Global Recombinant Hormone Biosimilars Market

Marktgröße in Milliarden USD

CAGR :

%

USD

217.80 Million

USD

460.12 Million

2025

2033

USD

217.80 Million

USD

460.12 Million

2025

2033

| 2026 –2033 | |

| USD 217.80 Million | |

| USD 460.12 Million | |

|

|

|

|

Global Recombinant Hormone Biosimilars Market Segmentation, By Product Type (Insulin biosimilars, Growth hormone biosimilars, Erythropoietin biosimilars, Follicle-stimulating hormone (FSH) biosimilars, Luteinizing hormone (LH) biosimilars, and Other recombinant hormone biosimilars), Application (Diabetes management, Growth disorders, Anemia treatment, fertility treatments, and Others), End User (Hospitals, Specialty clinics, Home care settings, and Others)- Industry Trends and Forecast to 2033

Recombinant Hormone Biosimilars Market Size

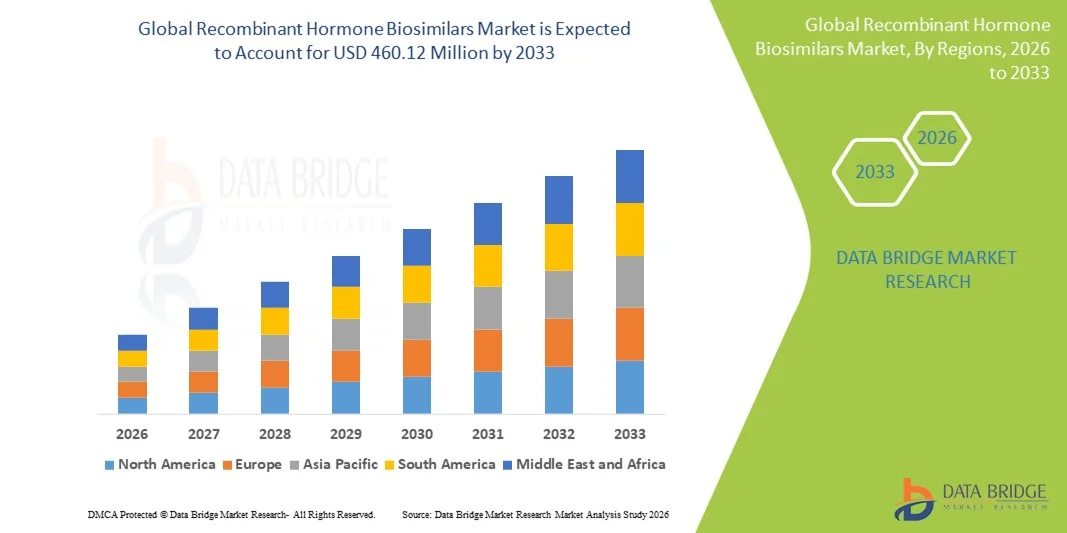

- The global recombinant hormone biosimilars market size was valued at USD 217.80 million in 2025 and is expected to reach USD 460.12 million by 2033, at a CAGR of 9.80% during the forecast period

- The market growth is largely driven by the increasing prevalence of diabetes, hormonal disorders, and chronic diseases, along with the growing adoption of cost-effective biosimilar therapies as alternatives to high-priced originator biologics across both developed and emerging healthcare systems

- Furthermore, continuous advancements in biopharmaceutical manufacturing, supportive regulatory pathways for biosimilars, and rising acceptance of recombinant hormone biosimilars in hospital and outpatient settings are positioning these products as preferred therapeutic options, thereby significantly accelerating overall market growth

Recombinant Hormone Biosimilars Market Analysis

- Recombinant hormone biosimilars, which are biologic medicines developed to closely replicate reference recombinant hormone products such as insulin, growth hormone, and erythropoietin, are increasingly vital components of modern therapeutic regimens due to their comparable clinical efficacy, improved affordability, and expanding use across hospital and outpatient care settings

- The rising demand for recombinant hormone biosimilars is primarily driven by the increasing prevalence of diabetes, hormonal deficiencies, anemia, and other chronic diseases, along with mounting pressure on healthcare systems to lower biologic treatment costs without compromising patient outcomes

- North America dominated the recombinant hormone biosimilars market with the largest revenue share of 41.4% in 2025, supported by a high burden of chronic diseases, strong regulatory clarity for biosimilar approvals, favorable reimbursement structures, and widespread adoption of biosimilar insulin and hormone therapies in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by large patient populations, improving healthcare infrastructure, increasing awareness of biosimilars, and expanding local manufacturing capabilities in countries such as China and India

- The insulin biosimilars segment dominated the market with largest market share of 46.9% in 2025, owing to the global diabetes epidemic, high treatment adherence requirements, and the rapid substitution of high-cost branded insulin products with more affordable biosimilar alternatives

Report Scope and Recombinant Hormone Biosimilars Market Segmentation

|

Attributes |

Recombinant Hormone Biosimilars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Recombinant Hormone Biosimilars Market Trends

Rising Regulatory Acceptance and Physician Confidence

- A major and accelerating trend in the global recombinant hormone biosimilars market is the increasing regulatory approvals and growing physician confidence in biosimilar therapies, driven by robust clinical comparability data and real-world evidence supporting safety and efficacy

- For instance, multiple biosimilar insulins and recombinant growth hormones have gained approvals across regulated markets, reinforcing trust among endocrinologists and hospital pharmacists for routine clinical use

- Growing clinical familiarity with biosimilars is enabling wider prescription adoption, particularly in chronic disease management, where long-term treatment affordability and continuity of care are critical

- Increased post-marketing surveillance data and pharmacovigilance outcomes are further strengthening confidence in recombinant hormone biosimilars, supporting broader substitution of reference biologics

- This trend is also supported by educational initiatives from healthcare authorities and professional bodies, which emphasize biosimilar equivalence and promote evidence-based switching practices

- As a result, pharmaceutical companies are increasingly prioritizing recombinant hormone biosimilars in their portfolios, accelerating product development pipelines and market penetration strategies

- In addition, the expansion of hospital tenders and centralized procurement programs is favoring biosimilars over branded biologics, reinforcing volume-based adoption

- Digital health records and prescribing systems are also facilitating biosimilar uptake by enabling formulary-driven recommendations at the point of care

Recombinant Hormone Biosimilars Market Dynamics

Driver

Rising Disease Burden and Cost-Containment Pressure in Healthcare Systems

- The increasing global prevalence of diabetes, hormonal disorders, anemia, and other chronic conditions is a key driver accelerating demand for recombinant hormone biosimilars

- For instance, the growing incidence of insulin-dependent diabetes has intensified the need for affordable long-term therapies, making biosimilar insulin a preferred option for payers and providers

- Escalating healthcare expenditures associated with originator biologics are compelling governments and insurers to encourage biosimilar adoption to improve patient access while controlling costs

- Supportive reimbursement policies and biosimilar substitution guidelines in hospitals are further reinforcing market growth across developed and emerging regions

- In addition, expanding awareness among patients regarding the cost benefits and therapeutic equivalence of biosimilars is contributing to sustained uptake across treatment settings

- The expiration of patents for several blockbuster recombinant hormone products is opening new avenues for biosimilar market entry and competition

- Increased investment in biosimilar manufacturing capacity by pharmaceutical companies is also supporting broader availability and supply stability

Restraint/Challenge

Complex Manufacturing Requirements and Market Acceptance Barriers

- The highly complex manufacturing processes required for recombinant hormone biosimilars pose significant challenges related to production consistency, scalability, and cost control

- For instance, minor variations in cell lines or purification processes can impact product comparability, increasing development timelines and regulatory scrutiny

- Limited interchangeability designations and cautious prescribing behavior among some clinicians continue to restrain faster adoption in certain markets

- In addition, strong brand loyalty toward originator biologics and concerns about switching stable patients can slow biosimilar penetration, particularly in specialist-driven therapies

- Overcoming these challenges through advanced manufacturing technologies, clear regulatory guidance, and continued physician education will be critical for long-term market expansion

- Price competition among multiple biosimilar entrants can compress margins, discouraging smaller manufacturers from sustained market participation

- Variability in regulatory and reimbursement frameworks across regions further complicates global commercialization strategies for recombinant hormone biosimilars

Recombinant Hormone Biosimilars Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the recombinant hormone biosimilars market is segmented into insulin biosimilars, growth hormone biosimilars, erythropoietin biosimilars, follicle-stimulating hormone (FSH) biosimilars, luteinizing hormone (LH) biosimilars, and other recombinant hormone biosimilars. The insulin biosimilars segment dominated the market with the largest revenue share of 45.9% in 2025, driven by the rapidly increasing global diabetes burden and the lifelong nature of insulin therapy. Insulin biosimilars offer significant cost savings compared to branded insulin products, making them highly attractive to payers, governments, and patients. Widespread inclusion of biosimilar insulin in national formularies and hospital procurement programs has further strengthened adoption. In addition, frequent dosing requirements and high patient volumes ensure consistent demand. Strong regulatory support for biosimilar insulin substitution in major markets has also reinforced segment dominance.

The growth hormone biosimilars segment is expected to register the fastest growth during the forecast period, supported by rising diagnosis rates of pediatric and adult growth hormone deficiencies. Improved awareness among clinicians and patients regarding biosimilar safety and efficacy is accelerating uptake. Cost advantages over originator growth hormone products are expanding access, particularly in emerging economies. Increasing use in both pediatric endocrinology and adult metabolic disorders further contributes to growth. Moreover, expanding reimbursement coverage is enabling broader adoption across healthcare systems.

- By Application

On the basis of application, the market is segmented into diabetes management, growth disorders, anemia treatment, fertility treatments, and others. The diabetes management segment held the largest market share in 2025, owing to the high and continuously growing prevalence of type 1 and insulin-dependent type 2 diabetes worldwide. Long-term insulin dependency makes affordability a critical factor, positioning biosimilars as preferred therapeutic options. Government initiatives to control diabetes-related healthcare spending are accelerating biosimilar insulin usage. Hospitals and outpatient clinics increasingly prioritize biosimilars to reduce treatment costs. In addition, strong patient familiarity with insulin therapies supports faster switching from branded products.

The growth disorders segment is anticipated to be the fastest-growing application segment during the forecast period, driven by improved screening, early diagnosis, and increasing treatment rates of growth hormone deficiencies. Expanding awareness among parents and healthcare providers regarding treatment benefits is fueling demand. Biosimilar growth hormones are improving affordability, particularly in middle-income countries. Rising acceptance of long-term hormone therapy is also supporting sustained growth. Furthermore, clinical evidence demonstrating comparable outcomes to reference products is strengthening physician confidence.

- By End User

On the basis of end user, the recombinant hormone biosimilars market is segmented into hospitals, specialty clinics, home care settings, and others. The hospitals segment dominated the market with the highest revenue share in 2025, driven by centralized procurement systems, high patient inflow, and formulary-based prescribing practices. Hospitals play a critical role in initiating biologic and biosimilar therapies, particularly for insulin, anemia, and growth hormone treatments. Favorable hospital tender systems often prioritize biosimilars due to cost efficiency. The presence of multidisciplinary care teams also supports confidence in biosimilar prescribing. In addition, hospital-based reimbursement structures encourage biosimilar utilization.

The home care settings segment is expected to witness the fastest growth during the forecast period, supported by the increasing shift toward self-administration of hormone therapies. Advances in injection devices and patient education are enabling safe home-based treatment. Growing preference for convenience and reduced hospital visits among chronic disease patients is accelerating adoption. Insulin and growth hormone therapies are particularly well-suited for home care use. Expanding digital health monitoring and telemedicine support further strengthen this segment’s growth potential.

Recombinant Hormone Biosimilars Market Regional Analysis

- North America dominated the recombinant hormone biosimilars market with the largest revenue share of 41.4% in 2025, supported by a high burden of chronic diseases, strong regulatory clarity for biosimilar approvals, favorable reimbursement structures, and widespread adoption of biosimilar insulin and hormone therapies in the U.S. and Canada

- Healthcare providers and payers in the region place strong emphasis on cost-effective treatment alternatives, while maintaining clinical efficacy, leading to growing acceptance of biosimilar insulin, growth hormone, and erythropoietin products across hospital and outpatient settings

- This widespread adoption is further supported by advanced healthcare infrastructure, favorable reimbursement frameworks, high awareness among physicians and patients, and the presence of major biopharmaceutical companies actively expanding biosimilar portfolios, establishing recombinant hormone biosimilars as a preferred therapeutic option across the U.S. and Canada

U.S. Recombinant Hormone Biosimilars Market Insight

The U.S. recombinant hormone biosimilars market captured the largest revenue share within North America in 2025, driven by the high prevalence of diabetes and hormonal disorders and the strong push toward cost containment in biologic therapies. Healthcare providers are increasingly prioritizing biosimilar insulin and growth hormone products to reduce long-term treatment costs while maintaining therapeutic efficacy. The presence of well-established regulatory pathways, favorable reimbursement policies, and growing physician confidence in biosimilars continues to propel market growth. Moreover, large patient populations requiring chronic hormone therapies significantly contribute to sustained demand.

Europe Recombinant Hormone Biosimilars Market Insight

The Europe recombinant hormone biosimilars market is projected to expand at a substantial CAGR during the forecast period, primarily supported by early biosimilar adoption, strong regulatory frameworks, and centralized healthcare systems. Countries across the region actively promote biosimilars through tender-based procurement and substitution policies. European healthcare systems emphasize affordability and access, encouraging widespread use of biosimilar insulin and erythropoietin products. Growth is evident across hospital and outpatient settings, supported by high physician acceptance and robust pharmacovigilance systems.

U.K. Recombinant Hormone Biosimilars Market Insight

The U.K. recombinant hormone biosimilars market is anticipated to grow at a notable CAGR during the forecast period, driven by National Health Service (NHS) initiatives focused on reducing biologic drug expenditure. Increased adoption of biosimilar insulin and growth hormone therapies is supported by clear clinical guidelines and strong institutional backing. Growing awareness among clinicians regarding biosimilar safety and efficacy is accelerating switching from originator products. In addition, cost-efficiency and long-term sustainability goals continue to support market expansion.

Germany Recombinant Hormone Biosimilars Market Insight

The Germany recombinant hormone biosimilars market is expected to expand at a considerable CAGR, fueled by strong regulatory support, advanced healthcare infrastructure, and high biosimilar penetration rates. Germany’s early acceptance of biosimilars has positioned it as a leading European market for hormone biosimilar adoption. Hospitals and sickness funds actively encourage biosimilar use to control pharmaceutical spending. The country’s emphasis on clinical evidence and structured prescribing practices further supports market growth.

Asia-Pacific Recombinant Hormone Biosimilars Market Insight

The Asia-Pacific recombinant hormone biosimilars market is expected to grow at the fastest CAGR during the forecast period, driven by large patient populations, increasing healthcare access, and rising awareness of cost-effective biologic alternatives. Rapid urbanization, improving diagnostic capabilities, and expanding insurance coverage are accelerating adoption across the region. Governments are increasingly supporting biosimilar manufacturing and usage to address affordability challenges. In addition, Asia-Pacific’s role as a global biopharmaceutical manufacturing hub enhances product availability and competitiveness.

Japan Recombinant Hormone Biosimilars Market Insight

The Japan recombinant hormone biosimilars market is gaining steady traction due to the country’s aging population and growing burden of chronic diseases requiring hormone therapies. Regulatory reforms and physician education initiatives are improving acceptance of biosimilars in clinical practice. Japan’s strong focus on quality, safety, and long-term treatment outcomes supports gradual but consistent biosimilar adoption. Increased use of biosimilar insulin and erythropoietin products is contributing to market growth.

India Recombinant Hormone Biosimilars Market Insight

The India recombinant hormone biosimilars market accounted for the largest revenue share in Asia-Pacific in 2025, supported by a high prevalence of diabetes, strong domestic manufacturing capabilities, and increasing access to affordable biologic therapies. India is a key producer and consumer of biosimilars, benefiting from cost-efficient production and supportive regulatory frameworks. Rising healthcare awareness and expanding public and private healthcare coverage are driving adoption. In addition, government initiatives promoting affordable treatments are reinforcing long-term market growth.

Recombinant Hormone Biosimilars Market Share

The Recombinant Hormone Biosimilars industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Samsung Bioepis (South Korea)

- Biocon Biologics Limited (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Celltrion, Inc. (South Korea)

- Intas Pharmaceuticals Ltd. (India)

- Gedeon Richter Plc (Hungary)

- Teva Pharmaceuticals (Israel)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Sandoz Group AG (Switzerland)

- Fresenius Kabi AG (Germany)

- Zentiva (Czech Republic)

- Bio-Thera Solutions Ltd. (China)

- LG Chem Ltd. (South Korea)

- Minapharm Pharmaceuticals (Egypt)

- Amega Biotech S.A. (Argentina)

- IVFarmA LLC (Russia)

- Jiangsu Alphamab Biopharmaceuticals Co. Ltd. (China)

- Biomm S.A. (Brazil)

What are the Recent Developments in Global Recombinant Hormone Biosimilars Market?

- In July 2025, the U.S. Food and Drug Administration (FDA) approved Kirsty™ (insulin aspart-xjhz), marking it as the first and only interchangeable rapid-acting insulin biosimilar to NovoLog in the United States, significantly expanding affordable treatment options for people with diabetes

- In June 2025, Biocon Biologics announced that it had supplied more than 100 million cartridges of recombinant human insulin to Malaysia’s Ministry of Health, marking a significant scale-volume commitment to expanding access in an emerging market

- In February 2025, Sanofi Aventis U.S. LLC’s Merilog (insulin-aspart-szjj) received approval from the U.S. FDA as a rapid-acting insulin biosimilar referencing NovoLog, adding strong competition in the U.S. insulin biosimilar space

- In November 2024, major regulatory bodies, including the European Medicines Agency (EMA), recorded a high number of biosimilar approvals across therapeutic classes, including biosimilars targeting hormones such as insulin and growth hormone products, reflecting accelerated biosimilar adoption and market diversification in Europe

- In July 2021, the FDA approved insulin glargine-yfgn (Semglee), the first interchangeable insulin biosimilar product in the United States, a landmark step that paved the way for deeper biosimilar penetration in chronic hormone therapy

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.