Global Specialtyhigh Barrier Film Packaging Market

Marktgröße in Milliarden USD

CAGR :

%

USD

25.40 Billion

USD

42.35 Billion

2025

2033

USD

25.40 Billion

USD

42.35 Billion

2025

2033

| 2026 –2033 | |

| USD 25.40 Billion | |

| USD 42.35 Billion | |

|

|

|

|

Global Specialty/High-Barrier Film Packaging Market Segmentation, By Material (Polyethylene, BOPET, Polypropylene, and Polyvinyl Chloride), Product (Bags & Pouches, Trays Lidding Films, Wrapping Films, Blister Packs, and Others), and Application (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Others) - Industry Trends and Forecast to 2033

What is the Global Specialty/High-Barrier Film Packaging Market Size and Growth Rate?

- The global specialty/high-barrier film packaging market size was valued at USD 25.4 Billion in 2025 and is expected to reach USD 42.35 Billion by 2033, at a CAGR of6.60% during the forecast period

- Rising demand for longer shelf-life packaging, increasing use of lightweight, durable, and contamination-resistant films, and rapid expansion in ready-to-eat and convenience food consumption are among the key factors accelerating market growth worldwide

- Growing adoption of high-barrier materials for moisture control, aroma protection, and oxygen resistance, along with the need for premium-quality pharmaceutical and cosmetic packaging, continues to support strong market expansion

- Increasing demand for sustainable films, recyclable barrier solutions, and improved food safety compliance is further boosting market adoption across developed and developing economies

What are the Major Takeaways of Specialty/High-Barrier Film Packaging Market?

- Rapid growth in the processed food, snacks, meat products, and dairy sectors, coupled with expanding packaging innovation and the rise of e-commerce-driven flexible packaging, continues to create significant new opportunities in the Specialty/High-Barrier Film Packaging market

- Increasing focus on eco-friendly barrier films, including bio-based and recyclable materials, is reshaping market dynamics and compelling manufacturers to invest in sustainable production technologies

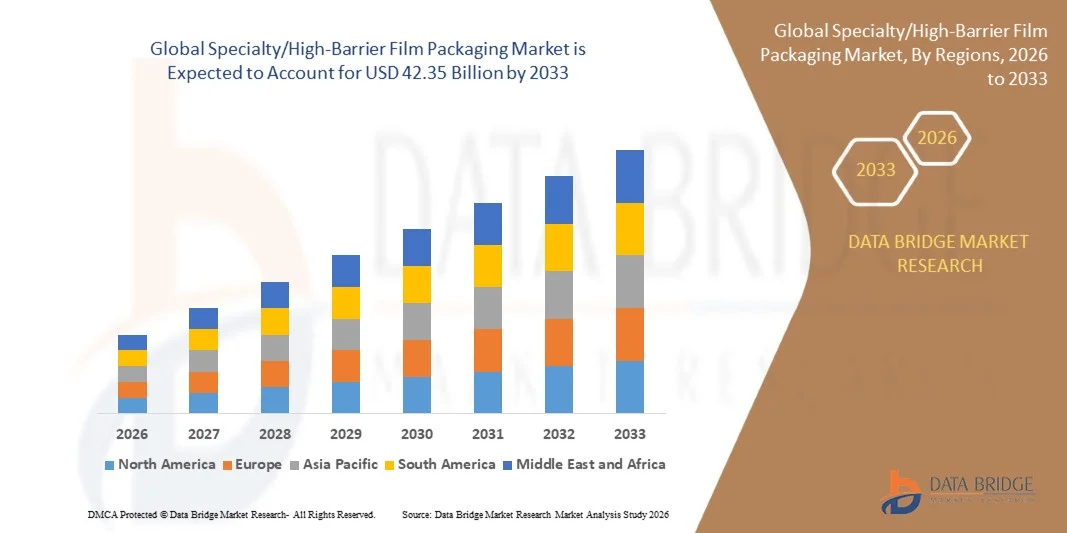

- North America dominated the specialty/high-barrier film packaging market with a 42.05% revenue share in 2025, driven by strong consumption of packaged food, rapid expansion of pharmaceutical production, and high adoption of advanced flexible packaging solutions across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.82% from 2026 to 2033, driven by rapid expansion in packaged food consumption, rising pharmaceutical production, and strong growth in personal care and cosmetic packaging across China, India, Japan, South Korea, and Southeast Asia

- Polyethylene dominated the market with a 38.6% share in 2025, driven by its excellent moisture barrier strength, flexibility, cost efficiency, and high compatibility with food, pharmaceutical, and personal care packaging formats

Report Scope and Specialty/High-Barrier Film Packaging Market Segmentation

|

Attributes |

Specialty/High-Barrier Film Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Specialty/High-Barrier Film Packaging Market?

“Growing Shift Toward Sustainable, Multi-Layer, and High-Performance Barrier Packaging Solutions”

- The specialty/high-barrier film packaging market is witnessing strong adoption of sustainable, recyclable, and bio-based high-barrier films designed to protect sensitive products such as food, pharmaceuticals, and personal care items

- Manufacturers are increasingly developing multi-layer, high-strength, and high-oxygen/moisture barrier structures offering extended shelf life, improved product safety, and enhanced compatibility with modern packaging machinery

- Growing demand for lightweight, flexible, and performance-driven packaging materials is accelerating usage across FMCG, retail, pharmaceuticals, and fresh food supply chains

- For instance, companies such as Amcor, Mondi, Sealed Air, and Huhtamaki have launched recyclable and mono-material high-barrier films with advanced sealing properties, downgauging benefits, and improved sustainability performance

- Rising need for longer shelf life, reduced food wastage, and compliance with global sustainability regulations is further fueling high-barrier film innovation

- As circular packaging and eco-friendly materials gain traction, Specialty/High-Barrier Films will remain critical for quality protection, operational efficiency, and sustainable packaging transformation

What are the Key Drivers of Specialty/High-Barrier Film Packaging Market?

- Rising demand for extended shelf life packaging, especially across meat, dairy, beverages, and pharmaceutical products, is driving adoption of high-barrier films globally

- For instance, in 2025, leading companies such as Amcor, Berry Global, and Constantia Flexibles upgraded their high-barrier portfolios with recyclable PE and PP solutions, improved barrier coatings, and high-performance laminates

- Growing penetration of ready-to-eat meals, packaged food, frozen food, and e-commerce packaging across the U.S., Europe, and Asia-Pacific is boosting market expansion

- Advancements in nanotechnology coatings, EVOH-based layers, metallized films, and bio-based materials are enhancing barrier strength, material efficiency, and compatibility with recycling streams

- Rising global demand for sustainability, lightweight packaging, and reduced plastic consumption is accelerating the shift toward recyclable mono-material barrier films

- Supported by strong investments in packaging modernization, food safety, and retail supply chain optimization, the Specialty/High-Barrier Film Packaging market is expected to witness long-term growth

Which Factor is Challenging the Growth of the Specialty/High-Barrier Film Packaging Market?

- High production costs associated with advanced barrier coatings, multi-layer structures, and specialty raw materials continue to challenge adoption among small converters and cost-sensitive industries

- For instance, during 2024–2025, fluctuations in polymer prices, aluminum costs, and specialty resin availability increased manufacturing expenses for global barrier film suppliers

- Technical complexities in designing recyclable high-barrier films, especially mono-material structures, require advanced R&D capabilities and specialized processing technologies

- Limited awareness in emerging markets regarding barrier performance standards, recycling guidelines, and sustainable packaging technologies slows adoption

- Competition from rigid packaging formats, glass containers, metal cans, and low-cost flexible alternatives creates pricing pressure and limits market differentiation

- To address these challenges, companies are investing in cost-optimized materials, advanced coating technologies, improved recycling compatibility, and digital quality monitoring to increase Specialty/High-Barrier Film Packaging adoption worldwide

How is the Specialty/High-Barrier Film Packaging Market Segmented?

The market is segmented on the basis of material, product, and application.

• By Material

On the basis of material, the specialty/high-barrier film packaging market is segmented into Polyethylene, BOPET, Polypropylene, and Polyvinyl Chloride (PVC). Polyethylene dominated the market with a 38.6% share in 2025, driven by its excellent moisture barrier strength, flexibility, cost efficiency, and high compatibility with food, pharmaceutical, and personal care packaging formats. Its recyclability and strong adoption across sustainable packaging initiatives further strengthen demand.

BOPET is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising use in premium flexible packaging, extended shelf-life applications, high mechanical strength, and superior oxygen and aroma barrier properties. Increasing demand for premium food exports, advanced medical packaging, and high-clarity product presentations continues to propel BOPET usage. Rapid R&D investments in bio-based and recyclable PET films are also contributing to segment expansion across global markets.

• By Product

On the basis of product, the market is segmented into Bags & Pouches, Trays Lidding Films, Wrapping Films, Blister Packs, and Others. Bags & Pouches dominated the market with a 41.2% share in 2025, owing to their lightweight structure, excellent barrier protection, versatility across food and pharma applications, and cost-effectiveness in mass packaging. Strong adoption in ready-to-eat meals, snacks, meat products, and personal care items further boosts segment strength.

Blister Packs are expected to grow at the fastest CAGR from 2026 to 2033, driven by rising global pharmaceutical production, increasing demand for dose-level packaging, and stringent safety and contamination-control standards. Growth in OTC medications, medical devices, and unit-dose formats is pushing rapid adoption of high-barrier blister materials. Advancements in thermoforming films and PVC-free high-barrier structures are also contributing to segment growth.

• By Application

On the basis of application, the market is segmented into Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Others. The Food & Beverages segment dominated the market with a 52.7% share in 2025, supported by rising consumption of packaged foods, increasing need for extended shelf life, and growing adoption of flexible films for meat, dairy, snacks, frozen meals, and beverages. High oxygen and moisture barrier requirements continue to drive usage of advanced multilayer films.

The Pharmaceuticals segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by expanding global drug manufacturing, rising demand for sterile, contamination-free packaging, and increased preference for blister and pouch-based medicine packaging. Growth in biologics, temperature-sensitive drugs, and home-healthcare medications further enhances demand for high-performance barrier films across pharma value chains.

Which Region Holds the Largest Share of the Specialty/High-Barrier Film Packaging Market?

- North America dominated the specialty/high-barrier film packaging market with a 42.05% revenue share in 2025, driven by strong consumption of packaged food, rapid expansion of pharmaceutical production, and high adoption of advanced flexible packaging solutions across the U.S. and Canada

- Rising demand for extended shelf-life products, growth in convenience food formats, and increasing emphasis on sustainable, recyclable, and multilayer high-barrier materials strengthen the region’s leadership

- Major packaging converters continue to introduce innovative barrier films with enhanced oxygen, aroma, and moisture protection, supporting premium food, dairy, meat, and pharma packaging. Strong regulatory standards, well-established manufacturing capabilities, and continuous investments in packaging automation and material R&D further reinforce market dominance across North America

U.S. Specialty/High-Barrier Film Packaging Market Insight

The U.S. serves as the largest contributor within North America, supported by high demand for processed foods, increasing pharmaceutical output, and widespread adoption of multilayer barrier films across key industries. Growth in frozen meals, ready-to-eat snacks, functional beverages, and medical packaging significantly boosts consumption of advanced barrier structures. Strong presence of global packaging manufacturers, increasing retail penetration, and continuous innovation in sustainable barrier materials—such as bio-based films and recyclable high-barrier solutions—further elevate market growth. Expanding food exports and stringent quality standards enhance long-term demand for Specialty/High-Barrier Film Packaging across the country.

Canada Specialty/High-Barrier Film Packaging Market Insight

Canada contributes notably to regional market expansion, driven by rising consumption of packaged foods, growing pharmaceutical manufacturing, and increasing preference for protective and lightweight packaging materials. High-barrier films are widely used in meat products, bakery items, dairy packaging, and specialized pharma applications due to strict regulatory and safety compliance requirements. Increasing investments in sustainable packaging technologies, supportive government initiatives for recyclability, and expansion of food processing facilities strengthen market adoption across the country.

Asia-Pacific Specialty/High-Barrier Film Packaging Market

Asia-Pacific is projected to register the fastest CAGR of 8.82% from 2026 to 2033, driven by rapid expansion in packaged food consumption, rising pharmaceutical production, and strong growth in personal care and cosmetic packaging across China, India, Japan, South Korea, and Southeast Asia. High-volume manufacturing capabilities, large consumer bases, and increasing urbanization continue to drive adoption of cost-efficient, high-performance barrier films. Growth in e-commerce, increasing preference for convenient packaging, and strong investments in sustainable, recyclable barrier materials further accelerate regional market growth. Expansion of flexible packaging manufacturing hubs and rising export activities strengthen Asia-Pacific’s long-term leadership trajectory.

China Specialty/High-Barrier Film Packaging Market Insight

China holds the largest share within Asia-Pacific, supported by massive food processing capacity, strong pharmaceutical manufacturing, and expanding demand for multilayer barrier films for meat, dairy, snacks, and medical packaging. Government-backed initiatives for packaging modernization, rising disposable incomes, and high export demand continue to accelerate adoption. Local manufacturers’ cost competitiveness and rapid innovation in bio-based and recyclable barrier materials further enhance domestic and global market penetration.

Japan Specialty/High-Barrier Film Packaging Market Insight

Japan shows steady market growth driven by advanced food safety standards, long-standing expertise in precision packaging, and strong demand for premium, high-quality barrier films. Increasing consumption of convenience foods, growth in high-value cosmetics, and strong pharmaceutical manufacturing infrastructure support continuous adoption. Focus on recyclable barrier technologies and high-performance multilayer structures reinforces long-term market expansion.

India Specialty/High-Barrier Film Packaging Market Insight

India is emerging as a rapidly expanding market, supported by rising processed food consumption, strong growth in pharmaceuticals, and increasing penetration of modern retail and e-commerce. Demand for moisture-resistant, aroma-preserving, and contamination-free films is accelerating across snacks, dairy, beverages, and generic drug manufacturing. Government initiatives promoting food processing, packaging modernization, and sustainability are further driving market penetration.

South Korea Specialty/High-Barrier Film Packaging Market Insight

South Korea contributes significantly to regional growth due to strong demand for packaged foods, high adoption of personal care products, and rapid development of pharmaceutical innovations. Manufacturers increasingly utilize advanced barrier materials for premium food, beauty, and medical packaging applications. Continuous investments in smart packaging, eco-friendly film technologies, and high-performance multilayer structures support the country’s strong market expansion.

Which are the Top Companies in Specialty/High-Barrier Film Packaging Market?

The specialty/high-barrier film packaging industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Sealed Air (U.S.)

- Huhtamaki (Finland)

- Klöckner Pentaplast (kp) (Germany)

- Mondi (U.K.)

- Constantia Flexibles (Austria)

- Berry Global Inc (U.S.)

- Coveris (Austria)

- Sonoco Products Company (U.S.)

- Wipak (Germany)

- Uflex Limited (India)

- Printpack (U.S.)

- Jindal Poly Films (India)

- Cosmo Films Ltd. (India)

What are the Recent Developments in Global Specialty/High-Barrier Film Packaging Market?

- In May 2025, Mondi unveiled a new mono-material high barrier laminate suitable for food and healthcare applications, offering strong oxygen and moisture resistance while supporting recyclability and sustainability, and this advancement is expected to significantly enhance eco-friendly packaging adoption across global markets

- In February 2025, Sealed Air developed an advanced smart high barrier film equipped with built-in freshness sensors for meat and seafood packaging, enabling real-time visibility of product condition through integrated apps, and this innovation is anticipated to transform transparency and safety in perishable goods packaging

- In April 2024, UFlex introduced a new range of high barrier packaging films engineered for enhanced product protection, longer shelf life, and improved sustainability, and this launch is set to reinforce the company’s leadership in next-generation flexible packaging solutions

- In March 2024, Toppan released a recyclable high barrier packaging film that combines strong barrier performance with environmental responsibility, and this development is expected to strengthen the global shift toward sustainable flexible packaging materials

- In December 2023, Amcor rolled out a new recyclable high barrier packaging film designed to offer superior product protection while supporting sustainability goals, and this innovation is poised to accelerate the industry’s transition toward recyclable and high-performance packaging formats

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.