Global Medical Aesthetics Market

Marktgröße in Milliarden USD

CAGR :

%

USD

21.86 Billion

USD

56.70 Billion

2024

2032

USD

21.86 Billion

USD

56.70 Billion

2024

2032

| 2025 –2032 | |

| USD 21.86 Billion | |

| USD 56.70 Billion | |

|

|

|

|

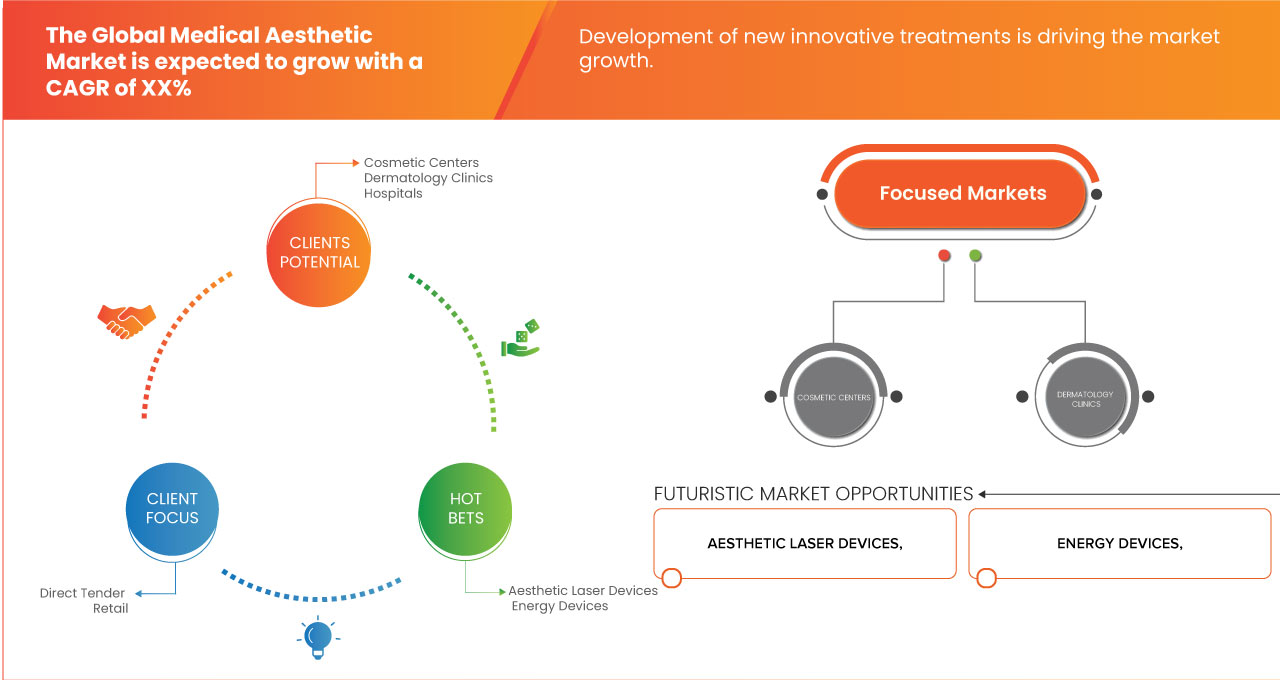

Global Medical Aesthetic Market Segmentation, By Product Type (Aesthetic Laser Devices, Energy Devices, Body Contouring Devices, Facial Aesthetic Devices, Aesthetic Implants, and Skin Aesthetic Devices), Application (Anti-Aging and Wrinkles, Facial and Skin Rejuvenation, Breast Enhancement, Body Shaping and Cellulite, Tattoo Removal, Vascular Lesions, Sears, Pigment Lesions, Reconstructive, Psoriasis and Vitiligo, and Others), End User (Cosmetic Centers, Dermatology Clinics, Hospitals, and Medical Spas and Beauty Centers), Distribution Channel (Direct Tender and Retail) - Industry Trends And Forecast To 2032

Global Medical Aesthetic Market Analysis

Medical aesthetic has a rich history that dates backs in ancient civilizations, where beauty treatments were practiced using natural remedies and early forms of cosmetic procedures. In the early 20th century, medical aesthetics began to merge with advancements in medical technology, with innovations such as the first injectable collagen for wrinkle treatment in the 1970s. The development of Botox in the 1980s marked a major milestone, introducing non-surgical facial rejuvenation. Over the decades, the field expanded with the advent of laser technologies, dermal fillers, and non-invasive body contouring treatments. Today, medical aesthetics combines advanced technology with the growing desire for non-invasive cosmetic procedures, making it a rapidly growing industry in global healthcare.

Global Medical Aesthetic Market Size

Global medical aesthetic market size was valued at USD 21.86 billion in 2024 and is projected to reach USD 56.70 billion by 2032, with a CAGR of 12.7% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Global Medical Aesthetic Market Trends

“Increasing Demand for Non-Surgical Procedures”

The global medical aesthetic market is witnessing a significant trend toward non-surgical cosmetic procedures, driven by advancements in technology, minimal recovery times, and increasing consumer preference for less invasive treatments. Procedures such as Botox injections, dermal fillers, laser treatments, and non-surgical body contouring are becoming increasingly popular as individuals seek to enhance their appearance without the risks and downtime associated with traditional surgeries. The growing awareness about aesthetic treatments, coupled with social media's influence on beauty standards, has contributed to this surge in demand. In addition, the rise in disposable income, coupled with aging populations in developed markets, is fueling the market's expansion. The increasing availability of innovative, personalized treatments and the growing acceptance of medical aesthetics in mainstream society further accelerate this trend, positioning non-surgical options as the preferred choice for many consumers.

Report Scope and Global Medical Aesthetic Market Segmentation

|

Attributes |

Global Medical Aesthetic Market Insights |

|

Segments Covered |

|

|

Region Covered |

U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Russia, Belgium, Netherlands, Turkey, Rest of Europe, China, India, Japan, South Korea, Australia, Indonesia, Thailand, Malaysia, Philippines, Singapore, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., and Rest of Middle East and Africa |

|

Key Market Players |

Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.), Allergan (A Subsidiary of AbbVie Inc.) (Ireland), GALDERMA (Switzerland), Cutera, Inc. (U.S.), Lumenis Be Ltd. (Israel), Densply Sirona (U.S.), Institut Straumann AG (U.S.), Candela Corporation (U.S.), Medytrox (South Korea), BioHorizons(U.S.), BTL (India), Nobel Biocare Services AG (Switzerland), Merz Pharma (Germany), Cynosure, LLC (U.S.), Sharplight Technologies Inc. (Israel), Alma Lasers (U.S.), MEGA'GEN IMPLANT CO., LTD. (India), 3M (U.S), Quanta System (Italy), Sciton (California) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Medical Aesthetic Market Definition

Medical aesthetics includes all medical treatments that are focused on improving the cosmetic appearance of patients. Medical aesthetics sits in a beautiful little niche in between the beauty industry and plastic surgery. Qualified doctors, nurses, or dentists can provide a multitude of stunning treatments to improve your appearance. These treatments require a high degree of skill, training, and knowledge of your anatomy and physiology. This is what separates medical aesthetic treatments from beauty treatments such as eyebrow threading, waxing, or eyelash extensions. On the other hand, medical aesthetic treatments are not as aggressive as surgical interventions (aesthetic medical treatments are sometimes referred to as non-surgical cosmetic treatments), which includes procedures like facelifts, breast augmentations, or liposuction.

Global Medical Aesthetic Market Definition Dynamics

Drivers

- Increase in the Ageing Population

The increase in the aging population significantly drives the aesthetic services market due to the growing desire among older adults to maintain a youthful appearance and enhance their quality of life. As people age, they often experience a decline in skin elasticity, the emergence of wrinkles, and other signs of aging that can impact self-esteem and overall well-being. This demographic shift has led to a higher demand for various aesthetic treatments, including non-invasive procedures such as botox, dermal fillers, and skin rejuvenation therapies. The increasing awareness of these aesthetic options, coupled with a cultural emphasis on beauty and appearance, prompts older adults to seek out solutions that allow them to look as vibrant as they feel, thus fueling the market growth.

For instance,

- In September 2022, according to an article published by The Nation, Thailand's health & aesthetics industry has been driven by the ageing population in the country. Moreover, according to the same source, as of December 31 last year, 12.24 million or 18.5% of Thailand’s population were aged 60 or above

- In January 2024, according to the news published by PRB, a significant increase in the aging population in the United States, with the number of Americans aged 65 and older projected to rise from 17% to 23% by 2060. This demographic shift drives the global medical aesthetics market as older adults seek treatments to address age-related concerns like wrinkles, sagging skin, and volume loss. The growing demand for anti-aging procedures, such as Botox, dermal fillers, and skin rejuvenation treatments, fuels market growth and innovation in aesthetic products and services

- In May 2023, according to the news published in The U.S. Census Bureau, the report highlights a 38.6% increase in the U.S. population aged 65 and over from 2010 to 2020, driving demand for anti-aging treatments such as Botox and dermal fillers, thus fueling growth in the global medical aesthetics market

Moreover, the rise in disposable income among the aging population further contributes to the expansion of the aesthetic services market. As the older adults seek to invest in their personal appearance and wellness, they are more willing to spend on enhancement treatments.

In conclusion, advancements in technology have made aesthetic procedures safer, minimally invasive, and more accessible, attracting a broader segment of older adults who may have previously been hesitant about such interventions. This convergence of demographic trends, increasing disposable incomes, and enhanced service offerings presents significant growth for the aesthetic services sector, driving innovation and competition among providers.

- Changing Beauty Standards and Social Media Influence

Evolving beauty standards and the influence of social media platforms significantly drive the demand for medical aesthetics treatments. Social media platforms such as Instagram and TikTok showcase idealized beauty standards, encouraging individuals to seek aesthetic enhancements to achieve similar looks. Influencers and celebrities often promote aesthetic treatments, making them more mainstream and desirable. This trend leads to increased awareness and acceptance of medical aesthetics, driving market growth.

For instance,

- In June 2023, according to an article published in The National Library of Medicine, the increasing demand for medical aesthetics driven by the aging population and advancements in technology. As people age, they seek treatments to address signs of aging, such as wrinkles and sagging skin. Technological advancements have made these treatments more effective and accessible, further driving market growth. In addition, the growing awareness and acceptance of aesthetic procedures contribute to the expanding market

- In July 2024, according to an article published in ResearchGate, social media had a significant influence on body image and cosmetic surgery considerations. Social media platforms often portray idealized beauty standards, leading individuals to seek aesthetic enhancements to achieve similar looks. This trend drives the demand for medical aesthetics treatments, as people are increasingly influenced by the images and lifestyles they see online. The review underscores the role of social media in shaping perceptions of beauty and the growing acceptance of cosmetic procedures, thereby fueling market growth

The global medical aesthetics market is propelled by changing beauty standards and the pervasive influence of social media. As individuals strive to meet these evolving ideals, the demand for aesthetic treatments continues to rise, fostering innovation and expansion within the industry.

Opportunities

- Development of New Innovative Treatments

The introduction of new and innovative treatments presents a significant opportunity for the medical aesthetic market. With advancements in medical technology, aesthetic treatments have evolved to include non-invasive, highly effective options that cater to the growing demand for improved results with minimal downtime. Treatments such as stem cell therapies, advanced laser techniques, and non-surgical face lifts are reshaping the market by providing consumers with a wider array of choices that meet their diverse needs and preferences. These innovations not only enhance the effectiveness and safety of treatments but also reduce the risks associated with more traditional surgical procedures. As consumers increasingly seek cutting-edge solutions to maintain their youthfulness and enhance their appearance, the demand for these advanced aesthetic services continues to rise. This shift towards newer, more effective treatments acts as a key opportunity, driving growth in the market and positioning it for long-term expansion as technology continues to transform the industry.

For instance,

- In February 2022, according to the article published by Science Direct, Stem cells, originally used for chronic degenerative diseases, are now emerging as a promising, minimally invasive treatment in aesthetics. This shift towards stem cell therapies offers effective solutions for skin rejuvenation and anti-aging, attracting growing consumer interest. As this innovative treatment gains traction, it presents a significant opportunity for the Southeast Asia aesthetic services market to expand and evolve

- In August 2021, according to the article published by NCBI, Stem cells, particularly adipose-derived ones, are gaining popularity in cosmetic dermatology due to their ability to self-renew and differentiate into various cell types. Their ease of collection and abundance make them an attractive option for aesthetic treatments, such as skin rejuvenation. This innovation presents a valuable opportunity for the Southeast Asia aesthetic services market to grow and diversify its offerings

- In January 2023, according to the article published in MedEsthetics Magazine, significant technological innovations driving growth in the medical aesthetic market. These advancements include new-age painless procedures, advanced devices, fractional resurfacing, third-generation ultrasound-assisted lipoplasty, and advanced skin imaging. The integration of VR, AR, AI, CAD, telemedicine, and IoT enhances the accuracy and efficiency of procedures, making them more precise and less invasive

- In February 2024, according to the article published in MDPI, the advancements in regenerative medicine for aesthetic dermatology focusing on innovative, minimally invasive treatments for facial rejuvenation and regeneration. The close correlation between tissue repair, regeneration, and aging has paved the way for applying regenerative medicine principles in cosmetic dermatology

The introduction of new and advanced treatments offers a valuable opportunity for the medical aesthetic market. Innovations such as stem cell therapies, improved laser treatments, and non-surgical face lifts provide consumers with safer, more effective options that require less recovery time. These advancements cater to the growing demand for non-invasive procedures and appeal to those seeking better, longer-lasting results. As these treatments gain popularity, they create strong demand, acting as a key driver for market growth and positioning it for continued expansion.

- Medical Partnerships and Innovations

Medical partnerships and innovations present a significant opportunity for the medical aesthetic market by enhancing the credibility and quality of services offered. Collaborations between aesthetic service providers and qualified medical professionals, such as dermatologists and plastic surgeons, ensure that treatments are not only effective but also safe for consumers. These partnerships also allow for the integration of advanced medical technologies and techniques into aesthetic procedures, making services more reliable and attractive to a broader customer base. With trusted medical professionals involved, consumers feel more confident in the procedures, leading to increased demand for aesthetic services. Moreover, such collaborations open doors to developing new, cutting-edge treatments that address emerging consumer needs. This alliance between aesthetics and medicine drives growth in the market by positioning it as a trusted, innovative, and high-quality sector.

For instance,

- Laut dem in The Nation veröffentlichten Artikel positioniert sich MASTER im November 2024 durch seine Partnerschaft mit dem indonesischen „Lumeo Health“ als führender Anbieter kosmetischer Chirurgie in Südostasien. Diese Zusammenarbeit fördert Innovationen und verbessert medizinische Partnerschaften, indem sie einem wachsenden Markt fortschrittliche ästhetische Dienstleistungen anbietet. Durch die Kombination von Fachwissen und Ressourcen eröffnet diese Allianz neue Möglichkeiten für einen erweiterten Zugang, hochmoderne Behandlungen und verbesserte Patientenergebnisse und fördert so das Wachstum im ästhetischen Sektor.

- Laut dem von Health365 veröffentlichten Artikel markiert die im Oktober 2023 geschlossene Partnerschaft mit dem Bangkok Hospital einen bedeutenden Schritt zur Verbesserung der ästhetischen Dienstleistungen in Südostasien. Durch die Kombination der Expertise von Health365 mit der medizinischen Innovation des Bangkok Hospital fördert diese Zusammenarbeit den Zugang zu erstklassigen Behandlungen und fortschrittlichen Technologien. Diese strategische Allianz bietet eine wertvolle Gelegenheit, den Markt für ästhetische Dienstleistungen in der Region zu stärken, das Wachstum voranzutreiben und die Patientenversorgung zu verbessern.

Medizinische Partnerschaften stellen eine wertvolle Chance für den Markt für medizinisch-ästhetische Dienstleistungen dar, da sie die Glaubwürdigkeit und Qualität der Dienstleistungen verbessern. Die Zusammenarbeit zwischen ästhetischen Anbietern und qualifiziertem medizinischem Fachpersonal stellt sicher, dass die Behandlungen sicher und wirksam sind, und stärkt das Vertrauen der Verbraucher. Diese Partnerschaften erleichtern auch die Einführung fortschrittlicher Techniken und Technologien und ziehen so eine breitere Kundenbasis an. Durch die Kombination medizinischer Expertise mit ästhetischer Innovation erlebt der Markt Wachstum und eine erhöhte Nachfrage.

Einschränkungen/Herausforderungen

- Mangel an ausgebildeten Fachkräften

Der Mangel an ausgebildeten Fachkräften im Markt für ästhetische Dienstleistungen behindert das Wachstum und die Verbreitung dieser Dienstleistungen erheblich. Ästhetische Verfahren, die oft spezielle Fähigkeiten und Kenntnisse erfordern, erfordern eine Belegschaft, die mit den neuesten Technologien, Techniken und Sicherheitsprotokollen vertraut ist. Der Mangel an zertifizierten Fachkräften schränkt die Verfügbarkeit von Dienstleistungen ein und birgt Risiken für die Patientensicherheit, was zu potenziellen Komplikationen und Unzufriedenheit mit den Ergebnissen führen kann. Dadurch entsteht ein Kreislauf, in dem Verbraucher zögern, ästhetische Angebote in Anspruch zu nehmen, was das Marktwachstum weiter stagnieren lässt.

Zum Beispiel,

- Laut einem im August 2023 von The Malaysian Reserve veröffentlichten Artikel stellt Unwissenheit oder mangelndes Bewusstsein in Bezug auf riskante ästhetische Verfahren, die von Kosmetikerinnen oder nicht lizenzierten Praktikern in Malaysia durchgeführt werden, eine ernsthafte Bedrohung für die Verbraucher dar. Die Verwendung minderwertiger Produkte oder unhygienischer Praktiken kann zu ernsthaften Gesundheitsproblemen, Infektionen oder irreversiblen Schäden führen. Darüber hinaus macht das Fehlen behördlicher Aufsicht die Verbraucher anfällig für betrügerische Praktiken, was es ihnen erschwert, im Falle von Behandlungsfehlern oder Nebenwirkungen Rechtsmittel einzulegen.

- Im Juli 2019 hieß es in einem Artikel mit dem Titel „Verband fördert qualifizierte Kosmetikerinnen in Malaysia“, dass es lokalen Schätzungen zufolge 20.000 nicht zertifizierte Kosmetikerinnen im Vergleich zu nur 200 zertifizierten Inhabern von Berufsqualifikationen gebe. Dies stellt die Branche vor die Herausforderung, ihre Standards bei der Bereitstellung ästhetischer Dienstleistungen aufrechtzuerhalten.

- Im Oktober 2024, so der in The Evaluation Company veröffentlichte Artikel, besteht in den USA ein erheblicher Mangel an medizinischem Personal, der den globalen Markt für medizinische Ästhetik behindert. Der Mangel betrifft nicht nur Ärzte, sondern auch Krankenschwestern und andere Angehörige der Gesundheitsberufe, was zu längeren Wartezeiten und einer geringeren Verfügbarkeit ästhetischer Behandlungen führt. Dieser Mangel an qualifizierten Fachkräften kann das Wachstum und die Expansion des Marktes für medizinische Ästhetik einschränken, da die Nachfrage nach qualifizierten Fachkräften das Angebot übersteigt

Darüber hinaus kann dieser Mangel an Fachkräften Kliniken und Dienstleister daran hindern, ihre Betriebe zu skalieren oder ihr Angebot zu erweitern. Während die Nachfrage nach ästhetischen Dienstleistungen weiter steigt, insbesondere bei jüngeren Bevölkerungsgruppen, die nicht-invasive Behandlungen suchen, wird die Fähigkeit, diese Nachfrage zu decken, durch einen begrenzten Pool an qualifizierten Fachkräften behindert. Diese Herausforderung wirkt sich auf den Ruf und das Vertrauen der Marke aus, da Kunden eher Einrichtungen wählen, die für ihr qualifiziertes und erfahrenes Personal bekannt sind. Ohne gezielte Schulungsprogramme und unterstützende Initiativen zur Förderung von Gesundheitsfachkräften im Bereich Ästhetik bleibt das Potenzial des globalen Marktes für medizinische Ästhetik daher ungenutzt.

- Risiko von Nebenwirkungen im Zusammenhang mit diesen Verfahren

Das Risiko von Nebenwirkungen im Zusammenhang mit ästhetischen Eingriffen stellt eine erhebliche Einschränkung für den Markt für medizinisch-ästhetische Eingriffe dar, da es bei potenziellen Kunden Befürchtungen hervorruft. Viele kosmetische Eingriffe, ob chirurgisch oder nicht-chirurgisch, bergen das inhärente Risiko von Komplikationen wie Infektionen, Narbenbildung oder unbefriedigenden Ergebnissen. Diese Angst vor Nebenwirkungen kann Menschen davon abhalten, diese Dienste in Anspruch zu nehmen, da Verbraucher über soziale Medien und Online-Plattformen zunehmend über die Erfahrungen anderer, einschließlich negativer Ergebnisse, informiert werden. Folglich kann das Potenzial für Nebenwirkungen den Eindruck erwecken, dass diese Eingriffe das Risiko nicht wert sind, was zu einer geringeren Nachfrage und Beteiligung am Markt führt.

Zum Beispiel,

- Im Oktober 2024 hieß es in einem Artikel mit dem Titel „Gefahren der kosmetischen Chirurgie in Thailand von Dr. Ehsan Jadoon“, dass die mit der kosmetischen Chirurgie verbundenen Gefahren Schwellungen, Blutergüsse, Infektionen, allergische Reaktionen, asymmetrische Ergebnisse, Gefäßverletzungen, Nerventraumata, Sehstörungen, psychische Traumata und schwere Körperschäden umfassen.

- Laut einem im Oktober 2024 im Journal of Cutaneous and Aesthetic Surgery veröffentlichten Artikel werden viele unerwünschte Ereignisse aufgrund fehlender Regulierung und mangelnder Durchsetzung nicht gemeldet, da Eingriffe häufig in nicht-medizinischen Einrichtungen wie Spas und Schönheitssalons durchgeführt werden. Dieser Mangel an Aufsicht kann zu Komplikationen wie Fettnekrose, Infektionen und anderen Nebenwirkungen führen, insbesondere wenn unerfahrene Ärzte Eingriffe durchführen. Die Angst vor negativer Medienberichterstattung und niedrigen Melderaten verschärfen diese Probleme noch weiter, sodass es für die Branche von entscheidender Bedeutung ist, strenge Risikobewertungs- und Präventionsmaßnahmen umzusetzen, um die Patientensicherheit zu gewährleisten und das Marktwachstum aufrechtzuerhalten

- Im August 2020 hieß es in der im PMFA Journal veröffentlichten Meldung: Komplikationen können durch verschiedene Faktoren entstehen, darunter Patientenauswahl, Injektionstechniken und die inhärenten Risiken der Verfahren selbst. Diese Komplikationen können von kleineren Problemen wie Blutergüssen und Schwellungen bis hin zu schwerwiegenderen Problemen wie Infektionen, Gefäßverschlüssen und allergischen Reaktionen reichen. Die Angst vor diesen potenziellen Komplikationen kann Menschen davon abhalten, ästhetische Behandlungen in Anspruch zu nehmen, und so das Marktwachstum einschränken.

Darüber hinaus verstärkt der Einfluss lokaler Gesundheitssysteme und regulatorischer Rahmenbedingungen die Bedenken hinsichtlich Nebenwirkungen in der Region noch weiter. Wenn Personen den Eindruck haben, dass die Sicherheit in einer Klinik nicht an erster Stelle steht oder sie sich nicht an strenge Gesundheitsvorschriften hält, sind sie möglicherweise weniger geneigt, ästhetische Behandlungen in Anspruch zu nehmen. Diese Skepsis kann durch Medienberichte über verpfuschte Eingriffe und unsichere Praktiken noch verstärkt werden, was potenzielle Kunden vor den damit verbundenen Risiken schreckt. Infolgedessen bremst die Angst vor Nebenwirkungen nicht nur das individuelle Interesse, sondern stellt auch eine Herausforderung für das Marktwachstum dar, da Unternehmen versuchen, das Vertrauen der Verbraucher in ihre Dienstleistungen zu gewinnen.

Globaler Marktumfang für medizinische Ästhetik

Der Markt ist nach Produkten, Anwendungen, Endbenutzern und Vertriebskanälen segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Ästhetische Lasergeräte

- Geräte zur ablativen Hauterneuerung

- CO2 Laser

- Erbium-Laser

- Sonstiges

- Nicht-ablative fraktionierte Laser-Oberflächenerneuerungsgeräte

- Radiofrequenz

- Intensives gepulstes Licht

- Fraktionierter Laser

- Der gütegeschaltete ND:YAG-Laser

- Sonstiges

- Energiegeräte

- Geräte für die Laserchirurgie

- Elektrokauterisationsgeräte

- Elektrochirurgiegeräte

- Kryochirurgiegeräte

- Harmonisches Skalpell

- Mikrowellengeräte

- Geräte zur Körperformung

- Fettabsaugung

- Nichtchirurgische Hautstraffung

- Cellulite-Behandlung

- Geräte zur Gesichtsästhetik

- Botox-Injektion

- Hautfüller

- Natürliche Hautfüller

- Synthetische Hautfüller

- Kollagen-Injektionen

- Chemisches Peeling

- Gesichtsstraffung

- Fraxel

- Kosmetische Akupunktur

- Elektrotherapie

- Mikrodermabrasion

- Permanent Make-up

- Ästhetische Implantate

- Brustvergrößerung

- Kochsalzimplantate

- Silikonimplantate

- Gesäßvergrößerung

- Ästhetische Zahnimplantate

- Zahnimplantate aus Titan

- Dentale Zerconium-Implantate

- Gesichtsimplantate

- Weichgewebeimplantate

- Transdermales Implantat

- Sonstiges

- Geräte zur Hautästhetik

- Geräte zur Laser-Hauterneuerung

- Nicht-chirurgische Geräte zur Hautstraffung

- Lichttherapiegeräte

- Geräte zur Tattooentfernung

- Micro-Needling Produkte

- Produkte zum Fadenlifting

- Lasergeräte zur Nagelbehandlung

- Sonstiges

Anwendung

- Anti-Aging und Falten

- Gesichts- und Hautverjüngung

- Brustvergrößerung

- Körperformung und Cellulite

- Tattooentfernung

- Gefäßläsionen

- Sears, Pigmentläsionen, Rekonstruktive

- Psoriasis und Vitiligo

- Sonstiges

Endbenutzer

- Kosmetische Zentren

- Dermatologische Kliniken

- Krankenhäuser

- Medizinische Spas und Schönheitszentren

Vertriebskanal

- Direkte Ausschreibung

- Einzelhandel

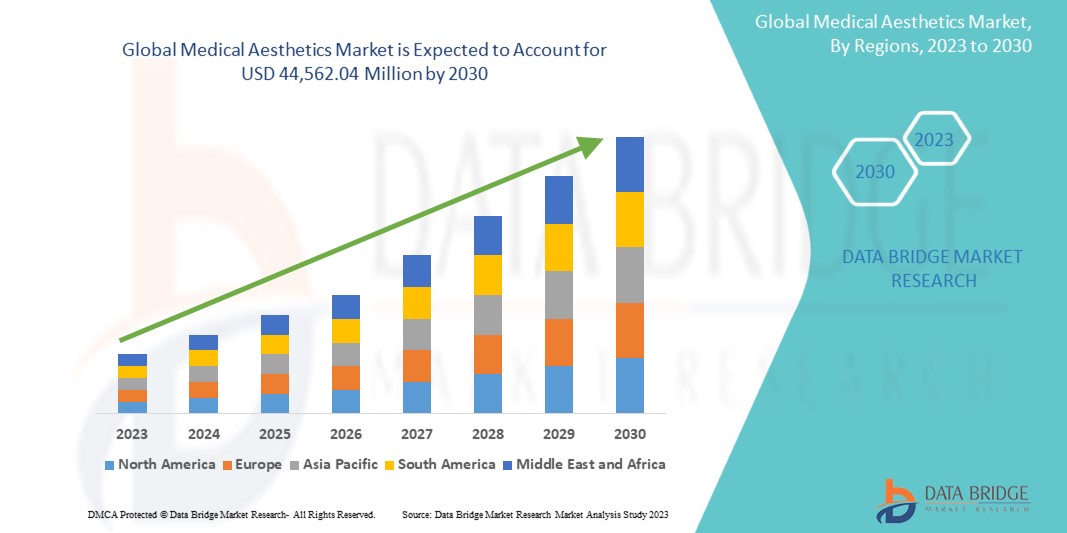

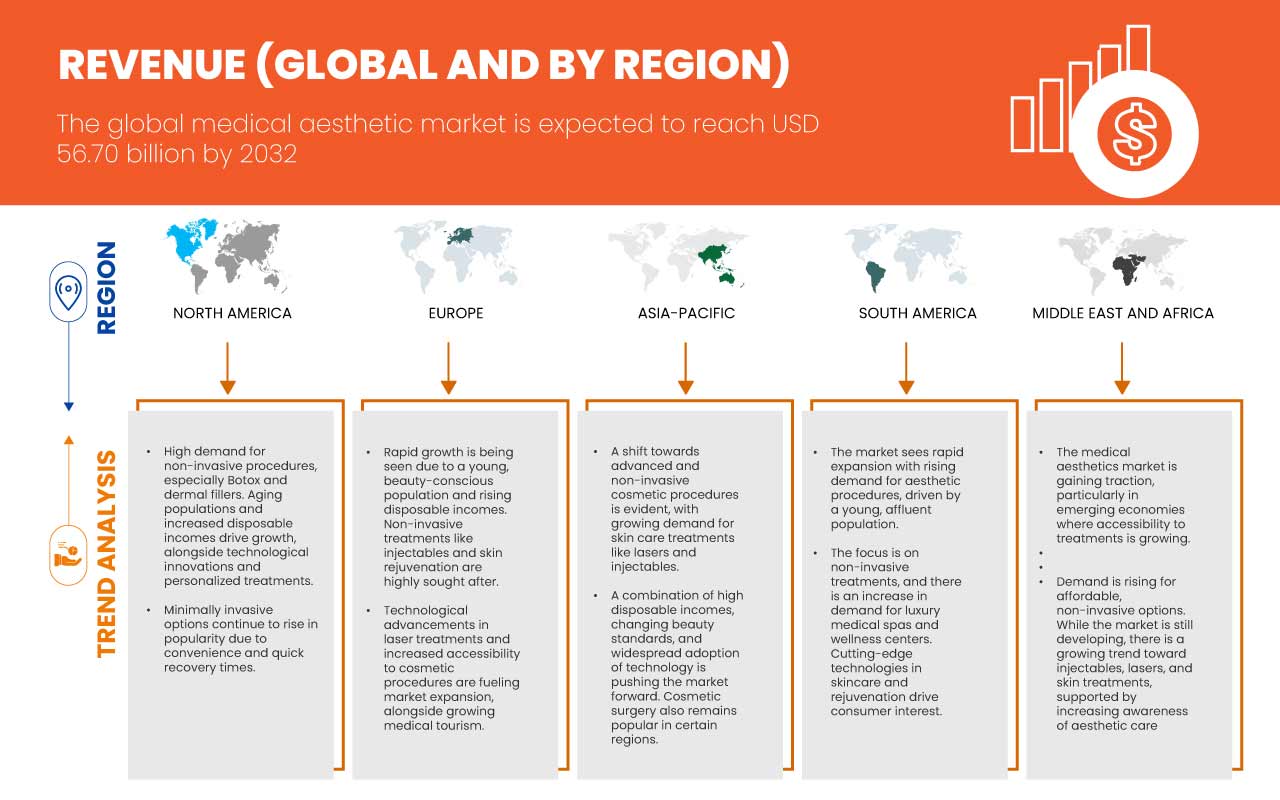

Globale regionale Analyse des medizinischen Ästhetikmarktes

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkten, Anwendungen, Endbenutzern und Vertriebskanälen wie oben angegeben bereitgestellt.

Die vom Markt abgedeckten Regionen umfassen die USA, Kanada, Mexiko, Deutschland, Frankreich, Großbritannien, Italien, Spanien, die Schweiz, Russland, Belgien, die Niederlande, die Türkei, das übrige Europa, China, Indien, Japan, Südkorea, Australien, Indonesien, Thailand, Malaysia, die Philippinen, Singapur, den übrigen asiatisch-pazifischen Raum, Brasilien, Argentinien, den übrigen Südamerika, Südafrika, Saudi-Arabien, die Vereinigten Arabischen Emirate sowie den übrigen Nahen Osten und Afrika.

Aufgrund der hohen Verbrauchernachfrage, der fortschrittlichen Gesundheitsinfrastruktur und der hohen Ausgaben für kosmetische Eingriffe wird Nordamerika voraussichtlich den Markt dominieren. Darüber hinaus tragen die Präsenz führender ästhetischer Marken und der Fokus auf Innovationen bei nicht-chirurgischen Behandlungen weiter zur Marktführerschaft der Region bei.

Der asiatisch-pazifische Raum dürfte aufgrund steigender verfügbarer Einkommen, wachsender Aufmerksamkeit für Schönheitsbehandlungen und einer großen, jungen Bevölkerung am schnellsten wachsen. Darüber hinaus treiben die wachsende Nachfrage nach nicht-chirurgischen Verfahren und Fortschritte in der Medizintechnik die schnelle Marktexpansion in der Region voran.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Globaler Marktanteil im Bereich medizinische Ästhetik

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den einzelnen Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die weltweit führenden Anbieter im Bereich der medizinischen Ästhetik sind:

- Mentor WorldWide LLC (eine Tochtergesellschaft von Johnsons & Johnsons) (USA)

- Allergan (eine Tochtergesellschaft von AbbVie Inc.) (Irland)

- GALDERMA (Schweiz)

- Cutera, Inc. (USA)

- Lumenis Be Ltd. (Israel)

- Densply Sirona (USA)

- Institut Straumann AG (US)

- Candela Corporation (USA)

- Medytrox (Südkorea)

- BioHorizons (USA)

- BTL (Indien)

- Nobel Biocare Services AG (Schweiz)

- Merz Pharma (Deutschland)

- Cynosure, LLC (USA)

- Sharplight Technologies Inc. (Israel)

- Alma Lasers (USA)

- MEGA’GEN IMPLANT CO., LTD. (Indien)

- 3M (USA)

- Quanta System (Italien)

- Sciton (Kalifornien)

Neueste Entwicklungen auf dem globalen Markt für medizinische Ästhetik

- Im Januar 2023 kündigte Galderma die Einführung von FACE by Galderma an, einer innovativen Augmented-Reality-Anwendung. Die bahnbrechende Lösung ermöglicht es ästhetischen Praktikern und Patienten, Behandlungsergebnisse bereits in der Planungsphase zu visualisieren. Die Technologie wird der ästhetischen Wissenschaftsgemeinschaft auf dem Weltkongress 2023 des International Master Course on Aging Science (IMCAS) vorgestellt.

- Im Februar 2022 gab Allergan (eine Tochtergesellschaft von AbbVie Inc.) die FDA-Zulassung von JUVÉDERM VOLBELLA XC zur Verbesserung der Infraorbitalhöhlen bei Erwachsenen über 21 Jahren bekannt. Dies half dem Unternehmen, das Produktportfolio der Ästhetik auf dem US-Markt zu erweitern.

- Im Januar 2022 gab Mentor Worldwide LLC (eine Tochtergesellschaft der Johnson & Johnson Medical Devices Companies) bekannt, dass die FDA das Brustimplantat MENTOR MemoryGel BOOST zur Brustvergrößerung und Brustrekonstruktion zugelassen hat. Dieses Produkt hat dem Unternehmen geholfen, das Produktportfolio der Ästhetik auf dem US-Markt zu erweitern

- Im Januar 2021 gab Cutera, Inc. bekannt, dass das Unternehmen truSculpt Flex+ auf den Markt gebracht hat, das für eine gezielte, wiederholbare und gleichmäßige Modellierung von Problemzonen optimiert ist. Dies hilft dem Unternehmen, sein Produktportfolio auf dem Markt zu erweitern.

- Im November 2019 gab Lumenis Be Ltd. die Übernahme von Baring Private Equity Asia (BPEA) bekannt, einem führenden Anbieter von speziellen energiebasierten medizinischen Geräten im Bereich der Ästhetik. Dies zeigt, dass das Unternehmen im Ästhetikmarkt starke Unterstützung für das Produktportfolio erhält.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL MEDICAL AESTHETIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE AGEING POPULATION

5.1.2 CHANGING BEAUTY STANDARDS AND SOCIAL MEDIA INFLUENCE

5.1.3 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES

5.1.4 INCREASE IN THE NUMBER OF TECHNOLOGICAL ADVANCEMENTS IN DERMATOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TRAINED PROFESSIONALS

5.2.2 RISK OF SIDE EFFECTS ASSOCIATED WITH THESE PROCEDURES

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF NEW INNOVATIVE TREATMENTS

5.3.2 MEDICAL PARTNERSHIPS AND INNOVATIONS

5.3.3 INCREASING DISPOSABLE INCOME

5.4 CHALLENGES

5.4.1 SAFETY AND LIABILITY RISKS ASSOCIATED WITH AESTHETIC TREATMENTS

5.4.2 LIMITED INSURANCE COVERAGE

6 GLOBAL MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AESTHETIC LASER DEVICES

6.2.1 ABLATIVE SKIN RESURFACING DEVICES

6.2.2 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

6.3 ENERGY DEVICES

6.4 BODY CONTOURING DEVICES

6.5 FACIAL AESTHETIC DEVICES

6.5.1 DERMAL FILLERS

6.6 AESTHETIC IMPLANTS

6.6.1 BREAST AUGMENTATION

6.6.2 AESTHETIC DENTAL IMPLANTS

6.7 SKIN AESTHETIC DEVICES

7 GLOBAL MEDICAL AESTHETIC MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANTI-AGING AND WRINKLES

7.3 FACIAL AND SKIN REJUVENATION

7.4 BREAST ENHANCEMENT

7.5 BODY SHAPING AND CELLULITE

7.6 TATTOO REMOVAL

7.7 VASCULAR LESIONS

7.8 SEARS, PIGMENT LESIONS, RECONSTRUCTIVE

7.9 PSORIASIS AND VITILIGO

7.1 OTHERS

8 GLOBAL MEDICAL AESTHETIC MARKET, BY END USER

8.1 OVERVIEW

8.2 COSMETIC CENTERS

8.3 DERMATOLOGY CLINICS

8.4 HOSPITALS

8.5 MEDICAL SPAS AND BEAUTY CENTERS

9 GLOBAL MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL

10 GLOBAL MEDICAL AESTHETIC MARKET, BY REGION

10.1 OVERVIEW

10.2 NORTH AMERICA

10.2.1 U.S.

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 U.K.

10.3.3 ITALY

10.3.4 FRANCE

10.3.5 SPAIN

10.3.6 RUSSIA

10.3.7 TURKEY

10.3.8 SWITZERLAND

10.3.9 NETHERLANDS

10.3.10 BELGIUM

10.3.11 REST OF EUROPE

10.4 ASIA-PACIFIC

10.4.1 JAPAN

10.4.2 INDIA

10.4.3 CHINA

10.4.4 SOUTH KOREA

10.4.5 AUSTRALIA

10.4.6 THAILAND

10.4.7 SINGAPORE

10.4.8 MALAYSIA

10.4.9 INDONESIA

10.4.10 PHILIPPINES

10.4.11 REST OF ASIA-PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 SOUTH AFRICA

10.6.2 UAE

10.6.3 SAUDI ARABIA

10.6.4 REST OF MIDDLE EAST & AFRICA

11 GLOBAL MEDICAL AESTHETIC MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CUTERA, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MENTOR WORLDWIDE LLC (A SUBSIDIARY OF JOHNSONS & JOHNSONS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 LUMENIS BE LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 GALDERMA

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALMA LASERS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIOHORIZONS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BTL

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CANDELA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CYNOSURE, LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DENTSPLY SIRONA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 INSTITUT STRAUMANN AG

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MEDYTROX

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MEGA'GEN IMPLANT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MERZ PHARMA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 3M

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOBEL BIOCARE SERVICES AG

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 QUANTA SYSTEM

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SCITON

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SHARPLIGHT TECHNOLOGIES INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 GLOBAL MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 GLOBAL AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL DERMAL FILLERS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL BREAST AUGMENTATION IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL ANTI-AGING AND WRINKLES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL FACIAL AND SKIN REJUVENATION IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL BREAST ENHANCEMENT IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL BODY SHAPING AND CELLULITE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL VASCULAR LESIONS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL SEARS, PIGMENT LESIONS, RECONSTRUCTIVE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL PSORIASIS AND VITILIGO IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL OTHERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL COSMETIC CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL DERMATOLOGY CLINICS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL HOSPITALS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL DIRECT TENDER IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL RETAIL IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 CANADA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 CANADA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CANADA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 MEXICO MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MEXICO AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MEXICO ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MEXICO NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MEXICO FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 98 EUROPE MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 99 EUROPE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 EUROPE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 EUROPE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 EUROPE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 EUROPE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 EUROPE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 EUROPE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 EUROPE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 EUROPE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EUROPE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 EUROPE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 EUROPE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EUROPE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 EUROPE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 113 EUROPE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 114 GERMANY MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 GERMANY AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 GERMANY ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 GERMANY NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 GERMANY ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 GERMANY BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 GERMANY FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 GERMANY DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 GERMANY AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 GERMANY BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 GERMANY AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 GERMANY SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 GERMANY MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 GERMANY MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 128 GERMANY MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 129 U.K. MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.K. AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.K. ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.K. NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.K. ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.K. BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.K. FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 144 ITALY MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 ITALY AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 ITALY ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 ITALY NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 ITALY ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 ITALY BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 ITALY DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 ITALY AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 ITALY BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 ITALY AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 ITALY SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 ITALY MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 ITALY MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 157 ITALY MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 158 FRANCE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 FRANCE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 FRANCE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 FRANCE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 FRANCE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 FRANCE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 FRANCE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 FRANCE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 FRANCE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 FRANCE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 FRANCE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 FRANCE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 FRANCE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 FRANCE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 172 FRANCE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 173 SPAIN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 SPAIN AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SPAIN ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 SPAIN NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SPAIN ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SPAIN BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SPAIN FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SPAIN DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SPAIN AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SPAIN BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SPAIN AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SPAIN SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SPAIN MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 SPAIN MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 187 SPAIN MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 188 RUSSIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 RUSSIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 RUSSIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 RUSSIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 RUSSIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 RUSSIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 RUSSIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 RUSSIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 RUSSIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 RUSSIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 RUSSIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 RUSSIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 RUSSIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 RUSSIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 202 RUSSIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 203 TURKEY MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 TURKEY AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 TURKEY ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 TURKEY NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 TURKEY ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 TURKEY BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 TURKEY FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 TURKEY DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 TURKEY AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 TURKEY BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 TURKEY AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 TURKEY SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 TURKEY MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 216 TURKEY MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 217 TURKEY MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 218 SWITZERLAND MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SWITZERLAND AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SWITZERLAND ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SWITZERLAND NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SWITZERLAND ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SWITZERLAND BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 SWITZERLAND FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SWITZERLAND DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SWITZERLAND AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SWITZERLAND BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SWITZERLAND AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SWITZERLAND SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SWITZERLAND MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 SWITZERLAND MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 232 SWITZERLAND MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 233 NETHERLANDS MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 NETHERLANDS AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 NETHERLANDS ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 NETHERLANDS DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NETHERLANDS AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NETHERLANDS BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NETHERLANDS AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 NETHERLANDS SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 NETHERLANDS MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 246 NETHERLANDS MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 247 NETHERLANDS MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 248 BELGIUM MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 BELGIUM AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 BELGIUM ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 BELGIUM NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BELGIUM ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 BELGIUM BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 BELGIUM FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 BELGIUM DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 BELGIUM AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 BELGIUM BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 BELGIUM AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 BELGIUM SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 BELGIUM MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 261 BELGIUM MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 262 BELGIUM MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 263 REST OF EUROPE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 265 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 ASIA-PACIFIC ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 ASIA-PACIFIC NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 ASIA-PACIFIC DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 ASIA-PACIFIC BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 ASIA-PACIFIC AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 278 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 279 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 280 JAPAN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 JAPAN AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 JAPAN ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 JAPAN NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 JAPAN ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 JAPAN BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 JAPAN FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 JAPAN DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 JAPAN AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 JAPAN BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 JAPAN AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 JAPAN SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 JAPAN MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 293 JAPAN MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 294 JAPAN MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 295 INDIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 INDIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 INDIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 INDIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 INDIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 INDIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 INDIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 INDIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 INDIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 INDIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 INDIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 INDIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 INDIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 308 INDIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 309 INDIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 CHINA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 CHINA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 CHINA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 CHINA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 CHINA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 CHINA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 CHINA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 CHINA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 CHINA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 CHINA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 CHINA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 CHINA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 CHINA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 323 CHINA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 324 CHINA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 325 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 SOUTH KOREA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SOUTH KOREA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SOUTH KOREA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 SOUTH KOREA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 SOUTH KOREA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 SOUTH KOREA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 SOUTH KOREA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 SOUTH KOREA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 SOUTH KOREA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 SOUTH KOREA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 SOUTH KOREA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 338 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 339 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 340 AUSTRALIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 AUSTRALIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 AUSTRALIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 AUSTRALIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 AUSTRALIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 AUSTRALIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 AUSTRALIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 AUSTRALIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 AUSTRALIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 AUSTRALIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 AUSTRALIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)