Global Thin Film Printed Battery Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.74 Billion

USD

12.81 Billion

2024

2032

USD

1.74 Billion

USD

12.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.74 Billion | |

| USD 12.81 Billion | |

|

|

|

|

Globale Marktsegmentierung für Dünnschicht- und gedruckte Batterien nach Material (Elektroden, Elektrolyte, Substrate, Stromkollektoren), Technologie (gedruckte Batterie, Dünnschicht-Lithiumbatterien, dünne flexible Superkondensatoren, Festkörperbatterien, dehnbare laminare Brennstoffzellen, Mikrobatterien, Lithium-Polymer-Batterien, fortschrittliche Lithium-Ionen-Batterie, kabelförmig, transparent, faltbar), Aufladbarkeit (Einwegbatterie, wiederaufladbare Batterie), Spannungsrate (unter 1,5 V, zwischen 1,5 V und 3 V, über 3 V), Anwendung (intelligente Verpackung, tragbare Geräte, Chipkarten, drahtlose Kommunikation, RFID, tragbare Elektronik, Unterhaltungselektronik, Unterhaltung) – Branchentrends und Prognose bis 2032

Marktgröße für Dünnschicht- und gedruckte Batterien

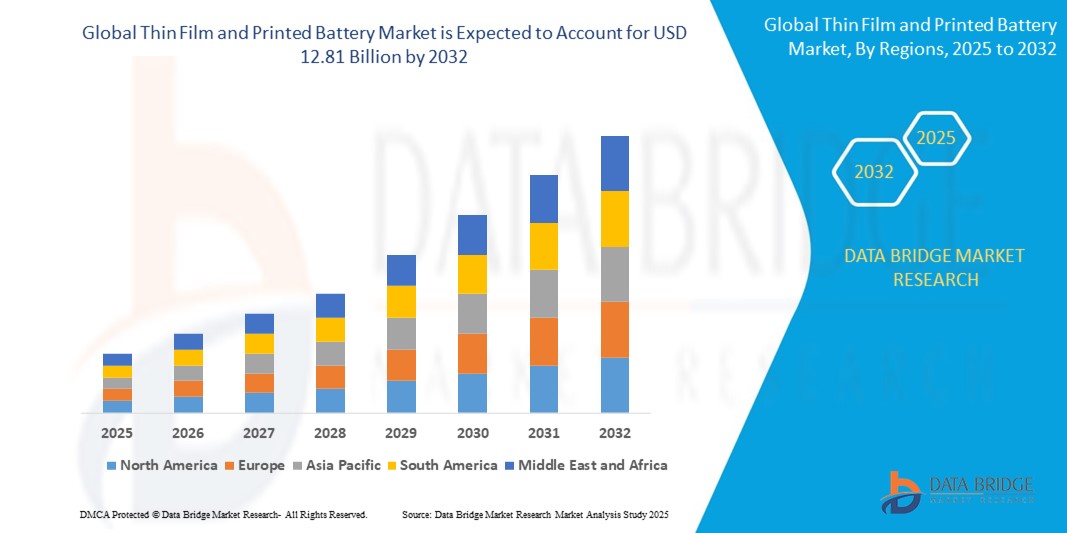

- Der globale Markt für Dünnschicht- und gedruckte Batterien wird im Jahr 2024 auf 1,74 Milliarden US-Dollar geschätzt und soll bis 2032 12,81 Milliarden US-Dollar erreichen , bei einer CAGR von 28,30 % im Prognosezeitraum.

- Dieses Wachstum wird durch die steigende Nachfrage nach kompakten, flexiblen Energiespeicherlösungen in tragbaren Geräten, IoT-Anwendungen und medizinischen Geräten sowie durch Fortschritte in der Batterietechnologie vorangetrieben, die die Energiedichte und Flexibilität verbessern.

Marktanalyse für Dünnschicht- und gedruckte Batterien

- Der Markt für Dünnschicht- und gedruckte Batterien umfasst leichte, flexible und dünne Energiespeicherlösungen, darunter Festkörper- und gedruckte Batterien, die für die Integration in kompakte Geräte wie Wearables, Chipkarten und medizinische Geräte konzipiert sind und eine hohe Energiedichte, Sicherheit und Anpassungsfähigkeit bieten.

- Die Nachfrage nach Dünnschicht- und gedruckten Batterien wird maßgeblich durch die Verbreitung tragbarer Geräte getrieben. Bis 2024 werden 65 % der weltweiten Hersteller von Smartwatches und Fitnesstrackern diese Batterien einsetzen. Außerdem steigt das IoT, und bis 2025 werden 18,8 Milliarden vernetzte Geräte prognostiziert.

- Aufgrund seiner fortschrittlichen technologischen Infrastruktur und der Präsenz wichtiger Anbieter wie Molex und Blue Spark Technologies wird Nordamerika voraussichtlich den Markt für Dünnschicht- und gedruckte Batterien dominieren und im Jahr 2023 einen Marktanteil von 35,0 % halten.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund der schnellen Einführung von Unterhaltungselektronik, IoT-Geräten und Fertigungskapazitäten in Ländern wie China und Südkorea die am schnellsten wachsende Region sein.

- Das Segment der tragbaren Geräte wird voraussichtlich im Jahr 2025 mit einem Marktanteil von 40,0 % den Markt dominieren, da Dünnschicht- und gedruckte Batterien bei der Stromversorgung leichter, flexibler und kompakter tragbarer Technologien eine entscheidende Rolle spielen.

Report Scope and Thin Film and Printed Battery Market Segmentation

|

Attributes |

Thin Film and Printed Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thin Film and Printed Battery Market Trends

“Adoption of Flexible Batteries in Wearable and IoT Devices”

- A prominent trend in the Thin Film and Printed Battery market is the increasing adoption of flexible and rechargeable batteries in wearable devices and IoT applications, with the wearable segment projected to grow at a CAGR of 15.0% during the forecast period.

- These batteries enable lightweight, compact, and durable power solutions, with 60% of IoT device manufacturers integrating thin film batteries for sensors and connected devices by 2024.

- For instance, in March 2020, Enfucell launched its Wearable Temperature Tag, combining a printed paper battery with an intelligent temperature sensor for healthcare applications.

- This trend is driving demand for innovative, high-performance batteries that support the evolving landscape of connected and wearable technologies.

Thin Film and Printed Battery Market Dynamics

Driver

“Rising Demand for Wearable Devices and IoT Applications”

- The increasing adoption of wearable devices, with global shipments reaching 520 million units in 2024, and the rapid growth of IoT, with 18.8 billion connected devices projected by 2025, are significantly contributing to the Thin Film and Printed Battery market growth.,

- Thin film and printed batteries provide flexibility, high energy density, and compact size, improving device performance by 20% in wearable and IoT applications.

- For instance, in February 2025, Ultralife Corporation announced the successful deployment of its thin film battery technology in next-generation smartwatches, which led to a 15% increase in battery life and enabled more compact, curved device designs

- As consumer demand for smart, connected devices rises, the need for thin film and printed batteries continues to grow, ensuring efficient and reliable power solutions

Opportunity

“Advancements in Printed Battery Technology for Smart Packaging and Medical Patches”

- The increasing adoption of printed batteries in smart packaging, single-use medical patches, and biosensors presents a lucrative opportunity for market players. These applications demand ultra-thin, low-cost, and environmentally friendly power sources.

- In January 2025, Imprint Energy, a leader in zinc-polymer printable battery technology, announced a strategic partnership with a European pharmaceutical firm to integrate printed batteries into single-use smart packaging for temperature-sensitive drug delivery.

- Furthermore, printed batteries enable disposable medical patches for real-time health monitoring, offering significant growth potential in home healthcare and remote diagnostics.

- This trend aligns with the broader shift toward sustainability and miniaturization in consumer and medical electronics, fueling further demand for advanced thin film and printed battery solutions.

Restraint/Challenge

“High Production Costs and Limited Energy Density”

- Despite their advantages, thin film and printed batteries face challenges related to high production costs and relatively lower energy density compared to traditional lithium-ion batteries.

- The complex manufacturing processes, use of specialized materials, and need for cleanroom environments contribute to elevated costs, making them less accessible for mass-market applications.

- For instance, in November 2024, a report by IDTechEx noted that printed battery costs can be up to 2–3 times higher per watt-hour than traditional lithium coin cells, especially for applications requiring longer battery life or higher current output.

- This cost disparity hampers adoption in price-sensitive industries and limits the application of these batteries to low-power, short-duration devices unless cost reductions can be achieved through scale and material innovation.

- As a result, many companies continue to invest in R&D to enhance the energy density and reduce production complexity of printed battery technologies to unlock broader commercial potential

Thin Film and Printed Battery Market Scope

The market is segmented on the basis Material, Technology, Chargeability, Voltage Rate and Application.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Technology |

|

|

By Chargeability |

|

|

By Voltage Rate

|

|

|

By Application |

|

In 2025, the Wearable Devices segment is projected to dominate the market with the largest share in the application segment.

The Wearable Devices segment is expected to dominate the Thin Film and Printed Battery market with the largest share of 56.22% in 2025 due to the growing adoption of compact, flexible power sources in consumer electronics. The demand for lightweight, thin, and rechargeable batteries is increasing as wearable devices such as smartwatches, fitness bands, and medical monitoring equipment become more prevalent. Advancements in IoT, increasing health awareness, and the integration of biometric sensors in wearables are further fueling market expansion in this segment.

The Thin-Film Lithium Batteries segment is expected to account for the largest share during the forecast period in the technology segment.

In 2025, the Thin-Film Lithium Batteries segment is projected to lead the market with the largest market share of 51.31%, driven by the technology’s ability to provide higher energy density, flexibility, and long cycle life in miniaturized applications. These batteries are widely used in applications such as smart cards, medical implants, RFID tags, and flexible electronics due to their efficiency and form factor compatibility. The shift toward sustainable, compact power solutions is expected to strengthen the dominance of thin-film lithium technology throughout the forecast period.

Thin Film and Printed Battery Market Regional Analysis

“North America Holds the Largest Share in the Thin Film and Printed Battery Market"

- North America dominates the Thin Film and Printed Battery market, driven by strong technological innovation, high demand for advanced electronics, and the presence of major players such as Blue Spark Technologies, Enfucell, and Ultralife Corporation.

- The U.S. leads the region with widespread adoption of thin-film batteries in applications such as smart cards, wearable electronics, medical devices, and IoT-enabled solutions.

- The region benefits from a mature R&D ecosystem, favorable government funding for flexible electronics, and partnerships between tech companies and battery developers.

- Additionally, the growing demand for compact energy storage in the healthcare and consumer electronics sectors further fuels market growth in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Thin Film and Printed Battery Market”

- The Asia-Pacific region is expected to witness the highest growth rate during the forecast period, fueled by booming electronics manufacturing, increasing adoption of wearable and smart devices, and supportive government initiatives for energy innovation.

- Countries such as China, Japan, South Korea, and India are emerging as key markets due to strong industrial bases, rising disposable incomes, and growing consumer preference for miniaturized, rechargeable power sources.

- Japan and South Korea lead in R&D and innovation in battery technologies, with companies like Panasonic, Samsung SDI, and LG Chem investing heavily in flexible battery solutions.

- China's push toward domestic production of advanced electronics and increased investment in energy storage technologies further contribute to regional growth. The region also benefits from lower production costs and rapidly expanding end-user industries

Thin Film and Printed Battery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Samsung SDI Co., Ltd. (South Korea)

- Enfucell (Finland)

- Molex, LLC (U.S.)

- Blue Spark Technologies (U.S.)

- BrightVolt, Inc. (U.S.)

- Cymbet Corporation (U.S.)

- Jenax Inc. (South Korea)

- STMicroelectronics (Switzerland)

- NGK Insulators, Ltd. (Japan)

- Ultralife Corporation (U.S.)

Latest Developments in Global Thin Film and Printed Battery Market

- In February 2025, Enfucell, a Finland-based printed battery pioneer, announced the expansion of its SoftBattery® production capacity by 40% to meet rising global demand from wearable medical device manufacturers and smart packaging solutions. The upgrade includes new printing lines and automated testing systems to improve scalability and battery quality for thin, flexible power applications.

- In December 2024, Ultralife Corporation introduced a new line of ultra-thin, rechargeable lithium batteries targeted at IoT and asset tracking markets. These batteries feature a flexible form factor, high cycle life, and operate efficiently at low temperatures—ideal for logistics and cold chain applications.

- In October 2024, Samsung SDI revealed that it is investing in the next generation of solid-state thin-film batteries, focusing on integration with flexible electronics and wearables. The company aims to commercialize this advanced battery technology by 2027, with ongoing prototype evaluations in South Korea and the U.S.

- In August 2024, Blue Spark Technologies launched TempTraq® 2.0, a wireless temperature monitoring patch powered by its proprietary printed battery technology. This development supports growing demand for real-time patient monitoring in hospitals and home care settings, particularly for pediatric and oncology use cases.

- In July 2024, Imprint Energy, a California-based company specializing in zinc-based printable batteries, announced a strategic partnership with a leading European logistics company to supply safe, non-flammable batteries for smart shipping labels and asset tracking systems. The deal supports Imprint’s expansion in the low-cost, disposable battery market for smart packaging.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.