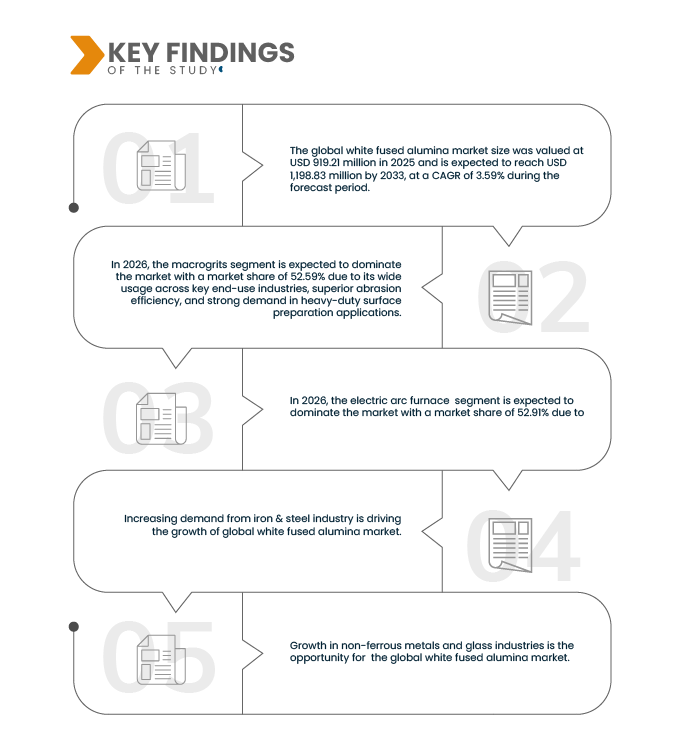

Growing demand from the iron and steel industry is being recognized as one of the most influential drivers of the global white fused alumina market. White fused alumina is extensively utilized in refractory applications essential for steelmaking processes, including ladle linings, slide gate refractories, tundish nozzles and high-temperature wear-resistant components. As production volumes of crude steel continue to increase in major manufacturing economies and new capacity additions are announced across Asia, the Middle East and emerging regions, consumption of high-performance refractory raw materials is being reinforced.

The shift toward higher-quality steel grades, extended furnace campaign life and reduced downtime has further intensified reliance on premium alumina-based refractories. Consequently, expansion in steelmaking throughput, along with modernization of furnaces and secondary metallurgy units, is expected to sustain strong structural demand for white fused alumina across the global refractory supply chain.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-white-fused-alumina-market

Data Bridge market research analyzes that the Global White Fused Alumina Market size was valued at USD 919.21 million in 2025 and is expected to reach USD 1,198.83 million by 2033, at a CAGR of 3.59% during the forecast period of 2026 to 2033.

Key Findings of the Study

Expanding Industrial End Use Demand of White Fused Alumina

Expanding industrial end-use demand is being recognized as a significant driver of the global white fused alumina market. Utilization of white fused alumina has been broadened across multiple industrial domains, including advanced abrasives, precision grinding, engineered ceramics, surface preparation systems, and high-performance wear-resistant components. As manufacturing sectors adopt tighter tolerance requirements, improved surface finishing standards, and higher durability specifications, demand for premium alumina-based materials has been reinforced. Industrial growth in automotive, machinery, electronics, aerospace and fabrication activities has further contributed to heightened consumption, particularly in segments requiring consistent hardness, thermal stability and chemical inertness. Consequently, the expansion of diversified industrial applications is expected to sustain strong structural pull for white fused alumina through the forecast period.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2018-2024 (Customizable to 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Product Type (Macrogrits, Microgrits & Powders, Specialty Grades, Others), Manufacturing Process (Electric Arc Furnace, Crushing, Grading & Classification, Post-Treatment, Others), Function (Cutting & Grinding (Abrasive), Refractory Function (Thermal/Wear Resistance), Ceramic Additive/Filler, Polishing & Lapping, Blasting & Surface Preparation, Anti-Skid/Anti-Slip Aggregate, and Others), Application (Abrasives, Refractories, Ceramics & Advanced Materials, Polishing, Lapping & Finishing, Others), End Use (Metals & Metallurgy, Automotive & Transportation, Machinery & Heavy Equipment, Construction & Infrastructure, Energy (Oil & Gas, Power Generation), Aerospace & Defense, Electronics & Semiconductors, and Others), Distribution Channel (Direct and Indirect)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, Italy, U.K., Russia, Spain, Turkey, Sweden, Netherlands, Switzerland, Finland, Norway, Belgium, Denmark, Rest of Europe, China, India, Japan, South Korea, Taiwan, Australia, Thailand, Indonesia, Malaysia, Philippines, Singapore, Hong Kong, New Zealand, Rest of Asia-Pacific, Brazil, Argentina, Colombia, Peru, Chile, Venezuela, Ecuador, Bolivia, Uruguay, Paraguay, Rest of South America, Saudi Arabia, South Africa, United Arab Emirates, Egypt, Israel, Kuwait, Oman, Qatar, Bahrain, Rest of Middle East and Africa

|

|

Market Players Covered

|

Washington Mills (U.S.), CUMI (India), MOTIM (Hungary), Henan Ruishi Renewable Resources Group Co., Ltd. (China), U.S. Electrofused Minerals, Inc. (U.S.), Qinai New Materials Co. Ltd. (China), Zhengzhou Yufa Abrasive Group Co., Ltd. (China), Fused Minerals Industries LLP (India), HarbisonWalker International (HWI) (U.S.), Henan Hongtai Kiln Refractory Co., Ltd. (China), Algrain Products Private Limited (India), IMERYS (France), LP Impex (China), Shandong Zhongji Metal Products Co., Ltd. (China), Alteo Alumina (France), Orient Abrasives Ltd. (India), Shandong Bosheng New Materials Co., Ltd. (China), JSR International (India) Pvt. Ltd. (India), Luoyang Hongfeng Abrasives Co., Ltd. (China), Zhengzhou Xinli Wear-resistant Materials Co., Ltd. (China), Nanping Yi Ze Abrasives & Tools Tech Co. (China), RUSAL (Russia), Shandong Honrel Co., Ltd. (China), Saint-Gobain (France), Cerablast (France), Luoyang Sunrise Abrasives Co., Ltd. (China), Quarzwerke GmbH (Germany), Kuhmichel Abrasiv GmbH (Germany), Wedge India (India), Zibo Jucos (China)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The global white fused alumina market is segmented into six notable segments based on the product type, manufacturing process, function, application, end use, distribution channel.

- On the basis of product type, the white fused alumina market is segmented into macrogrits, microgrits & powders, specialty grades, and others

In 2026, the macrogrits segment is expected to dominate the market

In 2026, the macrogrits segment is expected to dominate the market with 52.59% share due to its extensive use in abrasive, refractory, and surface finishing applications, offering high hardness, thermal stability, and superior performance across industries such as metals and metallurgy, automotive, construction, and electronics.

- On the basis of manufacturing process, the white fused alumina market is segmented into electric arc furnace, crushing, grading & classification, post-treatment, and others

In 2026, the electric arc furnace segment is expected to dominate the market

In 2026, the electric arc furnace segment is expected to dominate the market with 52.91% share due to its efficiency in producing high-quality, dense, and friable white fused alumina suitable for abrasive, refractory, and specialty applications across industries such as metals and metallurgy, automotive, and construction.

- On the basis of function, the global white fused alumina market is segmented into cutting & grinding (abrasive), polishing & lapping, blasting & surface preparation, refractory function (thermal/wear resistance), ceramic additive/filler, anti-skid/anti-slip aggregate, and others. In 2026, the cutting & grinding (abrasive) segment is expected to dominate the market with 39.69% share

- On the basis of application, the white fused alumina market is segmented into abrasives, refractories, ceramics & advanced materials, polishing, lapping & finishing, and others. In 2026, the abrasives segment is expected to dominate the market with 53.20% share

- On the basis of end-use, the white fused alumina market is segmented into metals & metallurgy, automotive & transportation, aerospace & defense, electronics & semiconductors, machinery & heavy equipment, construction & infrastructure, energy (oil & gas, power generation), and others. In 2026, the metals & metallurgy segment is expected to dominate the market with 26.85%

- On the basis of distribution channel, the white fused alumina market is segmented into direct and indirect. In 2026, the direct segment is expected to dominate the market with 66.91% share

Major Players

Data Bridge Market Research Analyses Imerys S.A. (France), Washington Mills (U.S.), Saint-Gobain (France), CUMI (India), Quarzwerke GmbH (Germany) as the major players operating in the market.

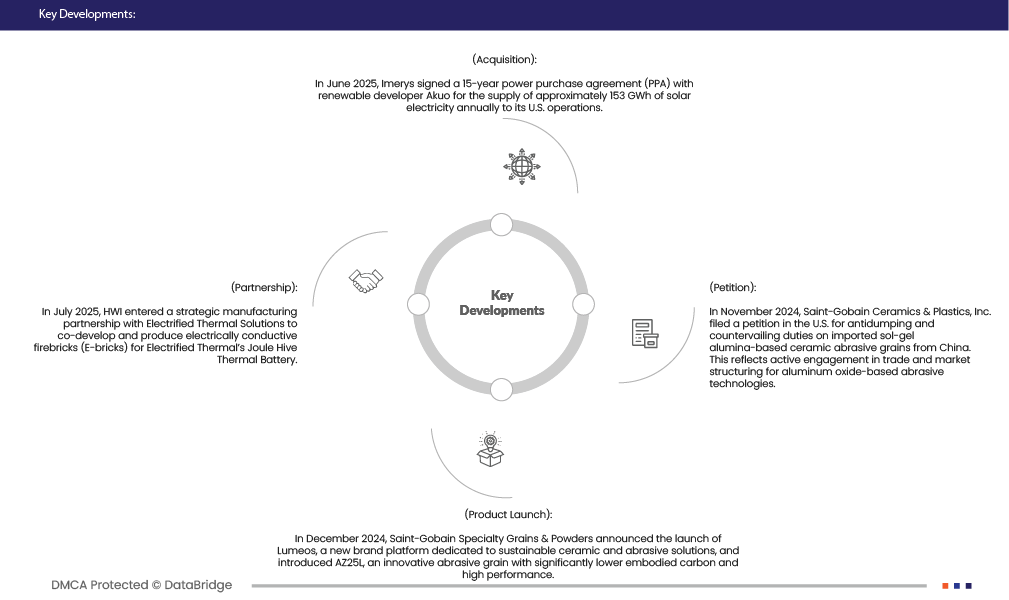

Market Developments

- In December 2025, HWI, a member of Calderys, completed construction of its new lightweight monolithics production facility at the Rotary Kiln complex in Fulton, Missouri. The state-of-the-art plant increases lightweight monolithics output capacity by nearly 60%, incorporates advanced automation (new furnace, robotic packaging and material-handling systems), and is expected to enhance product availability and shorten lead times for customers across the Americas.

- n July 2025, HWI entered a strategic manufacturing partnership with Electrified Thermal Solutions to co-develop and produce electrically conductive firebricks (E-bricks) for Electrified Thermal’s Joule Hive Thermal Battery. The collaboration combines Electrified Thermal’s high-temperature thermal-storage technology with HWI’s refractory expertise to support decarbonized industrial heat applications; the first commercial-scale demonstration was projected for 2025 with a longer-term goal of deploying 2 GW of electrified thermal power by 2030.

- In October 2024, Niche Fused Alumina was acquired by Alteo and integrated into the group as “Alteo Fused Alumina,” following approval of Alteo’s takeover bid by the Commercial Court of Chambéry. The acquisition was positioned as a strategic expansion of Alteo’s specialty alumina operations, reinforcing its global leadership and supporting sustainable industrial growth with a continued focus on innovation and environmental responsibility.

- In February 2024, Alteo has officially joined the European Cluster of Ceramics based in Limoges, France. This collaboration aims to strengthen Alteo’s presence across key high-tech and industrial sectors including aerospace, defence, electronics, energy, luxury goods and healthcare by leveraging the cluster’s network for innovation and industrial development in specialty alumina and technical ceramics markets.

- In September 2024, CUMI completed the acquisition of 100% equity in Silicon Carbide Products LLC (SCP), a U.S.-based firm specializing in advanced ceramics and silicon‑carbide materials. This strategic move strengthens CUMI’s global presence in the high-performance ceramics and abrasives market, enhancing its technological capabilities and access to North American customers.

Geographically Analysis

Geographically, the countries covered in the market are U.S., Canada, Mexico, Germany, France, Italy, U.K., Russia, Spain, Turkey, Sweden, Netherlands, Switzerland, Finland, Norway, Belgium, Denmark, Rest of Europe, China, India, Japan, South Korea, Taiwan, Australia, Thailand, Indonesia, Malaysia, Philippines, Singapore, Hong Kong, New Zealand, Rest of Asia-Pacific, Brazil, Argentina, Colombia, Peru, Chile, Venezuela, Ecuador, Bolivia, Uruguay, Paraguay, Rest of South America, Saudi Arabia, South Africa, United Arab Emirates, Egypt, Israel, Kuwait, Oman, Qatar, Bahrain, Rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

Asia-Pacific is the Dominant and Fastest Growing Region in the Global White Fused Alumina Market

The Asia-Pacific region is expected to dominate the global white fused packaging market with a 50.43% market share and continue expanding at the highest CAGR of 3.79%, primarily due to rapid industrialization, strong manufacturing activity, and the massive growth of e-commerce across major economies such as China, India, Japan, and Southeast Asian countries. Countries like China, India, Japan, and Southeast Asian nations are driving growth through investments in advanced manufacturing technologies and infrastructure development. The region benefits from a strong supply chain network and growing export activities, supported by favourable government policies. Additionally, rising demand for high-quality abrasives, refractory materials, and ceramics is propelling the market forward. Sustainability trends and innovations in production processes are also encouraging the adoption of eco-friendly white fused alumina products, reinforcing Asia-Pacific’s dominant position in the global market during the forecast period.

As per Data Bridge Market Research analysis:

For more detailed information about the Global White Fused Alumina Market report, click here – https://www.databridgemarketresearch.com/reports/global-white-fused-alumina-market