Global Track And Trace Solutions Market

Marktgröße in Milliarden USD

CAGR :

%

USD

5.88 Billion

USD

24.46 Billion

2024

2032

USD

5.88 Billion

USD

24.46 Billion

2024

2032

| 2025 –2032 | |

| USD 5.88 Billion | |

| USD 24.46 Billion | |

|

|

|

|

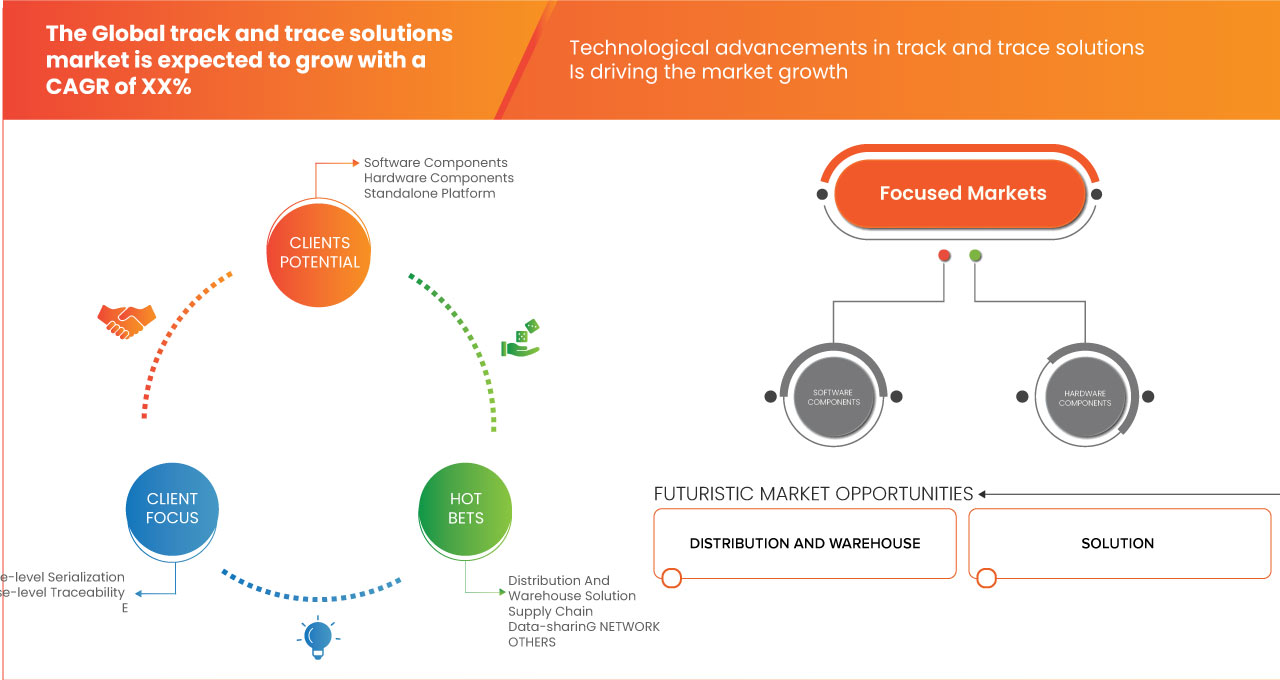

Global Track And Trace Solutions Market, By Product (Software Components, Hardware Components, and Standalone Platform), Solution (Line and Site-Level Serialization, Cloud Enterprise-Level Traceability, Distribution and Warehouse Solution, Supply Chain Data-Sharing Network, and Others), Application (Serialization, Printing, Labeling and Packaging Inspection, Aggregation, Tracking, Tracing, and Reporting), Technology (2D Barcodes, Radiofrequency Identification (RFID), and Linear/1D Barcodes), End User (Pharmaceutical and Biopharmaceutical Companies, Consumer Packaged Goods, Luxury Goods, Food and Beverage, Medical Device Companies, Contract Manufacturing Organizations, Repackagers, Cosmetics Companies, and Others), Distribution Channel (Direct Sales and Third Party Distributors) - Industry Trends and Forecast to 2032

Global Track and Trace Solutions Market Analysis

Tracking and tracing medications to enhance the accessibility of products in the prescription supply chain is not a novel phenomenon. In reality, the concept of serialization has been debated for more than 15 years. In 1999, after a study by the U.S. College of Medicine, President Bill Clinton put patient protection (including avoiding mistakes at the point of dispensing medicines) on the agenda of the federal government and proceeded to advocate for reform after his presidency. In 2003, the U.S. Food and Drug Administration (FDA) required barcoding at unit levels, and in the same year, the World Health Organization (WHO) released a study highlighting the scope of the counterfeit medication problem, claiming that 10% of medicines worldwide were counterfeit. A major shift in serialization took place around 2005 and the variety of countries started to set targets for adoption. However, after making several measures in protecting the supply chain, the challenge was less of a concern after the 2008 financial crisis.

As the world economy has changed, the focus has gradually moved. Turkey adopted serialization standards in 2010 and rules are in effect for other markets such as China, South Korea and India. With the EU Falsified Medicines Directive (FMD) coming into force in February 2019 and the U.S. adopting legislation as part of the Drug Supply Chain Security Act (DSCSA) in November 2017, more than 75% of global medicines are required to be protected by some form of monitor and trace regulations by 2019. The track and trace solutions market is of keen importance in various industries starting from pharmaceutical to medical devices and food and beverages among more.

The progress in demand of track and trace solutions in healthcare facilities is due to stringent laws formulated for serialization and labeling which leads to the lucrative growth of track and trace solutions in the market. The vast product portfolio with enormous options for almost all major industries such as food and beverage, cosmetic and medical devices among more further impels the growth of track and trace solutions in the global track and trace solutions market.

Global Track and Trace Solutions Market Size

Global track and trace solutions market size was valued at USD 5.88 Billion in 2024 and is projected to reach USD 24.46 Billion by 2032, with a CAGR of 19.5% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Global Track and Trace Solutions Market Trends

“Increased Demand For Supply Chain Transparency”

The demand for track and trace solutions is particularly strong due to the need for ensuring patient safety, product integrity, and regulatory compliance. Track and trace technologies help monitor the movement of pharmaceutical products, medical devices, and vaccines throughout the supply chain, minimizing the risk of counterfeit drugs and ensuring that products are stored and transported under proper conditions. Additionally, with the rising need for personalized medicine and greater healthcare accountability, these solutions enable healthcare providers to track products from production to end-use, ensuring they reach the right patients safely and efficiently. Regulatory bodies, such as the FDA, require stringent traceability measures, making track and trace systems an essential part of healthcare operations.

Report Scope and Global Track and Trace Solutions Market Segmentation

|

Attributes |

Global Track and Trace Solutions Market Market Insights |

|

Segments Covered |

|

|

Region Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Denmark, Poland, Sweden, Norway, Finland, Rest of Europe, China, Japan, India, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines, New Zealand, Vietnam, Taiwan, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Qatar, Egypt, Kuwait, Bahrain, Oman, Rest of Middle East and Africa |

|

Key Market Players |

SAP SE(Germany), Zebra Technologies Corp.(U.S.), Videojet Technologies, Inc.(U.S.), METTLER TOLEDO(U.S.), Tracelink Inc.(U.S.), Siemens, Domino Printing Sciences plc(U.K.), Laetus GmbH(Germany), Xyntek Incorporated(U.S.), IBM Corporation(U.S.), WIPOTEC-OCS GmbH(Germany), 3Keys(Germany), ACG(India), NJM Packaging Inc.(U.S.), OPTEL GROUP(Canada), Systech(U.S.), Robert Bosch Manufacturing Solutions GmbH(Germany), ANTARES VISION S.p.A.(Italy), Uhlmann(Germany), SEA VISION S.r.l.(Italy), Jekson Vision(India), Kevision Systems(india), Arvato Systems, Grant-Soft Ltd.(Turkey), PharmaSecure Inc.(U.S.), Axyway(France) and SL Controls Ltd.(U.S.) |

|

Market Opportunities |

Expansion in Global Trade |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Track and Trace Solutions Market Definition

The method of identifying the present and historical position (and other information) of a particular object or property involves the storage and transportation of several kinds of items, monitoring and tracking or tracing. This definition can be followed by the estimation and recording of the location of cars and containers, for instance, recorded in a real-time database. This method leaves the challenge of drawing up a cohesive description of the corresponding progress notes. Track and trace stands for linking machines to IT and data sharing at all rates. This includes strong hardware suite device modules or stand-alone systems. The major goal of track and trace solutions is to decline the chain of counterfeit drugs and fake products across globe and to provide smooth flow and traceability of the goods at each and every point.

Global Track and Trace Solutions Market Dynamics

Drivers

- Stringent Regulations and Standards for the Implementation 0f Serialization

The arrival of mandatory serialization has completely transformed the pharmaceutical market. With both the United States Drug Supply Chain Security Act (DSCSA) and European Union Falsified Medicines Directive (FMD) now “live”, the supply chain of pharmaceuticals is forever linked to serialized products and data. Looking deeper, a successful serialization program involves far more than just placing serial numbers on packaging. Regulations vary from market to market and can often change, which means that the regulatory professionals need to be prepared to adjust procedures, processes, and filings to keep up. Since the law on the labeling and serialization of medicines is fairly recent, it is subject to greater global complexity and varies more often than other regulations. Moreover, as the supply chain for genuine pharmaceuticals has grown longer, this creates an opportunity for counterfeiters at every step in the supply chain. Hence, stringent regulations and standardization are made in order to protect the goods.

- In July 2024, according to the article published by Food and Drug Administration, the Drug Supply Chain Security Act (DSCSA) mandates the electronic identification and tracing of prescription drugs at the package level to prevent harmful drugs from entering the U.S. supply chain. This stringent regulation drives the need for advanced track and trace solutions to ensure compliance, protect patients, and enable quick responses to threats, thereby acting as a key driver for the global market

- Laut einem vom USAID Global Health Supply Chain Program veröffentlichten Artikel hat die chinesische staatliche Lebensmittel- und Arzneimittelbehörde im Februar 2022 die Serialisierung von 502 Arzneimitteln auf der Liste der unentbehrlichen Arzneimittel vorgeschrieben, um Rückverfolgbarkeit und Authentizität zu gewährleisten. Diese strenge Regelung steigert die Nachfrage nach Track-and-Trace-Lösungen zur Einhaltung der Serialisierungsanforderungen. Infolgedessen fungiert sie als wichtiger Treiber für den globalen Markt und drängt auf eine breitere Einführung fortschrittlicher Tracking-Technologien

Das Problem der Arzneimittelverfälschung ist seit Jahrzehnten ein globales Problem. Angesichts ungesicherter physischer und virtueller globaler Lieferketten, Internetverkäufen und minimaler Strafen glauben die Regierung und verschiedene Pharmaunternehmen weltweit, dass die Einführung der Serialisierung die mit Fälschungen verbundenen Probleme verringern und stoppen könnte. Daher wirken die strengen Vorschriften und Standards für die Einführung der Serialisierung als Treiber für den globalen Markt für Track-and-Trace-Lösungen.

- Zunehmende Bedenken hinsichtlich Fälschungen

Die wachsende Besorgnis über gefälschte Produkte ist zu einem großen Problem geworden, insbesondere im Pharma- und Gesundheitssektor, wo das Vorhandensein gefälschter Medikamente schwerwiegende Folgen für die Gesundheit und Sicherheit der Patienten haben kann. Gefälschte Medikamente gefährden nicht nur die Integrität des Gesundheitssystems, sondern erhöhen auch das Risiko von Nebenwirkungen, Arzneimittelresistenzen und Behandlungsfehlern. Als Reaktion auf diese wachsende Bedrohung drängen Regulierungsbehörden und Branchenvertreter auf strengere Maßnahmen zur Rückverfolgbarkeit und Serialisierung. Diese Maßnahmen tragen dazu bei, die Echtheit von Produkten sicherzustellen, indem sie es Herstellern, Händlern und Einzelhändlern ermöglichen, die Bewegung von Waren durch die gesamte Lieferkette zu verfolgen. Technologien wie RFID, Barcodes und Blockchain werden zunehmend eingesetzt, um Fälschungen zu bekämpfen. Sie ermöglichen die Überwachung und Überprüfung von Produkten in jeder Phase der Lieferkette, von der Herstellung bis zum Endverbraucher. Mit der Ausweitung des globalen Handels und komplexeren Lieferketten ist das Risiko, dass gefälschte Produkte auf den Markt gelangen, größer geworden, was den Bedarf an verbesserten Rückverfolgbarkeitssystemen weiter erhöht. Dieses gesteigerte Bewusstsein für das Risiko von Produktfälschungen ist ein wichtiger Treiber für den weltweiten Markt für Track-and-Trace-Lösungen, da Unternehmen und Regierungen auf der Suche nach robusten Systemen sind, um Produkte zu authentifizieren, die Einhaltung gesetzlicher Vorschriften zu gewährleisten und Verbraucher vor potenziell schädlichen Produktfälschungen zu schützen.

Zum Beispiel,

- Laut einem im Mai 2024 von der Food and Drug Administration veröffentlichten Artikel bergen gefälschte Medikamente, die möglicherweise falsche, unzureichende oder schädliche Inhaltsstoffe enthalten, ernsthafte Gesundheitsrisiken, während sie fälschlicherweise als authentisch vermarktet werden. Diese wachsende Besorgnis über die Sicherheit und Wirksamkeit von Arzneimitteln führt zur Einführung von Track-and-Trace-Lösungen, um die Echtheit der Produkte sicherzustellen. Infolgedessen sind die zunehmenden Bedenken hinsichtlich gefälschter Produkte ein wichtiger Treiber für den globalen Markt für Track-and-Trace-Lösungen

- Laut dem im Oktober 2024 von Science Direct veröffentlichten Artikel stellen gefälschte und nachgeahmte Medikamente, insbesondere im internationalen Reiseverkehr, ein ernstes Risiko für die öffentliche Gesundheit dar. Mit dem Anstieg der gemeldeten Fälle weltweit sind die Bedenken hinsichtlich der Verbreitung gefälschter Medikamente erheblich gewachsen. Dies hat zu einem größeren Bedarf an Rückverfolgbarkeitssystemen geführt, um die Echtheit der Produkte sicherzustellen. Infolgedessen sind die zunehmenden Bedenken hinsichtlich gefälschter Medikamente ein wichtiger Treiber für den globalen Markt für Track-and-Trace-Lösungen

Bedenken hinsichtlich gefälschter Produkte, insbesondere in der Pharma- und Gesundheitsbranche, sind zu einem großen Problem geworden, da gefälschte Medikamente Patienten potenziell schaden können. Gefälschte Medikamente können zu unwirksamen Behandlungen und Gesundheitsrisiken führen, was zu einer erhöhten Nachfrage nach Rückverfolgbarkeitslösungen führt. Durch den Einsatz von Technologien wie RFID, Barcodes und Blockchain können Unternehmen Produkte entlang der gesamten Lieferkette verfolgen, um deren Echtheit sicherzustellen. Da die globalen Lieferketten immer komplexer werden, steigt das Risiko, dass gefälschte Waren auf den Markt gelangen, was den Bedarf an stärkeren Tracking-Systemen erhöht. Diese Nachfrage nach sicheren und zuverlässigen Rückverfolgbarkeitslösungen ist ein wichtiger Treiber für den globalen Markt für Track-and-Trace-Lösungen

Gelegenheiten

- Wachstum im E-Commerce-Sektor

Das rasante Wachstum des E-Commerce-Sektors bietet aufgrund der zunehmenden Komplexität und Größe des Online-Einzelhandels erhebliche Chancen für den globalen Markt für Track-and-Trace-Lösungen. Da immer mehr Verbraucher auf Online-Shopping umsteigen, müssen Unternehmen sicherstellen, dass ihre Logistik- und Lieferkettenprozesse effizient und transparent sind. Track-and-Trace-Lösungen ermöglichen die Echtzeitüberwachung von Lagerbeständen, Versandstatus und Lieferprozessen und ermöglichen es Unternehmen, ihren Kunden genaue Informationen zu ihren Bestellungen bereitzustellen. Diese erhöhte Transparenz stärkt das Kundenvertrauen und verbessert das allgemeine Einkaufserlebnis, wodurch E-Commerce-Unternehmen auf einem überfüllten Markt wettbewerbsfähiger werden.

Zum Beispiel,

- Laut einem im Juli 2024 im Marketplace Digest veröffentlichten Artikel mit dem Titel „Auswirkungen des E-Commerce auf die Logistik: Anpassung an die Nachfrage“ verbessert die Implementierung fortschrittlicher Tracking- und Sichtbarkeitslösungen die Tracking- und Sichtbarkeitslösungen und ist entscheidend, um den Anforderungen des E-Commerce gerecht zu werden. Echtzeit-Tracking-Technologie ermöglicht es Spediteuren, genaue Lieferschätzungen und -aktualisierungen bereitzustellen, was die Transparenz und das Kundenvertrauen verbessert

- Im April 2023 heißt es in einem Artikel mit dem Titel „Identifizierung von Vorteilen, Herausforderungen und Wegen in der E-Commerce-Branche“, der in ScienceDirect veröffentlicht wurde: „Ein integriertes zweiphasiges Entscheidungsmodell“. Die E-Commerce-Branche hat im letzten Jahrzehnt ein erhebliches Wachstum erlebt, da sie sich auf Bequemlichkeit und Zugänglichkeit konzentriert, was zu einem Anstieg des Online-Shoppings geführt hat und eine größere Anzahl von Verbrauchern sich dafür entscheidet.

Darüber hinaus steigt mit dem Aufstieg des E-Commerce das Risiko von Problemen wie Diebstahl, Betrug und gefälschten Waren. Daher sind robuste Track-and-Trace-Systeme erforderlich, die diese Herausforderungen abmildern können. Durch die Implementierung fortschrittlicher Technologien wie RFID, Blockchain und automatisierter Tracking-Systeme können E-Commerce-Unternehmen die Integrität ihrer Produkte vom Lager bis zur Lieferung aufrechterhalten. Diese Lösungen ermöglichen es Unternehmen außerdem, gesetzliche Anforderungen und Industriestandards in Bezug auf Produktverantwortung und -sicherheit einzuhalten. Mit der weiteren Expansion des E-Commerce wird die Nachfrage nach zuverlässigen Track-and-Trace-Lösungen steigen, was erhebliche Marktchancen für Anbieter solcher Technologien schafft.

- Expansion im globalen Handel

Die Ausweitung des globalen Handels eröffnet dem globalen Markt für Track-and-Trace-Lösungen große Chancen, angetrieben durch die zunehmende Komplexität grenzüberschreitender Lieferketten. Da Unternehmen bei der Beschaffung von Materialien und dem Vertrieb ihrer Produkte zunehmend auf globale Netzwerke angewiesen sind, wird der Bedarf an effektiven Tracking-Systemen immer größer. Track-and-Trace-Lösungen ermöglichen es Unternehmen, Sendungen in Echtzeit zu überwachen und so Transparenz und Effizienz im gesamten Logistikprozess sicherzustellen. Diese Fähigkeit steigert die betriebliche Effizienz und hilft Unternehmen, internationale Vorschriften und Standards einzuhalten, was zu größerem Vertrauen bei Partnern und Kunden führt. Da der globale Handel weiter wächst, wird die Nachfrage nach hochentwickelten Tracking-Technologien, die verschiedene gesetzliche Anforderungen erfüllen und Transparenz über mehrere Rechtsräume hinweg bieten können, wahrscheinlich steigen.

Zum Beispiel,

- Laut einem im Mai 2024 im Weltwirtschaftsforum veröffentlichten Artikel wird erwartet, dass der weltweite Handel mit Waren und Dienstleistungen in diesem Jahr um 2,3 % und im Jahr 2025 um 3,3 % wachsen wird – mehr als doppelt so viel wie das Wachstum von 1 % im Jahr 2023.

Darüber hinaus hat der Aufstieg des E-Commerce und des Online-Einzelhandels die Nachfrage nach Track-and-Trace-Lösungen weiter beschleunigt, da die Verbraucher pünktliche Lieferungen und Transparenz bezüglich ihrer Bestellungen erwarten. Da riesige Mengen an Waren rund um den Globus transportiert werden, benötigen Unternehmen robuste Systeme, um ihre Lagerbestände und Sendungen genau zu verfolgen. Diese Nachfrage hat Innovationen auf dem Track-and-Trace-Markt vorangetrieben und die Entwicklung fortschrittlicher Technologien wie Blockchain, IoT und künstliche Intelligenz gefördert. Diese Innovationen verbessern die Fähigkeiten von Track-and-Trace-Lösungen und bieten die Möglichkeit, sich auf einem überfüllten Markt zu differenzieren. Da der globale Handel weiter wächst und sich weiterentwickelt, ist der Markt für Track-and-Trace-Lösungen bereit, von diesem Trend zu profitieren und wichtige Tools bereitzustellen, die Unternehmen dabei unterstützen, die Komplexität des modernen Lieferkettenmanagements zu meistern und gleichzeitig die Anforderungen der Verbraucher nach Transparenz und Verantwortlichkeit zu erfüllen.

Einschränkungen/Herausforderungen

- Risiken im Zusammenhang mit Probenkontamination

Datenschutz- und Datenschutzbedenken stellen eine große Herausforderung für den Markt für Track-and-Trace-Lösungen im asiatisch-pazifischen Raum dar, da diese Systeme häufig die Erfassung, Speicherung und Übertragung vertraulicher Informationen beinhalten. Dazu können personenbezogene Daten, Produktdetails und Lieferketteninformationen gehören, die bei unzureichendem Schutz Risiken für Verbraucher und Unternehmen darstellen. Verstöße gegen die Datensicherheit können zu finanziellen Verlusten, Reputationsschäden und rechtlichen Konsequenzen führen, insbesondere angesichts zunehmend strengerer Vorschriften wie der DSGVO im asiatisch-pazifischen Raum und verschiedener Datenschutzgesetze im asiatisch-pazifischen Raum. Wenn Unternehmen Track-and-Trace-Technologien implementieren, müssen sie robuste Sicherheitsmaßnahmen gewährleisten, was die Kosten erhöhen und den Bereitstellungsprozess erschweren kann, was Unternehmen möglicherweise davon abhält, diese Lösungen einzuführen.

Zum Beispiel,

- Laut einem im August 2024 von Shriram Veritech Solutions Pvt. Ltd. veröffentlichten Artikel „Top-Herausforderungen bei der Implementierung von Track-and-Trace-Lösungen im Supply Chain Management“ verarbeiten Unternehmen bei der Implementierung von Track-and-Trace-Lösungen eine große Menge sensibler Daten, darunter geschützte Informationen, Kundendaten und Standortverfolgung in Echtzeit. Track-and-Trace-Systeme sind anfällig für Cyberangriffe.

Darüber hinaus wächst das Bewusstsein der Verbraucher hinsichtlich des Datenschutzes, was zu einer verstärkten Kontrolle von Unternehmen führt, die mit persönlichen Daten umgehen. Unternehmen stehen unter Druck, die Einhaltung von Datenschutzbestimmungen nachzuweisen und das Vertrauen ihrer Kunden aufzubauen. Wenn Unternehmen ihren Stakeholdern nicht überzeugend versichern können, dass sie in der Lage sind, Daten zu schützen, riskieren sie, Marktanteile zu verlieren und Gegenreaktionen von Verbrauchern zu erleben. Dieses Klima der Besorgnis kann die Bereitschaft von Unternehmen einschränken, umfassend in fortschrittliche Track-and-Trace-Lösungen zu investieren und diese einzuführen, die möglicherweise eine umfangreiche Datenverarbeitung erfordern. Folglich könnte der Markt langsamer wachsen, da Unternehmen diese Komplexität bewältigen und versuchen, die Vorteile verbesserter Tracking-Funktionen mit dem Gebot der Wahrung von Datenschutz und -sicherheit in Einklang zu bringen.

- Beschädigung der Sendungsverfolgungsetiketten während der Lieferung

Beschädigungen von Tracking-Tags während der Lieferung beeinträchtigen die Wirksamkeit von Track-and-Trace-Lösungen auf dem globalen Markt erheblich. Wenn Tracking-Tags wie RFID-Etiketten oder Barcodes während des Transports beschädigt werden, führt dies zu Datenungenauigkeiten, Verlust der Produktsichtbarkeit und Verzögerungen bei der Sendungsverfolgung. Dies beeinträchtigt die Zuverlässigkeit der Lieferkettenabläufe, insbesondere in Branchen, die auf präzise Produktbewegungen und Konformität angewiesen sind. Im Pharmasektor beispielsweise stören beschädigte Tags wichtige Rückverfolgbarkeitsprozesse und erhöhen das Risiko gefälschter Produkte und der Nichteinhaltung gesetzlicher Vorschriften. Solche Probleme führen zu Ineffizienzen, höheren Betriebskosten und einem Rückgang des Kundenvertrauens und wirken sich erheblich auf den globalen Markt für Track-and-Trace-Lösungen aus.

Zum Beispiel,

- Laut dem im August 2024 auf encstorge.com veröffentlichten Artikel sind RFID-Tags während der Lieferung anfällig für Schäden, die durch Faktoren wie Wasser, übermäßige Hitze, Chemikalien oder physische Brüche im Chip oder in den Antennenleitungen verursacht werden. Das Verständnis dieser Risiken ist entscheidend für die Optimierung der RFID-Leistung in verschiedenen Umgebungen. Solche Schäden stören Track-and-Trace-Systeme und führen zu Ungenauigkeiten und Ineffizienzen, die das Wachstum des globalen Marktes erheblich behindern.

- Laut einem im August 2023 von Lexicon Tech Solutions veröffentlichten Artikel können Barcodes während der Lieferung durch Feuchtigkeit, Öl oder raue Oberflächen beschädigt werden, was zu Problemen wie Verschmieren oder Reißen führen kann. Diese Beschädigung macht den Barcode unlesbar und stört den Tracking-Prozess. Solche Probleme mit der Barcode-Integrität können zu Verzögerungen, Ungenauigkeiten und Ineffizienzen in den Lieferketten führen und den globalen Markt für Track-and-Trace-Lösungen erheblich behindern.

Beschädigungen von Tracking-Tags während der Lieferung beeinträchtigen die Wirksamkeit von Track-and-Trace-Systemen auf dem Weltmarkt. Beschädigte RFID-Etiketten oder Barcodes führen zu Tracking-Fehlern, Verlust der Sichtbarkeit und Verzögerungen, was die Genauigkeit der Lieferkette beeinträchtigt. In Branchen wie der Pharmaindustrie beeinträchtigt dies die Compliance und Rückverfolgbarkeit, was zu Ineffizienzen, höheren Kosten und geringerem Vertrauen führt, was das Marktwachstum hemmt.

Globaler Marktumfang für Track-and-Trace-Lösungen

Der Markt ist nach Produkt, Lösung, Anwendung, Technologie, Endbenutzer und Vertriebskanal segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Softwarekomponenten

- Werksleiter

- Liniencontroller

- Enterprise- und Netzwerkmanager

- Paketverfolgung

- Fallverfolgung

- Lager- und Versandleiter

- Palettenverfolgung

- Sonstiges

- Hardwarekomponenten

- Drucken und Markieren

- Barcode-Scanner

- Überwachung und Überprüfung

- Etikettierer

- Kontrollwaage

- RFID-Lesegerät

- Sonstiges

- Standalone-Plattform

Lösung

- Serialisierung auf Zeilen- und Site-Ebene

- Rückverfolgbarkeit auf Cloud-Unternehmensebene

- Vertriebs- und Lagerlösung

- Netzwerk zum Austausch von Lieferkettendaten

- Sonstiges

Anwendung

- Serialisierung

- Kartonserialisierung

- Flaschenserialisierung

- Serialisierung medizinischer Geräte

- Serialisierung von Fläschchen und Ampullen

- Blister-Serialisierung

- Etikettierungs- und Verpackungsinspektion

- Aggregation

- Bündelaggregation

- Fallaggregation

- Palettenaggregation

- Sendungsverfolgung

- Ablaufverfolgung

- Berichterstattung

Technologie

- 2D-Barcodes

- Radiofrequenz-Identifikation (RFID)

- Lineare/1D-Barcodes

Endbenutzer

- Pharmazeutische und biopharmazeutische Unternehmen

- Konsumgüter

- Luxusgüter

- Essen und Trinken

- Hersteller medizinischer Geräte

- Auftragsfertigungsorganisationen

- Umverpacker

- Kosmetikfirmen

- Sonstiges

Vertriebskanal

- Direktvertrieb

- Drittanbieter

Globale Marktanalyse für Track & Trace-Lösungen

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkt, Lösung, Anwendung, Technologie, Endbenutzer und Vertriebskanal wie oben angegeben bereitgestellt.

Die vom Markt abgedeckten Länder sind die USA, Kanada, Mexiko, Deutschland, Großbritannien, Frankreich, Italien, Spanien, die Schweiz, Russland, die Türkei, Belgien, die Niederlande, Dänemark, Polen, Schweden, Norwegen, Finnland, der Rest von Europa, China, Japan, Indien, Südkorea, Australien, Singapur, Indonesien, Thailand, Malaysia, die Philippinen, Neuseeland, Vietnam, Taiwan, der Rest des asiatisch-pazifischen Raums, Brasilien, Argentinien, der Rest von Südamerika, Südafrika, Saudi-Arabien, die Vereinigten Arabischen Emirate, Katar, Ägypten, Kuwait, Bahrain, Oman sowie der Rest des Nahen Ostens und Afrikas.

Aufgrund des technologischen Fortschritts in der Region und der Präsenz wichtiger Akteure im Bereich Track-and-Trace-Lösungen dürfte Nordamerika den Markt dominieren.

The Asia-Pacific region is expected to witness the fastest in the global track and trace market due to rapid industrialization, growing e-commerce, stringent regulatory requirements, and increasing concerns over counterfeit products. Additionally, expanding pharmaceutical and healthcare sectors, along with technological advancements, are driving demand for efficient supply chain visibility solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Track and Trace Solutions Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global Track and Trace Solutions Market Leaders Operating in the Market Are:

- SAP SE (Germany)

- Zebra Technologies Corp. (U.S.)

- Videojet Technologies, Inc. (U.S.)

- METTLER TOLEDO (U.S.)

- Tracelink Inc. (U.S.)

- Siemens (Germany)

- Domino Printing Sciences plc (U.K.)

- Laetus GmbH (Germany)

- Xyntek Incorporated (U.S.)

- IBM Corporation (U.S.)

- WIPOTEC-OCS GmbH (Germany)

- 3Keys (Germany)

- ACG (India)

- NJM Packaging Inc. (U.S.)

- OPTEL GROUP (Canada)

- Systech (India)

- Robert Bosch Manufacturing Solutions GmbH (Germany)

- ANTARES VISION S.p.A. (Italy)

- Uhlmann (India)

- SEA VISION S.r.l. (Italy)

- Jekson Vision (India)

- Kevision Systems (India)

- Arvato Systems (Germany)

- Grant-Soft Ltd. (Turkey)

- PharmaSecure Inc. (U.S.)

- Axyway (France)

- SL Controls Ltd. (U.S.)

Latest Developments in Global Track and Trace Solutions Market

- In May 2024, Videojet has launched the 3350 30-Watt CO2 Laser, designed to provide high-quality, permanent marking for a variety of materials. This advanced laser solution improves operational efficiency and reduces downtime with its reliable, high-speed performance. It is particularly suited for industries requiring precision marking, like food, beverage, and pharmaceuticals

- Im Mai 2019 eröffnete METTLER TOLEDO in Barcelona sein neues Produktinspektionstestzentrum für Lebensmittel- und Pharmaverarbeiter im Nahen Osten und Afrika. Dieses neue Testzentrum des Unternehmens steigert seine Glaubwürdigkeit auf dem Markt und führt in Zukunft zu einer höheren Nachfrage und einem höheren Absatz seines Produkts.

- Im Februar 2020 führte ACG eine innovative Blockchain-basierte Markenplattform ein. Diese neue Plattform des Unternehmens wird die Nachfrage auf dem Markt steigern

- Im November 2019 stellte ACG die NXT-Serie vor, zukunftssichere Maschinen, die unseren Kunden ein intelligentes Benutzererlebnis bieten. Zur NXT-Serie gehören auf der PMEC 2019 die Maschinen Protab 300 NXT, Protab 700 NXT, BMax NXT, KartonX NXT und Verishield CS18 NXT. Diese neuen Produkte von ACG werden die Nachfrage nach ihren Produkten auf dem Markt steigern.

- Im Juli 2020 erhielt Axyway von Amazon Web Services (AWS) sowohl die AWS Healthcare Competency-Auszeichnung als auch die AWS Life Sciences Competency-Auszeichnung für seine in verschiedenen Branchen eingesetzten Lösungen. Diese Anerkennung wird das Unternehmen auf dem Markt stärken.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TRACK AND TRACE SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCTS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 GLOBAL TRACK & TRACE SOLUTIONS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION

6.1.2 RISING COUNTERFEIT CONCERNS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN TRACK AND TRACE SOLUTIONS

6.1.4 COMPLEXITY IN GLOBAL SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 RESISTANCE FROM SMALL BUSINESSES

6.2.2 DAMAGE TO TRACKING TAGS DURING DELIVERY

6.3 OPPORTUNITIES

6.3.1 GROWTH IN THE E-COMMERCE SECTOR

6.3.2 INCREASING FOCUS ON DATA ANALYTICS

6.3.3 EXPANSION IN GLOBAL TRADE

6.4 CHALLENGES

6.4.1 HIGH IMPLEMENTATION COSTS

6.4.2 DATA SECURITY AND PRIVACY CONCERNS

7 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 SOFTWARE COMPONENTS

7.2.1.1 PLANT MANAGER

7.2.1.2 ENTERPRISE & NETWORK MANAGER

7.2.1.3 BUNDLE TRACKING

7.2.1.4 PALLET TRACKING

7.2.1.5 CASE TRACKING

7.2.1.6 WAREHOUSE & SHIPMENT MANAGER

7.2.1.7 LINE CONTROLLER

7.2.1.8 OTHERS

7.3 HARDWARE COMPONENTS

7.3.1.1 PRINTING & MARKING

7.3.1.2 LABELER

7.3.1.3 BARCODE SCANNER

7.3.1.4 RFID READER

7.3.1.5 CHECKWEIGHER

7.3.1.6 MONITORING & VERIFICATION

7.3.1.7 OTHERS

7.4 STANDALONE PLATFORMS

8 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION

8.1 OVERVIEW

8.2 LINE & SITE LEVEL SERIALIZATION

8.3 CLOUD ENTERPRISE-LEVEL TRACEABILITY

8.4 DISTRIBUTION & WAREHOUSE SOLUTION

8.5 SUPPLY CHAIN DATA-SHARING NETWORK

8.6 OTHERS

9 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D BARCODES

9.3 RADIOFREQUENCY IDENTIFICATION (RFID)

9.4 LINEAR/1D BARCODESS

10 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SERIALIZATION

10.3 PRINTING

10.4 LABELING & PACKAGING INSPECTION

10.5 AGGREGATION

10.6 TRACKING

10.7 TRACING

10.8 REPORTING

11 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE

11.3 CONSUMER PACKAGED GOODS

11.4 LUXURY GOODS

11.5 FOOD & BEVERAGE

11.6 MEDICAL DEVICE COMPANIES

11.7 CONTRACT MANUFACTURING ORGANIZATIONS

11.8 REPACKAGERS

11.9 COSMETICS COMPANIES

11.1 OTHERS

12 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTORS

13 GLOBAL TRACK AND TRACE SOLUTIONS MARKET

13.1 GLOBAL

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 FRANCE

13.3.4 ITALY

13.3.5 SWITZERLAND

13.3.6 SPAIN

13.3.7 NETHERLANDS

13.3.8 BELGIUM

13.3.9 TURKEY

13.3.10 RUSSIA

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 CHINA

13.4.2 JAPAN

13.4.3 INDIA

13.4.4 SOUTH KOREA

13.4.5 AUSTRALIA

13.4.6 SINGAPORE

13.4.7 THAILAND

13.4.8 MALAYSIA

13.4.9 INDONESIA

13.4.10 PHILIPPINES

13.4.11 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 SAUDI ARABIA

13.6.3 U.A.E.

13.6.4 ISRAEL

13.6.5 EGYPT

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL TRACK AND TRACE SOLUTIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SAP SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 TRACELINK INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 VIDEOJET TECHNOLOGIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 METTLER TOLEDO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AXYWAY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ANTARES VISION S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ARVATO SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DOMINO PRINTING SCIENCES PLC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GRANT-SOFT LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IBM CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 JEKSON VISION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 3KEYS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KEVISION SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LAETUS GMBH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NJM PACKAGING INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 OPTEL GROUP

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 PHARMADECURE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROBERT BOSCH MANUFACTURING SOLUTIONS GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SEA VISION S.R.L.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SIEMENS

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SL CONTROLS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SYSTECH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 UHLMANN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPOTEC-OCS GMBH

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 XYNTEK INCORPORATED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 2 GLOBAL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL STANDALONE PLATFORMS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL LINE & SITE LEVEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL CLOUD ENTERPRISE-LEVEL TRACEABILITY IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL DISTRIBUTION & WAREHOUSE SOLUTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL SUPPLY CHAIN DATA-SHARING NETWORK IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL 2D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 15 GLOBAL RADIOFREQUENCY IDENTIFICATION (RFID) IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL LINEAR/1D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL PRINTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL LABELING & PACKAGING INSPECTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL TRACKING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL TRACING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL REPORTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL CONSUMER PACKAGED GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL LUXURY GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL FOOD & BEVERAGE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL MEDICAL DEVICE COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL CONTRACT MANUFACTURING ORGANIZATIONS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL REPACKAGERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL COSMETICS COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL DIRECT SALES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 39 GLOBAL THIRD-PARTY DISTRIBUTORS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 102 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 103 U.K. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 104 U.K. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 105 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 106 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 U.K. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 U.K. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 110 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 111 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 113 FRANCE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 114 FRANCE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 116 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 122 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 123 ITALY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 124 ITALY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 125 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 126 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 ITALY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 ITALY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 129 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 130 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 132 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 133 SWITZERLAND SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 134 SWITZERLAND HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 135 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 136 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 137 SWITZERLAND SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 138 SWITZERLAND AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 140 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 141 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 142 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 143 SPAIN SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 144 SPAIN HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 145 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 146 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 SPAIN SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 SPAIN AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 150 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 151 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 152 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 153 NETHERLANDS SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 154 NETHERLANDS HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 155 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 156 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 NETHERLANDS SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 NETHERLANDS AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 159 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 160 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 161 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 163 BELGIUM SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 164 BELGIUM HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 165 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 166 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 BELGIUM SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 BELGIUM AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 170 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 173 TURKEY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 174 TURKEY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 175 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 176 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 177 TURKEY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 TURKEY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 179 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 180 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 181 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 182 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 183 RUSSIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 184 RUSSIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 185 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 186 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 RUSSIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 188 RUSSIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 189 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 190 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 191 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 192 REST OF EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 193 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 194 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 195 ASIA-PACIFIC SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 196 ASIA-PACIFIC HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 197 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 198 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 ASIA-PACIFIC SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 200 ASIA-PACIFIC AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 202 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 204 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 205 CHINA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 206 CHINA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 207 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 208 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 209 CHINA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 CHINA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 211 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 215 JAPAN SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 216 JAPAN HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 217 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 218 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 219 JAPAN SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 JAPAN AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 221 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 222 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 223 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 224 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 225 INDIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 226 INDIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 227 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 228 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 229 INDIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 INDIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 232 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 233 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 234 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 239 SOUTH KOREA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH KOREA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 241 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 243 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 244 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 245 AUSTRALIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 246 AUSTRALIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 247 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 248 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 AUSTRALIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 250 AUSTRALIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 251 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 252 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 253 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 254 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 255 SINGAPORE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 256 SINGAPORE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 257 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 258 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 259 SINGAPORE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 260 SINGAPORE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 261 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 262 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 263 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 264 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 265 THAILAND SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 266 THAILAND HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 267 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 268 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 269 THAILAND SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 270 THAILAND AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 271 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 272 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 273 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 275 MALAYSIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 276 MALAYSIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 277 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 278 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 279 MALAYSIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 280 MALAYSIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 281 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 282 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 283 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 284 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 285 INDONESIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 286 INDONESIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 287 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 288 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 295 PHILIPPINES SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 296 PHILIPPINES HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 297 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 298 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 299 PHILIPPINES SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 300 PHILIPPINES AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 301 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 302 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 303 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 304 REST OF ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 305 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 306 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 307 SOUTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 308 SOUTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 309 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 310 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 311 SOUTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 312 SOUTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 313 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 314 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 315 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 316 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 317 BRAZIL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 318 BRAZIL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 319 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 320 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 321 BRAZIL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 322 BRAZIL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 323 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 324 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 325 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 326 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 327 ARGENTINA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 328 ARGENTINA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 329 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 330 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 331 ARGENTINA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 332 ARGENTINA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 333 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 334 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 335 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 336 REST OF SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 337 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 338 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 339 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 340 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 341 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 342 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 343 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 344 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 345 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 346 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 347 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 348 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 349 SOUTH AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 350 SOUTH AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 351 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 352 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 353 SOUTH AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 354 SOUTH AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 355 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 356 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 357 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 358 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)