Europe White Fused Alumina Market

Marktgröße in Milliarden USD

CAGR :

%

USD

199.22 Million

USD

252.05 Million

2025

2033

USD

199.22 Million

USD

252.05 Million

2025

2033

| 2026 –2033 | |

| USD 199.22 Million | |

| USD 252.05 Million | |

|

|

|

|

Marktsegmentierung für weißes Schmelztonerde in Europa nach Produkttyp (Makrogranulat, Mikrogranulat & Pulver, Spezialqualitäten, Sonstige), Herstellungsverfahren (Elektrolichtbogenofen, Brechen, Klassieren & Sortieren, Nachbehandlung, Sonstige), Funktion (Schneiden & Schleifen (Schleifmittel), Feuerfestfunktion (Wärme-/Verschleißbeständigkeit), Keramischer Zusatzstoff/Füllstoff, Polieren & Läppen, Strahlen & Oberflächenvorbereitung, Rutschhemmendes Zuschlagmaterial, Sonstige), Anwendung (Schleifmittel, Feuerfestmaterialien, Keramik & Hochleistungswerkstoffe, Polieren, Läppen & Veredeln, Sonstige), Endverwendung (Metall & Metallurgie, Automobil & Transport, Maschinenbau & Schwermaschinen, Bauwesen & Infrastruktur, Energie (Öl & Gas, Stromerzeugung), Luft- & Raumfahrt & Verteidigung, Elektronik & Halbleiter, Sonstige), Vertriebskanal (direkt und indirekt) – Branchentrends und Prognose bis 2033

Marktgröße für weißes Schmelzaluminiumoxid in Europa

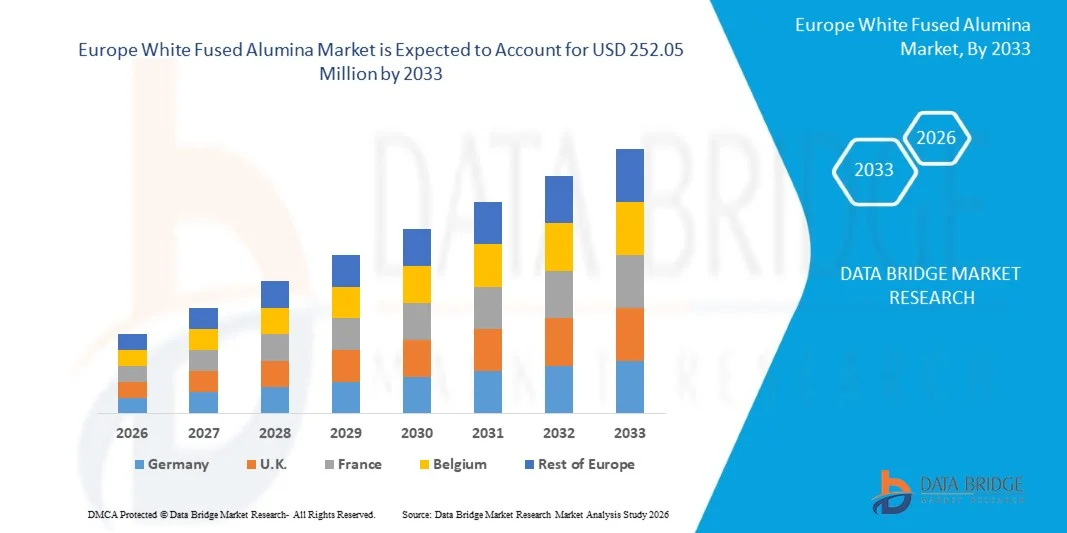

- Der europäische Markt für weißes Schmelzaluminiumoxid hatte im Jahr 2025 einen Wert von 199,22 Millionen US-Dollar und wird voraussichtlich bis 2033 auf 252,05 Millionen US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 3,20 % im Prognosezeitraum entspricht.

- Der europäische Markt für weißes Schmelzaluminiumoxid (Weißaluminiumoxid) umfasst ein hochreines, synthetisches Aluminiumoxid, das durch Schmelzen von hochwertigem Aluminiumoxid in einem Elektrolichtbogenofen bei extrem hohen Temperaturen hergestellt wird. Weißes Schmelzaluminiumoxid zeichnet sich durch seine Härte, thermische Stabilität und chemische Inertheit aus und eignet sich daher für abrasive Anwendungen, feuerfeste Werkstoffe, Keramik, Polieren und Oberflächenveredelung. Es findet breite Anwendung in Branchen wie der Metall- und Metallurgieindustrie, der Automobilindustrie, dem Bauwesen, der Elektronik und der Luft- und Raumfahrt und dient Funktionen wie Schneiden, Schleifen, Läppen sowie der Verbesserung der thermischen und Verschleißfestigkeit.

- Das Wachstum des europäischen Marktes für weißes Schmelzaluminiumoxid wird durch die steigende Nachfrage aus Schlüsselbranchen wie dem Bauwesen, der Automobilindustrie und der industriellen Fertigung angetrieben, wo hochwertige Schleifmittel, feuerfeste Werkstoffe und Poliermittel unerlässlich sind. Diese Branchen sind auf langlebige und effiziente Lösungen auf Aluminiumoxidbasis für Anwendungen wie Schneiden, Schleifen, Oberflächenbearbeitung sowie thermische und Verschleißbeständigkeit angewiesen, was die breite Akzeptanz und Marktexpansion in Europa fördert.

Marktanalyse für weißes Schmelzaluminiumoxid in Europa

- Technologische Fortschritte wie energieeffiziente Elektrolichtbogenöfen, verbesserte Kalzinierungs- und Schmelzprozesse, fortschrittliche Verfahren zur Entfernung von Verunreinigungen und eine präzisere Partikelgrößenkontrolle verbessern die Produktreinheit, den Weißgrad und die Konsistenz. Diese Verbesserungen fördern die Anwendung in den Bereichen Schleifmittel, Feuerfestmaterialien, Keramik und Präzisionspolierverfahren.

- Es bestehen weiterhin Herausforderungen, darunter die Volatilität der Aluminiumoxid- und Energiepreise, der hohe Energieverbrauch beim Schmelzprozess sowie strengere Umwelt- und Emissionsvorschriften, die die Betriebskosten erhöhen. Die Abhängigkeit von einer zuverlässigen Strominfrastruktur und die Konkurrenz durch alternative Schleifmittel wie braunes Schmelzaluminiumoxid und synthetische Alternativen schränken das Wachstum ebenfalls ein.

- Deutschland dürfte mit einem Marktanteil von 25,62 % dominieren, was auf ein starkes Wachstum im verarbeitenden Gewerbe, eine große Nachfrage nach Schleifmitteln und Feuerfestmaterialien, expandierende Bau- und Metallurgiebranchen, eine kostengünstige Produktion, reichlich vorhandene Rohstoffe und einen raschen Kapazitätsausbau in den Ländern zurückzuführen ist.

- Im Jahr 2026 wird erwartet, dass das Segment der Makrogrits mit einem Marktanteil von 51,35 % dominieren wird. Dies ist auf den umfangreichen Einsatz in Anwendungen wie dem Schwerlastschleifen, Schneiden, Strahlen und in der Feuerfestindustrie zurückzuführen, wo hohe Festigkeit, thermische Stabilität und eine gleichmäßige Partikelgröße für die industrielle Leistungsfähigkeit unerlässlich sind.

Berichtsgegenstand und Marktsegmentierung für weißes Schmelzaluminiumoxid in Europa

|

Attribute |

Europäischer Markt für weißes Schmelztonerde – Wichtigste Einblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch eingehende Expertenanalysen, geografisch dargestellte Produktions- und Kapazitätsdaten der Unternehmen, Netzwerkstrukturen von Vertriebspartnern und Partnern, detaillierte und aktualisierte Preistrendanalysen sowie Defizitanalysen der Lieferkette und der Nachfrage. |

Markttrends für weißes Schmelzaluminiumoxid in Europa

„Einführung fortschrittlicher Prozessautomatisierungs- und Hochreinheitsproduktionstechnologien“

- Hersteller integrieren zunehmend automatisierte Steuerungssysteme für Elektrolichtbogenöfen, Echtzeit-Prozessüberwachung und KI-gestützte Qualitätsanalysen, um gleichmäßige Schmelztemperaturen, eine engere Korngrößenverteilung und eine höhere Aluminiumoxidreinheit zu erreichen und so Chargenvariabilität und Defekte zu reduzieren.

- Dieser Trend wird durch die steigende Nachfrage der Schleifmittel-, Feuerfest-, Keramik- und Elektronikindustrie nach einheitlichen, hochleistungsfähigen weißen Schmelztonerdesorten angetrieben, die strengere technische und regulatorische Spezifikationen erfüllen. KI-gestützte Rekonstruktionsalgorithmen senken die Strahlendosis deutlich und verbessern gleichzeitig die Bildqualität, wodurch PET-CT-Untersuchungen sicherer und für eine breitere Patientengruppe zugänglicher werden.

- Fortschrittliche Kühl-, Zerkleinerungs- und Klassiertechnologien verbessern die Ausbeuteeffizienz und ermöglichen die Herstellung anwendungsspezifischer Makro- und Mikrogranulate, wodurch die Gesamtproduktleistung gesteigert wird.

- Darüber hinaus helfen digitalisierte Produktionsplanung, automatisierte Materialhandhabung und vorausschauende Wartungssysteme den Herstellern, energieintensive Prozesse zu steuern, Ausfallzeiten zu minimieren und die Betriebskosten zu kontrollieren.

Marktdynamik von weißem Schmelztonerde in Europa

Treiber

„Steigende Nachfrage aus der Eisen- und Stahlindustrie“

- Die steigende Nachfrage aus der Eisen- und Stahlindustrie gilt als einer der wichtigsten Treiber des europäischen Marktes für weißes Schmelzaluminiumoxid. Weißes Schmelzaluminiumoxid findet breite Anwendung in feuerfesten Materialien, die für Stahlherstellungsprozesse unerlässlich sind, darunter Pfannenauskleidungen, Schieberrohrauskleidungen, Verteilerdüsen und hochtemperaturbeständige, verschleißfeste Bauteile. Da die Rohstahlproduktion in den wichtigsten Produktionsnationen weiter zunimmt und in ganz Europa, Deutschland und den Schwellenländern neue Kapazitätserweiterungen angekündigt werden, steigt der Bedarf an Hochleistungs-Feuerfestmaterialien. Die Umstellung auf höherwertige Stahlsorten, längere Ofenlaufzeiten und reduzierte Stillstandszeiten haben die Abhängigkeit von hochwertigen Aluminiumoxid-basierten Feuerfestmaterialien weiter verstärkt.

- Es wird gefolgert, dass der Aufwärtstrend der europäischen Rohstahlproduktion maßgeblich zur Steigerung des Verbrauchs von weißem Schmelzaluminiumoxid beigetragen hat. Mit zunehmender Stahlproduktion steigt auch der Verschleiß der Feuerfestmaterialien proportional an, was zu häufigeren Austauschzyklen für die in Öfen, Gießpfannen und Verteilergefäßen benötigten aluminiumoxidbasierten Feuerfestmaterialien führt. Politisch bedingte Kapazitätserweiterungen, die Modernisierung älterer Stahlwerke und höhere Betriebsintensitäten haben die Nachfrage nach weißem Schmelzaluminiumoxid insgesamt verstärkt.

- Das anhaltende Produktionswachstum in führenden Stahlproduktionsländern deutet darauf hin, dass der Bedarf an Feuerfestmaterialien weiterhin strukturell an den Wachstumspfad des Stahlsektors gekoppelt sein wird. Folglich dürfte die steigende Stahlproduktion die starke und planbare langfristige Nachfrage nach weißem Schmelztonerde in europäischen metallurgischen Anwendungen aufrechterhalten.

Zurückhaltung/Herausforderung

„ Umweltvorschriften und Kosten der Einhaltung “

- Umweltauflagen und die damit verbundenen Kosten stellen ein wesentliches Hemmnis für das Wachstum des europäischen Marktes für weißes Schmelzkorund dar, insbesondere aufgrund der energieintensiven Hochtemperaturverfahren, die für die Herstellung des Materials notwendig sind, und der Abhängigkeit vom Abbau von Rohbauxit und Aluminiumoxid. In verschiedenen Ländern verschärfen Regierungen die Emissionskontrollen, die Standards für das Wassermanagement, die Abfallentsorgungsvorschriften und die Anforderungen an Umweltverträglichkeitsprüfungen. Dies erhöht die Betriebskosten der Hersteller, verlängert die Genehmigungszeiten für Projekte und erhöht die Markteintrittsbarrieren. Die Einhaltung der Vorschriften erfordert die Installation fortschrittlicher Emissionskontrollsysteme, kontinuierlicher Überwachungstechnologien und die Befolgung strenger Umweltauflagen, was alles zu höheren Fix- und laufenden Kosten führt.

- Umweltauflagen und die damit verbundenen Kosten bremsen den europäischen Markt für weißes Schmelzkorund erheblich, indem sie die Betriebskosten erhöhen, Genehmigungsverfahren verlängern und regulatorische Unsicherheiten schaffen. Weltweit verschärfen Regierungen die Umweltschutzmaßnahmen, verpflichten zu Sanierungsmaßnahmen und verhängen Strafen, die Raffinerien, Hüttenwerke und Bergwerke, die mit der Schmelzkorundproduktion verbunden sind, direkt betreffen.

Marktübersicht für weißes Schmelztonerde in Europa

Der europäische Markt für weißes Schmelzaluminiumoxid wird anhand von Produkttyp, Herstellungsverfahren, Funktion, Endanwendung und Vertriebskanal in sechs Segmente unterteilt.

- Nach Produkttyp

Der europäische Markt für weißes Schmelztonerde ist nach Produkttyp in Makrogranulat, Mikrogranulat und Pulver, Spezialqualitäten und Sonstige unterteilt. Im Jahr 2026 wird das Segment Makrogranulat voraussichtlich mit einem Marktanteil von 51,35 % dominieren. Dies ist auf den breiten Einsatz in anspruchsvollen Anwendungen wie Feuerfestmaterialien, gebundenen Schleifmitteln und metallurgischen Prozessen zurückzuführen, die hohe Härte und thermische Stabilität erfordern.

Das Segment der Mikrogrits und -pulver wird voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 3,83 % wachsen, da die Nachfrage nach Präzisionsbearbeitung, Polieren, Läppen und Anwendungen in der Hochleistungskeramik steigt, wo eine feine Partikelgröße, Gleichmäßigkeit und eine hervorragende Oberflächenqualität von entscheidender Bedeutung sind.

- Durch den Herstellungsprozess

Der europäische Markt für weißes Schmelzaluminiumoxid ist nach Herstellungsverfahren in Elektrolichtbogenofen, Brechen, Klassieren und Sortieren, Nachbehandlung und Sonstiges unterteilt. Im Jahr 2026 wird das Segment Elektrolichtbogenofen voraussichtlich mit einem Marktanteil von 51,67 % dominieren, da es hochreines und gleichbleibend hochwertiges weißes Schmelzaluminiumoxid mit hervorragenden mechanischen und thermischen Eigenschaften produziert.

Für das Segment der Nachbehandlung wird ein jährliches Wachstum von 4,04 % erwartet, da der Fokus zunehmend auf der Optimierung der Partikelgröße, der Oberflächenbehandlung, der Entfernung von Verunreinigungen und den kundenspezifischen Materialspezifikationen liegt, die für High-End-Schleifmittel, Keramik und Elektronikanwendungen erforderlich sind.

- Nach Funktion

Der europäische Markt für weißes Schmelztonerde ist funktionsbasiert in folgende Segmente unterteilt: Schneiden und Schleifen (Schleifmittel), Polieren und Läppen, Strahlen und Oberflächenvorbereitung, Feuerfest (Wärme- und Verschleißbeständigkeit), Keramikadditive/Füllstoffe, Antirutsch-/Rutschmittelzusätze und Sonstiges. Im Jahr 2026 wird das Segment Schneiden und Schleifen voraussichtlich mit einem Marktanteil von 38,11 % dominieren, bedingt durch seine breite Anwendung in der Metallverarbeitung, der Automobilindustrie und im Präzisionsmaschinenbau.

Für das Segment Polieren und Läppen wird ein jährliches Wachstum von 4,08 % erwartet, bedingt durch die steigende Nachfrage nach ultrafeiner Oberflächenbearbeitung in der Elektronik, Optik, Automobilkomponenten und im Präzisionsmaschinenbau, wo enge Toleranzen und eine glatte Oberflächenqualität unerlässlich sind.

- Durch Bewerbung

Basierend auf den Anwendungsgebieten ist der europäische Markt für weißes Schmelztonerde in die Segmente Schleifmittel, Feuerfestmaterialien, Keramik und Hochleistungswerkstoffe, Polieren, Läppen und Oberflächenbearbeitung sowie Sonstiges unterteilt. Im Jahr 2026 wird das Segment Schleifmittel voraussichtlich mit einem Marktanteil von 51,97 % dominieren, bedingt durch die breite Anwendung beim Schleifen, Schneiden und der Oberflächenbearbeitung in verschiedenen Branchen.

Für das Segment der feuerfesten Werkstoffe wird ein jährliches Wachstum von 3,52 % erwartet, bedingt durch die steigende Nachfrage der Stahl-, Zement-, Glas- und Nichteisenmetallindustrie nach hochtemperaturbeständigen Materialien, die in Öfen, Brennöfen und Wärmebehandlungsanlagen eingesetzt werden.

- Vom Endbenutzer

Der europäische Markt für weißes Schmelztonerde ist nach Endverbrauchern in die Segmente Metalle & Metallurgie, Automobil & Transport, Luft- & Raumfahrt, Elektronik & Halbleiter, Maschinenbau & Schwermaschinen, Bauwesen & Infrastruktur, Energie (Öl & Gas, Stromerzeugung) und Sonstige unterteilt. Im Jahr 2026 wird das Segment Metalle & Metallurgie aufgrund seines hohen Verbrauchs in der Stahlherstellung, der Aluminiumverarbeitung und Gießereien voraussichtlich mit einem Marktanteil von 24,93 % dominieren.

Für das Segment Elektronik & Halbleiter wird ein jährliches Wachstum von 4,67 % erwartet. Grund dafür ist der zunehmende Einsatz von hochreinem, weißem Schmelzaluminiumoxid beim Waferpolieren, bei elektronischen Substraten, Isolationskomponenten und in Präzisionsfertigungsprozessen, die minimale Verunreinigungen und eine hohe Materialkonsistenz erfordern.

- Nach Vertriebskanal

Der europäische Markt für weißes Schmelztonerde ist nach Vertriebskanal in Direkt- und Indirektvertrieb unterteilt. Für 2026 wird erwartet, dass der Direktvertrieb mit einem Marktanteil von 66,12 % dominieren wird. Grund dafür ist, dass große Industrieabnehmer den Direktbezug von Herstellern bevorzugen, um sich die Qualität zu sichern, von Mengenrabatten zu profitieren und kundenspezifische Produktspezifikationen zu erhalten.

Das Direktsegment dürfte mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 3,32 % am stärksten wachsen. Gründe hierfür sind die zunehmende Anzahl langfristiger Lieferverträge, die engere Zusammenarbeit zwischen Hersteller und Endverbraucher sowie die wachsende Nachfrage nach stabilen Lieferketten, die die industrielle Großproduktion unterstützen.

Einblick in den europäischen Markt für weißes Schmelzaluminiumoxid

Europa wird 2026 einen Marktanteil von 21,59 % erreichen und mit einer robusten durchschnittlichen jährlichen Wachstumsrate (CAGR) von 3,20 % wachsen. Die Stärke der Region basiert auf ihrer etablierten Industriebasis, fortschrittlichen Fertigungsstandards und der starken Nachfrage aus den Bereichen Schleifmittel, Feuerfestmaterialien und Spezialkeramik. Europa profitiert von kontinuierlichen Prozessinnovationen, darunter energieeffiziente Elektrolichtbogenofen-Technologien, strenge Qualitäts- und Umweltauflagen sowie die hohe Akzeptanz von hochwertigen Aluminiumoxidprodukten in Deutschland, Großbritannien, Frankreich und Italien. Darüber hinaus stärken die stabile Stahl- und Automobilproduktion, steigende Investitionen in die Modernisierung der Infrastruktur, der zunehmende Einsatz von weißem Schmelzaluminiumoxid in der Präzisionsbearbeitung und bei Hochleistungswerkstoffen sowie die enge Zusammenarbeit zwischen Herstellern, Forschungseinrichtungen und Endverbraucherbranchen Europas stabile Marktposition und nachhaltigen Wachstumskurs.

Markteinblicke für weißes Schmelztonerde in Deutschland und Europa

Deutschland wird 2026 mit 25,62 % den größten Anteil am europäischen Markt für weißes Schmelzkorund halten. Diese starke Position ist auf Deutschlands fortschrittliches industrielles Fertigungsökosystem, die starke Präsenz von Herstellern hochpräziser Schleifmittel und Feuerfestmaterialien sowie die frühzeitige Einführung energieeffizienter Elektrolichtbogenofen-Technologien zurückzuführen, die durch erhebliche öffentliche und private Investitionen unterstützt werden. Das Land profitiert von einer robusten Nachfrage aus der Stahl-, Automobil-, Maschinenbau- und Keramikindustrie sowie von strengen Qualitätsstandards und Prozessautomatisierung. Darüber hinaus stärken die kontinuierliche Modernisierung der Produktionsanlagen, der zunehmende Einsatz von hochreinem Aluminiumoxid in der Präzisionsbearbeitung, die wachsenden Exporte und die enge Zusammenarbeit zwischen Herstellern, Forschungsinstituten und Endverbraucherbranchen Deutschlands Führungsrolle und Wachstumsdynamik auf dem europäischen Markt für weißes Schmelzkorund.

Marktanteil von weißem Schmelzaluminiumoxid in Europa

Der europäische Markt für weißes Schmelzaluminiumoxid wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Washington Mills (USA)

- Motim (Slowakei)

- CUMI (Indien)

- Henan Ruishi Renewable Resources Group Co.,Ltd. (China)

- US Electrofused Minerals, Inc. (USA)

- Qinai New Materials (China)

- Zhengzhou Yufa Abrasive Group Co., Ltd. (China)

- Fused Minerals Industries LLP (Indien)

- HarbisonWalker International (HWI) (USA)

- Henan Hongtai Kiln Refractory Co., Ltd. (China)

- Algrain Products Private Limited (Indien)

- Imerys (Frankreich)

- LP Impex (Indien)

- Shandong Zhongji Metal Products Co., Ltd. (China)

- Alteo Alumina (Frankreich)

- Orient Abrasives Ltd. (Indien)

- Shandong Bosheng New Materials Co., Ltd. (China)

- JSR International (India) Pvt. Ltd. (Indien)

- Luoyang Hongfeng Abrasives Co., Ltd. (China)

- Zhengzhou Xinli Wear-resistant Materials Co., Ltd. (China)

- Nanping Yi Ze Abrasives & Tools Tech Co (China)

- RUSAL-Gruppe (Russland)

- Shandong Honrel Co., Ltd. (China)

- Saint-Gobain (Frankreich)

- Cerablast (Deutschland)

- Sunrise Refractory (Yingkou) Co., Ltd. (China)

- Quarzwerke GmbH (Deutschland)

- Kuhmichel Abrasiv GmbH (Deutschland)

- Wedge India (Indien)

- Zibo Jucos Co., Ltd. (China)

Neueste Entwicklungen auf dem europäischen Markt für weißes Schmelzaluminiumoxid

- Im Dezember 2025 schloss HWI, ein Mitglied von Calderys, den Bau seiner neuen Produktionsanlage für Leichtbau-Monolithe im Drehrohrofenkomplex in Fulton, Missouri, ab. Die hochmoderne Anlage steigert die Produktionskapazität für Leichtbau-Monolithe um fast 60 % und verfügt über fortschrittliche Automatisierungstechnik (neuer Ofen, robotergestützte Verpackungs- und Materialhandhabungssysteme). Dadurch sollen die Produktverfügbarkeit verbessert und die Lieferzeiten für Kunden in ganz Amerika verkürzt werden.

- Im Juli 2025 ging HWI eine strategische Fertigungspartnerschaft mit Electrified Thermal Solutions ein, um gemeinsam elektrisch leitfähige Feuerfeststeine (E-Steine) für die Joule Hive™ Wärmespeicherbatterie von Electrified Thermal zu entwickeln und herzustellen. Die Zusammenarbeit kombiniert die Hochtemperatur-Wärmespeichertechnologie von Electrified Thermal mit der Expertise von HWI im Bereich feuerfester Materialien, um dekarbonisierte industrielle Wärmeanwendungen zu unterstützen. Die erste Demonstration im kommerziellen Maßstab war für 2025 geplant, mit dem langfristigen Ziel, bis 2030 2 GW elektrifizierte Wärmeenergie bereitzustellen.

- Im Oktober 2024 wurde Niche Fused Alumina von Alteo übernommen und nach Genehmigung des Übernahmeangebots durch das Handelsgericht Chambéry als „Alteo Fused Alumina“ in den Konzern integriert. Die Akquisition wurde als strategische Erweiterung des Spezialaluminiumoxidgeschäfts von Alteo positioniert, um die europäische Marktführerschaft zu stärken und nachhaltiges industrielles Wachstum mit einem kontinuierlichen Fokus auf Innovation und Umweltverantwortung zu fördern.

- Im Februar 2024 trat Alteo offiziell dem Europäischen Keramikcluster mit Sitz in Limoges, Frankreich, bei. Ziel dieser Zusammenarbeit ist es, Alteos Präsenz in wichtigen Hightech- und Industriesektoren – darunter Luft- und Raumfahrt, Verteidigung, Elektronik, Energie, Luxusgüter und Gesundheitswesen – zu stärken, indem das Netzwerk des Clusters für Innovation und industrielle Entwicklung auf den Märkten für Spezialaluminiumoxid und technische Keramik genutzt wird.

- Im September 2024 schloss CUMI die Übernahme von 100 % der Anteile an Silicon Carbide Products LLC (SCP) ab, einem US-amerikanischen Unternehmen, das sich auf Hochleistungskeramik und Siliziumkarbid spezialisiert hat. Dieser strategische Schritt stärkt CUMIs Präsenz in Europa auf dem Markt für Hochleistungskeramik und Schleifmittel und erweitert die technologischen Kompetenzen sowie den Zugang zu nordamerikanischen Kunden.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE ANALYSIS

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 RISK ASSESSMENT AND MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PRICING ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7.4 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENTS

4.9 VALUE CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL PROCUREMENT

4.9.3 PRODUCTION / FUSION

4.9.4 PROCESSING & SURFACE TREATMENT

4.9.5 PACKAGING

4.9.6 LOGISTICS & DISTRIBUTION

4.9.7 INDUSTRIAL APPLICATIONS/ END USER DEMAND

4.9.8 CONCLUSION

4.1 VENDOR SELECTION CRITERIA

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEMAND FROM IRON & STEEL INDUSTRY

7.1.2 EXPANDING INDUSTRIAL END USE DEMAND OF WHITE FUSED ALUMINA

7.1.3 RISING INDUSTRIALIZATION AND INFRASTRUCTURE INVESTMENTS IN EMERGING MARKETS

7.1.4 RISING DEMAND FROM THE ELECTRONICS SECTOR

7.2 RESTRAINTS

7.2.1 ENVIRONMENTAL REGULATIONS AND COMPLIANCE COSTS

7.2.2 VOLATILITY IN RAW MATERIAL AND ENERGY COST

7.3 OPPORTUNITIES

7.3.1 GROWTH IN NON-FERROUS METALS AND GLASS INDUSTRIES

7.3.2 TECHNOLOGICAL ADVANCEMENTS IN REFRACTORY MANUFACTURING

7.3.3 DEVELOPMENT OF ADVANCED AND SPECIALIZED GRADES

7.4 CHALLENGES

7.4.1 SUPPLY CHAIN DISRUPTIONS AND LOGISTICS CONSTRAINTS

7.4.2 INTENSE COMPETITION AMONG REGIONAL MANUFACTURERS

8 EUROPE WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 EUROPE WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

8.2.1 MACROGRITS

8.2.2 MICROGRITS & POWDERS

8.2.3 SPECIALTY GRADES

8.2.4 OTHERS

8.3 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.3.1 FEPA F

8.3.2 FEPA P

8.3.3 ANSI

8.4 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

8.4.1 COARSE GRADES (F12–F46)

8.4.2 MEDIUM GRADES (F54–F80)

8.4.3 FINE GRADES (F90–F220)

8.5 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

8.5.1 UNTREATED

8.5.2 SILANE/COATED

8.6 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.6.1 ASIA-PACIFIC

8.6.2 EUROPE

8.6.3 NORTH AMERICA

8.6.4 SOUTH AMERICA

8.6.5 MIDDLE EAST & AFRICA

8.7 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.7.1 FEPA F MICRO

8.7.2 JIS

8.8 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

8.8.1 10–60 ΜM

8.8.2 1–10 ΜM

8.8.3 SUB-MICRON (D50 < 1 ΜM)

8.9 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

8.9.1 LAPPING

8.9.2 CMP/POLISHING

8.1 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 EUROPE

8.10.3 NORTH AMERICA

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

8.11.1 ≥ 99.5% AL2O3

8.11.2 99.0%–99.4% AL2O3

8.11.3 98.0%–98.9% AL2O3

8.12 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

8.12.1 LOW-SODA (NA2O ≤ 0.05%)

8.12.2 ULTRA-LOW-SODA (NA2O ≤ 0.02%)

8.13 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

8.13.1 HIGH-WHITENESS

8.13.2 STANDARD-WHITENESS

8.14 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 EUROPE

8.15.3 NORTH AMERICA

8.15.4 SOUTH AMERICA

8.15.5 MIDDLE EAST & AFRICA

9 EUROPE WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 EUROPE WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

9.2.1 ELECTRIC ARC FURNACE

9.2.2 CRUSHING, GRADING & CLASSIFICATION

9.2.3 POST-TREATMENT

9.2.4 OTHERS

9.3 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

9.3.1 FIXED/STATIONARY FURNACE

9.3.2 TILTING FURNACE

9.4 EUROPE FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.4.2 RAPID QUENCH (MORE FRIABLE)

9.5 EUROPE TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.5.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.5.2 RAPID QUENCH (MORE FRIABLE)

9.6 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

9.6.1 HIGH-PURITY CALCINED ALUMINA

9.6.2 TABULAR/SEEDING ADDITIVES

9.7 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 EUROPE CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 SECONDARY PROCESSING

9.8.2 PRIMARY CRUSHING

9.9 EUROPE SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.9.1 AIR CLASSIFICATION

9.9.2 BALL MILLING

9.9.3 MAGNETIC SEPARATION

9.1 EUROPE PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 JAW/IMPACT CRUSHING

9.10.2 ROLLER MILLING

9.11 EUROPE CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

9.12 EUROPE POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 ACID WASHING/IMPURITY REMOVAL

9.12.2 HEAT TREATMENT/ANNEALING

9.12.3 SURFACE MODIFICATION/COATING

9.13 EUROPE POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 EUROPE

9.13.3 NORTH AMERICA

9.13.4 SOUTH AMERICA

9.13.5 MIDDLE EAST & AFRICA

9.14 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.14.1 ASIA-PACIFIC

9.14.2 EUROPE

9.14.3 NORTH AMERICA

9.14.4 SOUTH AMERICA

9.14.5 MIDDLE EAST & AFRICA

10 EUROPE WHITE FUSED ALUMINA MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 EUROPE WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

10.2.1 CUTTING & GRINDING (ABRASIVE)

10.2.2 REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)

10.2.3 CERAMIC ADDITIVE/FILLER

10.2.4 POLISHING & LAPPING

10.2.5 BLASTING & SURFACE PREPARATION

10.2.6 ANTI-SKID/ANTI-SLIP AGGREGATE

10.2.7 OTHERS

10.3 EUROPE CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 EUROPE REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 EUROPE CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 EUROPE

10.5.3 NORTH AMERICA

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 EUROPE POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

10.7 EUROPE BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 EUROPE

10.7.3 NORTH AMERICA

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 EUROPE ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 EUROPE

10.8.3 NORTH AMERICA

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 EUROPE

10.9.3 NORTH AMERICA

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

11 EUROPE WHITE FUSED ALUMINA MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 EUROPE WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 ABRASIVES

11.2.2 REFRACTORIES

11.2.3 CERAMICS & ADVANCED MATERIALS

11.2.4 POLISHING, LAPPING & FINISHING

11.2.5 OTHERS

11.3 EUROPE ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 BONDED ABRASIVES

11.3.2 COATED ABRASIVES

11.3.3 BLASTING MEDIA

11.4 EUROPE BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 VITRIFIED BONDED

11.4.2 RESINOID BONDED

11.5 EUROPE COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 BELTS/DISCS/SHEETS

11.5.2 SANDPAPER

11.6 EUROPE BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 DRY BLASTING

11.6.2 WET/SLURRY BLASTING

11.7 EUROPE BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.7.1 ASIA-PACIFIC

11.7.2 EUROPE

11.7.3 NORTH AMERICA

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST & AFRICA

11.8 EUROPE REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 UN-SHAPED/CASTABLES

11.8.2 SHAPED REFRACTORIES

11.9 EUROPE UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 LOW-CEMENT / ULTRA-LOW CEMENT (LCC/ULCC)

11.9.2 GUNNABLE/RAMMABLE

11.1 EUROPE SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.10.1 BRICKS

11.10.2 PREFORMS

11.11 EUROPE REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 EUROPE

11.11.3 NORTH AMERICA

11.11.4 SOUTH AMERICA

11.11.5 MIDDLE EAST & AFRICA

11.12 EUROPE CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.12.1 TECHNICAL CERAMICS

11.12.2 THERMAL SPRAY/PLASMA SPRAY POWDERS

11.13 EUROPE CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 EUROPE

11.13.3 NORTH AMERICA

11.13.4 SOUTH AMERICA

11.13.5 MIDDLE EAST & AFRICA

11.14 EUROPE POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.14.1 METALS & ALLOYS

11.14.2 GLASS, CRYSTAL, STONE

11.15 EUROPE POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.15.1 ASIA-PACIFIC

11.15.2 EUROPE

11.15.3 NORTH AMERICA

11.15.4 SOUTH AMERICA

11.15.5 MIDDLE EAST & AFRICA

12 EUROPE WHITE FUSED ALUMINA MARKET, BY END USE

12.1 OVERVIEW

12.2 EUROPE WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 METALS & METALLURGY

12.2.2 AUTOMOTIVE & TRANSPORTATION

12.2.3 MACHINERY & HEAVY EQUIPMENT

12.2.4 CONSTRUCTION & INFRASTRUCTURE

12.2.5 ENERGY (OIL & GAS, POWER GENERATION)

12.2.6 AEROSPACE & DEFENSE

12.2.7 ELECTRONICS & SEMICONDUCTORS

12.2.8 OTHERS

12.3 EUROPE METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.3.1 STEEL & FOUNDRY

12.3.2 NON-FERROUS METALS

12.4 EUROPE METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 EUROPE AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.5.1 AFTERMARKET/MAINTENANCE

12.5.2 OEM

12.6 EUROPE AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 EUROPE MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

12.8 EUROPE CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.8.1 ASIA-PACIFIC

12.8.2 EUROPE

12.8.3 NORTH AMERICA

12.8.4 SOUTH AMERICA

12.8.5 MIDDLE EAST & AFRICA

12.9 EUROPE ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.9.1 ASIA-PACIFIC

12.9.2 EUROPE

12.9.3 NORTH AMERICA

12.9.4 SOUTH AMERICA

12.9.5 MIDDLE EAST & AFRICA

12.1 EUROPE AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 EUROPE

12.10.3 NORTH AMERICA

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 EUROPE ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.11.1 ASIA-PACIFIC

12.11.2 EUROPE

12.11.3 NORTH AMERICA

12.11.4 SOUTH AMERICA

12.11.5 MIDDLE EAST & AFRICA

12.12 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 EUROPE

12.12.3 NORTH AMERICA

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

13 EUROPE WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 EUROPE WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.2.1 DIRECT

13.2.2 INDIRECT

13.3 EUROPE DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 MANUFACTURER TO END-USER

13.3.2 MANUFACTURER TO REFRACTORY INSTALLATION COMPANIES

13.3.3 MANUFACTURER TO EPC / ENGINEERING FIRMS

13.4 EUROPE DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 EUROPE

13.4.3 NORTH AMERICA

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 EUROPE INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.5.1 DISTRIBUTORS / WHOLESALERS

13.5.2 RETAILERS / DEALERS

13.5.3 ONLINE SALES / E-COMMERCE PLATFORMS

13.6 EUROPE INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 EUROPE

13.6.3 NORTH AMERICA

13.6.4 SOUTH AMERICA

13.6.5 MIDDLE EAST & AFRICA

14 EUROPE WHITE FUSED ALUMINA MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 FRANCE

14.1.3 ITALY

14.1.4 U.K.

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 TURKEY

14.1.8 SWEDEN

14.1.9 NETHERLANDS

14.1.10 SWITZERLAND

14.1.11 FINLAND

14.1.12 NORWAY

14.1.13 BELGIUM

14.1.14 DENMARK

14.1.15 REST OF EUROPE

15 EUROPE WHITE FUSED ALUMINA MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 COMPANY PROFILES

16.1 MANUFACTURER

16.1.1 IMERYS S.A.

16.1.1.1 COMPANY SNAPSHOT

16.1.1.2 REVENUE ANALYSIS

16.1.1.3 COMPANY SHARE ANALYSIS

16.1.1.4 PRODUCT PORTFOLIO

16.1.1.5 RECENT DEVELOPMENT

16.1.2 WASHINGTON MILLS

16.1.2.1 COMPANY SNAPSHOT

16.1.2.2 COMPANY SHARE ANALYSIS

16.1.2.3 PRODUCT PORTFOLIO

16.1.2.4 RECENT DEVELOPMENT

16.1.3 SAINT-GOBAIN

16.1.3.1 COMPANY SNAPSHOT

16.1.3.2 REVENUE ANALYSIS

16.1.3.3 COMPANY SHARE ANALYSIS

16.1.3.4 PRODUCT PORTFOLIO

16.1.3.5 RECENT DEVELOPMENT

16.1.4 RUSAL

16.1.4.1 COMPANY SNAPSHOT

16.1.4.2 REVENUE ANALYSIS

16.1.4.3 PRODUCT PORTFOLIO

16.1.4.4 RECENT DEVELOPMENT

16.1.5 HWI

16.1.5.1 COMPANY SNAPSHOT

16.1.5.2 PRODUCT PORTFOLIO

16.1.5.3 RECENT DEVELOPMENT

16.1.6 ALGRAIN

16.1.6.1 COMPANY SNAPSHOT

16.1.6.2 PRODUCT PORTFOLIO

16.1.6.3 RECENT DEVELOPMENT

16.1.7 ALTEO FUSED ALUMINA

16.1.7.1 COMPANY SNAPSHOT

16.1.7.2 PRODUCT PORTFOLIO

16.1.7.3 RECENT DEVELOPMENT

16.1.8 CERABLAST

16.1.8.1 COMPANY SNAPSHOT

16.1.8.2 PRODUCT PORTFOLIO

16.1.8.3 RECENT DEVELOPMENT

16.1.9 CUMI

16.1.9.1 COMPANY SNAPSHOT

16.1.9.2 REVENUE ANALYSIS

16.1.9.3 PRODUCT PORTFOLIO

16.1.9.4 RECENT DEVELOPMENT

16.1.10 FUSED MINERALS INTERNATIONAL

16.1.10.1 COMPANY SNAPSHOT

16.1.10.2 PRODUCT PORTFOLIO

16.1.10.3 RECENT DEVELOPMENT

16.1.11 HENAN HONGTAI KILN REFRACTORY CO.,LTD.

16.1.11.1 COMPANY SNAPSHOT

16.1.11.2 PRODUCT PORTFOLIO

16.1.11.3 RECENT DEVELOPMENT

16.1.12 HENAN RUISHI RENEWABLE RESOURCES GROUP CO., LTD.

16.1.12.1 COMPANY SNAPSHOT

16.1.12.2 PRODUCT PORTFOLIO

16.1.12.3 RECENT DEVELOPMENT

16.1.13 JSR INTERNATIONAL(INDIA) PRIVATE LIMITED

16.1.13.1 COMPANY SNAPSHOT

16.1.13.2 PRODUCT PORTFOLIO

16.1.13.3 RECENT DEVELOPMENT

16.1.14 KUHMICHEL ABRASIV GMBH

16.1.14.1 COMPANY SNAPSHOT

16.1.14.2 PRODUCT PORTFOLIO

16.1.14.3 RECENT DEVELOPMENT

16.1.15 LP IMPEX

16.1.15.1 COMPANY SNAPSHOT

16.1.15.2 PRODUCT PORTFOLIO

16.1.15.3 RECENT DEVELOPMENT

16.1.16 LUOYANG HONGFENG ABRASIVES CO., LTD

16.1.16.1 COMPANY SNAPSHOT

16.1.16.2 PRODUCT PORTFOLIO

16.1.16.3 RECENT DEVELOPMENT

16.1.17 LUOYANG SUNRISE ABRASIVES CO., LTD.

16.1.17.1 COMPANY SNAPSHOT

16.1.17.2 PRODUCT PORTFOLIO

16.1.17.3 RECENT DEVELOPMENT

16.1.18 MOTIM

16.1.18.1 COMPANY SNAPSHOT

16.1.18.2 PRODUCT PORTFOLIO

16.1.18.3 RECENT DEVELOPMENT

16.1.19 NANPING YI ZE ABRASIVES & TOOLS TECH CO., LTD.

16.1.19.1 COMPANY SNAPSHOT

16.1.19.2 PRODUCT PORTFOLIO

16.1.19.3 RECENT DEVELOPMENT

16.1.20 ORIENT CERATECH LIMITED

16.1.20.1 COMPANY SNAPSHOT

16.1.20.2 REVENUE ANALYSIS

16.1.20.3 PRODUCT PORTFOLIO

16.1.20.4 RECENT DEVELOPMENT

16.1.21 QUARZWERKE GMBH

16.1.21.1 COMPANY SNAPSHOT

16.1.21.2 PRODUCT PORTFOLIO

16.1.21.3 RECENT DEVELOPMENT

16.1.22 QINAI NEW MATERIALS CO. LTD.

16.1.22.1 COMPANY SNAPSHOT

16.1.22.2 PRODUCT PORTFOLIO

16.1.22.3 RECENT DEVELOPMENT

16.1.23 SHANDONG BOSHENG NEW MATERIALS CO., LTD.

16.1.23.1 COMPANY SNAPSHOT

16.1.23.2 PRODUCT PORTFOLIO

16.1.23.3 RECENT DEVELOPMENT

16.1.24 SHANDONG HONREL CO., LTD

16.1.24.1 COMPANY SNAPSHOT

16.1.24.2 PRODUCT PORTFOLIO

16.1.24.3 RECENT DEVELOPMENT

16.1.25 SHANDONG ZHONGJI METAL PRODUCTS CO., LTD

16.1.25.1 COMPANY SNAPSHOT

16.1.25.2 PRODUCT PORTFOLIO

16.1.25.3 RECENT DEVELOPMENT

16.1.26 U.S. ELECTROFUSED MINERALS, INC.

16.1.26.1 COMPANY SNAPSHOT

16.1.26.2 PRODUCT PORTFOLIO

16.1.26.3 RECENT DEVELOPMENT

16.1.27 WEDGE INDIA

16.1.27.1 COMPANY SNAPSHOT

16.1.27.2 PRODUCT PORTFOLIO

16.1.27.3 RECENT DEVELOPMENT

16.1.28 ZHENGZHOU XINLI WEAR-RESISTANT MATERIALS CO. LTD.

16.1.28.1 COMPANY SNAPSHOT

16.1.28.2 PRODUCT PORTFOLIO

16.1.28.3 RECENT DEVELOPMENT

16.1.29 ZHENGZHOU YUFA ABRASIVE GROUP CO., LTD.

16.1.29.1 COMPANY SNAPSHOT

16.1.29.2 PRODUCT PORTFOLIO

16.1.29.3 RECENT DEVELOPMENT

16.1.30 ZIBO JUCOS CO.,LTD.

16.1.30.1 COMPANY SNAPSHOT

16.1.30.2 PRODUCT PORTFOLIO

16.1.30.3 RECENT DEVELOPMENT

16.2 DISTRIBUTOR

16.2.1 CALDERYS DISTRIBUTION.

16.2.1.1 COMPANY SNAPSHOT

16.2.1.2 PRODUCT PORTFOLIO

16.2.1.3 RECENT DEVELOPMENT

16.2.2 HWI DISTRIBUTION GROUP.

16.2.2.1 COMPANY SNAPSHOT

16.2.2.2 PRODUCT PORTFOLIO

16.2.2.3 RECENT DEVELOPMENT

16.2.3 LUOYANG ZHONGSEN REFRACTORY CO., LTD.

16.2.3.1 COMPANY SNAPSHOT

16.2.3.2 PRODUCT PORTFOLIO

16.2.3.3 RECENT DEVELOPMENT

16.2.4 PRATAP CORPORATION

16.2.4.1 COMPANY SNAPSHOT

16.2.4.2 PRODUCT PORTFOLIO

16.2.4.3 RECENT DEVELOPMENT

16.2.5 VESAVIUS

16.2.5.1 COMPANY SNAPSHOT

16.2.5.2 REVENUE ANALYSIS

16.2.5.3 PRODUCT PORTFOLIO

16.2.5.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTSR

Tabellenverzeichnis

TABLE 1 PRICING ANALYSIS

TABLE 2 EUROPE WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 4 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 5 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 6 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 8 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 9 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 10 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 13 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 14 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 17 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 EUROPE FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 EUROPE TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 21 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 EUROPE CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 EUROPE SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 EUROPE PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 EUROPE CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 EUROPE POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 EUROPE POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 30 EUROPE CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 EUROPE REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 EUROPE CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 EUROPE POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 EUROPE BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 EUROPE ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 EUROPE WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 38 EUROPE ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 EUROPE BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 EUROPE COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 EUROPE BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 EUROPE BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 EUROPE REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 EUROPE UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 EUROPE SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 EUROPE REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 EUROPE CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 EUROPE CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 EUROPE POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 EUROPE POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 EUROPE WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 52 EUROPE METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 EUROPE METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 EUROPE AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 EUROPE AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 EUROPE MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 EUROPE CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 EUROPE ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 EUROPE AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 EUROPE ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 61 EUROPE OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 EUROPE WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 63 EUROPE DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 EUROPE DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 EUROPE INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 EUROPE INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 EUROPE WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 68 EUROPE WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 69 EUROPE

TABLE 70 EUROPE WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 72 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 73 EUROPE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 74 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 75 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 76 EUROPE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 77 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 78 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 79 EUROPE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 80 EUROPE WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 81 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 EUROPE FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 EUROPE TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 EUROPE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 85 EUROPE CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 EUROPE SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 EUROPE PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 EUROPE POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 EUROPE WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 90 EUROPE WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 EUROPE ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 EUROPE BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 EUROPE COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 EUROPE BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 EUROPE REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 EUROPE UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 EUROPE SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 EUROPE CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 EUROPE POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 EUROPE WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 101 EUROPE METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 EUROPE AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 EUROPE WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 104 EUROPE DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 EUROPE INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 GERMANY WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 GERMANY MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 108 GERMANY MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 109 GERMANY MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 110 GERMANY MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 111 GERMANY MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 112 GERMANY MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 113 GERMANY SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 114 GERMANY SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 115 GERMANY SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 116 GERMANY WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 117 GERMANY ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 GERMANY FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 GERMANY TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 GERMANY ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 121 GERMANY CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 GERMANY SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 GERMANY PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 GERMANY POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 GERMANY WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 126 GERMANY WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 127 GERMANY ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 GERMANY BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 GERMANY COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 GERMANY BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 GERMANY REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 GERMANY UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 GERMANY SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 GERMANY CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 GERMANY POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 GERMANY WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 137 GERMANY METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 GERMANY AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 GERMANY WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 140 GERMANY DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 GERMANY INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 FRANCE WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 FRANCE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 144 FRANCE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 145 FRANCE MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 146 FRANCE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 147 FRANCE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 148 FRANCE MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 149 FRANCE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 150 FRANCE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 151 FRANCE SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 152 FRANCE WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 153 FRANCE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 FRANCE FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 FRANCE TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 FRANCE ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 157 FRANCE CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 FRANCE SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 FRANCE PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 FRANCE POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 FRANCE WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 162 FRANCE WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 163 FRANCE ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 FRANCE BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 FRANCE COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 FRANCE BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 FRANCE REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 FRANCE UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 FRANCE SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 FRANCE CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 FRANCE POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 FRANCE WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 173 FRANCE METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 FRANCE AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 FRANCE WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 176 FRANCE DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 FRANCE INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 ITALY WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 ITALY MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 180 ITALY MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 181 ITALY MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 182 ITALY MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 183 ITALY MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 184 ITALY MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 185 ITALY SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 186 ITALY SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 187 ITALY SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 188 ITALY WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 189 ITALY ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 ITALY FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 ITALY TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 ITALY ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 193 ITALY CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 ITALY SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 ITALY PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 ITALY POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 ITALY WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 198 ITALY WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 199 ITALY ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 ITALY BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 ITALY COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 ITALY BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 ITALY REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 ITALY UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 ITALY SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 ITALY CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 ITALY POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 ITALY WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 209 ITALY METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 ITALY AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 ITALY WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 212 ITALY DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 ITALY INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 U.K. WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 U.K. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 216 U.K. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 217 U.K. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 218 U.K. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 219 U.K. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 220 U.K. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 221 U.K. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 222 U.K. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 223 U.K. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 224 U.K. WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 225 U.K. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 U.K. FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 U.K. TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 U.K. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 229 U.K. CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 U.K. SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 U.K. PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 U.K. POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 U.K. WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 234 U.K. WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 235 U.K. ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 U.K. BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 U.K. COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 U.K. BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 U.K. REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 U.K. UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 U.K. SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 U.K. CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 U.K. POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 U.K. WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 245 U.K. METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 U.K. AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 U.K. WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 248 U.K. DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 U.K. INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 RUSSIA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 RUSSIA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 252 RUSSIA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 253 RUSSIA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 254 RUSSIA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 255 RUSSIA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 256 RUSSIA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 257 RUSSIA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 258 RUSSIA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 259 RUSSIA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 260 RUSSIA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 261 RUSSIA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 RUSSIA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 RUSSIA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 RUSSIA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 265 RUSSIA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 RUSSIA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 RUSSIA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 RUSSIA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 RUSSIA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 270 RUSSIA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 271 RUSSIA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 RUSSIA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 RUSSIA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 274 RUSSIA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 RUSSIA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 RUSSIA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 RUSSIA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 RUSSIA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 RUSSIA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 280 RUSSIA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 281 RUSSIA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 282 RUSSIA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 RUSSIA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 284 RUSSIA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 RUSSIA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 SPAIN WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 SPAIN MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 288 SPAIN MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 289 SPAIN MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 290 SPAIN MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 291 SPAIN MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 292 SPAIN MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 293 SPAIN SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 294 SPAIN SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 295 SPAIN SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 296 SPAIN WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 297 SPAIN ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 SPAIN FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 SPAIN TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 300 SPAIN ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 301 SPAIN CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 SPAIN SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 SPAIN PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 304 SPAIN POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 305 SPAIN WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 306 SPAIN WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 307 SPAIN ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 308 SPAIN BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)