUATION QUADRANT

4.7 BRAND OUTLOOK

4.7.1 BRAND COMPARATIVE ANALYSIS

4.7.2 COMPANY VS BRAND OVERVIEW

4.8 CONSUMER BUYING BEHAVIOUR

4.8.1 GROUP 1 DEFENSE & MILITARY USERS

4.8.2 GROUP 2 GOVERNMENT & PUBLIC SAFETY AGENCIES

4.8.3 GROUP 3 COMMERCIAL & ENTERPRISE USERS

4.8.4 GROUP 4 INDUSTRIAL INSPECTION & ENERGY SECTOR USERS

4.8.5 GROUP 5 AGRICULTURE & ENVIRONMENTAL MONITORING USERS

4.8.6 GROUP 6 CONSUMER & PROSUMER USERS

4.9 COST ANALYSIS BREAKDOWN

4.9.1 HARDWARE COSTS

4.9.2 R&D, SOFTWARE, SENSORS, AND IP COSTS

4.9.3 MANUFACTURING, CONTRACT ASSEMBLY, AND PROCUREMENT

4.9.4 TESTING, CERTIFICATION, AND REGULATORY COMPLIANCE

4.9.5 LOGISTICS, DISTRIBUTION, SALES & MARKETING

4.9.6 AFTER-SALES, SUSTAINMENT, TRAINING, AND DATA SERVICES

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND STRATEGIC PARTNERSHIPS

4.10.2 TECHNOLOGY COLLABORATIONS

4.10.3 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.4 STAGE OF DEVELOPMENT

4.10.5 TIMELINES AND MILESTONES

4.10.6 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.7 RISK ASSESSMENT AND MITIGATION

4.10.8 FUTURE OUTLOOK

4.11 PRICING ANALYSIS

4.11.1 PRICING BY UAV TYPE

4.11.2 PRICING BY APPLICATION

4.11.3 COST STRUCTURE DRIVERS

4.11.4 REGIONAL PRICING VARIATIONS

4.11.5 IMPACT OF TARIFFS AND LOCALIZATION

4.11.6 PRICING MODELS AND COMMERCIAL STRATEGIES

4.11.7 PRICING TREND AND FUTURE OUTLOOK

4.12 PROFIT MARGIN SCENARIO

4.12.1 MILITARY SEGMENT

4.12.2 COMMERCIAL SEGMENT

4.12.3 REGIONAL VARIATIONS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEFENSE MODERNIZATION AND MILITARY ISR (INTELLIGENCE, SURVEILLANCE, RECONNAISSANCE) REQUIREMENTS

7.1.2 RISING ADOPTION OF UAVS FOR BORDER SECURITY AND HOMELAND SURVEILLANCE

7.1.3 GROWING COMMERCIAL USE IN AGRICULTURE, INFRASTRUCTURE INSPECTION, MINING, AND CONSTRUCTION

7.1.4 EXPANSION OF UAV APPLICATIONS IN LOGISTICS AND LAST-MILE DELIVERY

7.2 RESTRAINTS

7.2.1 STRINGENT AIRSPACE REGULATIONS AND COMPLEX CERTIFICATION PROCESSES

7.2.2 LIMITED BATTERY LIFE AND PAYLOAD CAPACITY

7.3 OPPORTUNITIES

7.3.1 INCREASING DEMAND FOR UAVS IN DISASTER MANAGEMENT AND EMERGENCY RESPONSE

7.3.2 EXPANSION OF UAV-BASED MAPPING, SURVEYING, AND AERIAL IMAGING SERVICES

7.3.3 INTEGRATION OF UAVS WITH 5G, SATELLITE COMMUNICATIONS, AND CLOUD PLATFORMS

7.4 CHALLENGES

7.4.1 LACK OF HARMONIZED ASIA-PACIFIC REGULATIONS FOR UAV OPERATIONS

7.4.2 SAFE INTEGRATION INTO CIVILIAN AIR TRAFFIC MANAGEMENT SYSTEMS

8 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ROTARY-WING UAVS

8.3 FIXED-WING UAVS

8.4 HYBRID UAVS

8.5 OTHERS

8.6 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 MULTI-ROTOR (QUADCOPTER, HEXACOPTER, ETC.)

8.6.2 SINGLE ROTOR

8.7 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.7.1 REMOTE PILOTED

8.7.2 AUTONOMOUS

8.8 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 CONVENTIONAL FIXED-WING

8.8.2 HYBRID FIXED-WING

8.9 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

8.9.1 MEDIUM RANGE

8.9.2 LONG RANGE

8.9.3 SHORT RANGE

8.1 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.10.1 REMOTE PILOTED

8.10.2 AUTONOMOUS

8.11 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.11.1 VTOL (VERTICAL TAKE-OFF AND LANDING)

8.11.2 TILT-WING

8.12 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

8.12.1 DEFENSE VTOL

8.12.2 COMMERCIAL VTOL

8.12.3 OTHERS

8.13 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.13.1 REMOTE PILOTED

8.13.2 AUTONOMOUS

8.14 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 NORTH AMERICA

8.14.3 EUROPE

8.14.4 MIDDLE EAST AND AFRICA

8.14.5 SOUTH AMERICA

8.15 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 NORTH AMERICA

8.15.3 EUROPE

8.15.4 MIDDLE EAST AND AFRICA

8.15.5 SOUTH AMERICA

8.16 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 MIDDLE EAST AND AFRICA

8.16.5 SOUTH AMERICA

8.17 ASIA-PACIFIC OTHERS UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 MIDDLE EAST AND AFRICA

8.17.5 SOUTH AMERICA

9 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT

9.1 OVERVIEW

9.2 PLATFORM

9.3 SOFTWARE & CYBERSECURITY

9.4 DATA LINK

9.5 LAUNCH & RECOVERY SYSTEMS

9.6 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.6.1 AVIONICS

9.6.2 AIRFRAME

9.6.3 PROPULSION SYSTEM

9.6.4 GROUND CONTROL STATION

9.7 ASIA-PACIFIC AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.7.1 FLIGHT CONTROL SYSTEMS

9.7.2 SENSORS & PAYLOADS

9.7.3 NAVIGATION SYSTEMS

9.7.4 COMMUNICATION SYSTEMS

9.8 ASIA-PACIFIC SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 IMAGING PAYLOAD

9.8.2 LIDAR/RADAR MODULES

9.8.3 HYPERSPECTRAL SENSORS

9.9 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 MIDDLE EAST AND AFRICA

9.9.5 SOUTH AMERICA

9.1 ASIA-PACIFIC SOFTWARE & CYBERSECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.10.1 ASIA-PACIFIC

9.10.2 NORTH AMERICA

9.10.3 EUROPE

9.10.4 MIDDLE EAST AND AFRICA

9.10.5 SOUTH AMERICA

9.11 ASIA-PACIFIC DATA LINK IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 NORTH AMERICA

9.11.3 EUROPE

9.11.4 MIDDLE EAST AND AFRICA

9.11.5 SOUTH AMERICA

9.12 ASIA-PACIFIC LAUNCH & RECOVERY SYSTEMS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.12.1 ASIA-PACIFIC

9.12.2 NORTH AMERICA

9.12.3 EUROPE

9.12.4 MIDDLE EAST AND AFRICA

9.12.5 SOUTH AMERICA

10 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

10.3 MAPPING & SURVEYING

10.4 MONITORING & INSPECTION

10.5 DELIVERY & LOGISTICS

10.6 AGRICULTURE & PRECISION FARMING

10.7 AERIAL PHOTOGRAPHY

10.8 OTHERS

10.9 ASIA-PACIFIC INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR) IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 MIDDLE EAST AND AFRICA

10.9.5 SOUTH AMERICA

10.1 ASIA-PACIFIC MAPPING & SURVEYING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 MIDDLE EAST AND AFRICA

10.10.5 SOUTH AMERICA

10.11 ASIA-PACIFIC MONITORING & INSPECTION IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.11.1 ASIA-PACIFIC

10.11.2 NORTH AMERICA

10.11.3 EUROPE

10.11.4 MIDDLE EAST AND AFRICA

10.11.5 SOUTH AMERICA

10.12 ASIA-PACIFIC DELIVERY & LOGISTICS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 MIDDLE EAST AND AFRICA

10.12.5 SOUTH AMERICA

10.13 ASIA-PACIFIC AGRICULTURE & PRECISION FARMING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.13.1 ASIA-PACIFIC

10.13.2 NORTH AMERICA

10.13.3 EUROPE

10.13.4 MIDDLE EAST AND AFRICA

10.13.5 SOUTH AMERICA

10.14 ASIA-PACIFIC AERIAL PHOTOGRAPHY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA-PACIFIC

10.14.2 NORTH AMERICA

10.14.3 EUROPE

10.14.4 MIDDLE EAST AND AFRICA

10.14.5 SOUTH AMERICA

10.15 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 MIDDLE EAST AND AFRICA

10.15.5 SOUTH AMERICA

11 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE

11.1 OVERVIEW

11.2 ROTARY-WING

11.3 FIXED-WING

11.4 HYBRID VTOL

11.5 SINGLE-ROTOR HELICOPTER UAVS

11.6 NANO / MICRO DRONES

11.7 OTHERS

11.8 ASIA-PACIFIC ROTARY-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.8.1 ASIA-PACIFIC

11.8.2 NORTH AMERICA

11.8.3 EUROPE

11.8.4 MIDDLE EAST AND AFRICA

11.8.5 SOUTH AMERICA

11.9 ASIA-PACIFIC FIXED-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.9.1 ASIA-PACIFIC

11.9.2 NORTH AMERICA

11.9.3 EUROPE

11.9.4 MIDDLE EAST AND AFRICA

11.9.5 SOUTH AMERICA

11.1 ASIA-PACIFIC HYBRID VTOL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 MIDDLE EAST AND AFRICA

11.10.5 SOUTH AMERICA

11.11 ASIA-PACIFIC SINGLE-ROTOR HELICOPTER UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 NORTH AMERICA

11.11.3 EUROPE

11.11.4 MIDDLE EAST AND AFRICA

11.11.5 SOUTH AMERICA

11.12 ASIA-PACIFIC NANO / MICRO DRONES IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 MIDDLE EAST AND AFRICA

11.12.5 SOUTH AMERICA

11.13 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 NORTH AMERICA

11.13.3 EUROPE

11.13.4 MIDDLE EAST AND AFRICA

11.13.5 SOUTH AMERICA

12 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER

12.1 OVERVIEW

12.2 DEFENSE & SECURITY

12.3 COMMERCIAL

12.4 RECREATIONAL

12.5 CIVIL

12.6 OTHERS

12.7 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

12.7.1 DEFENSE & SECURITY

12.7.2 COMMERCIAL

12.7.3 RECREATIONAL

12.7.4 CIVIL

12.7.5 OTHERS

12.8 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.8.1 COMBAT OPERATIONS

12.8.2 BORDER PATROL

12.8.3 SEARCH & RESCUE

12.9 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.9.1 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.9.2 MONITORING & INSPECTION

12.9.3 DELIVERY & LOGISTICS

12.9.4 MAPPING & SURVEYING

12.9.5 AERIAL PHOTOGRAPHY

12.9.6 AGRICULTURE & PRECISION FARMING

12.9.7 OTHERS

12.1 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.10.1 AERIAL PHOTOGRAPHY

12.10.2 MAPPING & SURVEYING

12.10.3 AGRICULTURE & PRECISION FARMING

12.10.4 MONITORING & INSPECTION

12.10.5 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.10.6 DELIVERY & LOGISTICS

12.10.7 OTHERS

12.11 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.11.1 AERIAL PHOTOGRAPHY

12.11.2 MAPPING & SURVEYING

12.11.3 MONITORING & INSPECTION

12.11.4 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.11.5 DELIVERY & LOGISTICS

12.11.6 AGRICULTURE & PRECISION FARMING

12.11.7 OTHERS

12.12 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.12.1 ENVIRONMENTAL MONITORING

12.12.2 DISASTER MANAGEMENT

12.12.3 RESEARCH AND EDUCATION

12.13 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.13.1 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.13.2 MAPPING & SURVEYING

12.13.3 DELIVERY & LOGISTICS

12.13.4 AGRICULTURE & PRECISION FARMING

12.13.5 AERIAL PHOTOGRAPHY

12.13.6 MONITORING & INSPECTION

12.13.7 OTHERS

12.14 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.14.1 AERIAL PHOTOGRAPHY

12.14.2 MAPPING & SURVEYING

12.14.3 MONITORING & INSPECTION

12.14.4 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.14.5 DELIVERY & LOGISTICS

12.14.6 AGRICULTURE & PRECISION FARMING

12.14.7 OTHERS

12.15 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.15.1 ASIA-PACIFIC

12.15.2 NORTH AMERICA

12.15.3 EUROPE

12.15.4 MIDDLE EAST AND AFRICA

12.15.5 SOUTH AMERICA

12.16 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 MIDDLE EAST AND AFRICA

12.16.5 SOUTH AMERICA

12.17 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.17.1 ASIA-PACIFIC

12.17.2 NORTH AMERICA

12.17.3 EUROPE

12.17.4 MIDDLE EAST AND AFRICA

12.17.5 SOUTH AMERICA

12.18 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 MIDDLE EAST AND AFRICA

12.18.5 SOUTH AMERICA

12.19 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.19.1 ASIA-PACIFIC

12.19.2 NORTH AMERICA

12.19.3 EUROPE

12.19.4 MIDDLE EAST AND AFRICA

12.19.5 SOUTH AMERICA

13 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE

13.1 OVERVIEW

13.2 MILITARY

13.3 COMMERCIAL OPERATORS

13.4 GOVERNMENT & LAW ENFORCEMENT

13.5 CONSUMER / ENTHUSIAST

13.6 ASIA-PACIFIC MILITARY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 NORTH AMERICA

13.6.3 EUROPE

13.6.4 MIDDLE EAST AND AFRICA

13.6.5 SOUTH AMERICA

13.7 ASIA-PACIFIC COMMERCIAL OPERATORS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 NORTH AMERICA

13.7.3 EUROPE

13.7.4 MIDDLE EAST AND AFRICA

13.7.5 SOUTH AMERICA

13.8 ASIA-PACIFIC GOVERNMENT & LAW ENFORCEMENT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.8.1 ASIA-PACIFIC

13.8.2 NORTH AMERICA

13.8.3 EUROPE

13.8.4 MIDDLE EAST AND AFRICA

13.8.5 SOUTH AMERICA

13.9 ASIA-PACIFIC CONSUMER / ENTHUSIAST IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 NORTH AMERICA

13.9.3 EUROPE

13.9.4 MIDDLE EAST AND AFRICA

13.9.5 SOUTH AMERICA

14 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT

14.3 DIRECT

14.4 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

14.4.1 DISTRIBUTORS & AUTHORIZED DEALERS

14.4.2 SYSTEM INTEGRATORS

14.4.3 VALUE-ADDED RESELLERS (VARS)

14.5 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.5.1 ASIA-PACIFIC

14.5.2 NORTH AMERICA

14.5.3 EUROPE

14.5.4 MIDDLE EAST AND AFRICA

14.5.5 SOUTH AMERICA

14.6 ASIA-PACIFIC DIRECTOR IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.6.1 ASIA-PACIFIC

14.6.2 NORTH AMERICA

14.6.3 EUROPE

14.6.4 MIDDLE EAST AND AFRICA

14.6.5 SOUTH AMERICA

15 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY REGION

15.1 ASIA PACIFIC

15.1.1 CHINA

15.1.2 INDIA

15.1.3 JAPAN

15.1.4 SOUTH KOREA

15.1.5 AUSTRALIA

15.1.6 SINGAPORE

15.1.7 THAILAND

15.1.8 INDONESIA

15.1.9 MALAYSIA

15.1.10 PHILIPPINES

15.1.11 TAIWAN

15.1.12 HONG KONG

15.1.13 NEW ZEALAND

15.1.14 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 DJI

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 NORTHROP GRUMMAN

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 LOCKHEED MARTIN CORPORATION

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 GENERAL ATOMICS

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 BAE SYSTEMS

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ACTION DRONE, INC.

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AEROVIRONMENT, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 AIROBOTICS LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 AUTEL ROBOTICS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 EHANG

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 ELBIT SYSTEMS LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 HOLY STONE

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 INSITU (SUBSIDIARY OF THE BOEING COMPANY)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 LEONARDO S.P.A.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MICRODRONES

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 PARROT DRONES SAS

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 QUANTUM-SYSTEMS GMBH

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 SKYDIO, INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 TELEDYNE FLIR DEFENSE INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 TERRA DRONE CORP.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 THALES

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 WINGCOPTER

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 YUNEEC

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 ZIPLINE

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC OTHERS UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC SOFTWARE & CYBERSECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC DATA LINK IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC LAUNCH & RECOVERY SYSTEMS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR) IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC MAPPING & SURVEYING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC MONITORING & INSPECTION IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC DELIVERY & LOGISTICS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC AGRICULTURE & PRECISION FARMING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC AERIAL PHOTOGRAPHY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC ROTARY-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC FIXED-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC HYBRID VTOL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SINGLE-ROTOR HELICOPTER UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC NANO / MICRO DRONES IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 39 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC MILITARY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC COMMERCIAL OPERATORS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC GOVERNMENT & LAW ENFORCEMENT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC CONSUMER / ENTHUSIAST IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC DIRECTOR IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY COUNTRY, 2018-2033 (USD UNITS)

TABLE 62 ASIA-PACIFIC

TABLE 63 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 80 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 83 ASIA-PACIFIC RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 ASIA-PACIFIC CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 86 ASIA-PACIFIC OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 87 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 ASIA-PACIFIC UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 89 ASIA-PACIFIC INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 CHINA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 CHINA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 CHINA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 93 CHINA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 CHINA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 95 CHINA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 96 CHINA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 CHINA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 98 CHINA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 99 CHINA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 100 CHINA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 CHINA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 CHINA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 CHINA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 104 CHINA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 CHINA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 106 CHINA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 107 CHINA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 CHINA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 109 CHINA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 110 CHINA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 111 CHINA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 CHINA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 113 CHINA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 114 CHINA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 CHINA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 116 CHINA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 INDIA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 INDIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 INDIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 120 INDIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 INDIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 122 INDIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 123 INDIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 INDIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 125 INDIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 126 INDIA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 127 INDIA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 INDIA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 INDIA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 INDIA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 131 INDIA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 INDIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 133 INDIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 134 INDIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 INDIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 136 INDIA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 137 INDIA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 138 INDIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 INDIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 140 INDIA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 141 INDIA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 INDIA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 143 INDIA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 JAPAN ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 JAPAN ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 147 JAPAN FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 JAPAN FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 149 JAPAN FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 150 JAPAN HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 JAPAN HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 152 JAPAN HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 153 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 154 JAPAN PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 JAPAN AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 JAPAN SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 158 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 160 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 161 JAPAN DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 JAPAN DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 163 JAPAN COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 164 JAPAN RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 165 JAPAN CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 JAPAN CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 167 JAPAN OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 168 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 JAPAN UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 170 JAPAN INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 SOUTH KOREA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 SOUTH KOREA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 174 SOUTH KOREA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 SOUTH KOREA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 176 SOUTH KOREA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 177 SOUTH KOREA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 SOUTH KOREA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 179 SOUTH KOREA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 180 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 181 SOUTH KOREA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 SOUTH KOREA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 SOUTH KOREA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 185 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 187 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 188 SOUTH KOREA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 SOUTH KOREA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 190 SOUTH KOREA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 191 SOUTH KOREA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 192 SOUTH KOREA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 SOUTH KOREA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 194 SOUTH KOREA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 195 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 SOUTH KOREA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 197 SOUTH KOREA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 AUSTRALIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 AUSTRALIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 201 AUSTRALIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 AUSTRALIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 203 AUSTRALIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 204 AUSTRALIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 AUSTRALIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 206 AUSTRALIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 207 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 208 AUSTRALIA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 AUSTRALIA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 AUSTRALIA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 212 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 214 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 215 AUSTRALIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 AUSTRALIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 217 AUSTRALIA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 218 AUSTRALIA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 219 AUSTRALIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 AUSTRALIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 221 AUSTRALIA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 222 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 AUSTRALIA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 224 AUSTRALIA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 SINGAPORE ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 SINGAPORE ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 228 SINGAPORE FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 SINGAPORE FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 230 SINGAPORE FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 231 SINGAPORE HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 SINGAPORE HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 233 SINGAPORE HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 234 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 235 SINGAPORE PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 SINGAPORE AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 SINGAPORE SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 239 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 241 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 242 SINGAPORE DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 SINGAPORE DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 244 SINGAPORE COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 245 SINGAPORE RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 246 SINGAPORE CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 SINGAPORE CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 248 SINGAPORE OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 249 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 SINGAPORE UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 251 SINGAPORE INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 THAILAND ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 THAILAND ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 255 THAILAND FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 THAILAND FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 257 THAILAND FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 258 THAILAND HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 THAILAND HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 260 THAILAND HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 261 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 262 THAILAND PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 THAILAND AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 THAILAND SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 265 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 266 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 268 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 269 THAILAND DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 THAILAND DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 271 THAILAND COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 272 THAILAND RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 273 THAILAND CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 274 THAILAND CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 275 THAILAND OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 276 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 THAILAND UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 278 THAILAND INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 INDONESIA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 280 INDONESIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 INDONESIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 282 INDONESIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 INDONESIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 284 INDONESIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 285 INDONESIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 INDONESIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 287 INDONESIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 288 INDONESIA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 289 INDONESIA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 INDONESIA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 INDONESIA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 INDONESIA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 293 INDONESIA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 INDONESIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 295 INDONESIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)