Globaler Fintech-Blockchain-Markt, nach Anwendung (Smart Contracts, Identitätsmanagement und andere), Anbieter (Middleware-Anbieter und andere), Unternehmensgröße (kleine und mittlere Unternehmen (KMU) und Großunternehmen), Branche (Banken und andere), Land (USA, Kanada, Mexiko, Brasilien, Argentinien, Restliches Südamerika, Deutschland, Frankreich, Italien, Großbritannien, Belgien, Spanien, Russland, Türkei, Niederlande, Schweiz, Restliches Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Restlicher asiatisch-pazifischer Raum, Vereinigte Arabische Emirate, Saudi-Arabien, Ägypten, Südafrika, Israel, Restlicher Naher Osten und Afrika). Branchentrends und Prognose bis 2029.

Marktanalyse und Einblicke Globaler Fintech-Blockchain-Markt

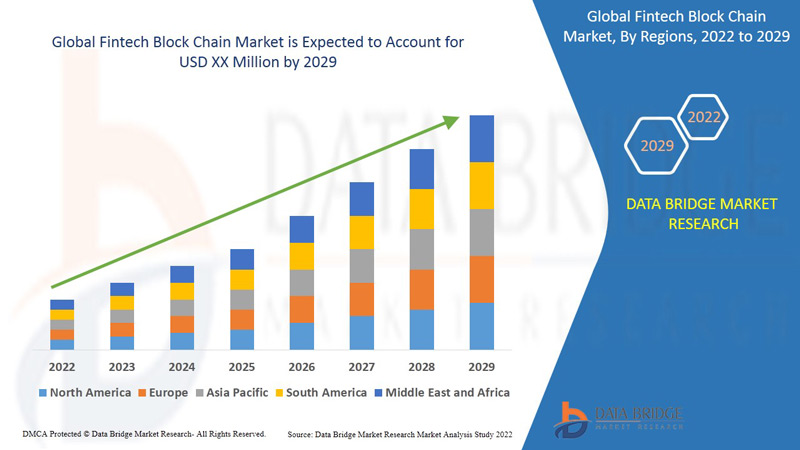

Laut einer Analyse von Data Bridge Market Research wird der Fintech-Blockchain-Markt im Prognosezeitraum 2022–2029 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 43,56 % aufweisen.

Die Daten aller Bitcoin-Austauschvorgänge, die jemals durchgeführt wurden, werden als Blockkette bezeichnet. Ein Block ist ein Teil der Blockkette, der einen Teil der laufenden Austauschvorgänge aufzeichnet und nach Abschluss in die permanente Datenbank eingeht.

Die zunehmende Kompatibilität mit Finanzdienstleistungen ist der Hauptfaktor, der das Wachstum des Fintech-Blockchain-Marktes beschleunigt. Darüber hinaus wird erwartet, dass die steigende Marktkapitalisierung von Kryptowährungen auf dem Aktienmarkt und eine neue Generation programmierbarer Blockchain-Plattformen, zunehmende Risikokapitalfinanzierungen und Investitionen in die Blockchain-Technologie das Wachstum der Fintech-Blockchain vorantreiben. Bedrohungen wie Sicherheit und Datenschutz schränken die Fintech-Blockchain jedoch ein, während das Datenschutzproblem bei Blockchain-Lösungen und Kontrollherausforderungen das Wachstum des Fintech-Blockchain-Marktes behindern werden.

Darüber hinaus werden das wachsende E-Commerce- Geschäft und neue Technologien für Investitionen in Online-Unternehmen reichlich Gelegenheiten für die Fintech-Blockchain schaffen.

Dieser Bericht zum Fintech-Blockchain-Markt enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Fintech-Blockchain-Markt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analyst Brief zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Globaler Fintech-Blockchain-Marktumfang und Marktgröße

Der Fintech-Blockchain-Markt ist nach Anwendung, Anbieter, Unternehmensgröße und Branche segmentiert. Das Wachstum in den verschiedenen Segmenten hilft Ihnen dabei, Erkenntnisse über die verschiedenen Wachstumsfaktoren zu gewinnen, die voraussichtlich auf dem gesamten Markt vorherrschen werden, und verschiedene Strategien zu entwickeln, um die wichtigsten Anwendungsbereiche und die Unterschiede in Ihrem Zielmarkt zu identifizieren.

- Basierend auf der Anwendung ist der Fintech-Blockchain-Markt in Zahlungen, Clearing und Abwicklung, Börsen und Überweisungen, Smart Contracts, Identitätsmanagement, Compliance-Management/Know Your Customer (KYC) und Sonstiges (Cyber-Haftung und Content-Storage-Management) segmentiert.

- Basierend auf dem Anbieter ist der Fintech-Blockchain-Markt in Anwendungs- und Lösungsanbieter, Middleware-Anbieter sowie Infrastruktur- und Protokollanbieter segmentiert.

- Basierend auf der Unternehmensgröße ist der Fintech-Blockchain-Markt in kleine und mittlere Unternehmen (KMU) sowie große Unternehmen segmentiert.

- Basierend auf der Branchenvertikale ist der Fintech-Blockchain-Markt in die Bereiche Banken und Sonstige segmentiert.

Fintech Blockchain Markt – Länderebene Analyse

Der Fintech-Blockchain-Markt wird analysiert und Informationen zu Marktgröße und Volumen werden wie oben angegeben nach Land, Anwendung, Anbieter, Organisationsgröße und Branche bereitgestellt.

Die im Fintech-Blockchain-Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in der Asien-Pazifik-Region (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten, Südafrika, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil Südamerikas.

Nordamerika dominiert den Fintech-Blockchain-Markt und wird seinen dominanten Trend im Prognosezeitraum aufgrund des dort entwickelten E-Commerce und der großen Investoren im Online-Geschäftsmarkt in der Region weiter ausbauen. Der asiatisch-pazifische Raum wird jedoch aufgrund des wachsenden Bewusstseins für Online-Investitionen und der Bereitstellung neuer Plattformen für den E-Commerce durch die Regierung in dieser Region die höchste durchschnittliche jährliche Wachstumsrate für diesen Zeitraum verzeichnen.

Der Länderabschnitt des Fintech-Blockchain-Marktberichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Verbrauchsmengen, Produktionsstandorte und -mengen, Import-Export-Analyse, Preistrendanalyse, Rohstoffkosten, Downstream- und Upstream-Wertschöpfungskettenanalyse sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Wettbewerbsumfeld und Fintech Block Chain Marktanteilsanalyse

Die Wettbewerbslandschaft des Fintech-Blockchain-Marktes liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich nur auf den Fokus der Unternehmen auf den Fintech-Blockchain-Markt.

Die wichtigsten Akteure im Fintech-Blockchain-Marktbericht sind unter anderem IBM, Microsoft, Ripple, Chain, Earthport, Bitfury Group Ltd., Bllomberg LP, Oracle, DigitalAssesment Holdings LLC, The Circle Group of Companies, Factom, AlphaPoint, Coinbase, Abra, AuxesisServices and Technologies Pvt. Ltd., BitPay, BlockCypher Inc., Applied Blockchain Ltd., RecordesKeeper, Symbiont Group Holdings Pvt. Ltd., Guardtime, Cambridge Bitfury Group Limited., TIBCO Software Inc., Applied Blockchain Ltd, GUARDTIME, OARO, Peer Ledger Inc., Venture Proxy Ltd., Datex Corporation, Omnichain Solutions, Amazon Web Services, Inc., Bitnation, Blockverify, BTL Group Ltd., Cambridge Blockchain, LLC, OpenXcell Blockchain, Tradle und Blockchain Advisory Mauritius Foundation.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.