Middle East And Africa Crop Protection Products Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4.12 Billion

USD

5.73 Billion

2024

2032

USD

4.12 Billion

USD

5.73 Billion

2024

2032

| 2025 –2032 | |

| USD 4.12 Billion | |

| USD 5.73 Billion | |

|

|

|

|

Marktsegmentierung für Pflanzenschutzmittel im Nahen Osten und in Afrika nach Wirkstoff (Bacillus Thuringiensis (BT), Azoxystrobin, Bifenthrin, Fludioxonil, Acephat, Boscalid, Bendiocarb, 1-Methylcyclopropen, Calciumchlorid, Daminozid, Benzyl-Adenin und andere), Produkttyp (Herbizide, Insektizide, Fungizide, Pflanzenwachstumsregulatoren, Akarizide, Begasungsmittel, Nemathisten, Klebemittel zum Auftragen und andere), Herkunft (synthetische und Biopestizide), Form (flüssig und trocken), Anwendung (Blattspray, Saatgutbehandlung, Bodenbehandlung, Nachernte, chemische Behandlung und andere), Pflanzenart (Getreide und Körner, Obst und Gemüse, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen und andere Pflanzen) – Branchentrends und Prognose bis 2032

Marktgröße für Pflanzenschutzmittel im Nahen Osten und Afrika

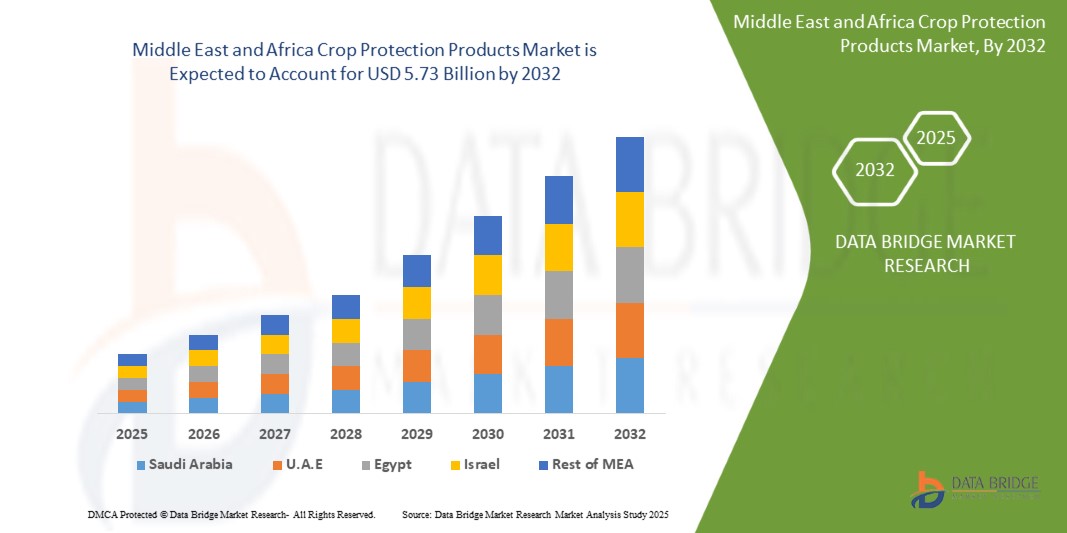

- Der Markt für Pflanzenschutzmittel im Nahen Osten und Afrika hatte im Jahr 2024 ein Volumen von 4,12 Milliarden US-Dollar und dürfte bis 2032 5,73 Milliarden US-Dollar erreichen , bei einer jährlichen Wachstumsrate von 4,20 % im Prognosezeitraum.

- Das Marktwachstum wird weitgehend durch die zunehmende Notwendigkeit zur Steigerung der landwirtschaftlichen Produktivität, die steigende Nachfrage nach Ernährungssicherheit und die Einführung fortschrittlicher landwirtschaftlicher Praktiken vorangetrieben

- Der wachsende Druck, Ernteverluste durch Schädlinge, Unkraut und Krankheiten zu reduzieren, sowie die Ausweitung der kommerziellen Landwirtschaft unterstützen die Marktexpansion zusätzlich.

Marktanalyse für Pflanzenschutzmittel im Nahen Osten und Afrika

- Der Markt für Pflanzenschutzmittel wächst stetig, da Landwirte und Agrarunternehmen zunehmend Wert auf wirksame Lösungen zur Sicherung der Erträge und Verbesserung der Qualität legen.

- Die zunehmende Nutzung nachhaltiger und biobasierter Pflanzenschutzalternativen verändert die Wettbewerbslandschaft und steht im Einklang mit strengeren gesetzlichen Standards und der Nachfrage der Verbraucher nach sicheren landwirtschaftlichen Produkten.

- Der südafrikanische Markt für Pflanzenschutzmittel dominierte die Region Naher Osten und Afrika mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch die weit verbreitete Einführung von Herbiziden, Insektiziden und Fungiziden in kommerziellen und kleinbäuerlichen Betrieben

- Die VAE werden voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) im Markt für Pflanzenschutzmittel im Nahen Osten und Afrika verzeichnen , da zunehmend moderne Anbaumethoden, Hydrokulturen und kontrollierter Anbau eingesetzt werden. Wachsende staatliche Initiativen zur Förderung von Ernährungssicherheit und Nachhaltigkeit treiben die Nachfrage nach innovativen Pflanzenschutzlösungen im Land weiter an.

- Das Segment Bacillus Thuringiensis (BT) hatte im Jahr 2024 den größten Marktanteil, was auf seine breit gefächerten Schädlingsbekämpfungseigenschaften und die Kompatibilität mit nachhaltigen landwirtschaftlichen Praktiken zurückzuführen ist. BT-basierte Lösungen werden aufgrund ihrer Effizienz, geringen Umweltbelastung und Eignung für eine Vielzahl von Kulturpflanzen weithin bevorzugt.

Berichtsumfang und Marktsegmentierung für Pflanzenschutzmittel im Nahen Osten und Afrika

|

Eigenschaften |

Wichtige Markteinblicke für Pflanzenschutzprodukte im Nahen Osten und Afrika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Naher Osten und Afrika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Pflanzenschutzmittel im Nahen Osten und Afrika

Steigende Akzeptanz moderner Pflanzenschutzlösungen

- Der zunehmende Trend zu modernen Pflanzenschutzlösungen verändert die Landwirtschaft: Sie ermöglicht höhere Ernteerträge und reduziert Verluste durch Schädlinge, Unkraut und Krankheiten. Diese Lösungen ermöglichen eine zeitnahe und präzise Anwendung und verbessern so die Gesamtproduktivität und Rentabilität der Landwirte. Das zunehmende Bewusstsein für die Pflanzengesundheit und die langfristigen Vorteile moderner Formulierungen beschleunigt die Einführung in verschiedenen landwirtschaftlichen Systemen zusätzlich.

- Die steigende Nachfrage nach nachhaltigen und biobasierten Pestiziden und Herbiziden beschleunigt die Einführung umweltfreundlicher Formulierungen. Diese Produkte tragen zur Erhaltung der Bodengesundheit bei, reduzieren die Umweltbelastung und gewährleisten gleichzeitig den Pflanzenschutz. Landwirte und Agrarunternehmen integrieren diese Lösungen zunehmend in langfristige Anbaustrategien und reagieren damit auf regulatorischen Druck und den Wunsch der Verbraucher nach sichereren Produkten.

- Die verbesserte Erschwinglichkeit und Benutzerfreundlichkeit moderner Pflanzenschutzmittel fördern die zunehmende Akzeptanz bei Kleinbauern und gewerblichen Landwirten. Die regelmäßige Anwendung ermöglicht eine bessere Überwachung der Ernte und reduziert das Risiko großer Verluste. Technologische Fortschritte wie vordosierte Formulierungen und intelligente Anwendungsgeräte machen einen wirksamen Pflanzenschutz auch in weniger mechanisierten Betrieben zugänglich.

- So konnten Landwirte, die in den letzten Jahren integrierte Schädlingsbekämpfungsgeräte und Präzisions-Herbizid-Applikatoren einsetzen, beispielsweise von einer höheren Erntequalität und einem geringeren Chemikalienverbrauch berichten. Diese Instrumente ermöglichen gezieltes Handeln, senken die Produktionskosten und verbessern die langfristige Bodennachhaltigkeit. Die Einführung dieser Innovationen fördert zudem den Wissensaustausch und die bessere Einhaltung von Umweltschutzstandards.

- Moderne Pflanzenschutzmittel steigern zwar Erträge und Effizienz, ihr Erfolg hängt jedoch von kontinuierlicher Innovation, der Schulung der Landwirte und der Kosteneffizienz ab. Hersteller müssen sich auf skalierbare, sichere und umweltverträgliche Lösungen konzentrieren, um die Marktnachfrage optimal zu nutzen. Die Zusammenarbeit mit landwirtschaftlichen Beratungsdiensten und Schulungsprogrammen ist entscheidend für die Maximierung ihrer Wirksamkeit und langfristigen Marktdurchdringung.

Marktdynamik für Pflanzenschutzmittel im Nahen Osten und Afrika

Treiber

Zunehmendes Auftreten von Schädlingen, Unkraut und Pflanzenkrankheiten

- Zunehmender Schädlings- und Unkrautbefall sowie Pflanzenkrankheiten treiben die Nachfrage nach wirksamen Pflanzenschutzmitteln voran. Landwirte und Agrarunternehmen legen Wert auf Lösungen, die Ertragsverluste minimieren und die Qualität der Pflanzen erhalten. Die weltweit steigende Nachfrage nach Nahrungsmitteln und die Notwendigkeit konsistenter Lieferketten verstärken den Einsatz von Schutzmaßnahmen zusätzlich.

- Das Bewusstsein für die finanziellen Auswirkungen unbehandelter Pflanzenschäden, einschließlich Produktivitätsverlusten und Ertragsverlusten, motiviert zum regelmäßigen Einsatz von Pestiziden, Herbiziden und Fungiziden. Ein angemessener Pflanzenschutz trägt direkt zur Rentabilität landwirtschaftlicher Betriebe und zur langfristigen Nachhaltigkeit bei. Die zunehmende Zusammenarbeit zwischen Agronomen und Landwirten trägt dazu bei, die Produktauswahl und den Einsatzzeitpunkt für maximale Effizienz zu optimieren.

- Staatliche Richtlinien und landwirtschaftliche Organisationen, die sichere und wirksame Pflanzenschutzpraktiken fördern, unterstützen das Marktwachstum zusätzlich. Regulatorische Rahmenbedingungen fördern integrierten Pflanzenschutz und umweltfreundliche Formulierungen. Anreize und Subventionen für den Einsatz fortschrittlicher Produkte spielen ebenfalls eine wichtige Rolle bei der Ausweitung der Nutzung in Betrieben unterschiedlicher Größe.

- So haben beispielsweise aktuelle Agrarprogramme den Einsatz integrierter Pflanzenschutzlösungen gefördert und sowohl konventionelle als auch biobasierte Produkte gefördert. Schulungsinitiativen und Sensibilisierungskampagnen ergänzen diese Programme, um die ordnungsgemäße Anwendung sicherzustellen und Missbrauch zu reduzieren. Das Ergebnis sind eine verbesserte Pflanzengesundheit, weniger chemische Rückstände und verbesserte Nachhaltigkeitskennzahlen.

- Während Schädlingsbefall und regulatorische Unterstützung den Markt antreiben, erfordert eine breite Akzeptanz angemessene Schulungen, Technologieintegration und erschwingliche Lösungen für alle Arten von Landwirten. Kontinuierliche Investitionen in digitale Landwirtschaftswerkzeuge und Präzisionslandwirtschaftsgeräte erhöhen die Wirksamkeit von Pflanzenschutzstrategien weiter. Partnerschaften mit Händlern und Genossenschaften helfen, die Lücke für Kleinbauern zu schließen.

Einschränkung/Herausforderung

Hohe Kosten für moderne Pflanzenschutzmittel und Zugangsbeschränkungen

- Die hohen Preise für moderne Pflanzenschutzmittel, Formulierungen und Präzisionsanwendungsgeräte erschweren den Zugang zu ihnen für Kleinbauern. Premiumprodukte sind oft nur für gewerbliche Betriebe erhältlich, was eine breite Anwendung einschränkt. Kostenbarrieren sind besonders in Regionen mit niedrigeren landwirtschaftlichen Einkommen oder fragmentierten Vertriebsnetzen von Bedeutung.

- Mangelndes Fachwissen und mangelnde Schulung zu effektiven Anwendungsmethoden mindern die Wirksamkeit von Pflanzenschutzmitteln, insbesondere bei Kleinbauern. Falsche Anwendung kann zu Ernteschäden, chemischen Resistenzen oder Umweltgefahren führen. Die Aufklärung der Landwirte über Dosierung, Zeitpunkt und Sicherheitsprotokolle ist entscheidend für die Maximierung von Produktivität und Sicherheit.

- Lieferkettenengpässe bei Spezialrezepturen und -geräten schränken die Verfügbarkeit zusätzlich ein, was zu einer suboptimalen Nutzung oder der Abhängigkeit von traditionellen Methoden führt. Lieferverzögerungen und inkonsistente Produktqualität können sich negativ auf die Erntezyklen auswirken. Um diese Herausforderungen zu meistern, ist die Stärkung der Logistik, der Lagerhaltung und der lokalen Fertigungskapazitäten unerlässlich.

- Umfragen zeigen beispielsweise, dass ein erheblicher Teil der Landwirte den Einsatz von Pestiziden aufgrund von Kosten oder mangelnder Beratung verzögert oder reduziert, was zu Ernteausfällen führt. Solche Lücken unterstreichen den Bedarf an erschwinglichen, einfach anzuwendenden und allgemein zugänglichen Pflanzenschutzlösungen. Marktteilnehmer müssen Strategien entwickeln, die Produktinnovationen mit praktischen Einsatzmodellen verbinden.

- Während Innovationen im Pflanzenschutz weiter voranschreiten, bleiben Erschwinglichkeit, Zugänglichkeit und Schulung von entscheidender Bedeutung. Marktteilnehmer müssen sich auf kostengünstige Lösungen, dezentralen Vertrieb und Bildungsprogramme konzentrieren, um langfristiges Marktpotenzial zu erschließen. Die Zusammenarbeit mit Behörden, NGOs und Genossenschaften kann die Einführung beschleunigen und die landwirtschaftliche Produktivität insgesamt steigern.

Marktumfang für Pflanzenschutzmittel im Nahen Osten und Afrika

Der Markt ist nach Wirkstoff, Produkttyp, Herkunft, Form, Anwendung und Pflanzenart segmentiert.

• Nach Wirkstoff

Der Markt für Pflanzenschutzmittel im Nahen Osten und Afrika ist nach Wirkstoffen in Bacillus Thuringiensis (BT), Azoxystrobin, Bifenthrin, Fludioxonil, Acephate, Boscalid, Bendiocarb, 1-Methylcyclopropen, Calciumchlorid, Daminozid, Benzyl-Adenin und andere unterteilt. Das Segment Bacillus Thuringiensis (BT) hatte 2024 den größten Marktanteil, was auf seine breit gefächerten Schädlingsbekämpfungseigenschaften und seine Kompatibilität mit nachhaltigen landwirtschaftlichen Praktiken zurückzuführen ist. BT-basierte Lösungen werden aufgrund ihrer Effizienz, geringen Umweltbelastung und Eignung für eine Vielzahl von Kulturen bevorzugt.

Das Azoxystrobin-Segment wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen, was auf die hohe Wirksamkeit gegen Pilzkrankheiten und die zunehmende Verbreitung bei Obst, Gemüse und Getreide zurückzuführen ist. Azoxystrobin-Formulierungen werden aufgrund ihrer Zuverlässigkeit, längeren Restaktivität und Kompatibilität mit integrierten Schädlingsbekämpfungsprogrammen zunehmend bevorzugt.

• Nach Produkttyp

Der Markt für Pflanzenschutzmittel im Nahen Osten und Afrika ist nach Produkttyp in Herbizide, Insektizide, Fungizide, Pflanzenwachstumsregulatoren, Akarizide, Begasungsmittel, Nemathisten, Streichkleber und Sonstiges unterteilt. Das Segment Herbizide hatte 2024 den größten Marktanteil, bedingt durch den steigenden Bedarf an effektiver Unkrautbekämpfung und höheren Ernteerträgen. Herbizide ermöglichen eine präzise Anwendung, minimieren Ernteschäden und werden in der großflächigen Getreideproduktion weithin eingesetzt.

Das Segment Insektizide wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, bedingt durch den zunehmenden Schädlingsbefall und die wachsende Bedeutung der Ernteausfallprävention. Fortschrittliche Insektizidformulierungen ermöglichen eine gezielte Wirkung, einen geringeren Chemikalieneinsatz und eine verbesserte Pflanzenschutzeffizienz, was zu einer zunehmenden Akzeptanz bei gewerblichen Landwirten und Kleinbauern führt.

• Nach Herkunft

Der Markt für Pflanzenschutzmittel im Nahen Osten und Afrika ist nach Herkunft in synthetische und Biopestizide unterteilt. Das Segment der synthetischen Produkte hatte 2024 den größten Marktanteil, was auf seine breite Wirksamkeit, Kosteneffizienz und umfassende Verfügbarkeit für alle Nutzpflanzenarten zurückzuführen ist. Synthetische Formulierungen werden in der großflächigen kommerziellen Landwirtschaft nach wie vor häufig eingesetzt.

Das Segment Biopestizide wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, getrieben durch die steigende Nachfrage nach umweltfreundlichen und nachhaltigen Pflanzenschutzlösungen. Biopestizide erfreuen sich aufgrund ihrer geringen Umweltbelastung, der Einhaltung gesetzlicher Vorschriften und ihrer Eignung für den ökologischen Landbau zunehmender Beliebtheit.

• Nach Formular

Der Markt für Pflanzenschutzmittel im Nahen Osten und Afrika ist in Flüssig- und Trockenprodukte unterteilt. Das Flüssigsegment hatte 2024 den größten Marktanteil, was auf die einfache Anwendung, die schnellere Absorption und die Kompatibilität mit automatisierten Sprühsystemen zurückzuführen ist. Flüssige Produkte werden häufig für Blattsprays und die Nacherntebehandlung verwendet.

Das Segment Trockenprodukte dürfte zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, vor allem aufgrund der Anwendung in der Saatgutbehandlung, Bodenbehandlung und Präzisionslandwirtschaft. Trockene Formulierungen werden aufgrund ihrer Stabilität, längeren Haltbarkeit und Eignung für mechanisierte Geräte bevorzugt.

• Nach Anwendung

Der Markt für Pflanzenschutzmittel im Nahen Osten und Afrika ist nach Anwendungsgebieten in Blattspray, Saatgutbehandlung, Bodenbehandlung, Nacherntebehandlung, chemische Behandlung und Sonstiges unterteilt. Das Segment Blattspray hatte 2024 den größten Marktanteil, was auf seine Fähigkeit zur schnellen und gezielten Schädlings- und Krankheitsbekämpfung zurückzuführen ist. Blattsprays werden aufgrund ihrer Effizienz und Benutzerfreundlichkeit häufig für hochwertige Nutzpflanzen eingesetzt.

Das Segment Saatgutbehandlung dürfte zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen. Dies ist auf den Bedarf an Pflanzenschutzmitteln im Frühstadium und die zunehmende Verbreitung bei Obst, Gemüse und Getreide zurückzuführen. Saatgutbehandlungen tragen dazu bei, Schädlingsbefall zu reduzieren, die Keimung zu verbessern und die Gesamtleistung der Pflanzen zu steigern.

• Nach Pflanzenart

Der Markt für Pflanzenschutzmittel im Nahen Osten und Afrika ist nach Kulturpflanzenart in Getreide und Körner, Obst und Gemüse, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen sowie sonstige Kulturpflanzen unterteilt. Das Segment Getreide und Körner hatte im Jahr 2024 den größten Marktanteil, getrieben durch den großflächigen Anbau und die weltweite Nachfrage nach Grundnahrungsmitteln. Diese Kulturen erfordern eine umfassende Unkraut- und Schädlingsbekämpfung, um die Erträge zu sichern.

Das Segment Obst und Gemüse wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, getrieben durch steigenden Konsum, höheren Wert und die Nachfrage nach hochwertigen und sicheren Produkten. Präzise Pflanzenschutzlösungen und biobasierte Produkte werden bei diesen hochwertigen Kulturen zunehmend eingesetzt, um die Lebensmittelsicherheit zu gewährleisten und die Erträge zu optimieren.

Regionale Analyse des Marktes für Pflanzenschutzmittel im Nahen Osten und Afrika

- Der südafrikanische Markt für Pflanzenschutzmittel dominierte die Region Naher Osten und Afrika mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch die weit verbreitete Einführung von Herbiziden, Insektiziden und Fungiziden in kommerziellen und kleinbäuerlichen Betrieben

- Landwirte konzentrieren sich auf die Optimierung der Ernteerträge und das Krankheitsmanagement mithilfe moderner agrochemischer Lösungen

- Die Verfügbarkeit moderner Pflanzenschutzmittel und die staatliche Unterstützung einer nachhaltigen Landwirtschaft fördern die breite Akzeptanz

Markteinblick in die VAE für Pflanzenschutzprodukte

Der Markt für Pflanzenschutzmittel in den VAE wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, angetrieben durch steigende Investitionen in moderne Anbautechniken und die Einführung der Präzisionslandwirtschaft. Landwirte setzen zunehmend biobasierte und chemische Pflanzenschutzmittel ein, um ihre Produktivität zu steigern und nachhaltige Praktiken zu gewährleisten. Regierungsinitiativen zur Förderung fortschrittlicher agrochemischer Lösungen und des Anbaus hochwertiger Nutzpflanzen beschleunigen das Marktwachstum zusätzlich.

Marktanteil von Pflanzenschutzmitteln im Nahen Osten und Afrika

Die Pflanzenschutzmittelindustrie im Nahen Osten und Afrika wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- ADAMA Agricultural Solutions (Israel)

- Makhteshim Agan Industries (Israel)

- Greener Crop (VAE)

- Advanta Seeds (VAE)

- Red Sea Farms (Saudi-Arabien)

- Pure Harvest (VAE)

- Madar Farms (VAE)

- RNZ Agrotech (VAE)

- Mozare3 (VAE)

- CropTech (Südafrika)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.