Serbia Romania And Bulgaria Cng Compressed Natural Gas Fuel Market

Marktgröße in Milliarden USD

CAGR :

%

USD

563.98 Million

USD

749.83 Million

2023

2035

USD

563.98 Million

USD

749.83 Million

2023

2035

| 2024 –2035 | |

| USD 563.98 Million | |

| USD 749.83 Million | |

|

|

|

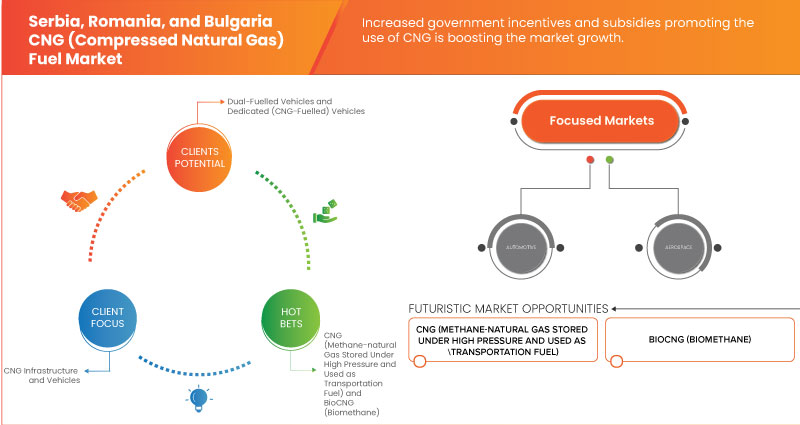

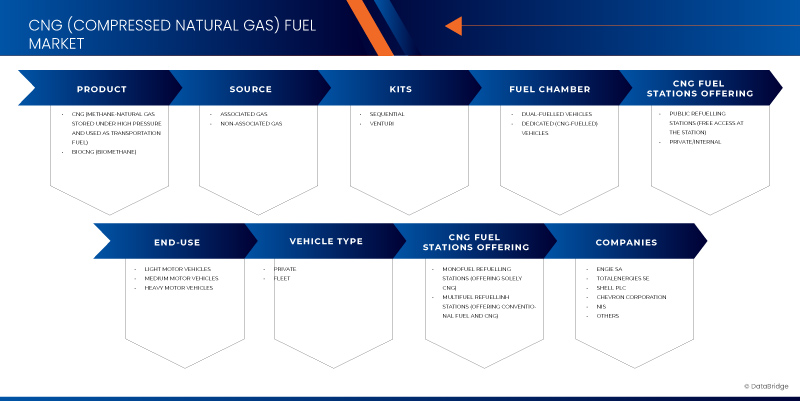

Serbia, Romania, and Bulgaria CNG (Compressed Natural Gas) Fuel Market Segmentation, By Products (CNG (Methane-Natural Gas Stored Under High Pressure and Used As Transportation Fuel) and BioCNG (Biomethane)), Source (Associated Gas and Non-Associated Gas), Kits (Sequential and Venturi), Fuel Chamber (Dual-Fuelled Vehicles and Dedicated (CNG-Fuelled) Vehicles), Vehicle Type (Private and Fleet), CNG Fuel Stations Offering (Monofuel Refuelling Stations (Offering Solely CNG) and Multifuel Refuelling Stations (Offering Conventional Fuels and CNG), CNG Fuel Stations Entity (Public Refuelling Stations (Free Access at the Station) and Private/Internal), End Use (Light Motor Vehicles, Medium Motor Vehicles, and Heavy Motor Vehicles) – Industry Trends and Forecast to 2035.

CNG (Compressed Natural Gas) Fuel Market Analysis

Serbia, Romania, and Bulgaria CNG (compressed natural gas) fuel market government policies and incentives boosting the CNG adoption by supporting cleaner energy solutions and encouraging its use as an alternative fuel. Technological advancements in Serbia, Romania, and Bulgaria CNG (compressed natural gas) fuel market enhances the performance and efficiency, making them more competitive and driving further market adoption. Growing environmental awareness is pushing the adoption of sustainable practices and eco-friendly materials in both markets. Thereby driving market growth globally.

CNG (Compressed Natural Gas) Fuel Market Size

Serbia, Romania, and Bulgaria CNG (compressed natural gas) fuel market size was valued at USD 563.98 million in 2023 and is projected to reach USD 749.83 million by 2035, growing with a CAGR of 2.4% during the forecast period of 2024 to 2035. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

CNG (Compressed Natural Gas) Fuel Market Trends

“Increasing stringent environmental policies and emission reduction targets in Serbia, Romania, and Bulgaria support the adoption of CNG”

In Serbia, Romania, and Bulgaria, strict environmental regulations and emission reduction targets are increasing the adoption of compressed natural gas as a cleaner fuel alternative to traditional options like coal, oil, propane, etc. Serbia is aligning with European Union standards by implementing policies aimed at reducing air pollution and greenhouse gas emissions. The government is supporting this shift by offering incentives for CNG vehicles and investing in the expansion of refueling infrastructure.

For Examples Romania has taken a proactive approach to incorporating CNG into its energy and transport sectors. The country’s policies focus on reducing urban air pollution and achieving EU emission targets. Romania offers subsidies and grants for CNG vehicles, leading to greater adoption, especially in public transportation and fleet operations. The growth of the CNG refueling network, supported by government initiatives, is further accelerating this transition.

Report Scope and Market Segmentation

|

Attributes |

CNG (Compressed Natural Gas) Fuel Key Market Insights |

|

Segments Covered |

By Product: CNG (Methane-Natural Gas Stored Under High Pressure and Used as Transportation Fuel) and BioCNG (Biomethane) By Source: Associated Gas and Non-Associated Gas By Kits: Sequential and Venturi By Fuel Chamber: Dual-Fuelled Vehicles and Dedicated (CNG-Fuelled) Vehicles By Vehicle Type: Private and Fleet By CNG Fuel Stations Offering: Monofuel Refuelling Stations (Offering Solely CNG) and Multifuel Refuelling Stations (Offering Conventional Fuels and CNG) By CNG Fuel Stations Entity: (Public Refuelling Stations (Free) Access at the Station) and (Private/Internal) By End Use: Light Motor Vehicles, Medium Motor Vehicles, and Heavy Motor Vehicles |

|

Countries Covered |

Bulgaria, Serbia, Romania |

|

Key Market Players |

NIS (Germany), KryoGas (Europe), Engie SA (France), Total Energies SE (France), Chevron Corporation (U.S.), and Shell PLC (U.K.) |

|

Market Opportunities |

· Substantial potential in converting existing fleets of public and private transportation to CNG · Collaborative efforts between Serbia, Romania, and Bulgaria in developing cross-border CNG infrastructure |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

CNG (Compressed Natural Gas) Fuel Market Definition

The CNG fuel market in Serbia, Romania, and Bulgaria covers the entire lifecycle of compressed natural gas as a transportation fuel, from production and distribution to consumption. It involves building infrastructure such as refueling stations, advancing CNG vehicle technology, and implementing regulations that support cleaner energy. The aim is to cut emissions and reduce reliance on traditional fuels, while exploring the unique economic and environmental advantages for each country.

CNG (Compressed Natural Gas) Fuel Market Dynamics

Drivers

- Increasing stringent environmental policies and emission reduction targets in Serbia, Romania, and Bulgaria support the adoption of CNG

In Serbia, Romania, and Bulgaria, strict environmental regulations and emission reduction targets are increasing the adoption of compressed natural gas as a cleaner fuel alternative to traditional options like coal, oil, propane, etc. Serbia is aligning with European Union standards by implementing policies aimed at reducing air pollution and greenhouse gas emissions. The government is supporting this shift by offering incentives for CNG vehicles and investing in the expansion of refueling infrastructure. Romania has taken a proactive approach to incorporating CNG into its energy and transport sectors. The country’s policies focus on reducing urban air pollution and achieving EU emission targets. Romania offers subsidies and grants for CNG vehicles, leading to greater adoption, especially in public transportation and fleet operations. The growth of the CNG refueling network, supported by government initiatives, is further accelerating this transition.

For instance,

- In 2021, according to the report of UNITED NATIONS ECONOMIC COMMISSION FOR EUROPE, Bulgaria’s coal-heavy power mix is limiting BEV adoption, but the existing NGV infrastructure offers potential. To advance NGV use, Bulgaria is expanding CNG/LNG refueling stations and supporting facilities, assessing demand, and evaluating investments, socio-economic, and environmental impacts

Rising economic benefits of using CNG

Compressed natural gas holds significant economic advantages, positioning it as a compelling alternative to traditional fuels like gasoline and diesel. A key benefit of CNG is its cost-effectiveness; it is generally cheaper than gasoline and diesel, resulting in lower fuel costs for consumers and businesses alike. This is especially advantageous for commercial vehicle fleets, where reduced fuel expenses can translate into substantial financial savings. CNG vehicles often incur lower maintenance costs due to their cleaner combustion, which reduces engine wear and the need for frequent repairs and oil changes. This leads to longer vehicle lifespans and additional savings. Another economic benefit of CNG is its price stability compared to the more volatile prices of oil-based fuels, offering more predictable and manageable fuel costs.

For instance,

- According to an article published by Pacific Gas and Electric Company, natural gas is a clean-burning fuel that quickly dissipates if leaked, avoiding water contamination and producing fewer greenhouse gases, helping to reduce global warming compared to other fuels

Opportunities

- Substantial potential in converting existing fleets of public and private transportation to CNG

Converting existing fleets of public and private transportation to Compressed Natural Gas (CNG) offers significant economic, environmental, and operational benefits. Economically, CNG is a cost-effective alternative to gasoline and diesel, leading to lower fuel costs and substantial savings for fleet operators. This is especially advantageous for large fleets, such as those used in public transit and logistics, where fuel expenses constitute a significant portion of operating budgets. CNG vehicles often incur lower maintenance costs due to their cleaner combustion, which reduces engine wear and the frequency of repairs. This results in longer vehicle lifespans and increased savings. Environmentally, CNG is a cleaner fuel that significantly reduces emissions of Nitrogen Oxides (NOx), particulate matter, and Carbon Dioxide (CO2) compared to conventional fuels. This reduction in pollutants helps improve air quality, comply with stringent emission regulations, and benefit public health.

- Collaborative efforts between Serbia, Romania, and Bulgaria in developing cross-border CNG infrastructure

The collaborative efforts of Serbia, Romania, and Bulgaria in developing cross-border Compressed Natural Gas (CNG) infrastructure represent a crucial advancement in enhancing regional energy security and promoting sustainable transportation. Recognizing the mutual benefits of a connected CNG network, these countries are working together to create an extensive and integrated refueling infrastructure that spans their borders. A central aspect of this collaboration is the development of cross-border refueling stations designed to provide uninterrupted access to CNG for vehicles traveling between these nations. By establishing a network of strategically placed refueling stations along key transportation routes, Serbia, Romania, and Bulgaria aim to facilitate the widespread adoption of CNG vehicles and streamline the movement of commercial and public transport fleets across borders.

For instance,

- According to a blog published by Vignette Bulgariia, Serbia and Bulgaria share a historical relationship shaped by periods of conflict and cooperation. Since the Yugoslav breakup in the 1990s, they have established their current internationally recognized border, with bilateral regulations for goods, people, and mutual security, including the requirement of a Bulgarian Vignette

Restraints/Challenges

- Increasing competition with alternative fuels

The rise of alternative fuels such as Electric Vehicles (EVs), hydrogen, and biofuels poses a direct competition to CNG. Electric vehicles, in particular, are gaining traction due to advances in battery technology and growing investments in charging infrastructure. Hydrogen fuel cells are also being explored for their potential to provide zero-emission transport solutions. These alternatives often benefit from strong governmental support and subsidies aimed at reducing carbon emissions. The development and expansion of refueling infrastructure for alternatives like electric vehicles and hydrogen may overshadow investments in CNG stations. Governments and private investors are increasingly focusing on these new technologies, which could divert resources and attention away from building a robust CNG network.

For instances

- In April 2024, according to news published by Green Forum, Romania is experiencing a shortage of charging stations, but the rising adoption of Electric Vehicles (EVs) underscores the increasing demand. To facilitate the transition to electric cars and support sustainable transportation, Romania needs to enhance its infrastructure and implement favorable regulations. Mihai Drăghici, partner at EY Romania, highlighted in an interview with Green that Romania anticipates an annual growth rate of 20-25% for EV sales, with the market share expected to reach nearly 30% by 2024 and possibly exceed 50% by 2027

Strict safety and regulatory standards heighten complexity and costs

Strict safety and regulatory standards significantly heighten the complexity and costs associated with various industries, presenting notable challenges. These standards, while crucial for ensuring the safety, reliability, and environmental sustainability of products and processes, introduce layers of complexity in compliance and implementation. Meeting rigorous safety and regulatory requirements often demands extensive documentation, testing, and certification processes. For manufacturers, this means investing in comprehensive testing facilities and procedures to ensure their products meet the required standards. This not only increases operational costs but also extends development timelines, which can delay market entry and impact competitive positioning.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Climate Change Scenario

Der Markt für CNG-Kraftstoffe (Compressed Natural Gas) wird oft als sauberere Alternative zu herkömmlichen fossilen Brennstoffen wie Benzin und Diesel dargestellt. Es bestehen jedoch weiterhin Umweltbedenken, insbesondere im Hinblick auf Methanlecks bei der Förderung, dem Transport und der Nutzung, die die Vorteile der Kohlenstoffreduzierung durch CNG zunichte machen können. Methan ist ein starkes Treibhausgas mit einem deutlich höheren Treibhauspotenzial als CO2, weshalb sein Umgang mit CNG für die Umweltverträglichkeit von entscheidender Bedeutung ist. Obwohl CNG sauberer verbrennt als andere fossile Brennstoffe, ist es dennoch eine nicht erneuerbare Ressource und seine langfristige Rolle in einer dekarbonisierten Wirtschaft wird diskutiert.

Regulatorischer Rahmen Inhalt

Auf dem CNG-Kraftstoffmarkt (Compressed Natural Gas) in Serbien, Rumänien und Bulgarien spielen Vorschriften eine entscheidende Rolle, da sie die Produktqualität, Sicherheit und Umweltverträglichkeit während des gesamten Herstellungsprozesses gewährleisten.

- Nachfolgend finden Sie eine Tabelle mit den verschiedenen Vorschriften, die den Markt regeln:

Ministerium für Bergbau und Energie (Republik Serbien): Das Ministerium für Bergbau und Energie hat einen neuen Regulierungsrahmen für den Gassektor eingeführt. Er schreibt dem Minister vor, Genehmigungen für verschiedene Gasinfrastrukturprojekte zu erteilen und neue Stellen für Transport und Verteilung einzurichten, um die Marktfunktionalität zu verbessern.

Regelung der Vereinten Nationen: Die Regelung Nr. 110 der Vereinten Nationen standardisiert die Zulassung von Komponenten und Fahrzeugen, die mit komprimiertem Erdgas (CNG) und verflüssigtem Erdgas (LNG) angetrieben werden, und gewährleistet einheitliche Einbau- und Sicherheitsstandards.

Bulgarischer Ministerrat: Die nationale Politik Bulgariens für alternative Kraftstoffe zielt darauf ab, sich durch den Ausbau der CNG- und LNG-Infrastruktur an die EU-Standards anzupassen. Dazu gehören reduzierte Verbrauchsteuern, Sonderparkplätze und Beschaffungsprämien. Der Plan sieht einen schrittweisen Ausbau der Infrastruktur von Verkehrskorridoren zu regionalen Netzen bis 2030 vor.

Produktionskostenszenario

Die durchschnittlichen Produktionskosten für Hersteller sind nicht konstant, sie hängen von verschiedenen Faktoren ab oder sind variabel. Laut unserer Analyse beträgt die durchschnittliche Produktion von CNG-Kraftstoff (Compressed Natural Gas) im Jahr 2023 458.708,69 Tonnen und wird voraussichtlich im Jahr 2024 460.447,76 Tonnen erreichen. Der durchschnittliche Verbrauch beträgt im Jahr 2023 421.507,42 Tonnen und wird voraussichtlich im Jahr 2024 427.111,35 Tonnen erreichen.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden.

Neben dem Standardbericht bieten wir auch detaillierte Analysen des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Warenanalysen, Produktionsanalysen, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalysen, Lösungen zum Lieferkettenrisikomanagement, erweitertes Benchmarking und andere Dienste für Beschaffung und strategische Unterstützung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Marktumfang für CNG-Kraftstoff (Compressed Natural Gas)

Der Markt ist segmentiert nach Produkten, Quelle, Kits, Tankkammer, Fahrzeugtyp, CNG-Tankstellenangebot, CNG-Tankstellenunternehmen und Endverbrauch. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkte

- CNG (unter hohem Druck gespeichertes und als Kraftstoff verwendetes Methan-Erdgas)

- BioCNG (Biomethan)

Quelle

- Begleitgas

- Nichtassoziiertes Gas

Bausätze

- Sequentiell

- Venturi

Brennstoffkammer

- Fahrzeuge mit Zweistoffbetrieb

- Spezielle (mit Erdgas betriebene) Fahrzeuge

Fahrzeugtyp

- Privat

- Flotte

- Taxi/Bus

- Polizei

- Lieferung

- Sonstiges

CNG-Tankstellenangebot

- Monofuel-Tankstellen (bieten ausschließlich CNG an)

- Multifuel-Tankstellen (Angebot für konventionelle Kraftstoffe und CNG)

CNG-Tankstellen-Unternehmen

- Öffentliche Tankstellen (Kostenloser Zugang an der Station)

- Privat/Intern

Endverwendung

- Leichte Kraftfahrzeuge

- Autos

- SUVs

- MUVs

- Schräghecklimousinen

- Limousinen

- Coupés

- Cabrios

- Sonstiges

- Jeep

- Minivan

- Sonstiges

- Autos

Mittelgroße Kraftfahrzeuge

- Bus

- Tempo

- Mini-LKW

Schwere Kraftfahrzeuge

- LKW

- Trailer

- Behälter

- Mehrachsiger Bus

- Sonstiges

Regionale Analyse des CNG-Kraftstoffmarktes (Compressed Natural Gas)

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkten, Quelle, Kits, Tankkammer, Fahrzeugtyp, CNG-Tankstellenangebot, CNG-Tankstelleneinheit und Endnutzung wie oben angegeben bereitgestellt.

Die vom Markt abgedeckten Länder sind Bulgarien, Serbien und Rumänien.

Aufgrund seiner Umweltvorteile und Kosteneffizienz dürfte Rumänien die Nase vorn haben, und seine geringeren Emissionen und Kosten werden zunehmend anerkannt.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit regionaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil von CNG-Kraftstoffen (Compressed Natural Gas)

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die Marktführer für CNG-Kraftstoff (Compressed Natural Gas) sind:

- NIS (Deutschland)

- KryoGas (Europa)

- Engie SA (Frankreich)

- Total Energies SE (Frankreich)

- Chevron Corporation (USA)

- Shell PLC (Großbritannien)

Neueste Entwicklungen auf dem CNG-Kraftstoffmarkt (Compressed Natural Gas)

- Laut einem Artikel von Djordje Jajcanin soll Serbien laut Energieministerin Dubravka Djedovic Handanovic bis Ende November 2023 seinen Abschnitt der serbisch-bulgarischen Erdgasverbindung fertigstellen. Die Pipeline, die jährlich 1,8 Milliarden Kubikmeter Erdgas transportieren wird, steht kurz vor der Inbetriebnahme. Serbien hat außerdem kürzlich einen Vertrag mit Aserbaidschan über den Import von 400 Millionen Kubikmetern Gas unterzeichnet und damit seine Energiequellen diversifiziert.

- Im Februar schloss Shell PLC die Übernahme von Nature Energy ab, einem führenden Produzenten von erneuerbarem Erdgas (RNG). Dieser strategische Schritt markiert eine bedeutende Erweiterung der Kapazitäten von Shell im Bereich kohlenstoffarmer Kraftstoffe und unterstreicht sein Engagement zur Beschleunigung der Energiewende. Nature Energy ist auf die Produktion von Biogas durch anaerobe Vergärung spezialisiert und wandelt organische Abfälle in erneuerbares Erdgas (RNG) um. Diese Übernahme stärkt Shells Position auf dem RNG-Markt und bietet eine nachhaltige Alternative zu fossilen Brennstoffen, die in den Bereichen Transport, Industrie und Heizung eingesetzt werden kann.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END-USE COVERAGE GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 BIO-CNG LEGISLATION

4.6 CNG OPERATING COMPANIES

4.7 ESTIMATION OF RETAIL CNG SALES PER OPERATING COMPANY

4.8 ESTIMATION OF TOTAL MOTOR FUELS RETAIL MARKET AND CNG RETAIL MARKET

4.9 NUMBER OF CNG REFUELING STATIONS

4.1 PRICE ANALYSIS

4.10.1 AVERAGE CNG PRICE PER COUNTRY IN EUR/KG – HISTORY AND FORECAST

4.10.2 PRICE STRUCTURE: INDUSTRIAL CNG PRICE/VAT/EXCISE DUTY PER COUNTRY IN EUR/KG – HISTORY & FORECAST

4.11 ANALYSIS OF TOTAL NUMBER OF REFUELING STATIONS (OFFERING ALL TYPES OF FUEL)

4.11.1 CURRENT DISTRIBUTION AND TRENDS

4.11.2 IMPLICATIONS AND FUTURE OUTLOOK

4.12 CLIMATE CHANGE SCENARIO

4.12.1 ENVIRONMENTAL CONCERNS

4.12.2 INDUSTRY RESPONSE

4.12.3 GOVERNMENT'S ROLE

4.12.4 ANALYST'S RECOMMENDATIONS

4.13 CNG REFUELLING INFRASTRUCTURE ANALYSIS

4.13.1 SERBIA

4.13.1.1 CURRENT STATE OF INFRASTRUCTURE

4.13.1.2 CHALLENGES

4.13.1.3 OPPORTUNITIES:

4.13.2 ROMANIA:

4.13.2.1 CURRENT STATE OF INFRASTRUCTURE:

4.13.2.2 CHALLENGES:

4.13.2.3 OPPORTUNITIES:

4.13.3 BULGARIA:

4.13.3.1 CURRENT STATE OF INFRASTRUCTURE:

4.13.3.2 CHALLENGES:

4.13.3.3 OPPORTUNITIES:

4.13.4 COMPARATIVE SUMMARY:

4.14 ESTIMATION OF TOTAL MOTOR FUELS RETAIL MARKET AND CNG RETAIL MARKET

4.14.1 INFRASTRUCTURE DEVELOPMENT:

4.14.2 GOVERNMENT POLICIES:

4.14.3 ENVIRONMENTAL CONCERNS:

4.14.4 MARKET SHARE DYNAMICS

4.15 GOVERNMENT AND LOCAL PERMITTING PROCESS FOR CNG INFRASTRUCTURE

4.15.1 INSTALLATION OF CNG EQUIPMENT

4.15.1.1 SERBIA:

4.15.1.2 ROMANIA:

4.15.1.3 BULGARIA:

4.15.2 FILLING OF STATIONARY CONTAINERS

4.15.2.1 SERBIA:

4.15.2.2 ROMANIA:

4.15.2.3 BULGARIA:

4.15.3 BUILDING REFUELING FACILITIES

4.15.3.1 SERBIA:

4.15.3.2 ROMANIA:

4.15.3.3 BULGARIA:

4.15.4 ADDITIONAL CONSIDERATIONS

4.15.4.1 SERBIA:

4.15.4.2 ROMANIA:

4.15.4.3 BULGARIA:

4.16 MARKET ANALYSIS ON VEHICLE TYPE: PASSENGER CARS VS. LDV (LIGHT DUTY BUSUES<5T AND LIGHT DUTY TRUCKS <3,5T) VS. HDV (HEAVY DUTY BUSES>5T AND HEAVY-DUTY VEHICLES>3,5T)

4.16.1 PASSENGER CARS

4.16.2 LIGHT DUTY VEHICLES (LDVS)

4.16.3 HEAVY DUTY VEHICLES (HDVS)

4.17 NATIONAL PROGRAM AND STRATEGIES FOR INCREASING CNG CONSUMPTION

4.17.1 SERBIA

4.17.2 ROMANIA

4.17.3 BULGARIA

4.18 NUMBER OF CNG REFUELING STATIONS AND THEIR SHARE

4.19 RAW MATERIAL COVERAGE

4.19.1 NATURAL GAS

4.19.2 SOURCES AND SUPPLY CHAIN

4.19.3 MARKET DYNAMICS

4.19.4 RECENT DEVELOPMENT

4.2 STANDARDS, TECHNICAL, AND SAFETY SPECIFICATIONS FOR CNG INFRASTRUCTURE

4.20.1 CNG CONTAINERS FOR STORAGE

4.20.1.1 MATERIAL STANDARDS

4.20.1.2 CERTIFICATION

4.20.1.3 INSPECTION AND TESTING

4.20.1.4 SAFETY FEATURES

4.20.2 COMPRESSION PLANTS

4.20.2.1 DESIGN STANDARDS

4.20.2.2 SAFETY PROTOCOLS

4.20.2.3 OPERATIONAL SAFETY

4.20.3 COMPRESSORS INSTALLATIONS

4.20.3.1 TECHNICAL SPECIFICATIONS

4.20.3.2 INSTALLATION REQUIREMENTS

4.20.3.3 SAFETY MEASURES

4.20.4 DISPENSING INSTALLATIONS

4.20.4.1 DISPENSER DESIGN

4.20.4.2 METERING ACCURACY

4.20.4.3 USER SAFETY

4.20.5 PIPING AND FITTINGS

4.20.5.1 MATERIAL SPECIFICATIONS

4.20.5.2 INSTALLATION STANDARDS

4.20.5.3 LEAK PREVENTION

4.20.6 SUPPLEMENTARY ELEMENTS

4.20.6.1 VALVES AND REGULATORS

4.20.6.2 CONTROL SYSTEMS

4.20.6.3 EMERGENCY SYSTEMS

4.20.7 COMPLIANCE AND CERTIFICATION

4.20.7.1 NATIONAL AND INTERNATIONAL STANDARDS

4.20.7.2 CERTIFICATION REQUIREMENTS

4.20.7.3 REGULAR AUDITS AND INSPECTIONS

4.21 SUPPLY CHAIN ANALYSIS

4.21.1 OVERVIEW

4.21.2 LOGISTIC COST SCENARIO

4.21.2.1 FUEL TRANSPORTATION COSTS

4.21.2.2 INFRASTRUCTURE-RELATED COSTS

4.21.2.3 ECONOMIES OF SCALE

4.21.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.21.3.1 SPECIALIZED KNOWLEDGE AND CAPABILITIES

4.21.3.2 NETWORK AND INFRASTRUCTUR

4.21.3.3 CROSS-BORDER COORDINATION

4.21.3.4 COST OPTIMIZATION

4.21.3.5 RISK MANAGEMENT

4.21.4 CONCLUSION

4.22 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.22.1 ADVANCED COMPRESSION TECHNOLOGY

4.22.2 IMPROVED STORAGE SOLUTIONS

4.22.3 INFRASTRUCTURE EXPANSION TECHNOLOGIES

4.22.4 DIGITAL MONITORING AND CONTROL SYSTEMS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING STRINGENT ENVIRONMENTAL POLICIES AND EMISSION REDUCTION TARGETS IN SERBIA, ROMANIA, AND BULGARIA SUPPORT THE ADOPTION OF CNG

6.1.2 RISING ECONOMIC BENEFITS OF USING CNG

6.1.3 INCREASED GOVERNMENT INCENTIVES AND SUBSIDIES PROMOTING THE USE OF CNG

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS ASSOCIATED WITH DEVELOPING CNG STATIONS AND INFRASTRUCTURE

6.2.2 LACK OF COMPREHENSIVE CNG REFUELLING INFRASTRUCTURE

6.3 OPPORTUNITIES

6.3.1 SUBSTANTIAL POTENTIAL IN CONVERTING EXISTING FLEETS OF PUBLIC AND PRIVATE TRANSPORTATION TO CNG

6.3.2 COLLABORATIVE EFFORTS BETWEEN SERBIA, ROMANIA, AND BULGARIA IN DEVELOPING CROSS-BORDER CNG INFRASTRUCTURE

6.4 CHALLENGES

6.4.1 INCREASING COMPETITION WITH ALTERNATIVE FUELS

6.4.2 STRICT SAFETY AND REGULATORY STANDARDS HEIGHTEN COMPLEXITY AND COSTS

7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 CNG (METHANE-NATURAL GAS STORED UNDER HIGH PRESSURE AND USED AS TRANSPORTATION FUEL)

7.3 BIOCNG (BIOMETHANE)

8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ASSOCIATED GAS

8.2.1 NON-ASSOCIATED GAS

9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS

9.1 OVERVIEW

9.2 SEQUENTIAL

9.3 VENTURI

10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER

10.1 OVERVIEW

10.2 DUAL-FUELLED VEHICLES

10.3 DEDICATED (CNG-FUELLED) VEHICLES

11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PRIVATE

11.3 FLEET

12 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING

12.1 OVERVIEW

12.2 MONOFUEL REFUELLING STATIONS (OFFERING SOLELY CNG)

12.3 MULTIFUEL REFUELLING STATIONS (OFFERING CONVENTIONAL FUELS AND CNG)

13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY

13.1 OVERVIEW

13.2 PUBLIC REFUELLING STATIONS (FREE ACCESS AT THE STATION)

13.3 PRIVATE/INTERNAL

14 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE

14.1 OVERVIEW

14.2 LIGHT MOTOR VEHICLES

14.3 MEDIUM MOTOR VEHICLES

14.4 HEAVY MOTOR VEHICLES

15 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY

15.1 ROMANIA

15.2 BULGARIA

15.3 SERBIA

16 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: SERBIA

16.2 COMPANY SHARE ANALYSIS: ROMANIA

16.3 COMPANY SHARE ANALYSIS: BULGARIA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 ENGIE SA

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 TOTALENERGIES SE

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 SHELL PLC

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 CHEVRON CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 KRYOGAS

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 NIS

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ESTIMATION OF RETAIL CNG SALES PER OPERATING COMPANY, TONS & SHARE

TABLE 2 SERBIA, ROMANIA, AND BULGARIA CNG FUEL RETAIL MARKET (TONS)

TABLE 3 SERBIA, ROMANIA, AND BULGARIA GASOLINE RETAIL MARKET (TONS)

TABLE 4 NUMBER OF CNG STATIONS AND AVERAGE PRICES IN EUROE, BY COUNTRY

TABLE 5 NATURAL GAS VEHICLES

TABLE 6 REGULATION COVERAGE

TABLE 7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 12 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 14 SERBIA, ROMANIA, AND BULGARIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 15 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 16 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 17 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 18 SERBIA, ROMANIA, AND BULGARIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 19 SERBIA, ROMANIA, AND BULGARIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 20 SERBIA, ROMANIA, AND BULGARIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 21 SERBIA, ROMANIA, AND BULGARIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 22 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY, 2020-2035 (USD THOUSAND)

TABLE 23 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY, 2020-2035 (TONS)

TABLE 24 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 25 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 26 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 27 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 28 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 29 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 30 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 31 ROMANIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 32 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 33 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 34 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 35 ROMANIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 36 ROMANIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 37 ROMANIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 38 ROMANIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 39 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 40 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 41 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 42 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 43 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 44 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 45 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 46 BULGARIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 47 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 48 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 49 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 50 BULGARIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 51 BULGARIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 52 BULGARIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 53 BULGARIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 54 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 55 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 56 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 57 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 58 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 59 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 60 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 61 SERBIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 62 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 63 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 64 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 65 SERBIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 66 SERBIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 67 SERBIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 68 SERBIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 2 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DATA TRIANGULATION

FIGURE 3 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DROC ANALYSIS

FIGURE 4 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: MULTIVARIATE MODELLING

FIGURE 7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS

FIGURE 13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: OVERVIEW

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING ECONOMIC BENEFITS OF USING CNG IS EXPECTED TO DRIVE THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET IN THE FORECAST PERIOD

FIGURE 16 THE CNG (METHANE-NATURAL GAS STORED UNDER HIGH PRESSURE AND USED AS TRANSPORTATION FUEL) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS: SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 22 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, PRODUCTS, 2023

FIGURE 23 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, SOURCE, 2023

FIGURE 24 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, KITS, 2023

FIGURE 25 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, FUEL CHAMBER, 2023

FIGURE 26 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, VEHICLE TYPE, 2023

FIGURE 27 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, CNG FUEL STATIONS OFFERING, 2023

FIGURE 28 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, CNG FUEL STATIONS ENTITY, 2023

FIGURE 29 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, END USE, 2023

FIGURE 30 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.