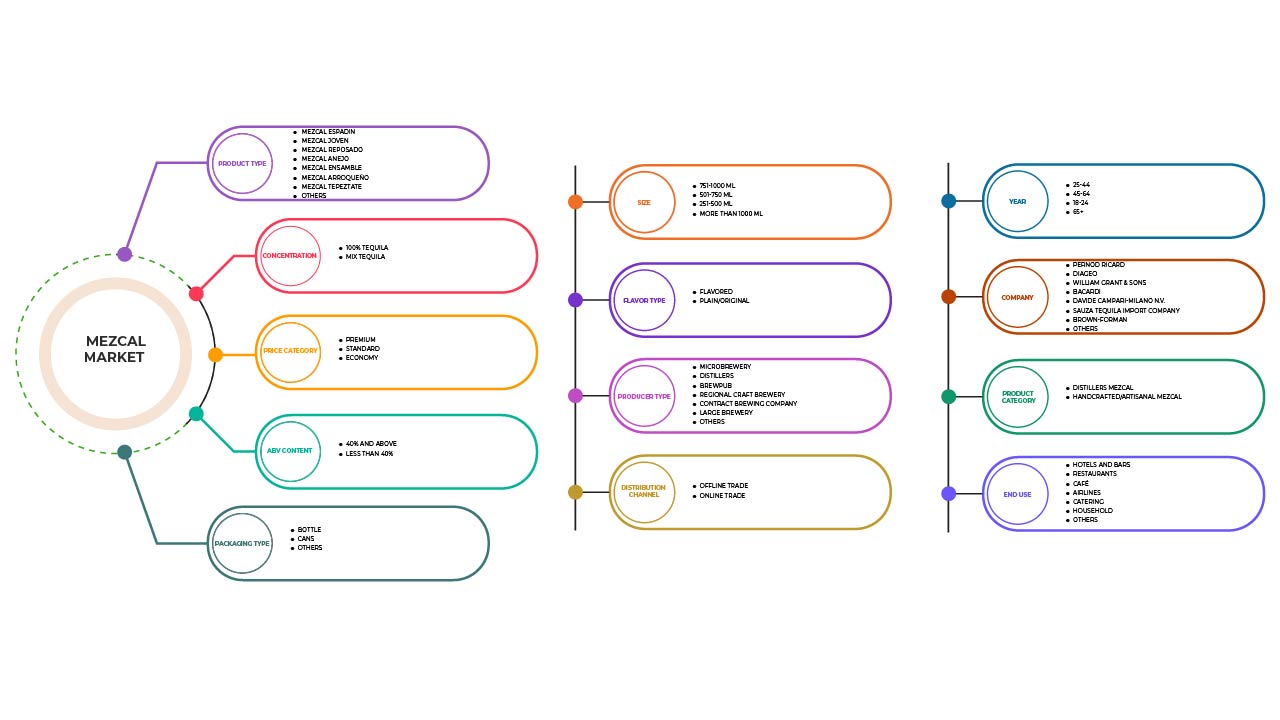

Europe Mezcal Market, By Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, And Others), Concentrate (100% Tequila And Mix Tequila), Price Category (Premium, Standard And Economy), ABV Content (40% And Above And Less Than 40%), Year (18-24 Years, 25-44 Years, 45-64 Years, 65+ Years), Packaging Type (Bottle, Cans, And Others), Size (251-500 Ml, 501-750 Ml, 751-1000 Ml, And More Than 100 Ml), Flavour Type (Plain/Original And Flavored), Producer Type (Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, And Others), Product Category (Distillers Mezcan And Handicrafted Mezcan/Artisanal Mezcan), End User (Restaurants, Hotels And Bars, Café, Catering, Airlines, Household, And Others), Distribution Channel (Offline Trade And Online Trade) – Industry Trends and Forecast to 2029.

Europe Mezcal Market Analysis and Size

The different agave species used, which have a wide variety of terpene compounds, the ability to use agave leaves in mezcal fermentation, variations in the ripening stage of agave, cooking of agave that can be done in ground holes with burning wood and heated stones that produce furans and smoky volatiles and are retained in the agave, and some herbs or other natural materials (such as worms) can all contribute to the flavor differences between mezcal.

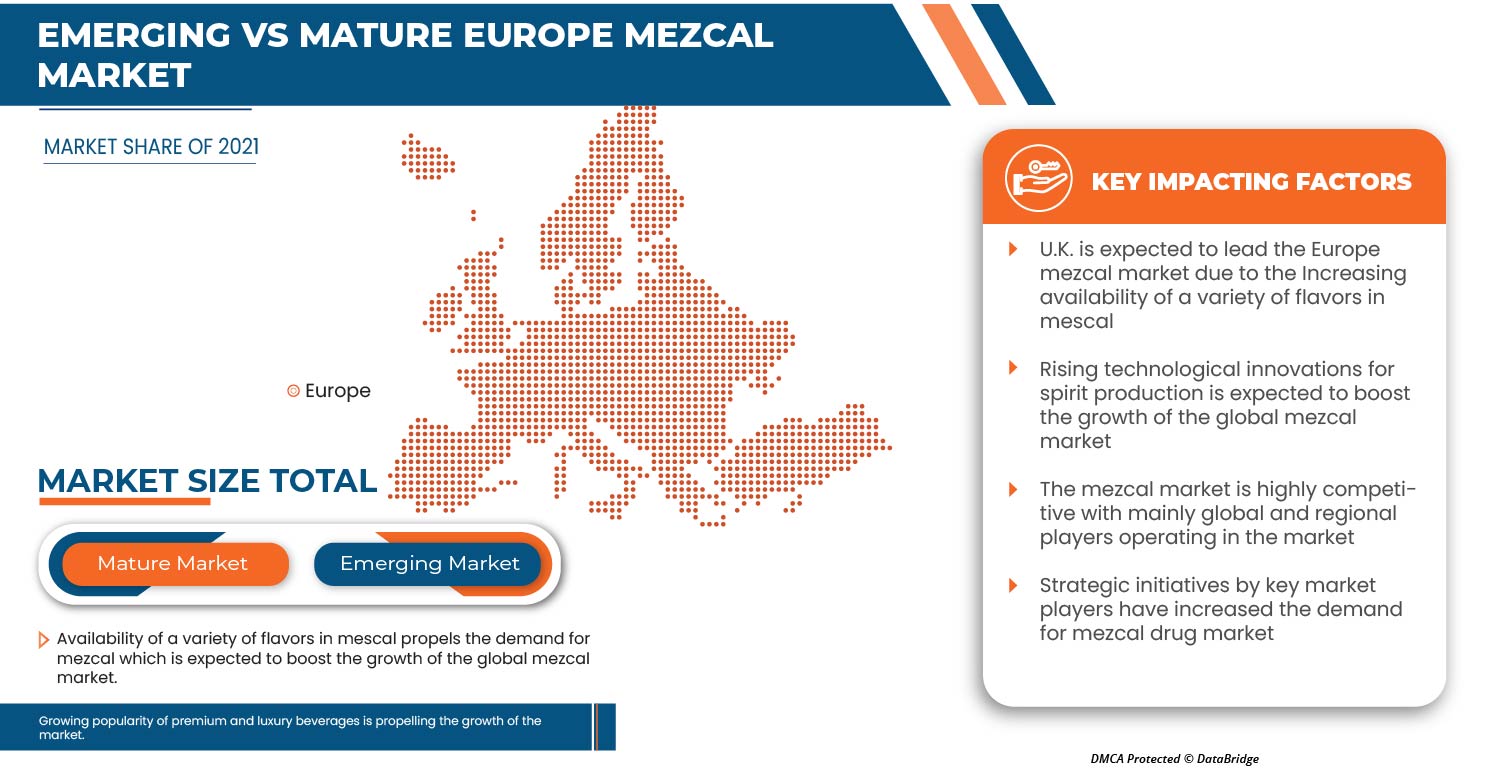

The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market in the forecast period. However, the heavy taxation and duties and stringent rules and regulations are expected to hamper the mezcal market growth in the forecast period.

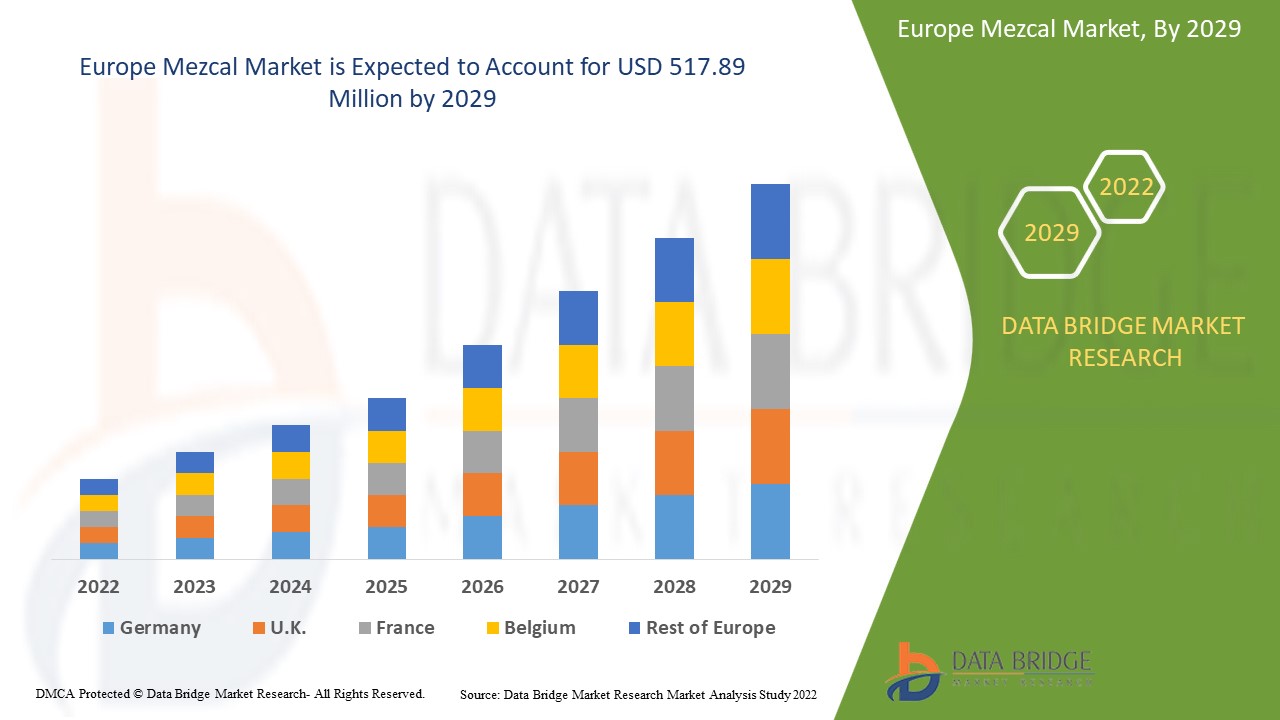

Data Bridge Market Research analyses that the mezcal market is expected to reach a value of USD 517.89 million by 2029, at a CAGR of 23.7% during the forecast period. The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market. The mezcal market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Liters |

|

Segments Covered |

By Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, And Others), Concentrate (100% Tequila And Mix Tequila), Price Category (Premium, Standard And Economy), ABV Content (40% And Above And Less Than 40%), Year (18-24 Years, 25-44 Years, 45-64 Years, 65+ Years), Packaging Type (Bottle, Cans, And Others), Size (251-500 Ml, 501-750 Ml, 751-1000 Ml, And More Than 100 Ml), Flavour Type (Plain/Original And Flavored), Producer Type (Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, And Others), Product Category (Distillers Mezcan And Handicrafted Mezcan/Artisanal Mezcan), End User (Restaurants, Hotels And Bars, Café, Catering, Airlines, Household, And Others), Distribution Channel (Offline Trade And Online Trade) |

|

Countries Covered |

U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe |

|

Market Players Covered |

The major companies which are dealing in the market are Davide Campari-Milano N.V., BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD among others. |

Market Definition

Mezcal is the name given to traditional distilled alcoholic beverages made in various rural areas of Mexico, from certain northern states up to south states, which is nahuatl mexcalli, "baked agave." These alcoholic beverages are made from the cooked stems of species of the genus Agave, also known as "maguey," which have fermented sugars. It is a traditional Mexican distilled beverage produced from the fermented juices of the cooked agave plant core. It is a type of distilled alcoholic beverage made from the cooked and fermented hearts, or piñas, of agave plants.

Mezcal Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

- AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

The quality and authenticity of mezcal are highly crucial because of the beverage's unique alcoholic flavor, which results from the volatile and non-volatile compounds, the direct precursors of which come from the raw agave itself. These include fatty acids, ranging from capric to lignoceric, free fatty acids, β-sitosterol, and groups of mono-, di-, and triacylglycerols, as well as fructans, the principal carbohydrate of the Agave. Due to higher temperatures and a lower pH in the agave cooking process, fructans could form Maillard compounds, such as furans, pyrans, and ketones.

Darüber hinaus ist das verwendete Destillationssystem der wichtige Parameter, der die Qualität von Agavengetränken definiert. Die Zusammensetzung des Aromas von Mezcal ist äußerst komplex. Ähnlichkeiten und Unterschiede zwischen Mezcalproben können neben der Herkunft und der Produktionssaison auch auf die Bedingungen und die verwendeten Rohstoffe zurückgeführt werden.

Aufgrund der Verfügbarkeit verschiedener Geschmacksrichtungen von Mezcal bevorzugen Verbraucher ihn gegenüber anderen handgefertigten Spirituosen. Darüber hinaus wird erwartet, dass das wachsende Interesse der Verbraucher an ethisch einwandfreien Produkten und die Tendenz, Getränke wie Craft Beer, kaltgepresste Säfte und Smoothies mit natürlichen Zutaten als Premium zu bewerben, das Marktwachstum im Prognosezeitraum vorantreiben wird.

- AKTUELLE TECHNOLOGISCHE INNOVATIONEN FÜR DIE SPIRITUOSENPRODUKTION

Die Agavenpflanze wird extrahiert, was zur Spirituosenherstellung verwendet wird und das flüchtige Profil von Mezcal anreichert. Der traditionelle Extraktionsprozess führt oft zu einem höheren Lösungsmittelverbrauch, längeren Extraktionszeiten, geringeren Erträgen und einer schlechteren Extraktionsqualität. Die Destillation von fermentiertem Maguey ist notwendig, um mehrere destillierte alkoholische Getränke wie Bacanora, Tequila und Mezcal herzustellen. So haben technologische Fortschritte eine Chance für eine nachhaltige Extrakt- und Spirituosenproduktion geschaffen. Die Hersteller sind an Produkt- und Technologieinnovationen beteiligt, um die Extraktions- und Herstellungskosten zu senken. Unternehmen können die Produktrückverfolgbarkeit verbessern, indem sie innovative Technologien einsetzen, die die Effektivität und Effizienz von Lieferketten erheblich steigern können, insbesondere in Branchen wie Lebensmittel und Getränke, Pharmazie und Gesundheitswesen.

Der Fermentationsprozess erzeugt Ethanol, höhere Alkohole, Ester, organische Säuren und andere. Einige dieser flüchtigen Verbindungen sind aufgrund ihrer Konzentration oder aromatischen Eigenschaften wichtiger als andere; einige könnten spezifisch für die Agavenart sein. Daher wird erwartet, dass die zunehmend fortschrittliche Produktionstechnologie den europäischen Mezcal-Markt ankurbeln wird.

- Positive Aussichten für fortschrittliche und intelligente Verpackungslösungen

Die Weinverpackungsindustrie setzt auf intelligente und nachhaltige Lösungen, um die Produktverpackung verbraucherorientierter und umweltfreundlicher zu gestalten. Durch Premiumisierung wird eine Marke oder ein Produkt für Verbraucher attraktiver, indem die überlegene Qualität und Exklusivität in der Kategorie der Getränke auf Agavenbasis hervorgehoben wird. Dadurch wird eine Marke attraktiver und damit teurer. Dies kann durch neue Verpackungen, handwerkliche Produktion, hochwertigere Zutaten, neue Geschmacksrichtungen und soziale/ökologische Botschaften erreicht werden.

Darüber hinaus bieten digital bedruckte Verpackungen erhebliches Einsparpotenzial gegenüber anderen Druckverfahren und geringe Einrichtungskosten. Hersteller können auf Großaufträge mit hohen Auflagen und Lagerhaltung verzichten. Bekannte Markendesignfirmen bevorzugen Glasflaschen für Mezcal-Verpackungen. Die Vorteile des Digitaldrucks sind für die heutige Verpackungsbranche unverzichtbar. Der Digitaldruck ist das ideale Verfahren für kleine bis mittlere Auflagen und ermöglicht die Erstellung individueller Drucke für Verpackungen und Displays. Darüber hinaus ist der Großteil des online erhältlichen Mezcals in Glasflaschen verpackt.

Daher ist aufgrund der Markteinführung und Entwicklung neuer Produkte mit einer steigenden Nachfrage nach modernen und intelligenten Verpackungen zu rechnen, die dem europäischen Mezcal-Markt Auftrieb geben wird.

Beschränkungen

- HOHE STEUERN UND ZÖLLE

Die weltweit gestiegene Nachfrage nach alkoholischen Getränken hat zu einem Anstieg der Importe auf diesem Wachstumsmarkt geführt. Hohe Steuern und Zölle dürften diesen Markt jedoch bremsen, da sie das Marktwachstum einschränken und die Produktkosten verteuern. Dies dürfte in der Folge die Nachfrage nach den Produkten einschränken.

Hohe Steuern und Verbrauchssteuern erhöhen also automatisch die Preise der Produkte und machen den Alkohol teurer, wodurch die Nachfrage nach dem Produkt sinkt. Dies führt sogar zu Kundenverlusten, was den Gesamtmarkt direkt behindert und das Marktwachstum voraussichtlich einschränkt.

Chancen/ Herausforderungen

- WACHSENDE POPULARITÄT VON PREMIUM- UND LUXUSGETRÄNKEN

Die Möglichkeit, den Cholesterinspiegel im Auge zu behalten und den Blutzuckerspiegel zu überwachen. Das Wachstum des Marktes wird zusätzlich durch den Anstieg des verfügbaren Einkommens und der Kaufkraft der Verbraucher vorangetrieben, die beide die Nachfrage der Verbraucher nach einer Vielzahl von Waren steigern. Die Nachfrage nach Mezcal steigt aufgrund des Premiumisierungstrends, der den Konsum hochwertiger alkoholischer und alkoholfreier Getränke fördert. Mehr als nur Alkoholkonsum ist Teil des Premiumisierungstrends. Unter den Millennial-Kunden gibt es eine wachsende Nachfrage nach Premium-Mezcal-Produkten. Aufgrund des steigenden verfügbaren Einkommens in Industrienationen wie Nordamerika und Westeuropa sind sie bereit, viel Geld für High-End- und Super-Premium-Waren auszugeben. Aufgrund des steigenden verfügbaren Einkommens der Verbraucher pro Person und der anhaltenden Expansion der Wirtschaft wuchs das Marktvolumen für hochwertige Premium-Spirituosen von 2019 bis 2021 jährlich um 5-6 %.

Es wird erwartet, dass der Markt im Prognosezeitraum expandiert, da die Nachfrage nach Mezcal in den letzten Jahren dramatisch gestiegen ist. Die steigende Nachfrage nach Premium-Mezcal ist eine Chance für das Wachstum des europäischen Mezcal-Marktes.

- GESUNDE, ALKOHOLFREIE GETRÄNKE WERDEN BELIEBT

Eine der sich am schnellsten entwickelnden Branchen ist die Getränkeindustrie, in der verschiedene Getränke wie Mezcal hergestellt werden. Das wachsende Bewusstsein der Verbraucher für die Verwendung natürlicher und organischer Zutaten in Lebensmitteln und Getränken wird voraussichtlich in Zukunft eine Herausforderung für das Wachstumstempo der Mezcal-Industrie darstellen.

Viele fermentierte Lebensmittel und Getränke enthalten Ethylcarbamat (EC), ein bekanntes genotoxisches Karzinogen. Ethylcarbamat ist nicht nur krebserregend, sondern auch ein bekannter lebertoxischer Stoff beim Menschen. Darüber hinaus wurde der Konsum kohlensäurehaltiger Getränke mit Nierensteinen in Verbindung gebracht, alles Risikofaktoren für chronische Nierenerkrankungen. Die zunehmende Zahl chronischer Leber- und Nierenerkrankungen macht die Verbraucher auf eine gesunde Trinkweise aufmerksam. Aufgrund solcher Gesundheitsprobleme bevorzugen die Menschen heute mehr alkoholfreie Getränke.

Der Anstieg chronischer Erkrankungen sensibilisiert die Verbraucher für den Konsum alkoholfreier Getränke, was sich als Herausforderung für das Marktwachstum darstellen könnte.

Auswirkungen von COVID-19 auf den Mezcal-Markt

Der COVID-19-Ausbruch hatte erhebliche Auswirkungen auf die Mezcal-Industrie. Die Aussperrung hat die Produktion in Europa beeinträchtigt und wird die Handelsunsicherheit und den aktuellen Einbruch in der Produktion noch verschlimmern. Im Vergleich dazu hatte die Pandemie wenig Auswirkungen auf den Betrieb des Lebensmittel- und Getränkesektors, aber die europäische Lieferkette wurde stark gestört, was weiteres Wachstum verhinderte. Der Wandel der Verbraucher hat sich negativ auf das Kaufverhalten der Verbraucher ausgewirkt. Der Sektor hatte sowohl kurzfristige als auch langfristige Auswirkungen aufgrund der Entstehung vieler Hindernisse, darunter die Einstellung zahlreicher Betriebe, das gebremste Unternehmenswachstum und andere Probleme. Diese Probleme hatten erhebliche Auswirkungen auf Angebot und Nachfrage. Der Lebensmittel- und Getränkesektor war einer der Sektoren, die von Produktions- und Rohstoffversorgungsunterbrechungen betroffen waren.

Die weltweiten Lieferketten wurden durch die Schließung vieler Industrien behindert, was zu Unterbrechungen der Industrieaktivitäten, Lieferpläne und des Verkaufs verschiedener Produkte geführt hat. Mehrere Unternehmen haben bereits gewarnt, dass Verzögerungen bei der Produktlieferung den zukünftigen Verkauf ihrer Produkte beeinträchtigen könnten. Die Reiseunterbrechung wirkt sich auf den Industriesektor aus, da sie die Unternehmensplanung und die Teamarbeit beeinträchtigt. Sowohl Offline- als auch Online-Händler bieten Mezcal an. Der Offline-Sektor erlitt aufgrund von Schließungen und Warnungen, nicht nach draußen zu gehen, um die Auswirkungen von COVID-19 abzumildern, erhebliche Verluste, die Online-Branche verzeichnete jedoch ein verstärktes Wachstum. Darüber hinaus verbessert sich die Lage, da es weltweit weniger COVID-Fälle gibt und der Markt schnell wächst und dies während des Prognosezeitraums auch weiterhin tun wird. Daher wird prognostiziert, dass der Markt nach COVID-19 erheblich wachsen wird.

Jüngste Entwicklungen

- Im Januar 2022 erwarb Diageo PLC Mezcal Union durch die Übernahme von Casa UM. Mezcal Union ist eine der führenden Marken der Mezcal-Produktion. Das Unternehmen nutzte diese Übernahme, um sein Geschäft mit Mezcal-Getränken auszubauen

- Im April 2021 sammelte Madre Mezcal, eine der am schnellsten wachsenden Mezcal-Marken in Amerika, 3 Millionen USD ein, um die erfolgreiche Wachstumsstrategie der Marke auf neue Produkte und Märkte anzuwenden. Die Finanzierungsrunde der Serie A wurde von Room 9 geleitet, einem in New York ansässigen Risikokapitalstudio, das auf Investitionen im Verbrauchersektor spezialisiert ist.

Umfang des europäischen Mezcal-Marktes

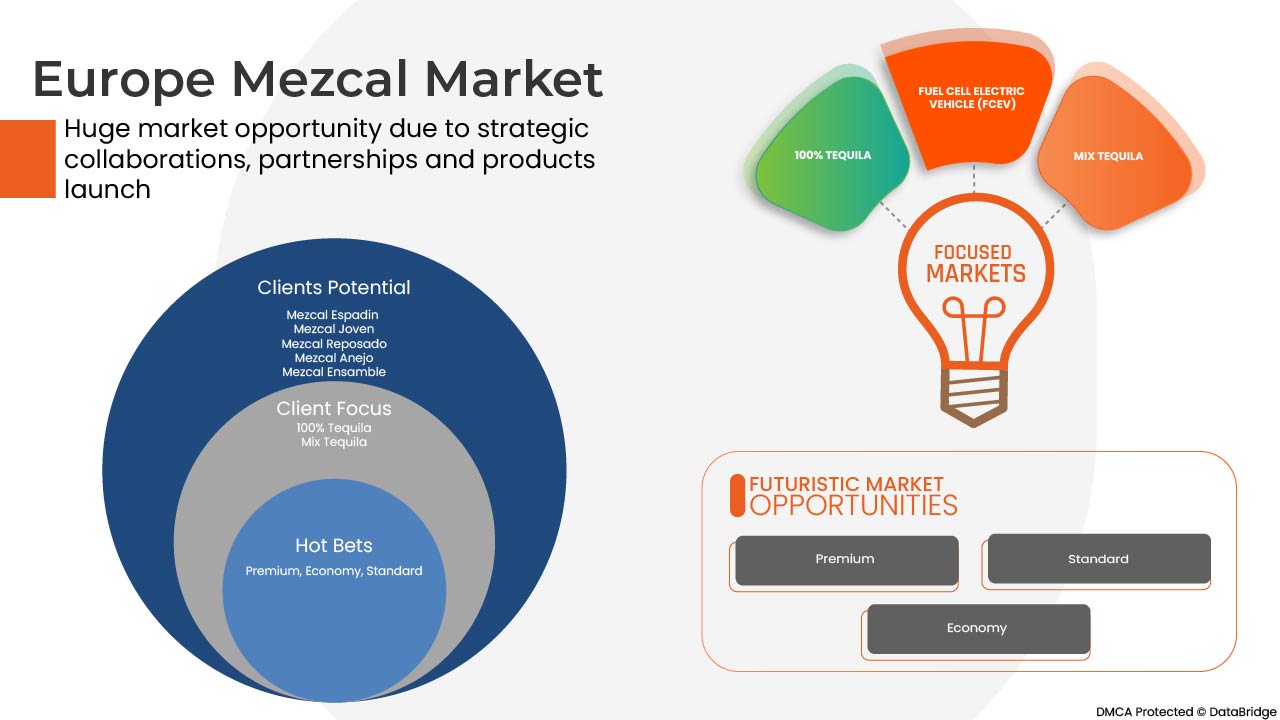

Der europäische Mezcal-Markt ist segmentiert nach Produkttyp, Konzentrat, Preiskategorie, Alkoholgehalt, Jahr, Verpackungsart, Größe, Geschmacksrichtung, Herstellertyp, Produktkategorie, Endverbraucher und Vertriebskanal. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse wichtiger Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkttyp

- Mezcal Espadin

- Mezcal Joven

- Mezcal Reposado

- Mezcal Añejo

- Mezcal Ensemble

- Mezcal Arroqueño

- Mezcal Tepeztate

- Sonstiges

Auf der Grundlage des Produkttyps ist der europäische Mezcal-Markt in Mezcal Joven, Mezcal Reposado, Mezcal Añejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble und andere unterteilt.

KONZENTRIEREN

- 100% Tequila

- Tequila mischen

Auf der Grundlage des Konzentrats wurde der europäische Mezcal-Markt in 100 % Tequila und Tequila-Mischungen segmentiert.

PREISKATEGORIE

- Prämie

- Standard

- Wirtschaft

Auf der Grundlage der Preiskategorien wurde der europäische Mezcal-Markt in Premium, Standard und Economy segmentiert.

ABV-INHALT

- 40 % und mehr

- Weniger als 40 %

Auf der Grundlage des ABV-Gehalts wurde der europäische Mezcal-Markt in unter 40 % sowie über und weniger als 40 % segmentiert.

JAHR

- 18-24

- 25-44

- 45-64

- 65+

Auf der Grundlage des Jahres wurde der europäische Mezcal-Markt in 18-24 Jahre, 25-44 Jahre, 45-64 Jahre und 65+ Jahre unterteilt

VERPACKUNGSART

- Flasche

- Dosen

- Sonstiges

Auf der Grundlage der Verpackungsart wurde der europäische Mezcal-Markt in Flaschen, Dosen und Sonstiges segmentiert.

GRÖSSE

- 251-500 ml

- 501-750 ml

- 751-1000 ml

- mehr als 100 ml

Auf der Grundlage der Größe wurde der europäische Mezcal-Markt in 251-500 ml, 501-750 ml, 751-1000 ml, mehr als 100 ml unterteilt

GESCHMACKSART

- Normal/Original

- Aromatisiert

Auf Grundlage der Geschmacksart wurde der europäische Mezcal-Markt in pur/original und aromatisiert segmentiert.

PRODUZENTENTYP

- Mikrobrauerei

- Destillerien

- Brauereigasthof

- Vertragsbrauerei

- Regionale Handwerksbrauerei

- Große Brauerei

- Sonstiges

Auf der Grundlage des Herstellertyps wurde der europäische Mezcal-Markt in Mikrobrauereien, Destillerien, Gasthausbrauereien, Vertragsbrauereien, regionale Handwerksbrauereien, Großbrauereien und andere unterteilt.

PRODUKTKATEGORIE

- Destillerien Mezcan

- Handgefertigter Mezcan/ handwerklicher Mezcan

Auf der Grundlage der Produktkategorie wurde der europäische Mezcal-Markt in Destillier-Mezcan und handgefertigten Mezcan unterteilt.

ENDVERWENDUNG

- Restaurants

- Hotels & Bars

- Cafe

- Gastronomie

- Fluggesellschaften

- Haushalt

- Sonstiges

Auf der Grundlage des Endverbrauchers wurde der europäische Mezcal-Markt in Restaurants, Hotels und Bars, Cafés, Catering, Fluggesellschaften, Haushalt und andere unterteilt.

VERTRIEBSKANAL

- Offline-Handel

- Onlinehandel

On the basis of distribution channel, the Europe mezcal market has been segmented into offline trade and online trade.

Mezcal Market Regional Analysis/Insights

The mezcal market is analyzed, and market size insights and trends are provided by country, product type, concentrate, price category, abv content, year, packaging type, size, flavor type, producer type, product category, end user, and distribution channel, as referenced above.

The countries covered in the Europe mezcal market report are the U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, and Rest of Europe in Europe.

U.K. is dominating the Europe mezcal market with a CAGR of around 26.9%. The broad base of the beverage industry in the country is set to drive the market growth.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mezcal Market Share Analysis

The mezcal market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the mezcal market.

Some of the major players operating in the mezcal market are Davide Campari-Milano N.V., BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, Rey Campero, Tequila & Mezcal Private Brands S.A. de C.V., Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra , Pensador Mezcal, Ilegal Mezcal among others.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE MEZCAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGY OPTED BY MICROBREWERIES

4.1.1 CREATING CUSTOM PACKAGING

4.1.2 PROVIDING BUSINESS PERSPECTIVES

4.1.3 SOCIAL MEDIA USE

4.1.4 DESIGNING CUSTOMER LOYALTY INITIATIVES

4.1.5 GETTING INVOLVED WITH THE COMMUNITY

4.2 KEY TRENDS SCENARIO

4.2.1 PREMIUMISATION

4.2.2 VALUE FOR MONEY

4.2.3 HEALTH AND WELL BEING

4.2.4 CONSUMER AWARENESS

4.2.5 PRODUCT INNOVATION

4.2.6 AVAILABILITY OF LOCAL PRODUCTS

4.2.7 OTHERS

4.3 FACTORS INFLUENCING PURCHASE DECISION

4.4 KEY DEMOGRAPHIC CONSUMER BASE INCLUDE:

4.5 PRICE ANALYSIS

4.6 PROMOTIONAL ACTIVITIES ADOPTED BY KEY MARKET PLAYERS

4.7 PRIVATE LABEL VS BRAND LABEL

4.8 TAXATION AND DUTY LEVIES

5 SUPPLY CHAIN OF EUROPE MEZCAL MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

5.5 LOGISTIC COST SCENARIO

5.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

6 EUROPE MEZCAL MARKET: SHOPPING BEHAVIOUR

6.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

6.2 RESEARCH

6.3 IMPULSIVE

6.4 ADVERTISEMENT:

6.4.1 TELEVISION ADVERTISEMENT

6.4.2 ONLINE ADVERTISEMENT

6.4.3 IN-STORE ADVERTISEMENT

7 EUROPE MEZCAL MARKET: REGULATIONS

7.1 REGULATION IN U.S

7.2 REGULATION IN EUROPE

7.3 REGULATION IN AUSTRALIA

8 EUROPE MEZCAL MARKET, NEW PRODUCT LAUNCH STRATEGY

8.1 OVERVIEW

8.2 NUMBER OF PRODUCT LAUNCHES

8.2.1 LINE EXTENSION

8.2.2 NEW PACKAGING

8.2.3 RE-LAUNCHED

8.2.4 NEW FORMULATION

8.3 DIFFERENTIAL PRODUCT OFFERING

8.4 MEETING CONSUMER REQUIREMENT

8.5 PACKAGE DESIGNING

8.6 PRICING ANALYSIS

8.7 PRODUCT POSITIONING

8.8 CONCLUSION

9 EXPORT AND IMPORT TRADE ANALYSIS

9.1 EXPORT ANALYSIS OF SPIRIT DRINKS

9.2 IMPORT ANALYSIS OF SPIRIT DRINKS

10 EUROPE MEZCAL MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

10.1 OVERVIEW

10.2 SOCIAL FACTORS

10.3 CULTURAL FACTORS

10.4 PSYCHOLOGICAL FACTORS

10.5 PERSONAL FACTORS

10.6 ECONOMIC FACTORS

10.7 PRODUCT TRAITS

10.8 MARKET ATTRIBUTES

10.9 EUROPE CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

10.1 CONCLUSION

11 MARKET OVERVIEW

11.1 DRIVERS

11.1.1 AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

11.1.2 RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

11.1.3 POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

11.1.4 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS EUROPELY

11.2 RESTRAINTS

11.2.1 HEAVY TAXATION AND DUTIES

11.2.2 STRINGENT RULES AND REGULATIONS

11.3 OPPORTUNITIES

11.3.1 GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

11.3.2 INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

11.3.3 INCREASED AVAILABILITY OF MEZCAL ON E-COMMERCE PLATFORMS

11.4 CHALLENGES

11.4.1 RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

11.4.2 HIGH COST OF MEZCAL

12 EUROPE MEZCAL MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 MEZCAL ESPADIN

12.2.1 BY CONCENTRATION

12.2.1.1 100% TEQUILA

12.2.1.2 MIX TEQUILA

12.2.2 BY ABV CONTENT

12.2.2.1 40% AND ABOVE

12.2.2.2 LESS THAN 40%

12.3 MEZCAL JOVEN

12.3.1 BY CONCENTRATION

12.3.1.1 100% TEQUILA

12.3.1.2 MIX TEQUILA

12.3.2 BY ABV CONTENT

12.3.2.1 40% AND ABOVE

12.3.2.2 LESS THAN 40%

12.3.3 BY DISTILLATION

12.3.3.1 COPPER

12.3.3.2 STEEL

12.4 MEZCAL REPOSADO

12.4.1 BY CONCENTRATION

12.4.1.1 100% TEQUILA

12.4.1.2 MIX TEQUILA

12.4.2 BY ABV CONTENT

12.4.2.1 40% AND ABOVE

12.4.2.2 LESS THAN 40%

12.4.3 BY DISTILLATION

12.4.3.1 COPPER

12.4.3.2 STEEL

12.5 MEZCAL ANEJO

12.5.1 BY CONCENTRATION

12.5.1.1 100% TEQUILA

12.5.1.2 MIX TEQUILA

12.5.2 BY ABV CONTENT

12.5.2.1 40% AND ABOVE

12.5.2.2 LESS THAN 40%

12.5.3 BY DISTILLATION

12.5.3.1 COPPER

12.5.3.2 STEEL

12.6 MEZCAL ENSAMBLE

12.6.1 BY CONCENTRATION

12.6.1.1 100% TEQUILA

12.6.1.2 MIX TEQUILA

12.6.2 BY ABV CONTENT

12.6.2.1 40% AND ABOVE

12.6.2.2 LESS THAN 40%

12.7 MEZCAL ARROQUEÑO

12.7.1 BY CONCENTRATION

12.7.1.1 100% TEQUILA

12.7.1.2 MIX TEQUILA

12.7.2 BY ABV CONTENT

12.7.2.1 40% AND ABOVE

12.7.2.2 LESS THAN 40%

12.8 MEZCAL TEPEZTATE

12.8.1 BY CONCENTRATION

12.8.1.1 100% TEQUILA

12.8.1.2 MIX TEQUILA

12.8.2 BY ABV CONTENT

12.8.2.1 40% AND ABOVE

12.8.2.2 LESS THAN 40%

12.9 OTHERS

12.9.1 BY CONCENTRATION

12.9.1.1 100% TEQUILA

12.9.1.2 MIX TEQUILA

12.9.2 BY ABV CONTENT

12.9.2.1 40% AND ABOVE

12.9.2.2 LESS THAN 40%

13 EUROPE MEZCAL MARKET, BY CONCENTRATION

13.1 OVERVIEW

13.2 100% TEQUILA

13.3 MIX TEQUILA

14 EUROPE MEZCAL MARKET, BY PRICE CATEGORY

14.1 OVERVIEW

14.2 PREMIUM

14.3 STANDARD

14.4 ECONOMY

15 EUROPE MEZCAL MARKET, BY ABV CONTENT

15.1 OVERVIEW

15.2 40% AND ABOVE

15.3 LESS THAN 40%

16 EUROPE MEZCAL MARKET, BY YEAR

16.1 OVERVIEW

16.2 25-44

16.3 45-64

16.4 18-24

16.5 65+

17 EUROPE MEZCAL MARKET, BY PACKAGING TYPE

17.1 OVERVIEW

17.2 BOTTLE

17.3 CANS

17.4 OTHERS

18 EUROPE MEZCAL MARKET, BY SIZE

18.1 OVERVIEW

18.2 751-1000 ML

18.3 501-750 ML

18.4 251-500 ML

18.5 MORE THAN 1000 ML

19 EUROPE MEZCAL MARKET, BY FLAVOR TYPE

19.1 OVERVIEW

19.2 FLAVORED

19.2.1 CITRUS FRUITS

19.2.1.1 ORANGE

19.2.1.2 LEMON

19.2.1.3 GRAPE FRUIT

19.2.1.4 OTHERS

19.2.2 FLORALS

19.2.3 SMOKED

19.2.4 GREEN PEPPER

19.2.5 OTHERS

19.3 PLAIN/ORIGINAL

20 EUROPE MEZCAL MARKET, BY PRODUCER TYPE

20.1 OVERVIEW

20.2 MICROBREWERY

20.3 DISTILLERS

20.4 BREWPUB

20.5 REGIONAL CRAFT BREWERY

20.6 CONTRACT BREWING COMPANY

20.7 LARGE BREWERY

20.8 OTHERS

21 EUROPE MEZCAL MARKET, BY PRODUCT CATEGORY

21.1 OVERVIEW

21.2 DISTILLERS MEZCAL

21.3 HANDCRAFTED/ARTISANAL MEZCAL

22 EUROPE MEZCAL MARKET, BY END USE

22.1 OVERVIEW

22.2 HOTELS AND BARS

22.3 RESTAURANTS

22.3.1 RESTAURANTS, BY TYPE

22.3.1.1 CHAIN RESTAURANTS

22.3.1.2 INDEPENDENT RESTAURANTS

22.3.2 RESTAURANTS, BY SERVICE CATEGORY

22.3.2.1 FULL SERVICE RESTAURANTS

22.3.2.2 QUICK SERVICE RESTAURANTS

22.4 CAFE

22.4.1 AIRLINES

22.4.2 CATERING

22.4.3 HOUSEHOLD

22.4.4 OTHERS

23 EUROPE MEZCAL MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 OFFLINE TRADE

23.2.1 NON-STORE BASED RETAILERS

23.2.1.1 VENDING MACHINE

23.2.1.2 OTHERS

23.2.2 STORE BASED RETAILER

23.2.2.1 HYPERMARKET/SUPERMARKET

23.2.2.2 CONVENIENCE STORES

23.2.2.3 SPECIALTY STORES

23.2.2.4 GROCERY STORES

23.2.2.5 OTHERS

23.3 ONLINE TRADE

23.4 COMPANY OWNED WEBSITE

23.5 E-COMMERCE

24 EUROPE MEZCAL MARKET, BY REGION

24.1 EUROPE

24.1.1 U.K.

24.1.2 FRANCE

24.1.3 GERMANY

24.1.4 SPAIN

24.1.5 ITALY

24.1.6 RUSSIA

24.1.7 NETHERLANDS

24.1.8 SWITZERLAND

24.1.9 TURKEY

24.1.10 BELGIUM

24.1.11 REST OF EUROPE

25 EUROPE MEZCAL MARKET: COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: EUROPE

26 SWOT ANALYSIS

27 COMPANY PROFILE

27.1 PERNOD RICARD

27.1.1 COMPANY SNAPSHOT

27.1.2 REVENUE ANALYSIS

27.1.3 COMPANY SHARE ANALYSIS

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENT

27.2 DIAGEO

27.2.1 COMPANY SNAPSHOT

27.2.2 REVENUE ANALYSIS

27.2.3 COMPANY SHARE ANALYSIS

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 WILLIAM GRANT & SONS

27.3.1 COMPANY SNAPSHOT

27.3.2 COMPANY SHARE ANALYSIS

27.3.3 PRODUCT PORTFOLIO

27.3.4 RECENT DEVELOPMENTS

27.4 BACARDI

27.4.1 COMPANY SNAPSHOT

27.4.2 COMPANY SHARE ANALYSIS

27.4.3 PRODUCT PORTFOLIO

27.4.4 RECENT DEVELOPMENT

27.5 DAVIDE CAMPARI-MILANO N.V.

27.5.1 COMPANY SNAPSHOT

27.5.2 REVENUE ANALYSIS

27.5.3 COMPANY SHARE ANALYSIS

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENT

27.6 BROWN-FORMAN

27.6.1 COMPANY SNAPSHOT

27.6.2 REVENUE ANALYSIS

27.6.3 PRODUCT PORTFOLIO

27.6.4 RECENT DEVELOPMENT

27.7 BOZAL MEZCAL

27.7.1 COMPANY SNAPSHOT

27.7.2 PRODUCT PORTFOLIO

27.7.3 RECENT DEVELOPMENT

27.8 CRAFT DISTILLERS

27.8.1 COMPANY SNAPSHOT

27.8.2 PRODUCT PORTFOLIO

27.8.3 RECENT DEVELOPMENTS

27.9 DOS HOMBRES LLC.

27.9.1 COMPANY SNAPSHOT

27.9.2 PRODUCT PORTFOLIO

27.9.3 RECENT DEVELOPMENTS

27.1 DEL MAGUEY SINGLE VILLAGE MEZCAL

27.10.1 COMPANY SNAPSHOT

27.10.2 PRODUCT PORTFOLIO

27.10.3 RECENT DEVELOPMENTS

27.11 DESTILERÍA TLACOLULA

27.11.1 COMPANY SNAPSHOT

27.11.2 PRODUCT PORTFOLIO

27.11.3 RECENT DEVELOPMENT

27.12 EL SILENCIO HOLDINGS, INC.

27.12.1 COMPANY SNAPSHOT

27.12.2 PRODUCT PORTFOLIO

27.12.3 RECENT DEVELOPMENTS

27.13 FAMILIA CAMARENA

27.13.1 COMPANY SNAPSHOT

27.13.2 PRODUCT PORTFOLIO

27.13.3 RECENT DEVELOPMENTS

27.14 ILEGAL MEZCAL

27.14.1 COMPANY SNAPSHOT

27.14.2 PRODUCT PORTFOLIO

27.14.3 RECENT DEVELOPMENTS

27.15 KING CAMPERO

27.15.1 COMPANY SNAPSHOT

27.15.2 PRODUCT PORTFOLIO

27.15.3 RECENT DEVELOPMENTS

27.16 MADRE MEZCAL

27.16.1 COMPANY SNAPSHOT

27.16.2 PRODUCT PORTFOLIO

27.16.3 RECENT DEVELOPMENTS

27.17 MEZCAL SOMBRA

27.17.1 COMPANY SNAPSHOT

27.17.2 PRODUCT PORTFOLIO

27.17.3 RECENT DEVELOPMENT

27.18 PENSADOR MEZCAL

27.18.1 COMPANY SNAPSHOT

27.18.2 PRODUCT PORTFOLIO

27.18.3 RECENT DEVELOPMENTS

27.19 SAUZA TEQUILA IMPORT COMPANY

27.19.1 COMPANY SNAPSHOT

27.19.2 PRODUCT PORTFOLIO

27.19.3 RECENT DEVELOPMENTS

27.2 TEQUILA & MEZCAL PRIVATE BRANDS S.A. DE C.V.

27.20.1 COMPANY SNAPSHOT

27.20.2 PRODUCT PORTFOLIO

27.20.3 RECENT DEVELOPMENTS

27.21 WAHAKA MEZCAL

27.21.1 COMPANY SNAPSHOT

27.21.2 PRODUCT PORTFOLIO

27.21.3 RECENT DEVELOPMENT

28 QUESTIONNAIRE

29 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 THE FOLLOWING ARE THE DIFFERENT PRICES OF DIFFERENT BRANDS.

TABLE 2 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029 (USD MILLION)

TABLE 3 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029, VOLUME (KILO LITERS)

TABLE 4 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 5 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 6 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 7 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 8 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 9 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 10 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 11 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 12 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 13 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 14 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 15 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 16 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 17 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 18 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 19 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 20 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 21 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 22 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 23 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 24 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 25 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 26 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 27 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 28 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 29 EUROPE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 31 EUROPE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE 100% TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE MIX TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PREMIUM IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE STANDARD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE ECONOMY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 39 EUROPE 40% AND ABOVE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE LESS THAN 40% IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 42 EUROPE 25-44 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE 45-64 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE 18-24 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE 65+ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE BOTTLES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE CANS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE 751-1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE 501-750 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE 251-500 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 EUROPE MORE THAN 1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 EUROPE MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 56 EUROPE FLAVORED IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 57 EUROPE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 58 EUROPE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 59 EUROPE PLAIN/ORIGINAL IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 60 EUROPE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE MICROBREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 EUROPE DISTILLERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 EUROPE BREWPUB IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 EUROPE REGIONAL CRAFT BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 EUROPE CONTRACT BREWING COMPANY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 EUROPE LARGE BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 68 EUROPE MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 69 EUROPE DISTILLERS MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 EUROPE HANDCRAFTED/ARTISANAL MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 EUROPE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE HOTELS AND BARS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 EUROPE RESTAURANTS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 EUROPE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 EUROPE CAFÉ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 EUROPE AIRLINES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 EUROPE CATERING IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 EUROPE HOUSEHOLD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 EUROPE OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 EUROPE MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 82 EUROPE OFFLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 83 EUROPE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 84 EUROPE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 85 EUROPE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 86 EUROPE ONLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 EUROPE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 88 EUROPE MEZCAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 89 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 EUROPE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 91 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 92 EUROPE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 93 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 94 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 95 EUROPE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 96 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 97 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 98 EUROPE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 99 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 100 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 101 EUROPE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 102 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 103 EUROPE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 104 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 105 EUROPE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 106 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 107 EUROPE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 108 EUROPE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 109 EUROPE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 110 EUROPE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 111 EUROPE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 112 EUROPE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 113 EUROPE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 114 EUROPE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 115 EUROPE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 116 EUROPE MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 117 EUROPE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 118 EUROPE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 EUROPE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 120 EUROPE MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 121 EUROPE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 122 EUROPE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 EUROPE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 124 EUROPE MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 EUROPE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 EUROPE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 EUROPE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 EUROPE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 U.K. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.K. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 131 U.K. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 132 U.K. MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 133 U.K. MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 134 U.K. MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 135 U.K. MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 136 U.K. MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 137 U.K. MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 138 U.K. MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 139 U.K. MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 140 U.K. MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 141 U.K. MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 142 U.K. MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 143 U.K. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 144 U.K. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 145 U.K. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 146 U.K. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 147 U.K. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 148 U.K. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 149 U.K. OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 150 U.K. OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 151 U.K. MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 152 U.K. MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 153 U.K. MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 154 U.K. MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 155 U.K. MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 156 U.K. MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 157 U.K. MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.K. FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 159 U.K. CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.K. MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 161 U.K. MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 162 U.K. MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 163 U.K. RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.K. RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 165 U.K. MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 U.K. OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 167 U.K. NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 U.K. STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 U.K. ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 FRANCE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 FRANCE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 172 FRANCE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 173 FRANCE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 174 FRANCE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 175 FRANCE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 176 FRANCE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 177 FRANCE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 178 FRANCE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 179 FRANCE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 180 FRANCE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 181 FRANCE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 182 FRANCE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 183 FRANCE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 184 FRANCE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 185 FRANCE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 186 FRANCE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 187 FRANCE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 188 FRANCE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 189 FRANCE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 190 FRANCE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 191 FRANCE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 192 FRANCE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 193 FRANCE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 194 FRANCE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 195 FRANCE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 196 FRANCE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 197 FRANCE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 198 FRANCE MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 199 FRANCE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 200 FRANCE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 FRANCE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 202 FRANCE MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 203 FRANCE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 204 FRANCE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 FRANCE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 206 FRANCE MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 FRANCE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 208 FRANCE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 FRANCE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 210 FRANCE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 211 GERMANY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 212 GERMANY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 213 GERMANY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 214 GERMANY MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 215 GERMANY MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 216 GERMANY MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 217 GERMANY MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 218 GERMANY MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 219 GERMANY MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 220 GERMANY MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 221 GERMANY MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 222 GERMANY MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 223 GERMANY MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 224 GERMANY MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 225 GERMANY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 226 GERMANY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 227 GERMANY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 228 GERMANY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 229 GERMANY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 230 GERMANY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 231 GERMANY OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 232 GERMANY OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 233 GERMANY MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 234 GERMANY MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 235 GERMANY MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 236 GERMANY MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 237 GERMANY MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 238 GERMANY MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 239 GERMANY MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 240 GERMANY FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 241 GERMANY CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 GERMANY MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 243 GERMANY MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 244 GERMANY MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 245 GERMANY RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 GERMANY RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 247 GERMANY MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 GERMANY OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 249 GERMANY NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 250 GERMANY STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 251 GERMANY ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 252 SPAIN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 253 SPAIN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 254 SPAIN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 255 SPAIN MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 256 SPAIN MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 257 SPAIN MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 258 SPAIN MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 259 SPAIN MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 260 SPAIN MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 261 SPAIN MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 262 SPAIN MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 263 SPAIN MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 264 SPAIN MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 265 SPAIN MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 266 SPAIN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 267 SPAIN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 268 SPAIN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 269 SPAIN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 270 SPAIN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 271 SPAIN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 272 SPAIN OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 273 SPAIN OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 274 SPAIN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 275 SPAIN MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 276 SPAIN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 277 SPAIN MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 278 SPAIN MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 279 SPAIN MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 280 SPAIN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 281 SPAIN FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 282 SPAIN CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 SPAIN MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 284 SPAIN MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 285 SPAIN MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 286 SPAIN RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 SPAIN RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 288 SPAIN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 SPAIN OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 290 SPAIN NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 291 SPAIN STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 292 SPAIN ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 ITALY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 294 ITALY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 295 ITALY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 296 ITALY MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 297 ITALY MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 298 ITALY MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 299 ITALY MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 300 ITALY MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 301 ITALY MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 302 ITALY MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 303 ITALY MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 304 ITALY MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 305 ITALY MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 306 ITALY MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 307 ITALY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 308 ITALY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 309 ITALY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 310 ITALY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 311 ITALY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 312 ITALY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 313 ITALY OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 314 ITALY OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 315 ITALY MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 316 ITALY MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 317 ITALY MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 318 ITALY MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 319 ITALY MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 320 ITALY MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 321 ITALY MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 322 ITALY FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 323 ITALY CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 ITALY MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 325 ITALY MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 326 ITALY MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 327 ITALY RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 328 ITALY RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 329 ITALY MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 330 ITALY OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 331 ITALY NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 332 ITALY STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 333 ITALY ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 334 RUSSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 335 RUSSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 336 RUSSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 337 RUSSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 338 RUSSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 339 RUSSIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 340 RUSSIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 341 RUSSIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 342 RUSSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 343 RUSSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 344 RUSSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 345 RUSSIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 346 RUSSIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 347 RUSSIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 348 RUSSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 349 RUSSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 350 RUSSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 351 RUSSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 352 RUSSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 353 RUSSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 354 RUSSIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 355 RUSSIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 356 RUSSIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 357 RUSSIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 358 RUSSIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 359 RUSSIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 360 RUSSIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 361 RUSSIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 362 RUSSIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 363 RUSSIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 364 RUSSIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 365 RUSSIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 366 RUSSIA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 367 RUSSIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 368 RUSSIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 369 RUSSIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 370 RUSSIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 371 RUSSIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 372 RUSSIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 373 RUSSIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 374 RUSSIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 375 NETHERLANDS MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 376 NETHERLANDS MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 377 NETHERLANDS MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 378 NETHERLANDS MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 379 NETHERLANDS MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 380 NETHERLANDS MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 381 NETHERLANDS MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 382 NETHERLANDS MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 383 NETHERLANDS MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 384 NETHERLANDS MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 385 NETHERLANDS MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 386 NETHERLANDS MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 387 NETHERLANDS MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 388 NETHERLANDS MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 389 NETHERLANDS MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 390 NETHERLANDS MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 391 NETHERLANDS MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 392 NETHERLANDS MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 393 NETHERLANDS MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 394 NETHERLANDS MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 395 NETHERLANDS OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 396 NETHERLANDS OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 397 NETHERLANDS MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 398 NETHERLANDS MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 399 NETHERLANDS MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 400 NETHERLANDS MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 401 NETHERLANDS MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 402 NETHERLANDS MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 403 NETHERLANDS MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 404 NETHERLANDS FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 405 NETHERLANDS CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 406 NETHERLANDS MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 407 NETHERLANDS MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 408 NETHERLANDS MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 409 NETHERLANDS RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 410 NETHERLANDS RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 411 NETHERLANDS MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 412 NETHERLANDS OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 413 NETHERLANDS NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 414 NETHERLANDS STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 415 NETHERLANDS ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 416 SWITZERLAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 417 SWITZERLAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 418 SWITZERLAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 419 SWITZERLAND MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 420 SWITZERLAND MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 421 SWITZERLAND MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 422 SWITZERLAND MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 423 SWITZERLAND MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 424 SWITZERLAND MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 425 SWITZERLAND MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 426 SWITZERLAND MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 427 SWITZERLAND MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 428 SWITZERLAND MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 429 SWITZERLAND MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 430 SWITZERLAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 431 SWITZERLAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 432 SWITZERLAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 433 SWITZERLAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 434 SWITZERLAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 435 SWITZERLAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 436 SWITZERLAND OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 437 SWITZERLAND OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 438 SWITZERLAND MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 439 SWITZERLAND MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 440 SWITZERLAND MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 441 SWITZERLAND MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 442 SWITZERLAND MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 443 SWITZERLAND MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 444 SWITZERLAND MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 445 SWITZERLAND FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 446 SWITZERLAND CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 447 SWITZERLAND MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 448 SWITZERLAND MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 449 SWITZERLAND MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 450 SWITZERLAND RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 451 SWITZERLAND RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 452 SWITZERLAND MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 453 SWITZERLAND OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 454 SWITZERLAND NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 455 SWITZERLAND STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 456 SWITZERLAND ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 457 TURKEY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 458 TURKEY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 459 TURKEY MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 460 TURKEY MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 461 TURKEY MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 462 TURKEY MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 463 TURKEY MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 464 TURKEY MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 465 TURKEY MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 466 TURKEY MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 467 TURKEY MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 468 TURKEY MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 469 TURKEY MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 470 TURKEY MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 471 TURKEY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 472 TURKEY MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 473 TURKEY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 474 TURKEY MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 475 TURKEY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 476 TURKEY MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 477 TURKEY OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 478 TURKEY OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 479 TURKEY MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 480 TURKEY MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 481 TURKEY MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 482 TURKEY MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 483 TURKEY MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 484 TURKEY MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 485 TURKEY MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 486 TURKEY FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 487 TURKEY CITRUS FRUITS IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 488 TURKEY MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 489 TURKEY MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 490 TURKEY MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 491 TURKEY RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 492 TURKEY RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 493 TURKEY MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 494 TURKEY OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 495 TURKEY NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 496 TURKEY STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 497 TURKEY ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 498 BELGIUM MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 499 BELGIUM MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 500 BELGIUM MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 501 BELGIUM MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 502 BELGIUM MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 503 BELGIUM MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 504 BELGIUM MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 505 BELGIUM MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 506 BELGIUM MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 507 BELGIUM MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 508 BELGIUM MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 509 BELGIUM MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 510 BELGIUM MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 511 BELGIUM MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 512 BELGIUM MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 513 BELGIUM MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 514 BELGIUM MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 515 BELGIUM MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)