North America Biopreservation Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.18 Billion

USD

3.45 Billion

2024

2032

USD

2.18 Billion

USD

3.45 Billion

2024

2032

| 2025 –2032 | |

| USD 2.18 Billion | |

| USD 3.45 Billion | |

|

|

|

|

North America Biopreservation Market Segmentation By Product Type (Biopreservation Media and Biopreservation Equipment), Biospecimens (Human Tissue Samples, Organs, Stem Cells and Other Biospecimens), Application (Therapeutic Applications, Research Applications, Clinical Trials and Other Applications), End User (Bio Banks, Gene Banks, Hospitals and Other End Users) - Industry Trends and Forecast to 2032

Biopreservation Market Size

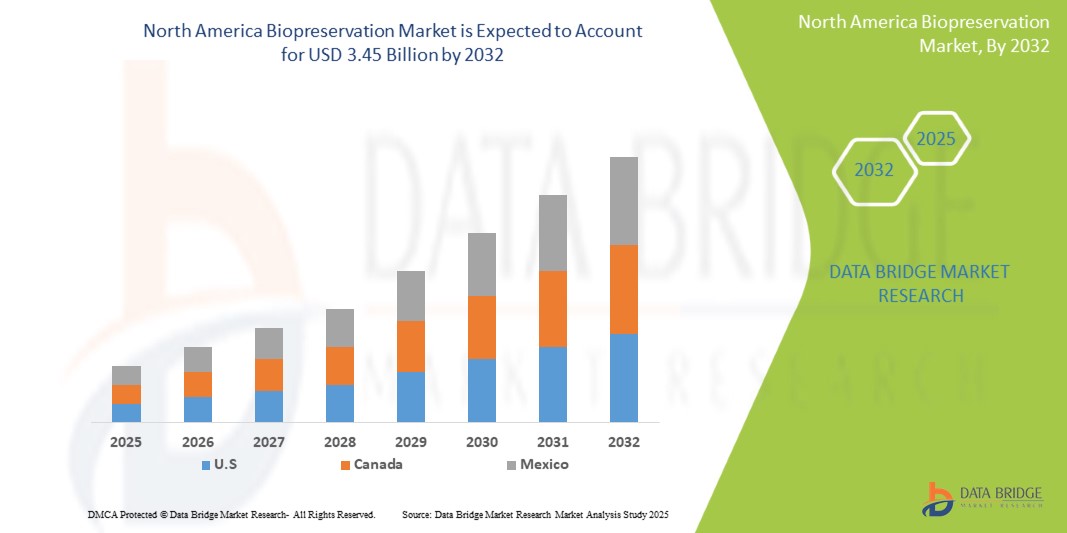

- The North America Biopreservation Market was valued atUSD2.18 billionin 2024and is expected to reachUSD3.45 billionby 2032at aCAGR of 8.3% during the forecast period

- The increasing demand for regenerative medicine and personalized healthcare solutions, require the reliable preservation of biological samples such as cells, tissues, and organs. The growing use of stem cell therapies, gene editing, and cell-based treatments has significantly heightened the need for advanced biopreservation techniques.

North America Biopreservation Market Analysis

- Biopreservation plays a pivotal role in the management of vertebral compression fractures (VCFs), which are frequently linked to osteoporosis and aging. This technique supports critical outcomes such as pain relief, restoration of vertebral height, and improved patient mobility—collectively enhancing quality of life. Biopreservation solutions are widely utilized across hospitals, outpatient clinics, and rehabilitation centers, and are seeing growing use in home care settings for post-surgical recovery support.

- The demand for Biopreservation in North America is primarily driven by the increasing prevalence of osteoporosis-related fractures among the aging population. This trend is amplified by rising awareness of the clinical and economic benefits of minimally invasive interventions. Advances in medical technologies that improve surgical precision and reduce recovery times are accelerating the adoption of biopreservation across clinical settings. Additionally, the shift toward outpatient procedures and home-based recovery options is supporting broader market expansion.

- North America continues to hold a leading position in the North America Biopreservation market, backed by its robust healthcare infrastructure, high rate of technology adoption, and supportive reimbursement frameworks. The United States, in particular, dominates the regional market due to its high healthcare expenditure, large elderly population, and widespread integration of innovative surgical techniques that reduce inpatient stays and improve long-term patient outcomes.

Report Scope Biopreservation Market Segmentation

|

Attributes |

Biopreservation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biopreservation Market Trends

“Minimally Invasive Innovations and Outpatient Procedure Growth”

- The market is witnessing a strong shift toward minimally invasive biopreservation procedures, driven by their ability to reduce surgical trauma, shorten recovery periods, and improve overall patient outcomes. Enhanced imaging systems and next-generation surgical tools are enabling greater procedural accuracy and efficiency, resulting in better spinal alignment and restoration in vertebral compression fracture (VCF) treatments.

- As procedures become faster and safer, there is a clear movement from inpatient settings to outpatient clinics and ambulatory surgical centers. This trend is fueled by cost-saving imperatives and improved procedural outcomes. With the support of advanced post-surgical care technologies and remote patient monitoring, healthcare providers are increasingly confident in managing recovery outside hospital walls—boosting accessibility and reducing system burden.

- For instance, the increasing focus on personalized medicine and regenerative therapies is driving a surge in demand for biopreservation solutions. As more emphasis is placed on preserving biological samples, such as cells, tissues, and organs, for research and therapeutic use, there is a growing need for advanced preservation technologies that ensure sample viability, improve recovery outcomes, and support the development of personalized treatment plans. This trend is particularly noticeable in stem cell therapies, tissue engineering, and biobanking sectors.

Biopreservation Market Dynamics

Driver

“Rising Prevalence of Osteoporotic Fractures and Increasing Geriatric Population”

- The North America Biopreservation Market is experiencing robust growth fueled by the increasing prevalence of osteoporosis-related vertebral compression fractures (VCFs), particularly among the aging population. As longevity rises, so does the demand for minimally invasive interventions that can address age-related spinal conditions effectively.

- The growing awareness of the benefits of minimally invasive procedures—such as quicker pain relief, restoration of spinal stability, and reduced hospital stays—is driving broader adoption of Biopreservation across both hospital and outpatient settings.

- With healthcare systems focusing on improving mobility and reducing long-term disability in older adults, Biopreservation is becoming a preferred approach due to its proven ability to restore vertebral height and function safely and effectively.

For instance,

- National Osteoporosis Foundation reports that approximately 1.5 million vertebral fractures occur annually in the U.S., with a large proportion linked to osteoporosis.

- In 2024, Medtronic launched a next-generation Biopreservation balloon catheter, offering improved navigation and enhanced bone access to facilitate safer, more effective fracture treatment.

Opportunity

“Technological Advancements and Expansion into Outpatient & Ambulatory Care Settings”

- A major opportunity in the Biopreservation market lies in the continuous innovation of procedural tools and materials, including advanced balloon technologies, integrated real-time imaging systems, and refined cement delivery techniques. These developments enhance surgical precision, safety, and procedural outcomes.

- The expansion of Biopreservation into outpatient clinics and ambulatory surgical centers (ASCs) presents a cost-effective alternative to hospital-based care. These settings provide improved accessibility, reduced overhead costs, and greater patient convenience.

For instance,

- For instance, in early 2024, Stryker introduced a streamlined Biopreservation system tailored for ambulatory surgery centers, reducing setup complexity and shortening procedure time.

- Collaborations between medical device companies and outpatient networks are also supporting workforce training and expanding access to Biopreservation beyond urban hospitals.

Restraint/Challenge

“High Procedure Cost and Reimbursement Barriers”

- One of the major challenges facing the North America Biopreservation Market is the high cost associated with the procedure. Expenses related to specialized equipment, real-time imaging, and post-operative care can limit patient access, especially among those lacking comprehensive insurance coverage.

- Inconsistent reimbursement policies across public and private insurers create uncertainty for healthcare providers and may deter smaller facilities from offering the procedure. Rural and underserved regions are particularly affected by these disparities.

- Furthermore, navigating the complex regulatory environment—which requires extensive clinical validation for new technologies—can delay product launches, increase development costs, and temporarily stifle innovation.

For instance,

- For instance, a 2023 CMS report noted variable reimbursement rates for vertebral augmentation procedures, contributing to inconsistent access across different U.S. states.

- Smaller clinics and healthcare providers often face financial hurdles in adopting Biopreservation systems due to low patient volumes and delayed reimbursement cycles.

Biopreservation Market Scope

The market is segmented on the basis, three notable segments based on By Product Type, application, End User .

|

Segmentation |

Sub-Segmentation |

|

By Product type |

|

|

By application |

|

|

By end user |

|

In 2025, the Biopreservation Media is projected to dominate the market with a largest share in product type segment

TheBiopreservation Mediais expected to lead the North America Biopreservation Market in 2025. with the largest share of 46.62% in 2025 driven by its critical role in maintaining cell viability during storage and transport. Increasing use in stem cell, gene therapy, and biobanking applications is driving demand. Technological advancements in formulation and stability are further supporting market growth.

TheTherapeutic Applicationsis expected to account for the largest share during the forecast period in application market

In 2025, Therapeutic Applications are projected to account for the largest share of the North America Biopreservation Market by application with the largest market share of 49.31% due to its growing use of preserved cells and tissues in regenerative medicine, stem cell therapy, and oncology treatments. Rising demand for personalized medicine further boosts the need for therapeutic biopreservation solutions.

Biopreservation Market Regional Analysis

“U.S. is the Dominant Country in the Biopreservation Market”

- The United States leads the North America Biopreservation Market, supported by a highly developed healthcare infrastructure, broad adoption of minimally invasive surgical technologies, and the strong presence of top-tier medical device manufacturers.

- The high incidence of osteoporosis-related vertebral compression fractures (VCFs), combined with a large and aging population, is fueling demand for effective, minimally invasive spinal procedures across hospitals and ambulatory surgical centers.

- Leading companies such as Medtronic, Stryker, and Globus Medical are deeply rooted in the U.S. market, offering advanced Biopreservation systems—including balloon-based kyphoplasty and precision cement delivery devices—that comply with regulatory standards and clinical performance requirements.

- Favorable reimbursement frameworks, increased physician training in minimally invasive techniques, and public health initiatives aimed at reducing long-term disability further cement the U.S.’s dominance in the regional Biopreservation landscape.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is poised to experience the fastest growth in the North America Biopreservation Market, driven by rising government investment in bone health and expanded access to spinal care services targeting its aging population.

- The country’s publicly funded healthcare model and increasing awareness of minimally invasive alternatives for vertebral fracture management are accelerating the adoption of Biopreservation procedures across clinical settings.

- Growth in ambulatory surgical centers and rehabilitation clinics—especially in urban and semi-urban areas—is fueling demand for cost-effective, low-complication spinal treatments.

- National collaboration between health ministries, orthopedic associations, and academic institutions is fostering clinical education, technology adaptation, and domestic innovation in Biopreservation tools and techniques.

Biopreservation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (U.S.)

- Boston Scientific (U.S.)

- Philips Healthcare (Netherlands/U.S.)

- Stryker (U.S.)

- Globus Medical (U.S.)

- Zimmer Biomet (U.S.)

- Smith & Nephew (U.K.)

- Johnson & Johnson (U.S.)

- NuVasive (U.S.)

- CareFusion (U.S.)

Latest Developments in North America Biopreservation Market

- In March 2024, Merck Invests More than € 300 Million in New Life Science Production Site in Korea. This New Bioprocessing Production Center in Daejeon strengthened footprint of Merck in fast-growing Asia-Pacific region.

- In September 2023, Avantor Partnered with Tobin Scientific to Provide End-to-End Solution for Research Lab Relocations, Sample Transport, and GMP Storage Services to support end-to-end moves for U.S. biopharma customers looking to relocate their labs, research facilities, and samples. This partnership will deliver upon the growing customer need for complex logistics solutions with temperature-specific requirements.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.