North America Cadcam Dental Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.12 Billion

USD

4.24 Billion

2024

2032

USD

2.12 Billion

USD

4.24 Billion

2024

2032

| 2025 –2032 | |

| USD 2.12 Billion | |

| USD 4.24 Billion | |

|

|

|

|

North America CAD-CAM Dental Devices Market Segmentation, By Product Type (CAD/CAM Systems, CAD/CAM Materials), Prosthodontic (Inlays and Onlays, Veneers, Crowns and Bridges, Fixed Partial Denture, Implant Abutment, Full Mouth Reconstruction), Software (Cerec, Delcam, Worknc dental, Renishaw plc), Application (Crowns, Dentures, Bridges, Veneers, Inlays/Onlays), End-User (Dental Laboratories, Milling Centres and Dental Clinics, Research/Academic Institute)- Industry Trends and Forecast to 2032

CAD-CAM Dental Devices Market Size

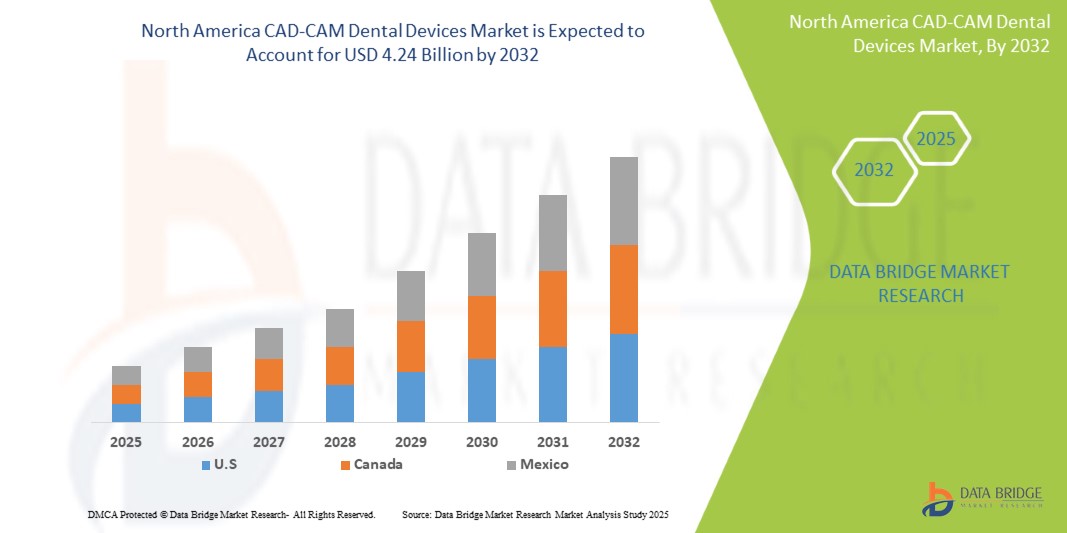

- The North America CAD-CAM Dental Devices Market was valued atUSD2.12 Billionin 2024and is expected to reachUSD4.24 Billionby 2032,at aCAGR of 9.1%during the forecast period.

- The drivers of the North America CAD-CAM Dental Devices Market include the rising demand for precision and aesthetic dental restorations, growing adoption of digital dentistry among dental professionals, and advancements in CAD-CAM technologies that enhance efficiency and reduce chair time. Additionally, the increasing prevalence of dental disorders, expanding geriatric population, and heightened awareness of oral health are contributing to the market's growth.

North America CAD-CAM Dental Devices Market Analysis

- CAD-CAM (Computer-Aided Design and Computer-Aided Manufacturing) dental devices have revolutionized dental restoration processes by enabling precise, efficient, and aesthetically pleasing restorations such as crowns, bridges, veneers, inlays, and dentures. These systems streamline dental workflows by reducing manual labor and allowing same-day prosthetics with improved accuracy.

- The demand for CAD-CAM dental devices in North America is driven by the rising prevalence of dental disorders, increasing demand for cosmetic dentistry, and a growing geriatric population with restorative dental needs. The shift toward digital dentistry and chairside solutions is also fueling adoption across dental clinics and laboratories.

- North America holds a leading position in the North America CAD-CAM dental devices market, supported by advanced dental care infrastructure, high dental expenditure, and strong presence of leading market players. The United States is at the forefront, owing to its early adoption of digital technologies, increased awareness of oral health, and a growing number of dental practices equipped with modern CAD-CAM systems.

- For instance, the U.S. dental industry has seen a surge in the use of chairside CAD-CAM systems that allow same-day crown placements, improving patient satisfaction and clinic efficiency.

- The North American market is also shaped by favorable reimbursement scenarios, continuous product innovations, and increasing investments in dental technology. Regulatory approvals from bodies such as the FDA, as well as educational initiatives promoting digital dentistry among practitioners, are further accelerating market growth. Moreover, the trend toward minimally invasive procedures and personalized dental care is strengthening the role of CAD-CAM devices in restorative and prosthetic dentistry.

Report ScopeCAD-CAM Dental DevicesMarket Segmentation

|

Attributes |

CAD-CAM Dental DevicesKeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

CAD-CAM Dental Devices Market Trends

“Rising Adoption of Digital Workflows and Chairside Solutions in Dentistry”

- The integration of CAD-CAM systems into dental practices is accelerating due to the growing demand for same-day restorations, improved precision, and enhanced patient experience. Chairside CAD-CAM devices allow dentists to design, fabricate, and place restorations in a single visit, streamlining workflows and reducing reliance on dental labs.

- The increasing digitization of dental practices, including intraoral scanning, digital design software, and 3D printing, is transforming traditional dental workflows. These innovations are particularly appealing to tech-savvy practitioners and patients seeking faster, more comfortable treatments.

- For instance, the integration of chairside CAD-CAM systems in dental clinics across North America enables same-day restorations, significantly reducing patient visits. Technologies such as CEREC allow dentists to design, mill, and place crowns or veneers in a single appointment, improving workflow efficiency and patient satisfaction

- Growing emphasis on aesthetic dentistry and minimally invasive procedures is driving the demand for CAD-CAM-fabricated restorations that offer superior fit, function, and cosmetic outcomes.

CAD-CAM Dental Devices Market Dynamics

Driver

“Increasing Awareness and Demand for Digitally Enhanced Dental Restoration”

- Rising awareness about the benefits of digital dentistry, including improved accuracy, faster turnaround times, and enhanced aesthetics, is driving the demand for CAD-CAM dental devices in North America. Patients and practitioners alike are recognizing the advantages of digital workflows over traditional methods.

- Educational initiatives by dental associations, universities, and companies are promoting the adoption of CAD-CAM technology among dental professionals, highlighting its role in improving clinical outcomes and practice efficiency.

- Greater accessibility to advanced dental care—supported by expanding insurance coverage, dental service organizations (DSOs), and government healthcare programs—has enabled more patients to benefit from CAD-CAM-based restorations.

- The rise of dental service chains and group practices is increasing investment in integrated CAD-CAM systems, as these practices prioritize scalable, high-efficiency solutions to meet growing patient volumes.

For instance,

- For instance, in 2023, Heartland Dental, a major U.S. dental service organization, announced a large-scale deployment of chairside CAD-CAM systems across its network to streamline workflows and reduce lab dependency

- Innovation in user-friendly CAD-CAM software and hardware, including touch-screen interfaces, automated design suggestions, and AI-powered planning tools, is making these devices more accessible to general dentists and not just specialists.

- The growing influence of e-commerce and digital platforms is also enabling wider access to CAD-CAM devices, components, and consumables, especially for independent practices and small labs.

- Furthermore, the adoption of teledentistry and remote design services is expanding the reach of CAD-CAM technology, allowing practitioners in rural or underserved areas to deliver high-quality prosthetic solutions with support from centralized design centers.

Opportunity

“Integration of CAD-CAM Dental Devices into Home-Based and Tele-Dentistry Platforms”

- The growing shift toward home-based healthcare and tele-dentistry is creating promising opportunities for the integration of CAD-CAM dental devices into virtual care models in North America. These trends are driven by patient demand for convenience, faster service, and remote access to dental consultations.

- As dental practices and patients increasingly embrace digital health technologies, there is rising interest in CAD-CAM systems that support remote dental design services, digital impressions, and virtual treatment planning. This is particularly impactful for rural and underserved populations with limited access to in-person dental care.

- The adoption of tele-dentistry is encouraging the development of connected devices such as portable intraoral scanners and cloud-based design software, enabling dentists to provide diagnostic and restorative solutions without requiring multiple in-office visits.

For instance,

- In January 2024, 3Shape launched an enhanced version of its TRIOS scanner with integrated cloud sharing and AI-assisted diagnostics, allowing general dentists and orthodontists to collaborate remotely on treatment plans and prosthetic designs.

- This trend is fueling demand for more compact, intuitive, and interoperable CAD-CAM systems that can seamlessly integrate into digital platforms and support remote workflows, enhancing patient convenience and practice efficiency.

- The expansion of digital dental ecosystems—including mobile apps for appointment scheduling, treatment previews, and patient education—is also supporting the broader adoption of CAD-CAM technologies across both clinical and home-based settings.

Restraint/Challenge

“High Equipment Costs and Complex Regulatory Approval Processes”

- Advanced CAD-CAM dental devices, including intraoral scanners, milling machines, and 3D printers with integrated AI and cloud-based platforms, often come with high capital investment and maintenance costs. These expenses pose a significant barrier for small dental clinics, independent practitioners, and laboratories, particularly in rural or cost-sensitive regions across North America.

- The initial setup and training required to integrate CAD-CAM systems into dental practices can be resource-intensive, leading to slower adoption among smaller practices that may lack technical expertise or financial resources.

- In addition, the complex and stringent regulatory approval processes governed by agencies such as the U.S. FDA and Health Canada pose challenges for manufacturers introducing new CAD-CAM technologies. These processes require rigorous testing, safety validation, and clinical documentation, which can delay product launches and increase development costs.

For instance,

- In March 2024, a report by the U.S. FDA cited challenges faced by emerging dental tech companies in obtaining regulatory clearance for CAD-CAM systems incorporating AI-based diagnostics and wireless data integration. These regulatory hurdles limited their ability to enter the market quickly, slowing innovation and giving a competitive edge to more established companies with greater regulatory experience and resources

Such challenges can hinder market expansion, particularly among start-ups and smaller players, and may restrict the availability of innovative solutions to broader segments of the dental care ecosystem

CAD-CAM Dental Devices Market Scope

The market is segmented on the basis, product type, Prosthodontic, software, application, end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Prosthodontic |

|

|

By Software |

|

|

ByApplication

|

|

|

ByEnd-User |

|

In 2025, the CAD-CAM Systems is projected to dominate the market with a largest share in product type segment

The CAD-CAM Systems segment is expected to dominate the North America CAD-CAM Dental Devices Market with the largest share of 42.22%. in 2025, primarily due to the increasing adoption of digital workflows in dental practices and laboratories. These systems—which include integrated scanning, designing, and milling units—enable dentists to fabricate precise restorations such as crowns, bridges, veneers, and inlays/onlays in a significantly shorter time frame. The efficiency, accuracy, and cost-effectiveness offered by CAD-CAM systems are driving their widespread implementation across the region. Additionally, advancements in software automation, AI-driven design tools, and compatibility with 3D printing technologies are enhancing clinical outcomes and expanding application areas. Growing patient demand for same-day restorations and aesthetically superior results further supports the segment’s leadership.

The Dental Laboratories is expected to account for the largest share during the forecast period in end user market

In 2025, Dental Laboratories are projected to capture the largest share of share of 31.31% the North America CAD-CAM Dental Devices Market by end user. This dominance is driven by the increasing digitization of clinical workflows, growing demand for efficient in-house restorative solutions, and rising patient volumes seeking aesthetic and minimally invasive dental procedures. Dental clinics, in particular, are leveraging chairside CAD-CAM solutions to offer same-day treatments, reduce reliance on external labs, and enhance patient satisfaction. Furthermore, hospitals are adopting CAD-CAM technologies to streamline surgical planning, implantology, and prosthodontics services. The trend is further supported by favorable reimbursement environments, investments in digital dental infrastructure, and the growing presence of large dental service organizations (DSOs) across North America.

CAD-CAM Dental Devices Market Regional Analysis

“U.S. is the Dominant Country in the CAD-CAM Dental Devices Market”

- The United States leads the North America CAD-CAM Dental Devices Market, driven by its advanced healthcare infrastructure, widespread adoption of digital dentistry, and the presence of key market players such as Dentsply Sirona Inc., Align Technology, Inc., and 3Shape A/S.

- The high demand for same-day dental restorations, combined with increasing patient preference for aesthetically superior and minimally invasive solutions, has significantly boosted the adoption of CAD-CAM technologies in the U.S.

- The U.S. also benefits from a strong presence of dental service organizations (DSOs) and a high number of dental practitioners who are transitioning to digital workflows, thus accelerating the demand for CAD-CAM systems.

- Technological advancements, such as AI-assisted design software, real-time intraoral scanning, and 3D printing integration, are further positioning the U.S. as the leading market for CAD-CAM dental solutions. The regulatory environment and reimbursement policies also support the widespread adoption of these technologies, making them more accessible across various practice sizes.

- Furthermore, ongoing investments in dental research and innovations in software and materials are reinforcing the U.S.'s role as the epicenter for CAD-CAM dental device growth.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is expected to register the fastest growth rate in the North America CAD-CAM Dental Devices Market, driven by increasing awareness of digital dentistry, expansion of dental healthcare services, and a rising aging population.

- The Canadian government’s initiatives to improve access to advanced dental care—especially in rural and underserved regions—are contributing to greater adoption of CAD-CAM technology. Additionally, enhanced insurance coverage for dental procedures is further fueling market growth.

- Provinces such as Ontario, British Columbia, and Quebec are witnessing higher rates of CAD-CAM system adoption, largely due to the increased presence of high-tech dental clinics and an expanding dental lab infrastructure.

- Canada’s growing trend toward digital health solutions, including tele-dentistry consultations, mobile dental apps, and cloud-based treatment planning, is making CAD-CAM devices more accessible and efficient across the country. This is accelerating the shift toward digital workflows and same-day dental treatments, further driving market penetration in Canada

CAD-CAM Dental Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dentsply Sirona Inc. (U.S.)

- Align Technology, Inc. (U.S.)

- Planmeca Oy (Finland)

- 3Shape A/S (Denmark)

- Straumann Group (Switzerland)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Ivoclar Vivadent AG (Liechtenstein)

Latest Developments in North America CAD-CAM Dental Devices Market

- In February 2024, Carbon launched automated 3D printing tools designed to enhance print preparation, post-processing, and production for dental users. The tools aim to improve efficiency and precision in dental applications. Additionally, Carbon collaborated with Desktop Health to advance digital dental solutions.

- In February 2024, Halo Dental Technologies introduced the "Digital Dental Mirror", an innovation that enhances patient care. The mirror integrates digital technology into traditional dental procedures, offering real-time insights and improving the overall patient experience by providing clearer and more accurate visual data for dental professionals

- In December 2023, Kerr Dental launched its SimpliCut rotary products, a line of pre-sterilized, single patient-use diamond burs. These products aim to improve operational efficiency by reducing the need for sterilization, cleaning, and processing, ultimately enhancing the dental treatment process while promoting patient safety

- In April 2024, Havant MP Alan Mak introduced a mobile dental service offering NHS care for residents of Hampshire and the Isle of Wight at risk of social exclusion. The initiative brings essential dental care to underserved communities, improving access to healthcare for vulnerable populations

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.