Global Social Commerce Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.55 Trillion

USD

12.58 Trillion

2025

2033

USD

1.55 Trillion

USD

12.58 Trillion

2025

2033

| 2026 –2033 | |

| USD 1.55 Trillion | |

| USD 12.58 Trillion | |

|

|

|

|

Global Social Commerce Market Segmentation, By Business Model (B2C, B2B, and C2C), Product Type (Personal & Beauty Care, Apparel, Accessories, Home Products, Health Supplements, Food & Beverage, and Others), and Platform/Sales Channel (Video Commerce, Social Network-led Commerce, Social Reselling, Group Buying, and Product Review Platforms) - Industry Trends and Forecast to 2033

Social Commerce Market Size

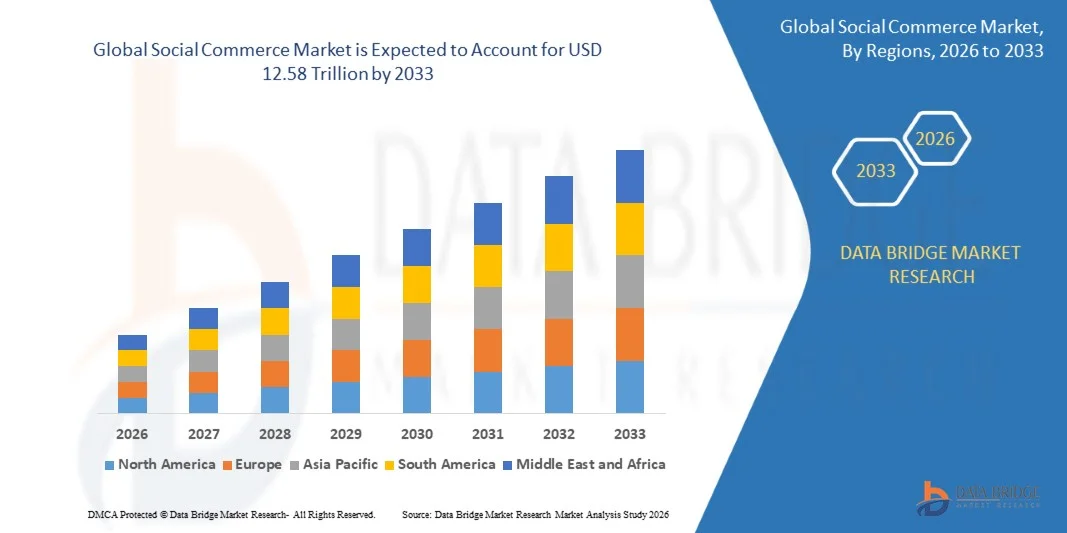

- The global social commerce market size was valued at USD 1.55 trillion in 2025 and is expected to reach USD 12.58 trillion by 2033, at a CAGR of 29.84% during the forecast period

- The market growth is largely fueled by the rapid expansion of social media platforms, increasing smartphone penetration, and continuous advancements in digital payment technologies, which are driving deeper integration of shopping features within social networking environments

- Furthermore, rising consumer preference for interactive, personalized, and convenient shopping experiences, combined with the growing influence of creators and peer recommendations, is accelerating adoption of social commerce platforms, thereby significantly strengthening overall market growth

Social Commerce Market Analysis

- Social commerce, which integrates product discovery, engagement, and purchasing directly within social media platforms, is becoming a critical component of modern digital retail strategies due to its ability to combine entertainment, community interaction, and seamless transactions

- The increasing demand for social commerce is primarily driven by high user engagement on social platforms, the effectiveness of influencer-led and video-based marketing, and growing trust in in-app purchasing, which together are reshaping consumer buying behavior and accelerating market expansion

- Asia-Pacific dominated the social commerce market with a share of 72.1% in 2025, due to high social media penetration, rapid smartphone adoption, and a strong culture of mobile-first shopping

- North America is expected to be the fastest growing region in the social commerce market during the forecast period due to rapid innovation in social shopping features and strong brand investments in influencer marketing

- B2C segment dominated the market with a market share of 59.3% in 2025, due to the strong presence of brands and retailers directly selling to consumers through social media platforms. Companies leverage influencer marketing, integrated checkout features, and personalized advertising to drive higher conversion rates and impulse purchases. The convenience of end-to-end shopping experiences within social apps further strengthens B2C dominance

Report Scope and Social Commerce Market Segmentation

|

Attributes |

Social Commerce Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Social Commerce Market Trends

“Growth of Video-Led and Live-Stream Shopping”

- A prominent trend in the social commerce market is the rapid growth of video-led and live-stream shopping formats, driven by rising consumer preference for interactive, real-time, and content-driven purchasing experiences across social media platforms. These formats combine entertainment, product discovery, and instant purchasing, significantly increasing user engagement and conversion rates

- For instance, platforms such as TikTok Shop and Douyin have enabled brands and creators to conduct live-stream selling sessions where products are demonstrated and purchased instantly, resulting in higher average order values and stronger impulse buying behavior. This approach has strengthened the role of creators as key sales enablers within the social commerce ecosystem

- Video-led commerce is gaining traction as short-form videos and live content allow brands to showcase product usage, quality, and benefits more effectively than static listings. This visual storytelling enhances trust and reduces purchase hesitation, particularly in categories such as fashion, beauty, and lifestyle products

- Major social platforms are investing heavily in live commerce tools, creator monetization features, and in-app checkout capabilities to support this trend. These investments are accelerating the shift from traditional e-commerce toward immersive social-first shopping journeys

- The growing influence of influencers and micro-creators is further reinforcing video-led commerce adoption, as consumers increasingly rely on peer-led recommendations and authentic content. This dynamic is reshaping how brands allocate marketing budgets toward social commerce strategies

- The sustained expansion of video and live-stream shopping is positioning social commerce platforms as full-funnel retail channels, strengthening their role in driving discovery, engagement, and direct sales within digital commerce environments

Social Commerce Market Dynamics

Driver

“Rising Social Media Penetration and Mobile-First Consumer Behavior”

- The social commerce market is strongly driven by the widespread penetration of social media platforms and the rapid shift toward mobile-first consumer behavior across global markets. Increased daily usage of social apps has created a natural environment for integrating shopping into routine digital interactions

- For instance, Meta Platforms, Inc. has embedded shopping features across Instagram and Facebook, enabling brands to reach users directly through feeds, stories, and reels. These integrations have improved product visibility and shortened the path from discovery to purchase

- The growing availability of affordable smartphones and mobile internet has expanded access to social commerce, particularly in emerging economies. Consumers increasingly prefer completing transactions within apps they already use, enhancing convenience and adoption rates

- Mobile-first interfaces support features such as one-click checkout, digital wallets, and personalized recommendations, which improve user experience and encourage repeat purchases. These capabilities are driving higher transaction volumes on social platforms

- The continuous rise in social media usage combined with mobile-centric shopping behavior is reinforcing social commerce as a core growth engine within the broader digital retail landscape

Restraint/Challenge

“Data Privacy Concerns and Trust Issues in Social Transactions”

- The social commerce market faces challenges related to data privacy concerns and consumer trust in conducting transactions directly within social platforms. The handling of personal data, payment information, and targeted advertising has raised regulatory and user scrutiny

- For instance, Meta Platforms, Inc. has faced ongoing regulatory attention in multiple regions regarding data protection practices, prompting platforms to enhance transparency and compliance measures. Such scrutiny increases operational complexity and impacts platform credibility

- Consumers remain cautious about sharing financial information on social apps, particularly in markets with rising awareness of data misuse and cybersecurity risks. This hesitation can slow adoption among privacy-conscious user segments

- Ensuring secure payment processing, fraud prevention, and transparent data usage policies requires continuous investment in technology and compliance frameworks. These requirements increase costs for platforms and merchants operating in social commerce ecosystems

- Ongoing concerns around privacy and trust are expected to influence platform design, regulatory engagement, and consumer adoption, shaping the long-term evolution of the social commerce market

Social Commerce Market Scope

The market is segmented on the basis of business model, product type, and platform or sales channel.

• By Business Model

On the basis of business model, the social commerce market is segmented into B2C, B2B, and C2C. The B2C segment dominated the market with the largest revenue share of 59.3% in 2025, driven by the strong presence of brands and retailers directly selling to consumers through social media platforms. Companies leverage influencer marketing, integrated checkout features, and personalized advertising to drive higher conversion rates and impulse purchases. The convenience of end-to-end shopping experiences within social apps further strengthens B2C dominance.

The C2C segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rapid rise of peer-to-peer selling and social reselling models. Individual sellers increasingly use social platforms to monetize personal networks, live selling, and community-based trust. Low entry barriers and minimal upfront investment encourage wider participation, accelerating growth across emerging and developed markets.

• By Product Type

On the basis of product type, the social commerce market is segmented into personal & beauty care, apparel, accessories, home products, health supplements, food & beverage, and others. The personal & beauty care segment dominated the market in 2025, supported by high visual appeal, frequent product launches, and strong influencer-driven demand. Short-form videos, tutorials, and reviews play a critical role in shaping purchase decisions and driving repeat sales. High margins and brand storytelling further contribute to segment leadership.

The apparel segment is expected to register the fastest growth from 2026 to 2033, driven by increasing adoption of live commerce and real-time product showcasing. Consumers benefit from size guidance, styling tips, and instant feedback during live sessions, improving confidence in online apparel purchases. Rapid trend cycles and social validation accelerate buying behavior, supporting sustained growth.

• By Platform/Sales Channel

On the basis of platform and sales channel, the social commerce market is segmented into video commerce, social network-led commerce, social reselling, group buying, and product review platforms. Social network-led commerce held the largest market revenue share in 2025 due to deep integration of shopping features within widely used social media platforms. Direct storefronts, in-app payments, and algorithm-driven product discovery enhance user engagement and purchase frequency. Strong data insights enable targeted promotions, reinforcing dominance.

The video commerce segment is projected to witness the fastest CAGR from 2026 to 2033, driven by growing consumer preference for interactive and immersive shopping experiences. Live streaming and short videos allow real-time product demonstrations and instant buyer interaction, increasing trust and conversion rates. The expanding creator economy and improved streaming infrastructure further accelerate adoption across regions.

Social Commerce Market Regional Analysis

- Asia-Pacific dominated the social commerce market with the largest revenue share of 72.1% in 2025, driven by high social media penetration, rapid smartphone adoption, and a strong culture of mobile-first shopping

- The region’s large young population, expanding digital payment infrastructure, and widespread use of influencer- and livestream-led selling models are accelerating market growth

- Rising internet accessibility, platform innovation, and increasing trust in social shopping ecosystems across emerging economies are supporting sustained expansion

China Social Commerce Market Insight

China held the largest share in the Asia-Pacific social commerce market in 2025, owing to its highly developed social media ecosystem and early adoption of livestream commerce. The strong integration of shopping features within social platforms, extensive creator economy, and widespread consumer acceptance of in-app purchases are key growth drivers. High engagement rates and seamless digital payments continue to reinforce China’s leadership position.

India Social Commerce Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid smartphone penetration, affordable mobile data, and increasing participation of small sellers and influencers. Growing adoption of social reselling models and vernacular content is expanding reach beyond metro cities. Rising trust in digital payments and strong user engagement on social platforms are further driving market momentum.

Europe Social Commerce Market Insight

The Europe social commerce market is expanding steadily, supported by rising adoption of social media shopping features and increasing collaboration between brands and content creators. Consumers show growing preference for personalized and community-driven shopping experiences. Strong data protection norms and emphasis on secure digital transactions are shaping platform strategies across the region.

Germany Social Commerce Market Insight

Germany’s social commerce market is driven by high internet penetration, strong e-commerce maturity, and increasing use of social platforms for product discovery. Brands focus on quality, transparency, and trusted reviews to engage consumers. The integration of social media with established online retail systems is supporting gradual but consistent growth.

U.K. Social Commerce Market Insight

The U.K. market benefits from a digitally savvy consumer base, widespread use of social media, and strong influence of creator-led marketing. Growth is supported by increasing adoption of video-based product promotion and seamless checkout integrations. High consumer engagement and trust in digital retail channels continue to strengthen market presence.

North America Social Commerce Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid innovation in social shopping features and strong brand investments in influencer marketing. High disposable income, advanced digital infrastructure, and growing acceptance of in-app purchasing are key factors. The expansion of video commerce and live shopping formats is further boosting adoption.

U.S. Social Commerce Market Insight

The U.S. accounted for the largest share in the North America social commerce market in 2025, supported by a mature social media landscape and strong participation from global brands. Advanced advertising tools, data-driven personalization, and widespread use of influencers enhance conversion rates. Continuous platform upgrades and high consumer engagement solidify the U.S.’s leading role in the region.

Social Commerce Market Share

The social commerce industry is primarily led by well-established companies, including:

- Snap, Inc. (U.S.)

- Xiaohongshu (China)

- Etsy, Inc. (U.S.)

- Roposo (India)

- WeChat / Weixin (China)

- Poshmark, Inc. (U.S.)

- Trell Shop (India)

- Meta Platforms, Inc. (U.S.)

- Yunji Sharing Technology Co., Ltd. (China)

- Pinterest, Inc. (U.S.)

- TikTok / Douyin (China)

- Fashnear Technologies Private Limited (India)

- Taobao (China)

- Twitter, Inc. (U.S.)

- Pinduoduo Inc. (China)

Latest Developments in Global Social Commerce Market

- In May 2025, Alibaba partnered with Xiaohongshu to strengthen social commerce integration in China, enabling direct redirection from content-driven product recommendations to purchases on Taobao and Tmall. This development significantly improved user engagement and conversion efficiency, as reflected by higher click-through rates and increased interaction, reinforcing the role of content-led platforms in driving transaction growth within the social commerce ecosystem

- In May 2025, Pinterest, Inc. introduced AI-generated content labeling to improve transparency and user trust on its platform. By clearly identifying AI-modified images through visual tags and advanced detection systems, the company enhanced content credibility, which is expected to positively influence user confidence, advertiser trust, and long-term engagement within social discovery and commerce-driven environments

- In April 2025, TikTok expanded its Shop feature across additional European markets, building on strong performance in the U.K. and Southeast Asia. This expansion supports TikTok’s strategy to scale in-app purchasing and live commerce, enabling brands to reach wider audiences and accelerating platform-driven sales growth across Europe’s rapidly expanding social commerce landscape

- In February 2025, Alibaba announced a strategic partnership with Apple to integrate its Qwen AI model into iPhone services in China, aiming to enhance personalization and recommendation accuracy in digital shopping experiences. This move strengthens AI-driven social commerce capabilities, allowing more tailored content, product discovery, and higher conversion rates across Alibaba’s ecosystem

- In November 2023, Meta Platforms, Inc. introduced account linking between Facebook, Instagram, and Amazon to streamline in-app shopping experiences. By enabling users to complete Amazon purchases directly within Meta’s platforms, this integration reduced purchase friction, improved ad conversion rates, and strengthened the role of social platforms as full-funnel commerce channels

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.