A medida que las pymes se enfrentan a la creciente complejidad de la gestión del cumplimiento tributario, recurren a soluciones automatizadas que simplifican los procesos, reducen los errores y garantizan la precisión. La necesidad de estas empresas de adaptarse a las diversas normativas tributarias, como el impuesto sobre las ventas, el IVA y otras leyes tributarias locales, ha impulsado el uso de software de TI tributario. Estas soluciones agilizan el cálculo de impuestos y se integran a la perfección con los sistemas financieros, ofreciendo una forma más eficiente de gestionar los impuestos y, al mismo tiempo, cumplir con las normativas en constante evolución.

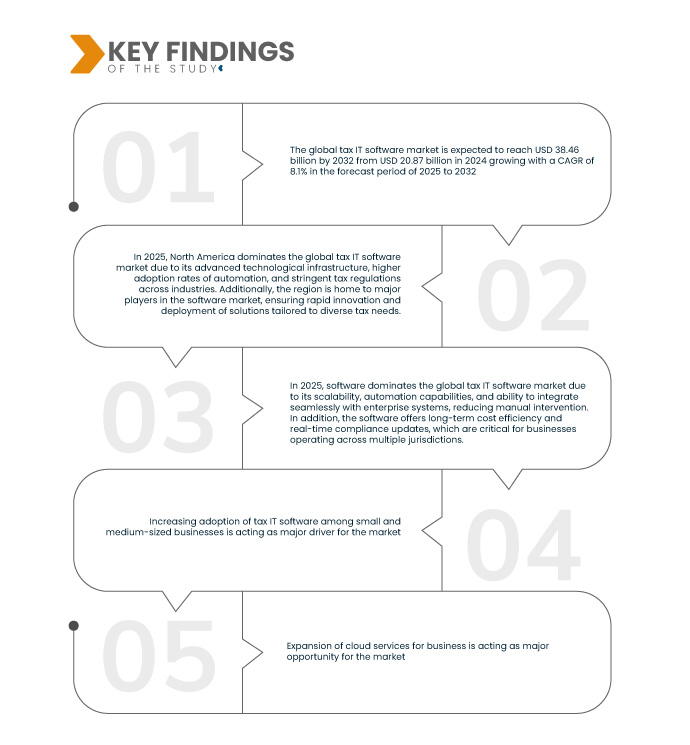

La creciente adopción de software de TI fiscal entre las pequeñas y medianas empresas está impulsando un crecimiento significativo en el mercado global de este tipo de software. Ante el reto de las pymes de adaptarse a las complejas y cambiantes normativas fiscales, estas soluciones de software proporcionan la automatización, la precisión y la eficiencia necesarias en la gestión tributaria. La transición hacia la digitalización, sumada a la escalabilidad y la rentabilidad de las soluciones tributarias en la nube, permite a las pymes optimizar sus operaciones financieras y garantizar el cumplimiento normativo sin grandes inversiones. Con la continua evolución de las leyes tributarias y la creciente necesidad de que las empresas se mantengan ágiles, la demanda de software de TI fiscal está a punto de expandirse, ofreciendo una solución valiosa para las empresas que buscan optimizar sus procesos tributarios y apoyar su crecimiento a largo plazo.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-tax-it-software-market

Data Bridge Market Research analiza que se espera que el mercado global de software de TI fiscal alcance los USD 38,46 mil millones para 2032 desde USD 20,87 mil millones en 2025, creciendo con una CAGR del 8,1% en el período de pronóstico de 2025 a 2032.

Principales hallazgos del estudio

Integración de IA y aprendizaje automático en software fiscal y contable

La integración de la IA y el aprendizaje automático (ML) en el software fiscal y contable está transformando el mercado del software de TI fiscal al automatizar procesos complejos y mejorar la capacidad de toma de decisiones. Las herramientas basadas en IA simplifican tareas como la extracción de datos, el cálculo de impuestos y la supervisión del cumplimiento, reduciendo la necesidad de intervención manual. Los algoritmos de ML mejoran la precisión de las auditorías fiscales y la detección del fraude mediante el análisis de grandes conjuntos de datos y la identificación de anomalías en tiempo real. Estos avances ayudan a las empresas a garantizar el cumplimiento de las normativas fiscales en constante evolución, a la vez que optimizan sus operaciones y ahorran tiempo.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2025 a 2032

|

Año base

|

2024

|

Años históricos

|

2023 (personalizable para 2013-2017)

|

Unidades cuantitativas

|

Ingresos en miles de millones de dólares

|

Segmentos cubiertos

|

Por oferta (software y servicios), tipo de impuesto (impuesto sobre la renta, impuesto corporativo e impuesto predial), modo de implementación (nube y local), tamaño de la organización (pequeñas y medianas empresas y grandes empresas), modelo de ingresos (compra única y suscripción), sector (banca, servicios financieros y seguros [BFSI], TI y telecomunicaciones, manufactura, comercio minorista y bienes de consumo, atención médica, energía y servicios públicos, y medios y entretenimiento).

|

Países cubiertos

|

EE. UU., Canadá, México, China, Japón, India, Corea del Sur, Australia y Nueva Zelanda, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Taiwán, Vietnam, Resto de Asia-Pacífico, Reino Unido, Alemania, Francia, Italia, España, Rusia, Países Bajos, Suiza, Suecia, Bélgica, Dinamarca, Polonia, Noruega, Turquía, Finlandia, Resto de Europa, Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos, Israel, Egipto, Catar, Omán, Kuwait, Baréin, Resto de Oriente Medio y África, Brasil, Argentina, Resto de Sudamérica

|

Actores del mercado cubiertos

|

Microsoft (EE. UU.), ADP, Inc. (EE. UU.), Yayoi Co., Ltd. (Japón), Wolters Kluwer NV (Países Bajos), Stripe (EE. UU.), SAP (EE. UU.), Thomson Reuters (EE. UU.), Oracle (EE. UU.), NTT data (Japón), QUICKBOOKS (INTUIT INC.) (EE. UU.), SAGE GROUP PLC (Reino Unido), Vertex (EE. UU.), TKC Corporation (Japón), SOVOS Compliance, LLC (EE. UU.), Avalara (EE. UU.), Money Forward, Inc. (Japón), freee KK (Japón), TaxDiva (India), Esker (Francia), PCA Corporation (Japón) y Epicor Software Corporation (EE. UU.).

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

|

Análisis de segmentos

El mercado global de software de TI para impuestos está segmentado en seis segmentos notables según la oferta, el tipo de impuesto, el modo de implementación, el tamaño de la organización, el modelo de ingresos y la industria.

- En función de la oferta, el mercado se ha segmentado en software y servicios.

En 2025, se espera que el segmento de software domine el mercado con una participación de mercado del 55,41%.

En 2025, el software dominará el mercado con una cuota de mercado del 55,41 % gracias a su escalabilidad, sus capacidades de automatización y su capacidad de integrarse a la perfección con los sistemas empresariales, lo que reduce la intervención manual. Además, el software ofrece rentabilidad a largo plazo y actualizaciones de cumplimiento en tiempo real, aspectos cruciales para las empresas que operan en múltiples jurisdicciones.

- En función del tipo de impuesto, el mercado se ha segmentado en impuesto sobre la renta, impuesto corporativo, impuesto sobre la propiedad y otros.

En 2025, se espera que el segmento de impuesto sobre la renta domine el mercado con una participación de mercado del 40,41%.

En 2025, se prevé que el impuesto sobre la renta domine el mercado con una cuota del 40,41 % debido a su aplicabilidad universal a particulares y empresas, lo que se traducirá en una mayor demanda. Además, las frecuentes actualizaciones regulatorias en materia de cumplimiento tributario impulsan la adopción de soluciones de software especializadas para garantizar la precisión y la eficiencia.

- Según el modo de implementación, el mercado se ha segmentado en nube y local. En 2025, se espera que la nube domine el mercado con una cuota de mercado del 70,42 %.

- Según el tamaño de la organización, el mercado se ha segmentado en pequeñas y medianas empresas (PYMES) y grandes empresas (GPE). En 2025, se prevé que el segmento de grandes empresas domine el mercado con una cuota de mercado del 54,13 %.

- Según el modelo de ingresos, el mercado se ha segmentado en compras únicas y suscripción. Se espera que en 2025, el segmento de suscripción domine el mercado con una cuota de mercado del 64,69 %.

- Según la industria, el mercado se ha segmentado en banca, servicios financieros y seguros (BFSI), TI y telecomunicaciones, manufactura, comercio minorista y bienes de consumo, salud, energía y servicios públicos, medios de comunicación y entretenimiento, entre otros. Se espera que en 2025, el segmento de banca, servicios financieros y seguros (BFSI) domine el mercado con una participación del 26,67 %.

Actores principales

Data Bridge Market Research analiza a Microsoft (EE. UU.), ADP, Inc. (EE. UU.), Yayoi Co., Ltd. (Japón), Wolters Kluwer NV (Países Bajos) y Stripe (EE. UU.) como las principales empresas que operan en el mercado.

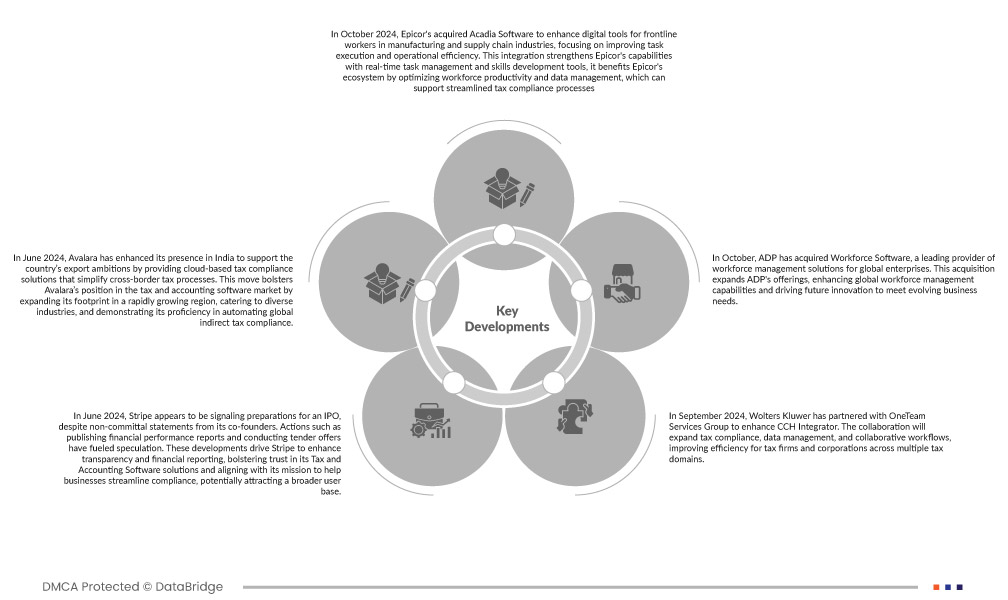

Desarrollo del mercado

- En octubre de 2024, Epicor adquirió Acadia Software para optimizar las herramientas digitales de los trabajadores de primera línea en las industrias de manufactura y cadena de suministro, con el objetivo de optimizar la ejecución de tareas y la eficiencia operativa. Esta integración fortalece las capacidades de Epicor con herramientas de gestión de tareas en tiempo real y desarrollo de habilidades. Además, beneficia al ecosistema de Epicor al optimizar la productividad de la fuerza laboral y la gestión de datos, lo que facilita la optimización de los procesos de cumplimiento tributario.

- En octubre de 2024, ADP adquirió Workforce Software, proveedor líder de soluciones de gestión de personal para empresas globales. Esta adquisición amplía la oferta de ADP, mejorando las capacidades globales de gestión de personal e impulsando la innovación futura para satisfacer las cambiantes necesidades empresariales.

- En septiembre de 2024, Wolters Kluwer se asoció con OneTeam Services Group para mejorar CCH Integrator. Esta colaboración ampliará el cumplimiento tributario, la gestión de datos y los flujos de trabajo colaborativos, mejorando la eficiencia de las empresas y despachos tributarios en múltiples ámbitos fiscales.

- En junio de 2024, Stripe parece estar dando señales de estar preparándose para una salida a bolsa, a pesar de las declaraciones evasivas de sus cofundadores. Acciones como la publicación de informes de rendimiento financiero y la realización de ofertas públicas de adquisición han alimentado la especulación. Estos avances impulsan a Stripe a mejorar la transparencia y la información financiera, lo que refuerza la confianza en sus soluciones de software fiscal y contable y se alinea con su misión de ayudar a las empresas a optimizar el cumplimiento normativo, lo que podría atraer a una base de usuarios más amplia.

- En junio de 2024, Avalara reforzó su presencia en India para impulsar las ambiciones exportadoras del país, ofreciendo soluciones de cumplimiento tributario basadas en la nube que simplifican los procesos tributarios transfronterizos. Esta iniciativa consolida la posición de Avalara en el mercado de software tributario y contable, expandiendo su presencia en una región en rápido crecimiento, atendiendo a diversos sectores y demostrando su competencia en la automatización del cumplimiento tributario indirecto a nivel global.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado global de administradores de infraestructura virtual son EE. UU., Canadá, México, China, Japón, India, Corea del Sur, Australia y Nueva Zelanda, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Taiwán, Vietnam, Resto de Asia-Pacífico, Italia, Francia, Alemania, España, Polonia, Países Bajos, Rumania, Dinamarca, Bélgica, Grecia, Hungría, Portugal, Irlanda, Austria, Chequia, Suecia, Bulgaria, Finlandia, Croacia, Lituania, Eslovenia, Letonia, Eslovaquia, Chipre, Estonia, Luxemburgo, Malta, Europa no perteneciente a la UE, Arabia Saudita, Sudáfrica, Egipto, Baréin, Omán, Israel, Kuwait, Qatar, Emiratos Árabes Unidos, Resto de Medio Oriente y África, Brasil, Argentina, México, Resto de América Latina.

Según el análisis de investigación de mercado de Data Bridge:

Se espera que América del Norte domine y sea la región de más rápido crecimiento en el mercado global de software de TI fiscal.

En 2025, Norteamérica dominará el mercado global de software de TI para impuestos gracias a su avanzada infraestructura tecnológica, las mayores tasas de adopción de la automatización y las estrictas regulaciones tributarias en todos los sectores. Además, la región alberga a importantes actores del mercado de software, lo que garantiza una rápida innovación e implementación de soluciones adaptadas a las diversas necesidades tributarias.

Para obtener información más detallada sobre el informe del mercado global de software de TI fiscal, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-tax-it-software-market