Us Ship Repair And Maintenance Services Market

Marktgröße in Milliarden USD

CAGR :

%

USD

11.94 Million

USD

13.13 Million

2024

2032

USD

11.94 Million

USD

13.13 Million

2024

2032

| 2025 –2032 | |

| USD 11.94 Million | |

| USD 13.13 Million | |

|

|

|

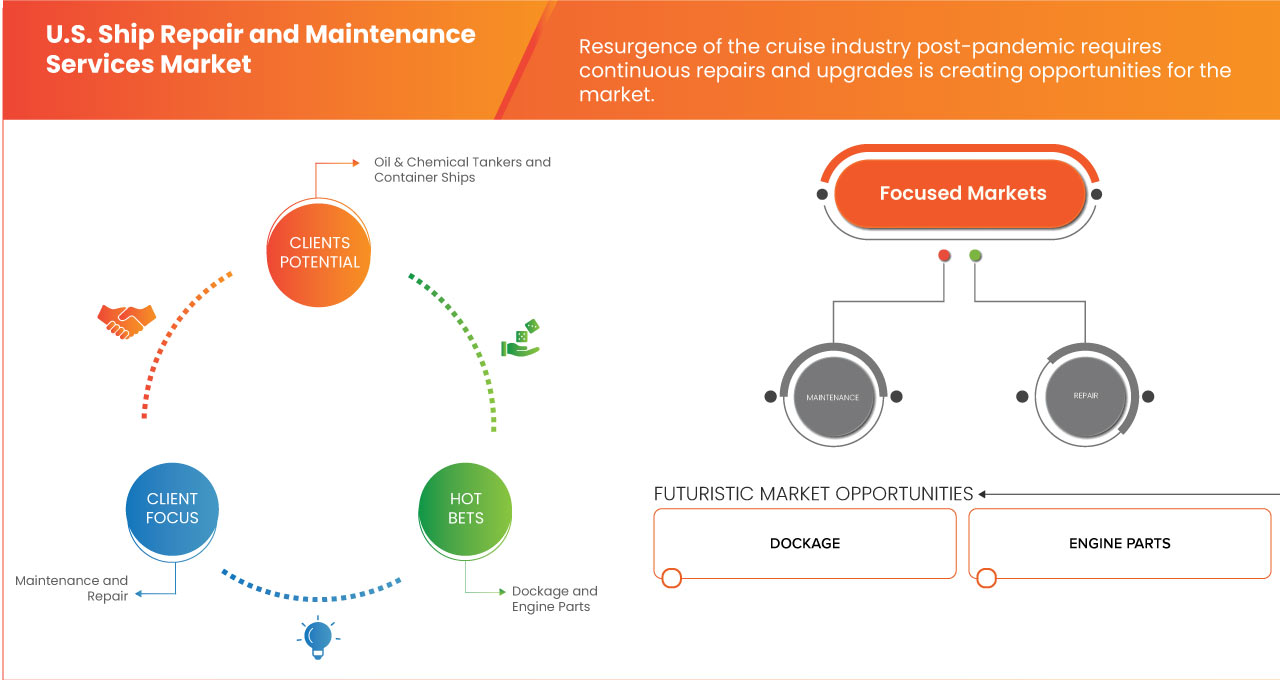

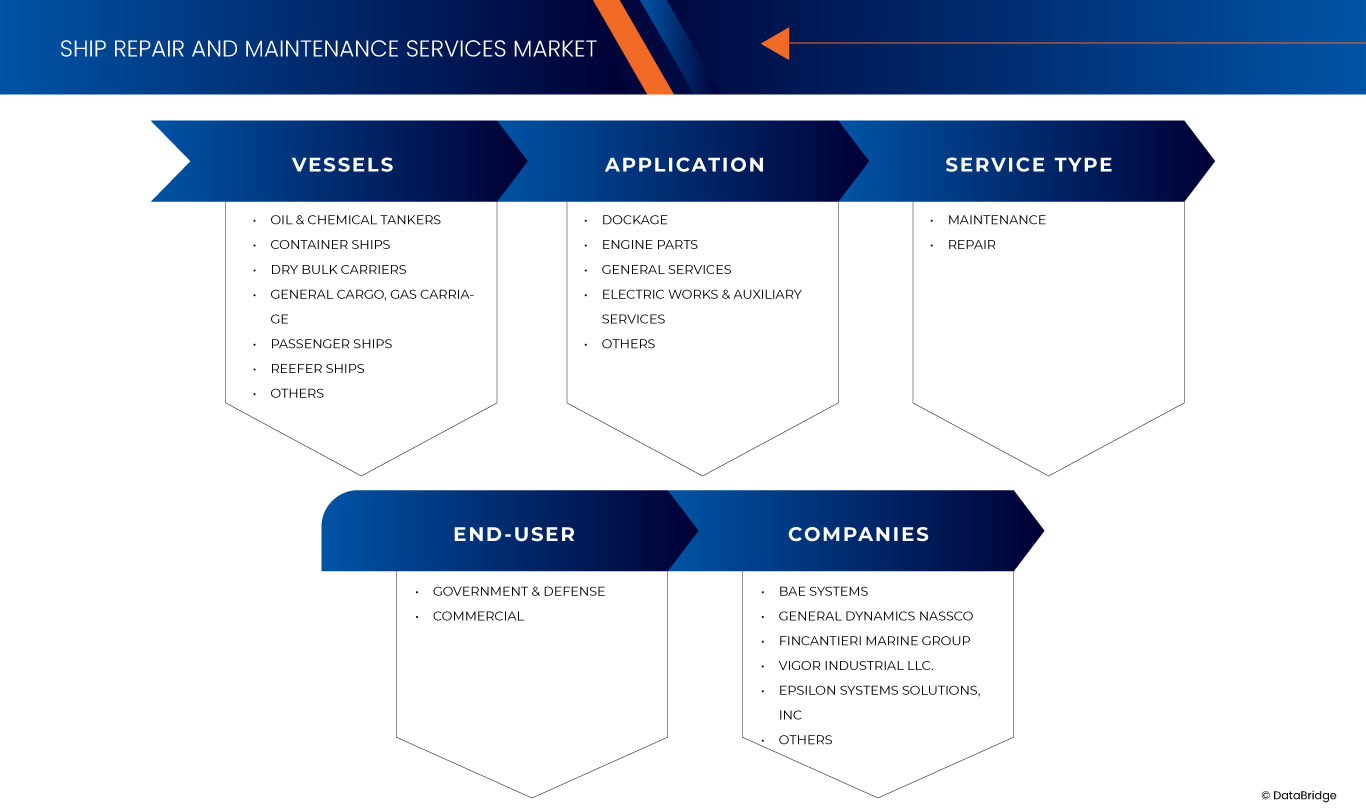

U.S. Ship Repair and Maintenance Services Market Segmentation, By Vessel (Oil & Chemical Tankers, Container Ships, Dry Bulk Carriers, General Cargo, Gas Carriage, Passenger Ships, Reefer Ships and Others), Service Type (Maintenance and Repair), Application (Dockage, Engine Parts, General Services, Electric Works & Auxiliary Services and Others), End-User (Government & Defense and Commercial) – Industry Trends and Forecast to 2031

Ship Repair and Maintenance Services Market Analysis

The ship repair and maintenance market is experiencing robust growth, driven by growing maritime trade and fleet expansion. As the U.S. ship repair and maintenance services industry continues to expand, due to the aging fleet of vessels in the U.S. adoption of advanced digital technologies, like predictive maintenance through IoT and AI and increased investments in military and defense ships are providing opportunities for the market. Market dynamics are also influenced by high costs of labor and facilities. Overall, the market is expected to continue expanding, with a focus on innovation and sustainability to meet evolving industrial demands.

Ship Repair and Maintenance Services Market Size

U.S. ship repair and maintenance services market size was valued at USD 11.90 billion in 2023 and is projected to reach USD 12.98 billion by 2031, with a CAGR of 1.2% during the forecast period of 2024 to 2031.

U.S. Ship Repair and Maintenance Services Market Trends

“Growth in Offshore Oil and Gas Activities”

As the demand for energy increases globally, offshore drilling and production operations have expanded, creating a robust need for specialized vessels and the services that maintain them. As offshore oil and gas exploration intensifies, there is a corresponding increase in the number and diversity of vessels required to support these operations. This includes supply ships, drilling rigs, and specialized construction vessels, all of which require regular maintenance and repairs to remain operational. The rising trend of offshore activities leads to an increased demand for ship repair services as companies seek to ensure their fleets are equipped to handle the rigors of challenging marine environments.

Vessels operating in offshore oil and gas sectors often face unique operational challenges, including exposure to harsh weather conditions and corrosive environments. This necessitates specialized maintenance and repair services that can address these challenges effectively. For instance, the integrity of hulls, propulsion systems, and safety equipment must be meticulously maintained to prevent accidents and ensure compliance with safety regulations. Shipyards that can provide specialized services tailored to the needs of offshore vessels are increasingly valuable, driving growth in the repair and maintenance sector.

The offshore oil and gas industry is subject to stringent regulatory standards designed to protect both the environment and human safety. Compliance with these regulations requires regular inspections and maintenance of vessels. Ship operators must ensure that their vessels meet the latest safety and environmental regulations, which often necessitates upgrades and repairs. This ongoing need for compliance creates a steady stream of work for shipyards, as operators seek to avoid penalties and maintain operational licenses.

The offshore sector is at the forefront of technological advancements, including the adoption of more sophisticated drilling and extraction techniques. As these technologies evolve, the vessels supporting them must also be updated and maintained to incorporate new systems and equipment. This creates opportunities for ship repair and maintenance companies to offer innovative solutions that can enhance operational efficiency and safety. Facilities that invest in advanced technologies and skilled labor to service these vessels are well-positioned for growth.

For instance,

- In 2021, according to an article published by J-Stage, as onshore energy sources deplete, offshore energy has become a vital strategic resource, prompting countries to accelerate research and development. The offshore oil and gas industry has evolved significantly, advancing from coastal areas to shallow and deep waters, with substantial increases in production. This paper reviews the industry's history concerning time, water depth, and output, explores technological advancements and equipment in offshore exploitation, and identifies current challenges. It concludes that the future of the industry will focus on deep water, automation, and gas hydrates, providing insights into the sector's evolution and prospects

The growth in offshore oil and gas activities is a crucial driver for the U.S. ship repair and maintenance services market. The increased demand for specialized vessels, the need for rigorous maintenance to withstand harsh conditions, compliance with regulatory standards, and the integration of advanced technologies collectively fuel the market's expansion. As offshore operations continue to grow, the importance of reliable repair and maintenance services will only intensify, providing significant opportunities for shipyards across the U.S.

Report Scope and Market Segmentation

|

Attributes |

Ship Repair and Maintenance Services Ingredients Key Market Insights |

|

Segments Covered |

· Vessel: Oil & Chemical Tankers, Container Ships, Dry Bulk Carriers, General Cargo, Gas Carriage, Passenger Ships, Reefer Ships and Others · Service Type: Maintenance and Repair · Application: Dockage, Engine Parts, General Services, Electric Works & Auxiliary Services and Others · End-User: Government & Defense and Commercial |

|

Countries Covered |

U.S. |

|

Key Market Players |

BAE Systems (U.K.), General Dynamics NASSCO (U.S.), Fincantieri Marine Group (U.S.), Vigor Industrial LLC. (U.S.), Epsilon Systems Solutions, INC (U.S.), Bludworth Marine, L.L.C. (U.S.), Colonna's Shipyard, INC (U.S.), Conrad Shipyards (U.S.), Detyens Shipyards (U.S.), Gulf Copper & Manufacturing Corporation (U.S.), HSD Marine and Shiprepair Pte LTD. (Singapore) among others |

|

Market Opportunities |

· Adoption of advanced digital technologies, like predictive maintenance through IOT and ai · Increased investments in military and defense ships |

|

Value Added Data Info sets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Ship Repair and Maintenance Services Market Definition

Ship repair and maintenance services encompass a range of activities aimed at ensuring the operational efficiency, safety, and longevity of maritime vessels. This market includes routine maintenance, emergency repairs, retrofitting, and refurbishment of ships, encompassing both commercial and military vessels. Key services involve hull repairs, machinery overhauls, electrical and electronic system upgrades, and the application of protective coatings. The industry serves ship-owners, operators, and managers, responding to regulatory compliance and environmental standards. Market growth is driven by increasing global trade, aging fleets, and advancements in repair technologies. Additionally, the rise of sustainability initiatives prompts the adoption of eco-friendly practices in ship maintenance, further shaping the landscape of this essential maritime sector.

Ship Repair and Maintenance Services Market Dynamics

Drivers

- Growing Maritime Trade and Fleet Expansion

The exponential growth in global trade has led to a marked increase in shipping volume. As economies around the world become more interconnected, the demand for shipping services rises accordingly. This increase means that shipping companies are expanding their fleets to accommodate a higher volume of goods. More vessels in operation translate to a greater need for regular maintenance and repair services. As ships log more miles, they face wear and tear that necessitates scheduled dry-dock repairs and maintenance work. This continuous cycle of repair not only ensures that vessels remain compliant with operational standards but also enhances their longevity, which is critical for shipping companies looking to maximize their investment. Consequently, U.S. shipyards that can offer reliable and timely maintenance services find themselves in high demand, thus driving the market's growth.

The maritime industry is heavily regulated, with stringent standards governing safety, environmental impact, and operational efficiency. These regulations mandate regular inspections and maintenance routines to ensure compliance. As regulatory frameworks become more rigorous, ship operators face pressure to maintain their fleets in accordance with evolving guidelines. This creates a consistent demand for ship repair and maintenance services, as compliance is not just a legal obligation but a critical factor in maintaining operational licenses and avoiding costly penalties. U.S. shipyards that can demonstrate compliance expertise and a track record of meeting regulatory requirements position themselves as essential partners to shipping companies, thus driving further growth in the market. Geopolitical dynamics play a significant role in influencing maritime trade patterns and shipping demands. Changes in trade policies, sanctions, or political instability can lead to shifts in shipping routes and the overall volume of goods transported. For instance, trade disputes can disrupt established routes, requiring companies to adapt quickly and possibly expand their fleets to explore new markets. This unpredictability necessitates a robust repair and maintenance network capable of responding to rapid changes. U.S. shipyards that offer flexible, responsive services are crucial in ensuring fleet readiness in a volatile environment, thereby enhancing their importance in the maritime ecosystem. The ability to adapt to geopolitical shifts not only secures a steady flow of business for repair services but also strengthens the overall resilience of the U.S. maritime industry.

For instance,

- In November 2020, according to an article published by Elsevier B.V., maritime trade and access to deep-water territories are crucial for a nation's economic success, with approximately 75% of international trade conducted via sea due to its fuel efficiency. Economic geography issues, such as being landlocked, directly impact global development patterns. A country's participation in international trade and its capacity to transport goods is vital in today's global economy. This study examines the connection between five key factors of maritime dependency and economic prosperity, revealing a significant correlation between maritime dependency and GDP per capita, leading to the creation of a Maritime Dependency Index mapped geographically.

The interplay of increased shipping volume, an aging fleet, technological advancements, regulatory compliance, and geopolitical factors collectively drives the growth of the U.S. ship repair and maintenance services market. As these dynamics evolve, they present ongoing opportunities for innovation and investment within this critical sector.

- Aging Fleet of Vessels in the U.S.

As many ships in operation reach or exceed their designed lifespan, the need for extensive repair and maintenance services becomes increasingly urgent. Older vessels often require more frequent maintenance due to wear and tear. Components such as engines, hulls, and safety equipment deteriorate over time, necessitating regular inspections and repairs to ensure operational safety and efficiency. This increased demand for repair services means that shipyards are seeing a rise in the number of dry-docking requests and routine maintenance jobs. As aging vessels frequently need to comply with updated regulatory standards, this further intensifies the need for specialized maintenance services tailored to older technology.

The maritime industry is governed by strict safety and environmental regulations. As ships age, they must be updated or repaired to meet these evolving standards. For example, older vessels may require retrofitting with modern emissions control technologies or safety equipment. The complexities involved in ensuring compliance with these regulations mean that ship operators often turn to specialized repair services, thereby generating consistent demand for the ship repair market. This creates a niche for companies that can provide expertise in regulatory compliance and safety upgrades, reinforcing the importance of ship repair services in maintaining fleet integrity.

Maintaining an aging fleet often requires specific skills and expertise, particularly for repairs that involve outdated technologies. Skilled labor is essential for retrofitting older ships with modern components or repairing specialized systems that may no longer be in production. As a result, the demand for workforce training and development in shipyards grows, further fueling the market for repair services. Companies that invest in training their workforce to handle the complexities of older vessels are likely to gain a competitive edge, positioning themselves as leaders in this niche market.

While aging vessels create a demand for repair services, they also present opportunities for modernization. Many ship owners are looking to extend the life of their vessels through upgrades, such as installing energy-efficient systems or retrofitting for compliance with new environmental regulations. This trend not only requires repair services but also opens avenues for innovation within the market. Companies that offer modernization solutions will find increased opportunities to collaborate with vessel owners, aiming to balance cost-effectiveness with regulatory compliance.

For instance,

- In May 2023, according to an article published by gCaptain, Aging cargo vessels, averaging over 20 years old, pose safety risks to crews and global trade. While some ships can last 25 to 30 years with proper maintenance, many face issues like hull corrosion and outdated technology. Notable disasters, such as the sinking of El Faro in 2015 and SS Marine Electric in 1983, highlight the dangers of neglected vessels. Despite calls for stricter regulations and modernization, older ships remain in operation due to economic factors. Industry stakeholders must prioritize improving safety standards and phasing out aging vessels to protect maritime workers.

The aging fleet of vessels in the U.S. is a significant driver for the ship repair and maintenance services market. The increasing frequency of repairs, the need for regulatory compliance, the demand for specialized skills, and the opportunities for modernization collectively create a robust environment for growth in this sector. As ship operators navigate the challenges of maintaining an aging fleet, the importance of reliable repair services will only continue to escalate.

Opportunity

- Adoption of Advanced Digital Technologies, Like Predictive Maintenance through IoT and AI

Predictive maintenance is a game-changer in the maritime industry, leveraging IoT sensor and AI to provide real-time monitoring of vessel conditions. These sensors can be installed on critical machinery and systems, gathering data on temperature, pressure, vibration, and other performance metrics. By analyzing this data using AI algorithms, ship operators can identify patterns that indicate potential failures before they occur. For example, if a sensor detects abnormal vibrations in an engine, the system can alert maintenance teams to investigate before a breakdown happens. This proactive maintenance approach not only minimizes costly unplanned repairs but also allows ship operators to schedule maintenance during optimal operational windows, thus reducing downtime. For shipyards, this means a more predictable workflow, enabling them to allocate resources more effectively. Rather than responding reactively to emergency repair requests, shipyards can plan their schedules around known maintenance needs, leading to improved efficiency and higher throughput. This transformation can also enhance customer satisfaction, as vessels can be serviced more quickly and reliably.

The implementation of predictive maintenance technologies can lead to significant cost savings across the board. For ship operators, reducing the frequency of unplanned repairs directly translates to lower operational expenses. Emergency repairs often come with inflated costs due to the need for rapid response, overtime labor, and potential losses from vessel downtime. By shifting to a predictive maintenance model, companies can optimize maintenance schedules based on actual data rather than routine checks or assumptions. For shipyards, this technological shift also presents an opportunity to increase throughput without a corresponding rise in overhead costs. By streamlining operations and improving the efficiency of the repair process, shipyards can handle more jobs simultaneously, enhancing their profitability.

For instance,

- In March 2023, according to an article published by SINAY SAS, the maritime industry is witnessing significant technological innovations aimed at enhancing sustainability and efficiency. Key advancements include robotics for automated cargo handling, big data analytics for optimizing routes and reducing emissions, and IoT for real-time monitoring and predictive maintenance. AI and cloud computing are streamlining operations, while autonomous ships promise improved safety and cost savings. Additionally, green shipping practices, renewable energy solutions, and blockchain technology are enhancing transparency and efficiency. Despite these advancements, challenges such as regulatory compliance, cyber risks, and a skills gap remain critical concerns for the industry

The adoption of advanced digital technologies like predictive maintenance through IoT and AI presents substantial opportunities for the U.S. ship repair and maintenance services market. By enhancing maintenance practices, improving safety and compliance, enabling data-driven decision-making, and providing a competitive advantage, these technologies are poised to transform the industry. Embracing this digital shift will be crucial for shipyards aiming to thrive in an increasingly competitive landscape, positioning them for sustained growth and innovation.

Restraints/Challenges

- Stringent Environmental Regulations Regarding Waste Management and Emission Control

Regulations are essential for promoting sustainability and protecting marine environments, but they impose considerable challenges on shipyards and repair facilities. The necessity to comply with increasingly stringent environmental regulations often requires significant investment from ship repair facilities. Shipyards must implement advanced waste management systems to handle hazardous materials, including oil, paint, and chemicals. Additionally, emission control technologies, such as scrubbers and other filtration systems, are often required to minimize pollutants released during repair activities. These compliance measures entail substantial capital expenditures and operational costs, which can strain the financial resources of shipyards, particularly smaller ones. As a result, the overall cost of repair services may increase, potentially discouraging shipowners from opting for maintenance work.

Environmental regulations can impose operational constraints on ship repair facilities. For example, strict guidelines on noise, air quality, and water discharges can limit the types of repairs that can be performed or the hours during which work can occur. These restrictions may lead to longer turnaround times for repair jobs, affecting the efficiency and capacity of shipyards. Consequently, ship operators may face delays in getting their vessels back into service, which can disrupt their operational schedules and affect their bottom line.

The regulatory landscape surrounding environmental issues is dynamic and can change rapidly, leading to increased liability for shipyards. Non-compliance with environmental regulations can result in hefty fines, legal actions, and reputational damage. Shipyards must invest in training and systems to ensure compliance, adding to operational costs. This heightened risk can deter investment in expansion or innovation, as shipyards prioritize compliance over growth, limiting their ability to adapt to market changes.

For instance,

- According to an article published by National Academy of Sciences, the Committee on Shipboard Pollution Control, established by the Naval Studies Board, examined the U.S. Navy's compliance with MARPOL Annex V regarding nonfood solid waste. Although naval ships are exempt from MARPOL, U.S. legislation mandates compliance. The committee assessed the technical feasibility of eliminating solid waste discharges by 2000 for surface ships and 2008 for submarines, focusing on waste management technologies. Recommendations include using compactors, shredders, and modern incinerators to reduce waste volume and improve compliance, despite challenges related to equipment and space limitations

Stringent environmental regulations regarding waste management and emission control pose significant restraints on the U.S. ship repair and maintenance services market. The high costs of compliance, operational limitations, increased liability, and competitive disadvantages collectively challenge the profitability and sustainability of U.S. shipyards. As the industry navigates these complexities, finding a balance between compliance and operational efficiency will be crucial for future growth.

- Lack of Skilled Labor in the U.S. Ship Repair Industry

As the demand for repair services continues to rise—driven by factors such as an aging fleet, increased military investments, and the resurgence of the cruise industry—shipyards are struggling to find and retain qualified workers capable of meeting these demands. The ship repair industry requires a diverse range of specialized skills, including welding, electrical work, mechanical maintenance, and naval architecture. However, many skilled workers are retiring, and there has been insufficient investment in training and apprenticeship programs to replace them. This gap has resulted in a shortage of experienced labor, forcing shipyards to either operate at reduced capacity or compromise the quality of their services. The challenge is compounded by competition from other sectors, such as construction and manufacturing, which also seek skilled labor but often offer better pay and benefits.

The shortage of skilled labor directly affects operational efficiency within shipyards. With fewer qualified workers available, shipyards may experience longer turnaround times for repair projects, leading to delays in returning vessels to service. This inefficiency can result in lost business opportunities, as ship owners may seek services elsewhere, particularly in regions or countries with more readily available skilled labor. Additionally, prolonged project timelines can lead to increased costs for shipyards, as they may need to employ overtime or hire temporary workers, which can affect profitability.

Addressing the skills gap requires significant investment in training and development programs, which many shipyards may struggle to afford. Developing comprehensive training programs takes time and resources, and smaller shipyards may lack the financial capability to implement these initiatives effectively. Moreover, attracting new talent to the industry can be challenging, as younger generations may perceive ship repair as a less appealing career choice compared to other, more high-tech fields.

Ein Mangel an qualifizierten Arbeitskräften wirft auch Bedenken hinsichtlich der Qualitätssicherung bei Schiffsreparaturen auf. Unzureichend ausgebildete Arbeiter sind möglicherweise nicht in der Lage, Reparaturen gemäß den erforderlichen Standards durchzuführen, was das Risiko von Unfällen und Compliance-Problemen erhöht. Dies gefährdet nicht nur die Sicherheit von Besatzung und Passagieren, sondern kann auch kostspielige rechtliche und finanzielle Folgen für die Werften haben. Schiffseigner werden wahrscheinlich Reparaturwerkstätten mit einem Ruf für qualitativ hochwertige Arbeit suchen, was den Druck auf Werften, die mit Arbeitskräftemangel zu kämpfen haben, zusätzlich erhöht.

Zum Beispiel,

- Laut einem im Juni 2024 im International Transport Journal veröffentlichten Artikel kämpft die maritime Branche mit einem erheblichen Mangel an Fachkräften, der durch technologische Fortschritte und neue Antriebsmethoden noch verschärft wird. Auf einer kürzlich in Berlin vom Verband Deutscher Reeder und dem Deutschen Nautischen Verband veranstalteten Konferenz diskutierten Experten über die Herausforderungen bei der Rekrutierung. Trotz eines Anstiegs der Neuzugänge um 11 % im Jahr 2023 schätzen Bimco und ICS den Bedarf von fast 18.000 Offizieren jährlich bis 2026. Branchenführer wie Erik Hirsch von Hapag-Lloyd betonen die Notwendigkeit, in Ausbildung und Digitalisierung zu investieren, um die Effizienz zu steigern und junge Talente anzuziehen, die für eine wettbewerbsfähige maritime Industrie von entscheidender Bedeutung sind

Der Mangel an qualifizierten Arbeitskräften in der US-Schiffsreparaturbranche stellt eine erhebliche Herausforderung für den Markt für Schiffsreparatur- und -wartungsdienste dar. Dieser Mangel wirkt sich auf die Betriebseffizienz, die Qualitätssicherung und die Fähigkeit der Werften aus, die steigende Nachfrage zu decken. Die Lösung dieser Probleme durch gezielte Schulungsinitiativen und verbesserte Rekrutierungsstrategien wird für das Wachstum und die Nachhaltigkeit der Branche in Zukunft von entscheidender Bedeutung sein. Ohne qualifizierte Arbeitskräfte könnten US-Werften Schwierigkeiten haben, ihre Wettbewerbsfähigkeit in einem zunehmend anspruchsvollen Markt aufrechtzuerhalten.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden.

Neben dem Standardbericht bieten wir auch detaillierte Analysen des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Warenanalysen, Produktionsanalysen, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalysen, Lösungen zum Lieferkettenrisikomanagement, erweitertes Benchmarking und andere Dienste für Beschaffung und strategische Unterstützung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Marktumfang für Schiffsreparatur- und -wartungsdienste

Der Markt ist nach Schiff, Servicetyp, Anwendung und Endbenutzer segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Schiff

- Öl- und Chemikalientanker

- Containerschiffe

- Massengutfrachter

- Stückgut

- Gasbeförderung

- Passagierschiffe

- Kühlschiffe

- Sonstiges

Diensttyp

- Wartung

- Wartung nach Servicetyp

- Vorbeugende Wartung

- Zustandspflege

- Pannenhilfe

- Wartung nach Servicetyp

- Reparieren

- Reparatur, nach Servicetyp

- Notreparaturen

- Mechanische Reparaturen

- Reparaturen von Elektrik und Instrumenten

- Hauptmotor-Wartungsreparaturen

- Motor-Rückspulreparaturen

- Unterwasserreinigung und Reparaturen

- Sonstiges

- Reparatur, nach Servicetyp

Anwendung

- Anlegeplatz

- Anlegeplatz, pro Schiff

- Öl- und Chemikalientanker

- Containerschiffe

- Massengutfrachter

- Stückgut

- Gasbeförderung

- Passagierschiffe

- Kühlschiffe

- Sonstiges

- Anlegeplatz, pro Schiff

- Motorteile

- Motorteile, nach Schiff

- Öl- und Chemikalientanker

- Containerschiffe

- Massengutfrachter

- Stückgut

- Gasbeförderung

- Passagierschiffe

- Kühlschiffe

- Sonstiges

- Motorteile, nach Schiff

- Allgemeine Dienstleistungen

- Allgemeine Dienste, nach Schiff

- Öl- und Chemikalientanker

- Containerschiffe

- Massengutfrachter

- Stückgut

- Gasbeförderung

- Passagierschiffe

- Kühlschiffe

- Sonstiges

- Allgemeine Dienste, nach Schiff

- Elektroarbeiten und Hilfsdienste

- Elektrische Arbeiten und Zusatzdienste, nach Schiff

- Passagierschiffe

- Kühlschiffe

- Öl- und Chemikalientanker

- Containerschiffe

- Massengutfrachter

- Stückgut

- Gasbeförderung

- Sonstiges

- Elektrische Arbeiten und Zusatzdienste, nach Schiff

- Sonstiges

- Andere, per Schiff

- Öl- und Chemikalientanker

- Containerschiffe

- Stückgut

- Massengutfrachter

- Gasbeförderung

- Passagierschiffe

- Kühlschiffe

- Sonstiges

- Andere, per Schiff

Endbenutzer

- Regierung und Verteidigung

- Kommerziell

Marktanteil für Schiffsreparatur- und Wartungsdienstleistungen

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Länderpräsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die Marktführer für Schiffsreparatur- und Wartungsdienstleistungen sind:

- BAE Systems (USA)

- General Dynamics NASSCO (USA)

- Fincantieri Marine Group (USA)

- Vigor Industrial LLC. (USA)

- Epsilon Systems Solutions, INC (USA)

- Bludworth Marine, LLC (USA)

- Colonna's Shipyard, INC (USA)

- Conrad Shipyards (USA)

- Detyens Shipyards (USA)

- Gulf Copper & Manufacturing Corporation (USA)

- HSD Marine und Schiffsreparatur Pte LTD. (Singapur)

Neueste Entwicklungen auf dem US-Markt für Schiffsreparatur- und Wartungsdienstleistungen

- Im Oktober 2024 erhielt BAE Systems von der US Navy einen Auftrag über 92 Millionen US-Dollar zur Herstellung von Antrieben für U-Boote der Virginia-Klasse. Dieser Auftrag wird die Fähigkeiten des Unternehmens im Bereich fortschrittlicher U-Boot-Technologien verbessern und seine Position im Verteidigungssektor stärken. Er trägt zu kontinuierlichem Wachstum und Innovation bei und unterstützt gleichzeitig nationale Sicherheitsinitiativen.

- Im Mai würdigte BAE Systems seine besten Schiffsreparaturlieferanten für 2023 und würdigte deren wichtige Rolle bei der Bereitstellung von Qualität und Leistung im maritimen Bereich. Die Veranstaltung unterstrich die Bedeutung starker Partnerschaften für die Erreichung operativer Spitzenleistungen. Mit der Anerkennung dieser Lieferanten bekräftigt BAE Systems sein Engagement für Zusammenarbeit und Innovation innerhalb der Schiffsreparaturbranche und stellt sicher, dass sie weiterhin die sich entwickelnden Bedürfnisse ihrer Kunden erfüllen und die allgemeine Servicebereitstellung verbessern.

- Im Oktober 2023 erhielt General Dynamics NASSCO von der US Navy einen Auftrag im Wert von bis zu 754 Millionen USD für die Wartung, Modernisierung und Reparatur der USS Chung-Hoon und der USS James E. Williams. Die erste Phase im Wert von 15,6 Millionen USD wird in Norfolk und San Diego stattfinden, mit möglichen Verlängerungen bis November 2030, was die Kapazitäten von NASSCO im Bereich der Marinereparaturdienste weiter stärkt.

- Im Juli 2023 erweitern Fincantieri Bay Shipbuilding und das Northeast Wisconsin Technical College ihre Partnerschaft zur Verbesserung der Ausbildung von maritimen Arbeitskräften. Nach einem erfolgreichen Pilotprogramm werden sie weitere Kurse anbieten, um der wachsenden Nachfrage nach Fachkräften in der maritimen Fertigungsindustrie gerecht zu werden

- Im September 2022 begann Fincantieri Bay Shipbuilding mit dem Bau einer neuen 19.000 Quadratmeter großen Maschinenwerkstatt in Sturgeon Bay. Die Anlage wird den Reparaturbetrieb mit moderner Infrastruktur verbessern, die Flotte der Großen Seen unterstützen und gleichzeitig die Umweltauswirkungen für die umliegende Gemeinde minimieren

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.