Middle East And Africa Corrugated Packaging Market

Marktgröße in Milliarden USD

CAGR :

%

USD

27.65 Million

USD

39.17 Million

2024

2032

USD

27.65 Million

USD

39.17 Million

2024

2032

| 2025 –2032 | |

| USD 27.65 Million | |

| USD 39.17 Million | |

|

|

|

Marktsegmentierung für Wellpappenverpackungen im Nahen Osten und Afrika nach Produkt (Regular Slotted Container (RSC), Half Slotted Container (HSC), Overlap Slotted Container (OSC), Full Overlap Slotted Container (FOL), Center Special Slotted Container (CSSC), 1-2-3-Bottom oder Auto-Lock Bottom Container (ALB), Teleskopboxen (Design Style Trays, Infold Trays, Outfold Trays), Folder und Wraparound Blank), Wellentyp (C-Welle, B-Welle, E-Welle, A-Welle, F-Welle und D-Welle), Kartonart (einwandig, doppelwandig, dreiwandig, einseitig und Liner Board), Kapazität (bis zu 100 Pfund, 100-300 Pfund und über 300 Pfund), Größe (0-10 Zoll, 10-20 Zoll, 20-30 Zoll und über 30 Zoll), Drucktyp (bedruckt und unbedruckt), Anwendung (E-Commerce & Einzelhandel, Lebensmittel, Elektronik Waren, Haushaltsgeräte , Automobil, Gesundheitswesen und Pharmazeutika, Getränke, Glaswaren und Keramik, Körperpflege, Haushaltspflege, Landwirtschaft und Gartenbau, Öl und Gas, Spielzeugprodukte, Babyprodukte und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Wellpappenverpackungen

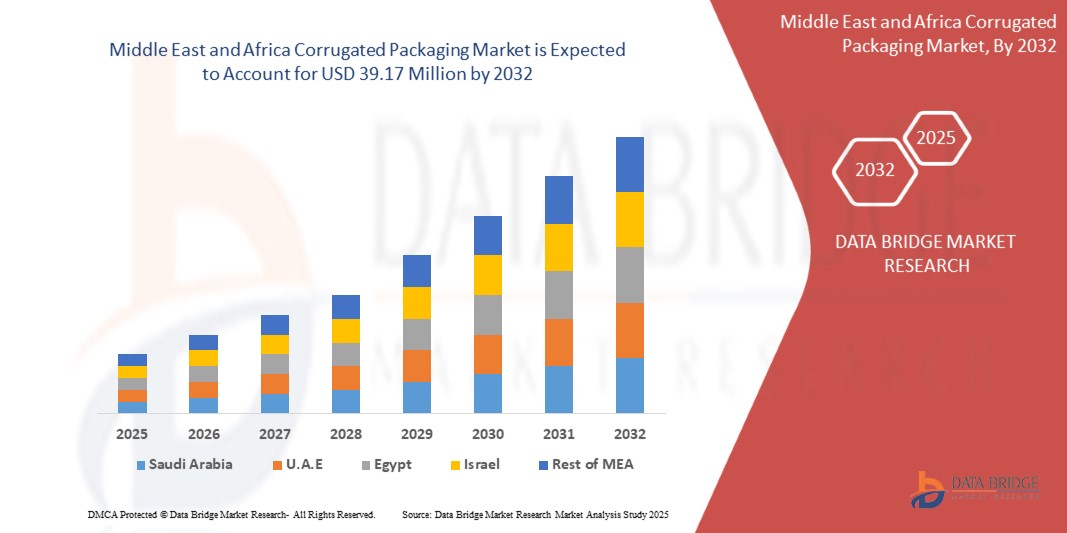

- Der Markt für Wellpappenverpackungen im Nahen Osten und Afrika wurde im Jahr 2024 auf 27,65 Millionen US-Dollar geschätzt und soll bis 2032 39,17 Millionen US-Dollar erreichen.

- Im Prognosezeitraum von 2025 bis 2032 wird der Markt voraussichtlich mit einer jährlichen Wachstumsrate von 4,6 % wachsen, vor allem getrieben durch den technologischen Fortschritt.

- Dieses Wachstum wird durch Faktoren wie die Personalisierung von Produkten, nachhaltige Verpackungen, die Verwendung von recycelbaren und erneuerbaren Materialien, E-Commerce mit Wellpappenverpackungen vorangetrieben.

Marktanalyse für Wellpappenverpackungen

- Wellpappe ist aufgrund ihrer Langlebigkeit, Recyclingfähigkeit und Wirtschaftlichkeit ein weit verbreitetes Material in Branchen wie E-Commerce, Lebensmittel und Getränke, Pharmazeutika und Konsumgütern. Sie bietet hervorragenden Schutz bei Versand und Lagerung und ist daher für die Lieferketten im Nahen Osten und Afrika unverzichtbar.

- Die wachsende Nachfrage nach nachhaltigen Verpackungslösungen und der Anstieg des E-Commerce haben das Wachstum des Wellpappenmarktes deutlich vorangetrieben. Da Unternehmen sich auf die Reduzierung von Plastikmüll konzentrieren, hat Wellpappe als umweltfreundliche Alternative an Bedeutung gewonnen.

- Die Vereinigten Arabischen Emirate gelten als eines der dominierenden Länder für Wellpappenverpackungen, angetrieben durch die zunehmende Industrialisierung, Urbanisierung und den boomenden Online-Einzelhandel.

Berichtsumfang und Marktsegmentierung für Wellpappenverpackungen

|

Eigenschaften |

Wichtige Markteinblicke in Wellpappenverpackungen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Naher Osten und Afrika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für Wellpappenverpackungen

„Steigende Nachfrage nach nachhaltigen und intelligenten Verpackungslösungen“

- Ein herausragender Trend auf dem Wellpappenverpackungsmarkt im Nahen Osten und Afrika ist die zunehmende Verlagerung hin zu nachhaltigen und intelligenten Verpackungslösungen, die durch Umweltvorschriften und Verbraucherpräferenzen getrieben wird

- Unternehmen investieren in umweltfreundliche, recycelbare und biologisch abbaubare Wellpappenverpackungen, um ihren CO2-Fußabdruck zu reduzieren und die Ziele der Kreislaufwirtschaft zu erreichen.

- So entwickelte Smurfit Kappa beispielsweise gemeinsam mit Mindful Chef 100 % recycelbare Isolierverpackungen aus Wellpappe, die den CO2-Fußabdruck um 30 % reduzierten. Die nachhaltige Verpackung hielt im Test über 30 Stunden lang die erforderlichen Temperaturen. Diese Innovation ersetzte nicht recycelbare Isolierbeutel und unterstützte so eine umweltfreundliche Lebensmittellieferung.

- Intelligente Verpackungstechnologien wie RFID-Tags, QR-Codes und Digitaldruck werden in Wellpappkartons integriert, um die Transparenz der Lieferkette, die Produktverfolgung und die Kundenbindung zu verbessern.

- Dieser Trend verändert die Wellpappenverpackungsindustrie und fördert Innovation, Kosteneffizienz und die Einhaltung der Vorschriften im Nahen Osten und Afrika.

- Nachhaltigkeitsstandards, die letztlich das langfristige Marktwachstum vorantreiben

Marktdynamik für Wellpappenverpackungen

Treiber

„Wachstum im Einzelhandel und im Konsumgütersektor beschleunigt die Einführung von Wellpappenverpackungen“

- Mit dem Anstieg des Online-Shoppings legen Marken Wert auf langlebige und umweltfreundliche Verpackungen, um die Produktsicherheit zu erhöhen und den sich wandelnden Erwartungen der Verbraucher gerecht zu werden.

- Darüber hinaus tragen staatliche Vorschriften zur Förderung recycelbarer Materialien dazu bei, dass Wellpappeverpackungen immer beliebter werden.

- Insbesondere der Graue Star ist eine der häufigsten Ursachen für Erblindung weltweit und erfordert chirurgische Eingriffe, die ein hohes Maß an Präzision erfordern.

- Da Konsumgüterhersteller ihre Produktlinien erweitern und innovative Verpackungsformate entwickeln, bieten Wellpappe vielseitige Möglichkeiten und individuelle Anpassungsmöglichkeiten. Von Lebensmitteln und Getränken bis hin zu Körperpflegeprodukten bieten diese Platten hervorragende strukturelle Festigkeit und Möglichkeiten zur Markenbildung.

Zum Beispiel,

- Laut Business Wire unterstützte SpendEdge im Februar 2020 ein Konsumgüterunternehmen bei der Entwicklung eines strategischen Ansatzes für die Verpackungsbeschaffung und erzielte dadurch jährliche Einsparungen von 15 Millionen US-Dollar. Durch die Optimierung der Lieferantenauswahl, der Ausgabenbündelung und der Kostenfaktoren steigerte das Unternehmen die Effizienz seiner Lieferkette und stärkte seine Marktposition. Da Konsumgüterunternehmen Kostenoptimierung und betriebliche Effizienz priorisieren, steigt die Nachfrage nach nachhaltigen und kostengünstigen Wellpappenverpackungen. Der Fokus auf strategische Beschaffung, Lieferantenbewertung und Gesamtkostenoptimierung treibt die Einführung von Wellpappenverpackungen im Einzelhandel und Konsumgütersektor weiter voran.

- In einem Artikel von Fresh Plaza vom März 2025 wurde hervorgehoben, dass Klabin die Binnenschifffahrt eingeführt hat, um den Wellpappentransport in Brasilien zu verbessern und so Kosten, Lieferzeiten und Umweltbelastungen zu reduzieren. Das Unternehmen investiert außerdem in feuchtigkeitsbeständige Pappe und unterstützt damit den wachsenden Einzelhandel und den Konsumgütersektor, der durch E-Commerce, den Export frischer Produkte und Nachhaltigkeitsanforderungen vorangetrieben wird.

- Das rasante Wachstum des Einzelhandels und der Konsumgüterbranche trägt maßgeblich zur zunehmenden Nutzung von Wellpappe bei. Da die Nachfrage der Verbraucher nach E-Commerce, nachhaltigen Verpackungen und kostengünstiger Logistik steigt, setzen Unternehmen zunehmend auf leichte, langlebige und recycelbare Wellpappelösungen. Der Trend zu umweltfreundlichen Verpackungen und die Notwendigkeit eines effizienten Lieferkettenmanagements verstärken diesen Trend zusätzlich. Da Einzelhändler und Konsumgüterhersteller Nachhaltigkeit und Produktschutz priorisieren, wird der Markt für Wellpappeverpackungen voraussichtlich weiterhin wachsen und Innovationen hervorbringen.

Gelegenheit

„Der wachsende E-Commerce im Nahen Osten und Afrika steigert die Nachfrage nach leichten, langlebigen Wellpappenverpackungen“

- Die rasante Expansion des E-Commerce im Nahen Osten und Afrika steigert die Nachfrage nach leichten, langlebigen Verpackungen, die Produkte während des Transports schützen, erheblich.

- Der Anstieg des Online-Handels schafft einen Bedarf an zuverlässigen, kostengünstigen Lösungen wie Wellpappeverpackungen, die für ihre Stärke und Recyclingfähigkeit bekannt sind.

- Hersteller setzen zunehmend auf fortschrittliche Designs, um die Logistik ihrer Lieferketten zu optimieren und die Schadensquote zu senken. Dieser Trend verspricht stetiges Umsatzwachstum und erhebliches Marktpotenzial, da sich der digitale Handel weiterentwickelt.

Zum Beispiel,

- Laut einem im Mai 2024 von Baywater Packaging & Supply veröffentlichten Artikel erhöhte das rasante Wachstum des E-Commerce im Jahr 2024 die Nachfrage nach Wellpappkartons deutlich, da der Online-Einkauf stark zunahm. Unternehmen benötigten haltbarere, leichtere und nachhaltigere Verpackungen, um dem steigenden Versandvolumen gerecht zu werden. Innovationen bei umweltfreundlichen Materialien und intelligenten Verpackungslösungen wurden unerlässlich, um Verbraucherpräferenzen und gesetzlichen Standards gerecht zu werden. Der Ausbau von Logistiknetzwerken und Verbesserungen in der Lieferkette steigerten die Nachfrage zusätzlich. Unternehmen konzentrierten sich auf die Optimierung von Produktion, Recycling und effizienten Verpackungsdesigns, um mit den sich entwickelnden Marktanforderungen Schritt zu halten.

- Im März 2024 veröffentlichte Mondi einen Bericht über Verpackungstrends im E-Commerce, basierend auf einer Umfrage unter 6.000 Verbrauchern in Europa und der Türkei. Die Studie untersuchte Einkaufsgewohnheiten, Verpackungspräferenzen, Recyclingverhalten und zukünftige Trends. Sie betonte die Zusammenarbeit zwischen E-Commerce-Marken und Verpackungsanbietern, um die Erwartungen der Verbraucher und Nachhaltigkeitsziele zu erfüllen. Mit der steigenden Nachfrage nach nachhaltigen Verpackungen bot der E-Commerce eine große Chance für Wellpappenverpackungen, umweltfreundliche und effiziente Lösungen zu unterstützen.

- Die rasante Expansion des E-Commerce im Nahen Osten und Afrika führt zu einer starken Nachfrage nach leichten, langlebigen Wellpappenverpackungen. Da der Online-Einzelhandel weiter wächst, setzen Unternehmen auf innovative, nachhaltige Verpackungslösungen, um den Versandanforderungen gerecht zu werden. Fortschritte in Logistik, Materialwissenschaft und intelligenter Verpackung werden den Markt für Wellpappenverpackungen weiter stärken und Effizienz und ökologische Nachhaltigkeit gewährleisten.

Einschränkung/Herausforderung

„Schwankende Rohstoffpreise erhöhen die Produktionskosten und drücken die Gewinnmargen“

- Volatile Rohstoffpreise, insbesondere für Kraftpapier und Recyclingfasern, erhöhen die Produktionskosten erheblich und drücken die Gewinnmargen in der Wellpappenverpackungsindustrie

- Schwankungen bei den Zellstoff- und Papierpreisen führen zu finanzieller Instabilität und erschweren den Herstellern die Budgetplanung und die Aufrechterhaltung der Rentabilität.

- Um mit steigenden Kosten Schritt zu halten, ergreifen Unternehmen häufig Kostensenkungsmaßnahmen, die sich auf die Produktqualität und die Betriebseffizienz auswirken können. Viele begegnen diesen Herausforderungen durch langfristige Lieferverträge und Investitionen in fortschrittliche Fertigungstechnologien, um die Effizienz zu steigern und Abfall zu reduzieren.

Zum Beispiel,

- Laut einem von JohnsByrne veröffentlichten Artikel stiegen die Verpackungskosten im E-Commerce im Juli 2024 aufgrund steigender Rohstoffpreise, Arbeitskräftemangels und höherer Transportkosten. Der Markt für Wellpappenverpackungen stand vor Herausforderungen, da die Nachfrage stieg und gleichzeitig die Nachhaltigkeitserwartungen stiegen. Um diese Probleme zu bewältigen, setzten Unternehmen auf maßgerechte Verpackungen, kostengünstige, nachhaltige Materialien, automatisierte Auftragsabwicklung und optimierte Produktsortimente. Diese Strategien trugen dazu bei, die Kosten zu senken und gleichzeitig Effizienz und Kundenzufriedenheit aufrechtzuerhalten.

- Im Oktober 2024 erhöhte die Kerala Corrugated Box Manufacturing Association (KeCBMA) laut einem von THG PUBLISHING PVT LTD. veröffentlichten Artikel die Preise für Wellpappekartons aufgrund steigender Kraftpapierkosten um 15 %. Die Hersteller standen vor der Herausforderung, angesichts steigender Rohstoffkosten ihre Rentabilität aufrechtzuerhalten, was sich auf den Markt für Wellpappenverpackungen auswirkte.

- Die Wellpappenverpackungsindustrie steht weiterhin vor erheblichen Herausforderungen aufgrund schwankender Rohstoffpreise, insbesondere steigender Kosten für Kraftpapier. Diese Preissteigerungen haben die Produktionskosten erhöht, die Gewinnmargen reduziert und die Hersteller zu Kostensenkungsstrategien wie Automatisierung und optimierter Verpackung gezwungen. Um die Rentabilität aufrechtzuerhalten, schließen Unternehmen langfristige Lieferverträge ab und prüfen alternative Materialien. Die Bewältigung dieses Kostendrucks ist weiterhin entscheidend für die Wahrung der Marktstabilität und Wettbewerbsfähigkeit.

Marktumfang für Wellpappenverpackungen

Der Markt ist nach Produkt, Wellentyp, Kartonstil, Kapazität, Größe, Druckart und Anwendung segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Produkt |

|

|

Nach Flötentyp |

|

|

Nach Board-Stil |

|

|

Nach Kapazität |

|

|

Nach Größe |

|

|

Nach Drucktyp

|

|

|

Nach Anwendung |

|

Regionale Analyse des Marktes für Wellpappenverpackungen

„Die Vereinigten Arabischen Emirate sind das dominierende Land auf dem Markt für Wellpappenverpackungen“

- Die VAE dominieren den Markt für Wellpappenverpackungen , angetrieben vom boomenden E-Commerce-Sektor, der schnellen Industrialisierung und der hohen Nachfrage nach kostengünstigen, nachhaltigen Verpackungslösungen

- Die Region profitiert von niedrigen Produktionskosten, einer starken Lieferkette und großen Verbrauchermärkten wie China und Indien, was zu einer höheren Produktion und einem höheren Verbrauch führt.

„Saudi-Arabien wird voraussichtlich das am schnellsten wachsende Land sein“

- Saudi-Arabien verzeichnet ein rasantes Wachstum im Markt für Wellpappenverpackungen, das durch Nachhaltigkeitsvorschriften, die zunehmende Nutzung des E-Commerce und eine Verlagerung hin zu umweltfreundlichen Verpackungslösungen vorangetrieben wird.

- Darüber hinaus treibt die wachsende Präsenz von Einzelhandels- und Lebensmittellieferdiensten in der Region die Nachfrage nach kostengünstigen und langlebigen Wellpappenverpackungslösungen an.

Marktanteil von Wellpappenverpackungen

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, regionale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Smurfit Kappa (Irland)

- Oji Holdings Corporation (Japan)

- Weltmeisterschaften (Großbritannien)

- Stora Enso (Finnland)

- Sonoco Products Company (USA)

- WestRock Company (USA)

- Rengo CO., LTD. (Japan)

- SCG Packaging (Thailand)

Neueste Entwicklungen auf dem Markt für Wellpappenverpackungen im Nahen Osten und Afrika

- Im Januar 2025 übernimmt International Paper DS Smith und schafft damit einen führenden Anbieter nachhaltiger Verpackungslösungen im Nahen Osten und Afrika. Ziel ist es, ein herausragendes Kundenerlebnis zu bieten und die Innovation in der Verpackungsindustrie zu fördern. Durch die Bündelung der Kompetenzen beider Unternehmen wollen sie nachhaltigere, effizientere und innovativere Verpackungslösungen anbieten, die wachsende Nachfrage nach umweltfreundlichen Produkten bedienen und ihre Führungsposition in der Branche stärken.

- Im Mai 2023 führt Stora Enso eine neue, leicht recycelbare Kartonqualität für Tiefkühl- und Kühlverpackungen ein. Tambrite Aqua+ ist ein neues kreislauffähiges Verpackungsmaterial für Tiefkühl- und Kühlverpackungen, das den Bedarf an fossilen Kunststoffen reduziert und die Recyclingfähigkeit nach Gebrauch verbessert.

- Im Juni 2024 erwirbt Smurfit Kappa ein Bag-in-Box-Werk in Bulgarien. Diese Akquisition stärkt die Position von Smurfit Kappa im Verpackungsmarkt im Nahen Osten und Afrika, indem sie das Produktangebot erweitert und die Fähigkeit verbessert, seinen Kunden nachhaltige und qualitativ hochwertige Lösungen anzubieten.

- Im August 2019 arbeitet Elsons International unter der Leitung von CEO Andrew Jackson aktiv mit der Gemeinde zusammen, um die Beschäftigungsmöglichkeiten im verarbeitenden Gewerbe zu verbessern. Das Unternehmen setzt seine Bemühungen fort, den Arbeitsmarkt in dieser Branche zu verbessern. Das bedeutet, dass die Wellpappenbranche von der Zusammenarbeit und der Schaffung zusätzlicher Arbeitsplätze profitieren wird. Dies wird voraussichtlich zu einer höheren Nachfrage nach Arbeitskräften und Ressourcen in der Wellpappenproduktion führen und so weitere Arbeitsplätze in diesem Segment schaffen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL:

4.2.2 ECONOMIC:

4.2.3 SOCIAL:

4.2.4 TECHNOLOGICAL:

4.2.5 LEGAL:

4.2.6 ENVIRONMENTAL:

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4.1 SMART PACKAGING INTEGRATION

4.4.2 MAX LAMINATION TECHNOLOGY

4.4.3 HIGH-PRECISION DIGITAL PRINTING

4.4.4 3 D & AI-DRIVEN PACKAGING DESIGN

4.4.5 AUTOMATED PRODUCTION & ROBOTICS

4.4.6 FLEXO PRINTING AND DIGITAL TECHNOLOGY

4.4.7 FIT-TO-PRODUCT (FTP)

4.5 RAW MATERIAL COVERAGE

4.5.1 CELLULOSE FIBERS

4.5.2 STARCH-BASED ADHESIVES

4.5.3 SPECIALTY COATINGS & ADDITIVES

4.5.4 REINFORCEMENT MATERIALS

4.5.5 RECYCLED MATERIALS & SUSTAINABILITY INNOVATIONS

4.6 IMPORT EXPORT SCENARIO

4.7 SUPPLY CHAIN ANALYSIS

4.8 LOGISTICS COST SCENARIO

4.9 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.11 VENDOR SELECTION CRITERIA

4.11.1 PRODUCT QUALITY & COMPLIANCE

4.11.2 COST & PRICING STRUCTURE

4.11.3 SUSTAINABILITY PRACTICES

4.11.4 PRODUCTION CAPACITY & LEAD TIME

4.11.5 CUSTOMIZATION & DESIGN CAPABILITIES

4.11.6 SUPPLY CHAIN RELIABILITY & LOGISTICS

4.11.7 TECHNOLOGICAL CAPABILITIES & INNOVATION

4.11.8 CUSTOMER SUPPORT & AFTER-SALES SERVICE

4.12 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN RETAIL AND FMCG SECTORS ACCELERATES CORRUGATED PACKAGING ADOPTION

6.1.2 SURGE IN DEMAND FOR PROTECTIVE PACKAGING ENHANCES INNOVATION IN CORRUGATED BOX DESIGNS

6.1.3 GROWING HEALTHCARE & PHARMACEUTICAL SECTOR DRIVES DEMAND FOR STERILE AND SECURE PACKAGING

6.1.4 INNOVATIONS IN DIGITAL PRINTING ENHANCE BRANDING AND CUSTOMIZATION IN CORRUGATED PACKAGING

6.2 RESTRAINTS

6.2.1 LIMITED RECYCLABILITY OF MULTI-LAYERED CORRUGATED PACKAGING HAMPERS SUSTAINABLE ADOPTION AND RAISING ENVIRONMENTAL CONCERNS

6.2.2 LIMITED DURABILITY COMPARED TO RIGID PACKAGING MATERIALS RESTRICTS ADOPTION FOR HEAVY-DUTY APPLICATIONS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR SUSTAINABLE PACKAGING CREATES OPPORTUNITIES FOR CORRUGATED SOLUTIONS

6.3.2 EXPANDING MIDDLE EAST AND AFRICA E-COMMERCE BOOSTS DEMAND FOR LIGHTWEIGHT, DURABLE CORRUGATED PACKAGING

6.3.3 ADVANCEMENT IN TECHNOLOGY VIA RFID AND QR CODES BOOSTS SMART PACKAGING TRACEABILITY

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES ELEVATE PRODUCTION COSTS AND COMPRESS PROFIT MARGINS

6.4.2 INTENSE COMPETITION FROM ALTERNATIVE PACKAGING MATERIALS REDUCES MARKET SHARE AND COMPRESSES PRICING

7 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REGULAR SLOTTED CONTAINER (RSC)

7.2.1 REGULAR SLOTTED CONTAINER (RSC), BY FLUTE TYPE

7.2.2 REGULAR SLOTTED CONTAINER (RSC), BY BOARD TYPE

7.3 HALF SLOTTED CONTAINER (HSC)

7.3.1 HALF SLOTTED CONTAINER (HSC), BY FLUTE TYPE

7.3.2 HALF SLOTTED CONTAINER (HSC), BY BOARD TYPE

7.4 OVERLAP SLOTTED CONTAINER (OSC)

7.4.1 OVERLAP SLOTTED CONTAINER (OSC), BY FLUTE TYPE

7.4.2 OVERLAP SLOTTED CONTAINER (OSC), BY BOARD TYPE

7.5 FULL OVERLAP SLOTTED CONTAINER (FOL)

7.5.1 FULL OVERLAP SLOTTED CONTAINER (FOL), BY FLUTE TYPE

7.5.2 FULL OVERLAP SLOTTED CONTAINER (FOL), BY BOARD TYPE

7.6 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.6.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.6.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.7 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.7.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.7.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.8 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.8.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.8.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.9 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.9.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.9.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS)

7.10.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY FLUTE TYPE

7.10.2 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY BOARD TYPE

7.11 FOLDERS

7.11.1 FOLDERS, BY FLUTE TYPE

7.11.2 FOLDERS, BY BOARD TYPE

7.12 WRAPAROUND BLANK

7.12.1 WRAPAROUND BLANK, BY FLUTE TYPE

7.12.2 WRAPAROUND BLANK, BY BOARD TYPE

8 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE

8.1 OVERVIEW

8.2 C FLUTE

8.3 B FLUTE

8.4 E FLUTE

8.5 A FLUTE

8.6 F FLUTE

8.7 D FLUTE

9 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BOARD STYLE

9.1 OVERVIEW

9.2 SINGLE WALL

9.3 DOUBLE WALL

9.4 TRIPLE WALL

9.5 SINGLE FACE

9.6 LINER BOARD

10 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 UPTO 100 LBS

10.3 100-300 LBS

10.4 ABOVE 300 LBS

11 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY SIZE

11.1 OVERVIEW

11.2 0-10 INCHES

11.3 10-20 INCHES

11.4 20-30 INCHES

11.5 ABOVE 30 INCHES

12 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE

12.1 OVERVIEW

12.2 PRINTED

12.3 NON-PRINTED

13 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 E-COMMERCE & RETAIL

13.3 FOOD

13.3.1 FOOD, BY APPLICATION

13.4 ELECTRONICS GOODS

13.4.1 ELECTRIC GOODS, BY APPLICATION

13.4.1.1 CONSUMER ELECTRONICS, BY TYPE

13.4.1.2 COMPUTER AND IT HARDWARE, BY TYPE

13.5 HOME APPLIANCES

13.5.1 HOME APPLIANCES, BY APPLICATION

13.5.1.1 MAJOR HOME APPLIANCES, BY TYPE

13.5.1.2 HEATING AND COOLING DEVICES, BY TYPE

13.5.1.3 SMALL KITCHEN, BY TYPE

13.6 AUTOMOTIVE

13.6.1 AUTOMOTIVE, BY APPLICATION

13.7 HEALTHCARE & PHARMACEUTICALS

13.7.1 HEALTHCARE, BY APPLICATION

13.7.1.1 PHARMACEUTICALS, BY TYPE

13.7.1.2 HEALTHCARE, BY TYPE

13.8 BEVERAGE

13.8.1 BEVERAGE, BY APPLICATION

13.9 GLASSWARE AND CERAMICS

13.9.1 GLASSWARE AND CERAMICS, BY APPLICATION

13.9.1.1 GLASSWARE, BY TYPE

13.9.1.2 CERAMICS, BY TYPE

13.1 PERSONAL CARE

13.10.1 PERSONAL CARE, BY APPLICATION

13.11 HOME CARE

13.11.1 HOME CARE, BY APPLICATION

13.12 AGRICULTURE & HORTICULTURE

13.12.1 AGRICULTURE & HORTICULTURE, BY APPLICATION

13.13 OIL AND GAS

13.13.1 OIL AND GAS, BY APPLICATION

13.14 TOYS

13.14.1 TOYS, BY APPLICATION

13.15 BABY PRODUCTS

13.15.1 BABY PRODUCTS, BY APPLICATION

13.16 OTHERS

14 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 UNITED ARAB EMIRATES

14.1.2 SAUDI ARABIA

14.1.3 SOUTH AFRICA

14.1.4 ISRAEL

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 WESTROCK COMPANY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT/NEWS

17.2 INTERNATIONAL PAPER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT/NEWS

17.3 STORA ENSO

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT/NEWS

17.4 SMURFIT KAPPA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT/NEWS

17.5 PACKAGING CORPORATION OF AMERICA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT NEWS

17.6 AMERIPAC INDUSTRIES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ELSONS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT/NEWS

17.8 GEORGIA-PACIFIC

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT/NEWS

17.9 MONDI

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT/NEWS

17.1 OJI HOLDINGS CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT/NEWS

17.11 PRATT INDUSTRIES, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 RENGO CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT/NEWS

17.13 SCG PACKAGING

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT/NEWS

17.14 SONOCO PRODUCTS COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 TGIPACKAGING.IN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 VPK GROUP NV

17.16.1 COMPANY SNAPSHOT

17.16.2 1.1.4 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT/NEWS

18 QUESTIONNAIRE

19 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 GREENHOUSE GAS EMISSIONS FOR COMMON BOX SIZES

TABLE 3 FIBERBOARD PERFORMANCE STANDARDS

TABLE 4 TIME TAKEN FOR GARBAGE TO DECOMPOSE IN THE ENVIRONMENT

TABLE 5 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 7 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA C FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA B FLUTE IN CORRUGATED PACKAGING MARKETMARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA E FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA A FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA F FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA D FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SINGLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA DOUBLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA TRIPLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA SINGLE FACE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA LINER BOARD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA UPTO 100 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA 100-300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA ABOVE 300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA 0-10 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA 10-20 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA 20-30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA ABOVE 30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA NON-PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA E-COMMERCE & RETAIL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA ELECTRONICS GOODS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 98 MIDDLE EAST AND AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 99 MIDDLE EAST AND AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA OTHERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 106 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 115 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 116 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 117 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 118 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 119 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 120 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 121 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 122 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 152 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 153 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 154 UNITED ARAB EMIRATES REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 155 UNITED ARAB EMIRATES REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 156 UNITED ARAB EMIRATES HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 157 UNITED ARAB EMIRATES HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 158 UNITED ARAB EMIRATES OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 159 UNITED ARAB EMIRATES OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 160 UNITED ARAB EMIRATES FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 161 UNITED ARAB EMIRATES FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 162 UNITED ARAB EMIRATES CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 163 UNITED ARAB EMIRATES CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 164 UNITED ARAB EMIRATES 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 165 UNITED ARAB EMIRATES 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 166 UNITED ARAB EMIRATES TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 167 UNITED ARAB EMIRATES TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 168 UNITED ARAB EMIRATES FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 169 UNITED ARAB EMIRATES FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 170 UNITED ARAB EMIRATES WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 171 UNITED ARAB EMIRATES WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 172 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 173 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 174 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 175 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 176 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 177 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 178 UNITED ARAB EMIRATES FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 179 UNITED ARAB EMIRATES ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 180 UNITED ARAB EMIRATES CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 UNITED ARAB EMIRATES COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 182 UNITED ARAB EMIRATES HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 183 UNITED ARAB EMIRATES MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 184 UNITED ARAB EMIRATES HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 UNITED ARAB EMIRATES SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 UNITED ARAB EMIRATES AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 187 UNITED ARAB EMIRATES HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 188 UNITED ARAB EMIRATES PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 UNITED ARAB EMIRATES HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 UNITED ARAB EMIRATES BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 191 UNITED ARAB EMIRATES GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 192 UNITED ARAB EMIRATES GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 UNITED ARAB EMIRATES CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 UNITED ARAB EMIRATES PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 195 UNITED ARAB EMIRATES HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 196 UNITED ARAB EMIRATES AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 UNITED ARAB EMIRATES OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 UNITED ARAB EMIRATES TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 UNITED ARAB EMIRATES BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 201 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 202 SAUDI ARABIA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 203 SAUDI ARABIA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 204 SAUDI ARABIA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 205 SAUDI ARABIA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 206 SAUDI ARABIA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 207 SAUDI ARABIA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 208 SAUDI ARABIA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 209 SAUDI ARABIA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 210 SAUDI ARABIA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 211 SAUDI ARABIA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 212 SAUDI ARABIA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 213 SAUDI ARABIA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 214 SAUDI ARABIA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 215 SAUDI ARABIA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 216 SAUDI ARABIA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 217 SAUDI ARABIA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 218 SAUDI ARABIA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 219 SAUDI ARABIA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 220 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 221 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 222 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 223 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 224 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 225 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 226 SAUDI ARABIA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 227 SAUDI ARABIA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 SAUDI ARABIA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 SAUDI ARABIA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 SAUDI ARABIA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 SAUDI ARABIA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 SAUDI ARABIA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 SAUDI ARABIA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 SAUDI ARABIA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 235 SAUDI ARABIA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 236 SAUDI ARABIA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 SAUDI ARABIA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 SAUDI ARABIA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 239 SAUDI ARABIA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 240 SAUDI ARABIA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 SAUDI ARABIA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 SAUDI ARABIA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 243 SAUDI ARABIA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 244 SAUDI ARABIA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 245 SAUDI ARABIA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 246 SAUDI ARABIA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 247 SAUDI ARABIA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 248 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 249 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 250 SOUTH AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 251 SOUTH AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 252 SOUTH AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 253 SOUTH AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 254 SOUTH AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 255 SOUTH AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 256 SOUTH AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 257 SOUTH AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 258 SOUTH AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 259 SOUTH AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 260 SOUTH AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 261 SOUTH AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 262 SOUTH AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 263 SOUTH AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 264 SOUTH AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 265 SOUTH AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 266 SOUTH AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 267 SOUTH AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 268 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 269 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 270 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 271 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 272 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 273 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 274 SOUTH AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 275 SOUTH AFRICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 276 SOUTH AFRICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 SOUTH AFRICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 SOUTH AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 279 SOUTH AFRICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 SOUTH AFRICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 SOUTH AFRICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 SOUTH AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 283 SOUTH AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 284 SOUTH AFRICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 SOUTH AFRICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 SOUTH AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 287 SOUTH AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 288 SOUTH AFRICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 289 SOUTH AFRICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 SOUTH AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 291 SOUTH AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 292 SOUTH AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 SOUTH AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 294 SOUTH AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 295 SOUTH AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 296 ISRAEL CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 297 ISRAEL CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 298 ISRAEL REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 299 ISRAEL REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 300 ISRAEL HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 301 ISRAEL HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 302 ISRAEL OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 303 ISRAEL OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 304 ISRAEL FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 305 ISRAEL FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 306 ISRAEL CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 307 ISRAEL CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 308 ISRAEL 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 309 ISRAEL 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 310 ISRAEL TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 311 ISRAEL TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 312 ISRAEL FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 313 ISRAEL FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 314 ISRAEL WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 315 ISRAEL WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 316 ISRAEL CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 317 ISRAEL CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 318 ISRAEL CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 319 ISRAEL CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 320 ISRAEL CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 321 ISRAEL CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 322 ISRAEL FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 323 ISRAEL ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 324 ISRAEL CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 325 ISRAEL COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 326 ISRAEL HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 327 ISRAEL MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 328 ISRAEL HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 ISRAEL SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 330 ISRAEL AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 331 ISRAEL HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 332 ISRAEL PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 ISRAEL HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 334 ISRAEL BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 335 ISRAEL GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 336 ISRAEL GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 ISRAEL CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 ISRAEL PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 339 ISRAEL HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 340 ISRAEL AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 341 ISRAEL OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 342 ISRAEL TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 343 ISRAEL BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 344 EGYPT CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 345 EGYPT CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 346 EGYPT REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 347 EGYPT REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 348 EGYPT HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 349 EGYPT HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 350 EGYPT OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 351 EGYPT OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 352 EGYPT FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 353 EGYPT FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 354 EGYPT CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 355 EGYPT CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 356 EGYPT 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 357 EGYPT 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 358 EGYPT TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 359 EGYPT TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 360 EGYPT FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 361 EGYPT FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 362 EGYPT WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 363 EGYPT WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 364 EGYPT CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 365 EGYPT CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 366 EGYPT CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 367 EGYPT CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 368 EGYPT CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 369 EGYPT CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 370 EGYPT FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 371 EGYPT ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 372 EGYPT CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 373 EGYPT COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 374 EGYPT HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 375 EGYPT MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 376 EGYPT HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 377 EGYPT SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 378 EGYPT AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 379 EGYPT HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 380 EGYPT PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 381 EGYPT HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 382 EGYPT BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 383 EGYPT GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 384 EGYPT GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 385 EGYPT CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 386 EGYPT PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 387 EGYPT HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 388 EGYPT AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 389 EGYPT OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 390 EGYPT TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 391 EGYPT BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 392 REST OF MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 393 REST OF MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

Abbildungsverzeichnis

FIGURE 1 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: PRODUCT TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 13 NINE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT (2024)

FIGURE 14 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWTH IN RETAIL AND FMCG SECTORS ACCELERATES CORRUGATED PACKAGING ADOPTION IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 REGULAR SLOTTED CONTAINER (RSC) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET IN 2025 & 2032

FIGURE 18 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 HIGHEST RECEIVERS OF PACKAGING EXPORTS (DOLLAR)

FIGURE 20 SUPPLY CHAIN ANALYSIS FOR THE MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 MARKET OVERVIEW

FIGURE 23 OVERALL RETAIL MARKET GROWTH IN INDIA (FY 18-FY 24)

FIGURE 24 DEMAND FOR CORRUGATED BOXES

FIGURE 25 SHARE OF ONLINE RETAIL TRANSACTIONS OVER THE YEARS

FIGURE 26 GROWTH IN RETAIL ECOMMERCE SALES GLOBALLY OVER THE YEARS

FIGURE 27 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: BY PRODUCT, 2024

FIGURE 28 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: BY FLUTE TYPE, 2024