Global Endocrinology Biosimilars Market

Marktgröße in Milliarden USD

CAGR :

%

USD

297.00 Million

USD

632.10 Million

2025

2033

USD

297.00 Million

USD

632.10 Million

2025

2033

| 2026 –2033 | |

| USD 297.00 Million | |

| USD 632.10 Million | |

|

|

|

|

Global Endocrinology Biosimilars Market Segmentation, By Product Type (Insulin Biosimilars and Growth Hormone Biosimilars), Indication ( Diabetes Management and Growth Hormone Deficiency )- Industry Trends and Forecast to 2033

Endocrinology Biosimilars Market Size

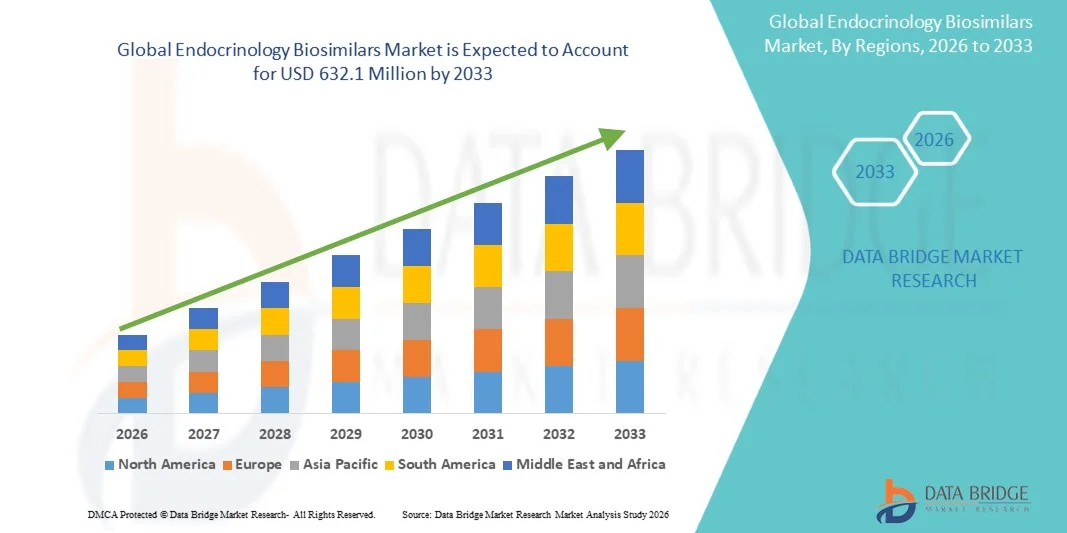

- The global endocrinology biosimilars market size was valued at USD 297 Million in 2025 and is expected to reach USD 632.1 Million by 2033, at a CAGR of 9.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of endocrine disorders, rising demand for affordable biologic therapies, and patent expiries of several originator biologics, leading to wider adoption of biosimilars in diabetes, growth hormone, and other endocrine treatments

- Furthermore, growing awareness among healthcare providers and patients, favorable reimbursement policies, and supportive government regulations are accelerating the uptake of Endocrinology Biosimilars solutions, thereby significantly boosting the industry's growth

Endocrinology Biosimilars Market Analysis

- Endocrinology biosimilars, including treatments for diabetes, growth hormone deficiencies, and other endocrine disorders, are increasingly vital components of modern healthcare due to their cost-effectiveness, comparable efficacy to originator biologics, and growing adoption among physicians and patients

- The escalating demand for endocrinology biosimilars is primarily fueled by the rising prevalence of endocrine disorders, patent expiries of several originator biologics, growing awareness among healthcare providers, and supportive government and payer policies encouraging biosimilar adoption

- North America dominated the endocrinology biosimilars market with the largest revenue share of approximately 38.6% in 2025, driven by strong healthcare infrastructure, high adoption rates of biosimilars, well-established reimbursement policies, and a strong presence of key industry players, particularly in the U.S., where early adoption and awareness are fueling market growth

- Asia-Pacific is expected to be the fastest growing region in the endocrinology biosimilars market during the forecast period, registering a robust CAGR of around 10.2%, supported by increasing prevalence of endocrine disorders, rising healthcare access, improving reimbursement policies, and expanding domestic pharmaceutical manufacturing capacities in countries such as India, China, and Japan

- The Diabetes Management segment dominated the largest market revenue share of 65% in 2025, due to the high prevalence of type 1 and type 2 diabetes worldwide, rising geriatric populations, and increasing government initiatives to improve access to cost-effective insulin therapies

Report Scope and Endocrinology Biosimilars Market Segmentation

|

Attributes |

Endocrinology Biosimilars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Endocrinology Biosimilars Market Trends

“Technological and Therapeutic Advancements in Endocrinology Biosimilars”

- A significant and accelerating trend in the global endocrinology biosimilars market is the growing development and adoption of next-generation biosimilar therapies for chronic endocrine disorders such as diabetes, growth hormone deficiencies, and thyroid disorders. Innovations in manufacturing techniques, formulation stability, and regulatory approvals are enhancing accessibility and affordability, making these treatments increasingly attractive to healthcare providers and patients alike

- For instance, pharmaceutical companies like Sandoz and Biocon have been actively developing biosimilar versions of established insulin analogs and recombinant growth hormones with improved stability and patient compliance features. These advancements are facilitating wider adoption in both developed and emerging markets, particularly across North America, Europe, and Asia-Pacific, where demand for cost-effective endocrine therapies is rising

- Advances in formulation technology, including long-acting insulin analogs and ready-to-use injection devices, are enabling improved dosing precision, reduced administration frequency, and enhanced patient adherence. For example, several recent biosimilar insulin products now offer pen-based delivery systems that simplify home administration and reduce injection-related anxiety among patients, particularly in pediatric and geriatric populations

- The increasing integration of pharmacovigilance and post-marketing surveillance programs is enhancing the safety monitoring of endocrinology biosimilars, providing clinicians with real-world evidence on efficacy and adverse events. This facilitates informed treatment decisions, fosters confidence among healthcare professionals, and encourages broader uptake of biosimilar therapies

- These developments are reshaping treatment paradigms in endocrinology by offering affordable, effective, and clinically comparable alternatives to originator biologics, ultimately expanding access to life-saving therapies for a larger patient population across global markets

- The demand for endocrinology biosimilars continues to grow, driven by the rising prevalence of chronic endocrine disorders, increasing healthcare expenditure, and supportive government policies that aim to reduce treatment costs and improve patient access

Endocrinology Biosimilars Market Dynamics

Driver

“Rising Incidence of Endocrine Disorders and Growing Patient Pool”

- The global increase in diabetes, growth hormone deficiency, and thyroid-related disorders is driving the demand for cost-effective treatment options, making endocrinology biosimilars a preferred alternative to expensive originator biologics

- For instance, the International Diabetes Federation (IDF) reported a significant rise in type 2 diabetes prevalence, particularly in Asia-Pacific and North America, encouraging healthcare systems to adopt biosimilar insulin therapies to improve affordability and patient coverage

- In addition, the aging population and rising obesity rates are contributing to a larger patient pool requiring endocrine interventions, further propelling market growth

- Furthermore, the introduction of patient-friendly delivery devices, such as prefilled pens, auto-injectors, and portable insulin pumps compatible with biosimilars, is increasing treatment adherence and satisfaction, particularly among pediatric, adolescent, and geriatric patients

- Healthcare initiatives and insurance coverage policies that promote cost-effective biologic alternatives are also encouraging physicians and hospitals to integrate biosimilars into standard treatment protocols, boosting market penetration

Restraint/Challenge

“Regulatory Complexity and High Development Costs”

- The relatively complex and stringent regulatory requirements for approval of endocrinology biosimilars pose a significant challenge to market entry. Manufacturers must demonstrate biosimilarity in terms of efficacy, safety, and immunogenicity compared to reference biologics, which requires extensive clinical trials and documentation

- For instance, biosimilar approval pathways set by the US FDA and EMA require rigorous pharmacokinetic, pharmacodynamic, and comparative clinical studies, resulting in high development costs and longer time-to-market for new products

- Furthermore, physician hesitation and patient concerns about the interchangeability and long-term safety of biosimilars can limit adoption, particularly in markets where originator biologics have established trust

- The high cost of production for certain biosimilar molecules, combined with challenges in cold-chain logistics, storage, and distribution, can constrain availability in emerging economies, slowing market penetration

- Overcoming these challenges through regulatory harmonization, enhanced awareness programs, cost-efficient manufacturing techniques, and collaborative partnerships between innovator and biosimilar manufacturers will be critical for sustained market growth in the endocrinology biosimilars sector

Endocrinology Biosimilars Market Scope

The market is segmented on the basis of product type and indication.

• By Product Type

On the basis of product type, the Endocrinology Biosimilars market is segmented into Insulin Biosimilars and Growth Hormone Biosimilars. The Insulin Biosimilars segment dominated the largest market revenue share of 61% in 2025, driven by the growing prevalence of diabetes globally, increased adoption of cost-effective insulin therapies, and reimbursement support in both developed and emerging countries. The segment benefits from robust clinical acceptance, extensive manufacturing pipelines, and patient familiarity with insulin regimens. Governments and healthcare payers encourage biosimilar adoption to reduce treatment costs, while hospitals and clinics favor insulin biosimilars due to ease of storage and administration. The ongoing innovation in long-acting and rapid-acting insulin formulations further reinforces market leadership, particularly in North America and Europe.

The Growth Hormone Biosimilars segment is expected to witness the fastest CAGR of 14.3% from 2026 to 2033, fueled by rising awareness of growth hormone deficiency (GHD) treatments in children and adults, increasing diagnosis rates, and improved access through government and private healthcare programs. Pharmaceutical companies are launching next-generation biosimilars with improved efficacy, safety profiles, and delivery devices, which accelerates adoption. The expansion of pediatric endocrinology centers and home-care administration of growth hormones also contributes to rapid market growth globally. Emerging markets in Asia-Pacific and Latin America are projected to drive a substantial portion of this CAGR.

• By Indication

On the basis of indication, the Endocrinology Biosimilars market is segmented into Diabetes Management and Growth Hormone Deficiency. The Diabetes Management segment dominated the largest market revenue share of 65% in 2025, due to the high prevalence of type 1 and type 2 diabetes worldwide, rising geriatric populations, and increasing government initiatives to improve access to cost-effective insulin therapies. This segment includes both long-acting and rapid-acting insulin biosimilars widely used in hospitals, clinics, and home care, with favorable reimbursement policies supporting adoption. The need for frequent glycemic control monitoring and growing awareness of diabetes complications sustain high demand for insulin biosimilars globally.

The Growth Hormone Deficiency segment is expected to witness the fastest CAGR of 13.8% from 2026 to 2033, driven by the increasing diagnosis of GHD, wider adoption of biosimilar therapies, and technological advancements in drug delivery systems such as prefilled pens and auto-injectors. Pediatric and adult endocrinology clinics are expanding globally, providing better access to treatments. The launch of cost-effective biosimilars compared to originator growth hormones further supports uptake in emerging economies. In addition, rising awareness campaigns and health insurance coverage enhancements accelerate market expansion.

Endocrinology Biosimilars Market Regional Analysis

- North America dominated the endocrinology biosimilars market with the largest revenue share of approximately 38.6% in 2025

- Driven by strong healthcare infrastructure, high adoption rates of biosimilars, well-established reimbursement policies, and a strong presence of key industry players, particularly in the U.S., where early adoption and awareness are fueling market growth

- The market is witnessing significant uptake of biosimilars across endocrinology therapies such as diabetes, growth hormone deficiencies, and thyroid disorders, supported by robust clinical acceptance and increasing patient awareness

U.S. Endocrinology Biosimilars Market Insight

The U.S. endocrinology biosimilars market captured the majority of North America’s revenue, fueled by rapid adoption of biosimilars in both hospital and outpatient settings. Factors such as proactive physician education, patient awareness campaigns, and favorable reimbursement policies are driving growth across diabetes, growth hormone, and thyroid therapy segments.

Europe Endocrinology Biosimilars Market Insight

The Europe endocrinology biosimilars market is projected to expand at a substantial CAGR during the forecast period, driven by increasing adoption of biosimilars across endocrine therapies, supportive government regulations, and rising healthcare spending. Countries such as Germany, the U.K., and France are witnessing growth due to well-established healthcare infrastructure and the presence of major biosimilar manufacturers.

U.K. Endocrinology Biosimilars Market Insight

The U.K. endocrinology biosimilars market is anticipated to grow steadily during the forecast period, supported by favorable reimbursement frameworks, increasing physician awareness, and government initiatives promoting cost-effective therapies. Rising prevalence of endocrine disorders and the growing adoption of biosimilars in hospital and clinical settings are driving market expansion.

Germany Endocrinology Biosimilars Market Insight

The Germany endocrinology biosimilars market is expected to grow at a considerable rate during the forecast period, fueled by increasing adoption of biosimilars, well-developed healthcare systems, and initiatives to reduce treatment costs. Awareness campaigns and collaborations between healthcare providers and pharmaceutical companies further support market penetration.

Asia-Pacific Endocrinology Biosimilars Market Insight

Asia-Pacific endocrinology biosimilars market is expected to be the fastest growing region in the Endocrinology Biosimilars market during the forecast period, registering a robust CAGR of around 10.2%, supported by increasing prevalence of endocrine disorders, rising healthcare access, improving reimbursement policies, and expanding domestic pharmaceutical manufacturing capacities in countries such as India, China, and Japan. Rapid growth in hospital infrastructure and awareness about biosimilars among physicians and patients are also key factors driving regional demand.

Japan Endocrinology Biosimilars Market Insight

The Japan endocrinology biosimilars market is gaining traction due to increasing adoption of biosimilars for diabetes, growth hormone deficiencies, and thyroid disorders. Supportive healthcare policies, high patient awareness, and technological advancements in pharmaceutical manufacturing are fueling market growth.

China Endocrinology Biosimilars Market Insight

The China endocrinology biosimilars market accounted for the largest revenue share in Asia-Pacific in 2025, driven by expanding healthcare infrastructure, rising prevalence of endocrine disorders, increasing government focus on cost-effective treatments, and strong domestic pharmaceutical manufacturing capabilities. China’s growing awareness of biosimilars and increasing approvals for endocrinology therapies are major factors propelling the market.

Endocrinology Biosimilars Market Share

The Endocrinology Biosimilars industry is primarily led by well-established companies, including:

- Biocon (India)

- Pfizer (U.S.)

- Amgen (U.S.)

- Samsung Bioepis (South Korea)

- Celltrion Healthcare (South Korea)

- Teva Pharmaceuticals (Israel)

- Stada Arzneimittel (Germany)

- Fresenius Kabi (Germany)

- Hetero Biopharma (India)

- Dr. Reddy’s Laboratories (India)

- Coherus BioSciences (U.S.)

- Glenmark Pharmaceuticals (India)

- Novartis (Switzerland)

- Merck & Co. (U.S.)

- AbbVie (U.S.)

- Genor Biopharma (China)

- Hansoh Pharmaceutical (China)

Latest Developments in Global Endocrinology Biosimilars Market

- In July 2021, the U.S. Food and Drug Administration (FDA) approved Semglee (insulin glargine‑vfgn) as an interchangeable biosimilar to the reference insulin product Lantus, marking one of the first interchangeable insulin biosimilars in the United States. This approval significantly expanded affordable treatment options for diabetes management and set a precedent for future interchangeable endocrinology biosimilars, encouraging wider adoption and competition in insulin therapy

- In April 2023, Eli Lilly and Company launched Rezvoglar (insulin glargine‑aglr), its second interchangeable insulin glargine biosimilar in the United States, further strengthening competition in the basal insulin segment. Rezvoglar’s market entry provided an additional accessible option for long‑acting insulin therapy, helping to address cost and access barriers for diabetes patients

- In September 2024, Sandoz announced the launch of a new insulin glargine biosimilar in selected Eastern European countries, aiming to enhance its endocrinology biosimilars footprint across regional markets. By targeting these emerging markets, Sandoz expanded access to cost‑effective insulin therapies and contributed to broader biosimilar availability beyond traditional Western markets

- In November 2024, Biocon Biologics received regulatory clearance to expand its insulin biosimilar supply to multiple European markets following successful manufacturing audits, reinforcing its global role in endocrinology biosimilars and enabling broader access to high‑quality insulin analogs in Europe

- In February 2025, the U.S. FDA approved Merilog (insulin‑aspart‑szjj) as a biosimilar to Novolog (insulin aspart), the first rapid‑acting insulin biosimilar product approved in the United States. This approval broadened treatment options for both adult and pediatric diabetes patients by introducing competition in the rapid‑acting insulin segment, addressing key unmet needs in mealtime glucose control

- In July 2025, the FDA granted approval to Kirsty (Insulin Aspart‑xjhz) as the first and only interchangeable biosimilar to NovoLog (insulin aspart) in the U.S. This milestone strengthened biosimilar insulin offerings by allowing automatic substitution at the pharmacy level, enhancing patient access and potentially lowering treatment costs

- In May 2025, Novo Nordisk announced a production partnership with Fujifilm Diosynth Biotechnologies to scale up manufacturing of insulin aspart biosimilars targeting Asian and European demand, underscoring strategic industry efforts to meet global needs for cost‑effective diabetes therapies through increased production capacity and geographic reach

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.