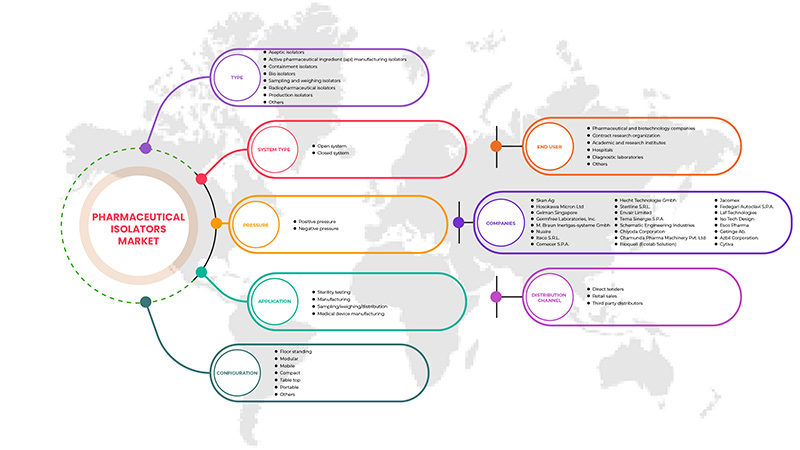

Global Pharmaceutical Isolator Market, By Type (Aseptic Isolators, Containment Isolators, Bio Isolators, Sampling And Weighing Isolators, Active Pharmaceutical Ingredient (API) Manufacturing Isolators, Radiopharmaceutical Isolators, Production Isolators, Others), System Type (Closed System, Open System), Pressure (Positive Pressure, Negative Pressure), Configuration (Floor Standing, Modular, Mobile, Compact, Table Top, Portable, Others), Application (Sterility Testing, Manufacturing, Sampling/ Weighing/ Distribution, Medical Device Manufacturing), End User (Hospitals, Diagnostic Laboratories, Academic And Research Institutes, Pharmaceutical And Biotechnology Companies, Contract Research Organizations, Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributors) Industry Trends And Forecast to 2029.

Pharmaceutical Isolator Market Analysis and Insights

Pharmaceutical isolators are used in the pharmaceutical industry as a contamination-free barrier system. Microbiological testing, cell therapy processing, advanced pharmaceutical (ATMP) manufacturing, and weighing, packaging, and distribution of sterile injectable products are just a few applications of pharmaceutical isolators. The use of pharmaceutical isolators is fueled by the continuous growth of the pharmaceutical market in developing and developed countries and the increase in R&D expenditures to produce innovative treatments. Advanced medical insulators and requirements of the pharmaceutical industry have led major manufacturers to grow the medical insulator industry. The rising use of hazardous compounds, the increasing cost of non-compliance, and the rise in research laboratories are important drivers driving the pharmaceutical isolators market during the forecast period.

However, most experts disagree that regulatory entities no longer stand in the way of breakthroughs such as the development of pharmaceutical insulators.

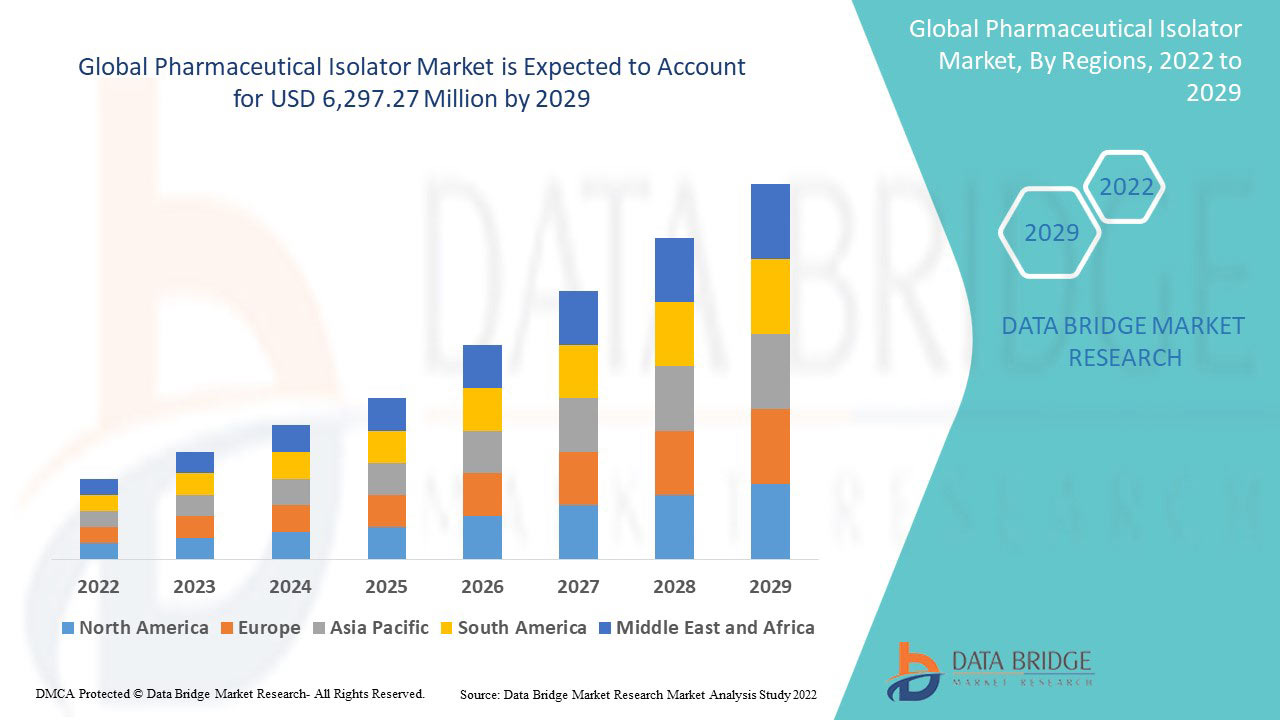

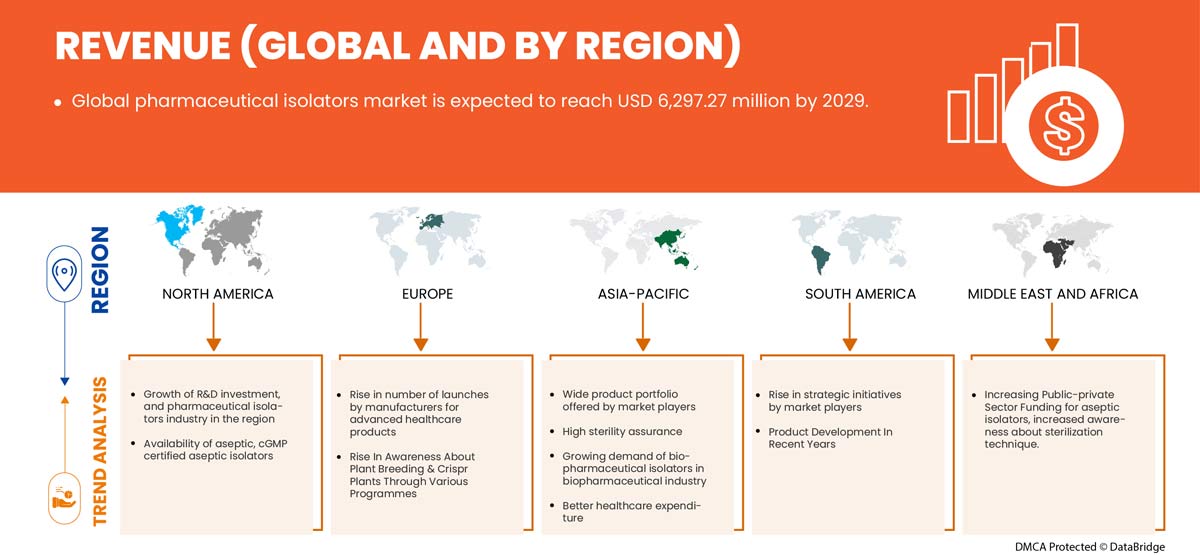

Data Bridge Market Research analyzes that the global pharmaceutical isolator market is expected to reach the value of USD 6,297.27 million by 2029, at a CAGR of 14.3% during the forecast period. Type accounts for the largest type segment in the market due to rapid demand of pharmaceutical isolator globally. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Aseptic Isolators, Containment Isolators, Bio Isolators, Sampling And Weighing Isolators, Active Pharmaceutical Ingredient (API) Manufacturing Isolators, Radiopharmaceutical Isolators, Production Isolators, Others), System Type (Closed System, Open System), Pressure (Positive Pressure, Negative Pressure), Configuration (Floor Standing, Modular, Mobile, Compact, Table Top, Portable, Others), Application (Sterility Testing, Manufacturing, Sampling/ Weighing/ Distribution, Medical Device Manufacturing), End User (Hospitals, Diagnostic Laboratories, Academic And Research Institutes, Pharmaceutical And Biotechnology Companies, Contract Research Organizations, Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributors). |

|

Countries Covered |

U.S., Canada, and Mexico, Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland and the rest of Europe, China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia, Philippines, Indonesia and rest of Asia-Pacific, South Africa, Saudi Arabia, UAE, Egypt, Israel and rest of the Middle East and Africa, Brazil, Argentina, and the rest of South America. |

|

Market Players Covered |

Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma. |

Global Pharmaceutical Isolator Market Definition

The isolation concept protects the process from the operator and or the operator from the process, while protecting the environment. The key to containment is minimal exposure. By controlling the exposure range below the hazard level set for the compound, the Operator and the environment are properly protected. Hence, the product is protected and therefore a key regulatory issue is addressed. A pharmaceutical isolator is a sealed bacterial enclosure used in the pharmaceutical surrounding for aseptic filling and toxic process. It is made of a perfectly sterile main isolator where the products are handled, stored or packaged using shoulder-high gloves placed on one of the walls. The pharmaceutical isolator enables the control and containment of pharmaceutical processes. The conditions required for working of a pharmaceutical isolator are sterile environment and free of viable microorganisms. A pharmaceutical isolator ensures that production area and aseptic environment are placed in separate positions. A pharmaceutical industry isolator is cost effective and efficient, in comparison to cleanrooms for the pharmaceutical industry in an aseptic environment. It creates a controlled atmosphere during the microbial and drug production process by adjusting with the different standards certification standard required for isolators and restricted access barriers. It ensures the protection of the product, the operators and the environment at the same time.

The abundant applications of pharmaceutical isolators, vary for production and control purposes. It is used while handling, transferring or packing solid semi-solid or powder pharma drugs, handling and filing solutions and infusions. The pharmaceutical isolators are applied in sterility testing, aseptic handling of tissues or biological production systems or pathogenic samples, etc. It can be used for the production and control of drugs and pharmaceutical products. The surge in demand for the isolators across pharmaceutical and biotechnology industry, along with low operational cost, high maintenance of aseptic condition in the production of pharmaceutical products and growing demand of biopharmaceutical industry are the factors expected to drive the market growth, in the forecast period.

Also, strategic initiative by market players, technological progressions in pharmaceutical isolators, high sterility assurance and increasing investment for healthcare infrastructure. These factors increase in the demand for pharmaceutical isolators market.

Global Pharmaceutical Isolator Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing demand for the pharmaceutical isolators across booming pharmaceutical

Pharmaceutical isolator is a separative device that divides a pharmaceutical procedure or activity from the operator and the adjacent environment. It is used for various purposes such as:

- Bereitstellung einer kategorisierten aseptischen Umgebung für eine Aktivität oder ein Verfahren und Schutz vor mikrobieller und nicht-mikrobieller Kontamination durch den Bediener und die angrenzende Umgebung, was als Produktschutz bezeichnet wird.

- Schutz des Produkts vor Verunreinigungen durch andere Produkte und Verfahren, insbesondere gleichzeitig oder bei früheren Vorgängen. Dies wird als Schutz vor verfahrensbedingter Kontamination oder Kreuzkontamination bezeichnet.

Die zunehmenden Kontaminationsprobleme in den Produktionseinheiten, in denen Isolatoren eingesetzt werden, führen zu einer Nachfrage nach pharmazeutischen Isolatoren, die bei der Kontamination und Dekontamination helfen.

- Niedrige Betriebskosten für Pharma-Isolatoren

Gehäuse, die bis zu einem gewissen Standard an Dichtheit abgedichtet sind und in qualifizierten, kontrollierten Umgebungen untergebracht sind, werden bei Anpassung an die Umgebungsbedingungen von der Forschung und Entwicklung über die Herstellung von Arzneimitteln bis hin zum Laboreinsatz, insbesondere für die mikrobiologische Qualitätskontrolle, eingesetzt. Die aseptische Produktion von Arzneimitteln hingegen erfordert extrem hohe Sauberkeitsstandards und nahezu vollständig partikel- und keimfreie Umgebungen für die aseptische Produktion.

Aufgrund des Wachstums der Pharmaindustrie und der zunehmenden Produktpalette müssen immer mehr Hersteller und Zulieferer über Investitionen in neueste Zusatztechnologien der Reinraumtechnik nachdenken.

Die aseptische Verarbeitung von Arzneimitteln ist der wichtigste Faktor, der in die guten Herstellungspraktiken einbezogen werden muss, um den gesetzlichen Vorschriften zu entsprechen. Die hohen Kosten für die Aufrechterhaltung der aseptischen Bedingungen durch Reinraumtechnologie, die etwa 62 % höher sind als die pharmazeutischen Isolatoren, veranlassen die Hersteller dazu, Isolatortechnologie zu erwerben und begrenzen so die Gesamtherstellungskosten der pharmazeutischen Produkte.

Zurückhaltung

- Strenge staatliche Vorschriften

Aktive pharmazeutische Inhaltsstoffe (API) und Zwischenprodukte für die pharmazeutische Verwendung (beispielsweise biologische, radiopharmazeutische und pharmazeutische) sowie solche, die zur Herstellung von Arzneimitteln für klinische Tests verwendet werden, unterliegen den Bestimmungen der Abschnitte 1A und 2, Teil C der Lebensmittel- und Arzneimittelverordnung.

- Abschnitt 1A, Teil C der Lebensmittel- und Arzneimittelverordnung beschreibt Aktivitäten, für die die Einhaltung der Good Manufacturing Practices (GMP) erforderlich ist und vor der Ausstellung einer API-Betriebslizenz (EL) nachgewiesen werden muss.

- Abschnitt 2, Teil C der Lebensmittel- und Arzneimittelverordnung definiert die Anforderungen an die GMP von APIs und API-Zwischenprodukten, die im vorliegenden Leitfaden interpretiert werden.

Aufgrund dieser strengen staatlichen Regulierung müssen bei der Produktion die Good Manufacturing Practices (GMP)-Richtlinien für pharmazeutische Wirkstoffe (API) – (GUI-0104) eingehalten werden, die die Marktwachstumsrate begrenzen.

Gelegenheit

-

Strategische Initiativen der Marktteilnehmer

Der Anstieg des Marktes für pharmazeutische Isolatoren erhöht den Bedarf an strategischen Geschäftsideen. Dazu gehören Partnerschaften, Geschäftserweiterungen und andere Entwicklungen. Die steigende Nachfrage nach Arzneimitteln erhöht den Bedarf an Hilfsstoffen erheblich und um dieser Nachfrage gerecht zu werden, bauen Unternehmen neben anderen strategischen Initiativen neue Produktionsstandorte.

Diese strategischen Initiativen wie Produkteinführungen, Vereinbarungen und Geschäftsausweitungen durch die wichtigsten Marktteilnehmer werden das Wachstum des Marktes für pharmazeutische Isolatoren ankurbeln und dürften eine Chance für den globalen Markt für medizinische Displays darstellen.

Herausforderung

- Mangel an Fachkompetenz

Der Mangel an qualifiziertem Fachwissen würde die Erholung und das Wachstum an einem Ort behindern. Oft verfügen die Menschen, die an einem Ort arbeitslos sind, über Fähigkeiten, die anderswo Mangelware sind. Darüber hinaus führt der schnelle technologische Fortschritt in diesem Bereich auch zu einem Mangel an Fachwissen.

Der Mangel an qualifizierten Fachkräften im Umgang mit pharmazeutischen Isolatoren stellt bei der Auswahl und Entwicklung pharmazeutischer Isolatoren eine große Herausforderung dar. Die Daten von Phys.org 2003 zeigen, dass die Medizindisplaybranche aufgrund der steigenden Nachfrage nach pharmazeutischen Isolatoren im asiatisch-pazifischen Raum und der starken Knappheit an Mikrochips für LED- und LCD-Displays, die die Preisvorlaufzeiten der LCD-Produktion verlängern, mit einem Mangel an Arbeitskräften konfrontiert ist.

Da die Anforderungen an die Qualifikationen zu hoch sind, ist es eine Herausforderung, Fachkräfte mit diesen Fähigkeiten zu halten und zu verwalten. Darüber hinaus ist der technologische Fortschritt ein weiterer Aspekt, der zu einer erhöhten Nachfrage nach Fachkräften führt. Neurologen berichten von erheblichen ungedeckten Bedürfnissen und Hindernissen in der unterstützenden Pflege in ihren Zentren, wobei sich nur eine kleine Minderheit selbst als kompetent in der Bereitstellung unterstützender Pflege einstuft. Es besteht ein dringender Bedarf an der Ausbildung von Neurologen und Fachkräften für die Behandlung von Demenz und die Beschaffung verfügbarer Ressourcen für unterstützende Pflege. Der Mangel an ausgebildeten und erfahrenen Fachkräften und anhaltende Qualifikationslücken schränken die Beschäftigungsaussichten und den Zugang zu hochwertigen Arbeitsplätzen ein. Es ist daher offensichtlich, dass die Verfügbarkeit von Fachkräften mit angemessenen Fähigkeiten das Marktwachstum herausfordern wird.

Auswirkungen von COVID-19 auf den globalen Markt für pharmazeutische Isolatoren

Die COVID-19-Pandemie ist zur größten Bedrohung der Welt geworden. Sie hat in vielen Geschäften und Unternehmen auf der ganzen Welt Chaos angerichtet. Andererseits hat die Pandemie den Pharma- und Biopharmaunternehmen viele Möglichkeiten geboten, ihre Forschungs- und Entwicklungsaktivitäten auszuweiten, um neue Impfstoffe gegen das neue Coronavirus zu entwickeln. Die Unternehmen führen klinische Studien durch, um die Ausbreitung des COVID-19-Virus zu stoppen. Die Lieferanten pharmazeutischer Isolatoren für Biopharmaunternehmen haben mehr Möglichkeiten, da die Zahl der klinischen Studien zunimmt.

Die Hersteller treffen verschiedene strategische Entscheidungen, um nach COVID-19 wieder auf die Beine zu kommen. Die Akteure führen zahlreiche F&E-Aktivitäten und Produktanläufe durch und gehen strategische Partnerschaften ein, um die Technologie und Testergebnisse auf dem Markt für pharmazeutische medizinische Displays zu verbessern.

Jüngste Entwicklungen

- Im Juni 2022 gab das Unternehmen eine Partnerschaft mit der Medical Supply Company (MSC) bekannt, um Jacomex-Geräte für die pharmazeutische und pharmazeutische Industrie in Irland zu vermarkten und zu warten. MSC verfügt über langjährige anerkannte Expertise auf dem Markt mit Außendienstteams, die den Kunden am nächsten sind, und das derzeit im Ausland tätige Vertriebsteam des Unternehmens hatte das Vergnügen, Cian Murphy willkommen zu heißen und die Vereinbarung zwischen Jacomex und MSC abzuschließen. Der Beginn einer langen und fruchtbaren Zusammenarbeit. Dies hat dem Unternehmen geholfen, sein Geschäft auszubauen.

- Im Januar 2022 ging Clario eine Partnerschaft mit XingImaging ein, einem Unternehmen, das sich mit der Produktion von Radiopharmazeutika und dem Erwerb von Positronen-Emissions-Tomographie (PET) beschäftigt, um klinische Studien mit PET-Bildgebung zur Erprobung neuartiger Therapeutika in China durchzuführen. Die Partnerschaft sieht die gemeinsame Nutzung der gemeinsamen Ressourcen und Neurowissenschaftsexperten von Clario und XingImaging vor, um den Start klinischer Studien und die Arzneimittelentdeckung in China zu beschleunigen.

Globaler Markt für pharmazeutische Isolatoren – Umfang

Der globale Markt für pharmazeutische Isolatoren ist nach Typ, Druck, Anwendung, Konfiguration, Systemtyp, Endbenutzer und Vertriebskanal segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

GLOBALER MARKT FÜR PHARMAZEUTISCHE ISOLATOREN, NACH TYP

- ASEPTISCHE ISOLATOREN

- CONTAINMENT-ISOLATOREN

- BIO-ISOLATOREN

- PROBENAHME- UND WÄGE-ISOLATOREN

- ISOLATOREN ZUR HERSTELLUNG PHARMAZEUTISCHER WIRKSTOFFE (API)

- RADIOPHARMAZEUTISCHE ISOLATOREN

- PRODUKTIONS-ISOLATOREN

- ANDERE

Auf der Grundlage des Typs ist der globale Markt für pharmazeutische Isolatoren in aseptische Isolatoren, Containment-Isolatoren, Bio-Isolatoren, Probenahme- und Wiege-Isolatoren, Isolatoren zur Herstellung pharmazeutischer Wirkstoffe (API), radiopharmazeutische Isolatoren, Produktionsisolatoren und andere unterteilt.

GLOBALER MARKT FÜR PHARMAZEUTISCHE ISOLATOREN, NACH SYSTEMTYP

- GESCHLOSSENES SYSTEM

- OFFENES SYSTEM

Auf der Grundlage des Systemtyps ist der globale Markt für pharmazeutische Isolatoren in geschlossene Systeme und offene Systeme unterteilt.

GLOBALER MARKT FÜR PHARMAZEUTISCHE ISOLATOREN, NACH DRUCK

- ÜBERDRUCK

- Unterdruck

Auf der Grundlage des Drucks wird der globale Markt für pharmazeutische Isolatoren in Überdruck und Unterdruck segmentiert.

GLOBALER MARKT FÜR PHARMAZEUTISCHE ISOLATOREN, NACH KONFIGURATION

- BODENSTÄNDER

- MODULAR

- MOBILE

- KOMPAKT

- TISCHPLATTE

- TRAGBAR

- ANDERE

Auf der Grundlage der Konfiguration ist der globale Markt für pharmazeutische Isolatoren in Standgeräte, modulare Geräte, mobile Geräte, Kompaktgeräte, Tischgeräte, tragbare Geräte und Sonstige unterteilt.

GLOBALER MARKT FÜR PHARMAZEUTISCHE ISOLATOREN, NACH ANWENDUNG

- STERILITÄTSTESTS

- HERSTELLUNG

- PROBENAHME/ WIEGUNG/ VERTEILUNG

- HERSTELLUNG MEDIZINISCHER GERÄTE

- ANDERE

Auf Grundlage der Anwendung ist der globale Markt für pharmazeutische Isolatoren in die Bereiche Sterilitätsprüfung, Herstellung, Probenahme/Wiegen/Verteilung, Herstellung medizinischer Geräte und Sonstiges segmentiert.

GLOBALER MARKT FÜR PHARMAZEUTISCHE ISOLATOREN, NACH ENDVERWENDER

- KRANKENHÄUSER

- DIAGNOSTISCHE LABORE

- AKADEMISCHE UND FORSCHUNGSINSTITUTE

- PHARMAZEUTISCHE UND BIOTECHNOLOGIEUNTERNEHMEN

- Vertragsforschungsinstitutionen

- ANDERE

Auf der Grundlage des Endverbrauchers ist der globale Markt für pharmazeutische Isolatoren in Krankenhäuser, Diagnoselabore, Hochschul- und Forschungsinstitute, Pharma- und Biotechnologieunternehmen, Auftragsforschungsinstitute und Sonstige unterteilt.

GLOBALER MARKT FÜR PHARMAZEUTISCHE ISOLATOREN NACH VERTRIEBSKANAL

- DIREKTE AUSSCHREIBUNG

- EINZELHANDELSVERKÄUFE

- DRITTANBIETER

Auf der Grundlage der Vertriebskanäle ist der globale Markt für pharmazeutische Isolatoren in Direktausschreibungen, Einzelhandelsverkäufe und Drittanbieter unterteilt.

Globaler Markt für pharmazeutische Isolatoren – regionale Analyse/Einblicke

Der globale Markt für pharmazeutische Isolatoren wird analysiert und Informationen zur Marktgröße werden basierend auf Typ, Druck, Anwendung, Konfiguration, Systemtyp, Endbenutzer und Vertriebskanal bereitgestellt.

Zu den in diesem Marktbericht abgedeckten Ländern gehören die USA, Kanada und Mexiko, Deutschland, Frankreich, Großbritannien, Italien, Spanien, Russland, die Türkei, Belgien, die Niederlande, die Schweiz und der Rest von Europa, China, Japan, Indien, Südkorea, Singapur, Thailand, Malaysia, Australien, die Philippinen, Indonesien und der Rest des asiatisch-pazifischen Raums, Südafrika, Saudi-Arabien, die Vereinigten Arabischen Emirate, Ägypten, Israel und der Rest des Nahen Ostens und Afrikas, Brasilien, Argentinien und der Rest von Südamerika.

Im Jahr 2022 dominiert Nordamerika aufgrund der Präsenz wichtiger Marktteilnehmer auf dem größten Verbrauchermarkt mit hohem BIP. Für die USA wird aufgrund des technologischen Fortschritts im Agrarsektor ein Wachstum erwartet.

Die steigenden Investitionen in Forschung und Entwicklung dürften das Marktwachstum ankurbeln. Die USA dominieren die Region Nordamerika aufgrund der starken Präsenz der Hauptakteure Getinge, SKAN AG, Hosokawa Micron Ltd., Gelman Singapore, Azbil Corporation und anderer. Großbritannien dominiert die Region Europa aufgrund der Massenproduktion pharmazeutischer Isolatoren und der steigenden Nachfrage aus Schwellenmärkten und der Expansion der Gesundheitsbranche. China dominiert die Region Asien-Pazifik aufgrund des schnell wachsenden Pharmamarkts in Verbindung mit einem Anstieg der Produktion pharmazeutischer Ausrüstung.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und globale Marktanteilsanalyse für pharmazeutische Isolatoren

Die Wettbewerbslandschaft des globalen Marktes für pharmazeutische Isolatoren liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens auf den globalen Markt für pharmazeutische Isolatoren.

Zu den wichtigsten Akteuren auf dem globalen Markt für pharmazeutische Isolatoren zählen Getinge, SKAN AG, Hosokawa Micron Ltd., Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd., Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva und Esco Pharma.

Forschungsmethodik: Globaler Markt für pharmazeutische Isolatoren

Die Datenerfassung und die Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Die wichtigste Forschungsmethode, die das DBMR-Forschungsteam verwendet, ist die Datentriangulation, die Data Mining, Analyse der Auswirkungen von Datenvariablen auf den Markt und primäre (Branchenexperten-)Validierung umfasst. Abgesehen davon umfassen die Datenmodelle ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, einen Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Firmenmarktanteilsanalyse, Messstandards, global vs. regional und eine Lieferantenanteilsanalyse. Bitte fordern Sie bei weiteren Fragen einen Analystenanruf an.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 GLOBAL PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 FRANCE

14.3.3 U.K.

14.3.4 ITALY

14.3.5 RUSSIA

14.3.6 SPAIN

14.3.7 TURKEY

14.3.8 NETHERLANDS

14.3.9 SWITZERLAND

14.3.10 BELGIUM

14.3.11 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 CHINA

14.4.2 JAPAN

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 AUSTRALIA

14.4.6 SINGAPORE

14.4.7 THAILAND

14.4.8 MALAYSIA

14.4.9 INDONESIA

14.4.10 PHILIPPINES

14.4.11 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST & AFRICA

14.6.1 SOUTH AFRICA

14.6.2 SAUDI ARABIA

14.6.3 U.A.E

14.6.4 EGYPT

14.6.5 ISRAEL

14.6.6 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 GLOBAL CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 GLOBAL ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 GLOBAL HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 GLOBAL DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 GLOBAL DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 GLOBAL OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 GLOBAL PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 64 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 65 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 U.S. PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 U.S. CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 U.S. ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 U.S. HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 U.S. DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 76 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 77 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 CANADA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 CANADA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 CANADA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 CANADA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 CANADA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 89 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 MEXICO PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 MEXICO CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 MEXICO ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 MEXICO HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 MEXICO DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 96 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 97 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 98 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 100 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 101 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 102 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 EUROPE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 EUROPE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 108 EUROPE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 109 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 112 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 113 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 114 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 GERMANY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 GERMANY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 GERMANY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 GERMANY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 GERMANY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 121 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 124 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 125 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 126 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 FRANCE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 FRANCE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 FRANCE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 FRANCE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 FRANCE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 133 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 134 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 137 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 138 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 U.K. PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 U.K. CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 U.K. ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 143 U.K. HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 144 U.K. DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 148 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 149 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 150 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 152 ITALY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 ITALY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 154 ITALY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 155 ITALY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 156 ITALY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 157 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 161 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 RUSSIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 166 RUSSIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 167 RUSSIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 168 RUSSIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 169 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 172 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 173 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 174 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 175 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 SPAIN PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 SPAIN CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 178 SPAIN ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 179 SPAIN HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 180 SPAIN DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 181 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 182 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 184 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 185 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 186 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 187 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 188 TURKEY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 189 TURKEY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 190 TURKEY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 191 TURKEY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 192 TURKEY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 193 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 194 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 196 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 197 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 198 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 200 NETHERLAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 201 NETHERLAND CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 202 NETHERLAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 203 NETHERLAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 204 NETHERLAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 205 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 208 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 209 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 210 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 211 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 212 SWITZERLAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 213 SWITZERLAND CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 214 SWITZERLAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 215 SWITZERLAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 216 SWITZERLAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 218 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 220 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 221 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 222 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 223 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 224 BELGIUM PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 225 BELGIUM CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 226 BELGIUM ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 227 BELGIUM HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 228 BELGIUM DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 229 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 230 REST OF EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 232 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 234 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 235 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 236 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 237 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 238 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 239 ASIA-PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 240 ASIA-PACIFIC ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 241 ASIA-PACIFIC HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 242 ASIA-PACIFIC DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 243 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 244 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 246 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 247 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 248 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 249 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 250 CHINA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 251 CHINA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 252 CHINA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 253 CHINA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 254 CHINA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 255 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 256 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 258 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 259 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 260 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 261 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 262 JAPAN PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 263 JAPAN CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 264 JAPAN ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 265 JAPAN HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 266 JAPAN DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 268 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 270 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 271 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 272 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 274 SOUTH KOREA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 275 SOUTH KOREA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 276 SOUTH KOREA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 277 SOUTH KOREA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 278 SOUTH KOREA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 279 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 280 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 282 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 283 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 284 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 285 INDIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 286 INDIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 287 INDIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 288 INDIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 289 INDIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 290 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 291 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 293 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 295 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 296 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 297 AUSTRALIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 298 AUSTRALIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 299 AUSTRALIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 300 AUSTRALIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 301 AUSTRALIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 302 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 303 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 305 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 306 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 307 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 308 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 309 SINGAPORE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 310 SINGAPORE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 311 SINGAPORE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 312 SINGAPORE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 313 SINGAPORE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 314 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 315 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 316 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 317 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 318 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 319 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 320 THAILAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 321 THAILAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 322 THAILAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 323 THAILAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 324 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 325 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 326 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 327 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 328 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 329 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 330 MALAYSIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 331 MALAYSIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 332 MALAYSIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 333 MALAYSIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 334 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 335 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 336 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 337 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 338 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 339 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 340 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 341 INDONESIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 342 INDONESIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 343 INDONESIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 344 INDONESIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 345 INDONESIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 346 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 347 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 348 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 349 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 350 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 351 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 352 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 353 PHILIPPINES PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 354 PHILIPPINES CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 355 PHILIPPINES ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 356 PHILIPPINES HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 357 PHILIPPINES DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 358 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 359 REST OF ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 360 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 361 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 362 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 363 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 364 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 365 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 366 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 367 SOUTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 368 SOUTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 369 SOUTH AMERICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 370 SOUTH AMERICA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 371 SOUTH AMERICA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 372 SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 373 BRAZIL PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 374 BRAZIL PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 375 BRAZIL PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 376 BRAZIL PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 377 BRAZIL PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 378 BRAZIL PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 379 BRAZIL PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 380 BRAZIL CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 381 BRAZIL ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 382 BRAZIL HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 383 BRAZIL DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 384 BRAZIL PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 385 ARGENTINA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 386 ARGENTINA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 387 ARGENTINA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 388 ARGENTINA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 389 ARGENTINA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 390 ARGENTINA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 391 ARGENTINA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 392 ARGENTINA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 393 ARGENTINA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 394 ARGENTINA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 395 ARGENTINA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 396 ARGENTINA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 397 REST OF SOUTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 398 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 399 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 400 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 401 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 402 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 403 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 404 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 405 MIDDLE EAST AND AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 406 MIDDLE EAST AND AFRICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 407 MIDDLE EAST AND AFRICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 408 MIDDLE EAST AND AFRICA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 409 MIDDLE EAST AND AFRICA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 410 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 411 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 412 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 413 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 414 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 415 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 416 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 417 SOUTH AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 418 SOUTH AFRICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 419 SOUTH AFRICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 420 SOUTH AFRICA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 421 SOUTH AFRICA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 422 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 423 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 424 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 425 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 426 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 427 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 428 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 429 SAUDI ARABIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)