Europe Anti Aging Skincare Ingredients Market

Marktgröße in Milliarden USD

CAGR :

%

USD

415.80 Million

USD

589.05 Million

2024

2032

USD

415.80 Million

USD

589.05 Million

2024

2032

| 2025 –2032 | |

| USD 415.80 Million | |

| USD 589.05 Million | |

|

|

|

|

Marktsegmentierung für Inhaltsstoffe für Anti-Aging-Hautpflegeprodukte in Europa nach Produkt (Retinoid, Hyaluronsäure, Antioxidantien, Peptide, Niacinamid (Vitamin B3), Alpha-Hydroxysäuren (AHAS), Ceramide, Zinkoxid und Titandioxid, Beta-Hydroxysäure (BHA), Coenzym Q10 (Ubichinon), Grüntee-Extrakt, Alpha-Liponsäure, Koffein, Bakuchiol, Squalan, Kojisäure, Alpha-Arbutin, Soja-Isoflavone und andere), Form (Pulver, Flüssigkeit und Granulat), Funktion (Feuchtigkeitsspendend, Kollagen-Boosting, Sonnenschutz, Peeling, Hautaufhellung, Entzündungshemmend, Hautreparatur und andere), Anwendung (Anti-Falten, Anti-Pigmentierung, Anti-Oxidation, Hautfüller und andere), Endverbrauch (Serum, Feuchtigkeitscreme, Reinigungsmittel, Augencreme, Gesichtsöl, Maske, Toner und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Anti-Aging-Hautpflege-Inhaltsstoffe in Europa

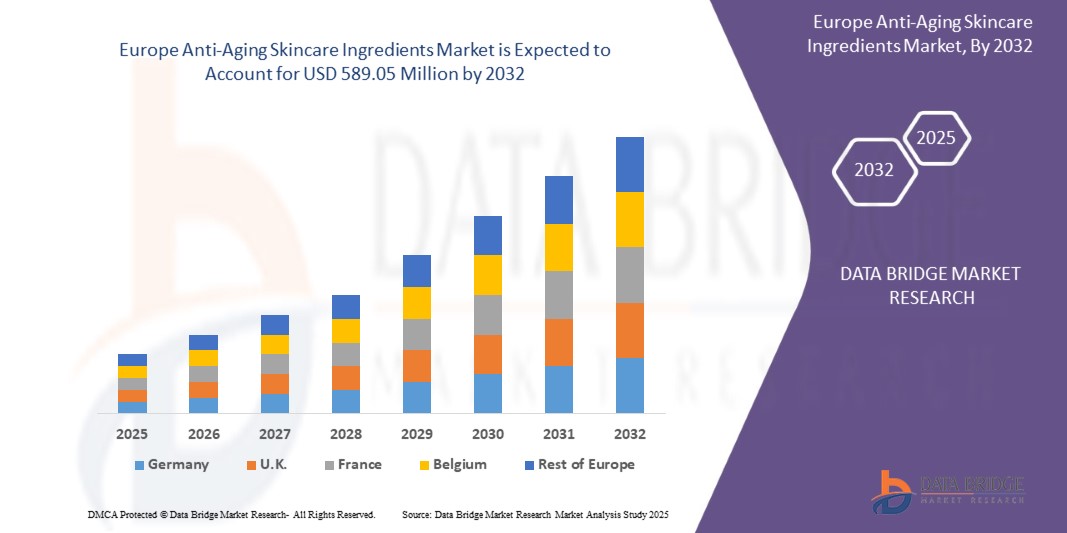

- Der europäische Markt für Anti-Aging-Hautpflegezutaten hatte im Jahr 2024 ein Volumen von 415,80 Millionen US-Dollar und wird bis 2032 voraussichtlich 589,05 Millionen US-Dollar erreichen , bei einer CAGR von 4,45 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch das steigende Verbraucherbewusstsein für Hautpflege, die steigende Nachfrage nach präventiven und Anti-Aging-Lösungen sowie technologische Innovationen bei bioaktiven und multifunktionalen Inhaltsstoffen vorangetrieben, die effektivere Formulierungen zur Faltenreduzierung, Hautaufhellung und Feuchtigkeitsversorgung ermöglichen.

- Darüber hinaus fördert die zunehmende Präferenz für natürliche, nachhaltig gewonnene und ethisch produzierte Inhaltsstoffe die Einführung hochwertiger Anti-Aging-Formeln. Diese zusammenlaufenden Faktoren beschleunigen die Akzeptanz fortschrittlicher Hautpflege-Inhaltsstoffe und fördern damit das Wachstum der Branche erheblich.

Marktanalyse für Anti-Aging-Hautpflege-Inhaltsstoffe in Europa

- Zu den Inhaltsstoffen von Anti-Aging-Hautpflegeprodukten gehören bioaktive Verbindungen wie Retinoide, Peptide, Hyaluronsäure, Antioxidantien und Ceramide, die sichtbare Zeichen der Hautalterung reduzieren, die Hautelastizität verbessern und die allgemeine Hautgesundheit fördern. Diese Inhaltsstoffe werden häufig in Seren, Cremes, Masken und Sonnenschutzmitteln sowohl zur präventiven als auch zur korrigierenden Hautpflege eingesetzt.

- Die steigende Nachfrage nach Anti-Aging-Hautpflegeprodukten wird vor allem durch die zunehmende Alterung der Bevölkerung, steigende verfügbare Einkommen, den zunehmenden Fokus der Verbraucher auf Körperpflege und die zunehmende Verbreitung hochwertiger Hautpflegeprodukte in Industrie- und Schwellenländern vorangetrieben. Die zunehmende digitale Nutzung und der E-Commerce-Ansatz verbessern die Produktverfügbarkeit und das Marktwachstum zusätzlich.

- Deutschland dominierte im Jahr 2024 den europäischen Markt für Anti-Aging-Hautpflege-Inhaltsstoffe aufgrund seiner gut etablierten Kosmetik- und Körperpflegeindustrie, seiner fortschrittlichen F&E-Infrastruktur und der hohen Akzeptanz hochwertiger und wissenschaftlich fundierter Hautpflegeprodukte.

- Großbritannien dürfte im Prognosezeitraum aufgrund der schnellen Einführung hochwertiger und multifunktionaler Hautpflegeprodukte das am schnellsten wachsende Land auf dem europäischen Markt für Anti-Aging-Hautpflegezutaten sein.

- Das Segment Antioxidantien dominierte den Markt mit einem Marktanteil von 34,2 % im Jahr 2024. Dies ist auf ihre nachgewiesene Fähigkeit zurückzuführen, freie Radikale zu neutralisieren, vor oxidativem Stress zu schützen und sichtbare Zeichen der Hautalterung wie Falten und feine Linien zu verlangsamen. Antioxidantien wie Vitamin C, Vitamin E, Grüntee-Extrakt und Coenzym Q10 werden häufig in Seren, Cremes und Sonnenschutzmitteln verwendet, was sie in Produktformulierungen äußerst vielseitig macht. Ihre multifunktionale Rolle bei der Aufhellung der Haut, der Verbesserung der Kollagenstabilität und dem Schutz vor Umwelteinflüssen wie UV-Strahlung und Umweltverschmutzung hat ihre Position als Eckpfeiler der Anti-Aging-Hautpflege gefestigt.

Berichtsumfang und Marktsegmentierung für Inhaltsstoffe für Anti-Aging-Hautpflegeprodukte in Europa

|

Eigenschaften |

Wichtige Markteinblicke zu Inhaltsstoffen für Anti-Aging-Hautpflegeprodukte in Europa |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Inhaltsstoffe zur Anti-Aging-Hautpflege in Europa

Verschiebung der Präferenz hin zu natürlichen und biologischen Produkten

- Der europäische Markt für Anti-Aging-Hautpflegeprodukte befindet sich im Wandel. Verbraucher bevorzugen natürliche und organische Inhaltsstoffe und suchen nach sichereren Alternativen zu synthetischen Chemikalien. Diese Vorliebe eröffnet neue Wachstumspfade und treibt Produktinnovationen sowohl im Massen- als auch im Premiumsegment voran.

- So haben beispielsweise Marken wie Shiseido und Lady Green organische Anti-Aging-Seren und Gesichtscremes mit biofermentierten Pflanzenstoffen und pflanzlichen Wirkstoffen auf den Markt gebracht. Solche Produkte erfreuen sich bei Millennials und gesundheitsbewussten Verbrauchern, die nach ethischen und nachhaltigen Hautpflegelösungen suchen, zunehmender Beliebtheit.

- Technologische Fortschritte bei der Wirkstoffverabreichung erhöhen die Wirksamkeit und das Vertrauen der Verbraucher. Unternehmen nutzen Verkapselung, Mikrofluidik und Biotechnologie, um natürliche Anti-Aging-Wirkstoffe wie Hyaluronsäure und Peptide in topischen Anwendungen bioverfügbarer und wirksamer zu machen.

- Die Nachfrage nach Transparenz bei Inhaltsstoffen und sicheren Rezepturen steigt. Kunden greifen zu Clean-Label- und vegan-zertifizierten Produkten. Nachhaltigkeits- und ethische Beschaffungsansprüche sind wichtige Kauffaktoren und beeinflussen die globale Positionierung ihrer Anti-Aging-Inhaltsstoffe.

- Individuelle Schönheitsprogramme mit natürlichen Anti-Aging-Wirkstoffen werden immer beliebter. Verbraucher suchen gezielte Lösungen für spezifische Probleme wie Falten, Pigmentflecken oder Elastizitätsverlust. Daher müssen Marken maßgeschneiderte Mischungen und ganzheitliche Hautpflegesets anbieten.

- Multifunktionale und minimalistische Anti-Aging-Produkte mit hochwertigen natürlichen Inhaltsstoffen erfreuen sich wachsender Beliebtheit. Marken vermarkten sie als effiziente Lösungen für einen geschäftigen Lebensstil und reduzieren die Belastung mit unnötigen Zusatzstoffen. Damit spiegeln sie Trends im Bereich Wellness und Selbstpflege wider.

Marktdynamik für Anti-Aging-Hautpflege-Inhaltsstoffe in Europa

Treiber

Innovative Produktmarken- und Werbeaktivitäten

- Effektive Marken- und Werbemaßnahmen verstärken das Marktwachstum, indem sie Anti-Aging-Hautpflegeprodukte schnell erkennbar machen, die Kundenbindung stärken und die Loyalität in einem wettbewerbsintensiven Umfeld stärken. Marken nutzen Design, soziale Medien und immersive Erlebnisse, um ihre Angebote zu differenzieren.

- So nutzen beispielsweise DSM und große Kosmetikunternehmen Influencer-Partnerschaften und gezielte Online-Kampagnen, um die klinisch nachgewiesenen Anti-Aging-Vorteile natürlicher Inhaltsstoffe wie Peptide und Antioxidantien hervorzuheben. Ihre datenbasierten Branding-Ansätze vergrößern die Reichweite und beschleunigen die Umsatzsteigerung in Kernmärkten.

- Fortschrittliche digitale Technologien ermöglichen Marken die direkte Interaktion mit Verbrauchern und stärken so das Bewusstsein und die Testbarkeit innovativer Hautpflegeprodukte. Virtuelle Anproben, KI-basierte Personalisierung und integrierte Omnichannel-Werbung prägen die Präferenzen für die Einführung neuer Inhaltsstoffe in einem dynamischen globalen Markt.

- Kontinuierliche Produktinnovationen sorgen für anhaltende Begeisterung bei den Verbrauchern. Marken präsentieren Anti-Aging-Wirkstoffe mit Fokus auf Wirksamkeit, Wissenschaft und Wellness. Strategische Kampagnen positionieren diese Produkte als unverzichtbare Bestandteile mehrstufiger Hautpflegeroutinen und ganzheitlicher Gesundheitsprogramme für alle Altersgruppen.

- Social-Media-Engagement und Kundenfeedback helfen Marken, ihr Angebot schnell anzupassen. Unternehmen optimieren Branding und Messaging, um den sich verändernden Kundenbedürfnissen gerecht zu werden und schaffen so ein reaktionsfähiges Marktumfeld, das nachhaltige Nachfrage und Marktwachstum fördert.

Einschränkung/Herausforderung

Zunehmende Nebenwirkungen einiger Inhaltsstoffe in Hautpflegeprodukten

- Die Nebenwirkungen mancher Anti-Aging-Wirkstoffe stellen eine anhaltende Herausforderung dar und beeinträchtigen das Vertrauen der Verbraucher und die behördliche Aufsicht. Berichte über allergische Reaktionen, Hautausschläge und Hautreizungen durch synthetische Zusatzstoffe oder gefälschte Produkte untergraben das Vertrauen in herkömmliche Anti-Aging-Lösungen.

- So hat beispielsweise das wachsende Bewusstsein für Parabene, Sulfate und künstliche Duftstoffe in mehreren Ländern zu Produktrückrufen und -beschränkungen geführt. Diese Kontrolle zwingt Hersteller dazu, ihre Rezepturen zu überdenken und sich ständig weiterentwickelnde Sicherheitsvorschriften einzuhalten, was die Marktaktivitäten zusätzlich komplexer macht.

- Langwierige Produktzulassungsverfahren und strenge Testanforderungen verlangsamen die Einführung neuer Inhaltsstoffe. Regulatorische Rahmenbedingungen, insbesondere in Europa und Nordamerika, erfordern umfangreiche Tests zur Überprüfung von Sicherheit und Wirksamkeit. Dies verzögert die Markteinführung und erhöht die Entwicklungskosten für die Zulieferer.

- Gefälschte und minderwertige Produkte verschärfen die Marktherausforderungen, da die breite Verfügbarkeit und der Konkurrenzkampf die Verbraucher zu unsicheren Alternativen verleiten. Diese Probleme führen dazu, dass die Industrie verstärkt in Authentizität, Rückverfolgbarkeit und Verbraucheraufklärungskampagnen investiert.

- Die steigende Nachfrage nach organischen und natürlichen Lösungen, getrieben von Bedenken hinsichtlich Nebenwirkungen, erhöht den Druck auf die Lieferketten für Inhaltsstoffe. Marken müssen Konsistenz, Rückverfolgbarkeit und Sicherheit gewährleisten und gleichzeitig Kostenschwankungen und Skalierbarkeitsprobleme bei Pflanzenextrakten und natürlichen Wirkstoffen bewältigen.

Marktumfang für Anti-Aging-Hautpflege-Inhaltsstoffe in Europa

Der Markt ist nach Produkt, Form, Funktion, Anwendung und Endnutzung segmentiert.

• Nach Produkt

Der europäische Markt für Anti-Aging-Hautpflege-Inhaltsstoffe ist nach Produkten segmentiert in Retinoid, Hyaluronsäure, Antioxidantien, Peptide, Niacinamid (Vitamin B3), Alpha-Hydroxysäuren (AHAs), Ceramide, Zinkoxid und Titandioxid, Beta-Hydroxysäure (BHA), Coenzym Q10 (Ubichinon), Grüntee-Extrakt, Alpha-Liponsäure, Koffein, Bakuchiol, Squalan, Kojisäure, Alpha-Arbutin, Soja-Isoflavone und weitere. Das Segment der Antioxidantien hatte 2024 mit 34,2 % den größten Marktanteil, was auf ihre nachgewiesene Fähigkeit zurückzuführen ist, freie Radikale zu neutralisieren, vor oxidativem Stress zu schützen und sichtbare Zeichen der Hautalterung wie Falten und feine Linien zu verlangsamen. Antioxidantien wie Vitamin C, Vitamin E, Grüntee-Extrakt und Coenzym Q10 werden häufig in Seren, Cremes und Sonnenschutzmitteln verwendet, was sie in Produktformulierungen äußerst vielseitig macht. Ihre multifunktionale Rolle bei der Aufhellung der Haut, der Verbesserung der Kollagenstabilität und dem Schutz vor Umwelteinflüssen wie UV-Strahlung und Verschmutzung hat ihre Position als Eckpfeiler der Anti-Aging-Hautpflege gefestigt.

Das Hyaluronsäure-Segment wird voraussichtlich von 2025 bis 2032 das schnellste Wachstum verzeichnen, angetrieben durch die steigende Verbrauchernachfrage nach feuchtigkeitsspendenden Anti-Aging-Lösungen. Hyaluronsäure wird allgemein für ihre feuchtigkeitsspeichernden Eigenschaften geschätzt, die die Hautelastizität verbessern und die Faltenbildung reduzieren. Ihre Verwendung in Seren, Tuchmasken und Feuchtigkeitscremes entspricht dem Clean-Label-Trend, da sie natürlich im Körper vorkommt und von allen Hauttypen gut vertragen wird. Die wachsende Attraktivität nicht-invasiver Feuchtigkeitsbehandlungen und ihre zunehmende Verwendung in dermalen Füllformulierungen verstärken ihre schnelle Akzeptanz zusätzlich.

• Nach Formular

Der Markt ist nach Form in Pulver, Flüssigkeiten und Granulate unterteilt. Das Flüssigkeitssegment hatte 2024 den größten Marktanteil, vor allem aufgrund seiner hohen Anwendbarkeit in Seren, Feuchtigkeitscremes und Cremes. Flüssigkeiten ermöglichen eine bessere Löslichkeit der Inhaltsstoffe, eine schnellere Aufnahme in die Haut und eine einfache Formulierung zu multifunktionalen Anti-Aging-Produkten. Dies macht sie zur bevorzugten Wahl für Hersteller, die mehrere Wirkstoffe wie Antioxidantien, Peptide und Retinoide in einer einzigen Formulierung kombinieren möchten.

Das Pudersegment wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, da Marken zunehmend auf pulverförmige Inhaltsstoffe setzen, um Stabilität und Haltbarkeit zu gewährleisten. Puder ermöglicht es Endverbrauchern, Produkte vor der Anwendung zu mischen, wodurch die Wirksamkeit erhalten bleibt und der Bedarf an Konservierungsstoffen reduziert wird. Das Format erfreut sich auch in der DIY-Hautpflege, bei minimalistischen Schönheitsroutinen und in nachhaltigen Verpackungen zunehmender Beliebtheit und entspricht damit gut den umweltbewussten Verbrauchertrends.

• Nach Funktion

Der Markt ist nach Funktionen segmentiert: Feuchtigkeitspflege, Kollagenförderung, Sonnenschutz, Peeling, Hautaufhellung, Entzündungshemmung, Hautreparatur und weitere. Das Feuchtigkeitssegment hatte 2024 den größten Marktanteil, da die Feuchtigkeitsversorgung nach wie vor der gefragteste Vorteil in der Anti-Aging-Hautpflege ist. Feuchtigkeitsspendende Inhaltsstoffe wie Hyaluronsäure, Ceramide und Squalan verbessern die Hautbarrierefunktion und sind daher fester Bestandteil praktisch aller Anti-Aging-Formulierungen. Das Segment profitiert von seiner universellen Anwendung über alle Altersgruppen, Hauttypen und Klimazonen hinweg, was seine langfristige Dominanz stärkt.

Das Segment der Kollagen-Booster wird voraussichtlich zwischen 2025 und 2032 am schnellsten wachsen, unterstützt durch die steigende Nachfrage nach strafferer, jugendlicher aussehender Haut. Inhaltsstoffe wie Peptide, Retinoide und Vitamin C werden zunehmend in Anti-Aging-Produkten eingesetzt, da sie die Kollagensynthese anregen und sichtbare Zeichen der Hautalterung reduzieren. Das wachsende Interesse an präventiver Hautpflege für die frühe Hautalterung, kombiniert mit wissenschaftlichen Innovationen in der Peptidtechnologie, treibt die beschleunigte Akzeptanz voran.

• Nach Anwendung

Der Markt ist nach Anwendungsgebieten in Anti-Falten-, Anti-Pigmentierungs-, Anti-Oxidations-, Hautfüller- und andere Produkte unterteilt. Das Anti-Falten-Segment hatte 2024 den größten Marktanteil, da es die Verbrauchernachfrage im Anti-Aging-Sektor maßgeblich antreibt. Mit Inhaltsstoffen wie Retinoiden, Peptiden und Hyaluronsäure, die direkt auf die Faltenreduzierung abzielen, wird in dieser Kategorie stark in Produktentwicklung und klinische Anwendungen investiert. Die zunehmende Alterung der Bevölkerung in den Industrieländern festigt diese Dominanz weiter.

Das Segment Anti-Pigmentierung wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben durch das wachsende Bewusstsein der Verbraucher für Hyperpigmentierung, ungleichmäßigen Hautton und sonnenbedingte Flecken. Inhaltsstoffe wie Niacinamid, Kojisäure und Alpha-Arbutin erfreuen sich in aufhellenden und Anti-Flecken-Formulierungen großer Beliebtheit. Dieser Trend wird durch die steigende Nachfrage in den Märkten im asiatisch-pazifischen Raum verstärkt, wo ein gleichmäßiger Hautton eine wichtige Schönheitspriorität darstellt, sowie in den westlichen Märkten, wo die Korrektur von Sonnenschäden zunehmend in den Vordergrund rückt.

• Nach Endverwendung

Auf der Grundlage der Endanwendung ist der Markt in Serum, Feuchtigkeitscreme, Reinigungsmittel, Augencreme, Gesichtsöl, Maske, Toner und andere segmentiert. Das Serumsegment hatte 2024 den größten Marktanteil, da Seren eine konzentrierte Abgabe aktiver Anti-Aging-Inhaltsstoffe bieten. Ihre leichte Formel und die tiefe Hautpenetration machen sie hochwirksam bei der Faltenreduzierung, Aufhellung und Feuchtigkeitsversorgung, was sowohl bei Premium- als auch bei Massenmarktkonsumenten großen Anklang findet. Die steigende Verbraucherpräferenz für multifunktionale Seren mit Mischungen aus Antioxidantien, Peptiden und Feuchtigkeitsboostern festigt die Führungsposition dieses Segments weiter.

Das Segment Augencremes wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen. Dies spiegelt das zunehmende Bewusstsein für frühe Anzeichen der Hautalterung wider, die häufig im empfindlichen Augenbereich auftreten. Augencremes werden mit gezielten Inhaltsstoffen wie Koffein, Peptiden und Hyaluronsäure formuliert, um Schwellungen, feine Linien und Augenringe zu bekämpfen. Die steigende Nachfrage jüngerer Bevölkerungsgruppen nach präventiven Lösungen und die zunehmende Innovation bei hautfreundlichen Formulierungen für empfindliche Haut treiben den Wachstumstrend voran.

Europa: Regionale Analyse des Marktes für Anti-Aging-Hautpflegezutaten

- Deutschland dominierte den europäischen Markt für Anti-Aging-Hautpflege-Inhaltsstoffe mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch seine gut etablierte Kosmetik- und Körperpflegeindustrie, eine fortschrittliche F&E-Infrastruktur und eine hohe Akzeptanz hochwertiger und wissenschaftlich fundierter Hautpflegeprodukte.

- Die Führungsrolle des Landes wird durch die starke Verbrauchernachfrage nach Anti-Aging-Lösungen, strenge Produktsicherheits- und Regulierungsstandards sowie gut entwickelte Lieferketten für hochwertige Inhaltsstoffe wie Retinoide, Peptide, Hyaluronsäure und Antioxidantien gestärkt.

- Die Position Deutschlands wird durch laufende Investitionen in innovative Formulierungen, den zunehmenden Fokus der Verbraucher auf natürliche und multifunktionale Inhaltsstoffe und die kontinuierliche Ausweitung dermatologisch getesteter und wirksamer Produkte weiter gestärkt.

Markteinblicke zu Anti-Aging-Hautpflegeinhaltsstoffen in Großbritannien und Europa

Der britische Markt wird voraussichtlich zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate in Europa verzeichnen, was auf die schnelle Akzeptanz hochwertiger und multifunktionaler Hautpflegeprodukte zurückzuführen ist. Das wachsende Bewusstsein für Anti-Aging-Routinen, die Vorliebe der Verbraucher für ethische, natürliche und tierversuchsfreie Inhaltsstoffe sowie die starke Verbreitung des E-Commerce beschleunigen die Nachfrage. Die Expansion des Einzelhandels und die Zusammenarbeit zwischen Dermatologen und Kosmetikmarken treiben das Marktwachstum voran, während Investitionen in hochwertige Formulierungen das anhaltende Vertrauen und die Akzeptanz der Verbraucher sichern.

Markteinblicke zu Inhaltsstoffen für Anti-Aging-Hautpflegeprodukte in Frankreich und Europa

Frankreich wird zwischen 2025 und 2032 voraussichtlich stetig wachsen. Dies wird durch eine starke Tradition im Bereich Premium- und Luxus-Hautpflege, einen zunehmenden Fokus der Verbraucher auf natürliche und nachhaltige Inhaltsstoffe sowie einen regulatorischen Schwerpunkt auf Produktsicherheit und Transparenz unterstützt. Das wachsende Interesse an multifunktionalen Formulierungen und innovativen bioaktiven Verbindungen verändert die Marktnachfrage. Investitionen in lokalisierte Lieferketten, Forschung und Entwicklung für neuartige Anti-Aging-Inhaltsstoffe und die Förderung hochwertiger, wissenschaftlich fundierter Hautpflegeprodukte unterstützen das Marktwachstum zusätzlich.

Marktanteil von Inhaltsstoffen für Anti-Aging-Hautpflegeprodukte in Europa

Die Branche der Inhaltsstoffe für Anti-Aging-Hautpflegeprodukte wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- ADEKA CORPORATION (Japan)

- Beiersdorf AG (Deutschland)

- Croda International Plc (Großbritannien)

- BASF SE (Deutschland)

- Wacker Chemie AG (Deutschland)

- Lonza (Schweiz)

- CLARIANT (Schweiz)

- Evonik Industries AG (Deutschland)

- DSM (Niederlande)

- Kao Corporation (Japan)

- BioThrive Sciences (USA)

- Contipro as (Tschechische Republik)

Neueste Entwicklungen auf dem europäischen Markt für Inhaltsstoffe für Anti-Aging-Hautpflege

- Im Februar 2025 kooperierten Estée Lauder Companies (ELC) und Serpin Pharma, um innovative Anti-Aging-Hautpflegewirkstoffe mit Fokus auf Langlebigkeit zu entwickeln. Diese Partnerschaft nutzt die Expertise von Serpin Pharma in der entzündungshemmenden Forschung, insbesondere im Bereich der Serinprotease-Inhibitoren, die den Körper bei der Reparatur entzündeter Zellen unterstützen. Die Zusammenarbeit soll das Portfolio von ELC im Bereich fortschrittlicher Hautpflegelösungen stärken, die Produktwirksamkeit verbessern und Verbraucher ansprechen, die nach langanhaltenden, wissenschaftlich fundierten Anti-Aging-Wirkungen suchen.

- Im Februar 2025 führte NIVEA MEN die Hautpflegelinie Age Defense ein, die häufige Zeichen der Hautalterung wie Fältchen, Trockenheit, raue Haut, Mattheit und Festigkeitsverlust bekämpft. Die Produktlinie enthält wichtige Inhaltsstoffe wie Thiamidol und Hyaluronsäure, um sichtbare Ergebnisse zu erzielen und gleichzeitig eine einfache Pflegeroutine zu gewährleisten. Die Produkteinführung, die fortschrittliche Seren, Augencremes und eine tägliche Feuchtigkeitscreme mit LSF 30 umfasst, dürfte den Marktanteil der Marke ausbauen und männliche Verbraucher ansprechen, die umfassende und dennoch praktische Anti-Aging-Lösungen suchen.

- Im Januar 2025 kündigte Croda International die Einführung von LongevityActive an, einem bioaktiven Wirkstoff zur Bekämpfung von Zellalterung und oxidativem Stress. Der Wirkstoff fördert die Hautreparatur und stärkt die natürlichen antioxidativen Abwehrkräfte und unterstützt die Formulierung fortschrittlicher Seren und Feuchtigkeitscremes. Diese Markteinführung soll die Produktdifferenzierung und -akzeptanz bei Premium-Hautpflegemarken mit Fokus auf wirksamen Anti-Aging-Lösungen vorantreiben.

- Im September 2023 erweiterte BASF ihre Produktionspräsenz im asiatisch-pazifischen Raum um Uvinul A Plus, einen der wenigen verfügbaren photostabilen UVA-Filter, der vor schädlichen UVA-Strahlen, freien Radikalen und Hautschäden schützt. Die öllösliche Granulatform des Produkts bietet Formulierungsflexibilität, hohe Wirksamkeit bei niedrigen Konzentrationen und ist frei von Konservierungsstoffen. Dies ermöglicht langanhaltenden Sonnenschutz und Anti-Aging-Produkte. Diese Expansion soll die Marktposition von BASF im schnell wachsenden Hautpflegesektor im asiatisch-pazifischen Raum stärken.

- Im März 2023 erweiterte DSM sein PARSOL-Portfolio mit der Einführung von PARSOL® DHHB, einem vielseitigen UVA-Filter für multifunktionale Hautpflegeprodukte. Seine hervorragende Löslichkeit und breite Formulierungskompatibilität ermöglichen die Herstellung von Sonnenschutzmitteln, Gesichtspflegeprodukten und dekorativer Kosmetik mit ausreichendem UVA-Schutz und hoher Öko-Klasse. Die Innovation bietet Formulierern die Flexibilität, die wachsende Verbrauchernachfrage nach nachhaltigen, multifunktionalen und leistungsstarken Anti-Aging-Hautpflegeprodukten zu erfüllen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.